USA Board Games Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD5793

November 2024

93

About the Report

USA Board Games Market Overview

- The USA Board Games market is valued at USD 2 billion. This market has been driven by a resurgence in tabletop gaming as families and groups of friends increasingly seek offline, interactive entertainment experiences. The popularity of board game cafs and conventions has grown, with board games becoming a central activity for social gatherings.

- Major cities like New York, Los Angeles, and Chicago dominate the market, largely due to their high population density, disposable income levels, and a strong presence of retail stores catering to board game enthusiasts. These cities also host large-scale board game conventions and events, further boosting consumer interest. s

- In 2024, the U.S. government allocated $2 billion towards STEM (Science, Technology, Engineering, and Math) education initiatives across schools. Part of this funding is being directed towards interactive learning tools, including educational board games, aimed at improving student engagement in STEM subjects. This initiative is encouraging board game manufacturers to design games that align with STEM learning objectives, increasing demand for educational board games in both the public and private sectors.

USA Board Games Market Segmentation

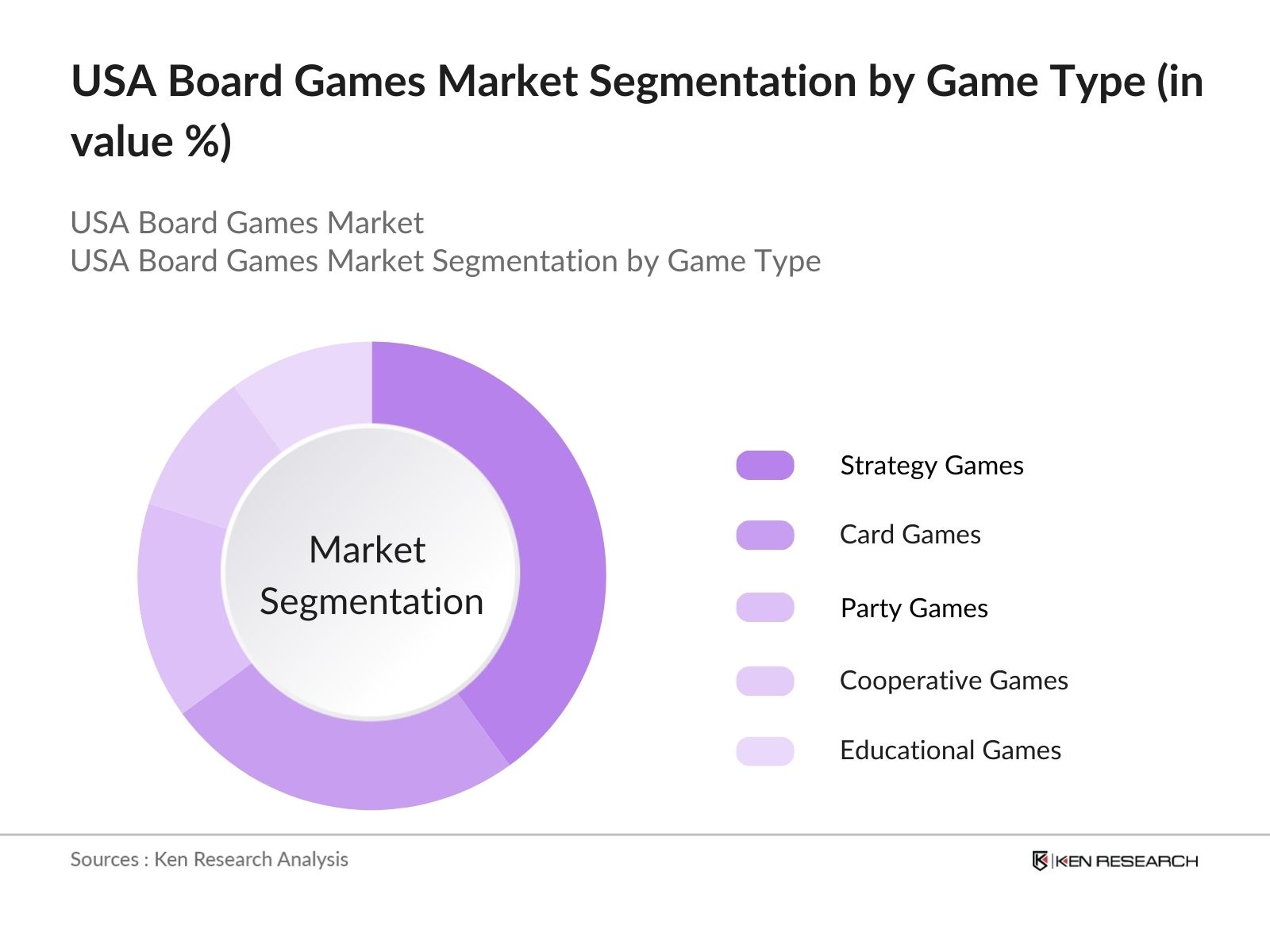

By Game Type: The market is segmented by game type into strategy games, card games, party games, cooperative games, and educational games. Strategy games dominate the market, particularly due to their popularity among adult consumers and hobbyist gamers. Games like "Settlers of Catan" and "Ticket to Ride" have garnered a strong fanbase. Their complex gameplay and replay ability have led to significant consumer engagement, especially among communities of competitive players.

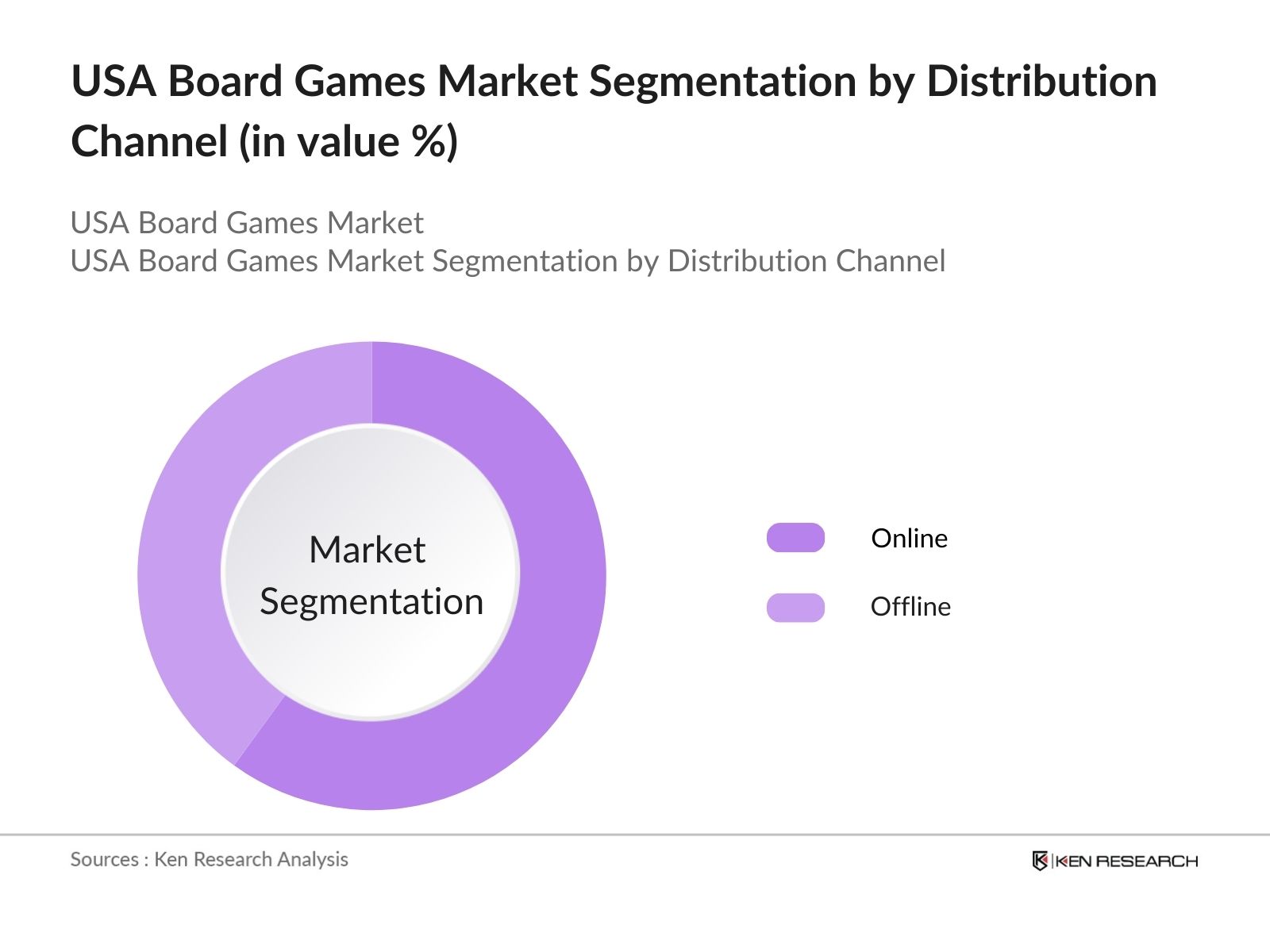

By Distribution Channel: The market is segmented by distribution channels into online and offline sales. Online sales lead the distribution channel segment due to the convenience of e-commerce platforms like Amazon, where a wide range of games is readily available. Additionally, many niche games and indie titles are only accessible online, contributing to this segment's dominance. The rise of crowdfunding platforms like Kickstarter has also driven online purchases, as gamers back new releases directly from creators.

USA Board Games Market Competitive Landscape

The market is dominated by several key players, which have established themselves through diverse product offerings and strong consumer loyalty. Companies like Hasbro Inc. and Mattel Inc. have capitalized on their well-known brands, while newer companies such as Fantasy Flight Games and CMON Limited have gained prominence through popular crowdfunding campaigns and community engagement.

|

Company |

Year Established |

Headquarters |

Number of Games |

Popular Titles |

Distribution Reach |

Annual Revenue (USD Bn) |

Key Innovations |

Crowdfunding Campaigns |

|

Hasbro Inc. |

1923 |

Rhode Island |

||||||

|

Mattel Inc. |

1945 |

California |

||||||

|

Fantasy Flight Games |

1995 |

Minnesota |

||||||

|

CMON Limited |

2001 |

Georgia |

||||||

|

Spin Master |

1994 |

Toronto |

USA Board Games Market Analysis

Market Growth Drivers

- Increased Interest in Educational Board Games: U.S. schools and educational institutions are increasingly integrating board games into their curriculum for cognitive development and collaborative learning. By 2024, an estimated 55,000 public and private schools across the U.S. are expected to adopt board games as supplementary educational tools, influencing an upsurge in demand for games that promote critical thinking, problem-solving, and social skills.

- Growing Influence of Crowdfunding Platforms: Crowdfunding platforms in the U.S. are becoming an avenue for launching new board games, with Kickstarter alone seeing over 2,300 game-related projects successfully funded by 2024. This new development model has facilitated market entry for small and independent game designers, who raised over $150 million through these platforms in 2023. The accessibility of these platforms has expanded product offerings in the board game space, increasing competition and product diversity, which drives growth.

- Increasing Popularity of Cooperative and Thematic Games: As of 2024, there has been a marked shift in consumer preferences toward thematic and cooperative board games, with sales increasing by 20 million units in comparison to 2023, reflecting a preference for immersive gaming experiences. Cooperative games that emphasize team-based play are becoming popular among diverse demographics, including families and young adults. This shift in consumer preferences is shaping game production trends, prompting companies to create more sophisticated thematic games with advanced storytelling features.

Market Challenges

- Saturation of the Market with Similar Game Concepts: The U.S. board game market, which saw the release of over 5,000 new games in 2024 alone, is becoming increasingly saturated. Many of these games are variations on popular mechanics like deck-building or worker placement, making it difficult for new games to stand out. The influx of similar game concepts has led to intense competition, reducing the ability of new entrants to capture significant market share and limiting innovation.

- Logistical Challenges and Supply Chain Disruptions: U.S.-based board game manufacturers continue to face logistics challenges, particularly in sourcing raw materials and shipping finished products. Shipping delays, especially from key suppliers in Asia, have caused backlogs, with lead times extending to over six months for some companies in 2024. This has affected timely product launches and restocking efforts, limiting market expansion and dampening sales potential during peak seasons like the holiday period.

USA Board Games Market Future Outlook

Over the next five years, the USA Board Games Industry is expected to see steady growth driven by the expansion of e-commerce platforms, increasing consumer interest in social and cooperative games, and the rising popularity of board game cafs and conventions.

Future Market Opportunities

- Growth in Collaborative Board Game Play via Digital Platforms: The trend toward online and hybrid board game play is expected to accelerate, with platforms such as Tabletopia and Board Game Arena forecasted to have 15 million active users by 2029. These platforms allow players to engage in collaborative play remotely, expanding the market for digital board games. Game publishers are expected to capitalize on this trend by developing more board games that support both physical and digital play, increasing consumer accessibility and engagement.

- Surge in Board Game Subscription Services: Subscription-based models for board games are set to gain popularity over the next five years, with companies offering monthly boxes that deliver curated game experiences directly to consumers. By 2029, it is anticipated that over 3 million households in the U.S. will subscribe to such services. This trend reflects a growing preference for convenience and discovery, as consumers look for ways to explore new games without committing to individual purchases. Subscription models will likely become a key revenue stream for publishers.

Scope of the Report

|

By Type |

Strategy Games Card Games Party Games Educational Games Cooperative Games |

|

By Distribution Channel |

Online Offline (Specialty Stores, General Retailers, Board Game Cafes) |

|

By Age Group |

Children Teens Adults |

|

By Game Mechanism |

Dice Rolling Deck Building Role-Playing Cooperative Play |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Banks and Financial Institution

Game Caf Owners

Board Games Manufacturers

Government and Regulatory Bodies (Consumer Product Safety Commission)

Investments and Venture Capital Firms

Private Equity Firms

Companies

Players Mentioned in the Report:

Hasbro Inc.

Mattel Inc.

Fantasy Flight Games

CMON Limited

Spin Master

Asmodee Editions

USAopoly

Ravensburger AG

Goliath Games

Z-Man Games

Wizards of the Coast

IELLO Games

Thames & Kosmos

Mayfair Games

Days of Wonder

Table of Contents

1. USA Board Games Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Revenue, Unit Sales, Consumer Adoption)

1.4. Market Segmentation Overview (By Type, By Distribution Channel, By Age Group, By Mechanism, By Region)

2. USA Board Games Market Size (In USD Bn)

2.1. Historical Market Size (In Value and Volume)

2.2. Year-On-Year Growth Analysis (Unit Sales, Market Expansion)

2.3. Key Market Developments and Milestones (New Product Launches, Major Investments)

3. USA Board Games Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Preference for Offline Gaming (Sales Volume, Popularity of Analog Gaming)

3.1.2. Rise in Collaborative and Strategy-Based Games (Demand for Social Interaction, Consumer Reviews)

3.1.3. Expansion of Distribution Channels (E-commerce Sales, Brick-and-Mortar Trends)

3.1.4. Growth in Board Game Cafs and Events (Increase in Game-Oriented Venues, Event Participation)

3.2. Market Challenges

3.2.1. Competition from Digital Games (Consumer Shift, Digital Gaming Revenue)

3.2.2. High Cost of Premium Board Games (Price Sensitivity, Consumer Spending Trends)

3.2.3. Saturation in Popular Genres (Limited Innovation, Overlap in Game Types)

3.3. Opportunities

3.3.1. Increasing Popularity of Crowdfunding for Game Development (Kickstarter Data, Indie Game Growth)

3.3.2. Sustainable and Eco-friendly Board Games (Consumer Interest in Sustainability, Eco-friendly Materials)

3.3.3. Expansion into Educational and Corporate Training Games (Market Size of Educational Products, B2B Sales)

3.4. Trends

3.4.1. Rise of Cooperative Board Games (Demand for Cooperative Play, Consumer Engagement)

3.4.2. Increasing Popularity of Board Game Streaming and Reviews (YouTube and Twitch Data, Review Influencers)

3.4.3. Customizable and Legacy Board Games (Emerging Demand for Replayability, Collector Engagement)

3.5. Government Regulations

3.5.1. Import and Safety Regulations (Toy Safety Standards, Regulatory Compliance for Board Games)

3.5.2. Environmental Guidelines (Sustainable Manufacturing Requirements, Recycling Regulations)

3.6. SWOT Analysis (Specific to USA Board Games Market)

3.7. Stakeholder Ecosystem

3.7.1. Manufacturers

3.7.2. Distributors

3.7.3. Retailers

3.7.4. Game Designers

3.8. Porters Five Forces (Market-Specific Analysis on Bargaining Power, Competition Intensity, etc.)

3.9. Competition Ecosystem

4. USA Board Games Market Segmentation

4.1. By Type (In Value %)

4.1.1. Strategy Games

4.1.2. Card Games

4.1.3. Party Games

4.1.4. Educational Games

4.1.5. Cooperative Games

4.2. By Distribution Channel (In Value %)

4.2.1. Online

4.2.2. Offline (Specialty Stores, General Retailers, Board Game Cafes)

4.3. By Age Group (In Value %)

4.3.1. Children

4.3.2. Teens

4.3.3. Adults

4.4. By Game Mechanism (In Value %)

4.4.1. Dice Rolling

4.4.2. Deck Building

4.4.3. Role-Playing

4.4.4. Cooperative Play

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

5. USA Board Games Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Hasbro Inc.

5.1.2. Mattel Inc.

5.1.3. Asmodee Editions

5.1.4. Ravensburger AG

5.1.5. Fantasy Flight Games

5.1.6. Spin Master

5.1.7. USAopoly

5.1.8. CMON Limited

5.1.9. Goliath Games

5.1.10. Z-Man Games

5.1.11. Thames & Kosmos

5.1.12. IELLO Games

5.1.13. Wizards of the Coast

5.1.14. Days of Wonder

5.1.15. Mayfair Games

5.2 Cross Comparison Parameters (Number of SKUs, Headquarters, Game Genre Focus, Distribution Network, Market Share, Inception Year, Annual Revenue, Online Presence)

5.3. Market Share Analysis (Top Players and New Entrants)

5.4. Strategic Initiatives (Partnerships, Collaborations, Marketing Campaigns)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Board Games Market Regulatory Framework

6.1. Toy Safety Regulations (Product Safety, Testing Requirements)

6.2. Import Tariffs (Impacts on Board Game Pricing)

6.3. Licensing Requirements (Board Game IP Regulations)

7. USA Board Games Future Market Size (In USD Bn)

7.1. Future Market Size Projections (In Value and Volume)

7.2. Key Factors Driving Future Market Growth (Product Innovation, Market Expansion)

8. USA Board Games Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Age Group (In Value %)

8.4. By Game Mechanism (In Value %)

8.5. By Region (In Value %)

9. USA Board Games Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involves identifying critical variables, such as revenue growth, product diversity, and market penetration. Comprehensive desk research is conducted using industry reports, government publications, and proprietary databases to assess the market dynamics of the USA Board Games market.

Step 2: Market Analysis and Construction

In this phase, historical data on sales, distribution, and consumer preferences are gathered and analyzed. The market's supply-demand equilibrium, market penetration, and overall revenue trends are examined in depth.

Step 3: Hypothesis Validation and Expert Consultation

We conduct interviews with leading manufacturers and distributors in the USA Board Games market to validate our hypotheses. Insights from these industry stakeholders are crucial to refining our data and enhancing the accuracy of our analysis.

Step 4: Research Synthesis and Final Output

The final output synthesizes data from primary and secondary research, presenting a comprehensive market analysis. Inputs from board game developers, retailers, and marketing experts ensure the data reflects current market realities.

Frequently Asked Questions

01. How big is the USA Board Games Market?

The USA Board Games market, valued at USD 2 billion, is driven by rising consumer interest in offline entertainment, the growth of board game cafs, and increasing participation in gaming events.

02. What are the challenges in the USA Board Games Market?

Challenges in this USA Board Games market include high competition from digital games, the rising costs of premium board games, and the saturation of popular genres, limiting innovation in new game categories.

03. Who are the major players in the USA Board Games Market?

Major players in the USA Board Games market include Hasbro Inc., Mattel Inc., Fantasy Flight Games, CMON Limited, and Spin Master, which dominate the market through strong brand loyalty and diverse product portfolios.

04. What are the growth drivers of the USA Board Games Market?

The USA Board Games market is driven by the increasing popularity of strategy and cooperative games, the rise of board game cafs, and the availability of games through online platforms. Crowdfunding has also become a key growth driver for indie game developers.

05. What trends are shaping the USA Board Games Market?

Key trends in the USA Board Games market include the rise of legacy and customizable games, the growing demand for eco-friendly board games, and the integration of digital and physical gaming experiences, such as app-assisted games.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.