USA Car Battery Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD6359

December 2024

92

About the Report

USA Car Battery Market Overview

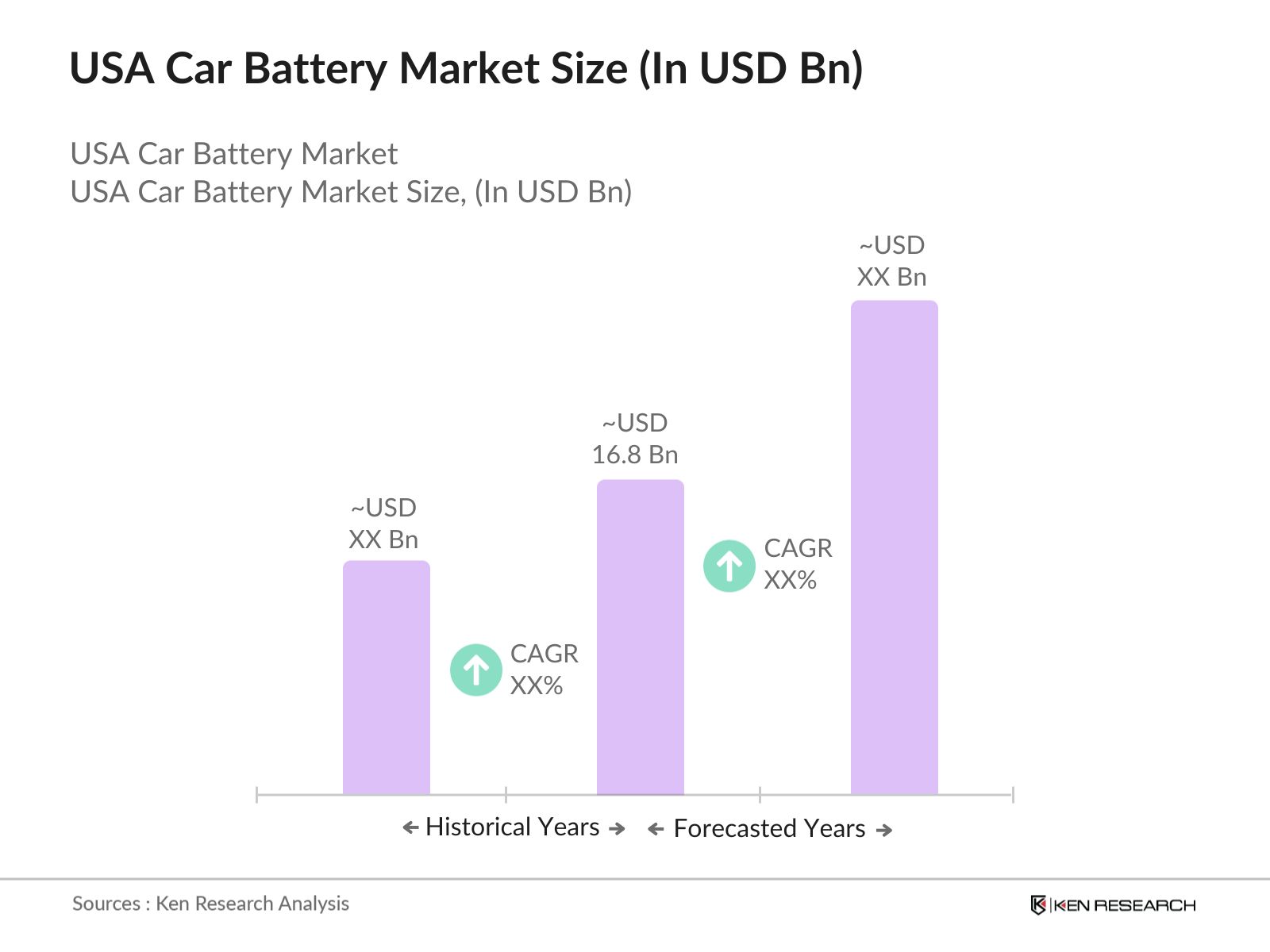

- The USA Car Battery Market is valued at USD 16.8 billion, based on a five-year historical analysis. This growth is driven by the increasing adoption of electric vehicles (EVs) across the country, bolstered by government incentives and regulations aimed at reducing carbon emissions. Additionally, advancements in battery technology, such as improvements in energy density and charging speed, have fueled the demand for both OEM and aftermarket battery products in the market. The market has shown robust growth due to strong support from both the public and private sectors, leading to significant investments in EV infrastructure.

- The market sees significant contributions from California, Texas, and Michigan due to their robust automotive manufacturing sectors and higher adoption rates of electric vehicles. California leads the way, driven by strict emissions regulations and a strong focus on renewable energy. Michigan, as a traditional automotive hub, benefits from extensive R&D investments and manufacturing capabilities in battery production. Texas, with its vast logistics and commercial vehicle fleets, has a growing demand for high-performance car batteries, particularly in electric and hybrid models. These states benefit from state-level incentives and a consumer shift toward sustainable mobility solutions.

- The federal EV tax credit program continues to play a crucial role in stimulating EV adoption, offering tax credits of up to $7,500 for eligible vehicles. This policy aims to make EVs more affordable and accessible, directly benefiting battery manufacturers as demand for advanced batteries grows. In 2023, the Treasury Department revised eligibility requirements, including the sourcing of critical minerals like lithium from approved trade partners. These updates have created a more favorable environment for domestic battery production, encouraging investments in the USA's battery manufacturing capabilities.

USA Car Battery Market Segmentation

By Battery Type: The Market is segmented by battery type into lead-acid batteries, lithium-ion batteries, nickel-metal hydride (NiMH) batteries, and solid-state batteries. Recently, lithium-ion batteries have a dominant market share under this segmentation. Their prominence is attributed to their higher energy density, longer lifespan, and suitability for electric vehicle applications. With increasing demand for lightweight, high-capacity batteries, manufacturers have focused on lithium-ion technology, making it the preferred choice for both EV manufacturers and consumers.

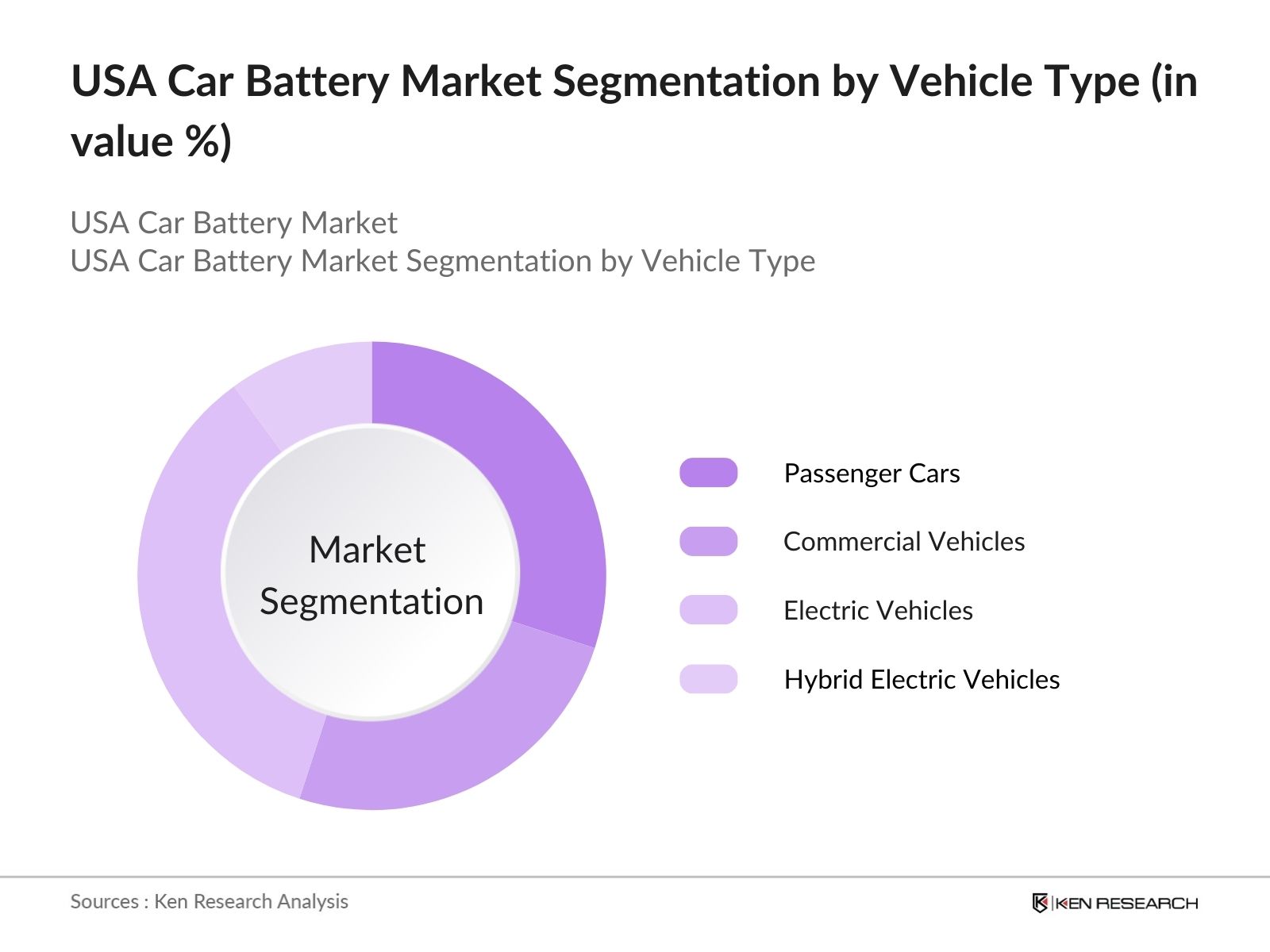

By Vehicle Type: The Market is also segmented by vehicle type into passenger cars, commercial vehicles, electric vehicles, and hybrid electric vehicles (HEVs). Electric vehicles have emerged as the leading segment, driven by rising consumer demand for sustainable transportation options and favorable government policies like federal tax credits. The transition toward zero-emission mobility solutions has propelled this segment's growth, with major automakers like Tesla and General Motors ramping up their EV production to meet consumer needs.

USA Car Battery Market Competitive Landscape

The USA Car Battery Market is dominated by a few major players, including both traditional battery manufacturers and new entrants focusing on advanced battery technologies. This competitive environment highlights the importance of innovation and partnerships in maintaining market leadership.

|

Company |

Establishment Year |

Headquarters |

Battery Production Capacity |

Revenue (USD Billion) |

R&D Investments |

Strategic Partnerships |

Manufacturing Facilities |

Sustainability Initiatives |

|

Clarios |

1885 |

Milwaukee, Wisconsin |

||||||

|

Exide Technologies |

1888 |

Milton, Georgia |

||||||

|

LG Chem |

1947 |

Seoul, South Korea |

||||||

|

Tesla Inc. |

2003 |

Palo Alto, California |

||||||

|

East Penn Manufacturing Co. |

1946 |

Lyon Station, Pennsylvania |

USA Car Battery Industry Analysis

Growth Drivers

- Rising Electric Vehicle Adoption: The adoption of electric vehicles (EVs) in the USA is a critical driver for the car battery market. In 2023, the USA saw over 1.2 million new EV registrations, significantly increasing the demand for advanced batteries. EV adoption contributes to the increased need for lithium-ion batteries, which power most modern EVs. According to the US Department of Energy, the production of lithium-ion batteries reached 30 gigawatt-hours in 2022, with projections of further growth in 2024 due to expanded manufacturing facilities in states like Michigan and Texas. The growing EV market necessitates efficient battery solutions to support the transition to greener transportation.

- Government Incentives for EVs: Government initiatives, including federal tax credits, have fueled demand for EVs and, subsequently, car batteries. As of 2024, the federal government offers a tax credit of up to $7,500 for eligible EV purchases. This policy, alongside state-level incentives, has played a significant role in making EVs more accessible, driving battery production and usage. For example, California has allocated $1.5 billion for EV infrastructure development, directly impacting the need for efficient battery solutions. These incentives are key in encouraging consumers to transition from internal combustion engines to electric vehicles.

- Advancements in Battery Technology: Technological advancements in battery manufacturing are shaping the car battery market. The Energy Information Administration (EIA) reported that the efficiency of battery cells has improved by 15% between 2022 and 2024. These innovations have enabled manufacturers to produce batteries with higher energy density, enhancing the range of EVs. The Department of Energys ARPA-E program has also invested over $400 million in research for solid-state and next-generation battery materials, aiming to make batteries safer and more durable. Such advancements contribute to the growing reliability and performance of car batteries in the market.

Market Challenges

- High Cost of Raw Materials: The car battery market faces challenges due to the high costs of raw materials like lithium and cobalt. According to the United States Geological Survey (USGS), the average price of lithium carbonate reached $77,000 per metric ton in 2023, making battery production more expensive. Cobalt prices, critical for battery stability, also remain high at around $53,000 per metric ton. This surge in material costs strains manufacturers and has led to increased exploration of alternative materials like lithium iron phosphate (LFP) batteries. However, the dependence on expensive raw materials continues to pressure profitability and pricing strategies.

- Supply Chain Disruptions: The car battery supply chain has been impacted by global disruptions, notably affecting production timelines. In 2022, supply chain issues caused delays in battery production, leading to a backlog of over 100,000 EV orders. Issues such as port congestion and semiconductor shortages have compounded the problem, with impacts lingering into 2024. The Bureau of Economic Analysis (BEA) noted a 5% decrease in production rates for key battery components in 2023 due to these disruptions. The challenges highlight the need for a more resilient and diversified supply chain to maintain steady production.

USA Car Battery Market Future Outlook

Over the next five years, the USA Car Battery Market is expected to experience substantial growth driven by a surge in electric vehicle production, advancements in battery technologies such as solid-state batteries, and continued investment in battery recycling infrastructure. The rise of sustainable mobility, alongside state and federal regulations aiming to reduce carbon emissions, will further fuel this demand. Companies are increasingly focusing on expanding their production capacities and enhancing the energy efficiency of batteries to meet evolving consumer needs. This period is anticipated to see a shift toward localized production and greater integration of second-life battery applications to reduce the environmental impact of battery disposal.

Future Market Opportunities

- Second-Life Battery Applications: Second-life battery applications represent an opportunity in the USA market, offering a solution to the growing pile of retired EV batteries. According to the US Department of Energy, by 2023, over 500,000 used EV batteries have been repurposed for energy storage systems. These batteries, which still retain 70% to 80% of their original capacity, are increasingly used in residential and commercial energy storage. This approach not only reduces waste but also meets the rising demand for grid storage solutions, especially as renewable energy adoption increases across states like California and New York.

- Expansion in Charging Infrastructure: The expansion of EV charging infrastructure is driving demand for high-capacity car batteries. In 2024, the US Department of Transportation announced $1.2 billion in grants to support the installation of over 500,000 new EV chargers across the country. This infrastructure push is essential to facilitate long-distance EV travel, requiring advanced batteries with improved range. Additionally, states like Texas and Florida have introduced state-level incentives to attract investments in EV charging stations. This expansion supports the growth of the battery market by ensuring that the necessary infrastructure aligns with the increasing number of EVs on the road.

Scope of the Report

|

Battery Type |

Lead-Acid Batteries Lithium-Ion Batteries Nickel-Metal Hydride (NiMH) Batteries Solid-State Batteries |

|

Vehicle Type |

Passenger Cars Commercial Vehicles Electric Vehicles Hybrid Electric Vehicles (HEVs) |

|

Sales Channel |

OEM (Original Equipment Manufacturer) Aftermarket |

|

Voltage Range |

12V Batteries 24V Batteries 48V and Above Batteries |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Automotive Manufacturers

Electric Vehicle Manufacturers

Battery Manufacturers

Charging Infrastructure Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Department of Energy, Environmental Protection Agency)

Logistics and Fleet Management Companies

Recycling and Waste Management Firms

Companies

Major Players

Clarios

Exide Technologies

LG Chem

Panasonic Corporation

Tesla Inc.

East Penn Manufacturing Co.

A123 Systems LLC

Samsung SDI Co. Ltd.

BYD Company Limited

General Motors (Ultium Cells)

Northvolt AB

Johnson Controls

CATL (Contemporary Amperex Technology Co. Limited)

Leoch International Technology Ltd.

EnerSys

Table of Contents

USA Car Battery Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Battery Types, Voltage Capacity, Technology)

1.3. Market Growth Rate

1.4. Market Segmentation Overview

1.5. Industry Value Chain Analysis

USA Car Battery Market Size (in USD Billion)

2.1. Historical Market Size (Lead-Acid, Lithium-Ion)

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

USA Car Battery Market Analysis

3.1. Growth Drivers

3.1.1. Rising Electric Vehicle Adoption

3.1.2. Government Incentives for EVs

3.1.3. Advancements in Battery Technology

3.1.4. Increasing Demand for Aftermarket Batteries

3.2. Market Challenges

3.2.1. High Cost of Raw Materials (Lithium, Cobalt)

3.2.2. Supply Chain Disruptions

3.2.3. Environmental Concerns in Battery Disposal

3.3. Opportunities

3.3.1. Second-Life Battery Applications

3.3.2. Expansion in Charging Infrastructure

3.3.3. Growth in Battery Recycling Technologies

3.4. Trends

3.4.1. Adoption of Solid-State Batteries

3.4.2. Increasing Production of Lithium-Iron Phosphate (LFP) Batteries

3.4.3. Integration with Vehicle-to-Grid (V2G) Systems

3.5. Government Regulations

3.5.1. Federal EV Tax Credits

3.5.2. Clean Air Act Compliance

3.5.3. Battery Safety Standards (SAE J2929)

3.5.4. Recycling and Waste Management Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Overview

USA Car Battery Market Segmentation

4.1. By Battery Type (In Value %)

4.1.1. Lead-Acid Batteries

4.1.2. Lithium-Ion Batteries

4.1.3. Nickel-Metal Hydride (NiMH) Batteries

4.1.4. Solid-State Batteries

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Cars

4.2.2. Commercial Vehicles

4.2.3. Electric Vehicles

4.2.4. Hybrid Electric Vehicles (HEVs)

4.3. By Sales Channel (In Value %)

4.3.1. OEM (Original Equipment Manufacturer)

4.3.2. Aftermarket

4.4. By Voltage Range (In Value %)

4.4.1. 12V Batteries

4.4.2. 24V Batteries

4.4.3. 48V and Above Batteries

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

USA Car Battery Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Clarios

5.1.2. Exide Technologies

5.1.3. LG Chem

5.1.4. Panasonic Corporation

5.1.5. East Penn Manufacturing Co.

5.1.6. Tesla Inc.

5.1.7. A123 Systems LLC

5.1.8. Enersys

5.1.9. Samsung SDI Co. Ltd.

5.1.10. BYD Company Limited

5.1.11. General Motors (Ultium Cells)

5.1.12. Northvolt AB

5.1.13. Johnson Controls

5.1.14. CATL (Contemporary Amperex Technology Co. Limited)

5.1.15. Leoch International Technology Ltd.

5.2. Cross Comparison Parameters (Battery Production Capacity, Revenue, R&D Investments, Strategic Partnerships, Technology Focus, Sustainability Initiatives, Number of Patents, Manufacturing Facilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Subsidies and Incentives

5.9. Technological Collaborations

USA Car Battery Market Regulatory Framework

6.1. Battery Production Regulations

6.2. Safety and Performance Standards

6.3. Import-Export Tariffs

6.4. Certification Requirements (UL, CE, IEC)

USA Car Battery Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

7.3. Impact of Emerging Technologies

USA Car Battery Future Market Segmentation

8.1. By Battery Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Sales Channel (In Value %)

8.4. By Voltage Range (In Value %)

8.5. By Region (In Value %)

USA Car Battery Market Analysts Recommendations

9.1. Total Addressable Market (TAM)/Serviceable Addressable Market (SAM)/Serviceable Obtainable Market (SOM) Analysis

9.2. Product Portfolio Optimization

9.3. Strategic Investment Areas

9.4. Market Entry Strategy

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Car Battery Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA Car Battery Market. This includes assessing market penetration, the ratio of OEM to aftermarket sales, and the resultant revenue generation. Furthermore, an evaluation of battery production statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple car battery manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Car Battery Market.

Frequently Asked Questions

01. How big is the USA Car Battery Market?

The USA Car Battery Market is valued at USD 16.8 billion, based on a five-year historical analysis, driven by increasing adoption of electric vehicles and advancements in battery technology.

02. What are the challenges in the USA Car Battery Market?

Challenges in the USA Car Battery Market include high costs of raw materials like lithium and cobalt, supply chain disruptions, and environmental concerns regarding battery disposal and recycling processes.

03. Who are the major players in the USA Car Battery Market?

Key players in the USA Car Battery Market include Clarios, Tesla Inc., LG Chem, Exide Technologies, and Panasonic Corporation, known for their robust production capacities and strong partnerships with automakers.

04. What are the growth drivers of the USA Car Battery Market?

The USA Car Battery Market is propelled by rising electric vehicle adoption, government incentives for clean energy, and advancements in lithium-ion battery technology, making batteries more efficient and affordable.

05. What trends are shaping the USA Car Battery Market?

The USA Car Battery Market is seeing a shift toward solid-state batteries, increased production of lithium-iron phosphate (LFP) batteries, and the integration of vehicle-to-grid (V2G) systems for better energy management.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.