USA Bicycles Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD3732

December 2024

85

About the Report

USA Bicycles Market Overview

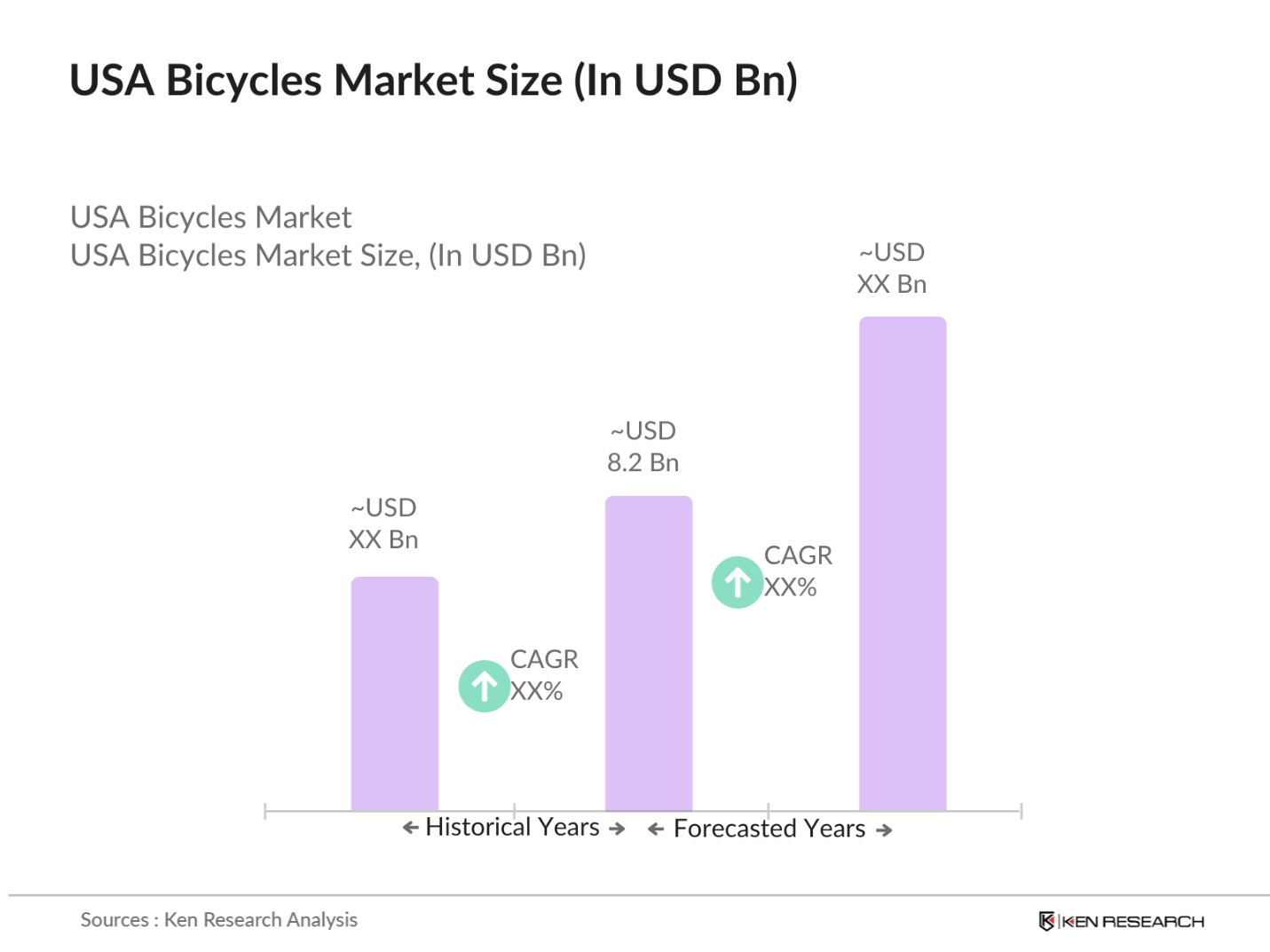

- The USA bicycles market is valued at USD 8.2 billion, based on a five-year historical analysis. The market is driven by several key factors, including a growing interest in cycling for health and fitness, increased adoption of electric bikes (e-bikes), and government incentives for eco-friendly transport solutions. Urbanization and increasing awareness of environmental sustainability have further pushed consumer interest in cycling, making it a popular transportation and fitness solution.

- In the USA, cities such as New York, Portland, and San Francisco dominate the market. These cities have invested heavily in cycling infrastructure, creating bike lanes and offering public bike-sharing programs, which have contributed to the popularity of bicycles. The governments support of cycling as a green transportation mode also encourages consumers to choose bicycles, especially e-bikes, over traditional vehicles.

- The U.S. Consumer Product Safety Commission (CPSC) enforces federal safety standards for bicycles, ensuring that all bicycles sold in the U.S. meet specific safety criteria. According to the CPSC, these standards are updated regularly to address new safety concerns, with more than 50,000 bicycle-related injuries reported annually . Compliance with these regulations is critical for manufacturers, as non-compliance can result in significant fines and product recalls. Federal safety standards will continue to shape product development, ensuring bicycles remain safe for consumers.

USA Bicycles Market Segmentation

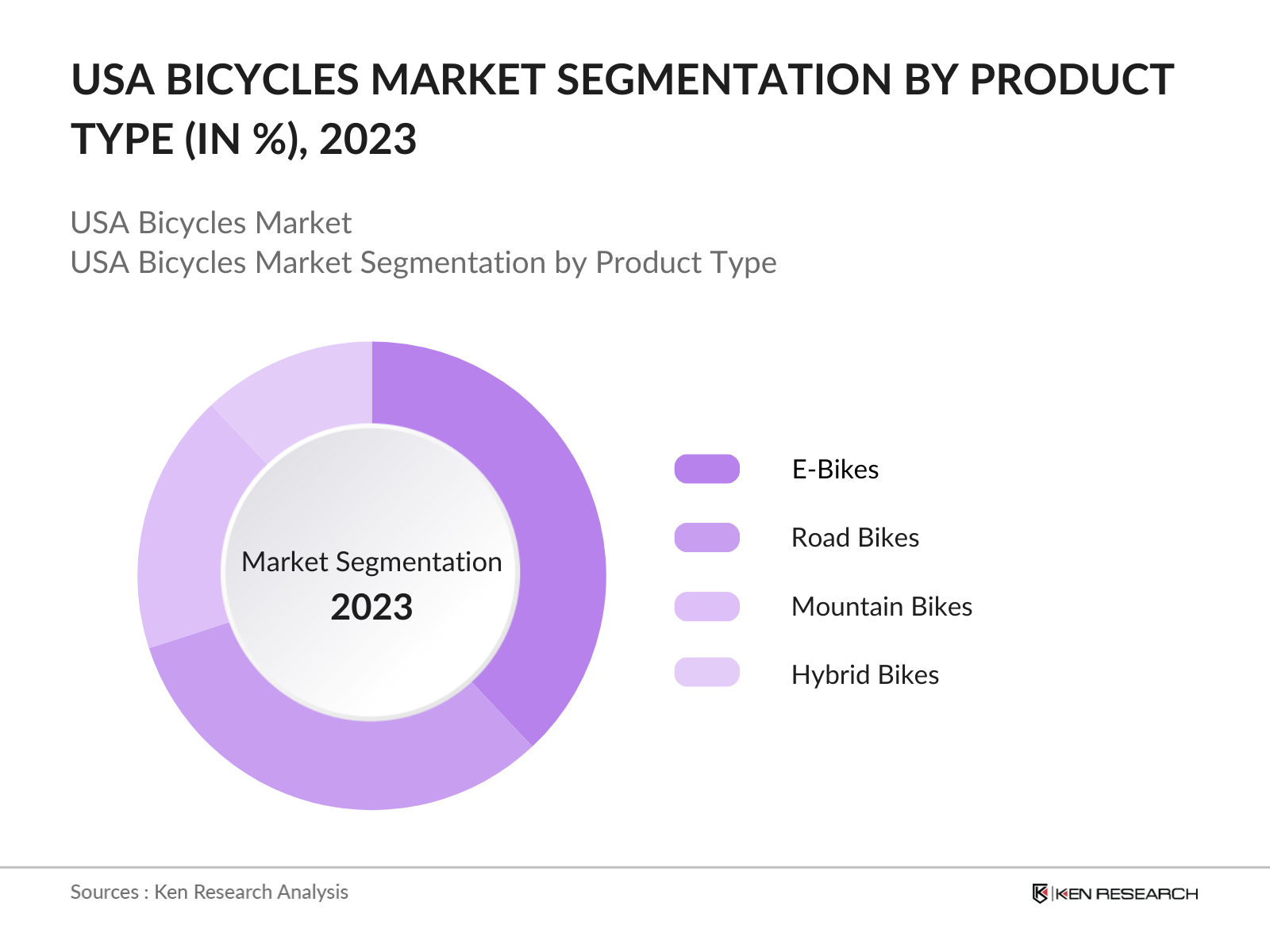

By Product Type: The USA bicycles market is segmented by product type into e-bikes, road bikes, mountain bikes, hybrid bikes, and folding bikes. Recently, e-bikes have captured a significant share of the market due to their convenience and appeal to both commuters and fitness enthusiasts. The shift toward electric mobility, combined with the ease of using e-bikes for longer distances, has driven this sub-segments dominance. Government incentives for electric vehicles and urban congestion also make e-bikes an attractive option.

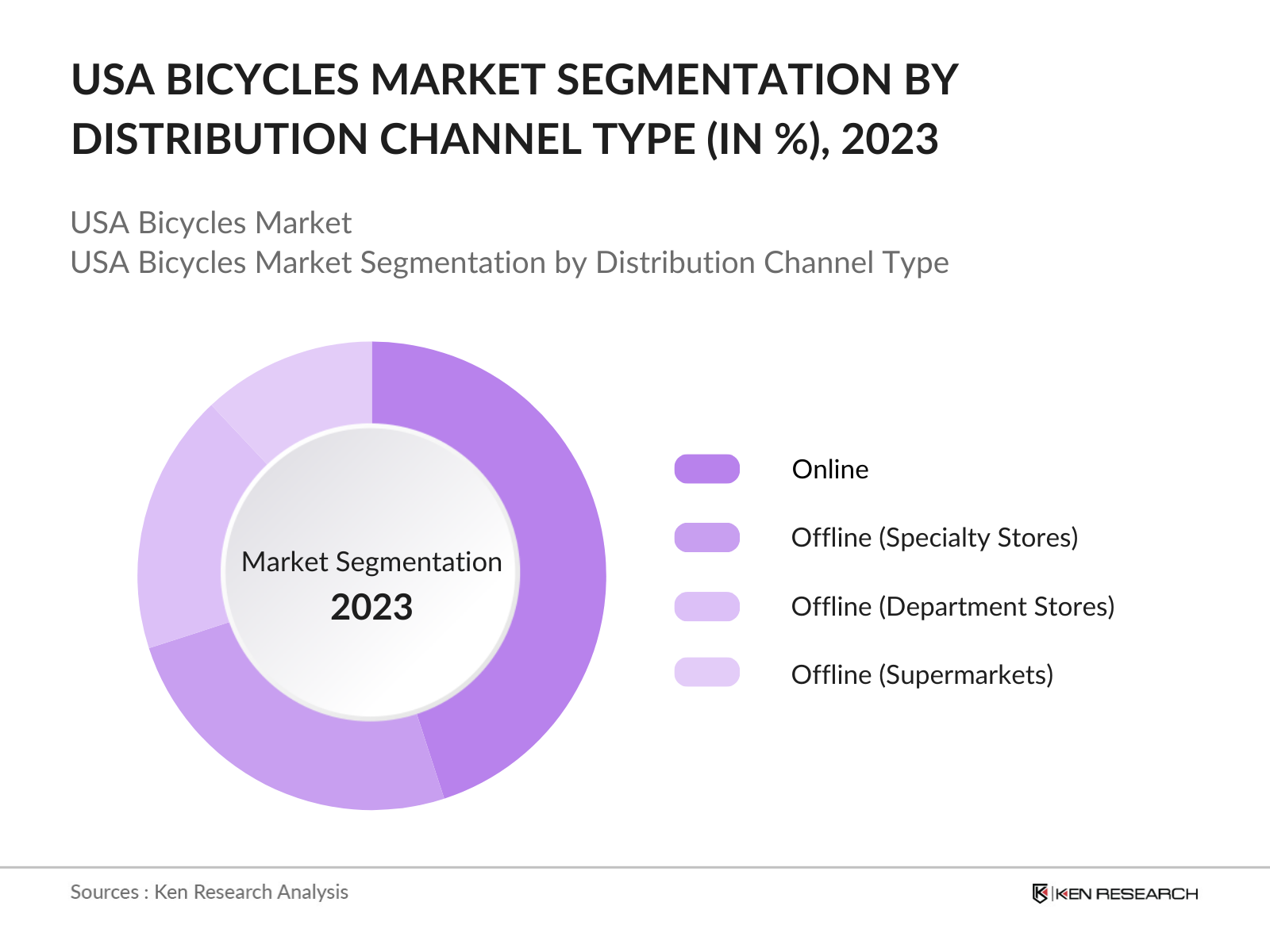

By Distribution Channel: The USA bicycles market is segmented by distribution channels into online and offline platforms, including specialty stores, department stores, and supermarkets. Online sales channels have been growing rapidly, especially during the pandemic, which shifted consumer purchasing behavior. The ease of access, wide selection, and home delivery options have made online channels the dominant segment.

USA Bicycles Market Competitive Landscape

The USA bicycles market is dominated by a mix of domestic and international players, ranging from manufacturers of premium bicycles to companies specializing in mass-market models. The market consolidation is largely due to the strength of key companies that have established extensive distribution networks, brand loyalty, and innovative product lines. The competitive landscape shows that larger brands, such as Trek and Specialized, dominate through their advanced manufacturing processes and sustainable business models, while global players like Giant also maintain a strong presence.

|

Company Name |

Establishment Year |

Headquarters |

Product Range |

Global Presence |

R&D Investment |

Sustainability Practices |

Revenue |

Market Share |

Distribution Channels |

|

Trek Bicycle Corporation |

1976 |

Wisconsin, USA |

- |

- |

- |

- |

- |

- |

- |

|

Specialized Bicycle Components |

1974 |

California, USA |

- |

- |

- |

- |

- |

- |

- |

|

Giant Manufacturing Co., Ltd |

1972 |

Taiwan |

- |

- |

- |

- |

- |

- |

- |

|

Cannondale (Dorel Industries) |

1971 |

Connecticut, USA |

- |

- |

- |

- |

- |

- |

- |

|

Schwinn (Pacific Cycle) |

1895 |

Illinois, USA |

- |

- |

- |

- |

- |

- |

- |

USA Bicycles Industry Analysis

Growth Drivers

- Rising Consumer Preference for Sustainable Transport: The shift towards sustainable transport options is becoming a key driver for bicycle sales in the USA. Bicycles, which produce zero emissions, are aligned with the growing global emphasis on reducing carbon footprints. In the United States, transportation accounts for over 28% of total greenhouse gas emissions . With state-level policies focusing on emissions reduction, bicycles are increasingly seen as a solution for eco-conscious consumers. Data from the U.S. Department of Energy highlights a push toward alternative transportation methods in urban areas, including cycling , further driving market growth in 2024.

- Increasing Urbanization and Traffic Congestion: Urbanization is intensifying in the U.S., with over 82% of the population now residing in urban areas . As cities become more densely populated, traffic congestion has emerged as a major issue, costing the U.S. economy billions in lost productivity annually. According to a 2023 report by the Texas A&M Transportation Institute, urban congestion costs the U.S. around $87 billion each year . Bicycles present an efficient alternative for urban mobility, particularly for shorter commutes. Urban cycling infrastructure developments across major U.S. cities are expected to drive further adoption of bicycles as a sustainable urban transport mode.

- Health and Fitness Awareness: Health-consciousness has been on the rise in the U.S., with millions of Americans adopting more active lifestyles. Bicycles offer a low-impact and accessible form of exercise that suits all age groups. According to a 2022 report by the CDC, 48% of U.S. adults engage in regular physical activity , and the use of bicycles for exercise has been steadily increasing. With rising concerns about sedentary lifestyles, bicycle commuting and recreational cycling are gaining popularity. This trend is expected to drive the market in 2024 as individuals continue to prioritize fitness and wellness.

Market Challenges

- Competition from Electric Vehicles: The rise of electric vehicles (EVs), including e-scooters and e-bikes, poses a challenge to the traditional bicycle market. According to the U.S. Department of Energy, sales of electric scooters and e-bikes in the U.S. reached nearly 790,000 units in 2022 . While bicycles still maintain a strong market share, the appeal of electric alternatives with their convenience and reduced physical effort is causing disruption. The increasing affordability of these electric options is further intensifying competition, making it essential for traditional bicycle manufacturers to innovate and capture evolving consumer preferences.

- Limited Cycling Infrastructure in Rural Areas: While urban cycling infrastructure is expanding, rural areas in the U.S. continue to face a deficit in safe and accessible cycling routes. According to the Federal Highway Administration, only 7% of rural roads are equipped with bicycle lanes, compared to 46% in urban areas . This infrastructure gap limits bicycle use in less populated regions where road safety concerns deter potential cyclists. The challenge of addressing infrastructure inequalities between urban and rural regions continues to hinder widespread adoption, impacting the growth of the overall bicycle market.

USA Bicycles Market Future Outlook

Over the next five years, the USA bicycles market is expected to witness strong growth driven by the rising demand for electric bikes, continuous government support for eco-friendly transportation, and the adoption of cycling as a mainstream fitness trend. With more cities investing in cycling infrastructure and bike-sharing programs, the demand for bicycles, especially e-bikes, is likely to continue its upward trajectory. Technological advancements such as connected bikes with smart features will further contribute to market growth, catering to urban commuters and health-conscious consumers.

Market Opportunities

- Expansion in E-Bikes Segment: The e-bike segment is experiencing rapid growth as consumers seek alternative modes of transport that combine the benefits of traditional cycling with the convenience of motor assistance. According to the National Renewable Energy Laboratory, e-bike sales in the U.S. grew by over 65% in 2023 . This growth is attributed to their appeal for both commuting and recreational purposes. E-bikes are particularly popular in urban areas, where they offer a solution to traffic congestion and longer-distance commuting. The expanding consumer base for e-bikes presents significant opportunities for market players in 2024.

- Collaboration with Ride-Sharing Platforms: Ride-sharing platforms like Uber and Lyft have begun integrating bicycles and e-bikes into their service offerings, expanding consumer access to shared mobility solutions. According to a 2023 report from the U.S. Department of Transportation, shared bike programs have been introduced in over 120 cities across the U.S. Partnerships between bicycle manufacturers and these platforms present growth opportunities by increasing bicycle usage and creating new revenue streams. Ride-sharing collaborations are expected to bolster market growth by making bicycles more accessible for urban commuters.

Scope of the Report

|

Product Type |

E-Bikes Road Bikes Mountain Bikes Hybrid Bikes Folding Bikes |

|

Distribution Channel |

Online Offline |

|

Customer Type |

Commuters Leisure Riders Professional Cyclists Fitness Enthusiasts Students |

|

Technology Type |

Manual Bikes Electric Bikes Smart/Connected Bikes |

|

Region |

Northeast Midwest South West Pacific |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Bicycle Manufacturers

Government and Regulatory Bodies (e.g., Department of Transportation, Environmental Protection Agency)

Bicycle Distribution Companies

E-bike Charging Station Companies

Fitness and Lifestyle Companies

Cycling Clubs and Organizations

Investment and Venture Capitalist Firms

Technology Integrators (for smart/connected bikes)

Companies

Players Mentioned in the Report:

Trek Bicycle Corporation

Specialized Bicycle Components

Giant Manufacturing Co., Ltd

Cannondale (Dorel Industries)

Schwinn (Pacific Cycle)

Santa Cruz Bicycles

Yeti Cycles

Cervlo Cycles

Colnago

Felt Bicycles

Table of Contents

1. USA Bicycles Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Bicycles Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Bicycles Market Analysis

3.1. Growth Drivers (Urban cycling infrastructure, Fitness trends, E-bike adoption, Government incentives)

3.1.1. Cycling Infrastructure Investments

3.1.2. Rising Fitness Awareness

3.1.3. E-Bike Popularity

3.1.4. Government Support and Incentives

3.2. Market Challenges (High cost of e-bikes, Seasonal demand fluctuations, Limited distribution channels, Competitive pricing)

3.2.1. High Manufacturing Costs

3.2.2. Seasonality Impact

3.2.3. Distribution Barriers

3.2.4. Competitive Pricing Pressure

3.3. Opportunities (Sustainability demand, Smart-bike technology, Rental services, Eco-conscious consumer segments)

3.3.1. Sustainability Focus

3.3.2. Technological Integration in Bikes

3.3.3. Expansion of Bicycle Rental Services

3.3.4. Targeting Eco-Conscious Consumers

3.4. Trends (E-bike growth, Customization demand, Smart bikes, Bicycle-sharing programs)

3.4.1. Customization and Personalization

3.4.2. Smart and Connected Bicycles

3.4.3. Expansion of Bicycle-Sharing Programs

3.5. Government Regulations (Subsidies for eco-friendly transport, Safety regulations, Infrastructure policies, Import tariffs)

3.5.1. Bicycle Subsidy Programs

3.5.2. Safety Regulations for Cyclists

3.5.3. National Cycling Infrastructure Policies

3.5.4. Tariffs on Imported Bicycle Parts

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Bicycles Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. E-Bikes

4.1.2. Road Bikes

4.1.3. Mountain Bikes

4.1.4. Hybrid Bikes

4.1.5. Folding Bikes

4.2. By Distribution Channel (In Value %)

4.2.1. Online

4.2.2. Offline (Specialty Stores, Department Stores, Supermarkets)

4.3. By Customer Type (In Value %)

4.3.1. Commuters

4.3.2. Leisure Riders

4.3.3. Professional Cyclists

4.3.4. Fitness Enthusiasts

4.3.5. Students

4.4. By Technology Type (In Value %)

4.4.1. Manual Bikes

4.4.2. Electric Bikes

4.4.3. Smart/Connected Bikes

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

4.5.5. Pacific

5. USA Bicycles Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Trek Bicycle Corporation

5.1.2. Specialized Bicycle Components

5.1.3. Giant Manufacturing Co., Ltd

5.1.4. Cannondale (Dorel Industries)

5.1.5. Schwinn (Pacific Cycle)

5.1.6. Brompton Bicycle

5.1.7. Scott Sports SA

5.1.8. Santa Cruz Bicycles

5.1.9. Yeti Cycles

5.1.10. Cervlo Cycles

5.1.11. Merida Industry Co., Ltd.

5.1.12. Orbea

5.1.13. Colnago

5.1.14. Felt Bicycles

5.1.15. Pinarello

5.2. Cross Comparison Parameters (No. of Employees, Product Range, Global Presence, Manufacturing Capacity, Innovation Rate, Sustainability Practices, Revenue, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Bicycles Market Regulatory Framework

6.1. Environmental Standards

6.2. Safety Compliance and Certification Requirements

6.3. Cycling Infrastructure Support Policies

7. USA Bicycles Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Bicycles Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Customer Type (In Value %)

8.4. By Technology Type (In Value %)

8.5. By Region (In Value %)

9. USA Bicycles Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying all the critical variables that drive the USA bicycles market. This includes gathering data from government agencies, industry reports, and proprietary databases. The goal is to define essential factors such as product preferences, distribution trends, and consumer behavior.

Step 2: Market Analysis and Construction

This phase focuses on historical market data analysis. The revenue generation by key players and market penetration by sub-segments such as e-bikes, road bikes, and hybrid bikes is examined to estimate accurate market shares and growth rates.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted to validate the research hypotheses through structured interviews. These interviews provide deeper insights into the sales performance, market challenges, and emerging trends, allowing for the refinement of market estimates.

Step 4: Research Synthesis and Final Output

The final stage consolidates all the gathered data, cross-verifying the trends and figures with market insights from multiple bicycle manufacturers and distributors. This ensures the final report reflects the most accurate and comprehensive overview of the USA bicycles market.

Frequently Asked Questions

01. How big is the USA Bicycles Market?

The USA bicycles market is valued at USD 8.2 billion, driven by rising demand for e-bikes, cycling infrastructure development, and government support for green transportation.

02. What are the challenges in the USA Bicycles Market?

Challenges in the USA bicycles market include high costs of electric bikes, seasonal demand fluctuations, and the intense competition from both domestic and international players.

03. Who are the major players in the USA Bicycles Market?

Key players in the market include Trek Bicycle Corporation, Specialized Bicycle Components, Giant Manufacturing Co., Ltd, Cannondale (Dorel Industries), and Schwinn (Pacific Cycle).

04. What are the growth drivers of the USA Bicycles Market?

The market is driven by factors such as the increasing popularity of e-bikes, government incentives for eco-friendly transport, and rising awareness of cycling as a fitness trend.

05. What are the trends in the USA Bicycles Market?

Key trends include the growing adoption of e-bikes, the expansion of bicycle-sharing programs, and technological advancements in smart and connected bicycles.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.