USA Automotive Radar Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD8440

November 2024

98

About the Report

USA Automotive Radar Market Overview

- The USA Automotive Radar market is valued at USD 1.2 billion, according to a five-year historical analysis. This growth is fueled by the increasing adoption of radar technologies in advanced driver assistance systems (ADAS) and autonomous vehicles, supported by government safety regulations. As automotive companies prioritize real-time collision avoidance and adaptive cruise control, radar solutions have become integral to enhancing vehicle safety, with demand particularly strong in urban areas with higher traffic density.

- In terms of geographic dominance, the USA leads due to a well-established automotive sector, progressive regulations, and high consumer adoption of ADAS technology. The automotive radar market is concentrated in key regions, such as California, Texas, and Michigan, were infrastructure and technological innovation support advancements in autonomous driving solutions. Californias strong emphasis on autonomous vehicle testing and Texas automotive manufacturing strength play pivotal roles in regional dominance.

- In response to increasing traffic incidents, NHTSA and the U.S. Department of Transportation have enforced regulations requiring radar-based crash avoidance systems in new vehicles. By 2024, radar systems became a standard for crash detection in over 70% of new passenger vehicles in the U.S., highlighting government efforts to mitigate road accidents.

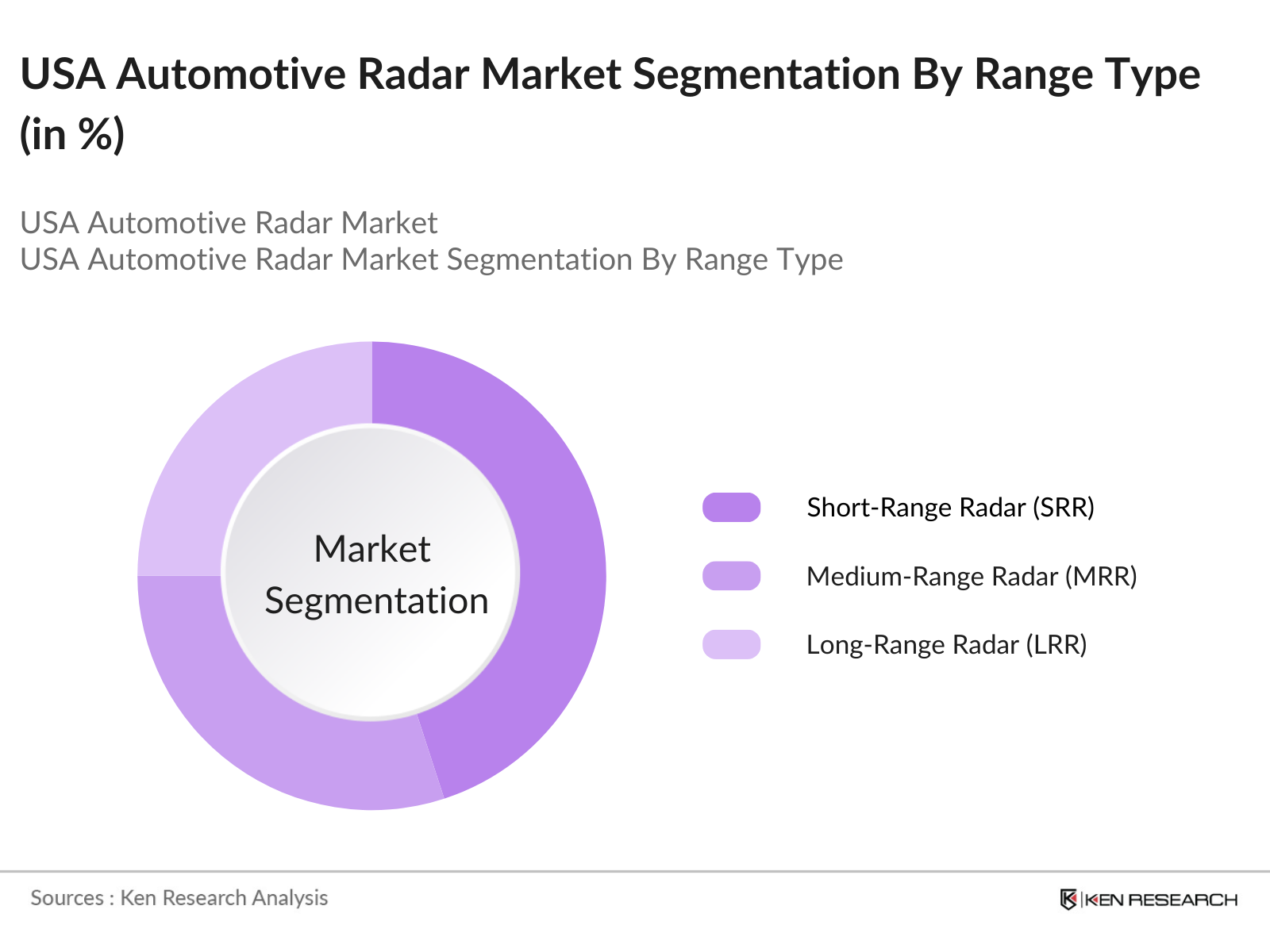

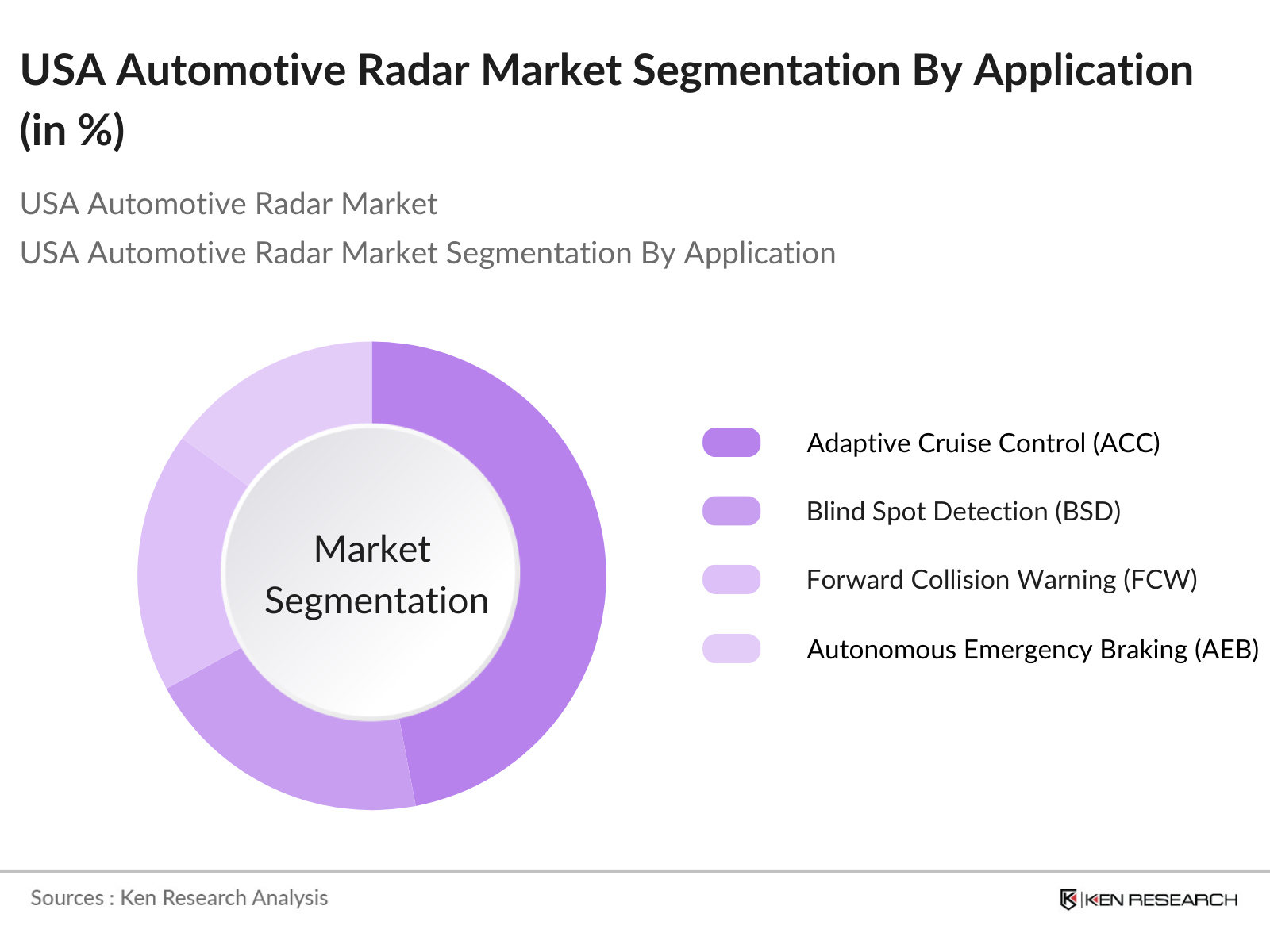

USA Automotive Radar Market Segmentation

By Range Type: The market is segmented by range type, including Short-Range Radar (SRR), Medium-Range Radar (MRR), and Long-Range Radar (LRR). Short-range radar currently dominates the market share, largely due to its critical application in ADAS features like blind-spot detection and parking assist systems.

By Application: The application segmentation includes Adaptive Cruise Control (ACC), Blind Spot Detection (BSD), Forward Collision Warning (FCW), Autonomous Emergency Braking (AEB), and Intelligent Park Assist. Adaptive cruise control (ACC) holds a substantial market share, driven by consumer and industry preferences for real-time traffic adaptation and collision avoidance capabilities, essential for both urban and highway driving environments.

USA Automotive Radar Market Competitive Landscape

The USA automotive radar market is shaped by a competitive landscape where a few key players hold significant influence. These companies drive innovation and market presence through their commitment to technological advancements and strategic partnerships. The consolidation of key players reflects the strong influence these companies have on technological innovation and regulatory compliance within the USA automotive radar market.

USA Automotive Radar Industry Analysis

Growth Drivers

- ADAS Adoption in Passenger Vehicles: The rise in the adoption of Advanced Driver Assistance Systems (ADAS) in passenger vehicles has gained momentum in 2024, fueled by the goal to enhance vehicular safety standards. According to the U.S. Department of Transportation, 94% of serious crashes in 2022 were due to human error, which ADAS technology could potentially reduce significantly. Current ADAS applications include adaptive cruise control, lane-keeping assist, and automated emergency braking, with over 18 million passenger vehicles on U.S. roads equipped with these features.

- Autonomous Vehicle Development: With advancing levels of vehicle autonomy, the development and deployment of self-driving vehicles have progressed globally. In 2023, the U.S. Federal Highway Administration recorded that 1,400 autonomous vehicles were being tested across the U.S. as part of urban mobility programs, and it has become a critical area of focus for tech and automotive giants. These vehicles rely heavily on radar and Lidar systems, which can identify objects up to 300 meters away, enabling safe navigation in various driving conditions.

- Demand for Collision Avoidance Systems: Collision avoidance technology has become essential in minimizing road accidents, with over 1.3 million fatalities recorded globally in road crashes as per the World Health Organizations 2022 report. Radar technology, capable of tracking multiple objects, is integral to these systems, and its demand has grown by 12% annually as vehicle manufacturers incorporate safety systems to meet regulatory standards and consumer safety demands.

Market Challenges

- High Installation Costs: Radar systems entail substantial installation costs due to complex manufacturing requirements and precision engineering. In 2023, the average installation cost for advanced radar systems in vehicles was approximately $1,500, a factor that restricts their use to mid-to-high-end vehicles. This remains a barrier for broader adoption across entry-level passenger cars, limiting overall market penetration.

- Technical Integration Challenges: Integrating radar systems with ADAS and autonomous platforms presents technical challenges, particularly in sensor fusion. A 2023 report from the European Commissions Directorate-General for Mobility and Transport cited that up to 40% of autonomous vehicle mishaps are due to integration issues between radar, camera, and Lidar systems. These challenges highlight the need for robust sensor integration to enhance operational efficiency in radar-based safety features.

USA Automotive Radar Market Future Outlook

The USA automotive radar market is expected to demonstrate robust growth over the next five years, spurred by ongoing technological advancements, increasing adoption of radar sensors in autonomous and electric vehicles, and favorable government regulations supporting safety and efficiency. The integration of 5G technology, higher radar frequencies, and an emphasis on ADAS will further drive market expansion as consumers seek enhanced driving experiences and manufacturers comply with rising safety standards.

Market Opportunities

- Technological Innovations in Radar (e.g., 4D Imaging): Innovations in radar technology, such as 4D imaging radar, are opening new possibilities in vehicle safety and navigation. 4D radar systems can deliver higher resolution images and detect object elevation, enhancing object recognition capabilities in ADAS. As of 2024, over 250 new patents have been filed globally for 4D radar technologies, marking a substantial interest in advancing radars role in autonomous and assisted driving.

- Expansion of Electric and Autonomous Vehicle Market: The market for electric and autonomous vehicles (EVs and AVs) continues to grow, with over 14 million EVs sold globally in 2023, supported by government incentives in various regions. AVs, which rely heavily on radar systems for navigation, are expected to form a significant part of urban fleets in coming years, driving radar adoption. This expansion is particularly noted in countries such as the U.S. and China, where EV and AV infrastructure investments are robust.

Scope of the Report

|

Range Type |

Short-Range Radar (SRR) Medium-Range Radar (MRR) Long-Range Radar (LRR) |

|

Application |

Adaptive Cruise Control (ACC) Blind Spot Detection (BSD) Forward Collision Warning (FCW) |

|

Autonomous Emergency Braking (AEB) Intelligent Parking Assistance |

|

|

Frequency |

24 GHz 77 GHz 79 GHz |

|

Vehicle Type |

Passenger Vehicles Commercial Vehicles |

|

Region |

North East West Mid-West South |

Products

Key Target Audience

Automotive Manufacturers (OEMs)

Component Suppliers (e.g., radar system manufacturers)

Technology Providers (for ADAS integration)

Venture Capitalist and Investment Firms

Government and Regulatory Bodies (e.g., NHTSA, FCC)

Autonomous Vehicle Development Companies

Fleet Management Service Providers

Insurance Providers

Companies

Players Mentioned in the Report

Robert Bosch GmbH

Continental AG

DENSO Corporation

Aptiv PLC

NXP Semiconductors

HELLA GmbH & Co. KGaA

ZF Friedrichshafen AG

Texas Instruments

Veoneer Inc.

Magna International

Table of Contents

1. Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Automotive Radar Market Size (USD)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Market Analysis

3.1. Growth Drivers

3.1.1. ADAS Adoption in Passenger Vehicles

3.1.2. Autonomous Vehicle Development

3.1.3. Government Safety Regulations (e.g., FCC frequency standards)

3.1.4. Demand for Collision Avoidance Systems

3.2. Market Challenges

3.2.1. High Installation Costs

3.2.2. Technical Integration Challenges

3.2.3. Frequency Band Constraints

3.2.4. Cybersecurity and Data Privacy Concerns

3.3. Opportunities

3.3.1. Technological Innovations in Radar (e.g., 4D Imaging)

3.3.2. Expansion of Electric and Autonomous Vehicle Market

3.3.3. Vehicle-to-Everything (V2X) Connectivity

3.4. Trends

3.4.1. Integration of FMCW Technology

3.4.2. Increasing Radar Frequency (24 GHz to 79 GHz)

3.4.3. Combined Radar and Lidar Systems

3.5. Government Regulations

3.5.1. NHTSA and DOT Safety Mandates

3.5.2. FCC Compliance for Radar Frequency

3.5.3. State-Level Autonomous Vehicle Laws

3.6. SWOT Analysis

3.7. Industry Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Automotive Radar Market Segmentation

4.1. By Range Type (Value %)

4.1.1. Short-Range Radar (SRR)

4.1.2. Medium-Range Radar (MRR)

4.1.3. Long-Range Radar (LRR)

4.2. By Application (Value %)

4.2.1. Adaptive Cruise Control (ACC)

4.2.2. Blind Spot Detection (BSD)

4.2.3. Forward Collision Warning (FCW)

4.2.4. Autonomous Emergency Braking (AEB)

4.2.5. Intelligent Parking Assistance

4.3. By Frequency (Value %)

4.3.1. 24 GHz

4.3.2. 77 GHz

4.3.3. 79 GHz

4.4. By Vehicle Type (Value %)

4.4.1. Passenger Vehicles

4.4.2. Commercial Vehicles

4.5. By Region (Value %)

4.5.1. North East

4.5.2. West

4.5.3. Mid-West

4.5.4. South

5. Competitive Analysis

5.1. Profiles of Key Competitors

5.1.1. Robert Bosch GmbH

5.1.2. Continental AG

5.1.3. Aptiv PLC

5.1.4. DENSO Corporation

5.1.5. NXP Semiconductors

5.1.6. Autoliv Inc.

5.1.7. HELLA GmbH & Co. KGaA

5.1.8. Texas Instruments

5.1.9. Analog Devices, Inc.

5.1.10. Veoneer Inc.

5.1.11. Renesas Electronics

5.1.12. Mitsubishi Electric Corporation

5.1.13. Magna International

5.1.14. Valeo

5.1.15. ZF Friedrichshafen AG

5.2 Cross Comparison Parameters (Market Share, Revenue, Number of Employees, Headquarters, Product Portfolio, Frequency Range, ADAS Integration Capabilities, Autonomous Vehicle Readiness)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity and Venture Capital Funding

6. Regulatory Framework

6.1. Radar Frequency Compliance Standards

6.2. Certification Requirements for ADAS

6.3. State-Level Autonomous Regulations

6.4. Future Regulations Impacting the Radar Market

7. Future Market Size (USD)

7.1. Future Market Size Projections

7.2. Key Growth Drivers

8. Future Market Segmentation

8.1. By Range Type

8.2. By Application

8.3. By Frequency

8.4. By Vehicle Type

8.5. By Region

9. Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation and Cohort Analysis

9.3. Product Innovation Opportunities

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase involves mapping out the ecosystem of the USA automotive radar market, focusing on key stakeholders and influential variables. Secondary data from industry publications and proprietary databases were used to define primary drivers and constraints.

Step 2: Market Analysis and Construction

Historical data collection and trend analysis were conducted to evaluate the growth trajectory of radar adoption in the automotive sector. Market penetration and consumer adoption rates were analyzed to understand market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Through direct interviews and CATI (Computer Assisted Telephone Interviewing), feedback from industry experts provided valuable insights into operational trends and technology adoption across sub-segments.

Step 4: Research Synthesis and Final Output

The synthesis of primary and secondary data, supported by direct manufacturer engagement, produced a validated analysis of the market size, growth drivers, and segment performance.

Frequently Asked Questions

1. How big is the USA Automotive Radar Market?

The USA Automotive Radar market is valued at USD 1.2 billion, according to a five-year historical analysis.

2. What are the challenges in the USA Automotive Radar Market?

Key challenges include high implementation costs, cybersecurity concerns, and integration hurdles with existing vehicle systems. Regulatory compliance also poses challenges for manufacturers.

3. Who are the major players in the USA Automotive Radar Market?

Major players include Robert Bosch GmbH, Continental AG, DENSO Corporation, NXP Semiconductors, and Aptiv PLC, with a strong presence in radar technologies for automotive safety.

4. What drives growth in the USA Automotive Radar Market?

Growth drivers include consumer demand for enhanced safety features, regulatory requirements for collision avoidance, and technological advancements in radar frequency and resolution.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.