USA Chocolate Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD4460

December 2024

84

About the Report

USA Chocolate Market Overview

- The USA chocolate market is valued at USD 27 billion, based on a five-year historical analysis. This market is driven by a steady consumer demand for indulgent confectioneries and a rising interest in premium and artisanal chocolates. Key growth factors include evolving consumer tastes favoring high-quality ingredients, health-oriented choices like dark and organic chocolates, and innovation in flavors and packaging. Additionally, demand for chocolate products surges during seasonal events and festivities, contributing to the markets steady expansion.

- Major cities such as New York, Los Angeles, and Chicago dominate the USA chocolate market due to their large, diverse populations and higher disposable incomes, which foster a robust demand for a variety of chocolate products. These urban centers also serve as hubs for culinary innovation, contributing to the prominence of premium and specialty chocolate brands.

- The U.S. Food and Drug Administration (FDA) enforces strict guidelines on chocolate production to ensure product safety and quality. In 2023, the FDA conducted over 1,200 inspections of chocolate manufacturing facilities, focusing on compliance with Good Manufacturing Practices (GMP). These regulations mandate proper sanitation, accurate labeling, and the absence of contaminants, safeguarding public health and maintaining industry standards.

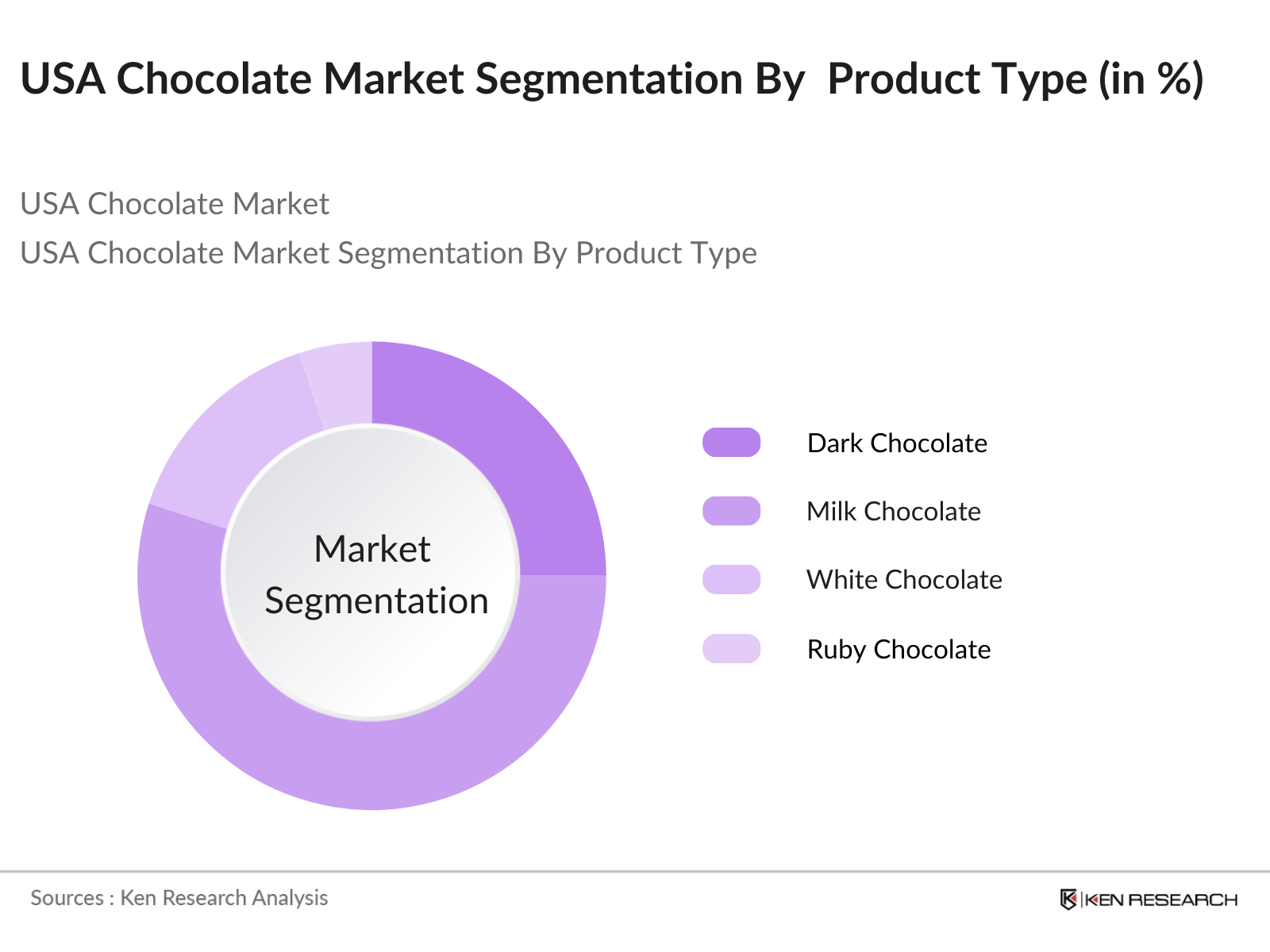

USA Chocolate Market Segmentation

By Product Type: The market is segmented by product type into dark chocolate, milk chocolate, white chocolate, and ruby chocolate. Milk chocolate holds a dominant market share, attributed to its widespread consumer appeal and versatility in various applications, from confectioneries to baking. Its creamy texture and sweet flavor profile make it a preferred choice among a broad demographic.

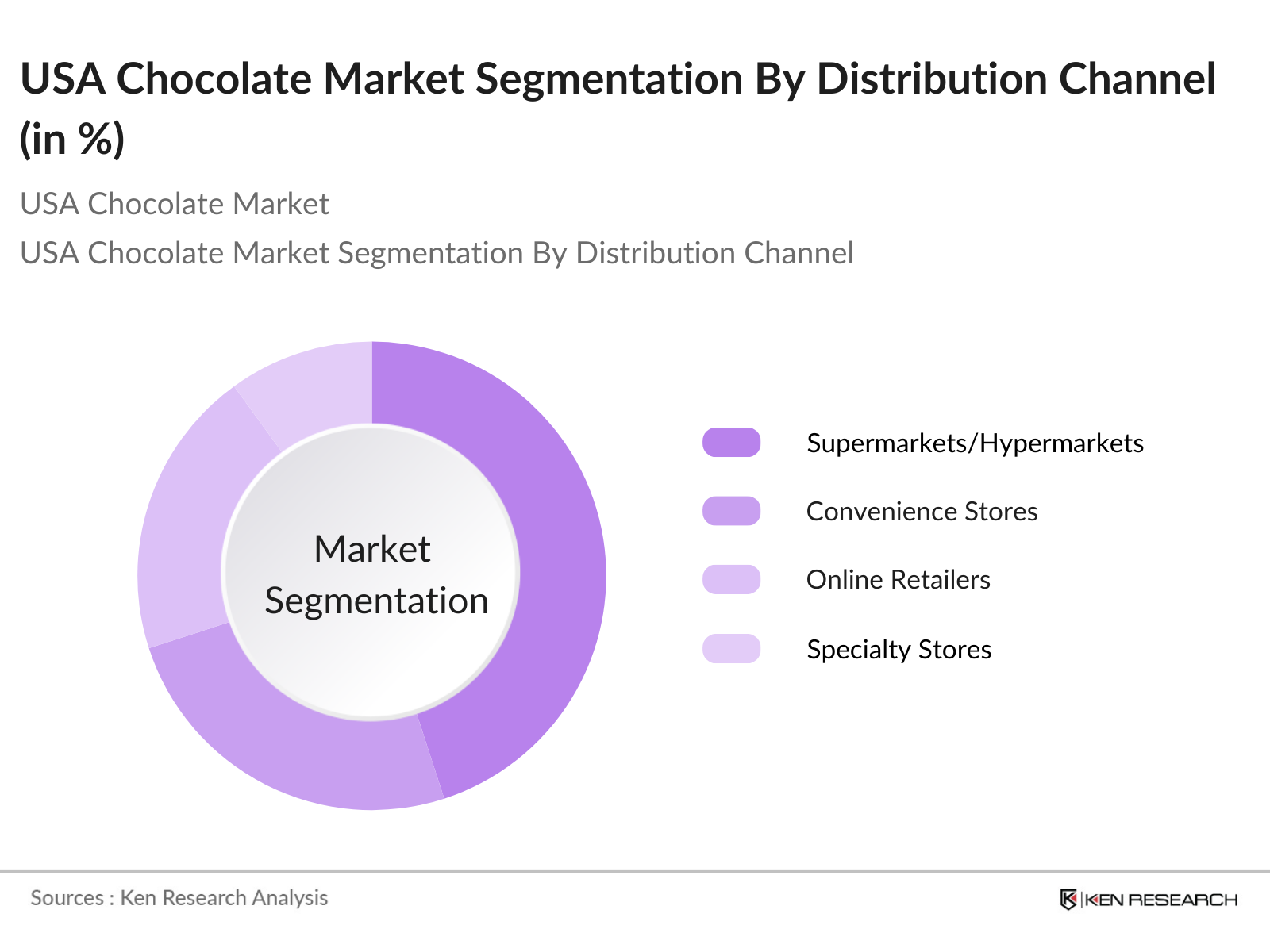

By Distribution Channel: Distribution channels in the USA chocolate market include supermarkets and hypermarkets, convenience stores, online retailers, specialty stores, and others. Supermarkets and hypermarkets lead in market share due to their extensive reach, diverse product offerings, and the convenience they provide to consumers seeking a one-stop shopping experience.

USA Chocolate Market Competitive Landscape

The USA chocolate market is characterized by the presence of both longstanding industry leaders and emerging artisanal brands, creating a dynamic competitive environment. Established companies leverage extensive distribution networks and brand loyalty, while newer entrants focus on innovation and niche markets to capture consumer interest.

USA Chocolate Industry Analysis

Growth Drivers

- Consumer Preference for Premium Chocolates: In 2023, the U.S. chocolate market experienced a notable shift towards premium products, driven by consumers' increasing disposable incomes and a growing desire for indulgent experiences. The U.S. Bureau of Economic Analysis reported a rise in personal income to $21.5 trillion in 2023, reflecting enhanced purchasing power. This economic uplift has enabled consumers to allocate more funds towards luxury items, including high-quality chocolates.

- Health Benefits Associated with Dark Chocolate: Dark chocolate consumption has surged due to its perceived health advantages. The U.S. Department of Agriculture highlights that dark chocolate is rich in flavonoids, which are antioxidants linked to improved heart health. A study published in the Journal of the American Heart Association in 2023 found that moderate dark chocolate intake was associated with a 10% reduction in cardiovascular disease risk. This growing awareness has led to increased consumer demand for dark chocolate products.

- Seasonal and Festive Demand: Seasonal events significantly boost chocolate sales in the U.S. The National Retail Federation reported that in 2023, Americans spent approximately $3.1 billion on Easter candy, with chocolate products comprising a substantial portion. Similarly, during Halloween, chocolate sales reached $4.1 billion, underscoring the product's popularity during festive periods. These occasions drive short-term spikes in demand, benefiting manufacturers and retailers alike.

Market Challenges

- Health Concerns Over Sugar Content: Rising health consciousness among U.S. consumers has led to increased scrutiny of sugar content in chocolate products. The Centers for Disease Control and Prevention reported that in 2023, 42% of American adults were classified as obese, prompting a shift towards healthier dietary choices. Consequently, there is growing demand for low-sugar or sugar-free chocolate alternatives, compelling manufacturers to reformulate products to meet these health-oriented preferences.

- Supply Chain Disruptions: The U.S. chocolate market has been affected by supply chain disruptions, particularly in 2023, due to global events impacting transportation and logistics. The U.S. Department of Transportation reported a 15% increase in shipping delays, affecting the timely delivery of cocoa and other essential ingredients. These disruptions have led to production delays and increased operational costs for chocolate manufacturers, challenging their ability to meet consumer demand efficiently.

USA Chocolate Market Future Outlook

Over the next five years, the USA chocolate market is expected to experience steady growth, driven by increasing consumer interest in premium and health-oriented chocolate products. Advancements in product innovation, such as the introduction of functional ingredients and sustainable sourcing practices, are anticipated to further stimulate market expansion.

Market Opportunities

- Growth in Organic and Fair-Trade Chocolate Segments: Consumer demand for ethically sourced and organic chocolate has risen. The U.S. Department of Agriculture reported a 10% increase in organic product sales in 2023, indicating a broader trend towards organic consumption. Additionally, Fair Trade USA certified over 1,000 new chocolate products in 2023, reflecting a commitment to ethical sourcing. This shift presents an opportunity for manufacturers to cater to socially conscious consumers by expanding their organic and fair-trade product lines.

- Expansion into Emerging Markets: While the U.S. remains a significant market, there is potential for growth in emerging economies. The International Trade Administration noted that U.S. chocolate exports to countries like China and India increased by 8% in 2023. These markets, with growing middle-class populations and increasing disposable incomes, offer opportunities for U.S. chocolate manufacturers to expand their global footprint and tap into new consumer bases.

Scope of the Report

|

Product Type |

Dark Chocolate |

|

Distribution Channel |

Supermarkets and Hypermarkets |

|

Application |

Confectionery |

|

Region |

Northeast |

Products

Key Target Audience

Chocolate Manufacturers

Retailers and Distributors

Ingredient Suppliers

Packaging Companies

Marketing and Advertising Agencies

Investment and Venture Capital Firms

Government and Regulatory Bodies (e.g., USA Food and Drug Administration)

Consumer Advocacy Groups

Companies

Players Mentioned in the Report

The Hershey Company

Mars, Incorporated

Mondelez International

Ferrero Group

Lindt & Sprngli

Nestl USA

Ghirardelli Chocolate Company

Godiva Chocolatier

Tootsie Roll Industries

Russell Stover Chocolates

Table of Contents

1. USA Chocolate Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Chocolate Market Size (USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Chocolate Market Analysis

3.1 Growth Drivers

3.1.1 Consumer Preference for Premium Chocolates

3.1.2 Health Benefits Associated with Dark Chocolate

3.1.3 Seasonal and Festive Demand

3.1.4 Innovations in Flavor and Packaging

3.2 Market Challenges

3.2.1 Fluctuating Cocoa Prices

3.2.2 Health Concerns Over Sugar Content

3.2.3 Supply Chain Disruptions

3.3 Opportunities

3.3.1 Growth in Organic and Fair-Trade Chocolate Segments

3.3.2 Expansion into Emerging Markets

3.3.3 E-commerce and Direct-to-Consumer Sales Channels

3.4 Trends

3.4.1 Rise of Plant-Based and Vegan Chocolates

3.4.2 Sustainable and Ethical Sourcing Practices

3.4.3 Personalization and Customization in Chocolate Products

3.5 Government Regulations

3.5.1 FDA Guidelines on Chocolate Production

3.5.2 Labeling Requirements for Cocoa Content

3.5.3 Import Tariffs and Trade Policies

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. USA Chocolate Market Segmentation

4.1 By Product Type (Value %)

4.1.1 Dark Chocolate

4.1.2 Milk Chocolate

4.1.3 White Chocolate

4.1.4 Ruby Chocolate

4.2 By Distribution Channel (Value %)

4.2.1 Supermarkets and Hypermarkets

4.2.2 Convenience Stores

4.2.3 Online Retailers

4.2.4 Specialty Stores

4.2.5 Others

4.3 By Application (Value %)

4.3.1 Confectionery

4.3.2 Beverages

4.3.3 Bakery Products

4.3.4 Cosmetics

4.3.5 Pharmaceuticals

4.4 By Region (Value %)

4.4.1 Northeast

4.4.2 Midwest

4.4.3 South

4.4.4 West

5. USA Chocolate Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 The Hershey Company

5.1.2 Mars, Incorporated

5.1.3 Mondelez International

5.1.4 Ferrero Group

5.1.5 Lindt & Sprngli

5.1.6 Nestl USA

5.1.7 Ghirardelli Chocolate Company

5.1.8 Godiva Chocolatier

5.1.9 Tootsie Roll Industries

5.1.10 Russell Stover Chocolates

5.1.11 See's Candies

5.1.12 Blommer Chocolate Company

5.1.13 Endangered Species Chocolate

5.1.14 Lake Champlain Chocolates

5.1.15 Theo Chocolate

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Portfolio, Sustainability Initiatives, Recent Developments)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. USA Chocolate Market Regulatory Framework

6.1 FDA Standards for Chocolate Products

6.2 Compliance Requirements for Labeling and Packaging

6.3 Certification Processes for Organic and Fair-Trade Chocolates

7. USA Chocolate Market Future Projections (USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Chocolate Market Future Segmentation

8.1 By Product Type (Value %)

8.2 By Distribution Channel (Value %)

8.3 By Application (Value %)

8.4 By Region (Value %)

9. USA Chocolate Market Analyst Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA chocolate market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA chocolate market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple chocolate manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA chocolate market.

Frequently Asked Questions

1. How big is the USA chocolate market?

The USA chocolate market is valued at USD 27 billion, based on a five-year historical analysis. This market is driven by a steady consumer demand for indulgent confectioneries and a rising interest in premium and artisanal chocolates.

2. What are the challenges in the USA chocolate market?

Challenges include fluctuating cocoa prices, health concerns over sugar content, and supply chain disruptions, which impact the stability and profitability of the market.

3. Who are the major players in the USA chocolate market?

Key players include The Hershey Company, Mars, Mondelez International, Ferrero Group, and Lindt & Sprngli, who dominate due to their extensive distribution networks, brand strength, and diverse product portfolios.

4. What are the growth drivers of the USA chocolate market?

The market is driven by consumer preference for premium and health-oriented chocolate products, innovations in flavor and packaging, and increased interest in organic and fair-trade chocolates.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.