USA Champagne Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD9840

December 2024

98

About the Report

USA Champagne Market Overview

- The USA Champagne Market is valued at USD 1.4 billion, based on a five-year historical analysis. This growth is driven by increasing consumer preference for premium alcoholic beverages, especially for special occasions and celebrations. The rise of e-commerce platforms has also played a pivotal role, allowing consumers easier access to various champagne brands and variations, which has fueled consumption.

- Major urban centers like New York, Los Angeles, and Miami are the dominant consumers in the USA Champagne market. These cities have a high concentration of wealth and are centers for luxury spending, social events, and celebrations. The cultural affinity for events such as weddings, fashion shows, and corporate gatherings in these cities fuels high demand for champagne. Additionally, the influence of affluent consumers and a thriving tourism industry further boosts champagne sales in these areas.

- Champagne imported into the U.S. must comply with stringent labeling requirements under the Appellation dOrigine Contrle (AOC) regulations. Only sparkling wine from the Champagne region of France can be labeled as champagne, ensuring authenticity. In 2023, U.S. customs enforced strict checks on origin certification, rejecting several shipments that did not meet these requirements. Compliance with AOC regulations is crucial for maintaining market access and consumer trust.

USA Champagne Market Segmentation

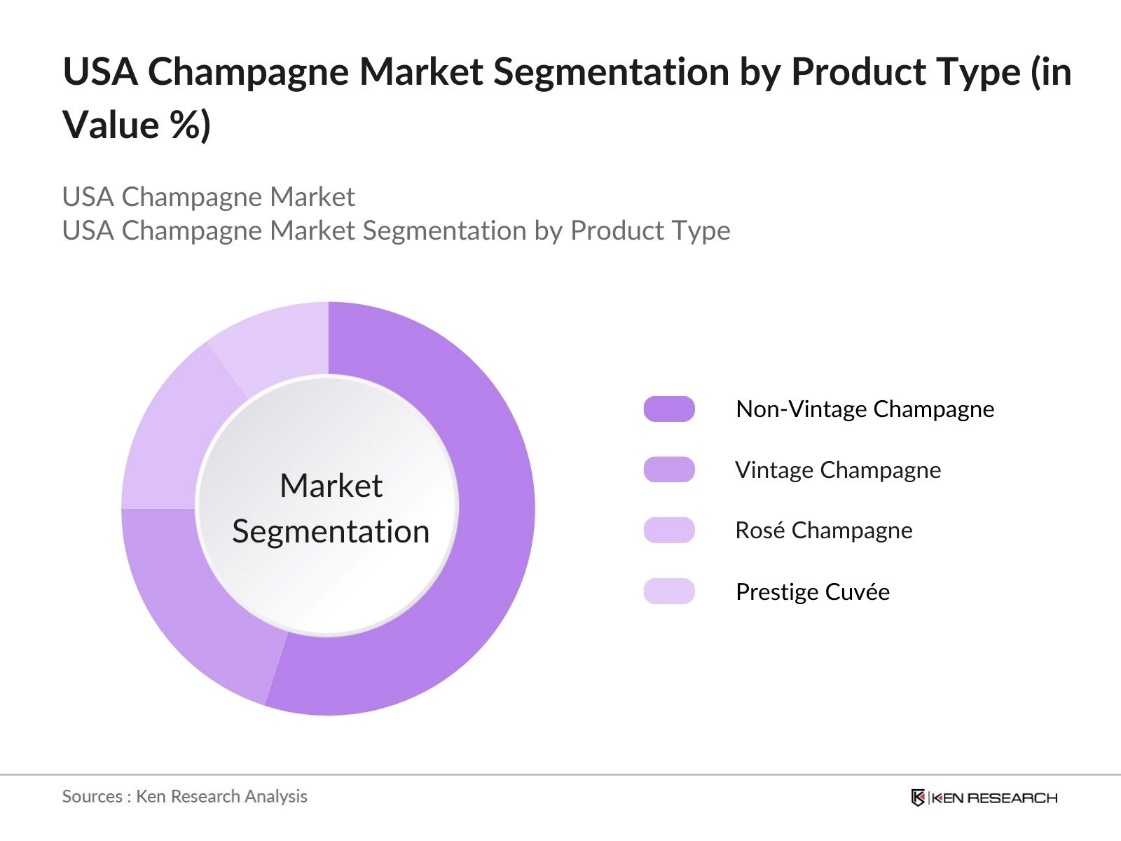

By Product Type: The USA Champagne market is segmented by product type into Vintage Champagne, Non-Vintage Champagne, Ros Champagne, and Prestige Cuve. Recently, Non-Vintage Champagne has emerged as the dominant sub-segment. Its dominance is largely due to its affordability compared to vintage varieties, making it more accessible to a broader range of consumers. Non-vintage champagnes are produced annually, using a blend of several vintages, which ensures consistency in quality and supply, a critical factor for meeting consumer demand in the USA, where buyers often prioritize quality and value.

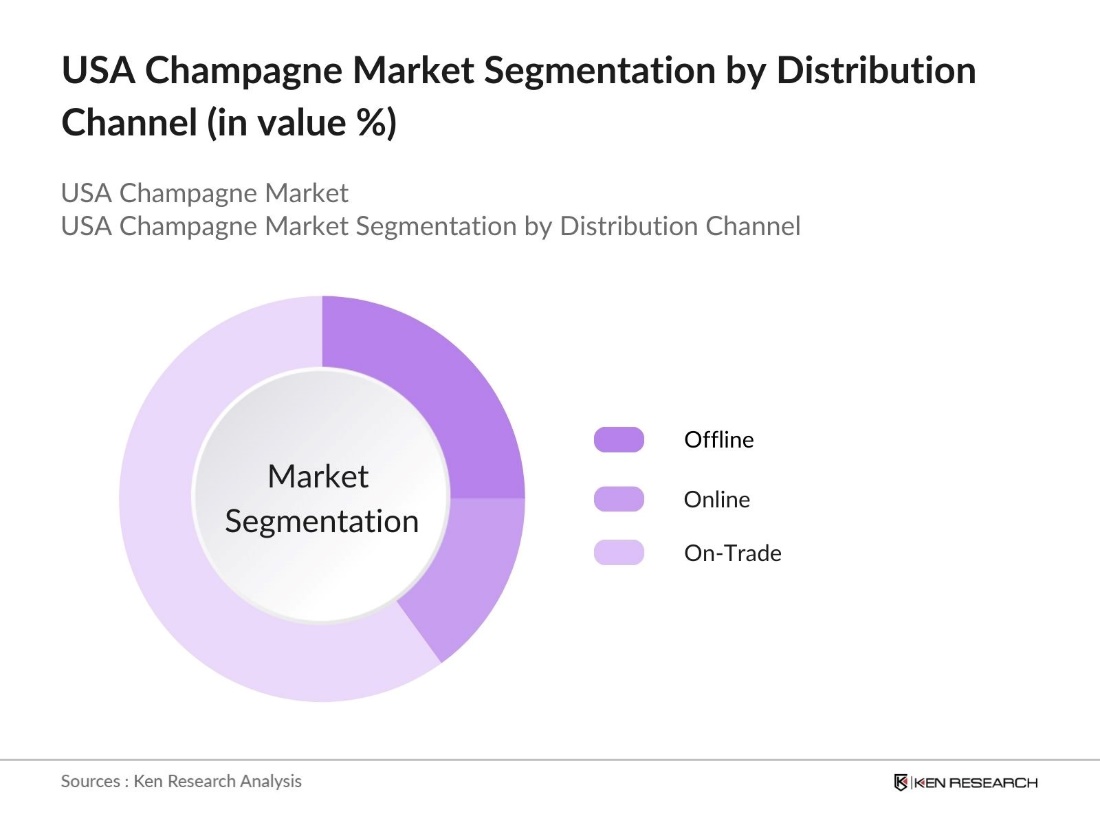

By Distribution Channel: The USA Champagne market is segmented by distribution channel into Offline (Retail Stores, Supermarkets, Liquor Stores), Online (E-Commerce Platforms, Direct-to-Consumer), and On-Trade (Restaurants, Bars, Hotels). On-Trade distribution leads in terms of market share due to the strong association of champagne with dining and special event experiences. Consumers often purchase champagne during fine dining experiences or at celebratory events like weddings and corporate functions. Restaurants and bars also create exclusive opportunities for showcasing high-end champagne products, contributing to the dominance of this segment.

USA Champagne Market Competitive Landscape

The USA Champagne market is dominated by a mix of international and local brands, with global giants leading the market in terms of brand recognition, product quality, and distribution networks. These companies invest heavily in marketing, and many have well-established relationships with luxury venues and events, ensuring their continued dominance.

|

Company Name |

Established Year |

Headquarters |

Production Capacity |

E-Commerce Integration |

Sustainability Initiatives |

Brand Endorsements |

New Product Introductions |

Global vs. Local Distribution |

|

Mot & Chandon |

1743 |

pernay, France |

||||||

|

Veuve Clicquot |

1772 |

Reims, France |

||||||

|

Louis Roederer |

1776 |

Reims, France |

||||||

|

Laurent-Perrier |

1812 |

Tours-sur-Marne, France |

||||||

|

Dom Prignon |

1668 |

pernay, France |

USA Champagne Industry Analysis

Growth Drivers

- Rising Consumer Disposable Income (Disposable Income, Purchasing Power): Rising disposable income in the U.S. has been a key driver in the champagne market. In 2023, the U.S. personal disposable income rose to 21782.20 USD billion, reflecting greater consumer purchasing power. The median household income which influences luxury spending, including premium champagne purchases. Increased consumer confidence in 2023 further enhanced this spending, with luxury items like champagne gaining traction in the affluent consumer segment. Higher disposable income enables consumers to indulge in celebratory goods, furthering demand in the premium segment.

- Increasing Demand for Premium Products (Premiumization): Premiumization continues to influence the U.S. champagne market, with consumers shifting towards higher-quality products. This trend has been particularly strong in 2023, when luxury goods spending showed growth due to evolving tastes. Champagne brands have increasingly launched premium products priced higher, reflecting the growing demand for exclusivity. Additionally, U.S. sales of luxury goods increased in 2023, with premium alcohol, including champagne, gaining market share as affluent consumers seek unique experiences.

- Rising E-Commerce and Online Distribution (E-commerce Penetration): E-commerce growth in the U.S. has boosted champagne sales through online platforms, with consumers favoring the convenience of home delivery. Champagne brands are increasingly using direct-to-consumer models, making premium options more accessible. As online shopping habits expand, champagne companies are leveraging e-commerce to reach wider audiences, ensuring consumers can easily purchase and enjoy their products from home.

Market Challenges

- Stringent Regulatory Framework (FDA and TTB Regulations): The market faces significant regulatory challenges due to strict guidelines from the Food and Drug Administration (FDA) and the Alcohol and Tobacco Tax and Trade Bureau (TTB). Import regulations, labeling standards, and safety inspections create barriers for foreign champagne producers. The FDA enforces ingredient disclosures, while the TTB regulates alcohol taxation and labeling, making compliance essential but often costly and time-consuming for producers trying to enter the U.S. market.

- Fluctuations in Production Due to Climate Change (Weather Impact, Crop Yields): The champagne industry is increasingly affected by climate change, particularly in the wine-growing regions that supply the U.S. market. Unpredictable weather conditions, such as extreme temperatures and frost, disrupt grape production, resulting in lower yields. These fluctuations in crop production can lead to champagne shortages, higher prices, and a strained supply chain, impacting the availability of champagne in the U.S

USA Champagne Market Future Outlook

Over the next five years, the USA Champagne market is expected to show consistent growth driven by an increasing affinity for luxury products, especially in urban areas. The market is likely to benefit from the continued expansion of e-commerce platforms, enabling broader consumer access to premium champagne offerings. Additionally, innovations in champagne production, including more sustainable practices and new flavor profiles, will cater to evolving consumer preferences for eco-friendly and diverse products.

Market Opportunities

- Rising Popularity of Non-Alcoholic Champagne (Health Consciousness, Non-Alcoholic Beverages Market): The growing trend of health consciousness among U.S. consumers has led to an increased demand for non-alcoholic champagne. Many people are opting for healthier alternatives without compromising on celebratory experiences. Non-alcoholic champagne has become a popular choice for events and special occasions, offering an inclusive option for those who prefer to avoid alcohol. This shift presents an opportunity for producers to expand their product offerings and cater to a broader, health-conscious audience.

- Expansion in New Distribution Channels (Direct-to-Consumer, E-Retailing): The champagne market is seeing a rise in direct-to-consumer sales, with brands increasingly selling through online platforms, bypassing traditional retail stores. This shift allows producers to reach customers more easily and directly, offering a more personalized experience. E-retailing platforms have also gained prominence, making it easier for consumers to purchase champagne online. This digital transformation offers opportunities for champagne brands to connect with a younger, tech-savvy audience and expand their market reach.

Scope of the Report

|

Product Type |

Vintage Champagne Non-Vintage Champagne Ros Champagne Prestige Cuve |

|

Distribution Channel |

Offline (Retail Stores, Supermarkets, Liquor Stores) Online (E-Commerce Platforms, Direct-to-Consumer) On-Trade (Restaurants, Bars, Hotels) |

|

Price Range |

Economy Mid-Range Premium Luxury |

|

End-User |

Individual Consumers Corporate Consumers Event-Based Consumers (Weddings, Celebrations) |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Event and Hospitality Industry

Luxury Lifestyle Media Companies

Private Jet and Yacht Companies

Luxury Gifting Companies

Government and Regulatory Bodies (FDA, TTB)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Mot & Chandon

Veuve Clicquot

Dom Prignon

Louis Roederer

Laurent-Perrier

Perrier-Jout

Pol Roger

Taittinger

Krug

Bollinger

Table of Contents

1. USA Champagne Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Champagne Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Champagne Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Disposable Income (Disposable Income, Purchasing Power)

3.1.2. Increasing Demand for Premium Products (Premiumization)

3.1.3. Influence of Celebratory Culture (Event and Occasions Spending)

3.1.4. Rising E-Commerce and Online Distribution (E-commerce Penetration)

3.2. Market Challenges

3.2.1. Stringent Regulatory Framework (FDA and TTB Regulations)

3.2.2. Fluctuations in Production due to Climate Change (Weather Impact, Crop Yields)

3.2.3. High Competition from Sparkling Wine Alternatives (Substitution by Prosecco, Cava)

3.3. Opportunities

3.3.1. Rising Popularity of Non-Alcoholic Champagne (Health Consciousness, Non-Alcoholic Beverages Market)

3.3.2. Expansion in New Distribution Channels (Direct-to-Consumer, E-Retailing)

3.3.3. Growth in Small and Independent Wineries (Craft and Boutique Producers)

3.4. Trends

3.4.1. Increasing Focus on Sustainability (Sustainable Viticulture, Eco-Friendly Packaging)

3.4.2. Innovations in Flavors and Packaging (Flavor Diversity, Customizable Bottles)

3.4.3. Celebrity Endorsements and Partnerships (Brand Collaborations with Influencers)

3.5. Government Regulation

3.5.1. Champagne Labeling Requirements (AOC Regulations, Origin Certification)

3.5.2. Import Tariffs and Trade Policies (Impact of Tariffs, International Trade Policies)

3.5.3. Marketing Restrictions for Alcoholic Beverages (Advertising Rules, Age Restrictions)

3.6. SWOT Analysis

3.6.1. Strengths (Premium Perception, Heritage and Luxury Positioning)

3.6.2. Weaknesses (Limited Supply, Seasonality)

3.6.3. Opportunities (Emerging Markets, E-Commerce Growth)

3.6.4. Threats (Economic Downturns, Competition from Sparkling Wines)

3.7. Stake Ecosystem

3.7.1. Producers (Vineyard Owners, Winemakers)

3.7.2. Distributors (Retailers, E-Commerce Platforms)

3.7.3. End-Consumers (Luxury Consumers, Event-Based Purchasers)

3.8. Porters Five Forces

3.8.1. Threat of New Entrants (Barriers to Entry, Capital Investment)

3.8.2. Bargaining Power of Suppliers (Raw Material Costs, Viticulture Dependencies)

3.8.3. Bargaining Power of Buyers (Consumer Preferences, Market Competition)

3.8.4. Threat of Substitutes (Sparkling Wines, Non-Alcoholic Alternatives)

3.8.5. Industry Rivalry (Brand Competitiveness, Product Differentiation)

3.9. Competition Ecosystem (Competitors, Market Shares, Competitive Strategies)

4. USA Champagne Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Vintage Champagne

4.1.2. Non-Vintage Champagne

4.1.3. Ros Champagne

4.1.4. Prestige Cuve

4.2. By Distribution Channel (In Value %)

4.2.1. Offline (Retail Stores, Supermarkets, Liquor Stores)

4.2.2. Online (E-Commerce Platforms, Direct-to-Consumer)

4.2.3. On-Trade (Restaurants, Bars, Hotels)

4.3. By Price Range (In Value %)

4.3.1. Economy

4.3.2. Mid-Range

4.3.3. Premium

4.3.4. Luxury

4.4. By End-User (In Value %)

4.4.1. Individual Consumers

4.4.2. Corporate Consumers

4.4.3. Event-Based Consumers (Weddings, Celebrations)

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Champagne Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Mot & Chandon

5.1.2. Veuve Clicquot

5.1.3. Dom Prignon

5.1.4. Louis Roederer

5.1.5. Laurent-Perrier

5.1.6. Perrier-Jout

5.1.7. Pol Roger

5.1.8. Taittinger

5.1.9. Krug

5.1.10. Bollinger

5.1.11. G.H. Mumm

5.1.12. Ruinart

5.1.13. Piper-Heidsieck

5.1.14. Nicolas Feuillatte

5.1.15. Charles Heidsieck

5.2 Cross Comparison Parameters (Headquarters, Production Capacity, Vintage vs. Non-Vintage Sales, Global vs. Local Distribution, Sustainability Practices, E-Commerce Integration, Marketing Expenditure, New Product Introductions)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Champagne Market Regulatory Framework

6.1. FDA and TTB Compliance

6.2. Alcohol Distribution Laws

6.3. Environmental Sustainability Certifications

7. USA Champagne Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Champagne Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Price Range (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. USA Champagne Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This stage involved identifying all key stakeholders in the USA Champagne market, including producers, distributors, retailers, and consumers. Extensive desk research was conducted, utilizing proprietary databases and industry reports to pinpoint the most influential market factors, such as consumer behavior trends, regulatory frameworks, and distribution channels.

Step 2: Market Analysis and Construction

In this phase, historical market data from various sources was compiled and analyzed. This included evaluating the production levels of champagne, consumer purchasing patterns, and the impact of marketing campaigns by key brands. Special emphasis was placed on identifying revenue generated through various distribution channels and product segments.

Step 3: Hypothesis Validation and Expert Consultation

To validate the collected data, consultations with industry experts, including champagne producers and retail managers, were conducted. These expert interviews provided valuable insights into the operational and financial dynamics of the champagne industry, especially in the USA market.

Step 4: Research Synthesis and Final Output

In the final stage, the research was synthesized, and the findings were compiled into a comprehensive report. The report includes validated data from primary and secondary sources, offering a detailed analysis of the USA Champagne market, including segmentation by product type and distribution channel, as well as competitive landscape and future growth potential.

Frequently Asked Questions

01 How big is the USA Champagne Market?

The USA Champagne Market is valued at USD 1.4 billion, driven by increasing demand for premium alcoholic beverages and the rise of e-commerce platforms.

02 What are the challenges in the USA Champagne Market?

Challenges in USA Champagne Market include stringent regulatory frameworks for alcoholic beverages, fluctuating production due to climate change, and rising competition from alternative sparkling wines like Prosecco and Cava.

03 Who are the major players in the USA Champagne Market?

Key players in the USA Champagne Market include Mot & Chandon, Veuve Clicquot, Dom Prignon, Louis Roederer, and Laurent-Perrier. These companies dominate due to their strong brand presence, premium product offerings, and global distribution networks.

04 What are the growth drivers of the USA Champagne Market?

The USA Champagne Market is propelled by the rising popularity of premium alcoholic beverages for celebratory events, increased disposable income among middle and upper-middle-class consumers, and the growth of e-commerce platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.