USA Computer-Aided Detection Market Outlook to 2030

Region:North America

Author(s):Samanyu

Product Code:KROD4637

November 2024

80

About the Report

USA Computer-Aided Detection Market Overview

- The USA Computer-Aided Detection market is valued at USD 750 million, based on a five-year historical analysis. The primary drivers behind the market's growth are the increasing prevalence of cancer and chronic diseases, especially in the aging population. The rise in diagnostic imaging procedures and the adoption of artificial intelligence (AI) in healthcare are also fueling demand. Hospitals and diagnostic centers are increasingly relying on CAD systems to improve accuracy in early detection and diagnosis, significantly contributing to the market's growth.

- The market dominance in the USA is led by cities like New York, Los Angeles, and Chicago. These metropolitan areas have well-established healthcare infrastructure and leading research institutions, which support the adoption of advanced diagnostic technologies like CAD systems. The high number of specialized cancer care centers and early adoption of AI-based solutions in these cities contributes to their leadership in this market. The availability of investment capital and supportive regulations also play a role in driving market dominance.

- Technological collaborations and research partnerships between healthcare providers, research institutions, and tech companies are accelerating CAD development. In 2023, the U.S. National Institutes of Health (NIH) launched several initiatives promoting collaboration between medical research entities and technology firms to develop AI-based CAD systems. These partnerships focus on improving the diagnostic accuracy and efficiency of CAD technologies through shared research and innovation. As a result, hospitals and research centers are increasingly implementing cutting-edge CAD systems, providing a strong foundation for future advancements in diagnostic tools.

USA Computer-Aided Detection Market Segmentation

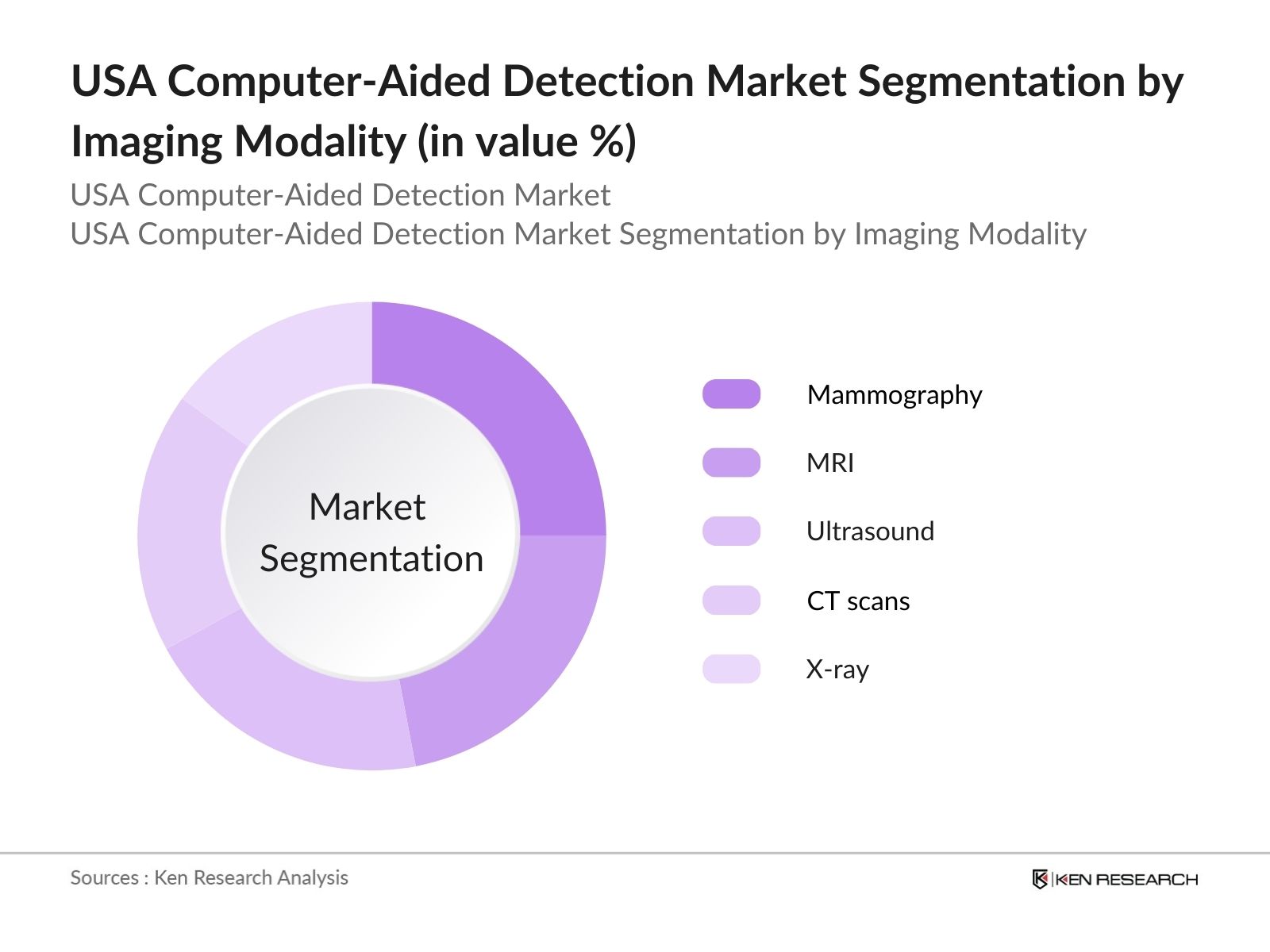

By Imaging Modality: The market is segmented by imaging modality into X-ray, MRI, CT scans, Ultrasound, and Mammography. Recently, mammography has held a dominant share due to its essential role in breast cancer detection, which is one of the leading cancers in the United States. The push for early detection has led to higher adoption rates of mammography CAD systems, especially due to the American Cancer Society's recommendation for regular breast cancer screening for women. Hospitals and diagnostic centers rely on CAD for reducing false negatives, thus increasing the effectiveness of mammograms.

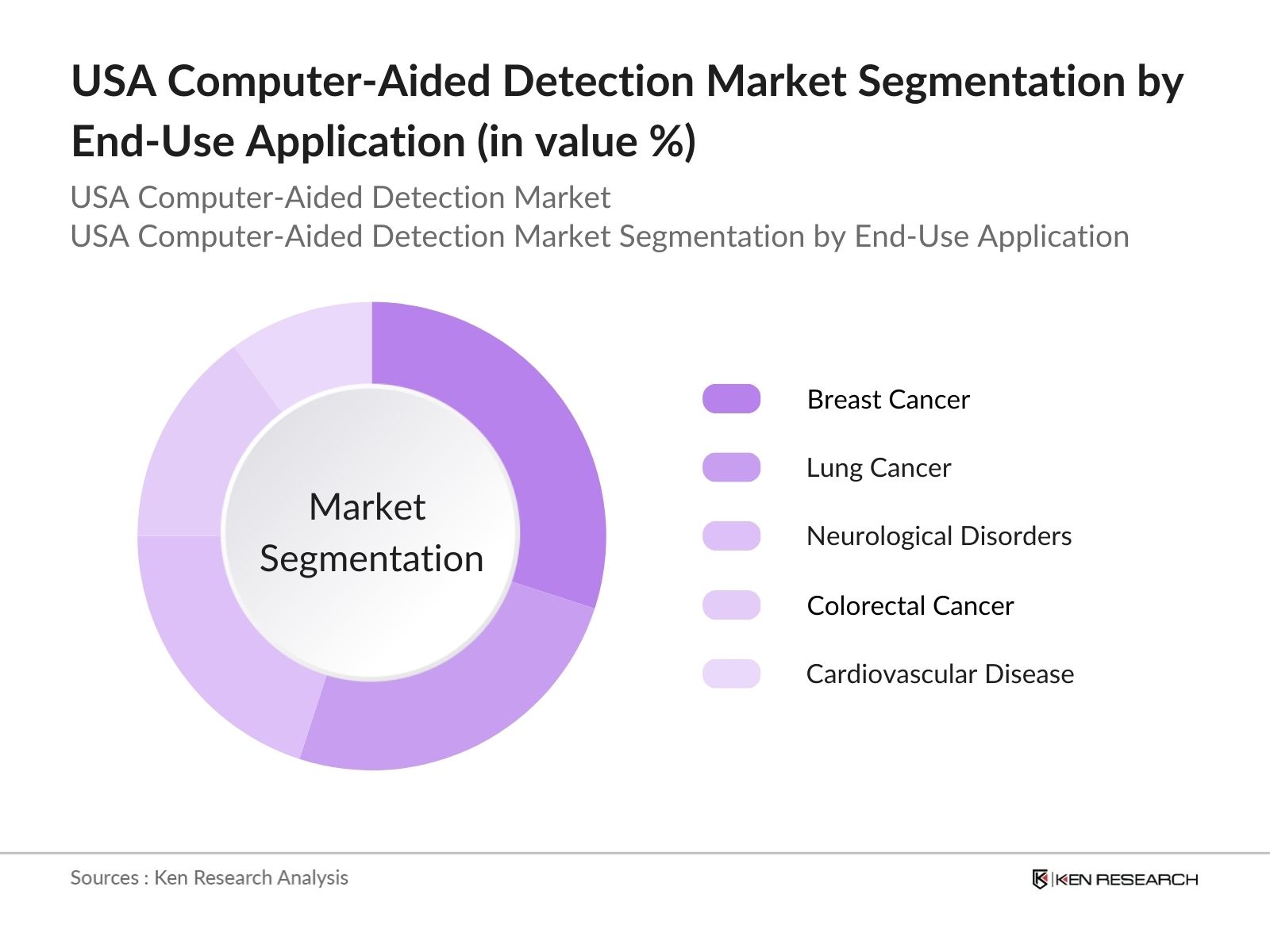

By End-Use Application: The market is segmented by end-use applications into Breast Cancer Detection, Lung Cancer Detection, Colorectal Cancer Detection, Neurological Disorder Detection, and Cardiovascular Disease Detection. Breast cancer detection dominates the market due to its widespread need and the advancements in AI-based CAD systems that offer higher accuracy. With breast cancer being one of the most diagnosed cancers in women, the implementation of CAD systems to improve diagnostic accuracy and reduce human error has become critical. AI-powered CAD systems are assisting radiologists in early detection and treatment planning, which is vital for improving patient outcomes.

USA Computer-Aided Detection Market Competitive Landscape

The USA Computer-Aided Detection market is dominated by a few major players who have established strong technological advancements and partnerships within the healthcare sector. These companies are leading in AI integration and have extensive research and development capabilities. The market is consolidated, with key players like iCAD, Siemens Healthineers, and Hologic leading the sector. Their leadership is due to their focus on AI-enabled CAD systems and their strategic partnerships with healthcare providers. Smaller companies are entering the market, but the heavy R&D investment required for AI-based CAD solutions gives larger players a significant advantage.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

R&D Investment |

No. of Patents |

AI-based CAD Systems |

|

iCAD, Inc. |

1984 |

Nashua, New Hampshire |

||||||

|

Siemens Healthineers |

1847 |

Erlangen, Germany |

||||||

|

Hologic, Inc. |

1985 |

Marlborough, Massachusetts |

||||||

|

Philips Healthcare |

1891 |

Amsterdam, Netherlands |

||||||

|

GE Healthcare |

1892 |

Chicago, Illinois |

USA Computer-Aided Detection Industry Analysis

Growth Drivers

- Increasing Incidence of Cancer and Chronic Diseases: The growing incidence of cancer and chronic diseases in the U.S. is driving demand for computer-aided detection (CAD) systems. According to the National Cancer Institute, there were an estimated 1.9 million new cancer cases in 2023 in the U.S., highlighting the need for more efficient diagnostic tools like CAD. Chronic conditions such as cardiovascular diseases, which cause 697,000 deaths annually (CDC, 2024), are also increasing demand. CAD systems play a critical role in early diagnosis, improving outcomes and reducing mortality rates. With these rising health challenges, CAD technology is crucial in enhancing diagnostic accuracy.

- Advancements in Imaging Technologies: Imaging technologies such as MRI, CT, and mammography have undergone significant advancements, contributing to the growth of CAD adoption. The U.S. National Institutes of Health (NIH) reports that the development of high-resolution imaging technologies with better contrast sensitivity has improved diagnostic accuracy in various conditions, including cancer. By 1st quarter of 2025, 25 million diagnostic imaging procedures are expected to be performed annually across the U.S. healthcare system. CAD systems, integrated with these advanced imaging technologies, are vital for ensuring precise image analysis and reducing human error in diagnostic processes.

- Favorable Government Initiatives: Government funding and research initiatives in the U.S. have been instrumental in driving CAD technology adoption. In 2023, the National Institutes of Health (NIH) allocated over $6 billion in cancer research funding, with a portion aimed at improving diagnostic technologies like CAD. In addition, government programs such as the Cancer Moonshot initiative, which targets cancer prevention, diagnosis, and treatment, have accelerated innovation in CAD systems. These initiatives not only support CAD development but also encourage healthcare institutions to adopt these technologies to improve diagnostic outcomes in various medical fields.

Market Challenges

- Integration Challenges with Existing Systems: Integrating CAD systems with existing healthcare infrastructure poses a technical challenge, particularly for older facilities that operate with outdated imaging equipment. According to a 2023 survey by the U.S. Department of Health and Human Services, more than 35% of healthcare facilities in the U.S. reported difficulties in seamlessly integrating CAD systems with their electronic medical records (EMRs) and legacy imaging systems. These challenges often lead to increased implementation time, higher operational costs, and disruptions in workflow, further slowing down the adoption of CAD technologies in the broader healthcare market.

- Limited Reimbursement Policies: Limited reimbursement policies for CAD procedures restrict adoption in several healthcare settings. In 2023, the Centers for Medicare & Medicaid Services (CMS) limited reimbursement for certain diagnostic imaging services where CAD systems were utilized, leading to financial constraints for healthcare providers. Furthermore, private insurers have yet to fully cover CAD-assisted imaging procedures, limiting the ability of healthcare institutions to adopt these technologies on a large scale. This lack of comprehensive reimbursement creates financial disincentives for providers who might otherwise be interested in implementing CAD solutions.

USA Computer-Aided Detection Market Future Outlook

Over the next five years, the USA Computer-Aided Detection market is expected to grow significantly due to advancements in AI, expanding applications in diagnostics beyond cancer, and increasing investment in healthcare technologies. AI-driven CAD systems will become more accurate and affordable, leading to greater adoption in both hospitals and outpatient settings. Additionally, government initiatives focused on early detection and treatment of diseases will further fuel market expansion.

Future Market Opportunities

- Expanding Applications Beyond Cancer Detection (Cardiovascular, Neurological): While CAD systems are traditionally associated with cancer detection, their applications are rapidly expanding to other areas such as cardiovascular and neurological disorders. In 2023, the U.S. Centers for Disease Control and Prevention (CDC) reported that cardiovascular diseases were responsible for nearly 700,000 deaths annually in the U.S., highlighting a need for early detection tools. CAD systems, when integrated with imaging modalities such as MRI and CT scans, offer new opportunities in the early diagnosis of conditions like stroke and coronary artery disease, providing healthcare professionals with advanced tools for better patient outcomes.

- Growing Adoption in Ambulatory Care Settings: The increasing adoption of CAD systems in ambulatory care settings presents a significant growth opportunity. According to the U.S. Department of Health and Human Services, there are over 5,500 Medicare-certified ambulatory surgery centers across the U.S., many of which are adopting advanced diagnostic tools like CAD to enhance patient care. CAD systems provide real-time diagnostic support in outpatient settings, enabling faster diagnoses and reducing the need for hospital-based imaging services. This growing trend in ambulatory care adoption offers potential for expanding the use of CAD systems beyond traditional hospital environments.

Scope of the Report

|

By Imaging Modality |

X-ray MRI CT scans Ultrasound Mammography |

|

By End-Use Application |

Breast Cancer Lung Cancer Colorectal Cancer Neurological Disorders Cardiovascular Diseases |

|

By Deployment Model |

Cloud-Based On-Premise |

|

By Technology |

AI-Based Detection Deep Learning Algorithms Hybrid Models |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Hospitals and Diagnostic Centers

AI Developers for Healthcare Solutions

Radiology Service Providers

Cancer Care Centers

Government and Regulatory Bodies (FDA, CMS)

Private and Public Healthcare Investors

Banks and Financial Institutes

Insurance Companies

Investments and Venture Capitalist Firms

Companies

Major Players

iCAD, Inc.

Siemens Healthineers

Hologic, Inc.

GE Healthcare

Philips Healthcare

Canon Medical Systems

Riverain Technologies

Fujifilm Medical Systems

Varian Medical Systems

IBM Watson Health

Hitachi Medical Systems

Agfa Healthcare

McKesson Corporation

Zebra Medical Vision

Median Technologies

Table of Contents

1. USA Computer-Aided Detection (CAD) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Market Adoption Rate, Patient Detection Accuracy Improvements)

1.4. Market Segmentation Overview (Imaging Modalities, End-Use Applications, Diseases Detected, AI-based Developments, Deployment Models)

2. USA Computer-Aided Detection (CAD) Market Size (In USD Million)

2.1. Historical Market Size (In Volume and Value)

2.2. Year-On-Year Growth Analysis (Screening Rates, Adoption in Clinical Settings)

2.3. Key Market Developments and Milestones (FDA Approvals, AI Integration, Key Patents)

3. USA Computer-Aided Detection (CAD) Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Incidence of Cancer and Chronic Diseases

3.1.2. Advancements in Imaging Technologies

3.1.3. Favorable Government Initiatives (Funding, Research)

3.1.4. Growing Use of AI in Diagnostics (Automation, Machine Learning)

3.2. Restraints

3.2.1. High Costs of Implementation

3.2.2. Integration Challenges with Existing Systems

3.2.3. Limited Reimbursement Policies

3.3. Opportunities

3.3.1. Expanding Applications Beyond Cancer Detection (Cardiovascular, Neurological)

3.3.2. Growing Adoption in Ambulatory Care Settings

3.3.3. Technological Collaborations and Research Partnerships

3.4. Trends

3.4.1. Integration with AI and Deep Learning Models

3.4.2. Remote Detection and Telehealth Expansion

3.4.3. Real-Time Imaging and Workflow Optimization

3.5. Government Regulations

3.5.1. FDA Approvals and Compliance Regulations

3.5.2. Medicare and Medicaid Reimbursement Policies

3.5.3. Health Technology Assessment (HTA) Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Computer-Aided Detection (CAD) Market Segmentation

4.1. By Imaging Modality (In Value %)

4.1.1. X-ray

4.1.2. MRI

4.1.3. CT scans

4.1.4. Ultrasound

4.1.5. Mammography

4.2. By End-Use Application (In Value %)

4.2.1. Breast Cancer Detection

4.2.2. Lung Cancer Detection

4.2.3. Colorectal Cancer Detection

4.2.4. Neurological Disorder Detection

4.2.5. Cardiovascular Disease Detection

4.3. By Deployment Model (In Value %)

4.3.1. Cloud-Based

4.3.2. On-Premises

4.4. By Technology (In Value %)

4.4.1. AI-Based Detection

4.4.2. Deep Learning Algorithms

4.4.3. Hybrid AI-Detection Models

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Computer-Aided Detection (CAD) Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. iCAD, Inc.

5.1.2. Siemens Healthineers

5.1.3. Hologic, Inc.

5.1.4. Philips Healthcare

5.1.5. GE Healthcare

5.1.6. Fujifilm Medical Systems

5.1.7. IBM Watson Health

5.1.8. Canon Medical Systems

5.1.9. McKesson Corporation

5.1.10. Agfa Healthcare

5.1.11. Hitachi Medical Systems

5.1.12. Riverain Technologies

5.1.13. Varian Medical Systems

5.1.14. Zebra Medical Vision

5.1.15. Median Technologies

5.2. Cross Comparison Parameters (No. of FDA Approvals, Revenue, Market Penetration, R&D Investments, AI-Detection Models Developed)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Computer-Aided Detection (CAD) Market Regulatory Framework

6.1. FDA Approval Pathways

6.2. HIPAA Compliance for Cloud-Based Systems

6.3. Data Privacy Regulations for AI-Integrated Models

6.4. Medicare and Medicaid Reimbursement Policies for CAD Applications

7. USA Computer-Aided Detection (CAD) Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (AI Innovations, Government Funding for Research, Adoption in Non-Traditional Healthcare Settings)

8. USA Computer-Aided Detection (CAD) Future Market Segmentation

8.1. By Imaging Modality (In Value %)

8.2. By End-Use Application (In Value %)

8.3. By Deployment Model (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. USA Computer-Aided Detection (CAD) Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Hospitals, Clinics, Diagnostic Centers)

9.3. Marketing Initiatives for AI-Based CAD Systems

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, a comprehensive ecosystem map was created to include all stakeholders within the USA Computer-Aided Detection market. This was done through extensive desk research using secondary and proprietary data sources to identify key variables such as AI adoption rates and diagnostic accuracy improvements.

Step 2: Market Analysis and Construction

Next, historical data was analyzed to understand market penetration, segment performance, and technological adoption trends. Data was compiled from both public and private sources to ensure accurate revenue estimates for CAD applications in healthcare settings.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts from leading companies. These consultations provided insights into the operational performance and future prospects of AI-based CAD systems.

Step 4: Research Synthesis and Final Output

Finally, data from AI developers, radiologists, and diagnostic centers were synthesized to confirm the findings. The data gathered was then corroborated with financial and operational insights to provide a comprehensive analysis of the market.

Frequently Asked Questions

01. How big is the USA Computer-Aided Detection (CAD) Market?

The USA Computer-Aided Detection market is valued at USD 750 million, driven by advancements in AI technology and the growing need for accurate diagnostic tools in hospitals and diagnostic centers.

02. What are the challenges in the USA Computer-Aided Detection (CAD) Market?

Challenges in USA Computer-Aided Detection market include the high costs of CAD systems, integration difficulties with existing healthcare infrastructures, and limited reimbursement policies for AI-based diagnostics.

03. Who are the major players in the USA Computer-Aided Detection (CAD) Market?

Key players in USA Computer-Aided Detection market include iCAD, Siemens Healthineers, Hologic, Philips Healthcare, and GE Healthcare, which dominate the market due to their strong AI integration and innovative diagnostic solutions.

04. What are the growth drivers of the USA Computer-Aided Detection (CAD) Market?

Growth in USA Computer-Aided Detection market is driven by the increasing prevalence of chronic diseases like cancer, advancements in AI technology, and the need for more accurate and early detection solutions in healthcare.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.