USA Beverage Cans Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD7945

December 2024

93

About the Report

USA Beverage Cans Market Overview

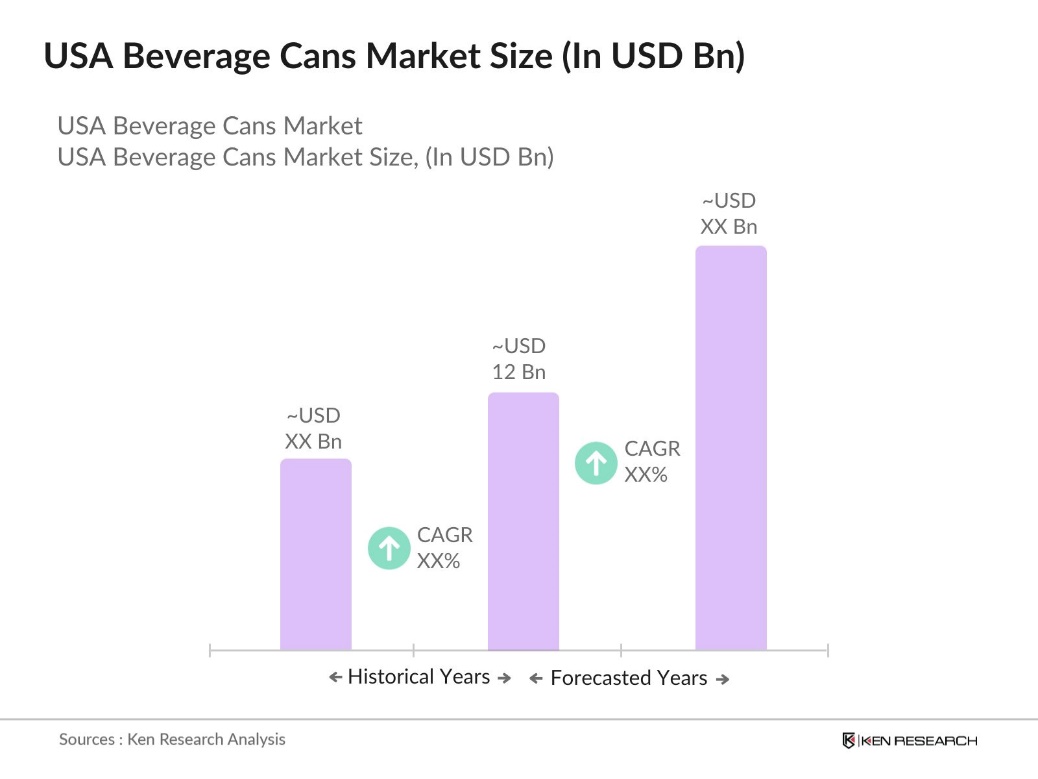

- The USA Beverage Cans Market is valued at USD 12 billion, based on a five-year historical analysis. The market is primarily driven by the increasing demand for sustainable packaging solutions, especially with a rising consumer preference for aluminum cans over plastic alternatives due to their recyclability. Growth is further fueled by innovations in the beverage industry, including the growing popularity of ready-to-drink (RTD) beverages such as energy drinks and sparkling water, alongside traditional soft drinks and alcoholic beverages.

- The dominant regions in the USA Beverage Cans Market include cities like Los Angeles, Chicago, and New York, driven by the concentration of beverage manufacturing hubs and high consumer demand for canned products. These cities benefit from strong infrastructure, easy access to raw materials, and proximity to major markets. Californias strict environmental regulations also push manufacturers toward eco-friendly packaging solutions like aluminum cans, contributing to their dominance in the market.

- The Food and Drug Administration (FDA) sets strict guidelines for materials used in food and beverage packaging to ensure consumer safety. In 2023, the FDA reaffirmed its regulations on the use of BPA-free linings in aluminum cans, affecting manufacturers' production processes. Compliance with these regulations is critical for beverage can producers in the U.S., as failure to adhere to safety standards could result in product recalls and legal penalties.

USA Beverage Cans Market Segmentation

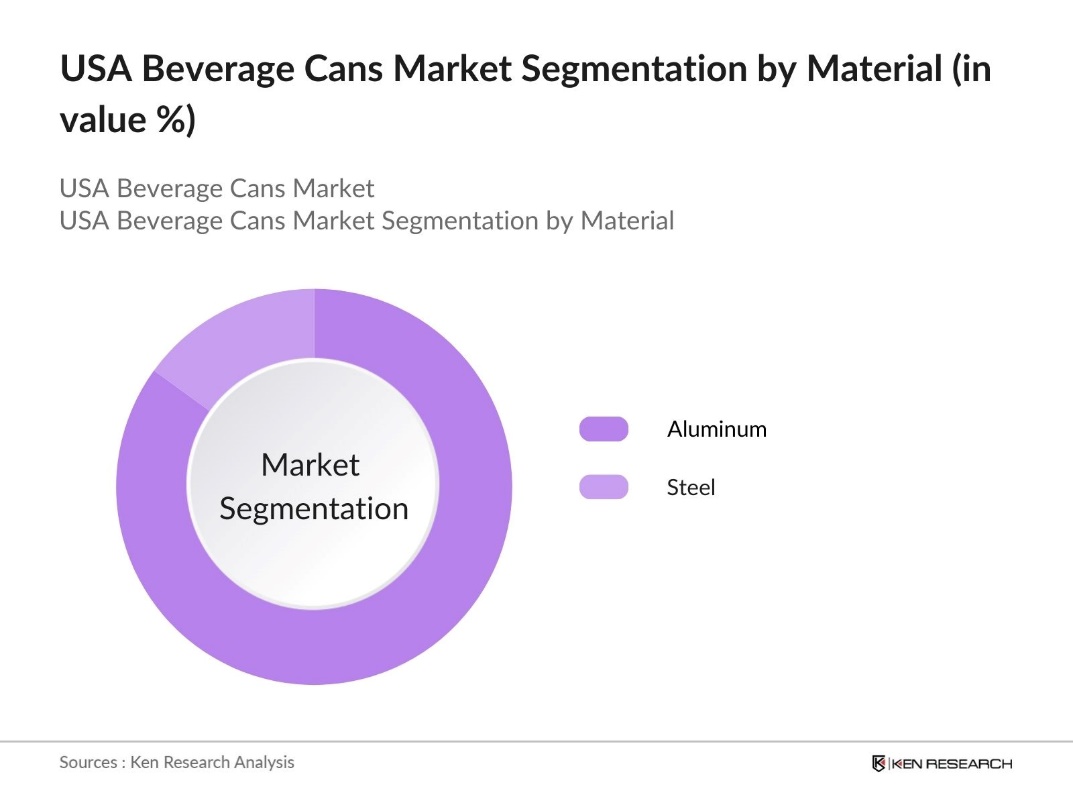

By Material: The USA Beverage Cans Market is segmented by material into aluminum and steel cans. Aluminum cans dominate this segment due to their lightweight nature and superior recyclability, making them the material of choice for both manufacturers and consumers. The widespread adoption of aluminum cans in the beverage industry is driven by their lower transportation costs and compliance with environmental regulations.

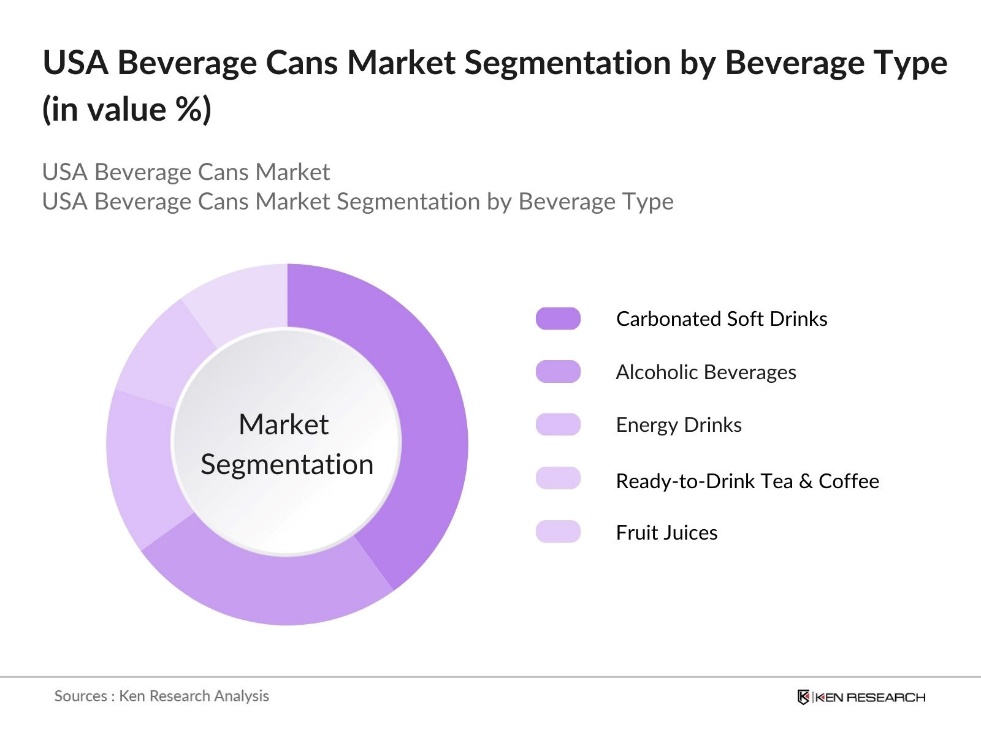

By Beverage Type: The USA Beverage Cans Market is segmented by beverage type into carbonated soft drinks, alcoholic beverages, energy drinks, ready-to-drink tea & coffee, and fruit juices. Carbonated soft drinks maintain the largest market share due to their entrenched consumer base and the significant marketing efforts of major brands like Coca-Cola and Pepsi. The long-standing consumer loyalty to these brands, coupled with their aggressive promotions, has kept carbonated drinks at the top of the beverage category.

USA Beverage Cans Market Competitive Landscape

The market is dominated by a few key players, with global giants and domestic manufacturers leading the industry. Companies like Ball Corporation and Crown Holdings have significant market shares, driven by their strong production capabilities, technological innovations, and sustainability initiatives. The market is characterized by fierce competition, with manufacturers constantly innovating in can design and sustainability practices.

|

Company |

Establishment Year |

Headquarters |

Production Capacity |

Revenue (USD Bn) |

Sustainability Programs |

Number of Plants |

Global Presence |

Recent Acquisitions |

Innovations |

|

Ball Corporation |

1880 |

Broomfield, CO |

|||||||

|

Crown Holdings |

1892 |

Yardley, PA |

|||||||

|

Ardagh Group |

1932 |

Dublin, Ireland |

|||||||

|

CANPACK Group |

1992 |

Krakw, Poland |

|||||||

|

Silgan Containers |

1987 |

Stamford, CT |

USA Beverage Cans Industry Analysis

Growth Drivers

- Rising Demand for Sustainable Packaging Solutions: Sustainability trends are reshaping the beverage cans market. A survey of U.S. consumers reported 84 percent as saying they expect products and packages to be easy to recycle and made with recycled content. Also, in a recent survey, 60 percent of consumers said they want non-plastic packaging. The aluminum cans being recycled, consumers are increasingly choosing aluminum over plastic, driven by sustainability concerns.

- Growing Preference for Aluminum over Plastic: Aluminum is becoming the preferred packaging material for beverages in the U.S. due to its recyclability and environmental benefits. The Aluminum Association has indicated that more than 70% of aluminum beverage cans are recycled. This has led to a strong consumer preference for aluminum over plastic packaging, as brands and consumers alike focus on reducing their carbon footprint.

- Expanding Beverage Categories (RTD Beverages, Sparkling Water, Energy Drinks): The beverage cans market is growing as ready-to-drink (RTD) beverages, sparkling water, and energy drinks gain popularity. Aluminum cans are favored for their durability, shelf life, and branding opportunities, making them ideal for a wider variety of beverages. This shift toward diverse, health-oriented drinks has pushed manufacturers to increasingly use cans to meet evolving consumer preferences.

Market Challenges

- High Energy Requirements for Aluminum Production: Aluminum can production is highly energy-intensive, presenting challenges as energy costs fluctuate. The smelting process requires substantial energy, making manufacturers vulnerable to rising energy prices. This adds pressure on production costs, especially in regions with high energy rates, impacting profitability for can manufacturers.

- Raw Material Price Volatility (Aluminum Price Fluctuations): Aluminum prices are subject to global market fluctuations, affecting the cost of producing beverage cans. Volatile raw material costs create uncertainty for manufacturers, making it difficult to predict long-term expenses. Price swings can strain profit margins and complicate contracts with beverage companies, impacting overall production stability.

USA Beverage Cans Market Future Outlook

The USA Beverage Cans Market is expected to experience steady growth over the next five years, driven by continued demand for sustainable and eco-friendly packaging. Consumer awareness regarding the environmental benefits of aluminum recycling, combined with government regulations aimed at reducing plastic usage, will further boost the adoption of aluminum cans in various beverage segments. Additionally, advancements in can design, such as resealable and lightweight cans, are anticipated to attract more beverage manufacturers and consumers.

Market Opportunities

- Lightweighting of Beverage Cans: Technological advancements in the lightweighting of aluminum cans offer manufacturers the ability to reduce material usage while maintaining strength and durability. This results in lower production costs and enhances sustainability by minimizing resource consumption. Additionally, lighter cans reduce shipping expenses, benefiting manufacturers and distributors alike. The trend toward lightweight cans supports both environmental goals and operational efficiency, making it an attractive opportunity for companies in the beverage industry.

- Innovations in Can Design (Resealable, Hybrid Materials): Innovations such as resealable cans and hybrid materials are opening new avenues for beverage brands. Resealable cans improve consumer convenience by allowing beverages to be stored and reused, reducing waste. Hybrid materials that combine aluminum with sustainable fibers offer eco-friendly packaging solutions, which align with growing consumer demand for environmentally conscious products. These innovative designs not only enhance functionality but also help brands differentiate themselves in a competitive market.

Scope of the Report

|

Material |

Aluminum Steel |

|

Beverage Type |

Carbonated Soft Drinks Alcoholic Beverages Energy Drinks Ready-to-Drink Tea & Coffee Fruit Juices |

|

Can Size |

Standard Size (12 oz) Slim Size (8 oz) Tall Size (16 oz) |

|

End-User |

Beverage Manufacturers Contract Packaging Companies |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Beverage Manufacturers

Packaging Companies

Recycling and Waste Management Organizations

Can Design and Innovation Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (EPA, FDA)

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Ball Corporation

Crown Holdings, Inc.

Ardagh Group S.A.

CANPACK Group

Silgan Containers LLC

CPMC Holdings Limited

Envases Group

Orora Packaging Solutions

Kian Joo Can Factory Berhad

Showa Aluminum Can Corporation

Table of Contents

1. USA Beverage Cans Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Beverage Cans Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Beverage Cans Market Analysis

3.1. Growth Drivers (Consumer Preferences, Sustainability Trends, Metal Recycling Policies, Packaging Innovations)

3.1.1. Increase in On-the-go Consumption

3.1.2. Rising Demand for Sustainable Packaging Solutions

3.1.3. Expanding Beverage Categories (RTD Beverages, Sparkling Water, Energy Drinks)

3.1.4. Growing Preference for Aluminum over Plastic

3.2. Market Challenges (Production Costs, Raw Material Fluctuations, Recycling Infrastructure)

3.2.1. High Energy Requirements for Aluminum Production

3.2.2. Raw Material Price Volatility (Aluminum Price Fluctuations)

3.2.3. Regional Disparities in Recycling Infrastructure

3.3. Opportunities (Technological Advancements, Strategic Partnerships, Circular Economy Initiatives)

3.3.1. Lightweighting of Beverage Cans

3.3.2. Innovations in Can Design (Resealable, Hybrid Materials)

3.3.3. Growth of Direct-to-Consumer Beverage Brands

3.4. Trends (Recyclability, Customization, Premiumization, Shorter Production Runs)

3.4.1. High Demand for Custom Printed Beverage Cans

3.4.2. Shift Towards Premium Packaging Options

3.4.3. Adoption of Digital Printing in Beverage Can Manufacturing

3.4.4. Growing Focus on Environmentally Friendly Production

3.5. Government Regulations (FDA, EPA, Recycling Mandates, Packaging Waste Laws)

3.5.1. Food Contact Material Regulations

3.5.2. Extended Producer Responsibility (EPR) Policies

3.5.3. Beverage Container Recycling Initiatives

3.5.4. Legislation on Single-use Packaging

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Suppliers, Government Agencies)

3.8. Porters Five Forces (Supply Chain, Bargaining Power, Competition)

3.9. Competition Ecosystem

4. USA Beverage Cans Market Segmentation

4.1. By Material (In Value %)

4.1.1. Aluminum

4.1.2. Steel

4.2. By Beverage Type (In Value %)

4.2.1. Carbonated Soft Drinks

4.2.2. Alcoholic Beverages

4.2.3. Energy Drinks

4.2.4. Ready-to-Drink Tea & Coffee

4.2.5. Fruit Juices

4.3. By Can Size (In Value %)

4.3.1. Standard Size (12 oz)

4.3.2. Slim Size (8 oz)

4.3.3. Tall Size (16 oz)

4.4. By End-User (In Value %)

4.4.1. Beverage Manufacturers

4.4.2. Contract Packaging Companies

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Beverage Cans Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ball Corporation

5.1.2. Crown Holdings, Inc.

5.1.3. Ardagh Group S.A.

5.1.4. CANPACK Group

5.1.5. Silgan Containers LLC

5.1.6. CPMC Holdings Limited

5.1.7. Envases Group

5.1.8. Orora Packaging Solutions

5.1.9. Kian Joo Can Factory Berhad

5.1.10. Showa Aluminum Can Corporation

5.1.11. Novelis Inc.

5.1.12. Tata Steel Ltd

5.1.13. UACJ Corporation

5.1.14. Reynolds Group Holdings Ltd.

5.1.15. Toyo Seikan Group Holdings, Ltd.

5.2. Cross Comparison Parameters (Market Share, Global Presence, Annual Revenue, Product Portfolio, Sustainability Initiatives, Manufacturing Capabilities, Number of Employees, Technological Innovation)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers, Acquisitions, Partnerships, Capacity Expansion)

5.5. Investment Analysis (Capex Investments, Green Technology Integration)

5.6. Venture Capital and Private Equity Investments

6. USA Beverage Cans Market Regulatory Framework

6.1. Packaging Standards and Certifications (ISO 9001, ISO 14001)

6.2. Compliance with Environmental Regulations

6.3. Certification Processes (Recyclability Certifications)

7. USA Beverage Cans Market Future Size (In USD Bn)

7.1. Key Factors Driving Future Market Growth

7.2. Expected Developments and Innovations

8. USA Beverage Cans Market Future Segmentation

8.1. By Material (In Value %)

8.2. By Beverage Type (In Value %)

8.3. By Can Size (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. USA Beverage Cans Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved creating an ecosystem map of all major stakeholders within the USA Beverage Cans Market. Extensive desk research was conducted using a combination of secondary and proprietary databases to gather comprehensive information on the industry. The objective was to identify and define critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on the USA Beverage Cans Market was compiled and analyzed. This included assessing market penetration, the balance of suppliers and manufacturers, and resultant revenue generation. Service quality statistics were also evaluated to ensure the accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through consultations with industry experts, including beverage manufacturers, packaging companies, and sustainability experts. These consultations provided valuable operational and financial insights, which were crucial in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involved engaging directly with manufacturers to acquire detailed insights into product segments, sales performance, and consumer preferences. This engagement helped verify and complement the data gathered through the bottom-up approach, ensuring a comprehensive and validated analysis of the USA Beverage Cans Market.

Frequently Asked Questions

01. How big is the USA Beverage Cans Market?

The USA Beverage Cans Market is valued at USD 12 billion, driven by the rising demand for sustainable packaging solutions and the growth of ready-to-drink beverages.

02. What are the challenges in the USA Beverage Cans Market?

Challenges in USA Beverage Cans Market include raw material price volatility, high production costs, and disparities in recycling infrastructure, which can hinder market growth.

03. Who are the major players in the USA Beverage Cans Market?

Key players in USA Beverage Cans Market include Ball Corporation, Crown Holdings, Ardagh Group, CANPACK Group, and Silgan Containers, who dominate due to their large production capacities and sustainability initiatives.

04. What are the growth drivers of the USA Beverage Cans Market?

The USA Beverage Cans Market is propelled by consumer preference for eco-friendly packaging, innovations in beverage categories, and strict environmental regulations favoring recyclable materials like aluminum.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.