USA Biosensors Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD9714

December 2024

85

About the Report

USA Biosensor Market Overview

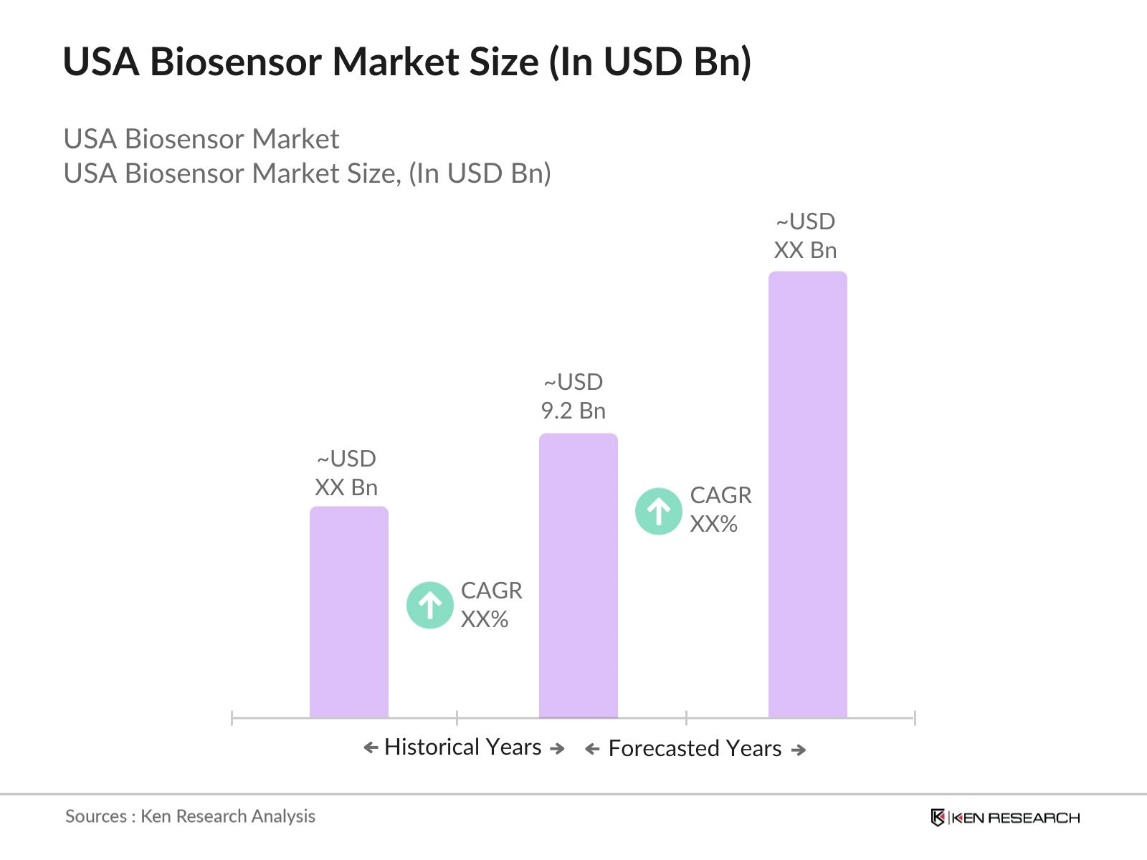

- The USA Biosensor Market is valued at USD 9.2 billion, driven by the rapid integration of biosensors in healthcare, consumer electronics, and industrial applications. The increasing prevalence of chronic diseases such as diabetes and cardiovascular disorders has led to heightened demand for point-of-care diagnostics, where biosensors play a pivotal role. Additionally, technological advancements such as miniaturization of biosensors and improvements in sensitivity have further fueled market growth.

- Major cities like New York, Los Angeles, and Boston dominate the market due to their established healthcare ecosystems and concentration of biosensor manufacturing companies. These cities are home to world-leading research institutions and hospitals that drive innovation, creating a favorable environment for biosensor companies. Bostons renowned biotech cluster and New Yorks healthcare infrastructure support clinical trials, product development, and market expansion, establishing these regions as biosensor hubs.

- In 2023, the Centers for Medicare & Medicaid Services (CMS) did indeed expand reimbursement policies to include biosensor-based diagnostic devices. This expansion represents a notable advancement in making biosensor technologies more accessible and affordable for patients. The move aligns with the growing demand for innovative medical devices that facilitate early diagnosis and continuous health monitoring, particularly in the context of chronic conditions like diabetes.

USA Biosensor Market Segmentation

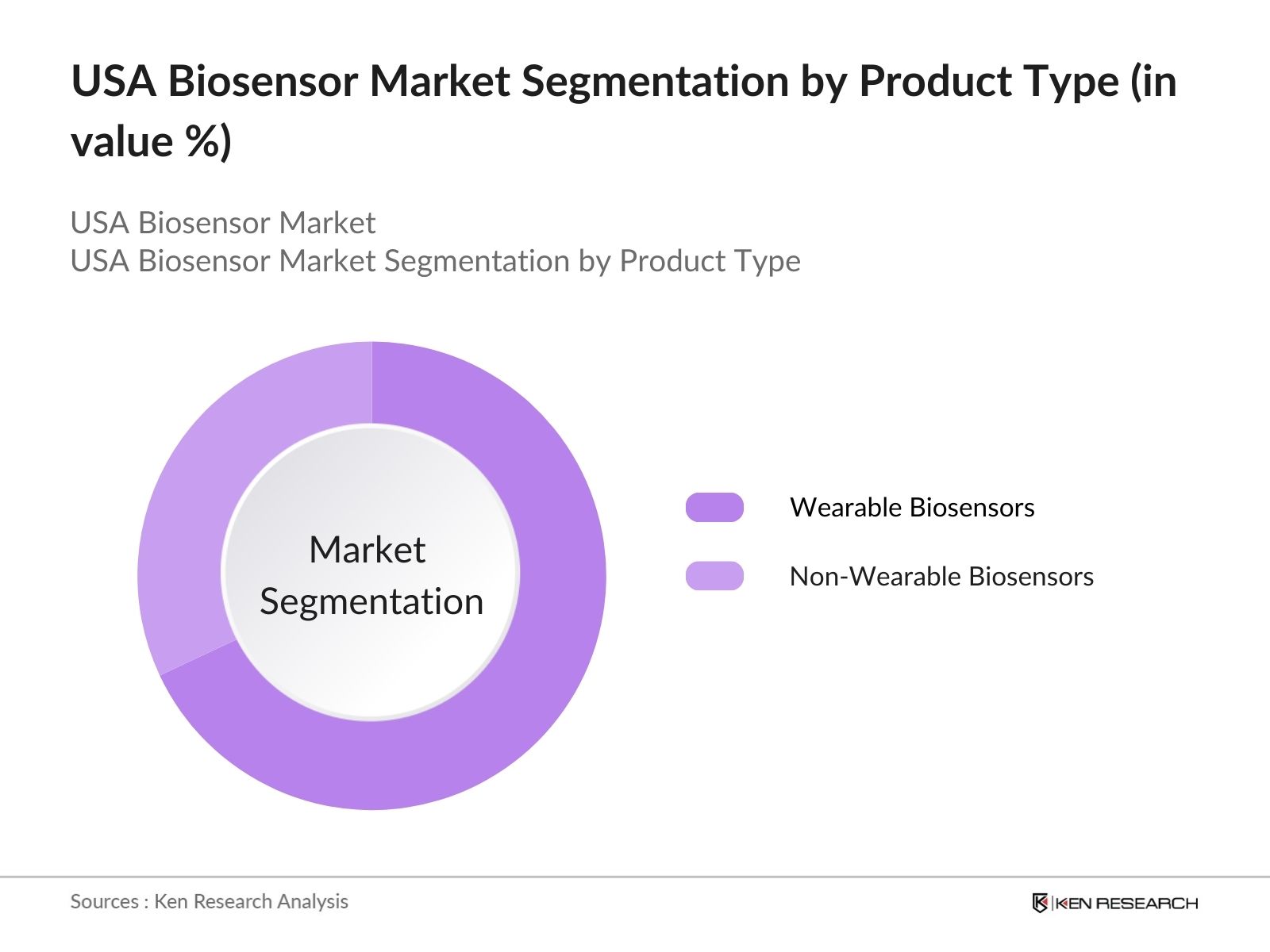

By Product Type: The USA biosensor market is segmented by product type into wearable biosensors and non-wearable biosensors. Wearable biosensors dominate the market due to their rising use in healthcare monitoring, fitness tracking, and early disease detection. The increasing popularity of wearable devices such as smartwatches, fitness bands, and continuous glucose monitors (CGM) drives this segments growth. Companies like Abbott Laboratories and Dexcom have launched advanced CGM systems, which are widely adopted due to their precision, compact size, and real-time monitoring capabilities.

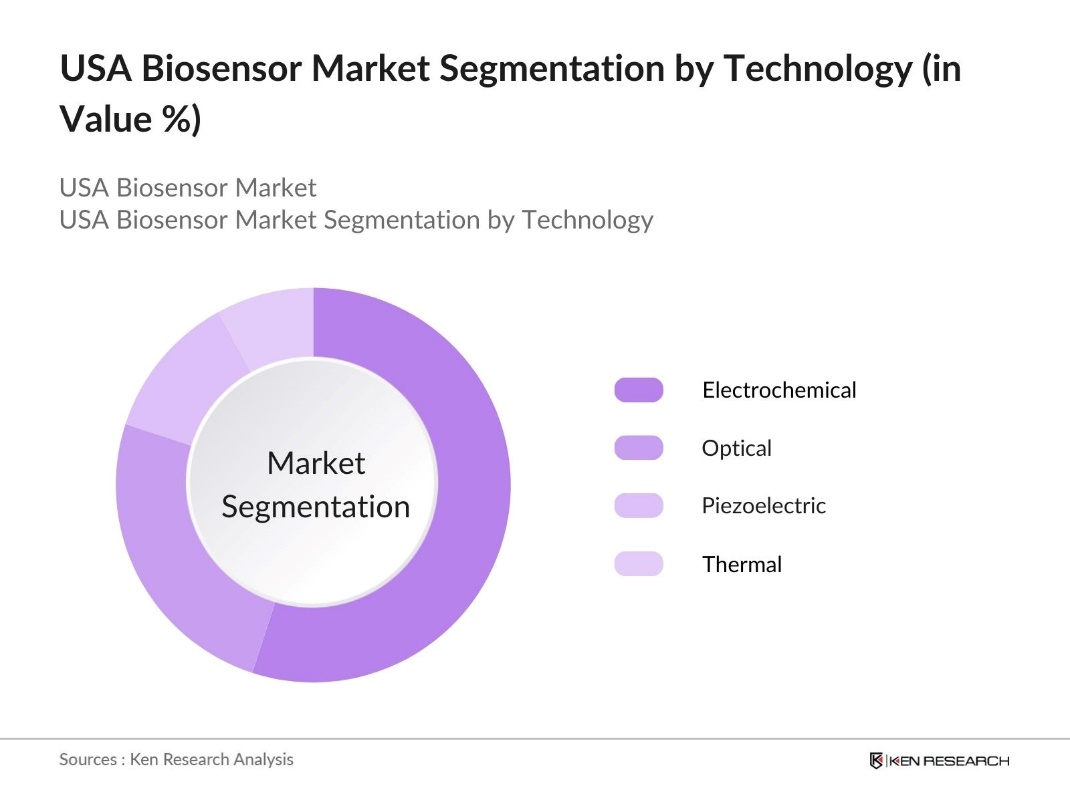

By Technology: The biosensor market is also segmented by technology, including electrochemical, optical, piezoelectric, and thermal biosensors. Electrochemical biosensors hold the largest share within this segment, driven by their application in glucose monitoring and other diagnostic tools. These sensors are highly sensitive, cost-effective, and easy to miniaturize, making them the preferred choice in medical diagnostics. Continuous advancements in electrochemical sensors have allowed their widespread use in wearable devices, further solidifying their dominance.

USA Biosensor Market Competitive Landscape

The USA biosensor market is dominated by major healthcare and technology companies that invest heavily in R&D and have strong distribution networks. The consolidation of these players highlights the importance of scale and innovation in this market.

|

Company |

Establishment Year |

Headquarters |

Revenue |

R&D Investment |

No. of Patents |

Product Portfolio |

Global Presence |

Mergers & Acquisitions |

|

Abbott Laboratories |

1888 |

Illinois, USA |

||||||

|

Medtronic PLC |

1949 |

Minnesota, USA |

||||||

|

Dexcom, Inc. |

1999 |

California, USA |

||||||

|

F. Hoffmann-La Roche Ltd |

1896 |

Basel, Switzerland |

||||||

|

GE Healthcare |

1892 |

Illinois, USA |

USA Biosensor Industry Analysis

Growth Drivers

- Rising Demand for Point-of-Care Devices: The USA is witnessing increased demand for point-of-care (POC) devices, driven by advancements in biosensor technologies. For example, POC biosensors for glucose monitoring have become essential for managing diabetes, which affects millions of people in the USA as of 2024. With chronic diseases rising, particularly in rural areas where access to healthcare is limited, POC devices offer a timely diagnostic solution. The aging population, accounting for nearly 54 million (16.9%) of the total population in 2022, is also fueling demand for POC diagnostics. This aligns with government health policies aimed at enhancing healthcare accessibility.

- Increased Use in Diabetes Management: As of 2021, approximately 11.6% of the U.S. population had diabetes. Biosensors, particularly continuous glucose monitoring (CGM) systems, play a crucial role in diabetes management by offering real-time monitoring. The FDA approved several biosensor-based CGM systems, such as the Dexcom G6, highlighting government support for advanced technologies. This integration of biosensors into diabetes management has contributed to a decrease in complications and hospital visits.

- Growing Adoption in Wearable Devices: Wearable biosensors are gaining popularity in the USA, driven by increased health awareness and the need for continuous monitoring of vital signs like heart rate and glucose levels. Integrated into fitness trackers and smartwatches, these devices support preventive healthcare by enabling individuals to track their health in real time. This trend reflects a growing demand for personalized health solutions and innovations in wearable technology.

Market Challenges

- High Development Costs: The biosensor market in the USA encounters substantial cost challenges, particularly in research, development, and production. Creating advanced biosensors requires heavy financial investment, and the need for extensive clinical trials adds to the burden. Small and medium-sized enterprises (SMEs) often struggle to bring innovations to market due to these high initial costs, which can slow the overall pace of technological advancement and market growth.

- Regulatory Barriers (FDA Approvals, Clinical Trials): Biosensor companies in the USA face stringent regulatory hurdles, especially with the FDAs rigorous approval processes. Medical biosensors require extensive clinical testing and approvals, which can take several years to complete. These regulatory challenges can delay market entry for new products, posing a significant barrier to innovation and progress in the biosensor industry.

USA Biosensor Market Future Outlook

Over the next five years, the USA biosensor market is expected to experience robust growth, driven by technological innovations, increasing use of biosensors in medical diagnostics, and growing demand for remote patient monitoring solutions. The rising adoption of wearable health monitoring devices, coupled with advancements in artificial intelligence and data analytics, will propel the market forward.

Market Opportunities

- Expansion in Non-Medical Applications: Biosensors are increasingly being applied in non-medical sectors such as environmental monitoring and food safety. These technologies help in detecting pollutants and ensuring the safety of water and food supplies. In industries like agriculture and food processing, biosensors are used to monitor contaminants in real-time, ensuring product safety. This expansion presents new opportunities for biosensor manufacturers to explore diverse, lucrative markets outside of traditional healthcare applications.

- Collaboration with Tech Giants: Partnerships between biosensor companies and tech giants are driving innovation and fostering market growth. By collaborating with technology firms, biosensor manufacturers gain access to advanced technologies such as artificial intelligence and data analytics. These collaborations not only enhance product capabilities but also open up opportunities in consumer health technology, enabling early disease detection and personalized healthcare solutions. This synergy is accelerating the adoption of biosensor technologies in various consumer markets.

Scope of the Report

|

By Product Type |

Wearable Biosensors Non-Wearable Biosensors |

|

By Technology |

Electrochemical Biosensors Optical Biosensors Piezoelectric Biosensors Thermal Biosensors |

|

By Application |

Healthcare Environmental Monitoring Food and Beverage Industry Industrial Process Control |

|

By End-User |

Hospitals and Clinics Home Healthcare Environmental Agencies |

|

By Region |

North-East Midwest Southern Western |

Products

Key Target Audience

Medical Device Manufacturers

Pharmaceutical Companies

Wearable Device Manufacturers

Industrial Process Monitoring Firms

Biotechnology Companies

Government and Regulatory Bodies (FDA, HIPAA)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Abbott Laboratories

Medtronic PLC

F. Hoffmann-La Roche Ltd

Dexcom, Inc.

Siemens Healthineers AG

GE Healthcare

Nova Biomedical

Lifescan, Inc.

Universal Biosensors

Honeywell International, Inc.

Table of Contents

1. USA Biosensor Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Technological advancements, healthcare adoption rates, sensor miniaturization)

1.4. Market Segmentation Overview

2. USA Biosensor Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Partnerships, technological innovations, FDA approvals)

3. USA Biosensor Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Point-of-Care Devices

3.1.2. Advancements in Biotechnology

3.1.3. Growing Adoption in Wearable Devices

3.1.4. Increased Use in Diabetes Management

3.2. Market Challenges

3.2.1. High Development Costs

3.2.2. Regulatory Barriers (FDA approvals, Clinical trials)

3.2.3. Integration with Traditional Healthcare Systems

3.3. Opportunities

3.3.1. Expansion in Non-Medical Applications (Environmental monitoring, food safety)

3.3.2. Collaboration with Tech Giants

3.3.3. Increasing Investment in R&D

3.4. Trends

3.4.1. Growth of Wearable and Implantable Biosensors

3.4.2. Integration with AI and IoT (Internet of Things)

3.4.3. Use of Nanotechnology in Biosensors

3.5. Government Regulation

3.5.1. FDA Regulatory Framework for Biosensors

3.5.2. Healthcare Data Privacy Laws (HIPAA compliance)

3.5.3. Reimbursement Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, healthcare providers, tech developers)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Biosensor Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Wearable Biosensors

4.1.2. Non-Wearable Biosensors

4.2. By Technology (In Value %)

4.2.1. Electrochemical Biosensors

4.2.2. Optical Biosensors

4.2.3. Piezoelectric Biosensors

4.2.4. Thermal Biosensors

4.3. By Application (In Value %)

4.3.1. Healthcare

4.3.2. Environmental Monitoring

4.3.3. Food and Beverage Industry

4.3.4. Industrial Process Control

4.4. By End-User (In Value %)

4.4.1. Hospitals and Clinics

4.4.2. Home Healthcare

4.4.3. Environmental Agencies

4.5. By Region (In Value %)

4.5.1. North-East

4.5.2. Midwest

4.5.3. Southern

4.5.4. Western

5. USA Biosensor Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Abbott Laboratories

5.1.2. Medtronic PLC

5.1.3. F. Hoffmann-La Roche Ltd

5.1.4. Dexcom, Inc.

5.1.5. Siemens Healthineers AG

5.1.6. GE Healthcare

5.1.7. Nova Biomedical

5.1.8. Bio-Rad Laboratories, Inc.

5.1.9. Lifescan, Inc.

5.1.10. Universal Biosensors

5.1.11. Honeywell International, Inc.

5.1.12. Johnson & Johnson

5.1.13. Sensirion AG

5.1.14. Nemaura Medical

5.1.15. Biovotion AG

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, R&D Investments, Partnerships, Patent Portfolio, No. of Employees, Market Penetration, Global Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Biosensor Market Regulatory Framework

6.1. Healthcare Standards (ISO certifications, FDA approvals)

6.2. Data Security and Compliance (HIPAA, GDPR)

6.3. Certification Processes

7. USA Biosensor Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Biosensor Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. USA Biosensor Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involved mapping the entire ecosystem of stakeholders in the USA biosensor market, supported by comprehensive desk research and credible databases. The goal was to identify the critical variables that influence the market's growth, including technological trends, regulatory requirements, and market penetration factors.

Step 2: Market Analysis and Construction

In this phase, historical data from the biosensor market was compiled and analyzed, focusing on the penetration of medical applications and the subsequent revenue streams generated from diagnostics and wearable technologies. The data was cross-referenced to ensure accuracy in revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed based on the initial data, then validated through expert consultations via computer-assisted telephone interviews (CATI). Industry leaders provided financial insights that helped refine market estimations.

Step 4: Research Synthesis and Final Output

In the final stage, direct engagement with major manufacturers of biosensors provided valuable insights into product segmentation, consumer preferences, and sales trends. The findings were synthesized to offer a comprehensive and validated analysis of the USA biosensor market.

Frequently Asked Questions

01 How big is the USA Biosensor Market?

The USA Biosensor Market is valued at USD 9.2 billion, supported by the rising demand for medical diagnostics and wearable technologies in healthcare monitoring.

02 What are the major challenges in the USA Biosensor Market?

Challenges in USA Biosensor Market include high R&D costs, strict regulatory approvals, and technical barriers associated with integrating biosensors into healthcare systems.

03 Who are the key players in the USA Biosensor Market?

Key players USA Biosensor Market include Abbott Laboratories, Medtronic PLC, F. Hoffmann-La Roche Ltd, Dexcom, Inc., and Siemens Healthineers AG.

04 What is driving growth in the USA Biosensor Market?

Growth is driven by technological advancements, the increasing prevalence of chronic diseases, and the adoption of wearable health monitoring devices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.