USA Business Intelligence Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD2005

June 2025

90

About the Report

USA Business Intelligence Market Outlook

- The USA Business Intelligence Market was valued at approximately USD 10 billion, based on a five-year historical analysis. This growth is driven by accelerated adoption of AI-enhanced analytics tools, cloud-based BI solutions, and real-time data processing capabilities. The market continues to benefit from increasing investments in predictive analytics and machine learning integration, enabling organizations to optimize supply chains, enhance customer experiences, and improve financial decision-making.

- Technology hubs including New York, San Francisco, and Chicago maintain leadership through concentrated tech talent pools and advanced infrastructure supporting BI innovation. These regions account for nearly 45% of domestic BI software deployments, with particular strength in financial services and healthcare analytics applications.

- Regulatory compliance remains critical, with existing frameworks like the California Consumer Privacy Act (CCPA) continuing to influence data management practices. Recent enforcement actions have emphasized the need for BI platforms with built-in compliance features for data anonymization and audit trails.

USA Business Intelligence Market Segmentation

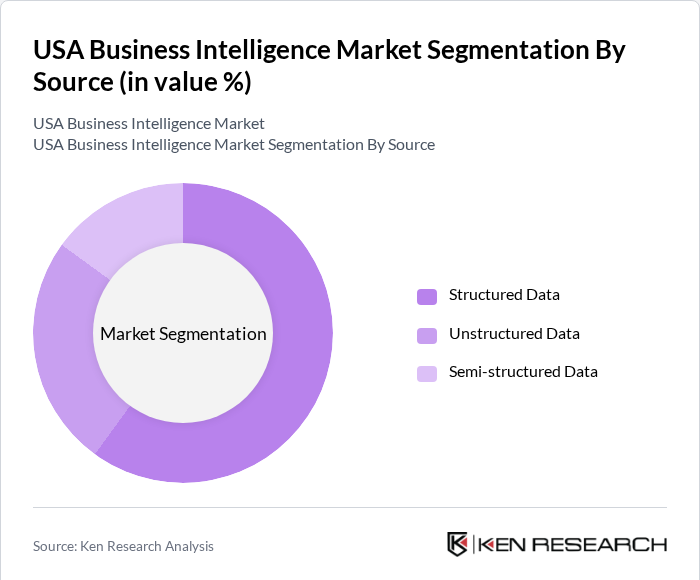

By Source:The market is segmented by source into Structured Data and Unstructured Data. Structured Data dominates because most organizations rely on well-defined, relational databases—such as ERP, CRM, and financial reporting systems—to feed their BI platforms. These systems provide consistent, high-quality information that underpins dashboards, scorecards, and predefined reporting workflows. As enterprises prioritize accuracy, compliance, and ease of integration, they continue to invest heavily in extracting insights from structured repositories, leaving unstructured sources—such as emails, social media, and free-text clinical notes still emerging in terms of BI adoption.

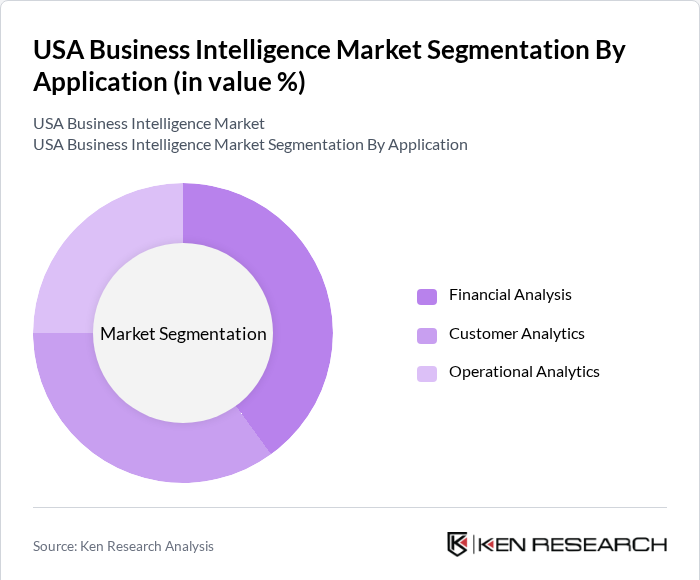

By Application: The market is segmented by application into Financial Analytics, Operational Analytics, Marketing Analytics, and Fraud Detection. Financial Analytics dominates because companies place the highest priority on revenue forecasting, budgeting, and profitability analysis. BI tools that consolidate general ledger, accounts payable/receivable, and cash-flow data enable CFOs and finance teams to produce timely, accurate financial reports and projections. As regulatory requirements tighten and investor scrutiny increases, organizations have focused their BI investments on financial modules, driving this segment’s leadership over operational, marketing, and fraud-detection applications.

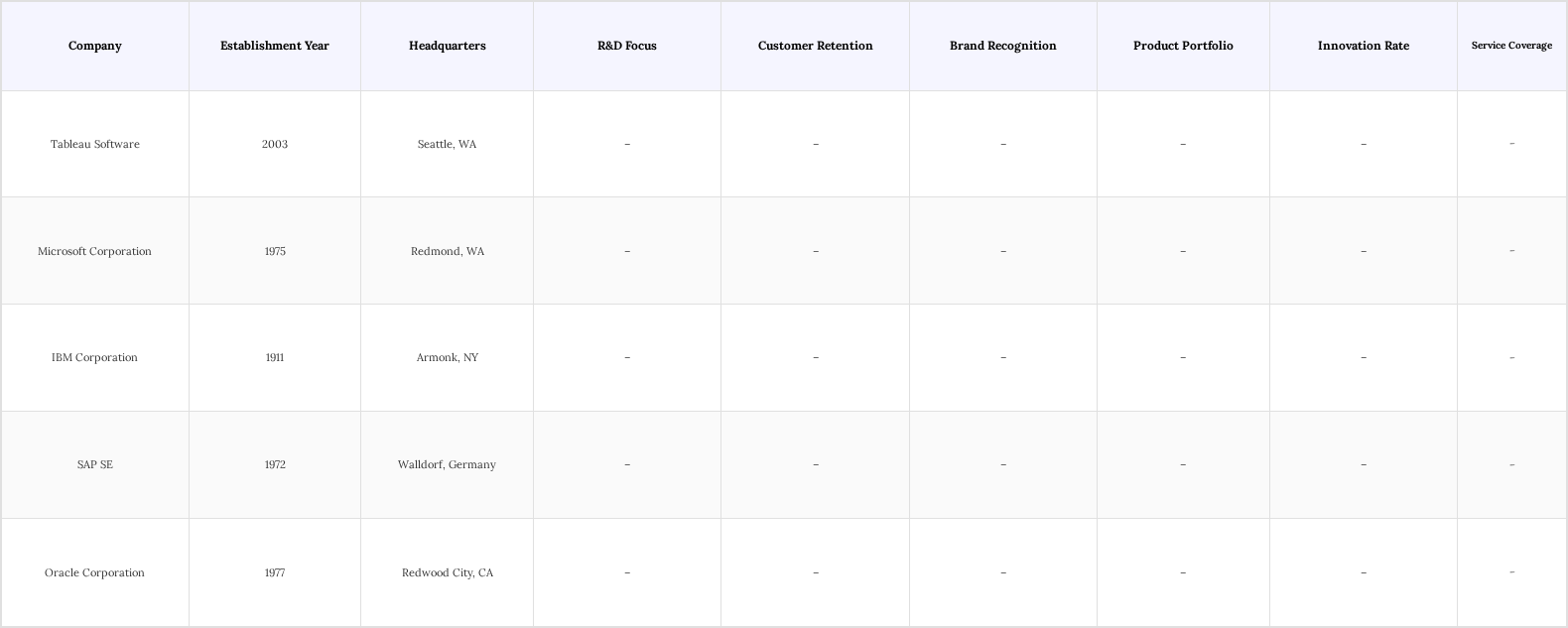

USA Business Intelligence Market Competitive Landscape

The competitive environment features intensified focus on AI-powered analytics, with Microsoft and Tableau recently introducing natural language processing capabilities for business users. Cloud migration continues to reshape delivery models, with majority of new BI implementations now using cloud-first architectures.

USA Business Intelligence Market Industry Analysis

Growth Drivers

- Increasing Demand for Data-Driven Decision Making: The USA Business Intelligence market is experiencing significant growth driven by the increasing demand for data-driven decision-making across various sectors. In 2024, the total data generated in the United States is projected to reach approximately 175 zettabytes, according to the International Data Corporation (IDC). This surge in data generation necessitates advanced analytics tools that can process and interpret vast amounts of information. Companies are increasingly recognizing the value of leveraging data to enhance operational efficiency, improve customer satisfaction, and drive revenue growth.

- Advancements in Data Analytics Technologies: The rapid advancements in data analytics technologies are significantly propelling the growth of the USA Business Intelligence market. In 2024, the global big data analytics market is anticipated to grow remarkably, with a substantial portion attributed to innovations in artificial intelligence (AI) and machine learning (ML). These technologies enable organizations to analyze complex datasets more efficiently and derive actionable insights. For example, AI-driven analytics tools can automate data processing, reducing the time required for analysis from days to mere hours. Furthermore, the integration of natural language processing (NLP) allows users to interact with data using conversational queries, making analytics more accessible to non-technical users.

- Rising Adoption of Cloud-Based Solutions: The shift towards cloud-based solutions is another critical driver of growth in the USA Business Intelligence market. As of 2024, it is estimated that over 80% of enterprises will have migrated to the cloud, according to a report by Flexera. This transition is largely due to the flexibility, scalability, and cost-effectiveness that cloud solutions offer. Businesses can access advanced analytics tools without the need for significant upfront investments in infrastructure. Moreover, cloud-based business intelligence platforms facilitate real-time data access and collaboration among teams, which is essential for timely decision-making. Majority of organizations reported improved data accessibility and collaboration after adopting cloud-based BI solutions.

Market Challenges

- Data Privacy and Security Concerns: One of the significant challenges facing the USA Business Intelligence market is the increasing concern over data privacy and security. With the implementation of regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), organizations are under pressure to ensure compliance while managing vast amounts of sensitive data. In 2024, it is estimated that data breaches will cost businesses an average of USD 2-4 million per incident, according to IBM's Cost of a Data Breach Report. This financial impact, coupled with the potential reputational damage, has made organizations wary of adopting new business intelligence solutions that may expose them to security vulnerabilities.

- Lack of Skilled Workforce: The shortage of skilled professionals in data analytics and business intelligence poses a significant challenge to the growth of the USA Business Intelligence market. As of 2024, it is estimated that there will be a shortage of thousands data scientists and analysts in the United States, according to a report by the U.S. Bureau of Labor Statistics. This skills gap limits organizations' ability to effectively leverage business intelligence tools and derive meaningful insights from data. Many companies struggle to find qualified candidates who possess the necessary technical skills and domain knowledge to interpret complex datasets.

USA Business Intelligence Market Future Outlook

The future of the USA Business Intelligence market appears promising, driven by ongoing technological advancements and an increasing emphasis on data-driven strategies. Organizations are expected to continue investing in innovative analytics solutions to enhance operational efficiency and customer engagement.

Market Opportunities

- Expansion of AI and Machine Learning in BI Tools: The integration of AI and machine learning technologies into business intelligence tools presents a significant opportunity for market growth. As organizations increasingly seek to automate data analysis and gain predictive insights, the demand for AI-powered BI solutions is expected to rise. In 2024, the AI in business intelligence market is projected grow rapidly, driven by the need for advanced analytics capabilities. Companies that leverage AI can enhance their decision-making processes by identifying patterns and trends in data that may not be immediately apparent.

- Growing Need for Real-Time Analytics: The increasing demand for real-time analytics is another key opportunity for the USA Business Intelligence market. In 2025, it is estimated that 60% of organizations will prioritize real-time data access to enhance decision-making processes, according to a report by Forrester Research. The ability to analyze data in real-time allows businesses to respond quickly to changing market conditions and customer preferences. This trend is particularly relevant in industries such as retail and finance, where timely insights can significantly impact revenue and customer satisfaction.

Scope of the Report

| By Source |

Structured Data Unstructured Data |

| By Application |

Financial Analytics Operational Analytics Marketing Analytics Fraud Detection |

| By Deployment Mode |

On-Premises Cloud-Based |

| By End-User |

Small and Medium Enterprises (SMEs) Large Enterprises Government |

| By Region |

North America Europe Asia-Pacific Latin America Middle East and Africa |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Commerce, Federal Trade Commission)

Data Analytics and Business Intelligence Software Providers

Cloud Service Providers

Market Research and Data Analytics Firms

Financial Institutions and Banks

Industry Associations (e.g., Data Management Association, Business Intelligence Association)

Technology and IT Infrastructure Providers

Companies

Players Mentioned in the Report:

Tableau Software

Microsoft Corporation

IBM Corporation

SAP SE

Oracle Corporation

QlikTech International AB

Sisense Inc.

Domo, Inc.

TIBCO Software Inc.

MicroStrategy Incorporated

Table of Contents

1. USA Business Intelligence Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Business Intelligence Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Business Intelligence Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Data-Driven Decision Making

3.1.2. Advancements in Data Analytics Technologies

3.1.3. Rising Adoption of Cloud-Based Solutions

3.2. Market Challenges

3.2.1. Data Privacy and Security Concerns

3.2.2. High Implementation Costs

3.2.3. Lack of Skilled Workforce

3.3. Opportunities

3.3.1. Expansion of AI and Machine Learning in BI Tools

3.3.2. Growing Need for Real-Time Analytics

3.3.3. Increasing Focus on Customer Experience Management

3.4. Trends

3.4.1. Integration of BI with IoT Technologies

3.4.2. Rise of Self-Service BI Tools

3.4.3. Enhanced Data Visualization Techniques

3.5. Government Regulation

3.5.1. Compliance with GDPR and CCPA

3.5.2. Regulations on Data Storage and Processing

3.5.3. Industry-Specific Compliance Standards

3.5.4. Impact of Federal Policies on Data Management Practices

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. USA Business Intelligence Market Segmentation

4.1. By Source

4.1.1. Structured Data

4.1.2. Unstructured Data

4.2. By Application

4.2.1. Financial Analytics

4.2.2. Operational Analytics

4.2.3. Marketing Analytics

4.2.4. Fraud Detection

4.3. By Deployment Mode

4.3.1. On-Premises

4.3.2. Cloud-Based

4.4. By End-User

4.4.1. Small and Medium Enterprises (SMEs)

4.4.2. Large Enterprises

4.4.3. Government

4.5. By Region

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East and Africa

5. USA Business Intelligence Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tableau Software

5.1.2. Microsoft Corporation

5.1.3. IBM Corporation

5.1.4. SAP SE

5.1.5. Oracle Corporation

5.1.6. QlikTech International AB

5.1.7. Sisense Inc.

5.1.8. Domo, Inc.

5.1.9. TIBCO Software Inc.

5.1.10. MicroStrategy Incorporated

5.2. Cross Comparison Parameters

5.2.1. Market Share Analysis

5.2.2. Revenue Growth Rate

5.2.3. Product Portfolio Diversity

5.2.4. Customer Satisfaction Ratings

5.2.5. Innovation Index

5.2.6. Geographic Presence

5.2.7. Strategic Partnerships and Alliances

5.2.8. Pricing Strategies

6. USA Business Intelligence Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. USA Business Intelligence Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Business Intelligence Market Future Market Segmentation

8.1. By Source

8.1.1. Structured Data

8.1.2. Unstructured Data

8.2. By Application

8.2.1. Financial Analytics

8.2.2. Operational Analytics

8.2.3. Marketing Analytics

8.2.4. Fraud Detection

8.3. By Deployment Mode

8.3.1. On-Premises

8.3.2. Cloud-Based

8.4. By End-User

8.4.1. Small and Medium Enterprises (SMEs)

8.4.2. Large Enterprises

8.4.3. Government

8.5. By Region

8.5.1. North America

8.5.2. Europe

8.5.3. Asia-Pacific

8.5.4. Latin America

8.5.5. Middle East and Africa

9. USA Business Intelligence Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Business Intelligence Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the USA Business Intelligence Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Business Intelligence Market.

Frequently Asked Questions

01. How big is the USA Business Intelligence Market?

The USA Business Intelligence Market is valued at USD 10 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the USA Business Intelligence Market?

Key challenges in the USA Business Intelligence Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the USA Business Intelligence Market?

Major players in the USA Business Intelligence Market include Tableau Software, Microsoft Corporation, IBM Corporation, SAP SE, Oracle Corporation, among others.

04. What are the growth drivers for the USA Business Intelligence Market?

The primary growth drivers for the USA Business Intelligence Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.