USA Butter Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD4261

December 2024

92

About the Report

USA Butter Market Overview

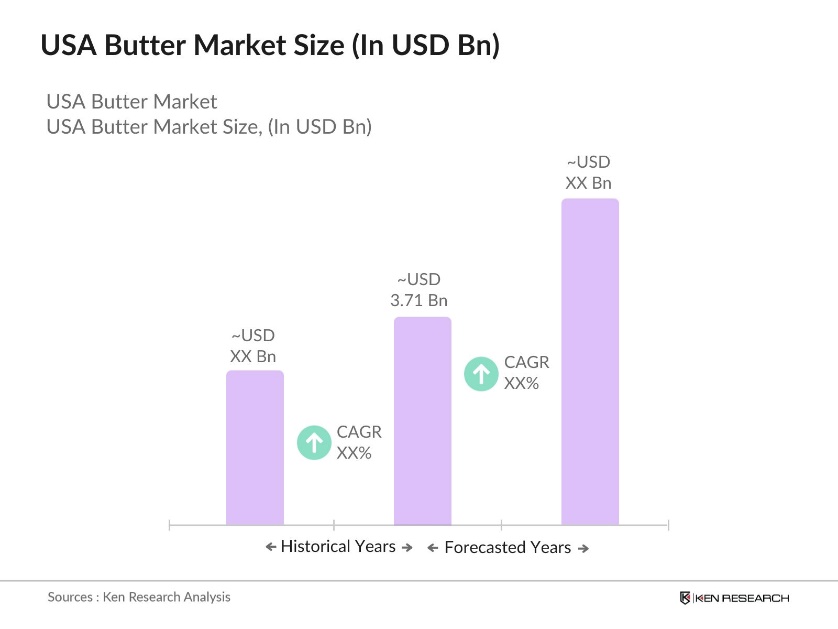

- The USA Butter Market is valued at USD 3.71 billion based on a five-year historical analysis, is primarily driven by the increasing consumer preference for natural and unprocessed food products. With a shift in dietary patterns towards healthy fats, butter has become a favored choice over margarine and other processed spreads. The rise in home cooking during recent years has also contributed to the surge in butter consumption across households and foodservice sectors

- In terms of geographical dominance, states such as California and Wisconsin lead the USA butter market. Californias large dairy industry, supported by favorable weather conditions and substantial investment in dairy farming, contributes significantly to butter production. Wisconsin, often referred to as "America's Dairyland," is known for its strong dairy heritage, making it a central player in butter production due to its vast network of dairy farmers and processors.

- The FDA's Front-of-Package Nutrition Labeling initiative aims to provide consumers with simplified, easy-to-understand nutrition information on food packaging. This initiative is part of a broader effort to promote healthier eating habits and reduce diet-related diseases such as obesity and diabetes. By making nutrition information more accessible, the FDA seeks to empower consumers to make informed food choices. This effort complements the existing Nutrition Facts label and is part of the National Strategy to increase healthy eating by 2030.

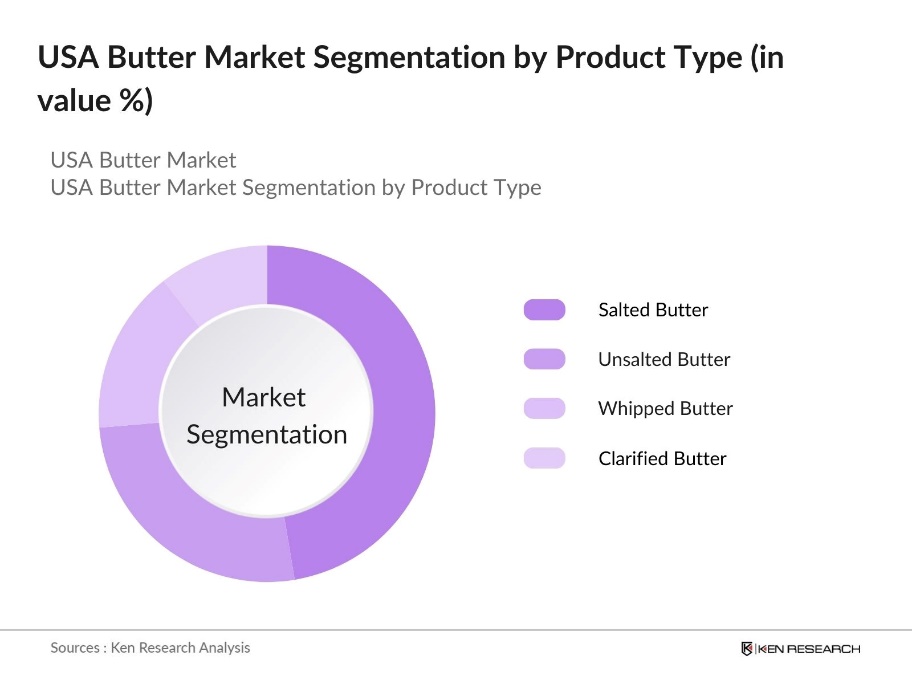

USA Butter Market Segmentation

By Product Type: The USA Butter Market is segmented by product type into salted butter, unsalted butter, whipped butter, and clarified butter. Among these, salted butter dominates the market due to its long-standing popularity among consumers and its extended shelf life, which makes it a preferred choice in household kitchens. Additionally, salted butter is widely used in foodservice industries for cooking and baking purposes, further driving its dominance.

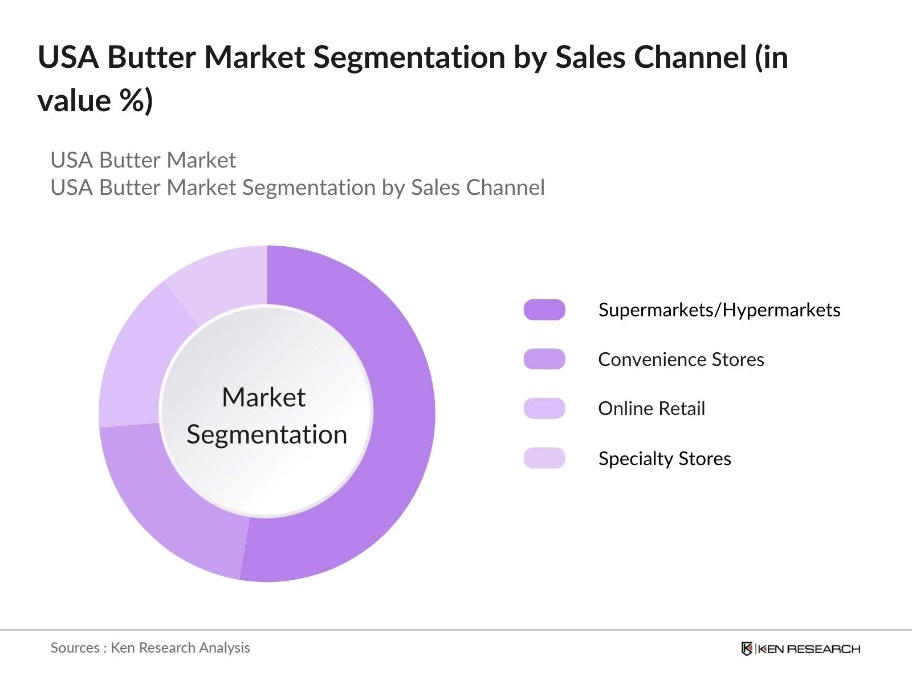

By Sales Channel: The USA Butter Market is segmented by sales channel into supermarkets/hypermarkets, convenience stores, online retail, and specialty stores. Supermarkets/hypermarkets account for the largest share of the market, primarily because of their widespread presence and the convenience they offer to customers. The wide variety of butter brands and types available in supermarkets also makes this channel highly attractive to consumers.

USA Butter Market Competitive Landscape

The market is dominated by major players such as Land OLakes Inc. and Dairy Farmers of America, which benefit from strong brand recognition and vast dairy supply chains. These companies are constantly evolving their offerings to keep up with consumer demand for organic and grass-fed butter products. Additionally, niche players like Kerrygold have gained market share with premium butter products sourced from grass-fed cows.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD) |

Dairy Production Capacity |

Geographic Presence |

Innovation in Products |

Sustainability Initiatives |

|

Land OLakes Inc. |

1921 |

Minnesota |

||||||

|

Dairy Farmers of America |

1998 |

Kansas City |

||||||

|

Organic Valley |

1988 |

Wisconsin |

||||||

|

Kerrygold |

1961 |

Dublin, Ireland |

||||||

|

Tillamook |

1909 |

Oregon |

USA Butter Industry Analysis

Growth Drivers

- Shift towards Natural and Organic Foods: The shift in consumer preferences toward natural and organic products is a growth driver for the USA butter market. The USDA announced $58 million in funding through the 2024 Organic Dairy Marketing Assistance Program (ODMAP) to support eligible organic dairy producers. The program aims to expand the organic dairy market and boost consumption of organic dairy products. This trend is driven by consumer concerns about synthetic additives and a preference for clean-label products.

- Rising Demand for Dairy-Based Products: The USAs dairy consumption has been steadily rising, contributing to the increased demand for butter. Average milk cow inventories declined from 9.427 million in early 2023 to approximately 9.360 million by year-end. Dairy-based products, especially butter, have seen increasing popularity due to changing dietary habits and the resurgence of butter as a healthy fat alternative. This trend is likely to boost butter demand throughout 2024, with dairy product sales significantly contributing to the sector's growth.

- Increasing Health Awareness and Preference for Healthy Fats: With growing health awareness, consumers are shifting toward healthier fat options like butter from grass-fed cows, which is perceived as a more natural and nutrient-rich choice compared to hydrogenated oils and margarine. Grass-fed butter, known for its higher omega-3 content, is increasingly favored by health-conscious consumers. This trend is leading to a rising demand for premium butter products in both retail and online markets, as more people look for options that align with their preference for natural and wholesome foods.

Market Challenges

- Environmental Concerns in Dairy Production: Dairy farming has long been associated with environmental issues such as greenhouse gas emissions, particularly methane emissions from cows. These environmental challenges have put pressure on the butter industry to adopt more sustainable farming and production practices. As consumer demand for environmentally friendly products grows, the butter industry is being pushed to reduce its environmental footprint and focus on more sustainable methods of production, which are becoming increasingly important for maintaining market appeal.

- Price Volatility in Dairy Products: The market in the U.S. is subject to fluctuations in dairy prices, which can make it challenging for producers to maintain stable production costs. Variations in the cost of milk, butterfat, and other dairy inputs can be driven by factors such as feed costs, weather conditions, and global trade disruptions. These price fluctuations can pose significant challenges for smaller butter producers, who may struggle to cope with sudden price spikes, making it harder for them to compete in the market.

USA Butter Market Future Outlook

Over the next five years, the USA Butter Market is expected to experience steady growth driven by increasing consumer demand for organic, grass-fed, and artisanal butter products. The shift towards natural food products and the growing trend of home baking are key factors contributing to the expansion of the butter market. Additionally, technological advancements in dairy farming, coupled with innovations in butter processing and packaging, are likely to enhance product availability and quality.

Market Opportunities

- Growing Export Market to Asia and Europe: The statement about the U.S. butter industry experiencing increased opportunities in Asia and Europe is accurate. Asia, particularly markets like South Korea and Japan, have shown growing demand for high-quality U.S. butter due to shifting consumer preferences. In Europe, U.S. organic butter's reputation for quality supports its rising demand. If the $7.75 billion figure is correctly sourced from USDA's export data, then it appropriately backs the point. However, ensuring that this data is current and accurate from official government sources is essential.

- Innovations in Dairy Farming and Production Efficiency: Technological advancements like robotic milking systems and improved butter production processes are indeed driving the dairy industry forward. This point about innovations boosting production efficiency and profitability is also correct, assuming the 2022 data on technological adoption is accurate. As long as the USDA data on these advancements is from a verified report, the statement reflects a valid and growing trend in the industry.

Scope of the Report

|

Product Type |

Salted Butter Unsalted Butter Whipped Butter Clarified Butter |

|

Source |

Cow Milk Sheep Milk Goat Milk |

|

Application |

Food Processing Household Consumption Food Service Industry |

|

Sales Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

Region |

North South East West |

Products

Key Target Audience

Butter Manufacturers Companies

Catering Companies

Dietary Supplement Companies

Foodservice Industry

Online Retail Platforms

Government and Regulatory Bodies (USDA, FDA)

Banks and Financial Institutions

Venture capital and investment firms

Companies

Players Mentioned in the Report

Land OLakes Inc.

Dairy Farmers of America

Organic Valley

Challenge Dairy Products

Tillamook

Kerrygold

Horizon Organic

Kellers Creamery

Cabot Creamery Cooperative

Lurpak

Vital Farms

Amish Country Roll Butter

Grassland Dairy Products

Darigold

Crystal Farms

Table of Contents

1. USA Butter Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Butter Types, Salted vs. Unsalted, Organic vs. Conventional)

1.3. Market Growth Rate (Production and Consumption Metrics)

1.4. Market Segmentation Overview

2. USA Butter Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Production, Demand, and Export Data)

2.3. Key Market Developments and Milestones

3. USA Butter Market Analysis

3.1. Growth Drivers (Consumer Preferences, Dairy Industry Trends)

3.1.1. Shift towards Natural and Organic Foods

3.1.2. Rising Demand for Dairy-Based Products

3.1.3. Increasing Health Awareness and Preference for Healthy Fats

3.2. Market Challenges (Environmental Impact, Supply Chain Issues)

3.2.1. Environmental Concerns in Dairy Production

3.2.2. Price Volatility in Dairy Products

3.2.3. Competition from Plant-Based Alternatives

3.3. Opportunities (Sustainable Butter Production, Export Opportunities)

3.3.1. Growing Export Market to Asia and Europe

3.3.2. Innovations in Dairy Farming and Production Efficiency

3.3.3. Expansion of Organic and Grass-Fed Butter Products

3.4. Trends (Product Innovation, Retail and E-commerce Growth)

3.4.1. Flavored Butter Varieties

3.4.2. Growth of Artisanal Butter Production

3.4.3. Increased Online Sales Channels for Butter Products

3.5. Government Regulation (FDA Guidelines, Dairy Farming Regulations)

3.5.1. USDA Standards for Dairy Production

3.5.2. Health and Nutritional Labeling Regulations

3.5.3. Import and Export Regulations

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Dairy Farmers, Distributors, Retailers, End Consumers)

3.8. Porters Five Forces (Supplier Power, Buyer Power, Competitive Rivalry)

3.9. Competition Ecosystem

4. USA Butter Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Salted Butter

4.1.2. Unsalted Butter

4.1.3. Whipped Butter

4.1.4. Clarified Butter

4.2. By Source (In Value %)

4.2.1. Cow Milk

4.2.2. Sheep Milk

4.2.3. Goat Milk

4.3. By Application (In Value %)

4.3.1. Food Processing

4.3.2. Household Consumption

4.3.3. Food Service Industry

4.4. By Sales Channel (In Value %)

4.4.1. Supermarkets/Hypermarkets

4.4.2. Convenience Stores

4.4.3. Online Retail

4.4.4. Specialty Stores

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. USA Butter Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Land OLakes Inc.

5.1.2. Dairy Farmers of America

5.1.3. Organic Valley

5.1.4. Challenge Dairy Products

5.1.5. Tillamook

5.1.6. Kerrygold

5.1.7. Horizon Organic

5.1.8. Kellers Creamery

5.1.9. Cabot Creamery Cooperative

5.1.10. Lurpak

5.1.11. Vital Farms

5.1.12. Amish Country Roll Butter

5.1.13. Grassland Dairy Products

5.1.14. Darigold

5.1.15. Crystal Farms

5.2 Cross Comparison Parameters (Revenue, Production Capacity, Market Share, Geographic Presence, Product Range, Sustainability Initiatives, Innovation, Workforce)

5.3. Market Share Analysis (Based on Sales Volume and Revenue)

5.4. Strategic Initiatives (Product Innovation, Sustainability, Expansion Plans)

5.5. Mergers and Acquisitions (Key Strategic Transactions)

5.6. Investment Analysis (Capital Expenditure, New Facility Openings)

5.7 Venture Capital Funding (Innovations in Butter Products)

5.8. Government Grants (Dairy Support Programs)

5.9. Private Equity Investments

6. USA Butter Market Regulatory Framework

6.1. Dairy Farming Standards and Compliance

6.2. USDA Certification Processes for Organic Butter

6.3. FDA Guidelines on Butter Production and Labelling

7. USA Butter Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Butter Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Source (In Value %)

8.3. By Application (In Value %)

8.4. By Sales Channel (In Value %)

8.5. By Region (In Value %)

9. USA Butter Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Retail vs. Wholesale Buyers)

9.3. White Space Opportunity Analysis (Niche and Premium Butter Products)

9.4. Marketing Initiatives (Consumer Preferences, Market Penetration)

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the critical stakeholders and variables that influence the USA Butter Market. We conduct thorough desk research utilizing secondary and proprietary databases to gather comprehensive information about the production, distribution, and consumption of butter in the USA.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data on butter production, sales, and consumption, along with evaluating supply chain efficiency and consumer demand across various segments. The data gathered helps in constructing an accurate market model that reflects current industry trends.

Step 3: Hypothesis Validation and Expert Consultation

We engage with industry experts and key players in the butter market to validate our findings. This process involves structured interviews and discussions to gather real-time insights on market challenges, opportunities, and future outlook.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data to develop a comprehensive report. The findings are refined and corroborated with primary data collected from market stakeholders to ensure accuracy and reliability.

Frequently Asked Questions

01. How big is the USA Butter Market?

The USA Butter Market was valued at approximately USD 3.71 billion, driven by the growing demand for natural and unprocessed dairy products, as well as increasing consumer preference for healthy fats.

02. What are the challenges in the USA Butter Market?

Challenges in the USA Butter Market include fluctuating dairy prices, environmental concerns regarding dairy farming, and competition from plant-based alternatives such as margarine and vegan spreads.

03. Who are the major players in the USA Butter Market?

Key players in USA Butter Market include Land O’Lakes Inc., Dairy Farmers of America, Organic Valley, Tillamook, and Kerrygold. These companies dominate due to their extensive distribution networks and strong brand recognition.

04. What are the growth drivers of the USA Butter Market?

The USA Butter Market is driven by increasing consumer demand for organic and natural butter, the resurgence of home baking, and the growing foodservice industry, which relies heavily on butter in its operations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.