USA Coffee Market Outlook to 2030

Region:North America

Author(s):Shambhavi

Product Code:KROD4633

December 2024

98

About the Report

USA Coffee Market Overview

- The USA coffee market is valued at USD 95 billion, driven by increasing consumer demand for specialty coffee and a growing culture of coffee consumption in urban areas. This growth is supported by a shift towards higher-quality, sustainably sourced products, as well as innovations in brewing technology. The rising trend of at-home brewing solutions due to pandemic-related changes has also contributed to this markets expansion. The market's expansion is also linked to the increasing availability of coffee machines and pods, catering to time-constrained consumers who desire convenience alongside quality.

- The USA market is dominated by major urban centers like New York, Los Angeles, and Seattle. These cities are home to some of the largest coffee chains and a high concentration of specialty coffee shops. Seattle, in particular, is a coffee hub due to its historical ties with Starbucks and the overall coffee culture it has cultivated. These cities' dominance stems from their dense populations, diverse consumer bases, and thriving coffeehouse cultures, fostering both domestic and international brands' growth.

- The U.S. coffee market is tightly regulated, with the Food and Drug Administration (FDA) enforcing stringent compliance standards on imported coffee. In 2023, the FDA reported inspecting over 90,000 shipments of imported coffee to ensure they met U.S. safety and quality standards. These regulations are crucial for maintaining product safety and consumer trust, as over 70% of coffee consumed in the U.S. is imported

USA Coffee Market Segmentation

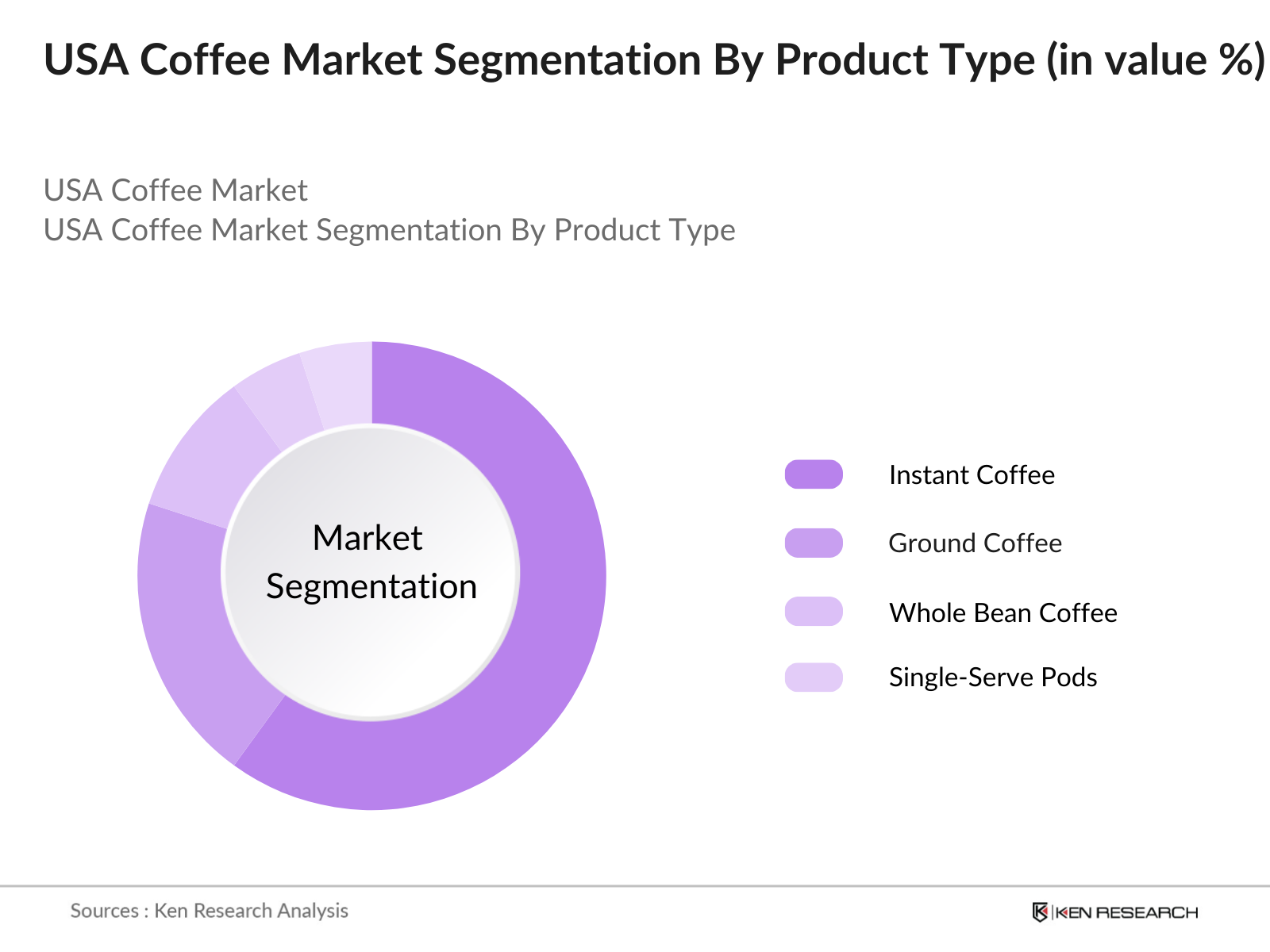

By Product Type: The USA coffee market is segmented by product type into instant coffee, ground coffee, whole bean coffee, and single-serve pods. Recently, ground coffee has dominated the product type segment in the USA due to its versatility and appeal to both traditional and modern consumers. Ground coffee strikes a balance between quality and convenience, making it a staple in households and coffee shops alike. The resurgence of drip coffee makers and the increasing use of French press methods contribute to this segments stronghold in the market.

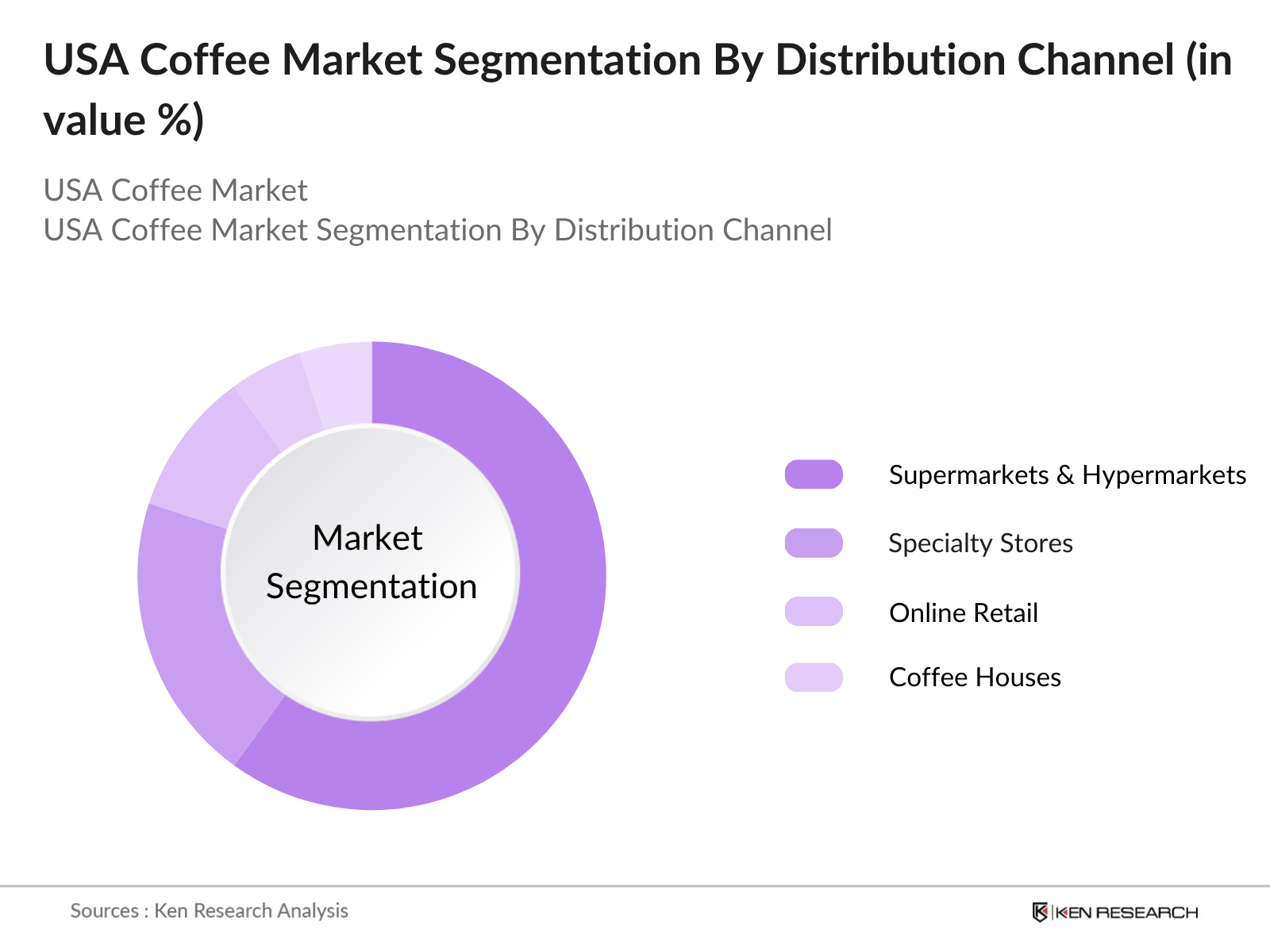

By Distribution Channel: The USA coffee market is segmented by distribution channels into supermarkets & hypermarkets, specialty stores, online retail, and coffee houses. Supermarkets and hypermarkets dominate the distribution channel as they offer a wide variety of coffee products at competitive prices, catering to consumers' demand for both premium and budget options. The convenience of one-stop shopping and the inclusion of both national and private-label brands help this segment maintain its dominance in the market.

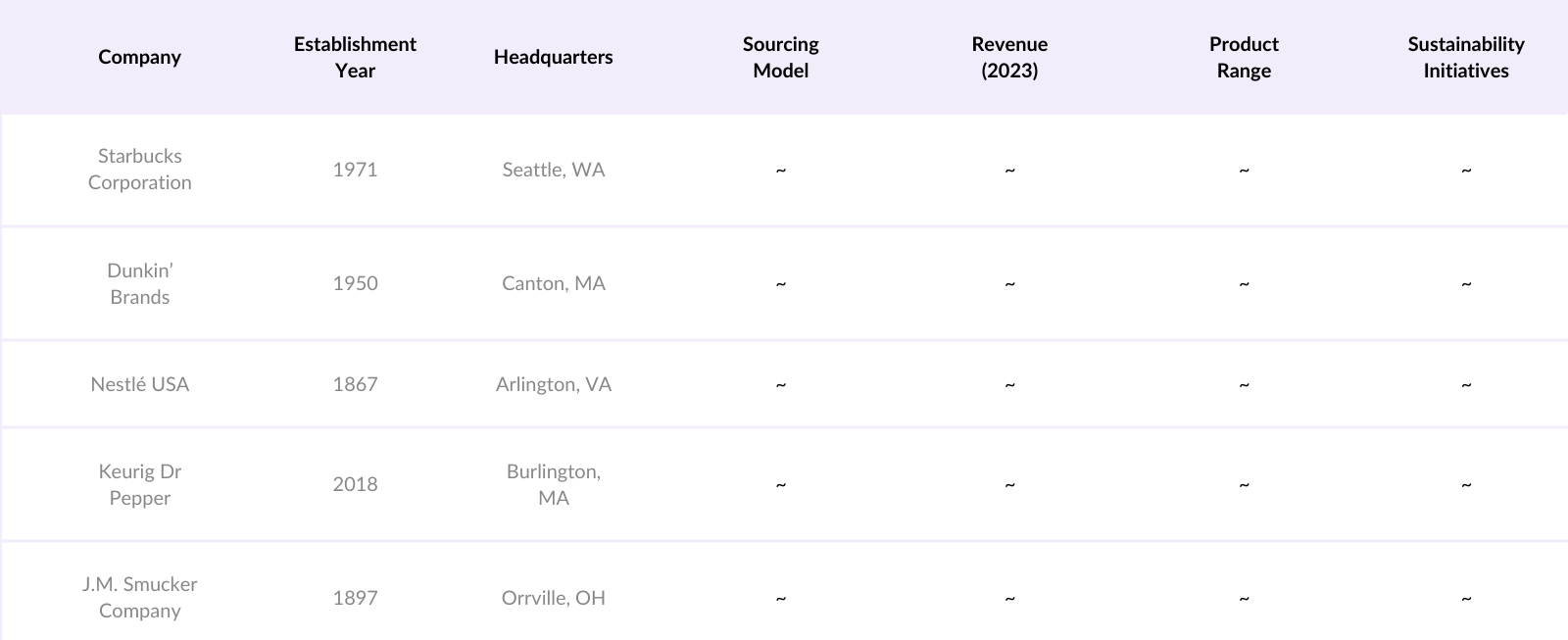

USA Coffee Market Competitive Landscape

The USA coffee market is dominated by a few key players that drive innovation and shape the industrys growth through their market strategies. These companies have established strong distribution networks and focus heavily on branding, sustainability initiatives, and expanding product portfolios. Market consolidation among these major players further underscores their influence within the market.

USA Coffee Market Analysis

Growth Drivers

- Rising Demand for Organic and Fair-Trade Coffee: The USAs coffee sector has seen a significant shift toward organic and fair-trade coffee due to increasing consumer awareness of sustainability and ethical sourcing. The USDA estimates that in 2024, coffee consumption in the U.S. is expected to maintain its high level of demand for organic products, driven by over 53 million U.S. households now prioritizing organic purchases in their weekly grocery lists. Additionally, the demand for ethically sourced coffee is driven by corporate commitments to fair-trade principles, particularly among companies that import large volumes of coffee. In 2023, over 2 million metric tons of fair-trade-certified coffee were sold globally, much of it to the U.S.

- Increasing Coffee Consumption in Younger Demographics: Young consumers, especially millennials and Generation Z, are at the forefront of coffee consumption trends in the U.S. According to the U.S. Census Bureau, nearly 72 million Americans in this demographic contribute to a surge in coffee culture and spending. Data from the National Coffee Association shows that more than 50% of Americans aged 18-34 consume specialty coffee daily. Furthermore, the growing number of students and young professionals in urban areas has fueled this rise, with coffee shops and on-the-go coffee solutions being highly popular among these groups.

- Growth in Coffee Shops and Specialty Cafes: The number of specialty coffee shops across the U.S. has been on the rise, contributing to the booming coffee culture. The U.S. Bureau of Labor Statistics reported that the number of coffee shop establishments reached over 37,000 in 2023, with a steady increase in job creation in this sector. Employment in cafes and coffeehouses saw a rise of over 2%, equating to over 800,000 jobs. This surge is largely driven by the demand for specialized, high-quality coffee, with cities like New York, Los Angeles, and Seattle leading in caf density

Market Challenges

- Volatility in Raw Coffee Bean Prices: The coffee market has faced significant volatility in raw coffee bean prices due to fluctuations in global production and supply chain issues. According to the U.S. Department of Agriculture (USDA), imports of coffee beans to the U.S. have been impacted by climate events and labor shortages in major coffee-producing countries like Brazil, resulting in unstable prices. In 2024, imports decreased by 4% compared to 2023. Additionally, currency fluctuations, particularly the depreciation of the Brazilian real, have exacerbated this price volatility.

- Climate Change Affecting Coffee Yield: The changing climate continues to pose a significant threat to coffee production globally, with the U.S. coffee market being highly dependent on imports from countries vulnerable to extreme weather conditions. Data from the U.S. Environmental Protection Agency (EPA) highlights that adverse weather conditions, including prolonged droughts in Brazil and flooding in Colombia, have reduced coffee yields by approximately 7% in 2023. This has directly impacted the U.S. supply chain, with reduced yields translating into higher import prices.

USA Coffee Market Future Outlook

The USA coffee market is expected to experience steady growth in the coming years, driven by increasing consumer preference for premium and specialty coffee products, the rise of sustainable coffee sourcing, and the expansion of direct-to-consumer platforms through e-commerce. The development of innovative brewing technologies, including cold brew systems and coffee machines, will continue to influence market dynamics. Companies focusing on sustainable production and ethical sourcing will likely see significant gains as consumers become more conscious of their purchasing decisions.

Market Opportunities

- Growth in Sustainable and Eco-Friendly Coffee Packaging: Sustainable and eco-friendly packaging has become a focal point for U.S. coffee companies in 2024. The Environmental Protection Agency (EPA) reports that the coffee industry generated over 4 million tons of packaging waste in 2023, prompting companies to adopt more sustainable packaging solutions. The shift toward biodegradable and compostable coffee packaging is evident, with over 12,000 coffee brands now transitioning to eco-friendly materials to meet consumer demand. This change is driven by both environmental concerns and regulatory pressure.

- Rise in Plant-Based Coffee Creamers: Plant-based coffee creamers are experiencing growing popularity, particularly in urban centers. Data from the U.S. Department of Agriculture reveals that plant-based milk alternatives, including almond, oat, and soy, now make up 30% of the creamer market in the U.S. In 2023, over 1.5 million gallons of plant-based creamers were sold nationwide, with an increasing number of consumers opting for these products due to dietary preferences and environmental concerns

Scope of the Report

|

By Product Type |

- Instant Coffee |

|

- Ground Coffee |

|

|

- Whole Bean Coffee |

|

|

- Single-Serve Pods |

|

|

By Distribution |

- Supermarkets & Hypermarkets |

|

Channel |

- Specialty Stores |

|

- Online Retail |

|

|

- Coffee Houses |

|

|

By Coffee Type |

- Arabica |

|

- Robusta |

|

|

- Blended Coffee |

|

|

By End-User |

- Household |

|

- Food Service |

|

|

- Office and Corporate |

|

|

By Region |

- Northeast |

|

- Midwest |

|

|

- West |

|

|

- South |

Products

Key Target Audience

Coffee Manufacturers

Coffee Shop Chains

E-commerce Retailers

Supermarket Chains

Coffee Equipment Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, US Department of Agriculture)

Sustainability Advocacy Groups

Companies

Players mentioned in the report

Starbucks Corporation

Dunkin Brands

Nestl USA

Keurig Dr Pepper

J.M. Smucker Company

Peet's Coffee & Tea

Lavazza Group

Caribou Coffee Company

Blue Bottle Coffee Inc.

Green Mountain Coffee Roasters

Eight O'Clock Coffee Company

Community Coffee Company

Death Wish Coffee Company

Intelligentsia Coffee Inc.

New England Coffee Company

Table of Contents

1. USA Coffee Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Coffee Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Coffee Market Analysis

3.1 Growth Drivers (Demand for Specialty Coffee, Increasing Health Consciousness, Rise of Coffee Culture)

3.1.1 Rising Demand for Organic and Fair-Trade Coffee

3.1.2 Increasing Coffee Consumption in Younger Demographics

3.1.3 Growth in Coffee Shops and Specialty Cafes

3.1.4 Preference for At-Home Brewing Solutions

3.2 Market Challenges (Supply Chain Disruptions, Fluctuating Coffee Prices, Sustainability Concerns)

3.2.1 Volatility in Raw Coffee Bean Prices

3.2.2 Climate Change Affecting Coffee Yield

3.2.3 Challenges with Certification Compliance

3.3 Opportunities (Expansion in Cold Brew and Ready-to-Drink Coffee, Innovations in Coffee Machines)

3.3.1 Growth in Sustainable and Eco-Friendly Coffee Packaging

3.3.2 Rise in Plant-Based Coffee Creamers

3.3.3 Market Penetration into E-Commerce Platforms

3.4 Trends (Direct Sourcing, Single-Origin Coffee, Traceability)

3.4.1 Increasing Popularity of Cold Brew Coffee

3.4.2 Growing Demand for Instant Coffee Innovations

3.4.3 Rise in Demand for Specialty Coffee Beans

3.5 Government Regulations (FDA Regulations on Coffee Import and Labeling, Sustainability Initiatives)

3.5.1 Coffee Import Compliance Standards

3.5.2 Fair Trade and Organic Certifications

3.5.3 Environmental Regulations on Coffee Production

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. USA Coffee Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Instant Coffee

4.1.2 Ground Coffee

4.1.3 Whole Bean Coffee

4.1.4 Single-Serve Pods

4.2 By Distribution Channel (In Value %)

4.2.1 Supermarkets & Hypermarkets

4.2.2 Specialty Stores

4.2.3 Online Retail

4.2.4 Coffee Houses

4.3 By Coffee Type (In Value %)

4.3.1 Arabica

4.3.2 Robusta

4.3.3 Blended Coffee

4.4 By End-User (In Value %)

4.4.1 Household

4.4.2 Food Service

4.4.3 Office and Corporate

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 West

4.5.4 South

5. USA Coffee Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Starbucks Corporation

5.1.2 Dunkin Brands

5.1.3 Nestl USA

5.1.4 Keurig Dr Pepper Inc.

5.1.5 Peet's Coffee & Tea

5.1.6 J.M. Smucker Company

5.1.7 Kraft Heinz Company

5.1.8 Lavazza Group

5.1.9 Caribou Coffee Company

5.1.10 Blue Bottle Coffee Inc.

5.1.11 Green Mountain Coffee Roasters

5.1.12 Eight O'Clock Coffee Company

5.1.13 Community Coffee Company

5.1.14 Death Wish Coffee Company

5.1.15 Intelligentsia Coffee Inc.

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Sourcing Model, Product Range, Organic Certification, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Coffee Market Regulatory Framework

6.1 FDA Regulations

6.2 Compliance Requirements for Importers

6.3 Coffee Certifications (Organic, Fair Trade)

7. USA Coffee Market Analysts Recommendations

7.1 TAM/SAM/SOM Analysis

7.2 Marketing Initiatives

7.3 White Space Opportunity Analysis

7.4 Consumer Cohort Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involved creating a detailed ecosystem map to identify major stakeholders within the USA coffee market, including manufacturers, distributors, and retailers. Through extensive desk research, key variables such as market trends, consumer behavior, and regulatory frameworks were defined to shape the market dynamics.

Step 2: Market Analysis and Construction

The second step focused on gathering and analyzing historical data on market performance. This analysis involved evaluating the markets penetration rate, consumer preferences for different coffee types, and the influence of market players on revenue generation. The focus was on understanding shifts in product demand over time.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, consultations were conducted with industry professionals through CATIS interviews, providing first-hand insights into market challenges, operational strategies, and financial trends. This helped refine and confirm key market insights and forecasts.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the data and insights gained from primary and secondary sources to generate a comprehensive report. The bottom-up approach was used to validate findings, ensuring the accuracy of market size, segmentation, and competitive analysis.

Frequently Asked Questions

How big is the USA Coffee Market?

The USA coffee market is valued at USD 95 billion, driven by a robust culture of specialty coffee consumption and innovative product offerings that cater to a wide range of consumer preferences.

What are the challenges in the USA Coffee Market?

Key challenges include fluctuating coffee bean prices due to supply chain disruptions, sustainability concerns, and the increasing costs of complying with ethical sourcing certifications.

Who are the major players in the USA Coffee Market?

Prominent players include Starbucks Corporation, Dunkin Brands, Nestl USA, Keurig Dr Pepper, and Peet's Coffee & Tea. These companies dominate the market due to their extensive distribution networks and strong brand presence.

What are the growth drivers of the USA Coffee Market?

Growth in the market is driven by increasing consumer demand for specialty coffee, a rising preference for sustainable and ethically sourced products, and innovations in coffee brewing technologies.

How is the USA Coffee Market segmented?

The market is segmented by product type into instant coffee, ground coffee, whole bean coffee, and single-serve pods. It is also segmented by distribution channel, with supermarkets and hypermarkets leading, followed by specialty stores, online retail, and coffee houses.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.