USA Coin-operated Commercial Laundry Market Outlook to 2030

Region:North America

Author(s):Meenakshi

Product Code:KROD6840

November 2024

87

About the Report

USA Coin-operated Commercial Laundry Market Overview

- The USA Coin-operated Commercial Laundry Market, based on a thorough five-year historical analysis, was valued at USD 1.35 billion. The market has shown steady growth due to the rising urban population, particularly in multifamily housing units and student accommodations, where the convenience of coin-operated laundry machines is a preferred choice.

- The USA market is dominated by major urban centers such as New York, Los Angeles, and Chicago, which are home to dense populations and extensive multifamily residential buildings. These cities have a high concentration of renters and transient populations, including students and tourists, who rely heavily on self-service laundry facilities.

- Water conservation mandates are a critical factor in regulating the U.S. coin-operated laundry market, particularly in drought-prone regions. California, Nevada, and Arizona have strict water usage regulations that commercial laundry operators must comply with. In 2023, California introduced Assembly Bill 1628, which aimed to require all new washing machines sold in the state to include a microfiber filtration system by January 1, 2029. These mandates are reshaping operational standards in the industry, particularly for laundromats in regions with limited water resources.

USA Coin-operated Commercial Laundry Market Segmentation

By Equipment Type: The market is segmented by equipment type into top-load washers, front-load washers, coin-operated dryers, and smart laundry systems. Among these, front-load washers hold the dominant market share due to their higher energy and water efficiency, which appeals to both laundromat operators and environmentally conscious consumers. Front-load machines are also preferred for their larger load capacities and gentler treatment of fabrics, making them suitable for a variety of customer needs, from small apartments to large residential complexes.

By End-user: In terms of end-user segmentation, the market is classified into multi-family residential buildings, student housing, military barracks, and RV parks/campgrounds. Multi-family residential buildings dominate this segment with the largest market share due to the growing number of rental properties in urban areas. These buildings typically rely on on-site laundry facilities as a value-added service for tenants. This trend is further fueled by the increasing preference for apartment living in metropolitan areas, where space for in-unit laundry is limited.

USA Coin-operated Commercial Laundry Market Competitive Landscape

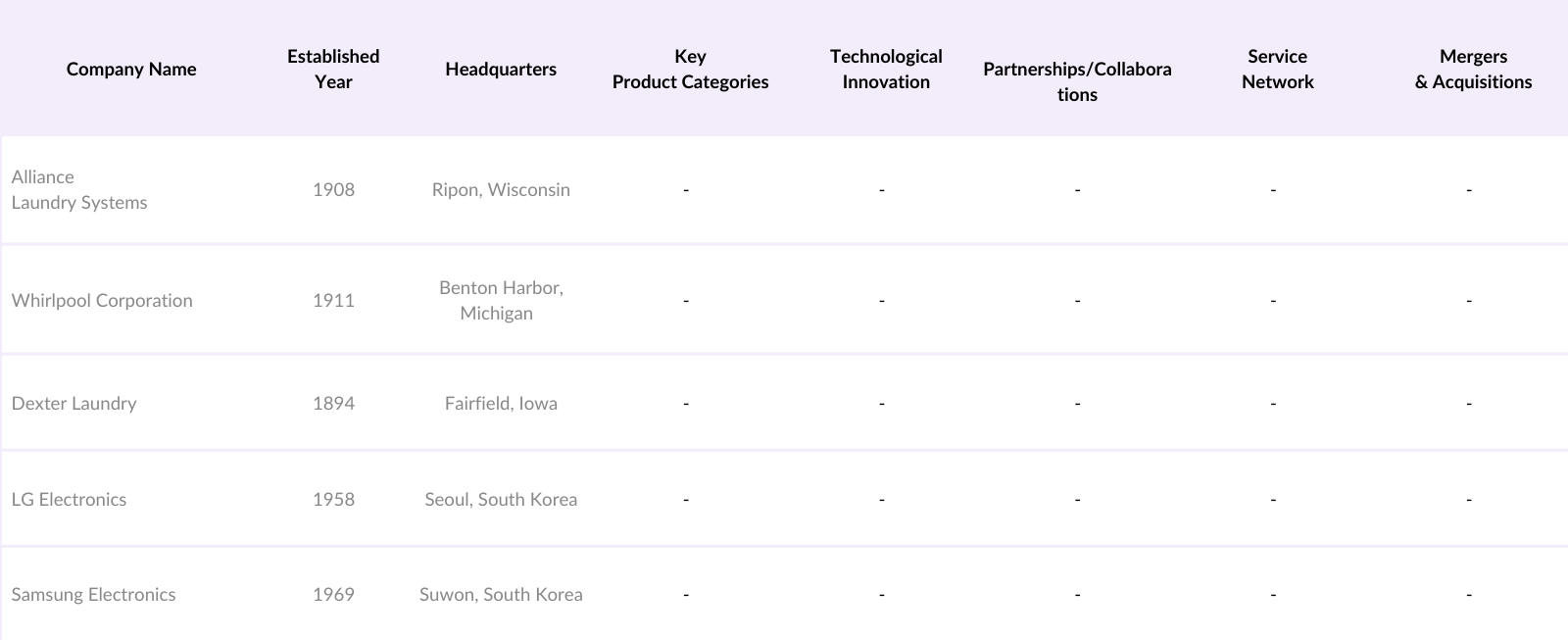

The USA Coin-operated Commercial Laundry Market is dominated by key players such as Alliance Laundry Systems and Whirlpool Corporation. These companies have solidified their presence through long-term partnerships with property management firms and by offering advanced, energy-efficient machines. The presence of newer entrants like LG and Samsung, which provide innovative smart laundry systems, is also reshaping the competitive dynamics by increasing customer demand for convenience and technological integration.

USA Coin-operated Commercial Laundry Industry Analysis

Growth Drivers

- Urban Population Growth (Increase in renters and multifamily units): The USA's urban population continues to grow, with more than 80% of Americans living in urban areas, according to the U.S. Census Bureau. As of 2024, there is a steady rise in multifamily housing units, driven by increasing demand for rentals. This growing number of renters, who often lack in-unit laundry facilities, significantly boosts demand for commercial laundry services.

- Rising Laundry Service Demand (Time-saving, convenience trends): The shift towards time-saving and convenient services has fueled demand for commercial laundry facilities. Over 45% of U.S. renters prioritize access to laundry services as an essential amenity in their apartments, according to a 2023 survey by the U.S. Department of Housing. Coin-operated laundry services, particularly in busy urban areas, cater to this need for convenience. The increasing number of professionals in urban regions, further supports the rising demand for such services.

- Technological Innovations (Smart laundry systems, IoT integration): Technological innovations, such as smart laundry systems and IoT-enabled machines, are reshaping the commercial laundry industry. These systems allow users to control washers and dryers via mobile apps, enhancing convenience. For operators, IoT technology provides real-time data for better machine management and maintenance, optimizing energy and water usage, and improving operational efficiency, making laundry operations more seamless and cost-effective.

Market Challenges

- High Initial Capital Requirements (Equipment and maintenance costs): Starting a coin-operated laundry business requires substantial upfront capital. The costs include purchasing commercial-grade equipment, securing a suitable location, and covering ongoing maintenance expenses. These financial commitments can be a significant burden, especially for new operators. Additionally, ongoing maintenance is essential to ensure machines remain operational and efficient, adding further to long-term costs. Access to financing can also be a challenge for small businesses, limiting growth opportunities in this sector.

- Declining Laundry Footfall in Rural Areas: Rural areas face challenges with decreasing foot traffic in coin-operated laundries due to population decline and the growing use of in-home laundry setups. As fewer people live in these regions, laundromats experience reduced customer visits, impacting revenue. This trend has led to the closure of many facilities in smaller towns, as maintaining profitability becomes increasingly difficult. The shift away from laundromats in rural areas is largely due to convenience and accessibility of alternative laundry solutions.

USA Coin-operated Commercial Laundry Market Future Outlook

Over the coming years, the USA Coin-operated Commercial Laundry Market is anticipated to show continued growth driven by urbanization, advancements in laundry technology, and the increasing demand for more energy-efficient and eco-friendly equipment. The introduction of mobile app-controlled systems is expected to further streamline operations for laundromat owners and enhance customer experiences, creating new revenue streams for the industry.

Market Opportunities

- Increasing Adoption of Cashless Payment Systems: The adoption of cashless payment systems in coin-operated laundries is becoming more widespread. Many laundromats are integrating card and mobile payment options into their machines, offering customers greater convenience. This shift appeals to tech-savvy users and simplifies operations for owners by reducing the need to handle physical coins. Cashless systems also streamline financial management, making operations more efficient and secure for business owners.

- Expansion into Student Housing and Co-living Spaces: Student housing and co-living spaces present strong opportunities for coin-operated laundry services. Many students and co-living residents rely on shared laundry facilities due to the lack of in-unit options. Expanding into this market provides laundromats with a consistent customer base, as these environments typically have high demand for laundry services. Coin-operated laundries in such spaces benefit from regular usage, contributing to stable revenue streams.

Scope of the Report

|

By Equipment Type |

Top-load Washers, Front-load Washers, Coin-operated Dryers, Smart Laundry Systems |

|

By End-User |

Multi-family Residential Buildings, Student Housing, Military Barracks, RV Parks and Campgrounds |

|

By Payment Method |

Coin-operated, Card-based Payment, Mobile Payment and App Integration |

|

By Technology Adoption |

Conventional Laundry Machines, IoT-enabled Laundry Machines, Water-saving and Energy-efficient Machines |

|

By Region |

Northeast, Midwest, South, West |

Products

Key Target Audience

Laundromat Owners and Operators

Student Housing Management Firms

Military Base Facility Managers

Multi-family Property Management Companies

Government and Regulatory Bodies (Energy Star, Department of Energy)

Investor and Venture Capitalist Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Alliance Laundry Systems

Whirlpool Corporation

Dexter Laundry

LG Electronics

Samsung Electronics

Maytag Commercial Laundry

Pellerin Milnor Corporation

Speed Queen

Continental Girbau

Huebsch

Table of Contents

1. USA Coin-operated Commercial Laundry Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Coin-operated Commercial Laundry Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Coin-operated Commercial Laundry Market Analysis

3.1. Growth Drivers

3.1.1. Urban Population Growth (Increase in renters and multifamily units)

3.1.2. Rising Laundry Service Demand (Time-saving, convenience trends)

3.1.3. Technological Innovations (Smart laundry systems, IoT integration)

3.1.4. Government Programs (Subsidies for energy-efficient machines)

3.2. Market Challenges

3.2.1. High Initial Capital Requirements (Equipment and maintenance costs)

3.2.2. Declining Laundry Footfall in Rural Areas

3.2.3. Competition from In-house Laundry Services in New Developments

3.3. Opportunities

3.3.1. Increasing Adoption of Cashless Payment Systems

3.3.2. Expansion into Student Housing and Co-living Spaces

3.3.3. Eco-friendly and Water-saving Technologies Adoption

3.4. Trends

3.4.1. Energy-efficient and Water-saving Laundry Machines

3.4.2. Integration with Mobile Apps for Reservation and Payment

3.4.3. Increased Focus on Hygiene and Sanitation Post-Pandemic

3.5. Government Regulation

3.5.1. Energy Efficiency Standards (Energy Star, Department of Energy Regulations)

3.5.2. Water Conservation Mandates

3.5.3. Local Zoning and Permit Requirements

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.8.1. Supplier Power (Equipment manufacturers and service providers)

3.8.2. Buyer Power (Independent owners, franchisees, multifamily property managers)

3.8.3. Competitive Rivalry (Local laundromats, franchise networks)

3.8.4. Threat of Substitutes (In-house laundry, laundry pickup services)

3.8.5. Threat of New Entrants (Low barriers to entry, except for capital investment)

3.9. Competition Ecosystem

4. USA Coin-operated Commercial Laundry Market Segmentation

4.1. By Equipment Type (In Value %)

4.1.1. Top-load Washers

4.1.2. Front-load Washers

4.1.3. Coin-operated Dryers

4.1.4. Smart Laundry Systems (IoT-enabled washers and dryers)

4.2. By End-User (In Value %)

4.2.1. Multi-family Residential Buildings

4.2.2. Student Housing

4.2.3. Military Barracks

4.2.4. RV Parks and Campgrounds

4.3. By Payment Method (In Value %)

4.3.1. Coin-operated

4.3.2. Card-based Payment

4.3.3. Mobile Payment and App Integration

4.4. By Technology Adoption (In Value %)

4.4.1. Conventional Laundry Machines

4.4.2. IoT-enabled Laundry Machines

4.4.3. Water-saving and Energy-efficient Machines

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Coin-operated Commercial Laundry Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Alliance Laundry Systems

5.1.2. Whirlpool Corporation

5.1.3. Dexter Laundry

5.1.4. Speed Queen

5.1.5. Continental Girbau

5.1.6. Electrolux Laundry Systems

5.1.7. Pellerin Milnor Corporation

5.1.8. LG Electronics

5.1.9. Samsung Electronics

5.1.10. Huebsch

5.1.11. Maytag Commercial Laundry

5.1.12. BDS Laundry Systems

5.1.13. Coinmach Service Corporation

5.1.14. National Laundry Equipment

5.1.15. CSC ServiceWorks

5.2 Cross Comparison Parameters (No. of Locations, Revenue, Customer Base, Technology Adoption, Service Offerings, Ownership Structure, Market Penetration, Mergers/Acquisitions)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisition

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Coin-operated Commercial Laundry Market Regulatory Framework

6.1. Energy Efficiency and Water Use Regulations

6.2. Federal and State Compliance Requirements

6.3. Permit and Licensing Requirements

7. USA Coin-operated Commercial Laundry Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Coin-operated Commercial Laundry Future Market Segmentation

8.1. By Equipment Type

8.2. By End-User

8.3. By Payment Method

8.4. By Technology Adoption

8.5. By Region

9. USA Coin-operated Commercial Laundry Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing and Customer Acquisition Strategies

9.3. White Space Opportunity Analysis

9.4. Service Expansion Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the first step, we establish a framework of key variables for the USA Coin-operated Commercial Laundry Market, incorporating factors such as urban population trends, technological advancements, and customer preferences. This is achieved by leveraging proprietary databases and extensive secondary research.

Step 2: Market Analysis and Construction

The second step involves gathering and analyzing historical data to understand market size and growth trends. This includes identifying the ratio of coin-operated laundromats to residential properties and evaluating the revenue contribution from smart laundry systems.

Step 3: Hypothesis Validation and Expert Consultation

We then validate our market hypotheses through consultations with industry experts, including laundromat operators and equipment manufacturers, using structured interviews to refine our market projections and understand key operational challenges.

Step 4: Research Synthesis and Final Output

Finally, we synthesize data collected from various sources to develop an accurate, comprehensive report on the USA Coin-operated Commercial Laundry Market, ensuring that insights are both actionable and validated through multiple channels.

Frequently Asked Questions

01. How big is the USA Coin-operated Commercial Laundry Market?

The USA Coin-operated Commercial Laundry Market was valued at USD 1.35 billion, driven by rising urban populations and the demand for self-service laundry facilities in densely populated cities.

02. What are the major challenges in the USA Coin-operated Commercial Laundry Market?

Key challenges in USA Coin-operated Commercial Laundry Market include high initial capital expenditure for laundromat owners and increasing competition from in-house laundry facilities in newly developed residential buildings, which reduces foot traffic in traditional laundromats.

03. Who are the major players in the USA Coin-operated Commercial Laundry Market?

Major players in USA Coin-operated Commercial Laundry Market include Alliance Laundry Systems, Whirlpool Corporation, Dexter Laundry, LG Electronics, and Samsung Electronics, known for their innovative and energy-efficient laundry equipment.

04. What are the growth drivers for the USA Coin-operated Commercial Laundry Market?

The growth of this USA Coin-operated Commercial Laundry Market is driven by increasing urbanization, advancements in smart laundry technology, and the demand for more convenient and eco-friendly laundry solutions in densely populated areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.