USA Bioplastics Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD3555

October 2024

92

About the Report

USA Bioplastics Market Overview

- The USA bioplastics market is valued at USD 3 billion, driven by the increasing demand for sustainable packaging solutions across diverse industries including food & beverages, consumer goods, and automotive. The growth is attributed to stringent environmental regulations, and corporate sustainability initiatives aimed at reducing plastic waste. Major factors influencing the market are the increasing awareness among consumers about environmental sustainability and the rising adoption of bioplastics as an alternative to conventional plastics in various applications such as packaging and agriculture.

- Key cities and regions such as California, Texas, and the Midwest dominate the USA bioplastics market due to the concentration of bioplastics manufacturing facilities and the presence of large consumer markets. California's leadership in the market is further strengthened by its strict regulations on single-use plastics and the states robust recycling programs. Meanwhile, Texas benefits from being a hub for chemical production, allowing for easier access to bioplastics raw materials.

- The EPAs National Recycling Strategy aims to build a circular economy by enhancing the capacity to recycle and reuse materials, with a strong emphasis on reducing plastic waste. In 2023, the draft National Strategy to Prevent Plastic Pollution was released, identifying key actions to reduce, reuse, and recycle plastics. The strategy focuses on improving solid waste management and reducing the environmental and health impacts of plastic pollution.

USA Bioplastics Market Segmentation

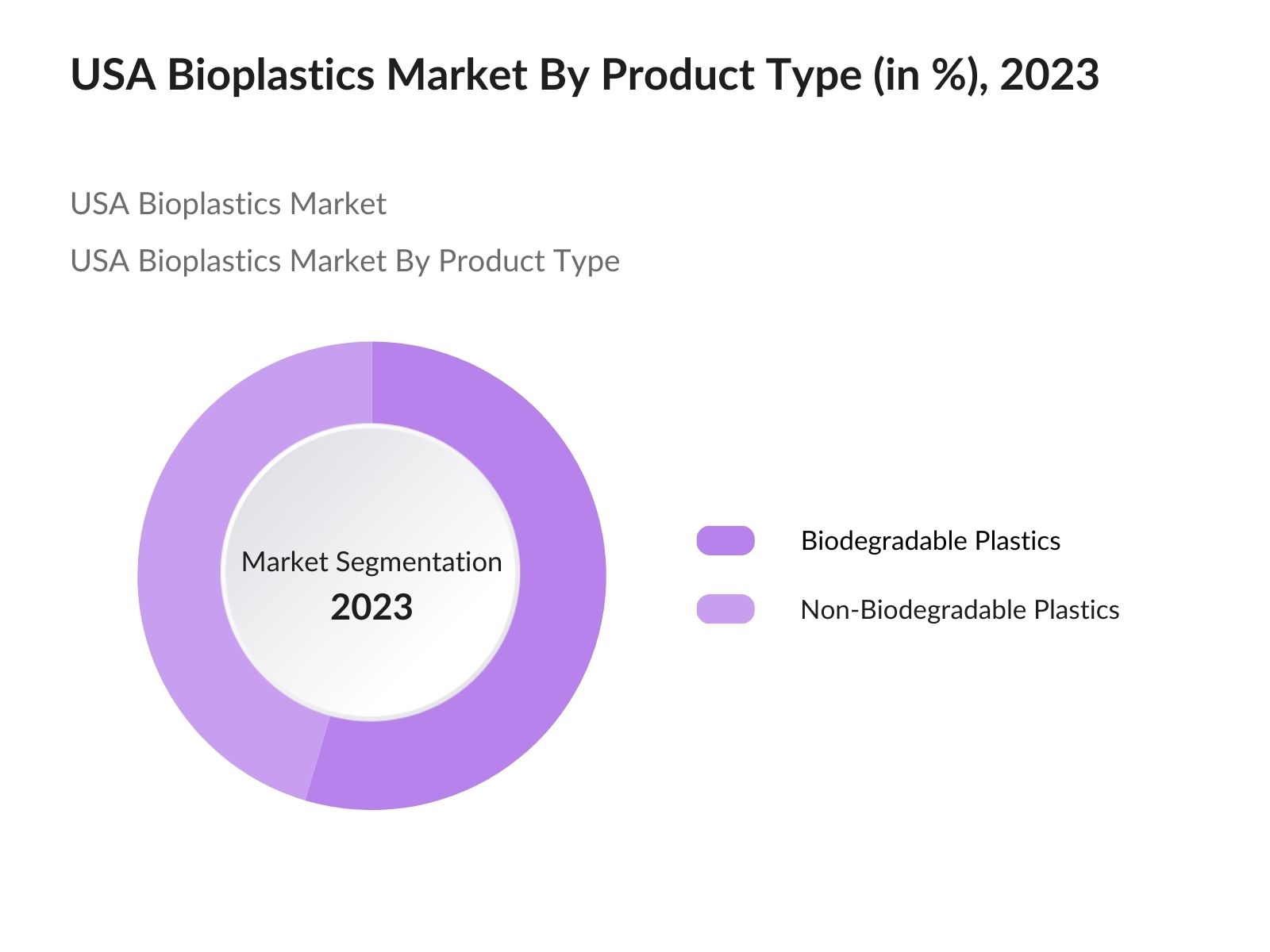

By Product Type: The market is segmented by product type into biodegradable and non-biodegradable plastics. Among these, biodegradable plastics such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA) hold a significant market share due to their ability to decompose naturally and the support from various governmental regulations promoting the use of biodegradable materials. Non-biodegradable plastics like polyethylene and polyethylene terephthalate (PET) are also prominent due to their application in sectors like automotive and electronics where durability and strength are key considerations.

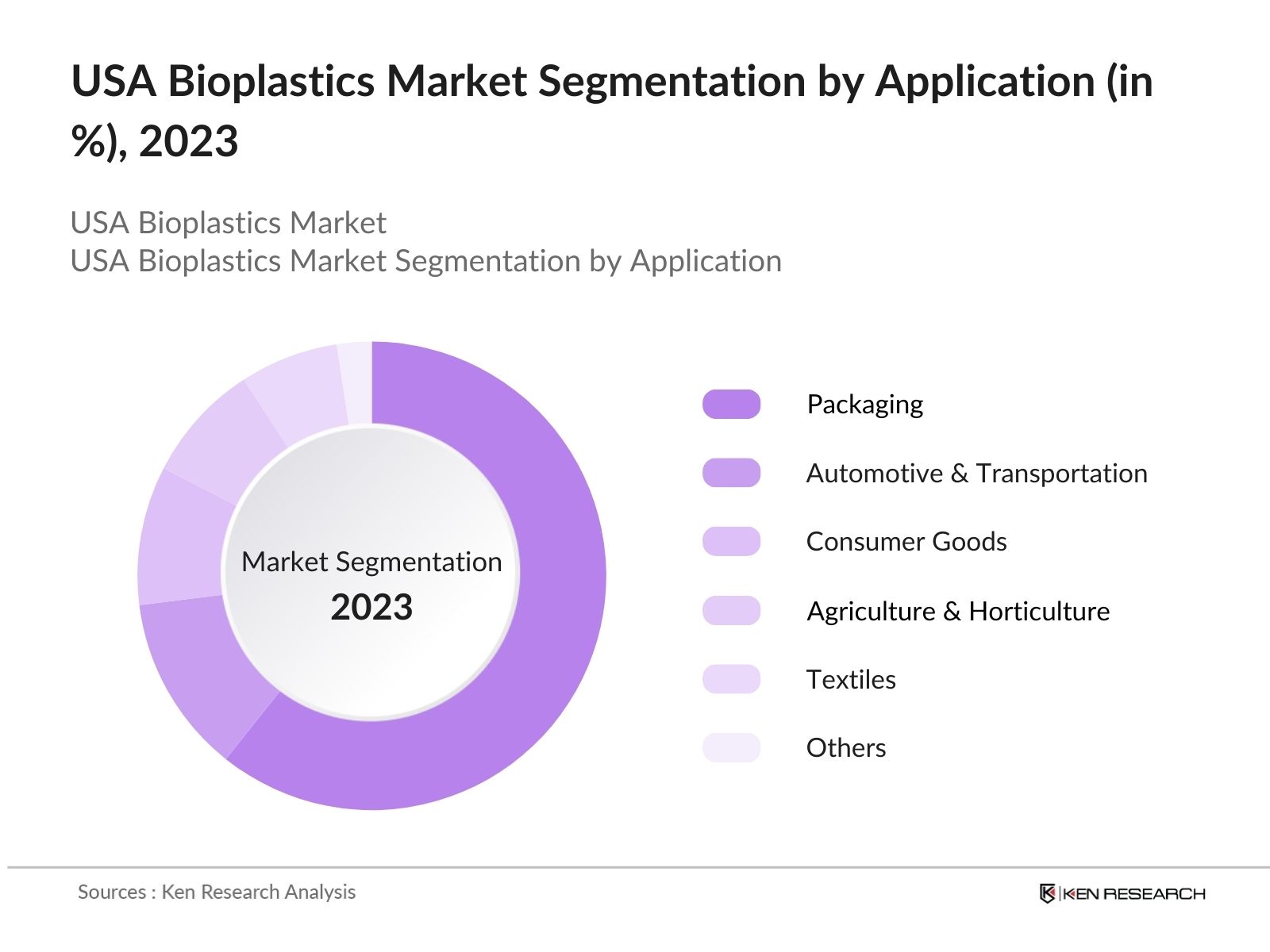

By Application: The bioplastics market in the USA is further segmented by application into packaging, agriculture & horticulture, consumer goods, automotive & transportation, and textiles. The packaging segment is the dominant one, accounting for over 60% of the market share in 2023, primarily due to its widespread use in food and beverage packaging. Packaging is considered a primary application as bioplastics such as PLA and starch blends are increasingly used to create compostable bags, containers, and bottles. Consumer preference for eco-friendly packaging solutions and a surge in demand for sustainable packaging in the food and beverage industry significantly contribute to the growth of this segment.

USA Bioplastics Market Competitive Landscape

The USA bioplastics market is primarily dominated by both domestic and international players, with key companies focusing on expanding their production capacity and introducing innovative bioplastic products to maintain their competitive edge. Major players such as NatureWorks LLC, Danimer Scientific, and Eastman Chemical Company have established themselves as leaders through significant investments in R&D and sustainability initiatives. The market is characterized by a high level of consolidation, with these companies holding a substantial share, which helps them influence pricing and supply dynamics.

USA Bioplastics Industry Analysis

Growth Drivers

- Environmental Concerns (Sustainability Initiatives): The USA government is implementing multiple strategies to combat plastic pollution due to the significant environmental impact of plastic waste. The Environmental Protection Agency (EPA) released the Draft National Strategy to Prevent Plastic Pollution, which aims to reduce pollution from plastic production and improve post-use materials management. This initiative highlights that over 35.7 million tons of plastic waste was generated in 2018, with only 3 million tons being recycled, resulting in significant environmental harm.

- Increasing Demand for Biodegradable Products: The demand for biodegradable and sustainable products has increased as a result of environmental concerns and consumer awareness. The USA has seen a notable rise in the use of bioplastics in consumer goods, such as packaging and single-use items, as part of the broader effort to shift away from conventional plastics. Initiatives like the Save Our Seas 2.0 Act further strengthen this demand by encouraging the development and adoption of biodegradable and eco-friendly alternatives to reduce marine debris and protect ecosystems.

- Support for the Domestic Bioeconomy and Biomass Supply Chain Resilience: The USA Department of Agriculture (USDA) is playing a pivotal role in strengthening the bioplastics market through initiatives that enhance biomass supply chain resilience. As part of the Building a Resilient Biomass Supply: A Plan to Enable the Bioeconomy in America initiative, the USDA has outlined strategies to increase the availability of biomass, which is essential for bioplastic production.

Market Challenges

- High Cost of Production: The cost of producing bioplastics remains a significant barrier to their widespread adoption. Bioplastic manufacturing relies on bio-based feedstock, which often has higher costs compared to conventional petroleum-based materials. Additionally, the infrastructure for processing and recycling bioplastics is not as established, further driving up production costs.

- Limited Raw Material Availability: The availability of raw materials for bioplastic production, such as agricultural by-products and plant-based feedstocks, is limited due to seasonal and geographical constraints. This limitation in supply leads to competition with other industries such as food and pharmaceuticals, which further complicates the scaling of bioplastic production. The scarcity of feedstock resources can disrupt production processes, affecting supply chains and limiting market expansion.

USA Bioplastics Market Future Outlook

Over the next five years, the USA bioplastics market is expected to witness significant growth driven by the rising adoption of sustainable and environmentally friendly materials across various industries, particularly in the packaging and automotive sectors. Advancements in bioplastic technology, increasing consumer awareness, and supportive government policies will further propel the market. Key players are anticipated to focus on capacity expansions and product innovations, which will lead to intensified competition and increased market penetration.

Market Opportunities

- Expansion in Packaging and Automotive Sectors: The packaging and automotive sectors present significant opportunities for the expansion of bioplastics in the USA market. Packaging materials, in particular, are under scrutiny for their environmental impact, with 14.5 million tons of plastic waste generated from packaging alone in 2018. As regulations tighten around single-use plastics and companies seek sustainable alternatives, bioplastics are increasingly being adopted in these sectors.

- Innovations in Bio-Based Feedstock: Innovations in bio-based feedstocks, including advances in the use of agricultural waste, algae, and other renewable sources, are helping to reduce reliance on traditional feedstocks. This shift is contributing to the development of new, more sustainable bioplastic products. Recent government strategies encourage investment in R&D for bio-based materials, creating an opportunity for manufacturers to explore alternative feedstocks and reduce costs associated with production.

Scope of the Report

|

Product Type |

Biodegradable Plastics Non-Biodegradable Plastics |

|

Application |

Packaging (Flexible, Rigid) Consumer Goods Automotive & Transportation Agriculture & Horticulture Textiles Other |

|

Distribution Channel |

Online Offline |

|

End-Use Industry |

Food & Beverage Healthcare Electronics Personal Care & Cosmetics |

|

Region |

New England Mideast Great Lakes Plains Southeast Southwest Rocky Mountain Far West |

Products

Key Target Audience

Bioplastic Manufacturers

Packaging Industry Stakeholders

Automotive OEMs and Suppliers

Consumer Goods Companies

Agricultural Product Distributors

Government and Regulatory Bodies (USA Environmental Protection Agency [EPA], USA Department of Agriculture [USDA])

Investment and Venture Capital Firms

Retail and Distribution Companies

Companies

Players Mentioned in the Report

NatureWorks LLC

Danimer Scientific

Eastman Chemical Company

BASF SE

Total Corbion PLA

Trinseo

Mitsubishi Chemical Corporation

Novamont S.p.A.

Genomatica Inc.

Amcor Rigid Plastics USA, LLC

Table of Contents

1. USA Bioplastics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Bioplastics Market Size (In USD Billion)

2.1. Current Market Size

2.2. Historical Market Size

2.3. Year-On-Year Growth Analysis

2.4. Future Market Size

3. USA Bioplastics Market Analysis

3.1. Market Drivers

Environmental Concerns (Sustainability Initiatives)

Increasing Demand for Biodegradable Products

Rising Government Regulations (Plastic Bans and Mandates)

3.2. Market Challenges

High Cost of Production

Limited Raw Material Availability

3.3. Opportunities

Expansion in Packaging and Automotive Sectors

Innovations in Bio-Based Feedstock

3.4. Market Trends

Technological Advancements in Bioplastic Processing

Rise in Flexible Packaging Demand

3.5. Government Regulations and Environmental Policies

USA Environmental Protection Agency (EPA) National Recycling Strategy

USDA BioPreferred Program

3.6. SWOT Analysis

3.7. Porter’s Five Forces Analysis

3.8. Competition Ecosystem and Market Positioning

4. USA Bioplastics Market Segmentation

4.1. By Product Type (In Value %)

Biodegradable Plastics (Polylactic Acid [PLA], Polyhydroxyalkanoates [PHA], Starch Blends, etc.)

Non-Biodegradable Plastics (Polyethylene, Polyethylene Terephthalate [PET], Polypropylene)

4.2. By Application (In Value %)

Packaging (Flexible and Rigid)

Agriculture & Horticulture

Consumer Goods

Automotive & Transportation

Textiles

4.3. By Distribution Channel (In Value %)

Online

Offline

4.4. By End-Use Industry (In Value %)

Food & Beverage

Healthcare

Electronics

Personal Care & Cosmetics

4.5. By Region (In Value %)

New England

Mideast

Great Lakes

Plains

Southeast

Southwest

Rocky Mountain

Far West

5. USA Bioplastics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. NatureWorks LLC

5.1.2. Trinseo

5.1.3. Danimer Scientific

5.1.4. Eastman Chemical Company

5.1.5. BASF SE

5.1.6. Genomatica Inc.

5.1.7. Arkema S.A.

5.1.8. Biome Bioplastics Limited

5.1.9. FKuR Kunststoff GmbH

5.1.10. Mitsubishi Chemical Corporation

5.1.11. Total Corbion PLA

5.1.12. Novamont S.p.A.

5.1.13. Amcor Rigid Plastics USA, LLC

5.1.14. Myriant Corporation

5.1.15. Glycosbio

5.2. Cross Comparison Parameters

(Revenue, Product Portfolio, Market Share, R&D Investment, Sustainability Initiatives, Headquarters, Employee Strength, Global Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. USA Bioplastics Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. USA Bioplastics Market Future Growth Projections (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Bioplastics Market Segmentation - Future Outlook

8.1. By Product Type

8.2. By Application

8.3. By Distribution Channel

8.4. By End-Use Industry

8.5. By Region

9. USA Bioplastics Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step involves constructing a comprehensive ecosystem map that encompasses all significant stakeholders within the USA bioplastics market. Extensive desk research is carried out, utilizing a mix of secondary sources and proprietary databases to collect industry-level data and identify critical variables that influence the market.

Step 2: Market Analysis and Construction

This phase includes compiling and analyzing historical data pertaining to the USA bioplastics market. It involves evaluating market penetration, product types, applications, and revenue generation. Additionally, service quality statistics are assessed to ensure reliable and precise revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and validated through expert consultations using computer-assisted telephone interviews (CATIs) with industry professionals. These consultations provide valuable operational and financial insights, which help refine and corroborate the market data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging directly with multiple bioplastic manufacturers to gain in-depth insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction verifies and complements the bottom-up approach, ensuring a comprehensive and validated analysis of the USA bioplastics market.

Frequently Asked Questions

01. How big is the USA Bioplastics Market?

The USA bioplastics market is currently valued at USD 3 billion, driven by an increased focus on sustainable packaging solutions and government regulations promoting the use of biodegradable materials.

02. What are the major challenges in the USA Bioplastics Market?

The USA bioplastics market challenges include high production costs, limited availability of raw materials, and competition from conventional plastics. Moreover, the lack of widespread consumer awareness about the benefits of bioplastics poses an additional barrier.

03. Who are the major players in the USA Bioplastics Market?

The USA bioplastics market key players include Nature Works LLC, Danimer Scientific, Eastman Chemical Company, BASF SE, and Total Corbion PLA, each dominating due to their extensive product portfolios and strategic investments in research and development.

04. What are the growth drivers of the USA Bioplastics Market?

The USA bioplastics market growth drivers include increasing demand for sustainable materials, stringent environmental regulations, and advancements in bioplastic production technologies. The packaging sector, in particular, drives significant demand due to its widespread applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.