USA Cigarettes Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD9730

December 2024

89

About the Report

USA Cigarettes Market Overview

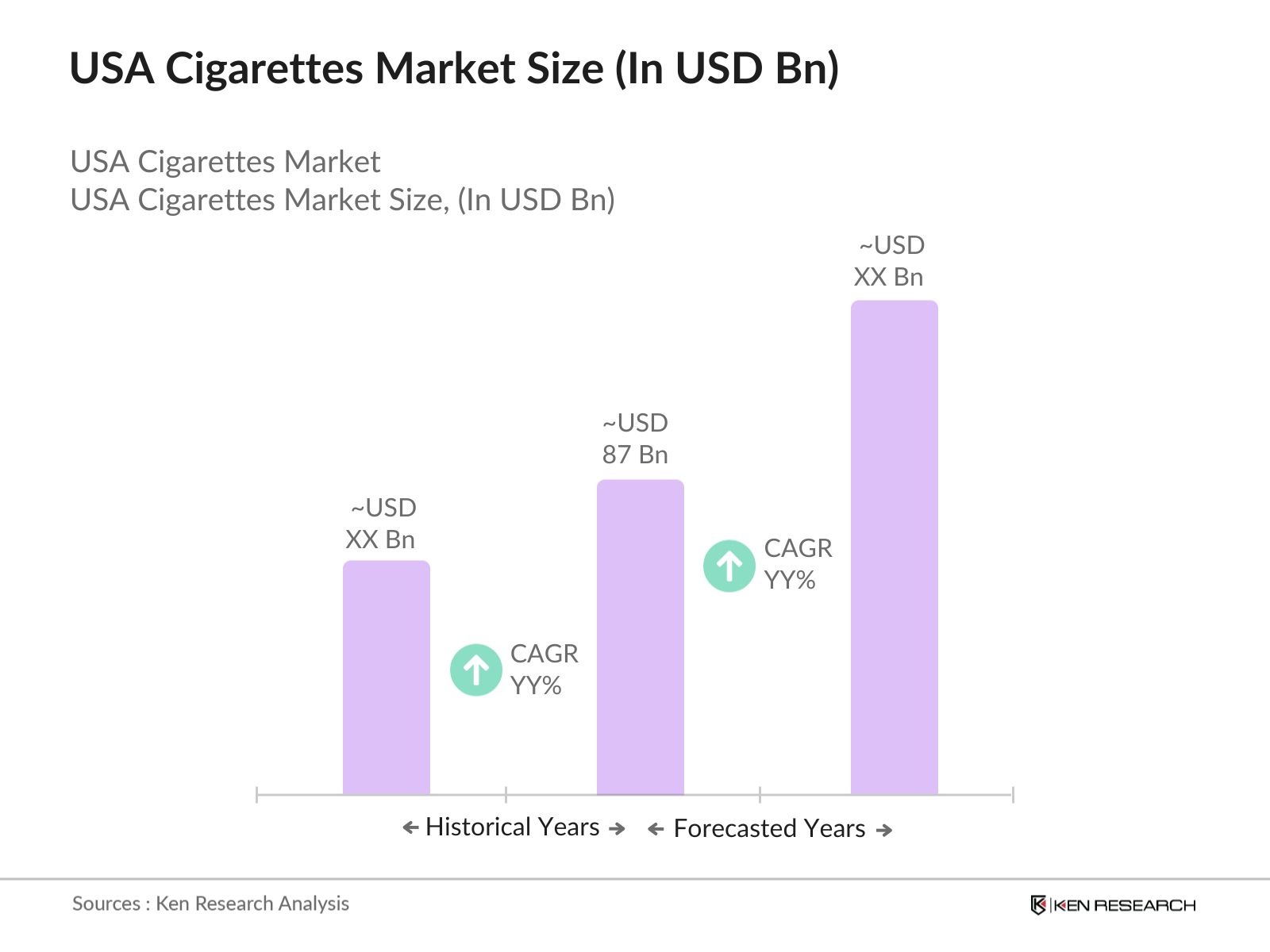

- The USA cigarettes market is valued at USD 87 billion based on a comprehensive five-year analysis. This market is primarily driven by a steady demand for premium and flavored cigarettes, despite rising health concerns and increasing government regulations. Factors like lifestyle stress, the introduction of innovative flavors, and a strong brand presence from companies like Philip Morris and Altria Group continue to drive consumption.

- Cities such as New York and Los Angeles dominate the market due to their large population sizes and the cultural acceptance of smoking in certain urban sectors. Additionally, cities with lower tobacco taxes, especially in the Southeast and Midwest, continue to report higher consumption. These regions attract smokers with competitive pricing and offer a vast network of offline retailers, making cigarettes more accessible.

- In 2024, the U.S. government has implemented further increases in cigarette taxes, with new federal taxes generating an additional $10 billion in revenue annually. These taxes aim to reduce smoking rates while funding healthcare programs. Although designed to reduce smoking, this initiative puts additional pressure on cigarette manufacturers and retailers.

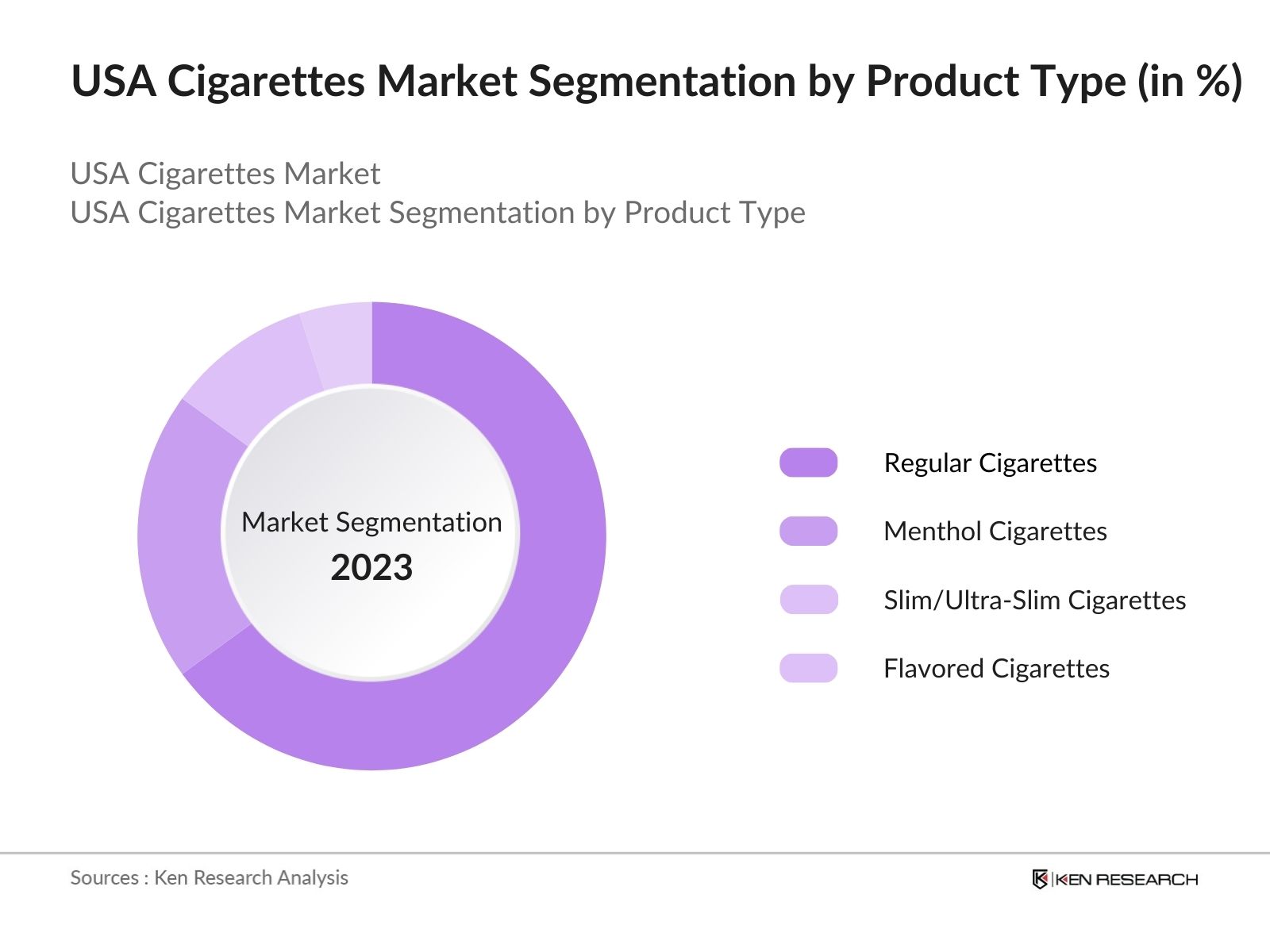

USA Cigarettes Market Segmentation

By Product Type: The market is segmented by product type into regular cigarettes, menthol cigarettes, slim/ultra-slim cigarettes, and flavored cigarettes. Among these, regular cigarettes hold a dominant market share, as they cater to a broad spectrum of smokers who prefer traditional cigarette options. Despite increasing health concerns, many smokers continue to favor regular cigarettes due to their established presence and consistent availability in retail stores across the country.

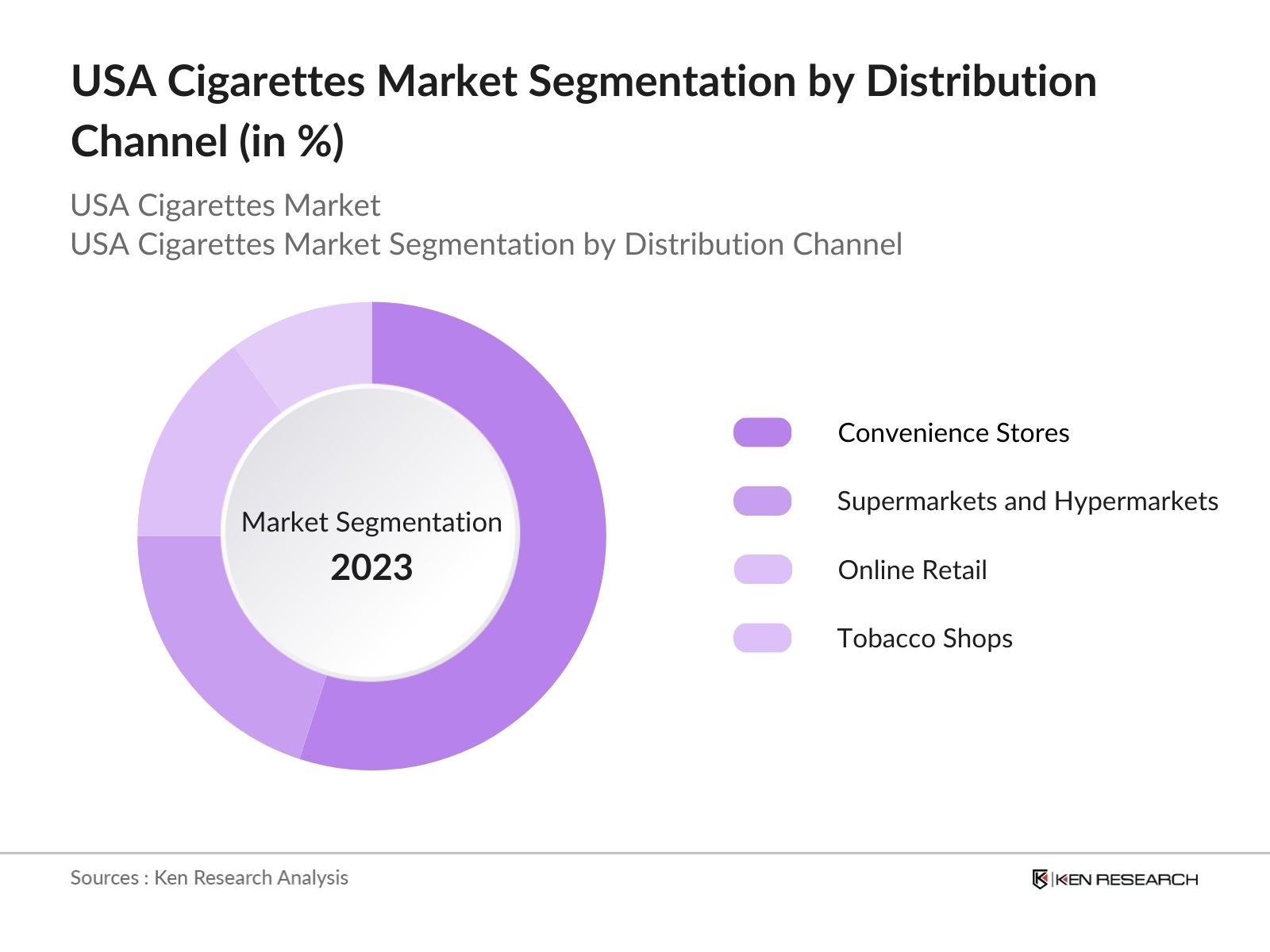

By Distribution Channel: The market is also segmented by distribution channels, including convenience stores, supermarkets and hypermarkets, online retail, and tobacco shops. Convenience stores lead the market due to their widespread availability and the convenience they offer to consumers. These stores, often located at gas stations and in urban areas, make cigarette purchasing quick and accessible for everyday smokers.

USA Cigarettes Market Competitive Landscape

The market is dominated by a few key players, each leveraging strong brand loyalty, diverse product portfolios, and widespread distribution networks. Philip Morris USA and Altria Group lead the market, focusing on premium cigarette brands and continuous product innovation.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Product Portfolio |

Revenue (2023, USD bn) |

Brand Reach |

Product Innovation |

Distribution Network |

Market Strategy |

|

Philip Morris USA |

1847 |

Richmond, Virginia |

|||||||

|

Altria Group |

1919 |

Richmond, Virginia |

|||||||

|

British American Tobacco |

1902 |

London, United Kingdom |

|||||||

|

Reynolds American Inc. |

1875 |

Winston-Salem, N.C. |

|||||||

|

ITG Brands |

2015 |

Greensboro, N.C. |

USA Cigarettes Market Analysis

Market Growth Drivers

- Increasing Prevalence of Smoking Among Certain Demographics: Despite global smoking reduction efforts, smoking rates in certain segments of the U.S. population, such as low-income and marginalized groups, remain high. According to recent data from the Centers for Disease Control and Prevention (CDC), approximately 30 million adults in the United States currently smoke cigarettes.

- Rising Demand for Premium and Niche Cigarette Brands: In the U.S., there is growing demand for premium cigarette brands and niche products like menthol and specialty cigarettes. In 2024, premium cigarette brands are expected to cater to around 15% of total smokers, especially in urban and affluent segments.

- Influence of Cultural and Social Factors in Certain Regions: Cigarette smoking remains culturally in certain regions of the U.S., particularly in the southern states. As of 2024, more than 20% of adults in states like Kentucky and West Virginia are regular smokers. This concentration of smokers in certain regions helps sustain cigarette sales in specific areas of the country, providing stability to the overall market.

Market Challenges

- Public Health Campaigns Against Smoking: Continuous public health campaigns promoting smoking cessation have led to a steady reduction in smoking rates. For instance, in 2024, the adult smoking rate dropped to approximately 14%, compared to 15.5% in 2022, according to national health data. These campaigns, which are driven by both federal and state governments, are decreasing the overall number of smokers, which is directly impacting cigarette sales.

- Shift Toward Healthier Alternatives and Nicotine Products: The increasing popularity of alternative nicotine products, such as e-cigarettes and nicotine pouches, is diverting consumers away from traditional cigarettes. As of 2024, more than 12 million American adults are estimated to use e-cigarettes. This shift in consumer preference poses a long-term challenge to the cigarette market.

USA Cigarettes Market Future Outlook

Over the next five years, the USA cigarettes industry is expected to undergo modest changes, with a shift toward reduced-risk products like e-cigarettes and heated tobacco.

Future Market Opportunities

- Increased Focus on Sustainable Packaging: As environmental concerns become more pronounced, the cigarette industry will see a shift toward sustainable packaging solutions. By 2029, leading cigarette manufacturers will likely adopt biodegradable or recyclable materials for all packaging, reducing their environmental footprint and catering to environmentally-conscious consumers.

- Expansion of Legal Restrictions on Smoking: Over the next five years, the U.S. government is expected to impose additional restrictions on cigarette sales and smoking in public areas. These measures are anticipated to further reduce the number of smoking-friendly environments, with legislation likely extending to outdoor public spaces in major cities by 2027. This will put additional pressure on cigarette manufacturers to innovate and adapt to a shrinking market.

Scope of the Report

|

By Product Type |

Regular Menthol Slim/Ultra-slim Flavored Others |

|

By Distribution Channel |

Convenience Stores Supermarkets/Hypermarkets Online Retail Tobacco Shops |

|

By Region |

North East South West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Cigarette Manufacturers

Tobacco Product Distributors

Retailers and Supermarkets

Banks and Financial Institution

Private Equity Firms

Government and Regulatory Bodies (FDA, CDC)

Investor and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Philip Morris USA

Altria Group

British American Tobacco

Reynolds American Inc.

ITG Brands

Liggett Vector Brands LLC

Japan Tobacco International

Vuse (BAT)

Marlboro

Sobraine

Table of Contents

1. USA Cigarettes Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Cigarettes Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Cigarettes Market Analysis

3.1. Growth Drivers

3.1.1. Introduction of Flavored Products

3.1.2. Consumer Shift Toward Premium Cigarettes

3.1.3. Low Tobacco Taxation in Select States

3.1.4. Increasing Online Sales Channel Penetration

3.2. Market Challenges

3.2.1. Regulatory Restrictions (Menthol Ban Proposal)

3.2.2. Health Awareness Campaigns

3.2.3. Declining Smoking Prevalence

3.2.4. Competition from Next-Generation Products (Vaping, E-cigarettes)

3.3. Opportunities

3.3.1. Growth in Reduced-risk Tobacco Products

3.3.2. Expansion in Emerging Tobacco Sub-categories

3.3.3. Development of Lower-priced Cigarette Brands

3.3.4. Investments in Digital and Targeted Marketing

3.4. Trends

3.4.1. Rise of Menthol and Slim Cigarettes

3.4.2. Impact of Social Media on Smoking Culture

3.4.3. Diversification into Heated Tobacco Products

3.4.4. Increased Focus on Ethical Sourcing of Tobacco

3.5. Government Regulation

3.5.1. Federal Cigarette Excise Tax and Its Implications

3.5.2. State-Level Smoking Regulations

3.5.3. Anti-smoking Campaigns and Legislation

3.5.4. Packaging and Advertising Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. USA Cigarettes Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Regular Cigarettes

4.1.2. Menthol Cigarettes

4.1.3. Slim/Ultra-Slim Cigarettes

4.1.4. Others (Clove, Flavored)

4.2. By Distribution Channel (In Value %)

4.2.1. Convenience Stores

4.2.2. Supermarkets and Hypermarkets

4.2.3. Online Retail

4.2.4. Tobacco Shops

4.3. By Region (In Value %)

4.3.1. North

4.3.2. East

4.3.3. South

4.3.4. West

5. USA Cigarettes Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Altria Group

5.1.2. Philip Morris USA

5.1.3. British American Tobacco

5.1.4. Reynolds American Inc.

5.1.5. ITG Brands

5.1.6. Japan Tobacco International (JTI)

5.1.7. Liggett Vector Brands LLC

5.1.8. Imperial Brands

5.1.9. Vuse (BAT)

5.1.10. Marlboro

5.1.11. Sobraine

5.1.12. Camel (Reynolds)

5.1.13. Newport

5.1.14. Natural American Spirit

5.1.15. Winston

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Brand Presence, Product Innovation, Market Strategy, Pricing Approach)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Cigarettes Market Regulatory Framework

6.1. FDA Regulations on Cigarette Products

6.2. PACT Act and Online Sales Restrictions

6.3. Cigarette Packaging Requirements

6.4. Compliance and Penalties

7. USA Cigarettes Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Cigarettes Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Region (In Value %)

9. USA Cigarettes Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Entry Strategy for New Players

9.3. Marketing Initiatives and Consumer Engagement

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying major variables impacting the USA cigarettes market, including industry regulations, consumer preferences, and distribution dynamics. This data is collected through extensive desk research using industry databases and government reports to construct a comprehensive market map.

Step 2: Market Analysis and Construction

Historical data on cigarette consumption, production, and retail sales are analyzed to determine market trends. This step includes evaluating consumer behaviors, sales growth, and the influence of taxation policies on cigarette pricing and distribution.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market assumptions, consultations with industry experts, including cigarette manufacturers and distributors, are conducted. These consultations provide insights into operational challenges, regulatory impacts, and emerging market opportunities.

Step 4: Research Synthesis and Final Output

Finally, the data is synthesized and verified through primary research with leading market participants. This ensures the accuracy and comprehensiveness of the final report, offering a clear picture of the current and future state of the USA cigarettes market.

Frequently Asked Questions

01. How big is the USA Cigarettes Market?

The USA cigarettes market is valued at USD 87 billion, driven by consistent demand for premium and flavored cigarettes, alongside the growing popularity of e-cigarettes.

02. What are the challenges in the USA Cigarettes Market?

Challenges in the USA cigarettes market include increasing government regulations, public health awareness, and competition from reduced-risk tobacco products like e-cigarettes. Additionally, the impending menthol cigarette ban could impact consumer choices.

03. Who are the major players in the USA Cigarettes Market?

Key players in the USA cigarettes market include Philip Morris USA, Altria Group, British American Tobacco, Reynolds American Inc., and ITG Brands. These companies dominate the market due to their well-established brands and extensive distribution networks.

04. What are the growth drivers of the USA Cigarettes Market?

Growth in the USA cigarettes market is primarily driven by product innovation, such as new flavors, and the development of reduced-risk products like heated tobacco and e-cigarettes. Additionally, online retail channels are expanding, offering more convenient purchasing options for consumers.

05. What impact will regulations have on the USA Cigarettes Market?

The ongoing regulatory landscape, including proposed bans on menthol cigarettes and increased excise taxes, is likely to reshape consumer preferences and push the market toward alternative tobacco products in the coming years.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.