USA Car Care Products Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD11194

December 2024

96

About the Report

USA Car Care Products Market Overview

- USA Car Care Products market, valued at USD 1 billion, is driven by an increased emphasis on vehicle maintenance and protection by consumers. Rising demand for DIY car care solutions and innovations in eco-friendly formulations contribute significantly to this valuation. The market's growth is influenced by a shift towards premium car care products that offer long-lasting results, especially in metropolitan areas where urban consumers prioritize aesthetic upkeep and convenience.

- Metropolitan cities like Los Angeles, New York, and Chicago dominate the USA Car Care Products market due to high vehicle ownership and an increased preference for premium maintenance products. These cities also experience higher environmental wear on vehicles, driving demand for specialized products like protective coatings and eco-friendly cleaners. Regional consumer awareness and access to a wide variety of car care products further boost market growth in these areas.

- EPA standards mandate VOC limits for automotive products, including car care items, impacting formulation requirements for manufacturers. In 2023, about 27% of car care product lines had to adjust formulations to comply with these standards, particularly products containing solvents. This regulatory framework compels ongoing adjustments, driving product reformulation costs across the industry.

USA Car Care Products Market Segmentation

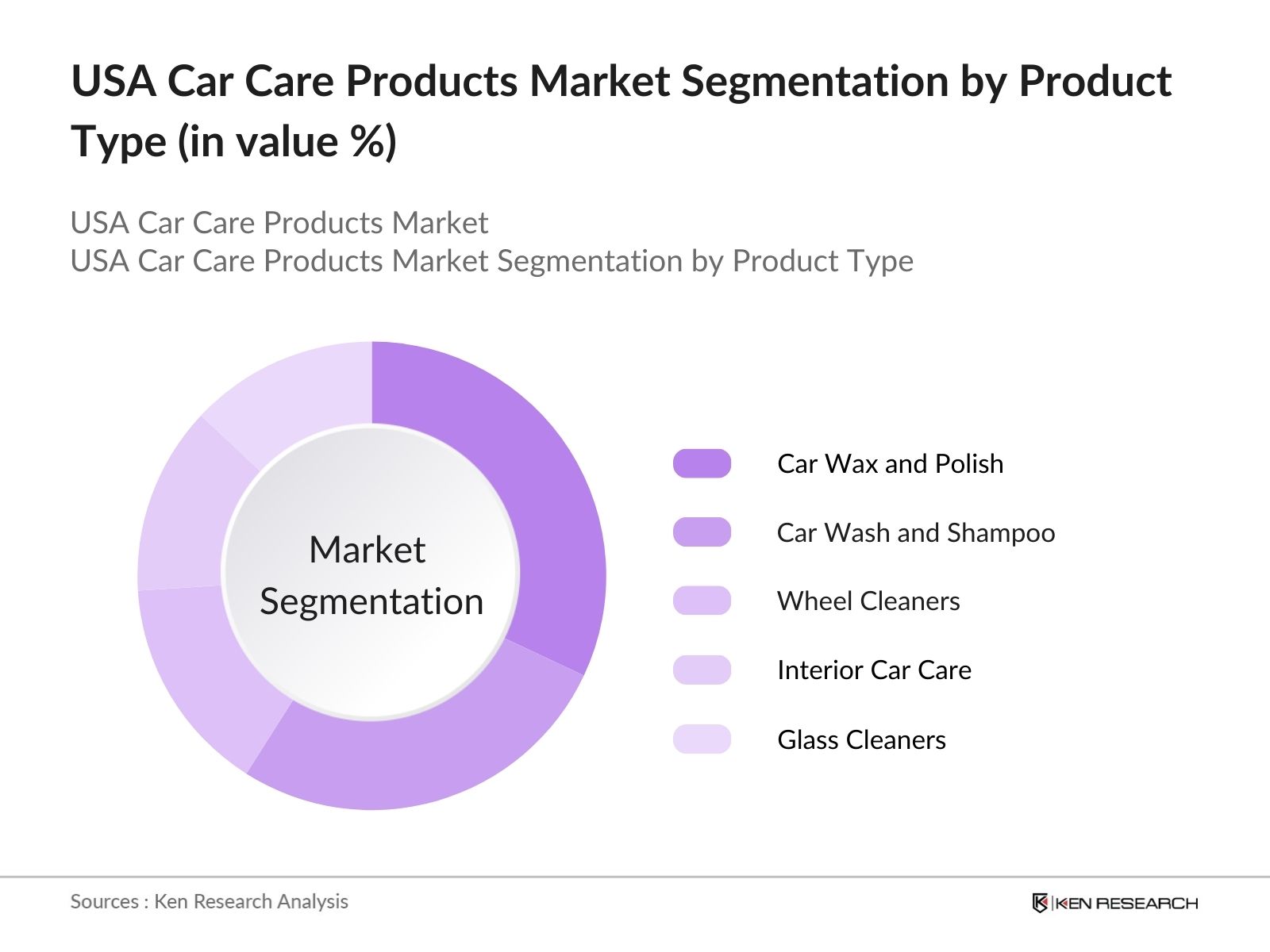

By Product Type: The USA Car Care Products market is segmented by product type into car wax and polish, car wash and shampoo, wheel cleaners, interior car care, and glass cleaners. Recently, car wax and polish products have a dominant market share in the USA under this segmentation, due to their established presence and the ongoing trend of maintaining a polished vehicle appearance. Leading brands like Turtle Wax and Meguiars contribute to this dominance through extensive product portfolios and high brand loyalty.

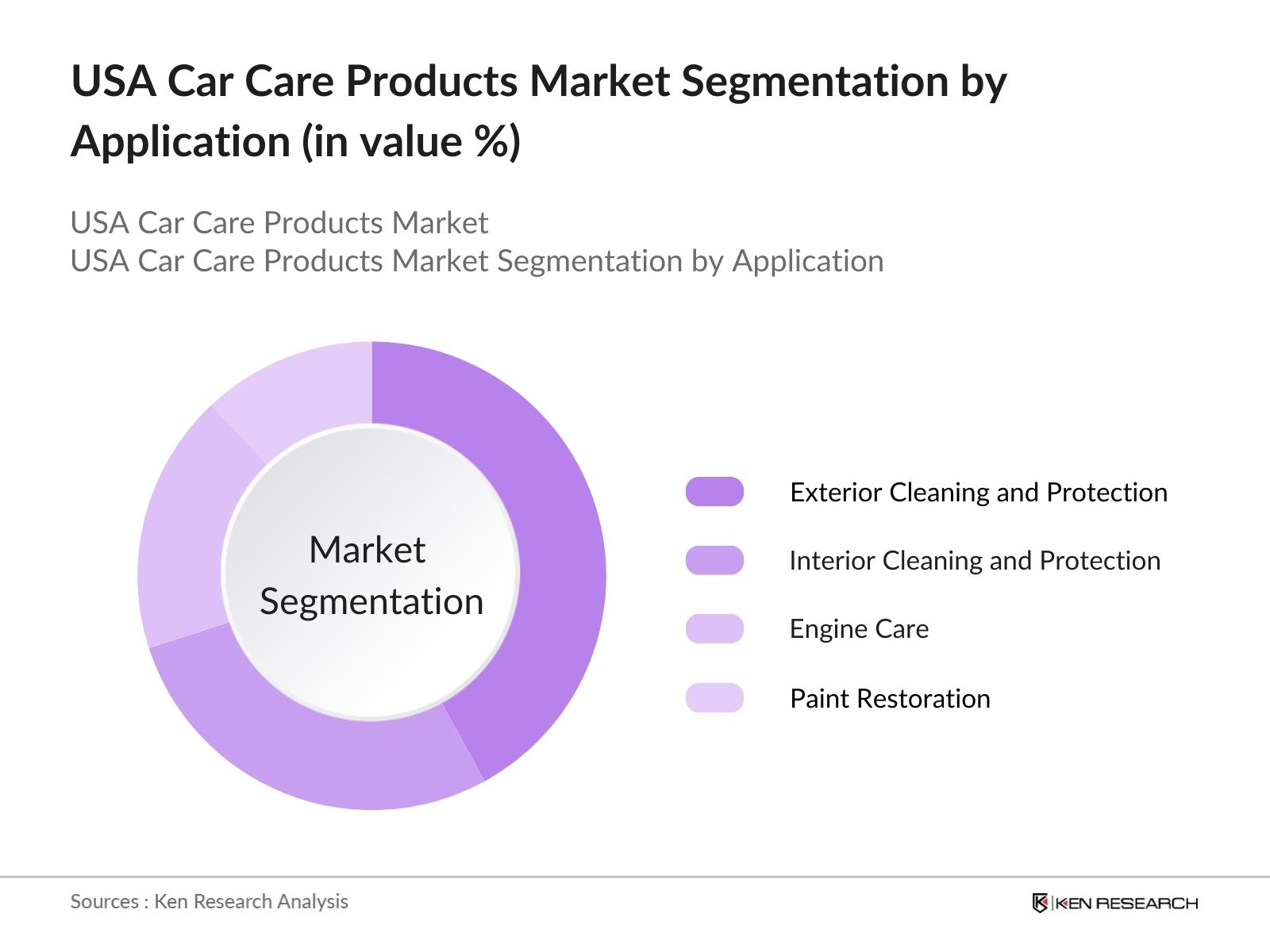

By Application: In the USA Car Care Products market, segmentation by application includes interior cleaning and protection, exterior cleaning and protection, engine care, and paint restoration. Exterior cleaning and protection hold a significant market share within this category, as environmental factors like UV exposure, pollution, and acid rain damage require regular maintenance for vehicle exteriors. Brands such as Armor All and SONAX offer specialized exterior protection products that appeal to consumers concerned with protecting vehicle paint and finishes.

USA Car Care Products Market Competitive Landscape

The USA Car Care Products market is dominated by major players, each bringing unique strengths in brand recognition, innovation, and distribution channels. This consolidation demonstrates the strong influence of these key companies.

USA Car Care Products Market Analysis

Growth Drivers

- Increasing Vehicle Ownership (Vehicle Penetration Rate): With the USAs total vehicle count surpassing 280 million in 2023, vehicle ownership rates are steadily increasing, driven by urban and suburban population expansion and higher disposable income levels. Additionally, recent statistics reveal that the U.S. Department of Transportation recorded 1.23 vehicles per household, reflecting a stable trend in personal car ownership, especially among middle-income households who form the core user base for car care products. This growing vehicle base fuels consistent demand for maintenance products essential for vehicle upkeep.

- Rising Demand for DIY Car Maintenance (Consumer Trends): Approximately 63 million U.S. households engaged in DIY car maintenance in 2023, reflecting a significant consumer shift towards self-maintenance as a cost-saving measure. This trend is notably prevalent among younger consumers, particularly in urban and suburban areas, who prioritize convenience and direct control over vehicle care. The automotive aftermarket industry has noted a substantial increase in DIY product purchases, especially among individuals aged 18-34, indicating a long-term shift in consumer behavior.

- Emphasis on Vehicle Aesthetics and Protection: An estimated 47% of American vehicle owners actively invest in car care products focused on aesthetics, as recorded in 2024, particularly in urban centers where car aesthetics contribute to social status. The increase in purchases of high-quality waxes, ceramic coatings, and UV protectants reflects a broader consumer interest in long-lasting vehicle appearance and protection. These preferences align with environmental conditions, particularly in states with high sun exposure, encouraging the use of products designed to counter UV and weather-related wear.

Challenges

- Fluctuating Raw Material Prices: The U.S. Bureau of Labor Statistics reported significant volatility in prices for raw materials like petroleum derivatives, key inputs for car care products, with a 2023 average increase of 6% due to global supply chain disruptions. This instability affects manufacturers profit margins and can potentially increase retail prices for car care products, impacting demand among price-sensitive consumers. These price fluctuations also pressure manufacturers to seek alternative materials or sustainable solutions, which can limit innovation due to cost concerns.

- Limited Product Awareness in Rural Areas: In 2023, rural U.S. regions comprised approximately 14% of total car care product sales, indicating low penetration relative to urban and suburban markets. Limited product awareness and accessibility are factors, particularly in the Midwest and certain Southern states where vehicle care knowledge and product accessibility are less extensive. This geographical challenge presents barriers to market expansion and reflects the need for targeted awareness campaigns to enhance demand in these under-served areas.

USA Car Care Products Market Future Outlook

USA Car Care Products market is expected to witness significant growth fueled by the expansion of e-commerce channels, consumer preference for eco-friendly products, and technological advancements in product formulation. Manufacturers are anticipated to innovate in eco-friendly and waterless products, addressing growing environmental concerns. Additionally, rising disposable incomes and the shift toward premium car care products are likely to propel market demand across urban and semi-urban regions.

Market Opportunities

- Growth in E-commerce and Online Sales Channels: E-commerce platforms contributed over $3 billion to the U.S. car care products market in 2023, demonstrating significant consumer preference for online purchasing. Platforms such as Amazon and Walmart are key drivers, facilitating access to a wide range of specialized products, which benefits small and niche brands. This shift aligns with broader e-commerce growth, reflecting a strong opportunity for manufacturers to expand direct-to-consumer sales channels that offer greater reach and operational efficiencies.

- Eco-friendly Car Care Products: In 2023, eco-friendly car care products saw an 18% increase in sales, a shift driven by consumer awareness around sustainable practices and environmental responsibility. The EPA has noted rising interest in biodegradable and non-toxic formulations, with demand primarily in metropolitan areas where regulatory standards are stringent. This trend reflects both consumer preference and regulatory encouragement, positioning eco-friendly products as a high-growth opportunity for manufacturers to capture environmentally conscious market segments.

Scope of the Report

|

Segments |

Sub-Segments |

|

Product Type |

Car Wax and Polish Car Wash and Shampoo Wheel Cleaners Interior Car Care Glass Cleaners |

|

Application |

Interior Cleaning and Protection Exterior Cleaning and Protection Engine Care Paint Restoration |

|

Sales Channel |

Online Retail Specialty Stores Hypermarkets/Supermarkets Direct Sales |

|

End User |

Individual Consumers Professional Car Washes Automotive Detailers |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Vehicle Maintenance and Repair Shops

Auto Parts Retailers and Distributors

Car Detailing Service Providers

Car Wash Franchises

OEM Manufacturers

Auto Insurance Providers

Government and Regulatory Bodies (e.g., EPA)

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report

3M Company

Turtle Wax, Inc.

Chemical Guys

Meguiars Inc.

Armor All

Mothers Polishes Waxes Cleaners

SONAX GmbH

Simoniz USA

Valvoline Inc.

Zep Inc.

Table of Contents

1. USA Car Care Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Car Care Products Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Car Care Products Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Vehicle Ownership (Vehicle Penetration Rate)

3.1.2. Rising Demand for DIY Car Maintenance (Consumer Trends)

3.1.3. Emphasis on Vehicle Aesthetics and Protection (Customer Preferences)

3.1.4. Advancements in Car Care Product Formulations (Innovation Drivers)

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices (Price Sensitivity)

3.2.2. Limited Product Awareness in Rural Areas (Geographical Distribution)

3.2.3. Regulatory Compliance (Environmental Regulations)

3.3. Opportunities

3.3.1. Growth in E-commerce and Online Sales Channels (Sales Channel Development)

3.3.2. Eco-friendly Car Care Products (Sustainability Trends)

3.3.3. Strategic Partnerships and Collaborations (Industry Collaboration)

3.4. Trends

3.4.1. Surge in Subscription-based Car Care Services (Subscription Models)

3.4.2. Growth in Demand for Specialized Car Care Products (Product Differentiation)

3.4.3. Increased Adoption of Waterless Car Wash Products (Sustainability Trends)

3.5. Regulatory Analysis

3.5.1. U.S. Environmental Protection Agency (EPA) Standards

3.5.2. CARB Regulations on Volatile Organic Compounds (VOC) Compliance

3.5.3. Local and State-Level Automotive Product Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Car Care Products Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Car Wax and Polish

4.1.2. Car Wash and Shampoo

4.1.3. Wheel Cleaners

4.1.4. Interior Car Care

4.1.5. Glass Cleaners

4.2. By Application (In Value %)

4.2.1. Interior Cleaning and Protection

4.2.2. Exterior Cleaning and Protection

4.2.3. Engine Care

4.2.4. Paint Restoration

4.3. By Sales Channel (In Value %)

4.3.1. Online Retail

4.3.2. Specialty Stores

4.3.3. Hypermarkets/Supermarkets

4.3.4. Direct Sales

4.4. By End User (In Value %)

4.4.1. Individual Consumers

4.4.2. Professional Car Washes

4.4.3. Automotive Detailers

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Car Care Products Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. 3M Company

5.1.2. Turtle Wax, Inc.

5.1.3. Chemical Guys

5.1.4. Meguiars Inc.

5.1.5. Armor All

5.1.6. Mothers Polishes Waxes Cleaners

5.1.7. SONAX GmbH

5.1.8. Simoniz USA

5.1.9. Valvoline Inc.

5.1.10. Zep Inc.

5.2. Cross Comparison Parameters (Market Presence, Revenue, Product Portfolio, R&D Focus, Market Share, Sustainability Efforts, Employee Count, Customer Retention Rate)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Car Care Products Market Regulatory Framework

6.1. EPA VOC Compliance Standards

6.2. State-Level Car Care Product Regulations

6.3. Health and Safety Certification Processes

7. USA Car Care Products Future Market Size (in USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Car Care Products Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Cohort Analysis

8.3. Marketing Initiatives

8.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves developing an ecosystem map of all major stakeholders in the USA Car Care Products Market. This phase is grounded in thorough desk research utilizing secondary databases to gather essential market-level information.

Step 2: Market Analysis and Construction

Here, we compile and analyze historical data pertaining to the USA Car Care Products Market, assessing market penetration, revenue growth, and consumer preference patterns. Quality statistics will be reviewed to ensure accuracy in the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are established and validated through direct consultations with industry experts via phone interviews, obtaining operational insights to refine market data accuracy.

Step 4: Research Synthesis and Final Output

In the final phase, car care manufacturers are engaged for direct insights into product trends, sales performance, and consumer preferences. This process corroborates findings from the bottom-up analysis, ensuring a comprehensive market report.

Frequently Asked Questions

01. How big is the USA Car Care Products Market?

The USA Car Care Products Market was valued at USD 1 billion, driven by rising consumer demand for high-quality maintenance products and growing DIY car care trends.

02. What are the challenges in the USA Car Care Products Market?

Major challenges in USA Car Care Products Market include volatile raw material prices, stringent VOC regulations, and limited awareness in rural areas, impacting market reach and profitability.

03. Who are the major players in the USA Car Care Products Market?

Key players in USA Car Care Products Market include 3M Company, Turtle Wax, Inc., Chemical Guys, Meguiars Inc., and Armor All, who lead due to strong brand presence and distribution networks.

04. What drives the growth of the USA Car Care Products Market?

Growth drivers in USA Car Care Products Market encompass increased consumer awareness, advancements in product formulation, and a rising preference for environmentally sustainable car care products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.