USA Bakery Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD3727

December 2024

86

About the Report

USA Bakery Market Overview

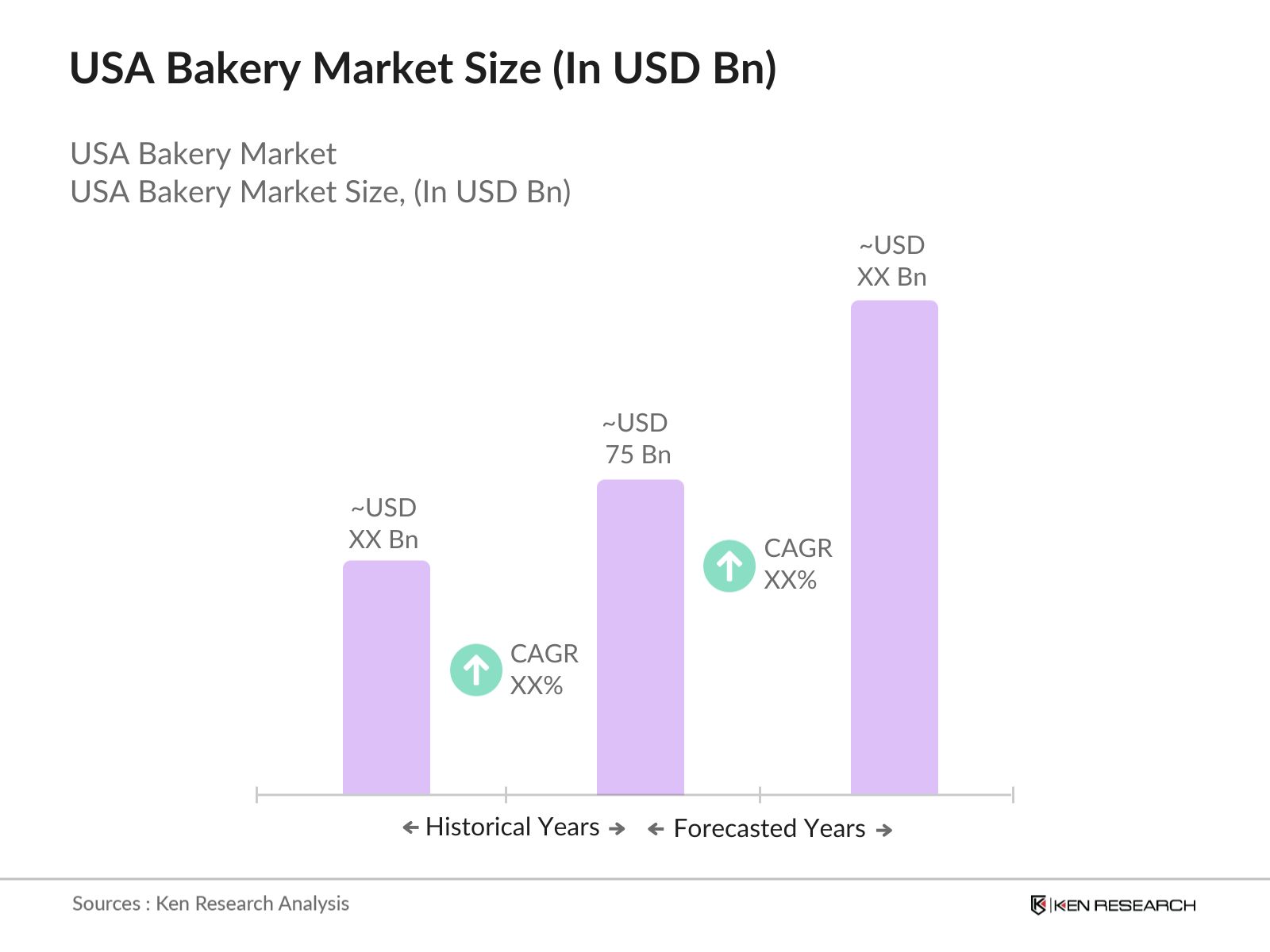

- The USA Bakery market is valued at USD 75 billion based on a comprehensive analysis of market growth over the past five years. This growth is largely driven by the rising demand for fresh and artisanal bakery products, coupled with an increasing consumer focus on health-conscious options such as gluten-free and organic baked goods. The surge in online sales and home deliveries of bakery items also contributes to the expansion of the market, providing significant convenience to consumers.

- The dominance of metropolitan areas such as New York, Los Angeles, and Chicago in the bakery market can be attributed to the high population density, diverse cultural influences, and thriving foodservice industries in these regions. The presence of affluent consumers willing to spend on premium bakery products, coupled with the high number of artisanal bakeries and cafes, further strengthens their dominance in the market.

- The use of sustainable ingredients in baking is becoming a major trend. Over 4,000 U.S. bakeries have indeed adopted sustainable practices, including sourcing ingredients like organic flour and ethically produced sugar. This trend is largely influenced by consumer preferences for environmentally responsible products. The push for sustainability is multifaceted, with two-thirds of Americans expressing that sustainability matters to them, although it influences purchasing decisions for only about one in five consumers.

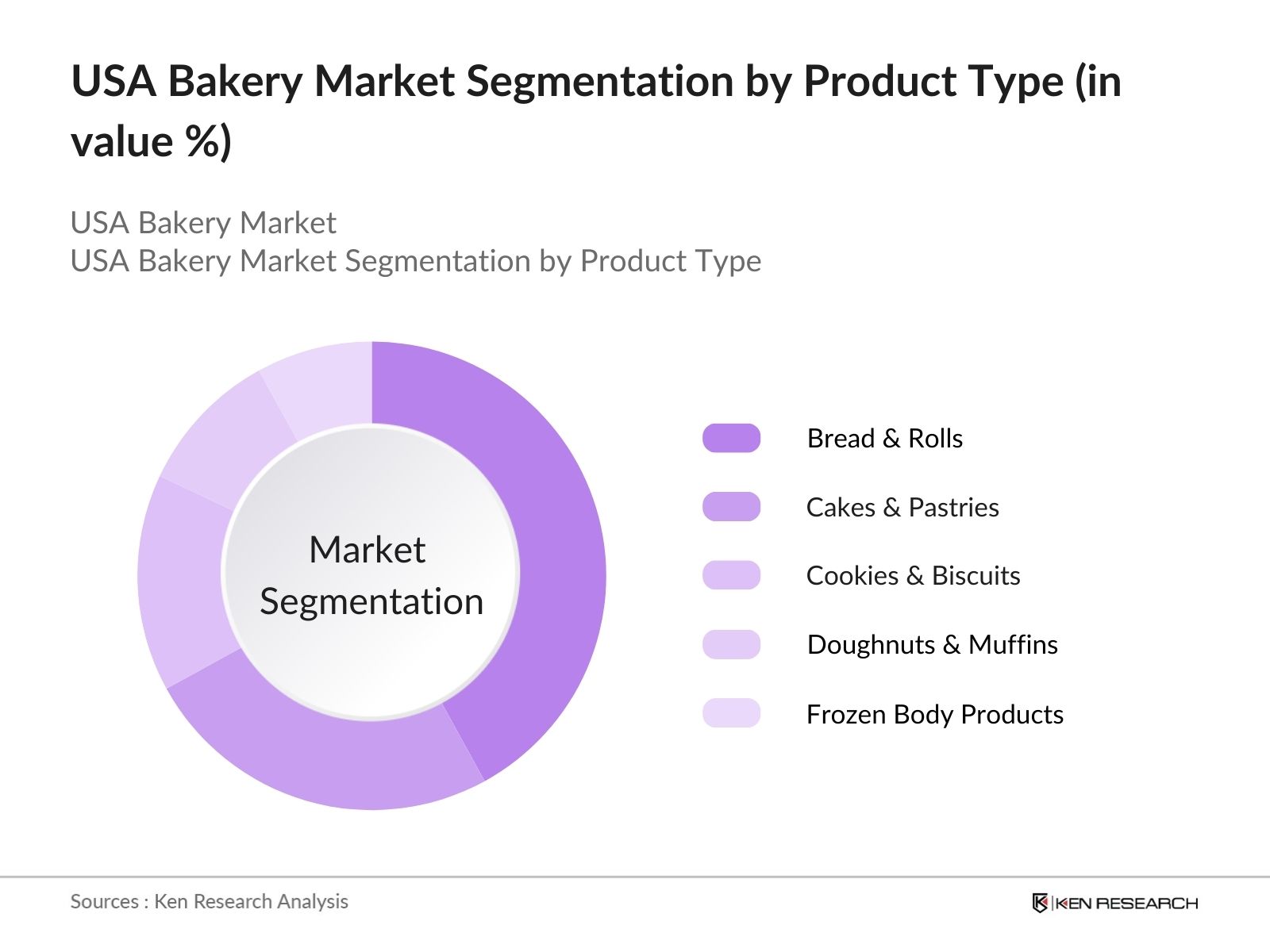

USA Bakery Market Segmentation

By Product Type: The USA Bakery market is segmented by product type into bread and rolls, cakes and pastries, cookies and biscuits, doughnuts and muffins, and frozen bakery products. Among these, bread and rolls dominate the market due to their staple status in American diets. Their versatility, ranging from sandwich bread to artisan rolls, ensures a continuous demand. The growth of health-conscious consumers opting for whole grain and organic bread varieties also boosts this segment, making it the most prominent in the product category.

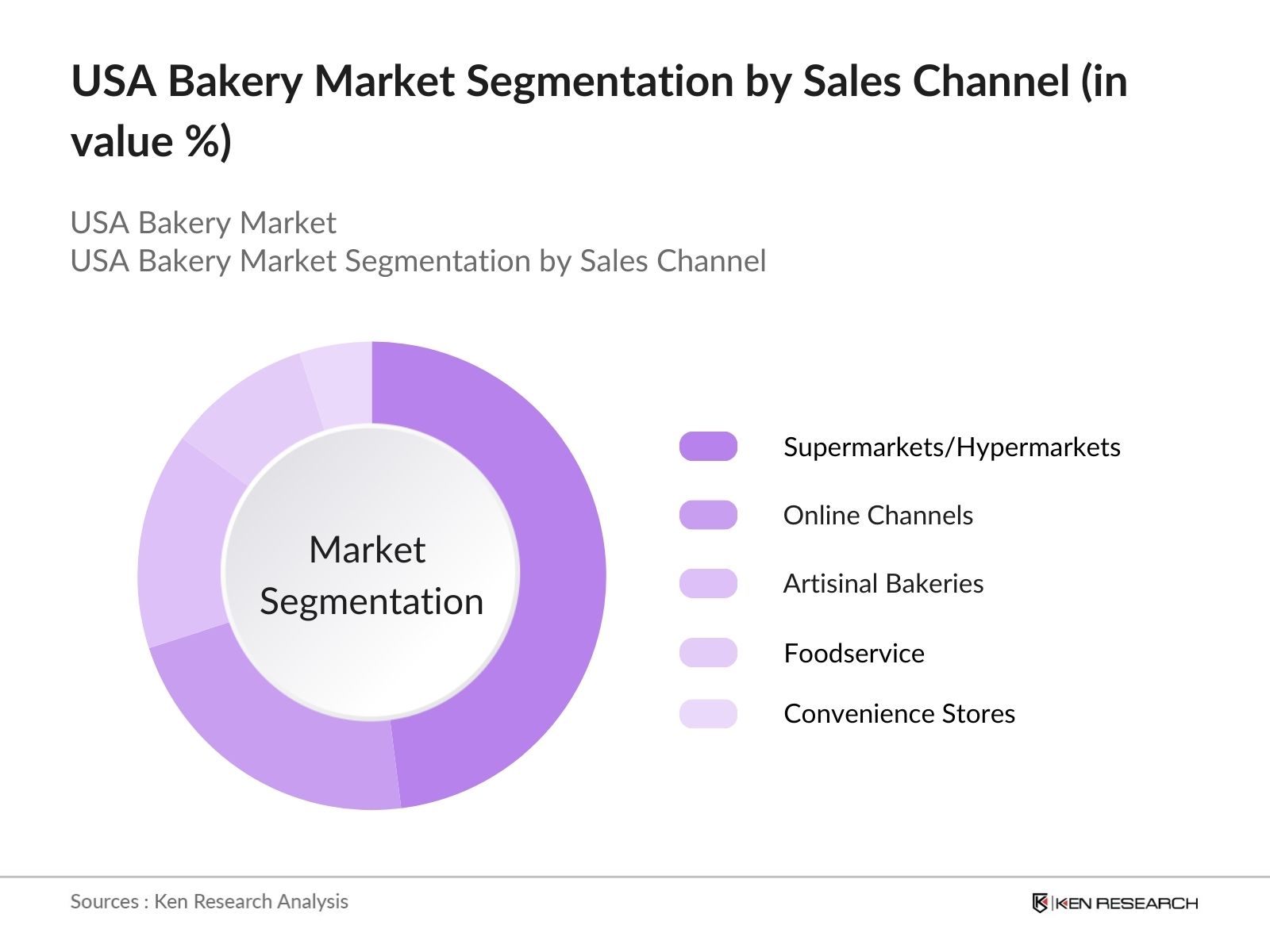

By Sales Channel: The USA Bakery market is also segmented by sales channel into supermarkets/hypermarkets, online channels, artisan bakeries, foodservice, and convenience stores. Supermarkets and hypermarkets dominate this segment due to their widespread presence and variety of offerings. They provide consumers with easy access to both mass-produced and artisanal bakery products. Moreover, many supermarkets have integrated in-house bakeries, further cementing their position as a key distribution channel.

USA Bakery Market Competitive Landscape

The USA Bakery market is dominated by a few major players with both local and global presence. Companies like Grupo Bimbo and Flowers Foods have established strong footholds in the market, thanks to their extensive distribution networks and product portfolios. The market remains competitive, with companies continuously innovating through new product launches and health-conscious alternatives.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Employees |

Product Portfolio |

Market Strategy |

Innovation |

Distribution Network |

|

Grupo Bimbo |

1945 |

Mexico City, Mexico |

- | - | - | - | - | - |

|

Flowers Foods |

1919 |

Thomasville, USA |

- | - | - | - | - | - |

|

Campbell Soup Company |

1869 |

Camden, USA |

- | - | - | - | - | - |

|

Aryzta AG |

1897 |

Zurich, Switzerland |

- | - | - | - | - | - |

|

Hostess Brands |

1919 |

Kansas City, USA |

- | - | - | - | - | - |

USA Bakery Market Analysis

Growth Drivers

- Shift Towards Health-Conscious Baking: Health-conscious consumers in the U.S. bakery market have driven a significant shift towards healthier options such as low-sugar, high-fiber products. U.S. bakery sales reflect increasing demand for whole grains, with more than 2,500 bakeries now focusing on nutritious options across the country. The Whole Grains Council notes significant growth in several categories of whole grain products, including a 7.4% increase in whole grain bread and baked foods.

- Rise in Demand for Gluten-Free and Vegan Options: The rise in demand for gluten-free and vegan bakery products is evident in the growing number of establishments offering these options. As of 2023, over 3,000 U.S. bakeries now cater to gluten-free preferences, with vegan bakeries reaching around 1,500. Public health campaigns promoting plant-based diets also contribute to this surge.

- Increasing Popularity of Specialty Bakeries: Specialty bakeries offering niche products, such as custom cakes and regional specialties, have gained popularity. The specialty bakery sector experienced a growth of 2.45% in 2022, reflecting consumer interest in healthier and innovative baked goods, such as gluten-free and organic options. Reports from the U.S. Department of Commerce highlight that 25% of these bakeries focus on organic and sustainable ingredients, addressing consumer preferences for authenticity and uniqueness in baked goods.

Market Challenges

- Fluctuating Prices of Key Ingredients: The cost of essential baking ingredients, such as flour, sugar, and butter, has fluctuated significantly in recent years. As of September 2023, the U.S. season-average farm price for wheat is forecast at $7.50 per bushel, down from $8.83 in 2022/23. This volatility affects bakery profit margins, with smaller businesses feeling the impact the most. Moreover, the U.S. reliance on imported sugar, which amounted to 3.1 million metric tons in 2022, further complicates the cost structure.

- Supply Chain Issues Impacting Freshness: Supply chain disruptions have particularly affected the freshness of bakery products. Common causes of shipping delays in 2023 like labor shortages, public holidays, weather conditions, and supply chain disruptions. These delays have led to reduced product shelf life and wastage, increasing operational costs for bakeries relying on fresh ingredients. Supply chain disruptions have become one of the most significant hurdles for maintaining product quality.

USA Bakery Market Future Outlook

Over the next five years, the USA Bakery market is expected to experience significant growth driven by several factors. These include rising consumer demand for healthy and premium bakery options, advancements in production technology, and the increasing prevalence of e-commerce channels. As consumers become more health-conscious, the market will likely see a surge in demand for gluten-free, vegan, and organic bakery products, offering new growth avenues for manufacturers and distributors.

Market Opportunities

- Growth in Functional Bakery Products: The demand for functional bakery products has surged, with ingredients like chia seeds, probiotics, and high-fiber grains becoming key additions to bread and pastries. In 2023, functional bakery products accounted for nearly 18% of total bakery sales in the U.S. With consumer interest in foods that offer health benefits beyond basic nutrition growing, there is significant potential for the development of more functional bakery products.

- Expansion into New Demographics and Global Markets: Bakeries in the U.S. are expanding into new demographics, including younger, health-conscious consumers. Additionally, U.S. bakeries are increasingly exporting their products to international markets, with $2.6 billion in bakery exports reported in 2023. This expansion into global markets has provided U.S. bakeries with new avenues for growth.

Scope of the Report

|

By Product Type |

Bread and Rolls Cakes and Pastries Cookies and Biscuits Doughnuts and Muffins Frozen Bakery Products |

|

By Sales Channel |

Supermarkets/Hypermarkets Online Channels Artisan Bakeries Food Service Convenience Stores |

|

By Ingredient Type |

Wheat Flour Whole Grains Organic and Natural Ingredients Gluten-Free Ingredients |

|

By Consumer Type |

Retail Consumers Foodservice Providers Institutional Buyers |

|

By Region |

North-East Midwest South West |

Products

Key Target Audience

Bakery Product Manufacturers

Foodservice Providers

Large Bakery Manufacturers

Food & Beverage Companies

Bakery Equipment Manufacturers

E-commerce Platforms

Government and Regulatory Bodies (FDA, USDA)

Investment and Venture Capital Firms

Companies

Major Players

Grupo Bimbo

Flowers Foods

Campbell Soup Company

Aryzta AG

Hostess Brands

Dawn Foods

McKee Foods

King's Hawaiian

Panera Bread

Starbucks Corporation

Mondelez International

Krispy Kreme

Tasty Baking Company

La Brea Bakery

George Weston Limited

Table of Contents

1. USA Bakery Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Bakery Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Bakery Market Analysis

3.1 Growth Drivers

3.1.1 Shift Towards Health-Conscious Baking

3.1.2 Rise in Demand for Gluten-Free and Vegan Options

3.1.3 Increasing Popularity of Specialty Bakeries

3.1.4 Growth in E-commerce for Bakery Products

3.2 Market Challenges

3.2.1 Fluctuating Prices of Key Ingredients

3.2.2 Lack of Skilled Bakers

3.2.3 Supply Chain Issues Impacting Freshness

3.2.4 Increasing Competition from Packaged Foods

3.3 Opportunities

3.3.1 Growth in Functional Bakery Products

3.3.2 Development of Frozen Bakery Products for Convenience

3.3.3 Expansion into New Demographics and Global Markets

3.4 Trends

3.4.1 Use of Sustainable Ingredients

3.4.2 Rising Popularity of Online and Subscription-based Bakeries

3.4.3 Automation in Large-Scale Baking

3.4.4 Increased Collaboration with Food Delivery Services

3.5 Government Regulation

3.5.1 Nutritional Label Requirements

3.5.2 Compliance with FDA Food Safety Standards

3.5.3 Government Programs Supporting Small-Scale Bakeries

3.5.4 Impact of Trade Tariffs on Imported Ingredients

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Ecosystem

4. USA Bakery Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Bread and Rolls

4.1.2 Cakes and Pastries

4.1.3 Cookies and Biscuits

4.1.4 Doughnuts and Muffins

4.1.5 Frozen Bakery Products

4.2 By Sales Channel (In Value %)

4.2.1 Supermarkets/Hypermarkets

4.2.2 Online Channels

4.2.3 Artisan Bakeries

4.2.4 Food Service

4.2.5 Convenience Stores

4.3 By Ingredient Type (In Value %)

4.3.1 Wheat Flour

4.3.2 Whole Grains

4.3.3 Organic and Natural Ingredients

4.3.4 Gluten-Free Ingredients

4.4 By Consumer Type (In Value %)

4.4.1 Retail Consumers

4.4.2 Foodservice Providers

4.4.3 Institutional Buyers

4.5 By Region (In Value %)

4.5.1 North-East

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Bakery Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Grupo Bimbo

5.1.2 Flowers Foods

5.1.3 Campbell Soup Company (Pepperidge Farm)

5.1.4 Aryzta AG

5.1.5 Hostess Brands

5.1.6 Dawn Foods

5.1.7 McKee Foods

5.1.8 Kings Hawaiian

5.1.9 Panera Bread

5.1.10 Starbucks Corporation (Bakery Segment)

5.1.11 Mondelez International (Nabisco)

5.1.12 Krispy Kreme

5.1.13 Tasty Baking Company

5.1.14 La Brea Bakery

5.1.15 George Weston Limited

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Innovation)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity Investments

5.8 Government Grants and Support Programs

6. USA Bakery Market Regulatory Framework

6.1 USDA Guidelines

6.2 FDA Compliance for Bakery Goods

6.3 Import and Export Regulations for Bakery Ingredients

7. USA Bakery Future Market Size (In USD Bn)

7.1 Future Market Projections

7.2 Key Factors Driving Future Market Growth

8. USA Bakery Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Sales Channel (In Value %)

8.3 By Ingredient Type (In Value %)

8.4 By Consumer Type (In Value %)

8.5 By Region (In Value %)

9. USA Bakery Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Market Penetration Strategies

9.4 White Space Opportunity Analysis

10. Disclaimer

11. Contact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involved mapping all the key stakeholders within the USA Bakery market through a mix of secondary and proprietary research. We identified critical market drivers, such as rising health-consciousness and consumer demand for artisanal products, along with evaluating key growth barriers like supply chain disruptions and ingredient costs.

Step 2: Market Analysis and Construction

In this step, historical data from industry reports was assessed, covering aspects such as market penetration and the sales performance of various bakery products. Additionally, metrics on consumer preferences were integrated to form a reliable revenue model for the market.

Step 3: Hypothesis Validation and Expert Consultation

Our hypotheses on market growth and trends were validated via expert consultations, including interviews with bakery manufacturers, distributors, and foodservice providers. This feedback helped refine our market projections and offered valuable insights into consumer behavior.

Step 4: Research Synthesis and Final Output

After synthesizing data from both top-down and bottom-up approaches, we engaged bakery product manufacturers to cross-verify the market estimates. This step ensured a well-rounded, reliable analysis of the USA Bakery market, leading to an accurate forecast for the coming years.

Frequently Asked Questions

01. How big is the USA Bakery Market?

The USA Bakery market is valued at USD 75 billion, driven by consumer demand for fresh and artisanal products, as well as growth in the online bakery sales sector.

02. What are the challenges in the USA Bakery Market?

Challenges include rising costs of key ingredients like wheat and sugar, labor shortages in the bakery industry, and supply chain disruptions impacting product freshness and availability.

03. Who are the major players in the USA Bakery Market?

Key players include Grupo Bimbo, Flowers Foods, Campbell Soup Company, Aryzta AG, and Hostess Brands. These companies dominate the market through strong distribution networks, product innovation, and global presence.

04. What are the growth drivers of the USA Bakery Market?

Growth drivers include increasing consumer interest in health-conscious bakery products, demand for gluten-free and organic offerings, and the convenience of online sales channels.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.