USA Bone Graft and Substitutes Market Outlook to 2030

Region:North America

Author(s):Meenakshi

Product Code:KROD2180

November 2024

84

About the Report

USA Bone Graft and Substitutes Market Overview

- The USA bone graft and substitutes market is valued at USD 976 million, driven primarily by the increasing number of bone-related surgeries and the growing demand for advanced surgical techniques. Key drivers include the rise in orthopedic conditions such as osteoarthritis, osteoporosis, and trauma cases that require bone grafts for recovery. Additionally, technological advancements, such as bioactive materials and synthetic grafts, are revolutionizing treatment options, increasing the demand for bone substitutes in the healthcare industry.

- The market is dominated by major metropolitan areas like New York, Los Angeles, and Chicago, due to their large and growing populations of elderly individuals, coupled with the high concentration of healthcare facilities specializing in orthopedic and spinal surgeries. These cities also have significant access to cutting-edge medical technology and a strong presence of healthcare professionals skilled in orthopedic procedures, contributing to their dominance in the bone graft and substitutes market.

- Compliance with international medical device standards, particularly ISO 13485, is critical for manufacturers of bone graft substitutes. By 2024, all major U.S. producers adhere to ISO 13485, ensuring that their products meet the required safety and quality standards. This compliance not only facilitates regulatory approvals but also enhances trust among healthcare providers, ensuring widespread adoption of certified bone graft products in clinical practice.

USA Bone Graft and Substitutes Market Segmentation

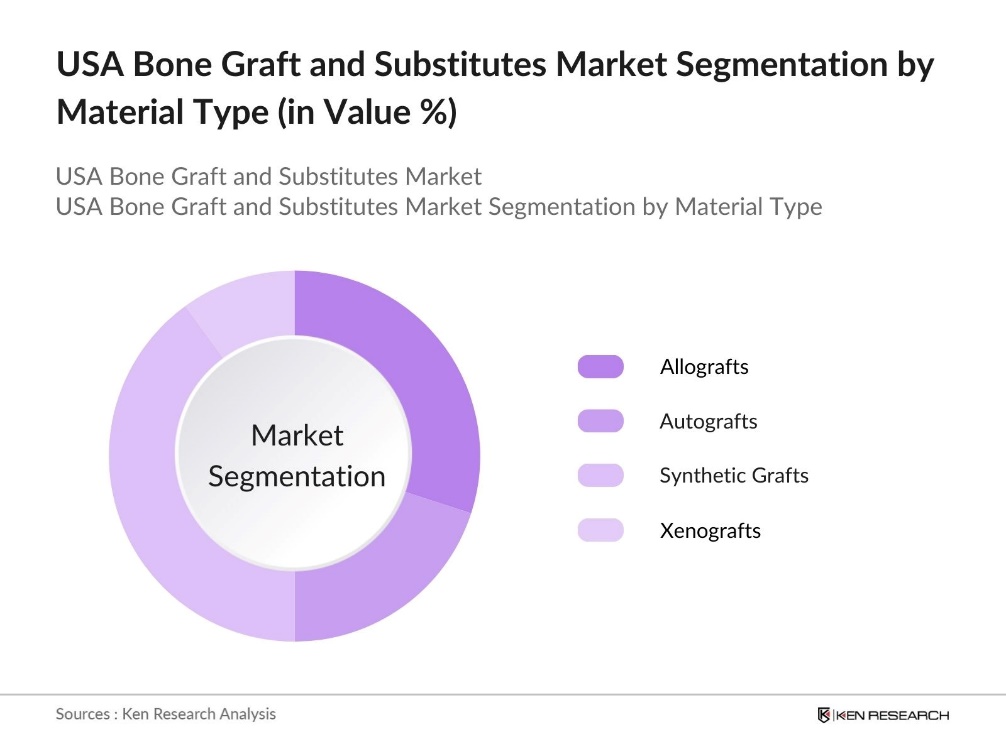

By Material Type: The USA bone graft and substitutes market is segmented by material type into allografts, autografts, synthetic grafts, and xenografts. Synthetic grafts, such as hydroxyapatite and tricalcium phosphate, are currently dominating the market due to their biocompatibility and the ease of availability. Synthetic grafts offer a lower risk of disease transmission compared to allografts and xenografts and can be customized for specific clinical needs. Their increasing use in spinal fusion surgeries and the development of bioresorbable materials have further solidified their leading position in the market.

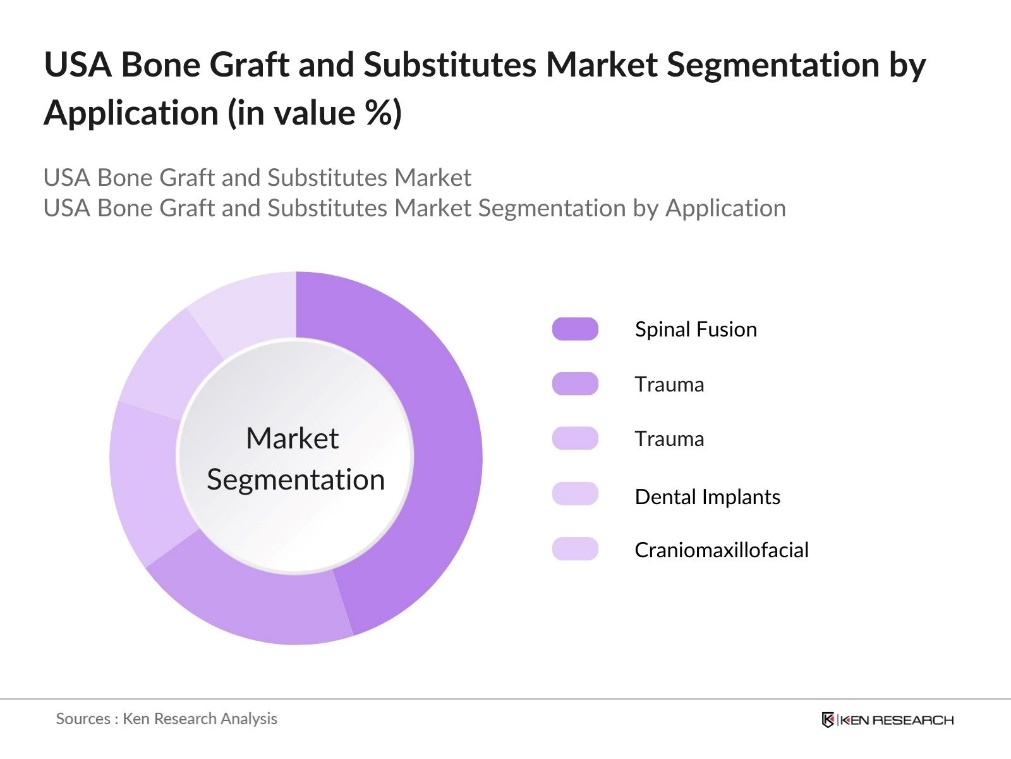

By Application: The USA bone graft and substitutes market is segmented by application into spinal fusion, trauma, joint reconstruction, dental implants, and craniomaxillofacial procedures. Spinal fusion procedures hold the largest share of the market due to the rising incidence of spinal disorders and the increasing demand for minimally invasive surgeries. In particular, the aging population in the U.S. is driving demand for these procedures, as conditions like degenerative disc disease become more prevalent. Spinal fusion surgeries are expected to continue dominating as advanced bone graft substitutes, such as those based on 3D printing and biologics, gain traction.

USA Bone Graft and Substitutes Market Competitive Landscape

The USA bone graft and substitutes market is dominated by a few key players, including major medical device companies and specialists in biomaterials. The landscape is highly competitive, with players engaging in strategic mergers and acquisitions, collaborations, and constant innovation to maintain market dominance. For example, companies like Medtronic and Stryker lead the market due to their broad product portfolios, global reach, and commitment to R&D in orthopedic solutions.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

Revenue (2023, USD Mn) |

FDA Approvals |

R&D Investment |

Number of Employees |

Global Presence |

|

Medtronic |

1949 |

Dublin, Ireland |

||||||

|

Stryker Corporation |

1941 |

Michigan, USA |

||||||

|

Zimmer Biomet |

1927 |

Warsaw, Indiana, USA |

||||||

|

NuVasive, Inc. |

1997 |

California, USA |

||||||

|

DePuy Synthes (J&J) |

1895 |

New Jersey, USA |

USA Bone Graft and Substitutes Industry Analysis

Growth Drivers

- Rising incidence of orthopedic conditions (osteoporosis, spinal fusion surgeries): Orthopedic conditions, such as osteoporosis and the need for spinal fusion surgeries, are significant growth drivers in the U.S. bone graft and substitutes market. In 2024, osteoporosis affects over 10 million Americans aged 50 and older, leading to an increased demand for bone grafts. This rise in orthopedic procedures significantly supports the demand for bone graft substitutes.

- Increasing adoption of minimally invasive surgeries: Minimally invasive surgical techniques have become more prevalent in the U.S. due to reduced recovery times and lower risk of complications. This including those requiring bone grafts, have shifted toward minimally invasive methods, resulting in a preference for synthetic graft substitutes. This shift enhances the demand for materials that can be implanted through smaller incisions, aligning with the rise in procedures like arthroplasty, with more than 400 participating sites submitted PROMs, which is a 38% increase compared with the previous year.

- Technological advancements (3D printing, bioactive graft materials): Technological advancements like 3D printing and bioactive materials are boosting the bone graft market. 3D printing allows for customized grafts, enhancing patient-specific treatments, while bioactive materials stimulate natural bone growth and healing. These innovations improve outcomes in complex surgeries, offering better integration and faster recovery. The growing adoption of these technologies is reshaping orthopedic procedures and driving market growth.

Market Challenges

- High costs associated with bone graft procedures: The high costs of bone graft procedures continue to be a significant challenge in the U.S. market. These expenses create financial barriers for many patients, even for those with insurance. The elevated costs, particularly for synthetic or bioactive grafts, limit widespread access and adoption, highlighting disparities in healthcare affordability and availability for more advanced treatment options.

- Risk of complications (immune rejection, infection in allografts): Allografts, which involve bone grafts from donors, carry risks such as immune rejection and infection. These complications can lead to adverse patient outcomes, despite improvements in processing and sterilization techniques. The persistent risks associated with allografts are pushing a shift toward synthetic alternatives that offer fewer complications and better overall safety profiles for patients.

USA Bone Graft and Substitutes Market Future Outlook

Over the next few years, the USA bone graft and substitutes market is expected to witness significant growth driven by technological advancements in graft materials, the rising number of orthopedic and spinal surgeries, and the increasing aging population. The development of personalized medicine, including custom graft materials through 3D printing and stem cell therapies, will likely create new opportunities in the market. In addition, the trend toward minimally invasive surgical techniques is expected to further boost the demand for bone graft substitutes, especially in urban centers with advanced healthcare infrastructure.

Market Opportunities

- Increased R&D funding for synthetic and bio-composite grafts: Investments from both government and private sectors in research and development have significantly boosted innovation in synthetic and bio-composite graft materials. These efforts focus on creating advanced, next-generation grafts, including biodegradable and bio-composite options. This emphasis on R&D is driving technological advancements in the bone graft market, offering new growth opportunities and improved treatment solutions.

- Growth in outpatient and ambulatory surgical centers: The rise of outpatient and ambulatory surgical centers (ASCs) has opened new opportunities for the bone graft market. ASCs provide more accessible, cost-effective options for patients undergoing bone graft procedures, especially for minimally invasive surgeries. The increasing presence of these centers supports faster recovery times and greater patient volumes, facilitating broader use of bone graft substitutes in various treatments.

Scope of the Report

|

Material Type |

Allografts Autografts Synthetic Grafts (Hydroxyapatite, Calcium sulfate, etc.) Xenografts |

|

Application |

Spinal Fusion Trauma Joint Reconstruction Dental Implants Craniomaxillofacial |

|

End User |

Hospitals Ambulatory Surgical Centers Specialty Clinics Research & Academic Institutes |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Distributors and Suppliers of Medical Devices

Medical Device Manufacturers

Biotechnology Companies

Government and Regulatory Bodies (FDA, Medicare, Medicaid)

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Medtronic

Stryker Corporation

Zimmer Biomet

NuVasive, Inc.

DePuy Synthes (Johnson & Johnson)

Orthofix Medical Inc.

Baxter International

Bioventus

AlloSource

RTI Surgical

Table of Contents

1. USA Bone Graft and Substitutes Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Annual growth rate, CAGR)

1.4. Market Segmentation Overview

2. USA Bone Graft and Substitutes Market Size (In USD Mn)

2.1. Historical Market Size (Market value in $USD)

2.2. Year-On-Year Growth Analysis (YOY market performance)

2.3. Key Market Developments and Milestones (Notable FDA approvals, partnerships, product launches)

3. USA Bone Graft and Substitutes Market Analysis

3.1. Growth Drivers

3.1.1. Rising incidence of orthopedic conditions (osteoporosis, spinal fusion surgeries)

3.1.2. Increasing adoption of minimally invasive surgeries

3.1.3. Technological advancements (3D printing, bioactive graft materials)

3.1.4. Favorable reimbursement policies (Medicare/Medicaid coverage)

3.2. Market Challenges

3.2.1. High costs associated with bone graft procedures

3.2.2. Risk of complications (immune rejection, infection in allografts)

3.2.3. Lack of skilled professionals in rural areas

3.3. Opportunities

3.3.1. Increased R&D funding for synthetic and bio-composite grafts

3.3.2. Growth in outpatient and ambulatory surgical centers

3.3.3. Expansion in personalized medicine and custom implants

3.4. Trends

3.4.1. Shift toward synthetic bone graft substitutes

3.4.2. Integration of nanotechnology and biomaterials

3.4.3. Growing focus on patient-specific solutions through AI and 3D modeling

3.5. Government Regulation

3.5.1. FDA Regulatory Pathways (510(k) clearances, PMAs)

3.5.2. Compliance with medical device standards (ISO 13485)

3.5.3. HIPAA and data security regulations for clinical trials

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stake Ecosystem (Manufacturers, distributors, healthcare providers)

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Competitive Rivalry

3.9. Competition Ecosystem (Industry dynamics, market share, innovation strategy)

4. USA Bone Graft and Substitutes Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Allografts (Demineralized bone matrix (DBM), others)

4.1.2. Autografts

4.1.3. Synthetic Grafts (Hydroxyapatite, Calcium sulfate, others)

4.1.4. Xenografts

4.2. By Application (In Value %)

4.2.1. Spinal Fusion

4.2.2. Trauma

4.2.3. Joint Reconstruction

4.2.4. Dental Implants

4.2.5. Craniomaxillofacial

4.3. By End User (In Value %)

4.3.1. Hospitals

4.3.2. Ambulatory Surgical Centers (ASCs)

4.3.3. Specialty Clinics

4.3.4. Research and Academic Institutes

4.4. By Region (In Value %)

4.4.1. Northeast

4.4.2. Midwest

4.4.3. South

4.4.4. West

5. USA Bone Graft and Substitutes Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Medtronic

5.1.2. Stryker Corporation

5.1.3. Zimmer Biomet

5.1.4. Johnson & Johnson (DePuy Synthes)

5.1.5. NuVasive, Inc.

5.1.6. Orthofix Medical Inc.

5.1.7. Baxter International

5.1.8. AlloSource

5.1.9. Bioventus

5.1.10. Integra LifeSciences Holdings Corporation

5.1.11. SeaSpine Holdings Corporation

5.1.12. RTI Surgical

5.1.13. Osiris Therapeutics

5.1.14. Wright Medical Group

5.1.15. Xtant Medical

5.2. Cross Comparison Parameters (Revenue, product portfolio, R&D investment, market presence, product recalls, FDA approvals, strategic alliances)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product innovations, collaborations, geographical expansions)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Capital investments, partnerships)

5.7. Government Grants and Incentives

5.8. Private Equity and Venture Capital Investments

6. USA Bone Graft and Substitutes Market Regulatory Framework

6.1. FDA Approval Process

6.2. ISO and CE Marking Requirements

6.3. Compliance with HIPAA for Data Security

6.4. Medicare and Medicaid Reimbursement Policies

7. USA Bone Graft and Substitutes Future Market Size (In USD Mn)

7.1. Future Market Size Projections (Forecasts based on trends in technology, population aging, surgery volumes)

7.2. Key Factors Driving Future Market Growth (R&D breakthroughs, clinical outcomes, policy changes)

8. USA Bone Graft and Substitutes Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Application (In Value %)

8.3. By End User (In Value %)

8.4. By Region (In Value %)

9. USA Bone Graft and Substitutes Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the entire ecosystem within the USA bone graft and substitutes market. Through extensive desk research, including proprietary databases and publicly available government data, we identified critical variables such as the volume of surgeries, product adoption rates, and reimbursement scenarios.

Step 2: Market Analysis and Construction

In this phase, historical data on the adoption of bone graft substitutes in orthopedic and dental surgeries were analyzed. We compiled data on market penetration and constructed revenue estimates by considering sales volumes and pricing from industry reports and government sources.

Step 3: Hypothesis Validation and Expert Consultation

Interviews were conducted with industry experts, including medical professionals, product managers, and regulatory specialists, to validate key hypotheses. The expert insights provided clarity on the market dynamics and verified trends in technology adoption and material preference.

Step 4: Research Synthesis and Final Output

In this final stage, our research was cross-verified through engagement with leading medical device manufacturers, ensuring that the statistics and insights reflected real-world market conditions. The synthesis of primary and secondary research enabled the construction of a robust analysis of the USA bone graft and substitutes market.

Frequently Asked Questions

01 How big is the USA Bone Graft and Substitutes Market?

The USA bone graft and substitutes market is valued at USD 976 million, driven by technological advancements in synthetic grafts and the growing number of orthopedic surgeries.

02 What are the challenges in the USA Bone Graft and Substitutes Market?

Challenges in the USA bone graft and substitutes market include high costs of advanced graft materials, risk of post-surgical complications, and regulatory hurdles associated with FDA approvals and clinical trials.

03 Who are the major players in the USA Bone Graft and Substitutes Market?

Key players in USA bone graft and substitutes market include Medtronic, Stryker Corporation, Zimmer Biomet, NuVasive, and DePuy Synthes (J&J). These companies dominate due to their extensive product portfolios and strong presence in both the spinal and joint reconstruction sectors.

04 What are the growth drivers of the USA Bone Graft and Substitutes Market?

The USA bone graft and substitutes market is driven by increasing orthopedic and dental surgeries, the growing aging population, advancements in bioactive graft materials, and a shift towards minimally invasive surgical techniques.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.