USA Buy Now, Pay Later (BNPL) Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD4256

November 2024

85

About the Report

USA Buy Now, Pay Later Market Overview

The USA Buy Now, Pay Later (BNPL) market has seen a substantial surge in recent years, reaching a valuation of USD 1.72 billion, driven by growing consumer demand for flexible payment options and the rapid expansion of e-commerce platforms. The convenience of paying in installments without interest has become increasingly appealing to younger generations, particularly Millennials and Gen Z, who prefer flexible and short-term payment options. Moreover, the increasing integration of BNPL services with major retailers and online platforms has further contributed to its growth, providing seamless payment options to consumers.

In the USA, cities like New York, San Francisco, and Los Angeles, along with states like California, dominate the BNPL market. These regions lead due to their dense populations, high internet penetration, and the presence of major e-commerce and retail hubs. The tech-savvy nature of consumers in these cities, combined with the presence of digital financial services and the growing number of tech startups in the region, has bolstered the BNPL adoption rate, further driving growth.

Government regulations play a crucial role in ensuring fair lending practices within the BNPL industry. The Consumer Financial Protection Bureau (CFPB) introduced regulations in 2023 requiring BNPL providers to comply with fair lending laws, focusing on transparency in fees, interest rates, and repayment terms. These regulations affect more than 40 million active BNPL users in the U.S. and are designed to prevent predatory lending practices that could disproportionately impact lower-income consumers.

USA Buy Now, Pay Later Market Segmentation

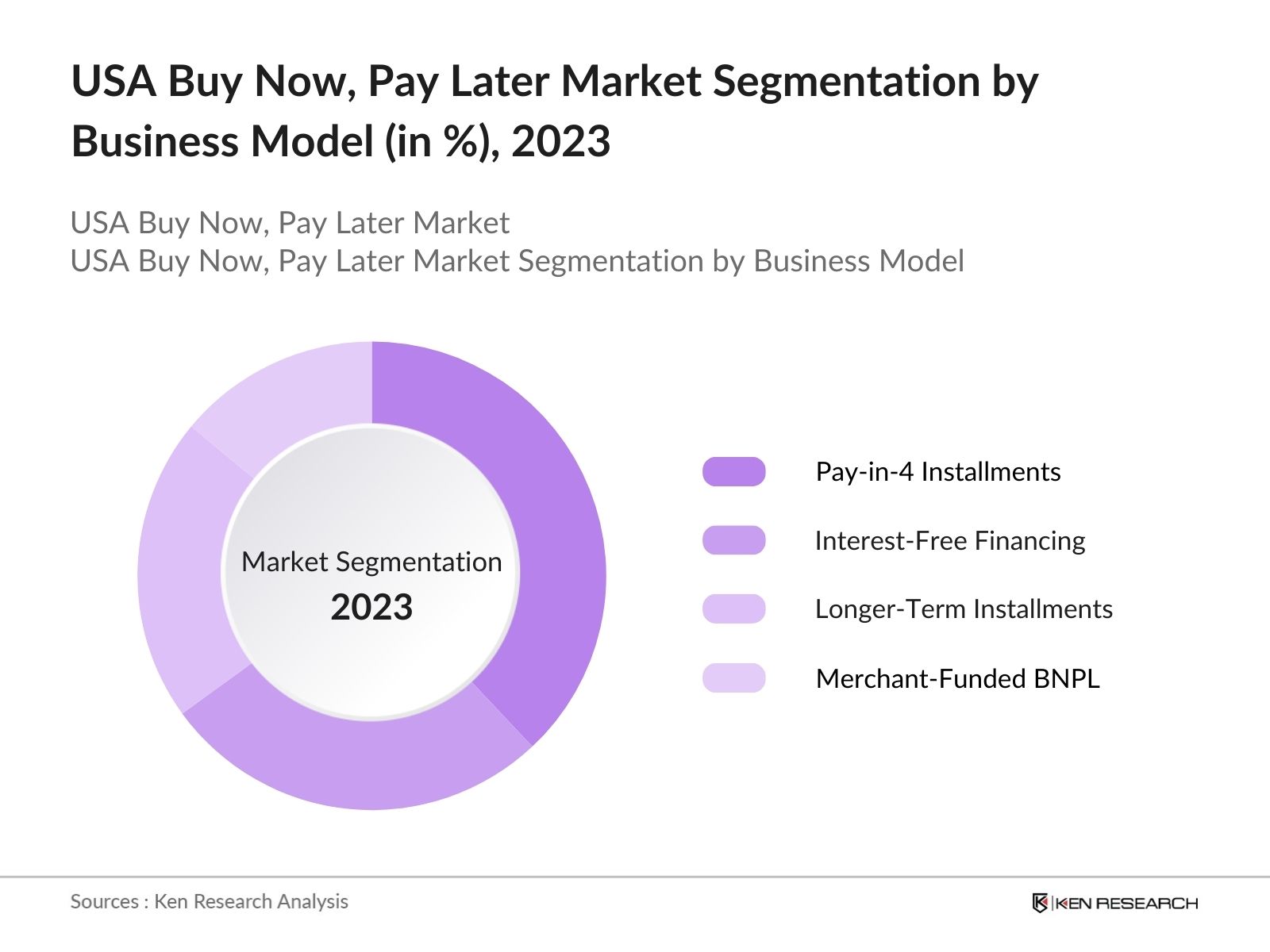

By Business Model: The market is segmented by business model into Pay-in-4 Installments, Interest-Free Financing, Longer-Term Installments, and Merchant-Funded BNPL. Among these, Pay-in-4 Installments has gained dominance due to its simplicity and widespread adoption by consumers and retailers alike. The quick approval process and interest-free nature of this model make it attractive to consumers seeking short-term financial relief. Leading BNPL players such as Affirm and Klarna offer this model, further driving its popularity.

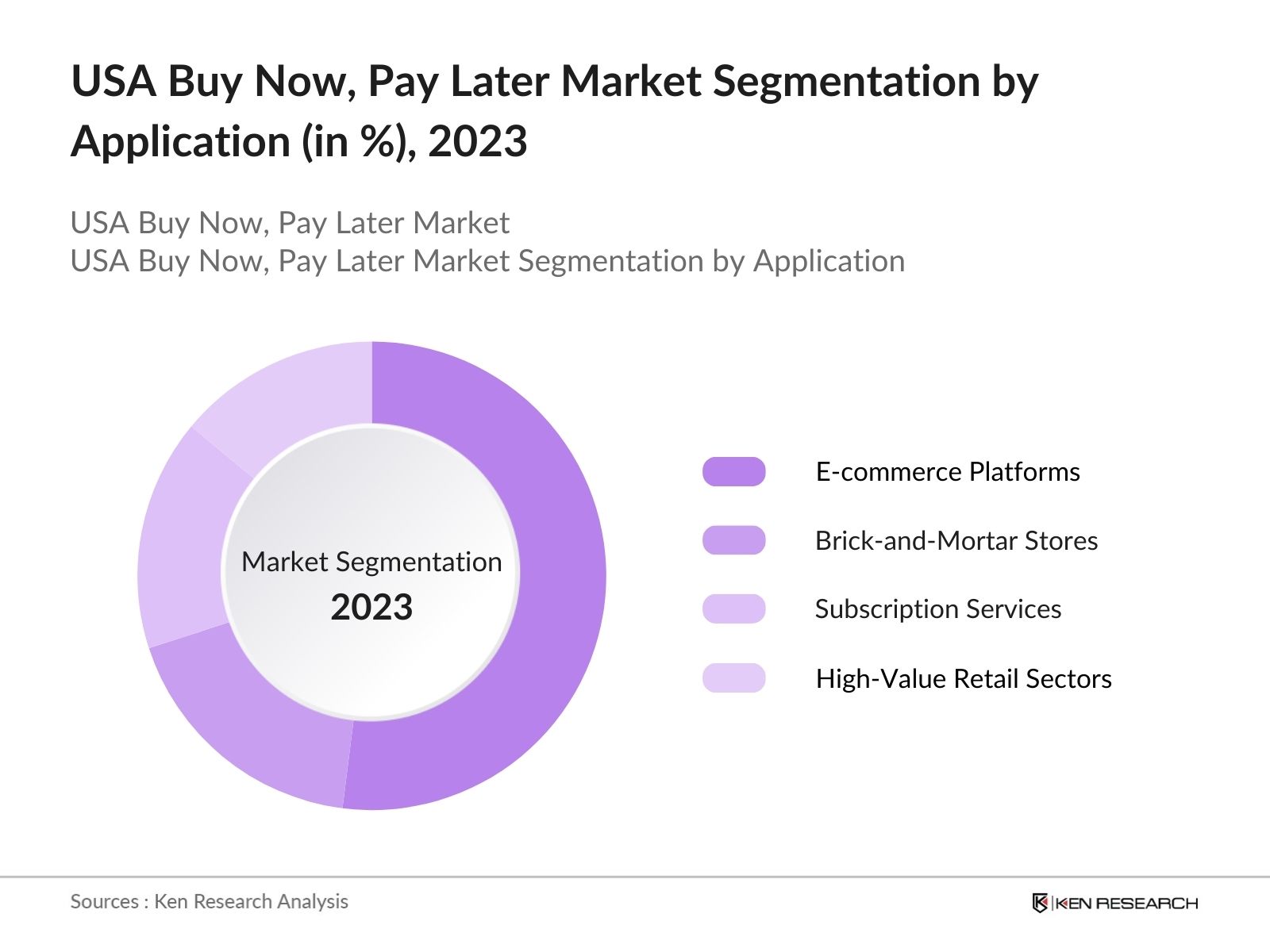

By Application: The market is also segmented by application into E-commerce Platforms, Brick-and-Mortar Stores, Subscription Services, and High-Value Retail Sectors such as electronics and fashion. E-commerce platforms currently dominate the market due to the sheer volume of online transactions. With the increasing shift toward online shopping, especially post-pandemic, the BNPL model has been highly integrated into major e-commerce platforms like Amazon and Walmart, which have contributed to the segments growth.

USA Buy Now, Pay Later Market Competitive Landscape

The USA BNPL market is dominated by a few key players who have secured strategic partnerships with major retailers and e-commerce platforms. These companies leverage technology to provide a seamless payment experience for consumers while maintaining compliance with financial regulations. The market also sees competition from traditional financial institutions introducing BNPL offerings as a complementary product to their credit card services.

Company Name | Establishment Year | Headquarters | No. of Active Users | Annual Revenue | Transaction Volume | Geographical Reach | Payment Partners | Merchant Partnerships | Inception Type |

|---|---|---|---|---|---|---|---|---|---|

Affirm Holdings | 2012 | San Francisco, CA | |||||||

Klarna Bank AB | 2005 | Stockholm, Sweden | |||||||

Afterpay Ltd. | 2014 | Melbourne, Australia | |||||||

PayPal Holdings | 1998 | San Jose, CA | |||||||

Sezzle Inc. | 2016 | Minneapolis, MN |

USA Buy Now, Pay Later Industry Analysis

Growth Drivers

Expansion of E-commerce: The rise of e-commerce has been a significant growth driver for BNPL services in the USA. U.S. e-commerce sales reached $1.04 trillion in 2023, with over 15% of online purchases now involving BNPL options. As major e-commerce platforms such as Amazon, Walmart, and Shopify integrate BNPL solutions, consumer adoption has accelerated. This symbiotic relationship between BNPL providers and online retailers is transforming the digital shopping experience, with BNPL-enabled transactions growing by more than 30 million users between 2022 and 2023.

Increasing Millennial and Gen-Z Adoption: Millennials and Gen-Z represent a substantial proportion of BNPL users, with 75% of consumers under 40 preferring installment-based financing solutions. In 2023, over 60% of BNPL users fell within the 18-39 age group, reflecting a shift toward digital-first financial solutions. These generations prioritize flexible payments over traditional credit cards, further cementing BNPLs role in the evolving U.S. consumer finance market. This demographic trend is critical, as younger generations continue to adopt digital and mobile banking solutions, fueling further BNPL growth.

Rise of Digital and Contactless Payments: As contactless payments surged during the pandemic, BNPL services became even more attractive for consumers and retailers. By mid-2024, 60% of all U.S. retail transactions were conducted using digital or contactless payment methods. The growth of mobile wallets like Apple Pay and Google Pay has seamlessly integrated BNPL options, leading to 45 million BNPL-linked mobile payment transactions in 2023 alone. This growth is underpinned by digital transformation efforts, allowing users to select BNPL at checkout on mobile and web-based platforms.

Market Challenges

Regulatory Compliance: As BNPL services expand, regulatory scrutiny has intensified in the U.S. to ensure consumer protection. In 2023, the Consumer Financial Protection Bureau (CFPB) issued several guidelines for BNPL providers, mandating transparency in terms, disclosures of fees, and clear communication of repayment obligations. These regulations aim to protect over 40 million users from potential debt traps and financial risks associated with missed payments. Additionally, the Federal Trade Commission (FTC) is investigating BNPL platforms for compliance with fair lending practices.

Credit Risk and Debt Accumulation: BNPL services are facing challenges related to consumer credit risk, particularly as debt levels in the U.S. rise. In 2023, household debt climbed to over $17 trillion, exacerbating concerns about users accumulating unsustainable levels of debt through BNPL schemes. BNPL delinquency rates are higher than traditional credit products, with default rates among BNPL users reaching nearly 5% in 2023. This risk is intensified by the ease of approval and lack of credit checks, posing long-term sustainability concerns for providerssource: Federal Reserve Bank of New York.

USA Buy Now, Pay Later Future Outlook

The future of the USA BNPL market is poised for significant growth due to increasing consumer preference for flexible payment solutions, growing partnerships with retailers, and ongoing technological advancements. Over the next five years, the market will benefit from continuous product innovation, more stringent regulatory frameworks aimed at protecting consumers, and the entry of traditional financial institutions expanding their product offerings into BNPL. Furthermore, as consumer behavior shifts towards digital and contactless payment solutions, BNPL is likely to see sustained adoption both in online and offline channels.

Future Market Opportunities

Collaboration with E-commerce Platforms: Collaborations between BNPL providers and e-commerce platforms offer significant growth potential. In 2023, over 15% of e-commerce purchases in the U.S. were made using BNPL, a figure projected to grow as more platforms adopt this payment method. For example, partnerships between BNPL companies and Amazon, Walmart, and Shopify have led to millions of new users opting for installment payments. This trend has solidified BNPL's role in e-commerce ecosystems and presents opportunities for expanding digital retail integrations.

Expansion into Physical Retail: While BNPL has been dominant in e-commerce, it is also expanding into physical retail. Major retailers like Target, Best Buy, and Macy's have integrated BNPL options into their in-store offerings, enabling consumers to use installment payment plans at checkout. In 2023, 12% of in-store purchases in the U.S. were made using BNPL services, creating opportunities for further expansion into brick-and-mortar retail. This integration provides flexibility to consumers while increasing retailers average transaction values.

Scope of the Report

Segments | Sub-Segments |

|---|---|

By Business Model | Pay-in-4 Installments |

Interest-Free Financing | |

Longer-Term Installments | |

Merchant-Funded BNPL | |

By Application | E-commerce Platforms |

Brick-and-Mortar Stores | |

Subscription Services | |

High-Value Retail Sectors | |

By Consumer Demographic | Millennials |

Gen Z | |

Gen X and Baby Boomers | |

By Provider Type | Pure-Play BNPL Providers |

Financial Institutions (Banks, Credit Unions) | |

Credit Card Companies Offering BNPL | |

By Region | Northeast |

Midwest | |

Southern | |

Western |

Major Players in the USA Buy Now, Pay Later Market

- Affirm Holdings Inc.

- Klarna Bank AB

- Afterpay Ltd.

- PayPal Holdings, Inc.

- Sezzle Inc.

- Zip Co Limited

- Splitit

- Uplift Inc.

- Perpay Inc.

- Zilch

- QuadPay

- FuturePay

- Openpay

- Laybuy

- Latitude Financial Services

Products

Key Target Audience

Retailers (Brick-and-Mortar and Online Retailers)

E-commerce Platforms

Payment Gateway Providers

Digital Wallet Companies

Financial Institutions (Banks, Credit Unions)

Venture Capital and Investment Firms

Banks and Financial Institutes

Government and Regulatory Bodies (Consumer Financial Protection Bureau, Federal Reserve)

Merchant Service Providers

Table of Contents

- USA Buy Now, Pay Later Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

- USA Buy Now, Pay Later Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

- USA Buy Now, Pay Later Market Analysis

3.1. Growth Drivers

3.1.1. Consumer Demand for Alternative Financing Solutions

3.1.2. Expansion of E-commerce

3.1.3. Increasing Millennial and Gen-Z Adoption

3.1.4. Rise of Digital and Contactless Payments

3.2. Market Challenges

3.2.1. Regulatory Compliance (Consumer Protection Regulations)

3.2.2. Credit Risk and Debt Accumulation

3.2.3. Competition from Traditional Financial Institutions

3.3. Opportunities

3.3.1. Collaboration with E-commerce Platforms

3.3.2. Expansion into Physical Retail

3.3.3. Growing SME (Small and Medium Enterprises) Market

3.4. Trends

3.4.1. Integration of BNPL into Multi-Channel Retail

3.4.2. Partnerships with Financial Services Providers

3.4.3. Adoption of Subscription-Based BNPL Models

3.5. Government Regulation

3.5.1. Fair Lending Practices

3.5.2. Financial Consumer Protection Laws

3.5.3. Credit Reporting Requirements

3.5.4. Interest Rate Caps and Transparency Requirements

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stakeholder Ecosystem

3.7.1. BNPL Service Providers

3.7.2. Retailers (Online & Offline)

3.7.3. Financial Institutions

3.8. Porters Five Forces Analysis

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Consumers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Intensity of Competitive Rivalry

3.9. Competition Ecosystem (Market-Specific Competitors)

- USA Buy Now, Pay Later Market Segmentation

4.1. By Business Model

4.1.1. Pay-in-4 Installments

4.1.2. Interest-Free Financing

4.1.3. Longer-Term Installments

4.1.4. Merchant-Funded BNPL

4.2. By Application

4.2.1. E-commerce Platforms

4.2.2. Brick-and-Mortar Stores

4.2.3. Subscription Services

4.2.4. High-Value Retail Sectors (Electronics, Fashion, Travel)

4.3. By Consumer Demographic

4.3.1. Millennials

4.3.2. Gen Z

4.3.3. Gen X and Baby Boomers

4.4. By Provider Type

4.4.1. Pure-Play BNPL Providers

4.4.2. Financial Institutions (Banks, Credit Unions)

4.4.3. Credit Card Companies Offering BNPL

4.5. By Region

4.5.1. Northeast

4.5.2. Midwest

4.5.3. Southern

4.5.4. Western

- USA Buy Now, Pay Later Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Affirm Holdings Inc.

5.1.2. Afterpay Ltd.

5.1.3. Klarna Bank AB

5.1.4. PayPal Holdings, Inc.

5.1.5. Sezzle Inc.

5.1.6. Zip Co Limited

5.1.7. Splitit

5.1.8. Uplift Inc.

5.1.9. Perpay Inc.

5.1.10. Zilch

5.1.11. QuadPay

5.1.12. FuturePay

5.1.13. Openpay

5.1.14. Laybuy

5.1.15. Latitude Financial Services

5.2. Cross Comparison Parameters (Transaction Volume, Average Order Value, No. of Active Users, Revenue, BNPL Penetration Rate, Market Share, Payment Partners, Geographical Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

- USA Buy Now, Pay Later Market Regulatory Framework

6.1. Consumer Financial Protection Bureau (CFPB) Regulations

6.2. Truth in Lending Act (TILA) Compliance

6.3. Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements

6.4. State-by-State Regulatory Compliance

- USA Buy Now, Pay Later Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

- USA Buy Now, Pay Later Future Market Segmentation

8.1. By Business Model

8.2. By Application

8.3. By Consumer Demographic

8.4. By Provider Type

8.5. By Region

- USA Buy Now, Pay Later Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This initial step involves mapping all critical components within the USA BNPL market. Our research team carried out detailed desk research, reviewing both proprietary and publicly available databases. The aim was to define the major variables influencing market dynamics, including consumer behavior, payment methods, and financial regulations.

Step 2: Market Analysis and Construction

In this stage, historical data on BNPL transactions, user demographics, and merchant participation were analyzed. We also assessed market growth by segmenting it based on business models, applications, and regional activity, using validated data sources.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses derived from the data were verified through direct industry engagements and consultations with financial service experts, BNPL providers, and retail analysts, employing methods like Computer-Assisted Telephone Interviews (CATIs).

Step 4: Research Synthesis and Final Output

This phase incorporated primary interviews with major BNPL providers and detailed analysis of transaction volumes and customer preferences. The results were cross-validated with industry reports and internal datasets, culminating in a comprehensive and reliable market analysis.

Frequently Asked Questions

01. How big is the USA Buy Now, Pay Later Market?

The USA Buy Now, Pay Later market is valued at USD 1.72 billion, driven by the growing demand for flexible payment options among younger consumers and expanding partnerships with major retailers.02. What are the challenges in the USA Buy Now, Pay Later Market?

Challenges in the USA Buy Now, Pay Later market include increasing regulatory scrutiny, the risk of consumer debt accumulation, and rising competition from traditional financial institutions offering similar payment solutions.03. Who are the major players in the USA Buy Now, Pay Later Market?

Key players in the USA Buy Now, Pay Later market include Affirm, Klarna, Afterpay, PayPal, and Sezzle, dominating due to their technological capabilities and partnerships with leading retailers.04. What are the growth drivers of the USA Buy Now, Pay Later Market?

Growth in the USA Buy Now, Pay Later market is driven by the expansion of e-commerce platforms, increasing consumer demand for installment-based payment options, and partnerships with both online and offline retailers.05. How is the regulatory landscape shaping the USA Buy Now, Pay Later Market?

The USA Buy Now, Pay Later market is influenced by evolving financial regulations, including consumer protection laws and credit reporting requirements set by the Consumer Financial Protection Bureau (CFPB).Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.