USA Baby Diapers Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD4186

December 2024

88

About the Report

USA Baby Diapers Market Overview

- The USA baby diapers market, valued at USD 17.4 billion, is primarily driven by increasing disposable incomes, a rising number of working parents, and heightened awareness of infant hygiene. These factors contribute to the growing demand for convenient and effective diaper solutions.

- Major urban centers such as New York City, Los Angeles, and Chicago dominate the market due to their large populations and higher birth rates. The concentration of affluent consumers in these cities further boosts the demand for premium and eco-friendly diaper products.

- Diaper imports and exports are subject to tariffs and trade regulations impacting product pricing and availability in the U.S. market. According to the U.S. International Trade Commission, tariffs on imported diapers range from 5% to 20%, depending on the country of origin. These tariffs influence production costs for companies importing materials, encouraging some brands to source domestically to mitigate these expenses.

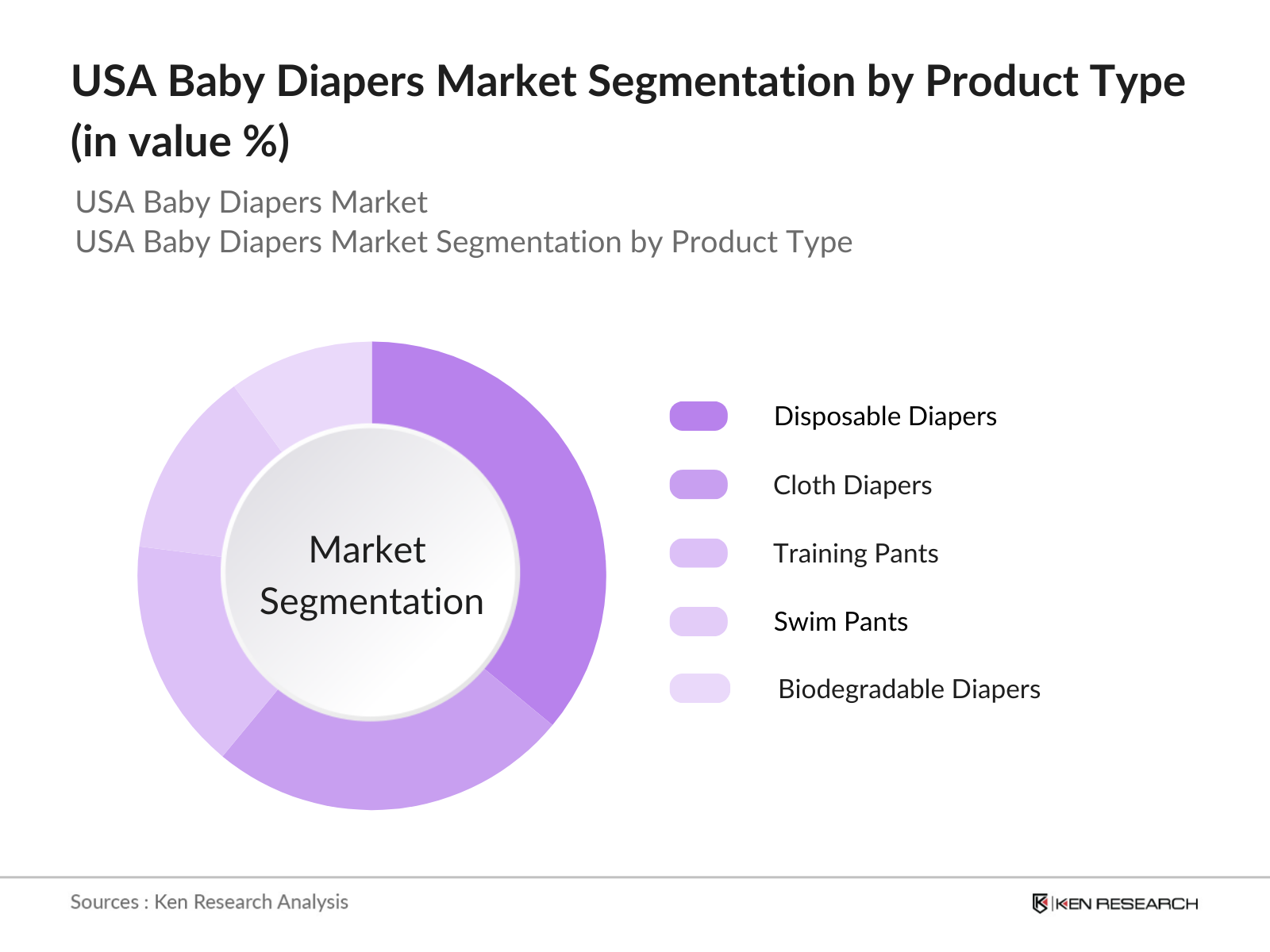

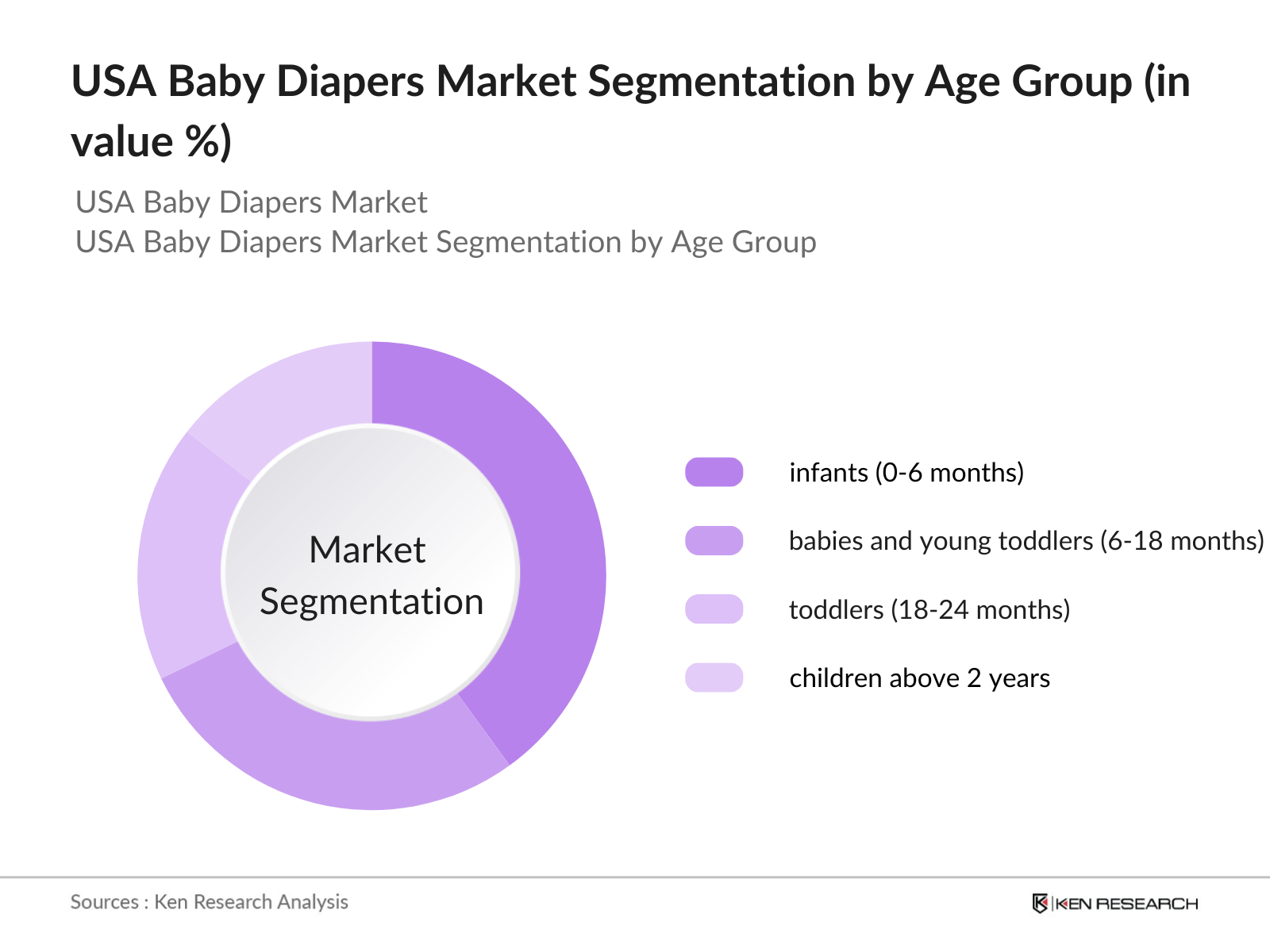

USA Baby Diapers Market Segmentation

By Product Type: The market is segmented by product type into disposable diapers, cloth diapers, training pants, swim pants, and biodegradable diapers. Disposable diapers hold a dominant market share due to their convenience and widespread availability. Brands like Pampers and Huggies have established strong brand loyalty over the years, contributing to the dominance of this segment.

By Age Group: The market is also segmented by age group into infants (0-6 months), babies and young toddlers (6-18 months), toddlers (18-24 months), and children above 2 years. The infants (0-6 months) segment holds a significant market share, as newborns require frequent diaper changes, leading to higher consumption rates. Parents prioritize comfort and protection for their newborns, driving demand in this segment.

USA Baby Diapers Market Competitive Landscape

The market is characterized by the presence of several key players, including Procter & Gamble Co., Kimberly-Clark Corporation, Johnson & Johnson, Unicharm Corporation, and Essity AB. These companies have established strong brand recognition and extensive distribution networks, enabling them to maintain significant market shares.

USA Baby Diapers Industry Analysis

Growth Drivers

- Rising Awareness of Hygiene: The increasing emphasis on infant hygiene in the U.S. reflects broader health and wellness trends driven by parent awareness and government health programs. In 2023, the U.S. Department of Health and Human Services reported over 3.6 million births, highlighting a substantial demand for baby hygiene products such as diapers. Studies show a marked shift in parental preferences for premium diaper options that ensure better skin protection and health. Additionally, a 2023 survey by the National Institute of Child Health and Human Development found that nearly 88% of parents consider hygiene a top priority in infant care.

- High Female Workforce Participation: With an estimated 74 million women in the workforce in 2023, nearly 10% of whom are new mothers, the U.S. sees a continued demand for disposable baby diapers that provide convenience to working parents. The Bureau of Labor Statistics highlights that 56% of mothers with infants participate in the workforce, a factor driving the sale of convenient hygiene products such as diapers. This trend has led to heightened demand for eco-friendly and premium diapers, as working parents seek products that are both practical and safe for infants.

- Product Innovation and Sustainable Materials: The U.S. diaper industry has seen an increase in the availability of products made from sustainable materials, driven by innovation. By 2024, over 20% of baby diaper brands offer plant-based or biodegradable diapers, according to EPA estimates, as consumers prioritize reducing their carbon footprint. In 2023, approximately 22% of parents reported purchasing eco-friendly diaper options, according to the U.S. Environmental Protection Agency, as companies adopt renewable materials like bamboo fiber.

Market Challenges

- Environmental Impact and Waste Management: The Environmental Protection Agency reported that disposable diapers contribute to 7.6 million tons of waste annually in the U.S., leading to landfill accumulation and environmental concerns. Despite the rise in sustainable diaper brands, waste management remains a significant challenge as only a small portion of these products are compostable or recyclable. With 3.6 million babies born each year in the U.S., reducing diaper waste becomes increasingly pressing. The current infrastructure for waste management lacks the capacity to handle the volume of disposable diapers generated each year.

- Brand Loyalty and Market Entrants: Brand loyalty presents a challenge for new entrants in the U.S. diaper market, as parents typically prefer established brands. According to a 2023 study by the Department of Commerce, 68% of parents continue to purchase from a single brand once they find a diaper that meets their needs. This preference creates a barrier for new brands attempting to establish a market presence, especially as established brands dominate retail spaces and online platforms. The difficulty for newer brands to secure shelf space compounds this challenge.

USA Baby Diapers Market Future Outlook

Over the next five years, the USA baby diapers market is expected to experience steady growth, driven by continuous product innovations, increasing consumer preference for eco-friendly products, and the expansion of e-commerce platforms. Manufacturers are likely to focus on developing biodegradable and organic diapers to cater to environmentally conscious consumers.

Future Market Opportunities

- Private Label and Economy Segment Growth: Private label brands, accounting for nearly 25% of diaper sales in 2023 according to the Bureau of Labor Statistics, reflect an opportunity for cost-effective solutions in the diaper market. As inflationary pressures impact household budgets, more parents are turning to economical diaper options, including store brands that offer quality at a lower price. The expansion of this segment offers a valuable market entry point for retailers and brands that can cater to budget-conscious consumers, especially given the price sensitivity of many U.S. households.

- Expanding Adoption of Subscription-Based Models: Subscription-based diaper services have seen a significant increase, with over 1 million U.S. families using such services in 2023, as per the U.S. Census Bureau. This model provides convenience and cost savings, appealing to parents seeking regular diaper delivery. Platforms offering subscriptions report higher retention rates due to the predictability of diaper needs, and brands like Hello Bello have tapped into this trend.

Scope of the Report

|

Product Type |

Disposable Diapers |

|

Age Group |

Infants (0-6 Months) |

|

Distribution Channel |

Supermarkets and Hypermarkets |

Products

Key Target Audience

Baby Diaper Manufacturers

Raw Material Suppliers

Retailers and Distributors

Healthcare Providers

Consumer Advocacy Groups

Environmental Organizations

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Food and Drug Administration)

Companies

Major Players

Procter & Gamble Co.

Kimberly-Clark Corporation

Johnson & Johnson

Unicharm Corporation

Essity AB

Kao Corporation

The Honest Company, Inc.

Ontex Group NV

First Quality Enterprises, Inc.

Domtar Corporation

Hengan International Group Company Ltd.

Drylock Technologies NV

Seventh Generation, Inc.

Bambo Nature USA

Earths Best (The Hain Celestial Group, Inc.)

Table of Contents

USA Baby Diapers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

USA Baby Diapers Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

USA Baby Diapers Market Analysis

3.1. Growth Drivers

3.1.1. Rising Birth Rates

3.1.2. Increasing Disposable Income

3.1.3. Urbanization Trends

3.1.4. Enhanced Awareness of Infant Hygiene

3.2. Market Challenges

3.2.1. Environmental Concerns Over Disposable Diapers

3.2.2. Fluctuating Raw Material Prices

3.2.3. Intense Market Competition

3.3. Opportunities

3.3.1. Growth in Eco-friendly and Biodegradable Diapers

3.3.2. Expansion in E-commerce Distribution Channels

3.3.3. Technological Innovations in Diaper Design

3.4. Trends

3.4.1. Adoption of Smart Diapers

3.4.2. Shift Towards Premium and Organic Products

3.4.3. Subscription-based Diaper Services

3.5. Government Regulations

3.5.1. Safety Standards for Baby Products

3.5.2. Environmental Policies on Waste Management

3.5.3. Import and Export Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

USA Baby Diapers Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Disposable Diapers

4.1.2. Cloth Diapers

4.1.3. Training Pants

4.1.4. Swim Pants

4.1.5. Biodegradable Diapers

4.2. By Age Group (In Value %)

4.2.1. Infants (0-6 Months)

4.2.2. Babies and Young Toddlers (6-18 Months)

4.2.3. Toddlers (18-24 Months)

4.2.4. Children Above 2 Years

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets and Hypermarkets

4.3.2. Convenience Stores

4.3.3. Pharmacy and Drug Stores

4.3.4. Online Retail Channels

4.3.5. Others

4.4. By Material Type (In Value %)

4.4.1. Conventional

4.4.2. Organic

4.5. By Price Range (In Value %)

4.5.1. Economy

4.5.2. Premium

USA Baby Diapers Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Procter & Gamble Co.

5.1.2. Kimberly-Clark Corporation

5.1.3. Johnson & Johnson

5.1.4. Unicharm Corporation

5.1.5. Essity AB

5.1.6. Kao Corporation

5.1.7. The Honest Company, Inc.

5.1.8. Ontex Group NV

5.1.9. First Quality Enterprises, Inc.

5.1.10. Domtar Corporation

5.1.11. Hengan International Group Company Ltd.

5.1.12. Drylock Technologies NV

5.1.13. Seventh Generation, Inc.

5.1.14. Bambo Nature USA

5.1.15. Earths Best (The Hain Celestial Group, Inc.)

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Distribution Network, R&D Investment, Sustainability Initiatives, Technological Innovations, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

USA Baby Diapers Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

USA Baby Diapers Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

USA Baby Diapers Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Age Group (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Material Type (In Value %)

8.5. By Price Range (In Value %)

USA Baby Diapers Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Baby Diapers Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA Baby Diapers Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple baby diaper manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Baby Diapers Market.

Frequently Asked Questions

01 How big is the USA Baby Diapers Market?

The USA baby diapers market is valued at USD 17.4 billion, driven by increasing disposable incomes, a rising number of working parents, and heightened awareness of infant hygiene.

02 What are the challenges in the USA Baby Diapers Market?

Challenges in the USA baby diapers market include environmental concerns over disposable diapers, fluctuating raw material prices, and intense market competition. Additionally, the declining birth rate in the USA poses a threat to market growth.

03 Who are the major players in the USA Baby Diapers Market?

Key players in the USA baby diapers market include Procter & Gamble Co., Kimberly-Clark Corporation, Johnson & Johnson, Unicharm Corporation, and Essity AB. These companies dominate due to their extensive distribution networks, strong brand presence, and diverse product portfolios.

04 What are the growth drivers of the USA Baby Diapers Market?

The USA baby diapers market is propelled by factors such as the rising disposable incomes, the growth of dual-income households, and a heightened awareness of infant hygiene. Additionally, the increasing availability of premium and eco-friendly diapers is boosting consumer preference and driving market growth.

05 What trends are shaping the USA Baby Diapers Market?

The USA baby diapers market is seeing trends such as the adoption of biodegradable and organic diapers, advancements in smart diapers, and the rise of subscription-based diaper services. These trends highlight the markets move toward convenience and environmental sustainability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.