USA Bioprocess Technology Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD10714

November 2024

83

About the Report

USA Bioprocess Technology Market Overview

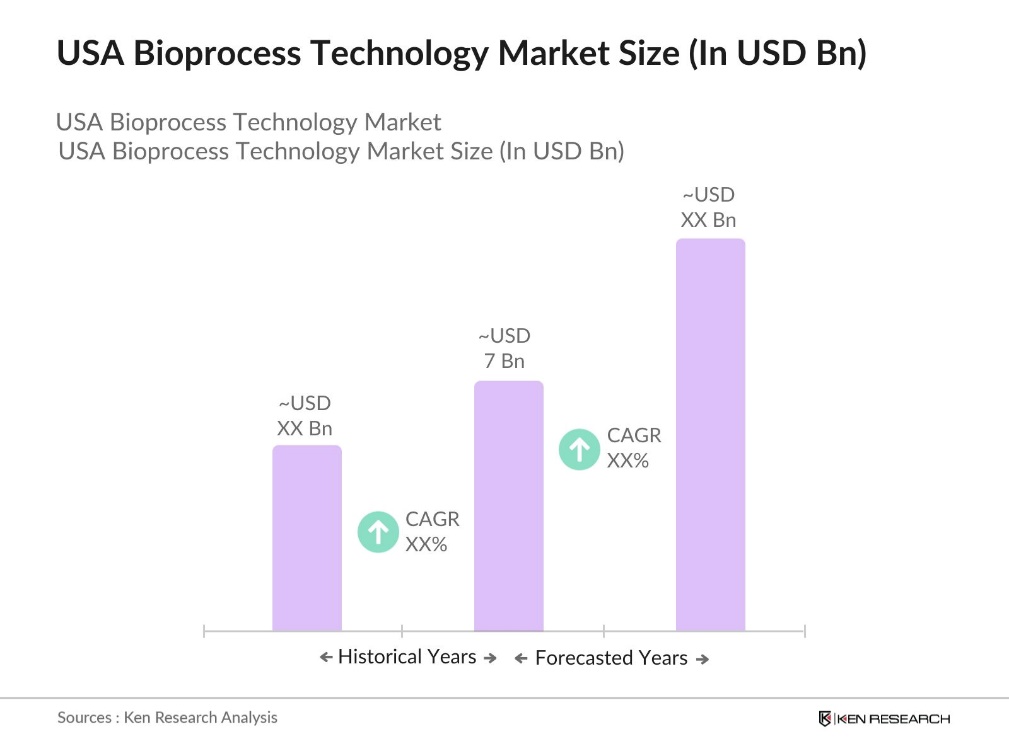

- The USA Bioprocess Technology Market, valued at USD 7 billion based on recent data, is driven by increasing demand in biopharmaceutical production and rising investments in R&D across the biotechnology sector. As more healthcare facilities and biomanufacturing firms adopt advanced cell culture systems and single-use bioprocessing technologies, the market shows consistent growth.

- Key players in the USA Bioprocess Technology Market are concentrated in cities with strong biotech hubs, such as Boston, San Francisco, and San Diego. These regions dominate due to their robust infrastructure for biotechnology R&D, a high concentration of skilled workforce, and significant investments in bioprocessing capabilities. Additionally, access to top-tier research universities and innovation clusters supports continual advancements in bioprocess technology, making these cities pivotal in driving market growth.

- The U.S. Environmental Protection Agency (EPA) requires that bioprocessing facilities meet environmental regulations to minimize emissions and waste. For instance, the EPA projected over $875 million in industry costs for implementing this rule, with small businesses facing costs averaging around $863,484 for one-time reporting alone. These standards ensure that bioprocessing companies operate sustainably, maintaining safe practices and minimizing environmental impact while adhering to regulatory obligations.

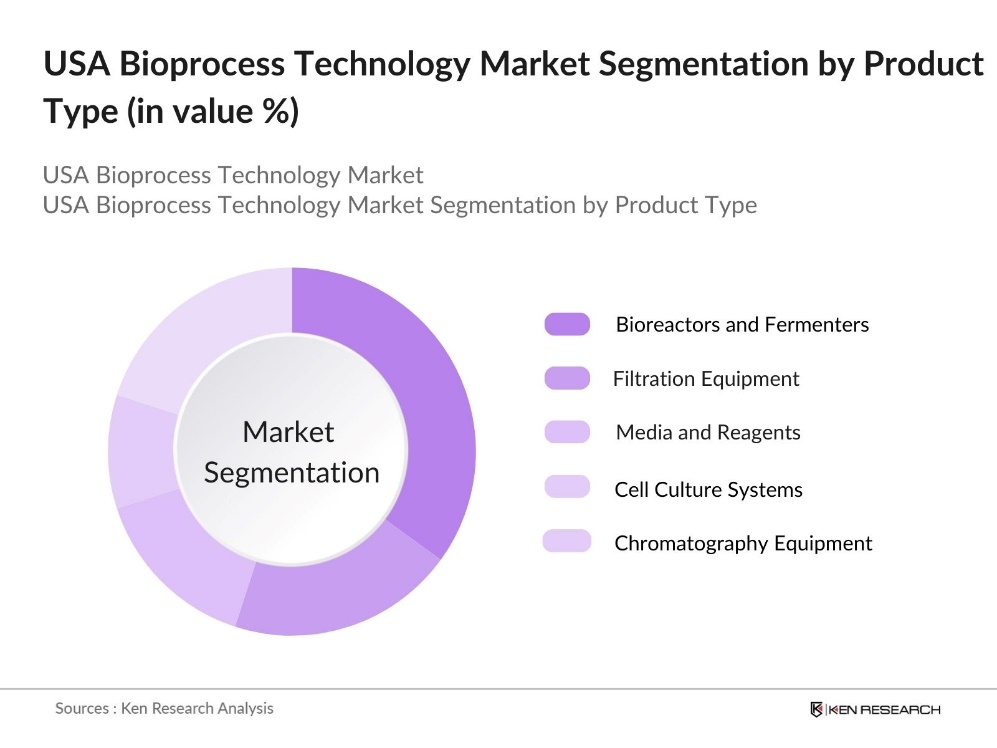

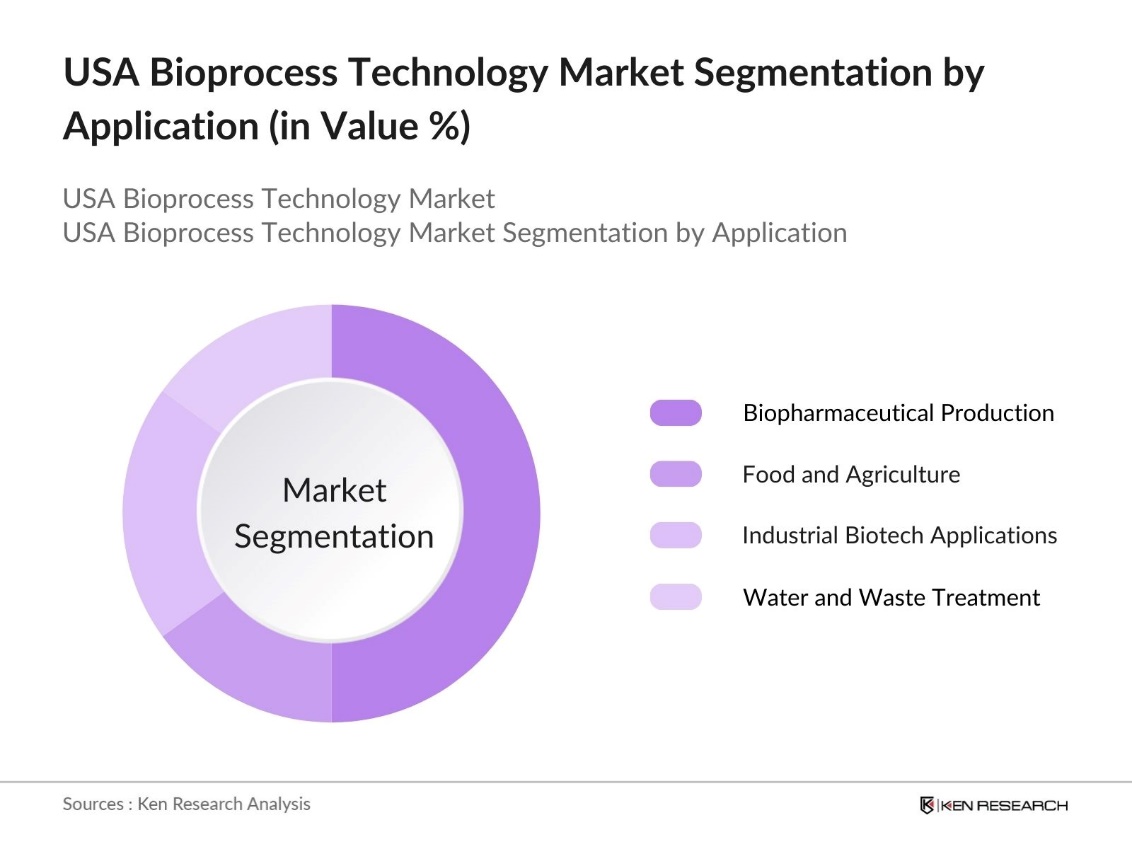

USA Bioprocess Technology Market Segmentation

By Product Type: The market is segmented by product type into bioreactors and fermenters, filtration equipment, media and reagents, cell culture systems, and chromatography equipment. Among these, bioreactors and fermenters hold a dominant market share due to their essential role in upstream processing and biomanufacturing. They facilitate the cultivation and scaling of cell lines for therapeutic products, an area experiencing rapid growth due to the demand for biologics and biosimilars.

By Application: The market is segmented by application-based segmentation, biopharmaceutical production, food and agriculture, industrial biotech applications, and water and waste treatment represent primary categories. Biopharmaceutical production is the most dominant segment, driven by the continuous demand for vaccines, therapeutic proteins, and cell therapies. The technological advancements in downstream processing, which include filtration and purification, enhance the production efficiency, making this sub-segment pivotal in the market.

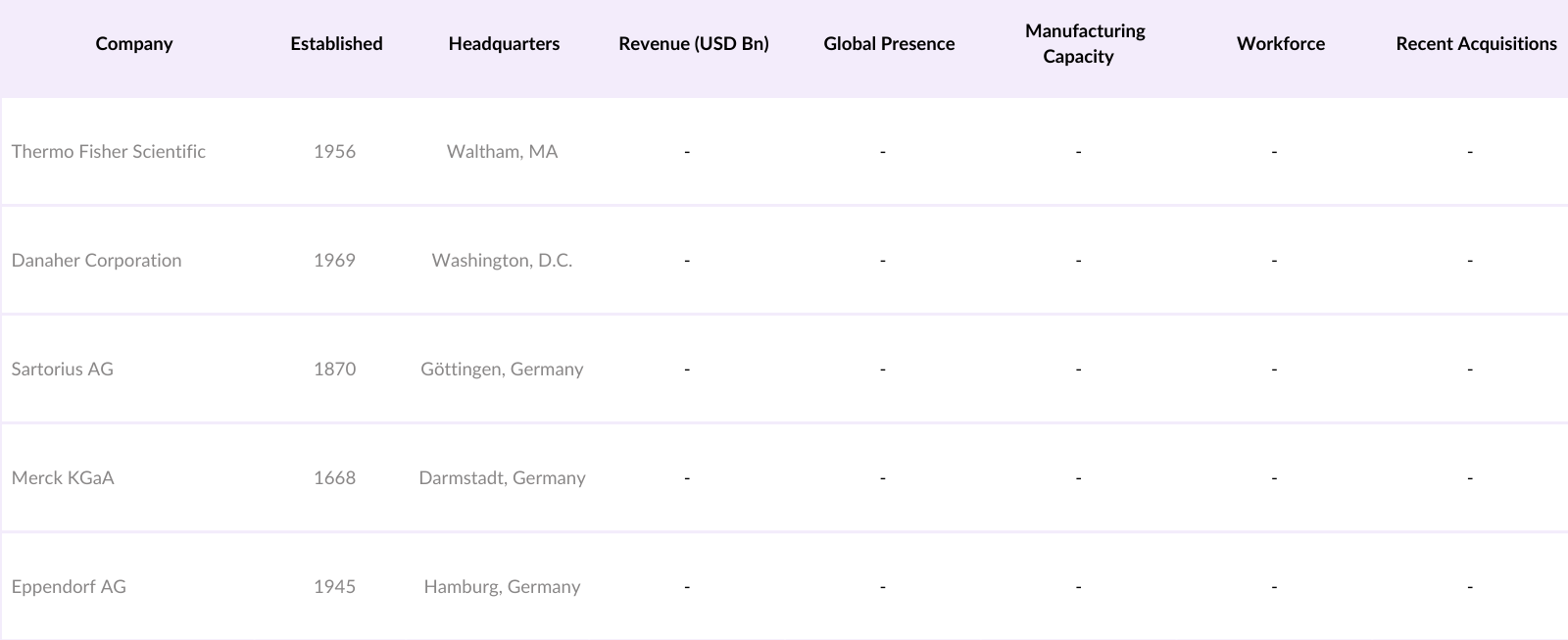

USA Bioprocess Technology Market Competitive Landscape

The USA Bioprocess Technology Market is dominated by several prominent companies that invest significantly in product innovation, R&D, and strategic collaborations to maintain market position. These players form a concentrated competitive landscape, highlighting their substantial market influence.

USA Bioprocess Technology Industry Analysis

Growth Drivers

- Increased Adoption in Biopharmaceuticals: The USA has seen significant growth in biopharmaceutical adoption, attributed to an aging population and a rise in chronic disease prevalence, resulting in heightened demand for biologic drugs and therapies. For instance, the American Cancer Society projected about 1.9 million new cancer cases in 2022 alone, highlighting the urgent need for innovative therapies. This demand underpins growth in bioprocessing technology, which is essential for large-scale production of biologics. This emphasizing the ongoing need for advanced bioprocessing systems to support biologics manufacturing.

- Technological Advancements in Cell Culture Systems: Advances in cell culture technology have supported enhanced productivity and precision in biopharmaceutical production, significantly benefiting the bioprocess technology market. The global pharmaceutical industry has seen significant R&D investments, with the top 20 pharmaceutical companies collectively spending approximately $145 billion in 2023. These advancements have allowed for high-yield, contamination-free cell culture processes essential in producing high-purity biologics, thus reinforcing the sectors expansion.

- Rising Investments in R&D: R&D investments in bioprocessing technology are growing, driven by the demand for advanced biologics production solutions. Life sciences companies are channeling significant funding into bioprocess innovations, particularly in equipment and cell culture systems, to enhance production efficiency and quality. These advancements are crucial for meeting the rising demand for biologics, strengthening the U.S. bioprocessing sectors capabilities and competitiveness.

Market Challenges

- Initial High Costs: The bioprocess technology industry encounters significant financial barriers, particularly for small and medium enterprises. High initial investments are needed for essential equipment like bioreactors and cell culture systems, making market entry challenging. These substantial costs can restrict competition and potentially slow innovation, as only larger companies may be able to afford the initial setup.

- Regulatory Hurdles: Navigating stringent U.S. regulatory requirements poses another challenge in the bioprocess industry. Compliance with FDA regulations for biopharmaceutical manufacturing demands extensive resources and strict adherence to updated guidelines. These rigorous standards increase operational costs and place additional financial pressure on companies, affecting their ability to innovate and expand within the market.

USA Bioprocess Technology Market Future Outlook

The USA Bioprocess Technology Market is projected to experience consistent growth over the coming years. Key factors driving this trajectory include the increasing complexity of biopharmaceuticals, growing demand for biologics, and adoption of single-use bioprocessing systems. Additionally, advancements in automation and real-time process analytics will significantly enhance productivity, positioning the USA market as a global leader in bioprocessing.

Market Opportunities

- Innovation in Single-use Bioprocessing: Single-use bioprocessing technology is increasingly popular for its cost-efficiency and flexibility in manufacturing. These systems reduce contamination risks and simplify the production process by allowing for quick equipment changeovers. As a result, single-use technology offers an efficient alternative to traditional stainless-steel systems, enabling manufacturers to scale up production more easily, especially in biologics manufacturing.

- Collaborative Industry Research: Collaborations between academic institutions and private sector companies are on the rise in the U.S. bioprocess technology market. These partnerships integrate academic research into commercial applications, facilitating rapid advancements in bioprocessing technology. By combining resources and expertise, these collaborations create a mutually beneficial environment that accelerates innovation and addresses industry challenges.

Scope of the Report

|

By Product Type |

Bioreactors and Fermenters Filtration Equipment Media and Reagents Cell Culture Systems Chromatography Equipment |

|

By Application |

Biopharmaceutical Production Food and Agriculture Industrial Biotech Applications Water and Waste Treatment |

|

By Workflow Process |

Upstream Processing Downstream Processing Analytical and Quality Control |

|

By End-User |

Research Institutes and Academics Biotech Companies CMOs |

|

By Region |

North East South West |

Products

Key Target Audience

Biopharmaceutical Manufacturers

Industrial Biotech Companies

Water and Waste Treatment Companies

Contract Manufacturing Organizations (CMOs)

Government and Regulatory Bodies (FDA, NIH)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Thermo Fisher Scientific

Danaher Corporation

Sartorius AG

Merck KGaA

Eppendorf AG

Applikon Biotechnology

Boehringer Ingelheim BioXcellence

Corning Incorporated

Repligen Corporation

Novasep Holding SAS

Table of Contents

1. USA Bioprocess Technology Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Dynamics

1.4 Key Market Segmentation Overview

2. USA Bioprocess Technology Market Size (USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Milestones in Market Development

3. USA Bioprocess Technology Market Analysis

3.1 Growth Drivers (e.g., Biopharmaceutical Demand, Process Innovation, FDA Approvals)

3.1.1 Increased Adoption in Biopharmaceuticals

3.1.2 Technological Advancements in Cell Culture Systems

3.1.3 Rising Investments in R&D

3.1.4 Enhanced Government Initiatives

3.2 Market Challenges (e.g., High Capital Requirements, Technological Complexity)

3.2.1 Initial High Costs

3.2.2 Regulatory Hurdles

3.2.3 Limited Technical Workforce

3.3 Opportunities (e.g., Partnerships, Process Automation)

3.3.1 Innovation in Single-use Bioprocessing

3.3.2 Collaborative Industry Research

3.3.3 Growing Demand in Emerging Therapies

3.4 Trends (e.g., Process Optimization, Bioprocess Automation)

3.4.1 Shift Toward Continuous Bioprocessing

3.4.2 Integration with AI and Automation

3.4.3 Increased Demand for Modular Bioprocessing Facilities

3.5 Regulatory Framework

3.5.1 cGMP Compliance Requirements

3.5.2 FDA Bioprocess Validation Standards

3.5.3 Environmental and Safety Standards

3.5.4 Emerging Guidelines for Novel Biologics

3.6 SWOT Analysis

3.7 Value Chain Analysis

3.8 Stakeholder Ecosystem

3.9 Porters Five Forces

4. USA Bioprocess Technology Market Segmentation

4.1 By Product Type (Value %)

4.1.1 Bioreactors and Fermenters

4.1.2 Filtration Equipment

4.1.3 Media and Reagents

4.1.4 Cell Culture Systems

4.1.5 Chromatography Equipment

4.2 By Application (Value %)

4.2.1 Biopharmaceutical Production

4.2.2 Food and Agriculture

4.2.3 Industrial Biotech Applications

4.2.4 Water and Waste Treatment

4.3 By Workflow Process (Value %)

4.3.1 Upstream Processing

4.3.2 Downstream Processing

4.3.3 Analytical and Quality Control

4.4 By End-User (Value %)

4.4.1 Research Institutes and Academics

4.4.2 Biotech Companies

4.4.3 Contract Manufacturing Organizations (CMOs)

4.5 By Region (Value %)

4.5.1 North

4.5.2 East

4.5.3 South

4.5.4 West

5. USA Bioprocess Technology Market Competitive Analysis

5.1 Profiles of Major Companies

5.1.1 Thermo Fisher Scientific Inc.

5.1.2 Danaher Corporation

5.1.3 Sartorius AG

5.1.4 Merck KGaA

5.1.5 GE Healthcare

5.1.6 Eppendorf AG

5.1.7 Applikon Biotechnology

5.1.8 Boehringer Ingelheim BioXcellence

5.1.9 Corning Incorporated

5.1.10 Repligen Corporation

5.1.11 Novasep Holding SAS

5.1.12 Asahi Kasei Medical Co. Ltd.

5.1.13 Charles River Laboratories

5.1.14 Lonza Group

5.1.15 Wuxi Biologics

5.2 Cross-Comparison Parameters (Manufacturing Capacity, Technological Innovation, R&D Investment, Supply Chain Optimization, Global Presence, Revenue, Market Focus, Workforce Strength)

5.3 Market Share Analysis

5.4 Strategic Partnerships and Alliances

5.5 Mergers and Acquisitions

5.6 Investment Patterns and Private Funding

5.7 Government Grants and Incentives

5.8 Emerging Private Equity Investments

6. USA Bioprocess Technology Market Regulatory Framework

6.1 cGMP Standards

6.2 FDA Regulatory Compliance

6.3 Environmental Regulations for Waste Management

6.4 Biopharmaceutical Safety and Quality Standards

7. Future Market Size (USD Mn)

7.1 Future Growth Analysis

7.2 Key Drivers in Future Market Expansion

8. Future Market Segmentation

8.1 By Product Type (Value %)

8.2 By Application (Value %)

8.3 By Workflow Process (Value %)

8.4 By End-User (Value %)

8.5 By Region (Value %)

9. USA Bioprocess Technology Market Analysts Recommendations

9.1 Total Addressable Market (TAM) / Serviceable Available Market (SAM) / Serviceable Obtainable Market (SOM)

9.2 Customer Behavior Analysis

9.3 Targeted Marketing Strategies

9.4 Gap and White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involves identifying the primary factors influencing the USA Bioprocess Technology Market. This includes a comprehensive mapping of the market ecosystem to determine demand drivers, production capacities, and technological advancements.

Step 2: Market Analysis and Construction

This step encompasses the analysis of historical and current market data, covering variables like revenue generation, adoption rates, and end-user segmentation. Rigorous analysis of industry-specific indicators helps build a robust market model.

Step 3: Hypothesis Validation and Expert Consultation

Through a series of expert interviews and consultations with industry stakeholders, hypotheses about market dynamics are validated. These consultations yield detailed insights into market trends and operational challenges directly from industry insiders.

Step 4: Research Synthesis and Final Output

The final phase synthesizes research insights, integrating them with data collected from primary and secondary sources. This provides a validated, comprehensive view of the USA Bioprocess Technology Market, ensuring accuracy and reliability in the final report.

Frequently Asked Questions

How big is the USA Bioprocess Technology Market?

The USA Bioprocess Technology Market is valued at USD 7 billion, driven by increasing demand in biopharmaceutical production and investments in bioprocessing innovation.

02 What are the challenges in the USA Bioprocess Technology Market?

The USA Bioprocess Technology Market faces challenges such as high capital requirements, complex regulatory frameworks, and a limited skilled workforce, which can impact market expansion.

03 Who are the major players in the USA Bioprocess Technology Market?

Key players in USA Bioprocess Technology Market include Thermo Fisher Scientific, Danaher Corporation, Sartorius AG, Merck KGaA, and Eppendorf AG, all of which maintain strong market positions due to their extensive product portfolios and strategic investments.

04 What drives the growth of the USA Bioprocess Technology Market?

Growth in the USA Bioprocess Technology Market is propelled by the rising demand for biologics, advancements in single-use bioprocessing, and increasing investments in R&D, particularly for complex biopharmaceuticals.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.