USA Biotechnology Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD10935

November 2024

97

About the Report

USA Biotechnology Market Overview

- The USA Biotechnology market is valued at USD 370 billion, driven by innovations in genetic engineering, rising demand for personalized medicine, and government and private sector investments in R&D. These factors have created a robust growth environment, underpinned by public-private partnerships that facilitate advancements in biotechnology solutions. The sector has experienced consistent growth, demonstrating resilience and adaptability in addressing healthcare and environmental needs.

- In the biotechnology landscape, cities such as Boston, San Francisco, and Raleigh-Durham stand out as dominant hubs. Bostons extensive research ecosystem, San Franciscos technology-centric approach, and Raleigh-Durhams biotechnology parks drive innovation and product development. These cities benefit from a concentration of skilled labor, proximity to research institutions, and significant venture capital investment, making them central to the markets growth.

- In 2024, the federal government introduced a $5 billion National Biotechnology Strategy aimed at supporting biotechnological research, particularly in genomics and regenerative medicine. This initiative includes grants for startups, tax incentives, and funding for innovation hubs, enhancing the overall infrastructure and enabling rapid advancements in biotech applications.

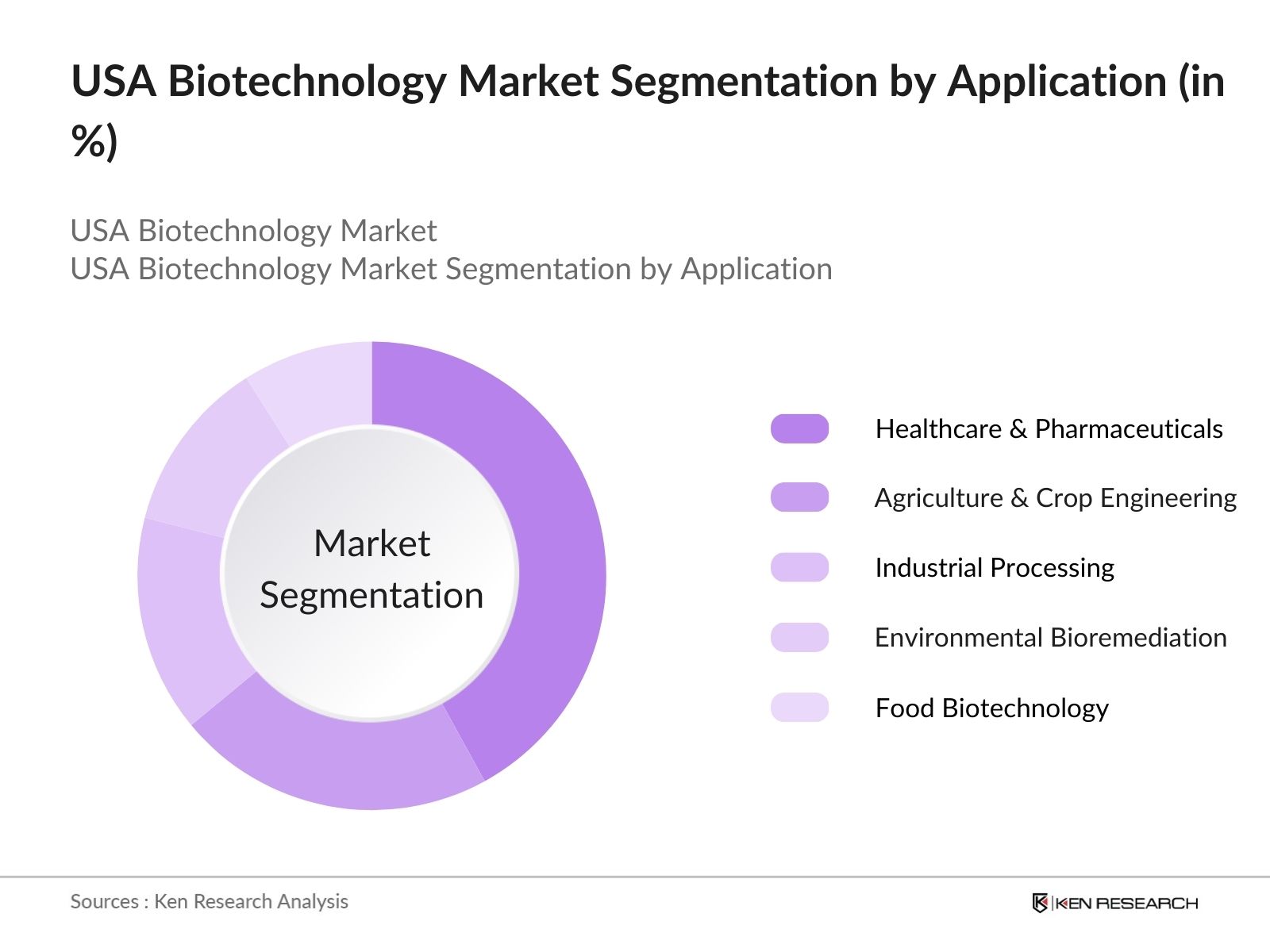

USA Biotechnology Market Segmentation

By Application: The market is segmented by application into healthcare and pharmaceuticals, agriculture and crop engineering, industrial processing, environmental bioremediation, and food biotechnology. Healthcare and pharmaceuticals hold a dominant share in this segment due to their role in developing gene therapies, vaccines, and biologics. The segments growth is driven by advancements in precision medicine and regulatory support, which facilitates swift drug approvals, fueling a high demand for biotechnological innovations.

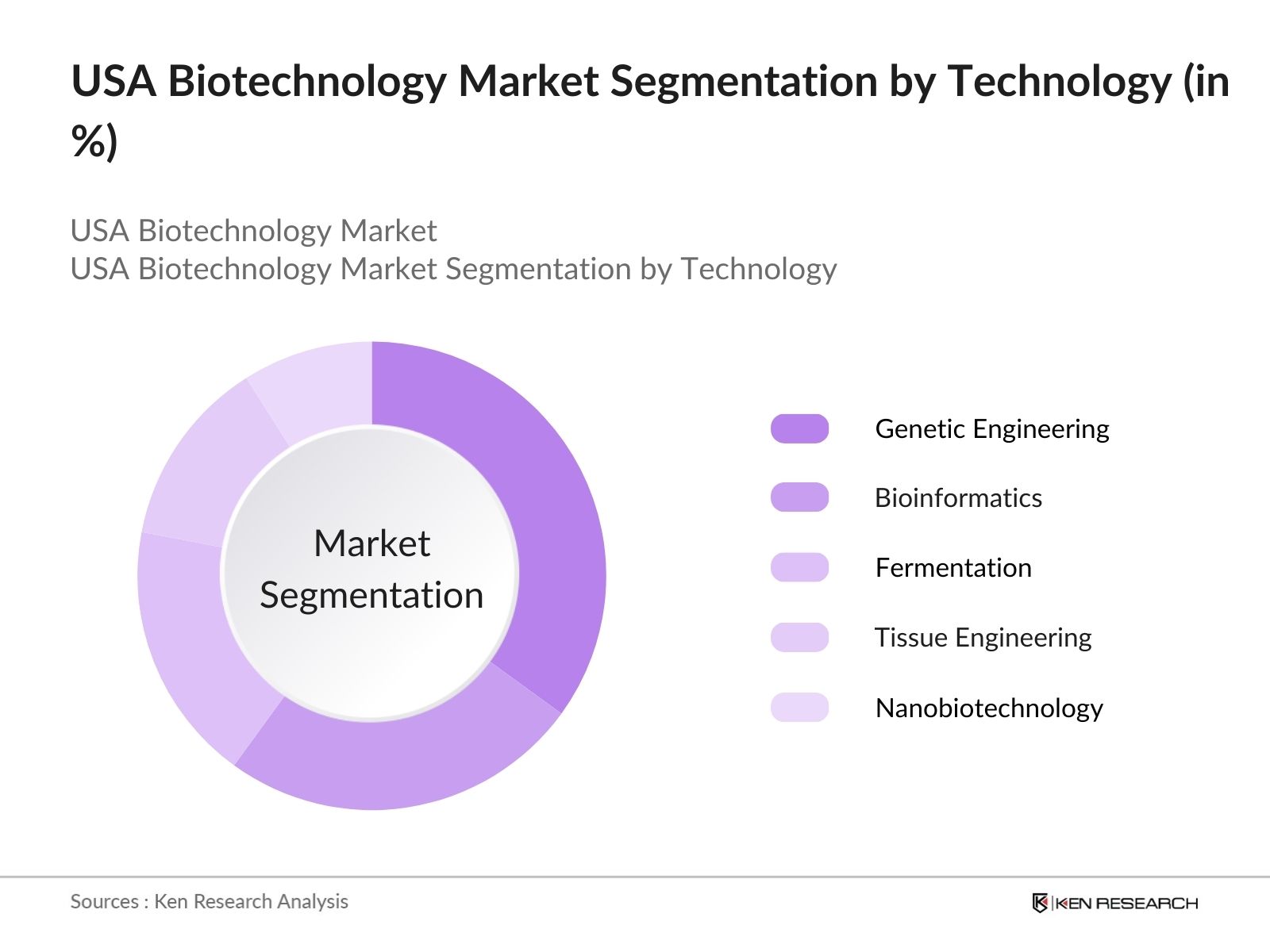

By Technology: The market is also segmented by technology into genetic engineering, bioinformatics, fermentation, tissue engineering, and nanobiotechnology. Genetic engineering leads this category due to its broad application in gene therapies and the development of genetically modified organisms (GMOs) for both agricultural and medical use. As research in CRISPR and other gene-editing technologies advances, genetic engineerings share continues to expand, largely due to its effectiveness in precision treatments and the enhanced efficacy of genetically modified crops.

USA Biotechnology Market Competitive Landscape

The market is characterized by a blend of local and global players, with prominent companies driving innovation through significant investments in research, strategic collaborations, and acquisitions. The market remains competitive as major players continue to expand their portfolios through innovative solutions in genetic engineering, CRISPR technology, and cell therapy.

USA Biotechnology Market Analysis

Market Growth Drivers

- Investment Surge in Genomic Research: The USA biotechnology sector has seen investments toward genomic research, with annual investments totaling over $3 billion in 2024 from both public and private entities. This funding is driving advancements in personalized medicine, leveraging genomic data to develop targeted treatments. The US governments commitment of an additional $1.2 billion for gene sequencing projects further supports this growth by increasing the capacity for genome-based disease diagnostics and treatment development.

- Expansion of Biotechnology Infrastructure: In 2024, around 10 new biotechnology research facilities have been established across the country, with combined investments of nearly $4.5 billion. This expansion enhances research capabilities and strengthens the biotech sectors infrastructure, facilitating further innovations in therapeutics and diagnostics. State governments have also contributed about $500 million toward infrastructure development to support regional biotech clusters, underscoring the focus on building a robust biotechnological ecosystem.

- Rise in Biotechnology Exports: The USA has seen an uptick in biotechnology exports in 2024, reaching a record $25 billion, driven by demand for advanced biopharmaceuticals and diagnostic solutions. This increase is supported by trade agreements and export incentives, enabling biotech companies to access international markets. The favorable export environment is bolstered by supportive policies, with federal incentives adding around $1 billion in support for companies exporting biotechnological goods.

Market Challenges

- High R&D Costs and Extended Development Timelines: Biotechnology companies face R&D expenditures of around $90 million annually per company, attributed to high costs in drug discovery and lengthy regulatory processes. This financial burden, combined with the requirement for FDA compliance, elongates the commercialization timeline, creating a substantial challenge for smaller companies lacking the capital for sustained R&D investment.

- Regulatory Compliance and Approval Hurdles: Biotech products in the USA are subjected to rigorous FDA regulations, which involve average approval times of 2-3 years and cost companies close to $500,000 per drug. This stringent regulatory framework can delay product launches, making it difficult for companies to bring novel solutions to the market swiftly. Compliance with these standards adds further costs and operational constraints for the biotech sector.

USA Biotechnology Market Future Outlook

Over the next five years, the USA Biotechnology industry is expected to experience growth, driven by continued advancements in gene and cell therapies, an increasing focus on sustainable biofuels, and rising demand for biotechnological applications in food and agriculture.

Future Market Opportunities

- Expansion of Biomanufacturing Capabilities: Over the next five years, the USA is projected to establish 15 new biomanufacturing facilities, with $10 billion in investments earmarked for these projects. This will address increasing demand for biotech products domestically and internationally, ensuring the USA remains a leader in biomanufacturing capacity and innovation.

- Growth in Precision Medicine Market: The precision medicine sector in the USA is anticipated to grow by $12 billion by 2029, driven by the integration of AI and machine learning in genomics. This growth will enable biotech companies to develop highly tailored treatments, and government funding for precision medicine is expected to double, supporting technological advancements in this field.

Scope of the Report

|

Application |

Healthcare and Pharmaceuticals Agriculture and Crop Engineering Industrial Processing Environmental Bioremediation Food Biotechnology |

|

Technology |

Genetic Engineering Bioinformatics Fermentation Tissue Engineering Nanobiotechnology |

|

Product Type |

Recombinant Proteins Monoclonal Antibodies Vaccines Enzymes Biofuels |

|

End-User Industry |

Pharmaceutical and Healthcare Agriculture Environmental Services Industrial Biotech |

|

Region |

North-East West Coast Mid-West Southern States |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Pharmaceutical and Biotech Companies

Agricultural Firms

Environmental Organizations

Food and Beverage Corporations

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, NIH)

Healthcare Providers and Research Institutes

Diagnostic Labs and Genetic Testing Facilities

Companies

Amgen Inc.

Gilead Sciences

Genentech, Inc.

Moderna, Inc.

Vertex Pharmaceuticals

BioMarin Pharmaceutical Inc.

Illumina, Inc.

CRISPR Therapeutics

Thermo Fisher Scientific

Agilent Technologies

Table of Contents

1.USA Biotechnology Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Biotechnology Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Biotechnology Market Analysis

3.1. Growth Drivers

3.1.1. Technological Advancements in Genetic Engineering

3.1.2. Rising Demand for Personalized Medicine

3.1.3. Increasing Federal and Private Funding (Funding Sources)

3.1.4. Public-Private Partnerships in R&D

3.2. Market Challenges

3.2.1. High R&D Costs and Regulatory Compliance (Regulatory Requirements)

3.2.2. Intellectual Property Barriers

3.2.3. Talent Shortage in Biotechnology Sector

3.3. Opportunities

3.3.1. Expansion into Gene and Cell Therapies (Emerging Biotechnologies)

3.3.2. Growing Demand for Biofuels

3.3.3. Increase in Precision Medicine Applications

3.4. Trends

3.4.1. Rise of CRISPR Technology

3.4.2. Integration with AI and Machine Learning (Digital Innovation)

3.4.3. Growth of Biomanufacturing and Synthetic Biology

3.5. Government Initiatives and Policies

3.5.1. NIH Research Programs

3.5.2. FDA Regulations and Approvals

3.5.3. Tax Incentives for Biotech Firms

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Stakeholder Mapping)

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Ecosystem

4. USA Biotechnology Market Segmentation

4.1. By Application (in Value %)

4.1.1. Healthcare and Pharmaceuticals

4.1.2. Agriculture and Crop Engineering

4.1.3. Industrial Processing

4.1.4. Environmental Bioremediation

4.1.5. Food Biotechnology

4.2. By Technology (in Value %)

4.2.1. Genetic Engineering

4.2.2. Bioinformatics

4.2.3. Fermentation

4.2.4. Tissue Engineering

4.2.5. Nanobiotechnology

4.3. By Product Type (in Value %)

4.3.1. Recombinant Proteins

4.3.2. Monoclonal Antibodies

4.3.3. Vaccines

4.3.4. Enzymes

4.3.5. Biofuels

4.4. By End-User Industry (in Value %)

4.4.1. Pharmaceutical and Healthcare

4.4.2. Agriculture

4.4.3. Environmental Services

4.4.4. Industrial Biotech

4.5. By Region (in Value %)

4.5.1. North-East

4.5.2. West Coast

4.5.3. Mid-West

4.5.4. Southern States

5. USA Biotechnology Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amgen Inc.

5.1.2. Gilead Sciences

5.1.3. Biogen Inc.

5.1.4. Genentech, Inc.

5.1.5. Moderna, Inc.

5.1.6. Regeneron Pharmaceuticals

5.1.7. Vertex Pharmaceuticals

5.1.8. BioMarin Pharmaceutical Inc.

5.1.9. Illumina, Inc.

5.1.10. Novavax, Inc.

5.1.11. CRISPR Therapeutics

5.1.12. Agilent Technologies

5.1.13. Thermo Fisher Scientific

5.1.14. Kite Pharma

5.1.15. Bluebird Bio, Inc.

5.2. Cross Comparison Parameters (R&D Investments, Headquarters Location, Revenue, Patent Filings, Employee Count, Market Share, Revenue Growth Rate, Key Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Strategic Expansion)

5.5. Mergers and Acquisitions (M&A Activities)

5.6. Investment Analysis (Venture Capital and Private Equity Investments)

5.7. Government Grants and Funding

6. USA Biotechnology Market Regulatory Framework

6.1. FDA Regulatory Guidelines

6.2. Compliance Requirements

6.3. Patent and Intellectual Property Standards

7. USA Biotechnology Future Market Size (in USD Bn)

7.1. Future Market Size Projections

7.2. Key Drivers of Future Growth

8. USA Biotechnology Future Market Segmentation

8.1. By Application

8.2. By Technology

8.3. By Product Type

8.4. By End-User Industry

8.5. By Region

9. USA Biotechnology Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing and Expansion Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase focuses on identifying core variables in the USA Biotechnology Market, covering stakeholders such as pharmaceutical firms, healthcare providers, and agricultural enterprises. An ecosystem map is developed through desk research, drawing from secondary and proprietary databases to define influential factors shaping the market.

Step 2: Market Analysis and Construction

Using historical data, we assess market penetration and revenue generation, especially within healthcare and environmental applications. Service quality statistics and biomanufacturing trends are analyzed to establish reliable revenue estimates across biotechnology applications.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through interviews with industry experts across biotech segments. These consultations provide practical insights into financial and operational aspects, enhancing data precision through first-hand industry validation.

Step 4: Research Synthesis and Final Output

In this phase, data from biotechnology companies are synthesized to verify statistics derived from a bottom-up approach. Direct engagement with sector leaders further validates the analysis, ensuring a robust and comprehensive review of the USA Biotechnology Market.

Frequently Asked Questions

1. How big is the USA Biotechnology Market?

The USA Biotechnology Market was valued at USD 370 billion, with growth driven by advancements in genetic engineering, precision medicine, and increased investments in biotechnology R&D.

2. What are the primary challenges in the USA Biotechnology Market?

Key challenges in the USA Biotechnology Market include high R&D costs, regulatory complexities, and intellectual property barriers, all of which impact the scalability and accessibility of biotechnology innovations.

3. Who are the major players in the USA Biotechnology Market?

Leading players in the USA Biotechnology Market include Amgen Inc., Genentech, Gilead Sciences, and Moderna, among others, all of whom influence the market through extensive R&D and strategic partnerships.

4. What drives the USA Biotechnology Markets growth?

Growth in the USA Biotechnology Market is primarily driven by federal funding, advancements in gene and cell therapies, and increasing applications of biotechnology across sectors such as healthcare and agriculture.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.