USA Baby Food Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD11229

December 2024

89

About the Report

USA Baby Food Market Overview

- The USA baby food market is valued at USD 8.3 billion. This valuation is driven by growing consumer awareness around infant nutrition and increased demand for convenient, ready-to-consume baby food products. Factors such as rising disposable income and a preference for organic and natural ingredients contribute to the market's growth, with industry leaders focusing on quality, safety, and innovative formulations to meet the evolving needs of health-conscious parents.

- Major cities driving the market include New York, Los Angeles, and Chicago, where high-income levels, urban lifestyles, and significant retail penetration support the demand for premium and organic baby food products. Additionally, these metropolitan areas have higher awareness of health and nutrition, along with greater access to innovative baby food brands through diverse distribution channels, which consolidates their role in dominating market trends.

- In 2024, the U.S. government allocated an additional $300 million to the WIC program to improve access to nutritious baby food for low-income families. The expanded funding facilitated the inclusion of organic and allergen-free baby food options, making healthier choices available to approximately 9 million beneficiaries nationwide.

USA Baby Food Market Segmentation

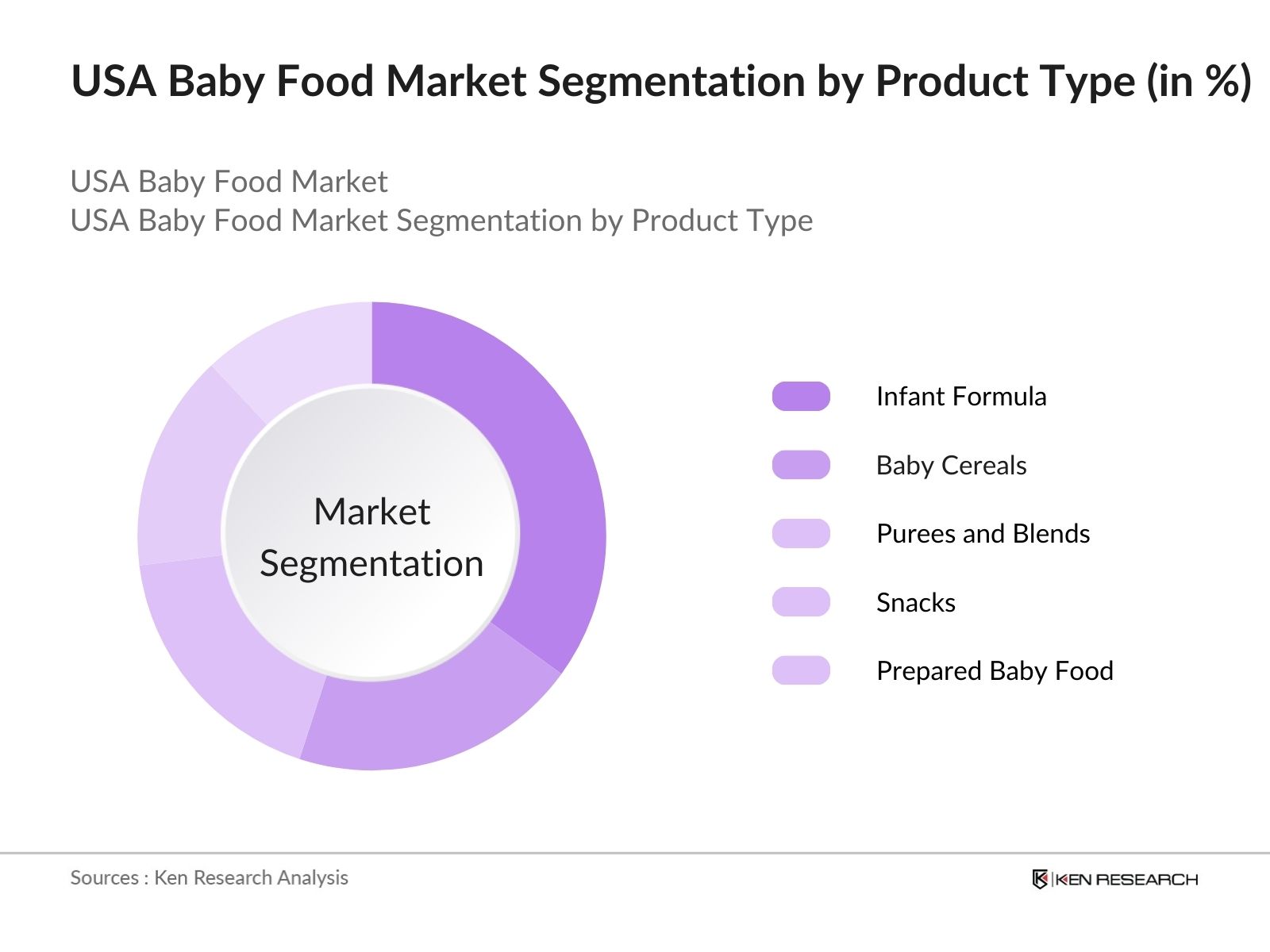

By Product Type: The market is segmented by product type into infant formula, baby cereals, purees and blends, snacks, and prepared baby food. Infant formula currently holds a dominant market share due to its convenience, nutritional value, and positioning as a substitute for breast milk. With brands like Similac and Enfamil leading the category, demand is sustained by busy, working parents who seek nutritionally balanced, safe alternatives to breastfeeding.

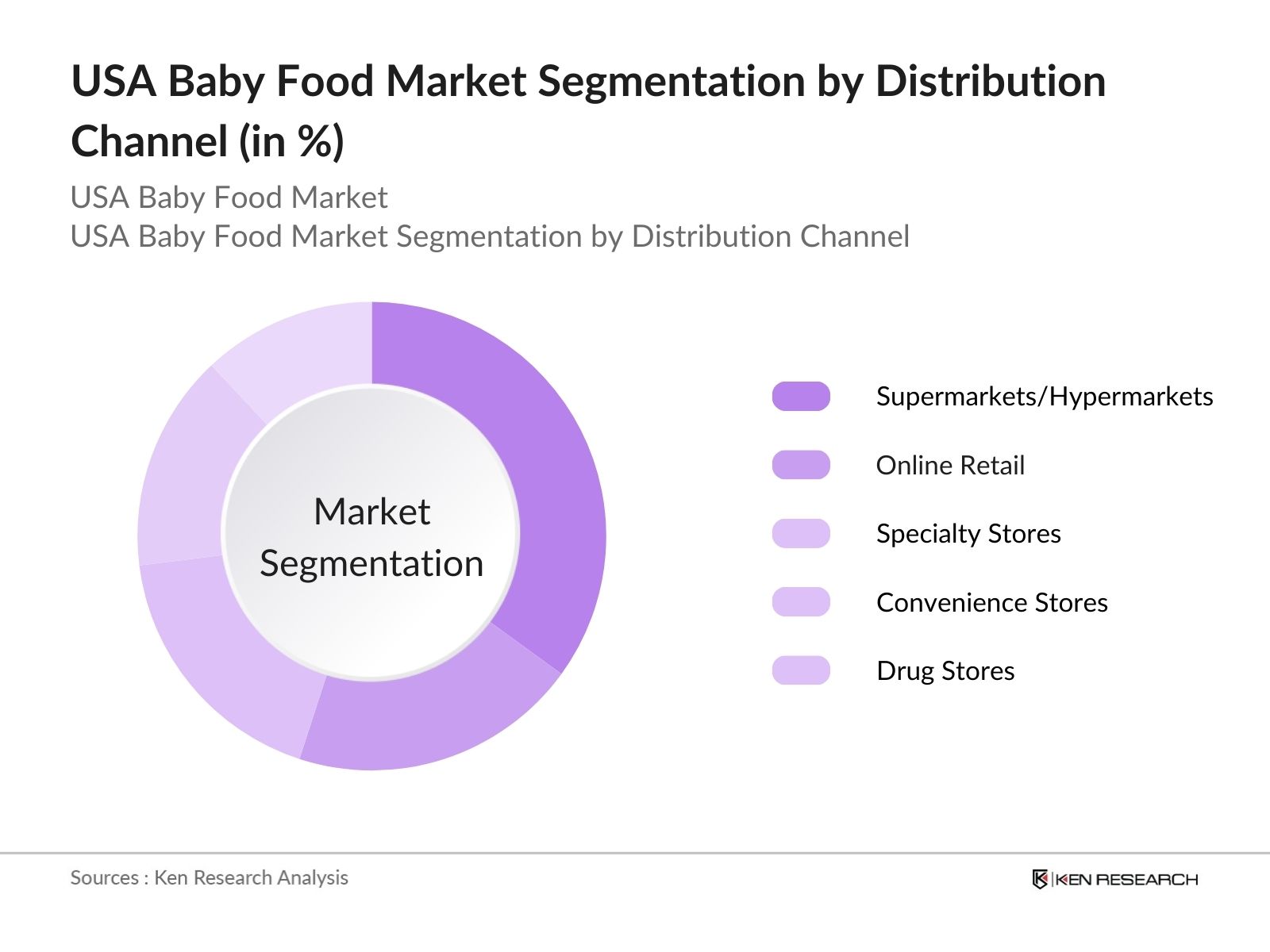

By Distribution Channel: The market is segmented by distribution channel into supermarkets/hypermarkets, online retail, specialty stores, convenience stores, and drug stores. Supermarkets/hypermarkets have a leading market share within the distribution channel segmentation due to their widespread reach, competitive pricing, and ability to provide a variety of options under one roof. Stores like Walmart and Target offer both premium and budget-friendly choices, catering to a wide demographic of parents.

USA Baby Food Market Competitive Landscape

The market is concentrated, with several prominent players contributing to a competitive landscape that prioritizes safety, quality, and product innovation. This consolidation highlights the impact and influence of these companies in shaping industry standards and trends.

USA Baby Food Market Analysis

Market Growth Drivers

- Increasing Awareness and Demand for Organic Baby Food: The demand for organic baby food has surged in the USA, with parents increasingly prioritizing food safety and health benefits. In 2024, the market saw the consumption of organic baby food rise by over 30 million units compared to non-organic options, according to USDA's data. This growth aligns with heightened awareness of the health implications of synthetic additives in traditional baby food, contributing to the organic baby food segment's expansion.

- Growth in Infant Population in Key Regions: As per U.S. Census Bureau data, the infant population in states like Texas, California, and Florida collectively surpassed 2.5 million in 2024, showing a steady annual growth rate. This increase in infant numbers has directly influenced the demand for baby food, as these states contribute substantially to the national consumption patterns, boosting the markets volume.

- Rising Concerns about Child Nutrition Deficiencies: The American Academy of Pediatrics has reported an increase in iron and vitamin deficiencies among infants, particularly in lower-income households, with around 1.8 million cases reported in 2023. As a result, there has been a shift toward fortified baby food options, with manufacturers increasingly introducing nutrient-enriched products to cater to parents concerned about fulfilling dietary requirements for their infants.

Market Challenges

- High Production Costs of Organic and Specialty Baby Food: The production of organic and allergen-free baby food requires stringent quality checks and certifications, resulting in higher manufacturing costs. In 2024, the average production cost for organic baby food was recorded at $3.4 per unit, nearly double that of non-organic options. This cost disparity limits the affordability for some consumer segments, constraining broader market penetration.

- Limited Shelf Life of Baby Food Products: According to industry data, baby food products have an average shelf life of just 6-12 months, impacting supply chain logistics and storage. Due to rapid spoilage, retailers reported a 15% product wastage rate in 2024, which adds to costs and lowers profitability for manufacturers, especially in the perishable, non-refrigerated categories.

USA Baby Food Market Future Outlook

Over the next five years, the USA baby food industry is projected to experience significant growth driven by rising consumer awareness around infant nutrition, advancements in organic product offerings, and increased online shopping convenience.

Future Market Opportunities

- Increasing Adoption of Plant-Based and Allergy-Free Baby Food: Over the next five years, plant-based baby food sales are expected to grow, with projections indicating that by 2028, this category will reach 100 million units annually. This shift will be driven by heightened awareness and increasing numbers of children with allergies, compelling manufacturers to innovate in allergen-free product offerings.

- Integration of Smart Packaging for Enhanced Consumer Engagement: By 2028, smart packaging solutions embedded with QR codes and tracking features will become more prevalent in the baby food market. These solutions are anticipated to enhance product transparency and traceability, allowing parents to verify ingredient sourcing and manufacturing practices, thus increasing trust in baby food brands.

Scope of the Report

|

Product Type |

Infant Formula Baby Cereals Purees and Blends Snacks Prepared Baby Food |

|

Distribution Channel |

Supermarkets/Hypermarkets Online Retail Specialty Stores Convenience Stores Drug Stores |

|

Ingredient Type |

Organic Ingredients Conventional Ingredients Plant-Based Ingredients |

|

Form |

Powder Liquid Ready-to-Eat |

|

Age Group |

0-6 Months 6-12 Months 1-2 Years 2-3 Years |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Baby Food Manufacturers

Organic Ingredient Suppliers

Packaging Solution Providers

Retail and E-commerce Platforms

Pediatric and Health Care Organizations

Non-Governmental Health Organizations

Companies

Players Mentioned in the Report:

Nestle SA

Abbott Nutrition

The Kraft Heinz Company

Danone

Reckitt Benckiser Group plc

Hero Group

Beech-Nut Nutrition Company

Plum Organics

Happy Family Organics

Gerber (owned by Nestle)

Table of Contents

1. USA Baby Food Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Baby Food Market Size (in USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Developments and Milestones

3. USA Baby Food Market Dynamics

3.1 Growth Drivers

3.1.1 Increasing Focus on Infant Nutrition

3.1.2 Rise in Disposable Income

3.1.3 Increasing Awareness of Organic Products

3.1.4 Expanding Online Retailing of Baby Food

3.2 Market Challenges

3.2.1 High Price of Premium Baby Foods

3.2.2 Stringent Regulatory Standards

3.2.3 Supply Chain Issues in Baby Food

3.3 Opportunities

3.3.1 Innovations in Organic and Natural Baby Food

3.3.2 Growth of Plant-Based Baby Foods

3.3.3 Expansion into Non-Traditional Retail Channels

3.4 Market Trends

3.4.1 Increased Demand for Ready-to-Feed Formula

3.4.2 Shift Toward Transparent and Clean Labeling

3.4.3 Growth in Baby Food Subscription Services

3.5 Regulatory Environment

3.5.1 FDA Guidelines on Baby Food Safety

3.5.2 Nutritional Labeling Requirements

3.5.3 Regulations on Heavy Metal Content

3.6 SWOT Analysis

3.7 Value Chain Analysis

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. USA Baby Food Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Infant Formula

4.1.2 Baby Cereals

4.1.3 Purees and Blends

4.1.4 Snacks

4.1.5 Prepared Baby Food

4.2 By Distribution Channel (in Value %)

4.2.1 Supermarkets/Hypermarkets

4.2.2 Online Retail

4.2.3 Specialty Stores

4.2.4 Convenience Stores

4.2.5 Drug Stores

4.3 By Ingredient Type (in Value %)

4.3.1 Organic Ingredients

4.3.2 Conventional Ingredients

4.3.3 Plant-Based Ingredients

4.4 By Form (in Value %)

4.4.1 Powder

4.4.2 Liquid

4.4.3 Ready-to-Eat

4.5 By Age Group (in Value %)

4.5.1 0-6 Months

4.5.2 6-12 Months

4.5.3 1-2 Years

4.5.4 2-3 Years

4.6 By Region (in Value %)

North

East

West

South

5. USA Baby Food Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Nestle SA

5.1.2 Danone

5.1.3 Abbott Nutrition

5.1.4 The Kraft Heinz Company

5.1.5 Reckitt Benckiser Group plc

5.1.6 Hero Group

5.1.7 Beech-Nut Nutrition Company

5.1.8 Plum Organics

5.1.9 Happy Family Organics

5.1.10 Gerber (owned by Nestle)

5.1.11 Earth's Best (owned by Hain Celestial)

5.1.12 Little Spoon

5.1.13 Once Upon a Farm

5.1.14 Cerebelly

5.1.15 Yumi

5.2 Cross Comparison Parameters (Market Share, Product Portfolio Diversity, Geographical Presence, Production Facilities, Innovation Investment, Product Recall Frequency, Ingredient Sourcing Practices, Environmental Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. USA Baby Food Market Regulatory Framework

6.1 FDA Standards and Requirements

6.2 Nutrition and Safety Compliance

6.3 Labeling and Packaging Standards

6.4 Organic Certification Requirements

7. USA Baby Food Future Market Size (in USD Billion)

7.1 Market Size Projections

7.2 Key Factors Influencing Future Growth

8. USA Baby Food Future Market Segmentation

8.1 By Product Type (in Value %)

8.2 By Distribution Channel (in Value %)

8.3 By Ingredient Type (in Value %)

8.4 By Form (in Value %)

8.5 By Age Group (in Value %)

8.6 By Region (in Value %)

9. USA Baby Food Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Cohort Analysis

9.3 Marketing Strategy Initiatives

9.4 Unmet Market Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins by mapping the ecosystem of stakeholders in the USA Baby Food Market, which includes major producers, retailers, and regulatory agencies. Primary objectives are to identify variables influencing market dynamics, utilizing both secondary sources and proprietary data.

Step 2: Market Analysis and Construction

In this phase, historical market data is assessed, analyzing factors like consumer buying patterns, infant formula market penetration, and category-specific growth drivers. This provides a foundation for reliable market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are established and validated through interviews with industry experts, allowing for real-time insights on market dynamics and operational factors, enhancing the accuracy of data and projections.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing insights gained from direct discussions with baby food manufacturers. This step ensures that the market analysis is comprehensive and incorporates perspectives on product innovation, consumer preferences, and regulatory impacts.

Frequently Asked Questions

01. How big is the USA Baby Food Market?

The USA baby food market was valued at USD 8.3 billion, reflecting strong growth influenced by consumer demand for convenient, nutrition-rich products.

02. What are the key growth drivers in the USA Baby Food Market?

Growth drivers in the USA baby food market include increasing awareness of infant nutrition, a rise in dual-income households, and the expansion of organic and specialty baby food products in the USA market.

03. What are the major challenges faced by the USA Baby Food Market?

Challenges in the USA baby food market include stringent FDA regulations, high production costs for organic offerings, and the need for consistent supply chain management to ensure product safety.

04. Who are the dominant players in the USA Baby Food Market?

Key players in the USA baby food market include Nestle SA, Abbott Nutrition, The Kraft Heinz Company, Danone, and Reckitt Benckiser Group plc, each with extensive product portfolios and robust distribution networks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.