USA Clinical Trial Management System (CTMS) Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD8052

December 2024

83

About the Report

USA Clinical Trial Management System (CTMS) Market Overview

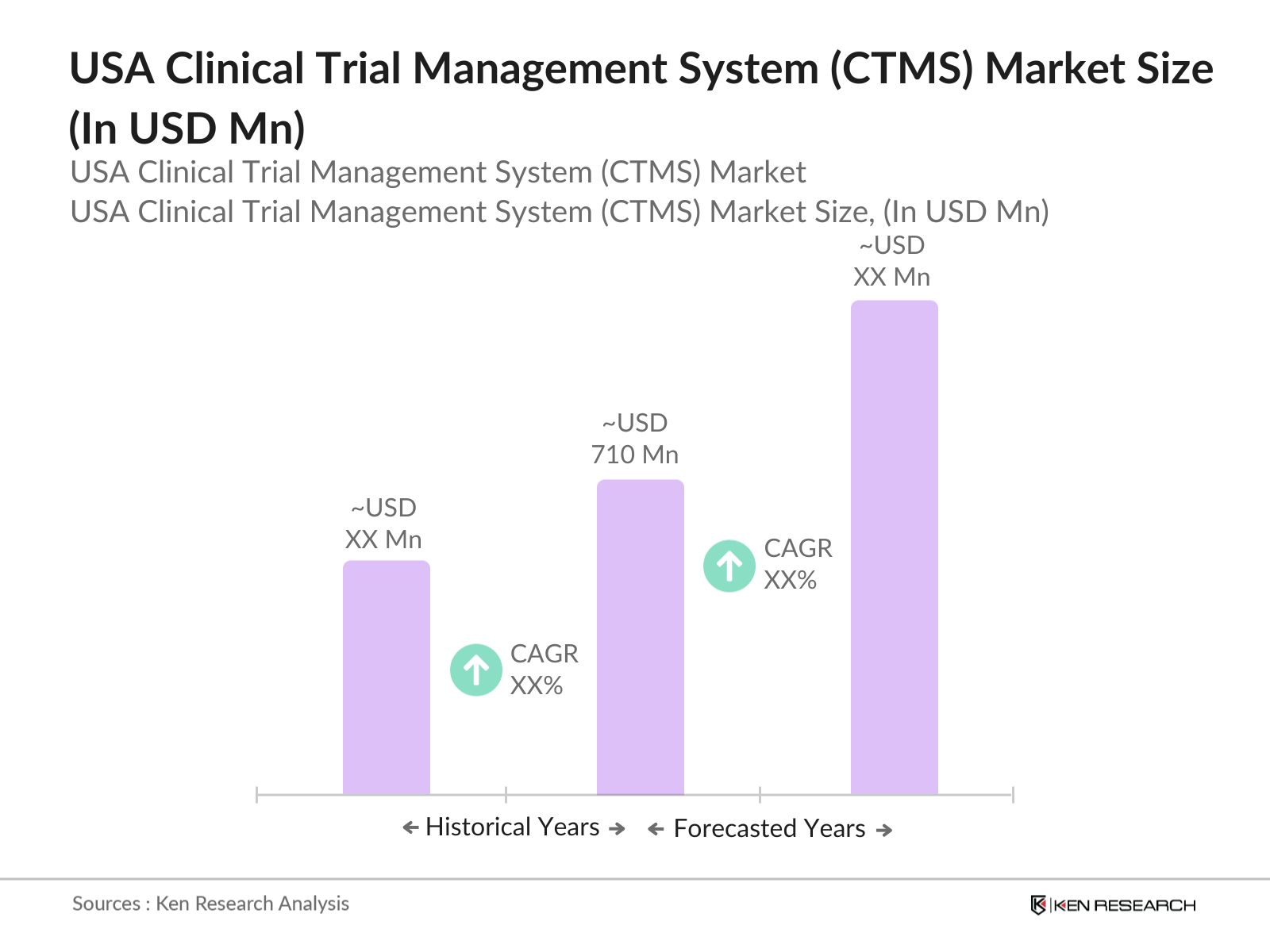

- The USA Clinical Trial Management System market is valued at USD 710 million, based on a five-year historical analysis. This growth is primarily driven by the pharmaceutical and biotechnology industries rising investment in drug development and clinical trials. Key advancements in digital tools, such as e-clinical solutions, are also contributing to the expanding market size. Additionally, strict regulatory standards demand robust data management and reporting in clinical trials, further increasing the demand for CTMS solutions in the U.S.

- New York, California, and Massachusetts dominate the CTMS market, largely due to the concentration of pharmaceutical companies, biotechnology firms, and research institutions in these regions. These states are also leading in healthcare innovation and R&D activities, making them prime locations for clinical trials and boosting the need for efficient management systems like CTMS. High levels of funding and venture capital support further amplify the market strength in these states.

- The FDA plays a pivotal role in shaping the regulatory environment for CTMS, setting stringent guidelines to ensure patient safety and data integrity. In 2023, the FDA updated its electronic records compliance requirements, directly impacting CTMS features like audit trails and data verification. Approximately 3,500 clinical trials in the USA had to upgrade their systems to meet these updated standards, reflecting the regulatory influence on CTMS adoption

USA Clinical Trial Management System (CTMS) Market Segmentation

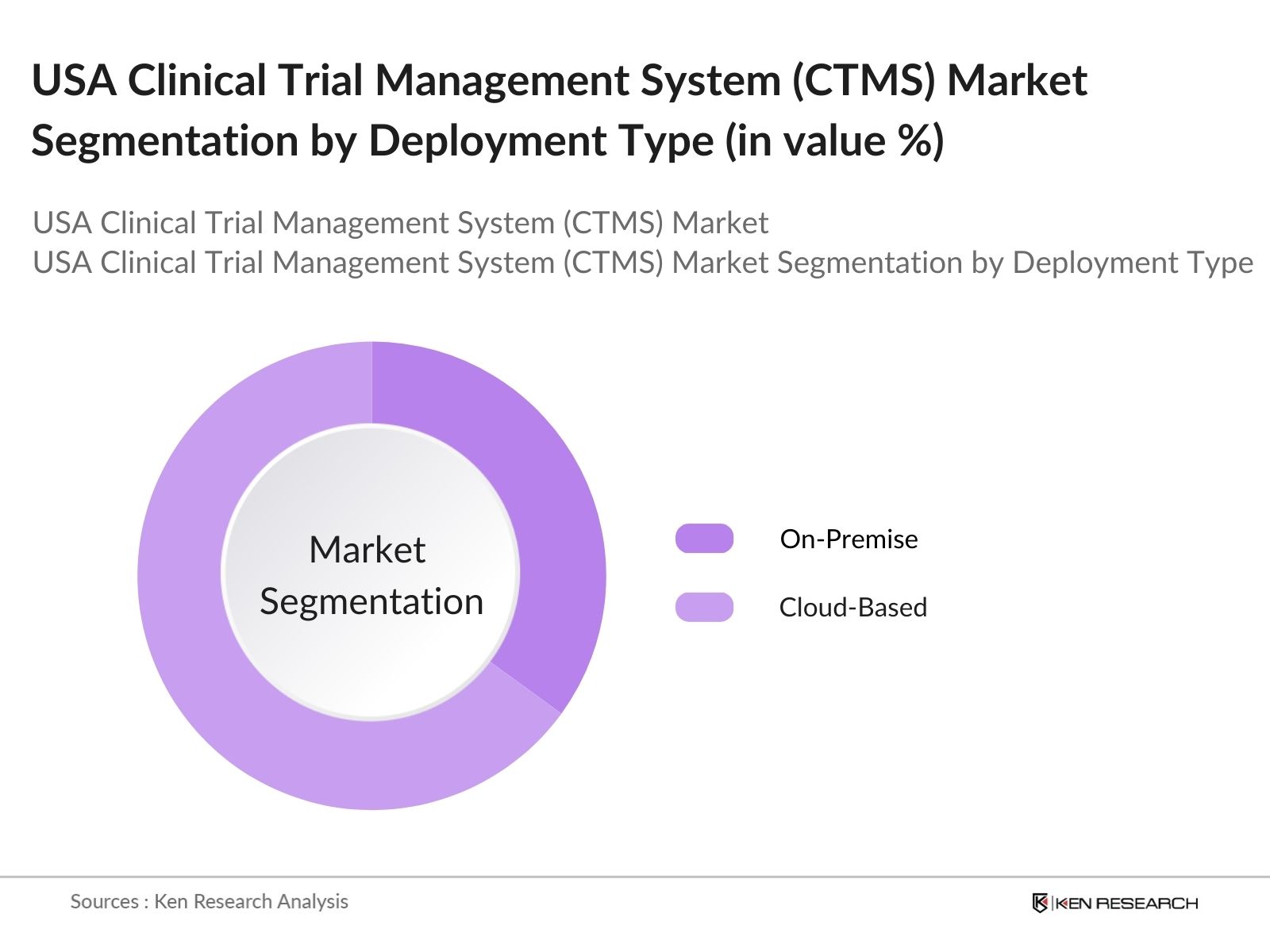

By Deployment Type: The USA Clinical Trial Management System market is segmented by deployment type into On-Premise and Cloud-Based solutions. Recently, cloud-based solutions hold a dominant market share within this segmentation, largely due to their flexibility, scalability, and lower upfront costs. Cloud-based CTMS allows real-time data access and collaboration among geographically dispersed teams, making it a preferred choice for CROs and multinational pharmaceutical companies conducting global trials.

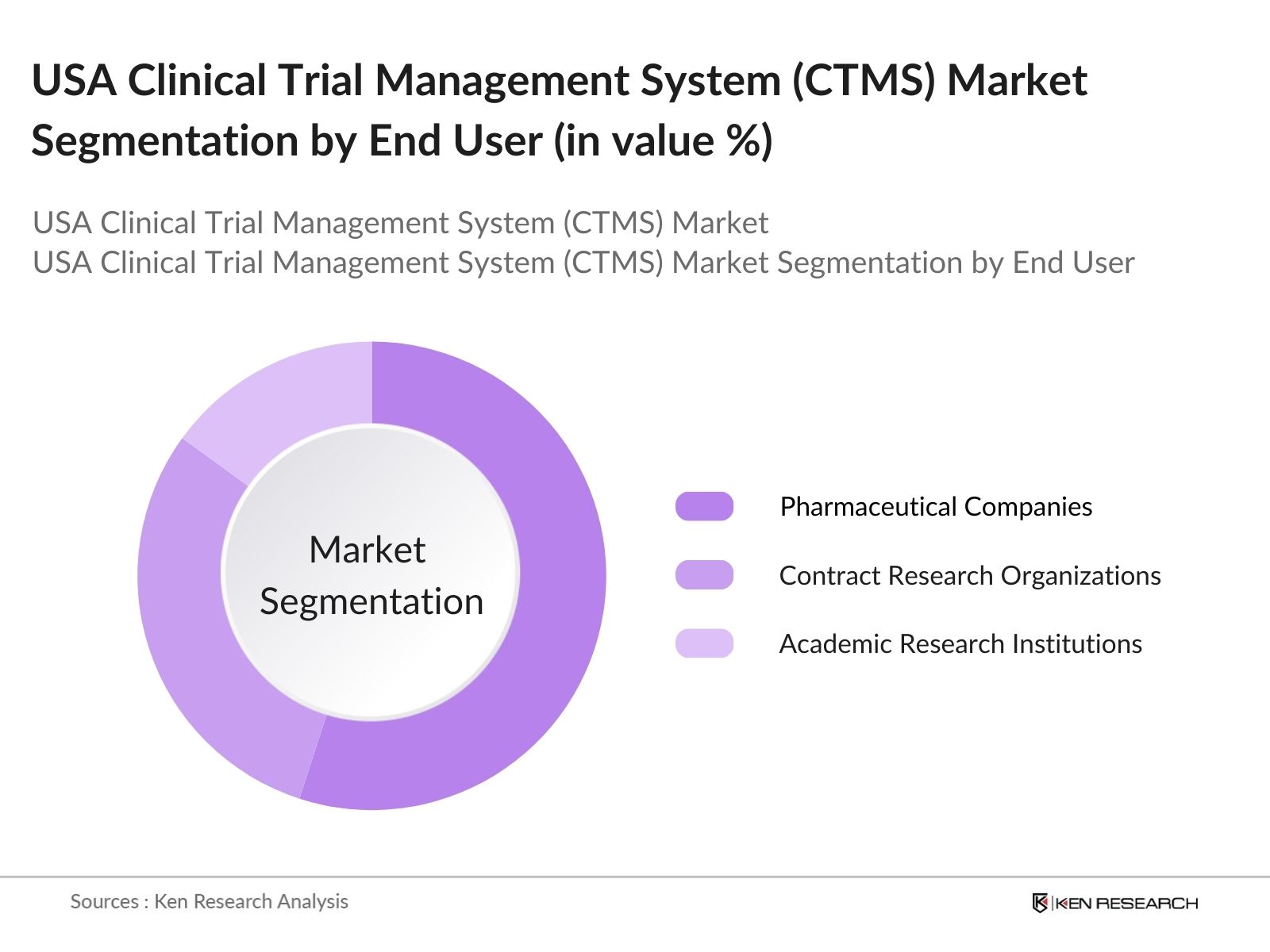

By End User: The CTMS market in the USA is further segmented by end user, including Pharmaceutical Companies, Contract Research Organizations (CROs), and Academic Research Institutions. Pharmaceutical companies dominate this segment due to their extensive requirement for managing high volumes of clinical data, ensuring regulatory compliance, and streamlining the overall clinical trial process. Their significant investment in R&D and the need for efficient systems for multi-phase trials add to their market leadership.

USA Clinical Trial Management System (CTMS) Market Competitive Landscape

The USA CTMS market is dominated by major players that offer advanced solutions catering to diverse trial management needs, with companies like Oracle Corporation and Medidata Solutions at the forefront due to their robust portfolios and customer reach. This consolidation underscores the influence these key companies have on innovation and standardization within the industry.

|

Company |

Establishment Year |

Headquarters |

Number of Employees |

Revenue (USD Million) |

R&D Investments |

Customer Base |

Key Partnerships |

Digital Capabilities |

Market Presence |

|

Medidata Solutions |

1999 |

New York, USA |

|||||||

|

Oracle Corporation |

1977 |

Austin, Texas, USA |

|||||||

|

Veeva Systems Inc. |

2007 |

California, USA |

|||||||

|

Bio-Optronics, Inc. |

1985 |

New York, USA |

|||||||

|

Parexel International Corp. |

1982 |

Massachusetts, USA |

USA Clinical Trial Management System (CTMS) Industry Analysis

Growth Drivers

- Rise in Clinical Trials: The rise in clinical trials is a key growth driver in the USA Clinical Trial Management System (CTMS) market. In 2024, over 450,000 clinical trials were actively registered in the USA, marking a significant increase in the volume of trials, especially for emerging treatments in oncology and gene therapy. The National Institutes of Health (NIH) reported heightened activity in states like California, Massachusetts, and Texas, which combined host around 40% of these trials. This increase places strong demand on efficient CTMS solutions to manage trial logistics, patient data, and compliance requirements.

- Adoption of E-Clinical Solutions: The adoption of e-clinical solutions is accelerating in response to the need for streamlined, digital trial management. According to data from the Department of Health and Human Services (HHS), 35% of pharmaceutical trials in 2023 incorporated e-clinical solutions, allowing for faster data collection and real-time updates on trial statuses. This digital shift also reduced manual errors by over 50%, enhancing data accuracy and compliance tracking.

- Regulatory Compliance Requirements: Regulatory requirements, such as those mandated by the FDA, drive the CTMS market by necessitating robust compliance and data management systems. In 2024, the FDA issued over 3,000 compliance notifications, underlining the critical need for systems that ensure adherence to evolving regulatory standards. Companies using CTMS software saw a 30% improvement in compliance reporting accuracy, highlighting the software's role in streamlining regulatory adherence.

Market Challenges

- High Implementation Costs: The high cost of CTMS implementation remains a barrier for many organizations. A survey by the Centers for Medicare & Medicaid Services (CMS) found that initial setup and integration costs for CTMS software range from $300,000 to $500,000, making it a costly investment for small and mid-sized firms. This financial hurdle can limit adoption, particularly among clinical research organizations (CROs) and smaller pharmaceutical companies that may struggle to allocate sufficient funds.

- Integration with Legacy System: Legacy system integration is a major challenge in CTMS deployment, as many organizations continue to rely on older data management systems. The Department of Health reported that around 60% of healthcare providers in the USA still use legacy systems incompatible with modern CTMS solutions, resulting in increased operational complexity and a 40% rise in data management inefficiencies. This integration challenge underscores the importance of compatibility in software selection.

USA Clinical Trial Management System (CTMS) Market Future Outlook

Over the next five years, the USA Clinical Trial Management System market is projected to witness significant growth. This growth will be fueled by increasing demand for data-driven insights, the adoption of cloud-based CTMS platforms, and continued advancements in artificial intelligence and machine learning that optimize clinical trial workflows. Additionally, regulatory requirements will continue to push for transparency and efficiency in trial management, supporting ongoing market expansion.

Future Market Opportunities

- Cloud-Based CTMS Solutions: Cloud-based CTMS solutions offer significant opportunities due to their scalability and cost-effectiveness. In 2023, approximately 40% of clinical trial management systems in the USA were cloud-based, driven by the flexibility they provide for remote trial management and data access. Cloud solutions reduce physical infrastructure needs, lowering operational costs by nearly 20% compared to on-premise systems, making them particularly attractive for decentralized trials.

- Increasing Outsourcing of Clinical Trials: The increasing trend of outsourcing clinical trials presents growth potential for the CTMS market, as outsourcing to CROs drives demand for specialized management systems. According to the Association of Clinical Research Organizations (ACRO), approximately 70% of phase II and III trials in 2024 were outsourced, underscoring the need for advanced CTMS to ensure seamless communication, data sharing, and compliance oversight between sponsors and CROs.

Scope of the Report

|

Deployment Type |

On-Premise |

|

Delivery Mode |

Licensed Enterprise (On-Site) |

|

End User |

Pharmaceutical Companies |

|

Product Type |

Software |

|

Phase |

Phase I |

Products

Key Target Audience

Pharmaceutical Companies

Contract Research Organizations (CROs)

Academic Research Institutions

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, NIH)

Healthcare Technology Providers

Biotechnology Firms

Clinical Research Laboratories

Companies

Major Players

Medidata Solutions

Oracle Corporation

Veeva Systems Inc.

Bio-Optronics, Inc.

Parexel International Corporation

IBM Watson Health

Medrio Inc.

Forte Research Systems, Inc.

ArisGlobal LLC

CRF Health

Bioclinica

Dassault Systmes

MasterControl Inc.

Clintrax Global

RealTime Software Solutions, LLC

Table of Contents

1. USA Clinical Trial Management System Market Overview

- 1.1. Definition and Scope

- 1.2. Market Taxonomy

- 1.3. Market Growth Rate Analysis

- 1.4. Segmentation Overview

- 1.5. Market Demand Analysis (Therapeutic Area Demand, Study Phase Distribution, User Type)

2. USA Clinical Trial Management System Market Size (In USD Million)

- 2.1. Historical Market Size

- 2.2. Year-on-Year Growth Analysis

- 2.3. Market Dynamics and Milestones

3. USA Clinical Trial Management System Market Analysis

- 3.1. Growth Drivers

- 3.1.1. Rise in Clinical Trials

- 3.1.2. Adoption of E-Clinical Solutions

- 3.1.3. Regulatory Compliance Requirements

- 3.1.4. Increased R&D Investments in Pharmaceuticals

- 3.2. Market Challenges

- 3.2.1. High Implementation Costs

- 3.2.2. Integration with Legacy Systems

- 3.2.3. Data Security and Compliance Challenges

- 3.3. Opportunities

- 3.3.1. Cloud-Based CTMS Solutions

- 3.3.2. Increasing Outsourcing of Clinical Trials

- 3.3.3. Expansion in Emerging Markets

- 3.4. Trends

- 3.4.1. Adoption of AI and Machine Learning in CTMS

- 3.4.2. Decentralized Trials Management

- 3.4.3. Integration with Data Analytics Tools

- 3.5. Regulatory Environment

- 3.5.1. FDA Regulations on CTMS

- 3.5.2. GCP (Good Clinical Practice) Compliance

- 3.5.3. Privacy and Security Standards (HIPAA, GDPR)

- 3.6. SWOT Analysis

- 3.7. Stakeholder Ecosystem Analysis

- 3.8. Porters Five Forces Analysis

- 3.9. Competitive Landscape Ecosystem

4. USA Clinical Trial Management System Market Segmentation

- 4.1. By Deployment Type (In Value %)

- 4.1.1. On-Premise

- 4.1.2. Cloud-Based

- 4.2. By Delivery Mode (In Value %)

- 4.2.1. Licensed Enterprise (On-Site)

- 4.2.2. Web-Based (Hosted)

- 4.3. By End User (In Value %)

- 4.3.1. Pharmaceutical Companies

- 4.3.2. Contract Research Organizations (CROs)

- 4.3.3. Academic Research Institutions

- 4.4. By Product Type (In Value %)

- 4.4.1. Software

- 4.4.2. Services

- 4.5. By Phase (In Value %)

- 4.5.1. Phase I

- 4.5.2. Phase II

- 4.5.3. Phase III

- 4.5.4. Phase IV

5. USA Clinical Trial Management System Market Competitive Analysis

- 5.1. Detailed Profiles of Major Companies

- 5.1.1. Medidata Solutions

- 5.1.2. Oracle Corporation

- 5.1.3. Parexel International Corporation

- 5.1.4. Bio-Optronics, Inc.

- 5.1.5. Veeva Systems Inc.

- 5.1.6. IBM Watson Health

- 5.1.7. Medrio Inc.

- 5.1.8. Forte Research Systems, Inc.

- 5.1.9. ArisGlobal LLC

- 5.1.10. CRF Health

- 5.1.11. Bioclinica

- 5.1.12. Dassault Systmes

- 5.1.13. MasterControl Inc.

- 5.1.14. Clintrax Global

- 5.1.15. RealTime Software Solutions, LLC

- 5.2. Cross Comparison Parameters (Number of Employees, Revenue, Headquarters, R&D Investments, Technological Capability, Market Presence, Customer Base, Strategic Partnerships)

- 5.3. Market Share Analysis

- 5.4. Strategic Initiatives

- 5.5. Mergers & Acquisitions

- 5.6. Investment and Funding Analysis

- 5.7. Government Funding and Grants

- 5.8. Private Equity and Venture Capital Investments

6. USA Clinical Trial Management System Regulatory Framework

- 6.1. FDA Guidelines and Regulations

- 6.2. Data Privacy Standards and Compliance (HIPAA, GDPR)

- 6.3. Clinical Trial Reporting Requirements

- 6.4. Certification Standards (ISO for Clinical Research)

7. USA Clinical Trial Management System Future Market Size (In USD Million)

- 7.1. Projected Market Growth Analysis

- 7.2. Key Drivers of Future Market Growth

8. USA Clinical Trial Management System Future Market Segmentation

- 8.1. By Deployment Type (In Value %)

- 8.2. By Delivery Mode (In Value %)

- 8.3. By End User (In Value %)

- 8.4. By Product Type (In Value %)

- 8.5. By Phase (In Value %)

9. USA Clinical Trial Management System Market Analysts Recommendations

- 9.1. TAM/SAM/SOM Analysis

- 9.2. Customer Segmentation and Behavior Analysis

- 9.3. Market Entry and Expansion Strategies

- 9.4. Identification of Untapped Opportunities and White Space Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the ecosystem of the USA Clinical Trial Management System market, capturing key variables like deployment models, target end-users, and regulatory factors. Initial data gathering leverages proprietary databases and secondary research.

Step 2: Market Analysis and Construction

Historical data analysis is conducted, focusing on CTMS deployment, industry adoption rates, and revenue trends. Key quality indicators in clinical trial performance are assessed to ensure robust market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Using hypothesis-driven research, consultations with industry experts across pharmaceuticals, CROs, and research institutions validate data and capture nuanced insights into CTMS functionalities and adoption challenges.

Step 4: Research Synthesis and Final Output

The final analysis phase involves direct engagement with CTMS solution providers to refine insights and validate the results, ensuring an accurate, comprehensive view of the USA CTMS market.

Frequently Asked Questions

01 How big is the USA Clinical Trial Management System market?

The USA Clinical Trial Management System market is valued at USD 710 million, driven by increasing clinical trial activities and regulatory demands for data transparency.

02 What are the challenges in the USA Clinical Trial Management System market?

Challenges in the USA Clinical Trial Management System market include high implementation costs, complex integration with legacy systems, and data security concerns, particularly around regulatory compliance with HIPAA and GDPR.

03 Who are the major players in the USA Clinical Trial Management System market?

Key players in the USA Clinical Trial Management System market include Medidata Solutions, Oracle Corporation, Veeva Systems Inc., Parexel International Corporation, and Bio-Optronics, each with a significant market presence due to their comprehensive CTMS offerings.

04 What are the growth drivers of the USA Clinical Trial Management System market?

The USA Clinical Trial Management System market is driven by rising R&D investments in drug development, regulatory requirements for compliance, and a growing preference for cloud-based CTMS solutions.

05 Which deployment type is preferred in the USA Clinical Trial Management System market?

Cloud-based solutions lead in adoption due to their scalability, cost-effectiveness, and suitability for decentralized trial operations across multiple locations in the USA Clinical Trial Management System market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.