USA Construction Aggregate Market Outlook to 2030

Region:North America

Author(s):Pranav Krishn

Product Code:KROD302

June 2024

95

About the Report

USA Construction Aggregate Market Overview

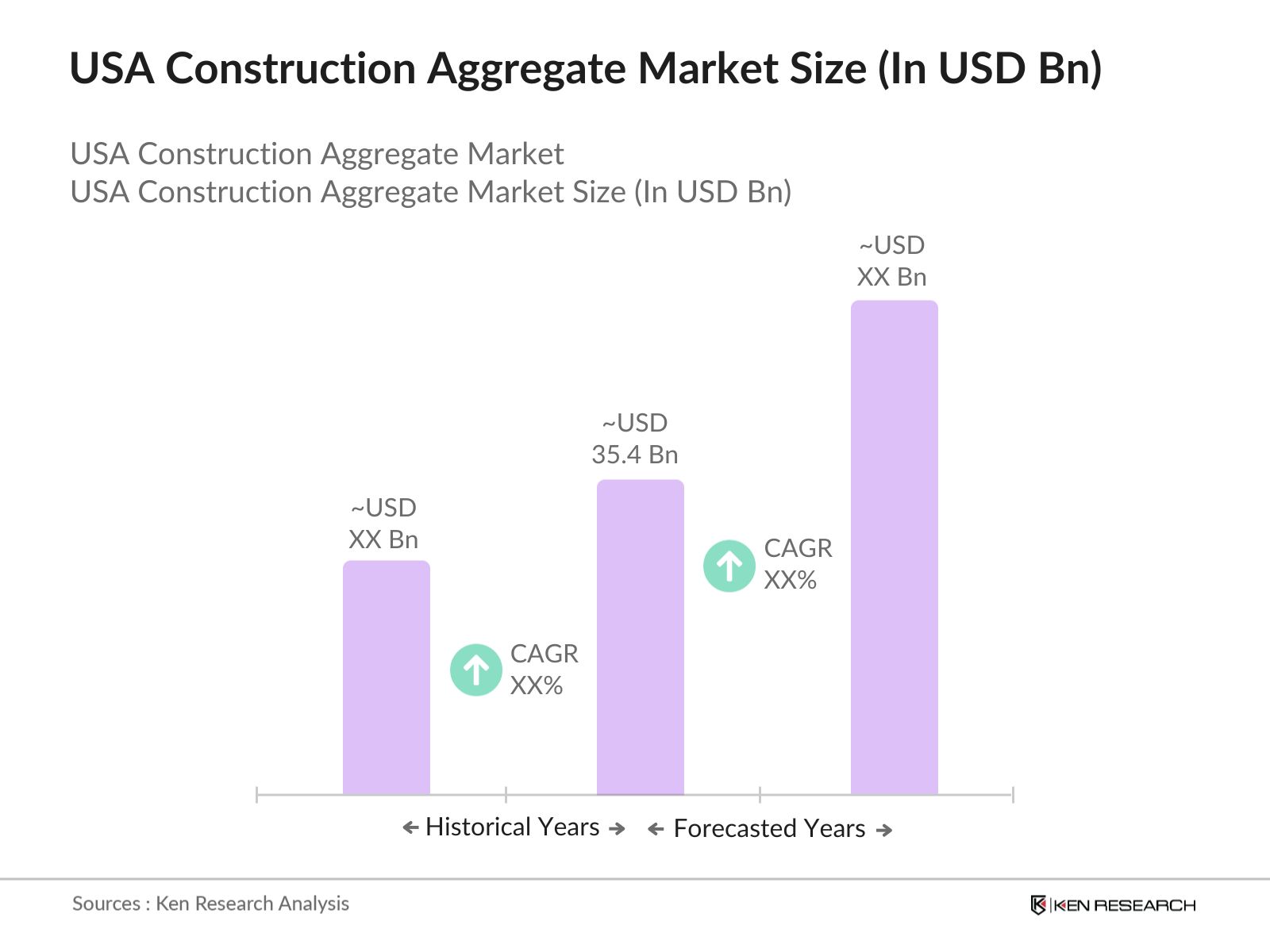

- The USA Construction Aggregate Market, valued at USD 35.4 billion in 2023, showcases rapid growth driven by the construction and infrastructure activities across the country, fueled by government investments and urbanization trends. In 2018, the market was valued at USD 27.9 billion, at a CAGR of 5.7%.

- Key players in the USA aggregates market include Vulcan Materials Company, Martin Marietta Materials, Inc., and CRH plc, dominating the market with their extensive product offerings, geographic presence, and technological advancements. These industry leaders play a pivotal role in shaping market dynamics and setting industry standards.

- In 2023, Vulcan Materials Company announced the acquisition of U.S. Concrete, Inc., a leading producer of aggregates and ready-mixed concrete, for USD 1.3 billion. This acquisition aims to enhance Vulcan's market presence and expand its product offerings in key U.S. markets.

USA Construction Aggregate Market Analysis

- The U.S. government's initiatives to upgrade transportation infrastructure, including highways, bridges, and airports, are major growth drivers. For instance, the Infrastructure Investment and Jobs Act (2021) allocated USD 1.2 trillion for infrastructure projects over the next decade.

- Rapid urbanization and population growth in metropolitan areas such as New York City, Los Angeles, and Houston significantly increase the demand for residential and commercial construction. This surge in construction activities drives the aggregate market, as these urban centres require extensive infrastructure development to accommodate the growing population and economic activities.

- The aggregate market significantly impacts the construction industry, providing essential materials for building infrastructure and housing projects. It also influences the economic development of regions by creating jobs and supporting local businesses involved in construction activities.

USA Construction Aggregate Market Segmentations

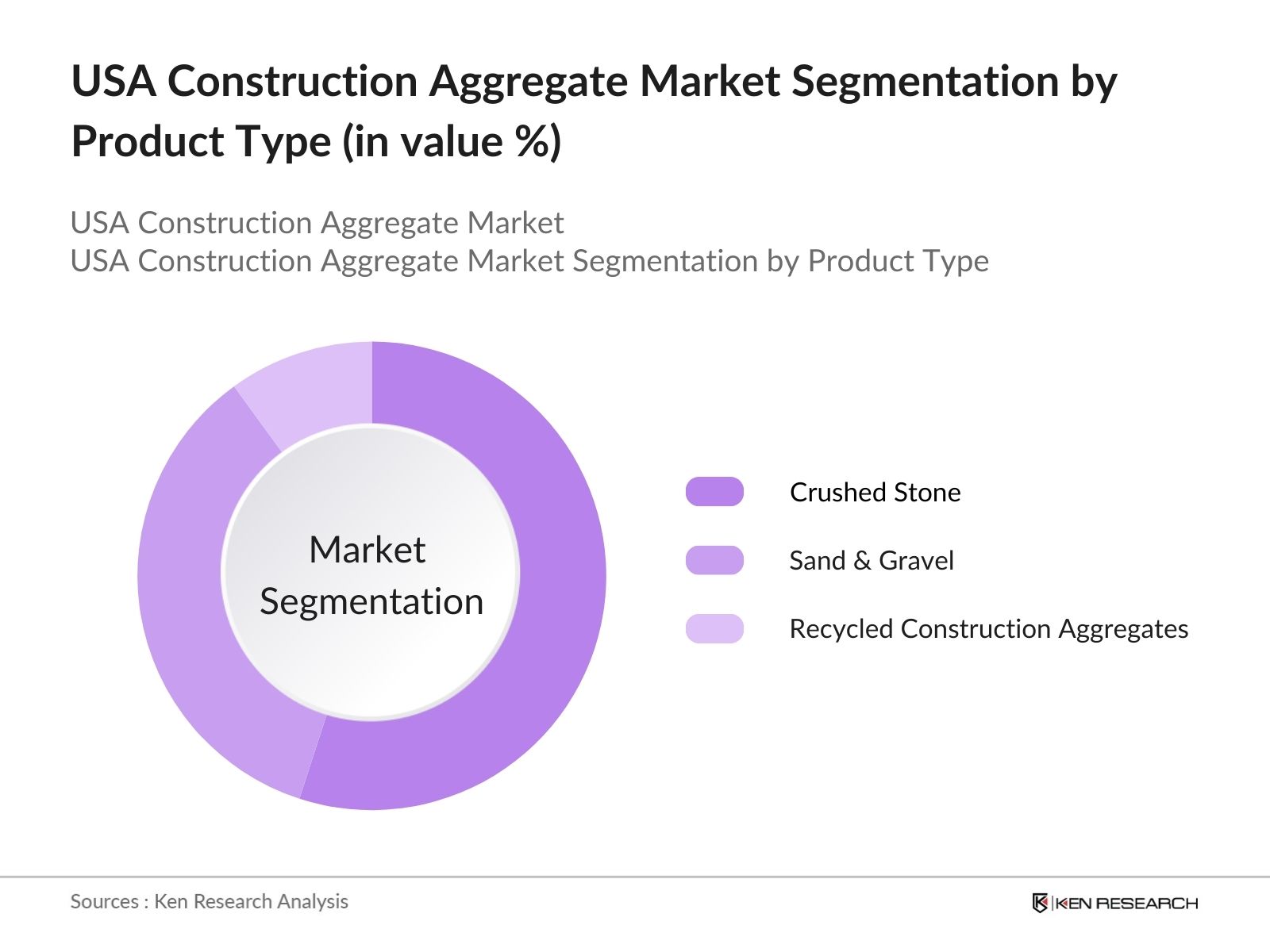

By Product: In 2023, the USA Construction Aggregate Market is segmented by product into crushed stone, sand & gravel and recycled construction aggregates. Crushed stone dominates due to its versatility and durability. It's widely used in construction for road base, concrete aggregate, and railroad ballast, offering strength and stability.

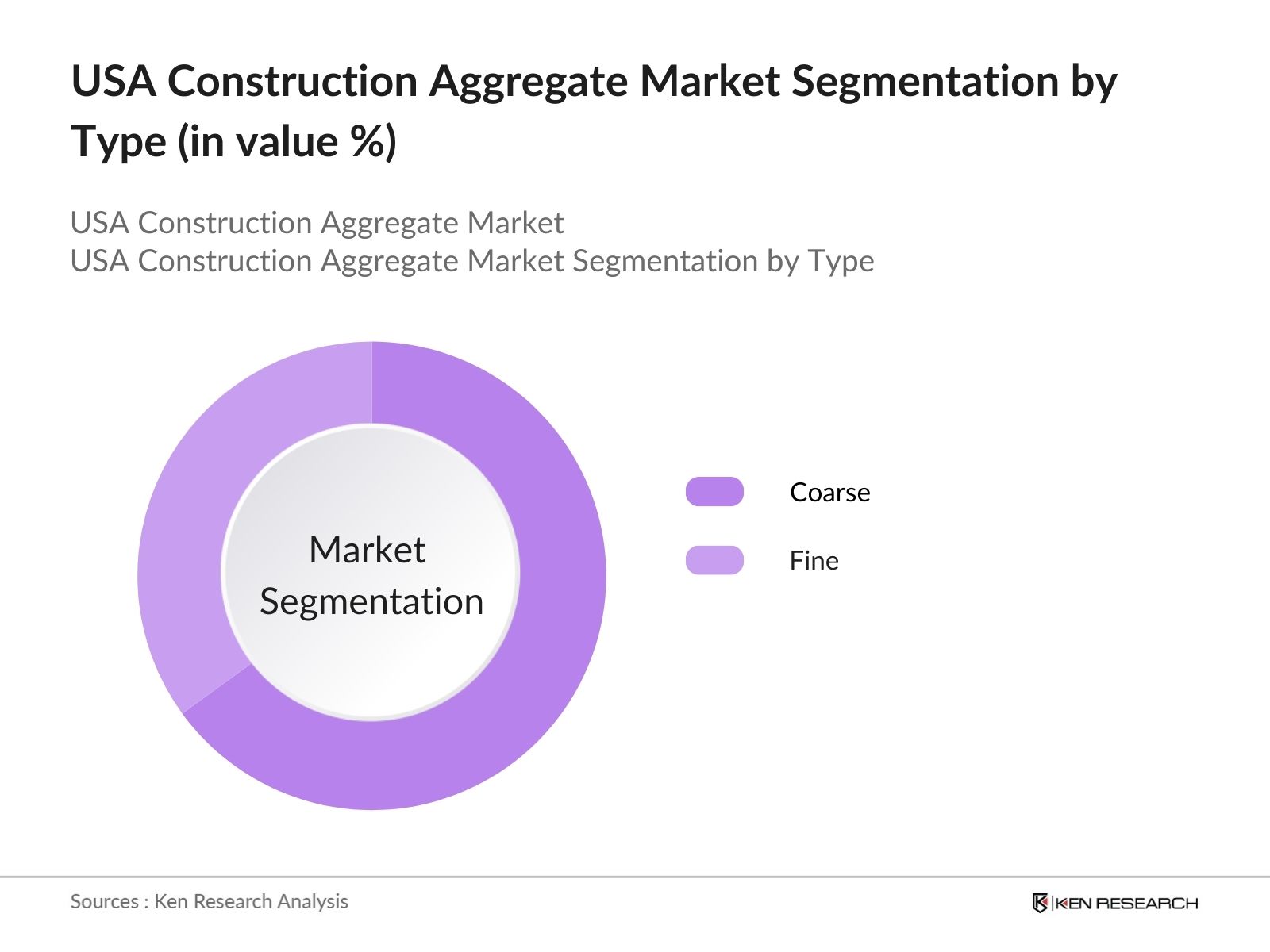

By Type: In 2023, the USA Construction Aggregate Market is segmented by type into coarse and fine. Coarse aggregates hold a dominant market share due to their widespread use in construction projects requiring structural integrity, such as roads and foundations. Coarse aggregates provide strength and stability, making them essential for various infrastructure developments, thus contributing to their market dominance.

By End-User: In 2023, the USA Construction Aggregate Market is segmented by end-user into non-building, residential and non-residential. Non-Building Residential dominates the USA aggregates market due to continuous infrastructure development and maintenance, fueled by the growing demand for housing. This segment benefits from ongoing construction needs, including residential projects such as housing complexes and apartment buildings.

USA Construction Aggregate Market Competitive Landscape

| Company Name | Establishment Year | Headquarters |

| Vulcan Materials Company | 1909 | Birmingham, AL |

| Martin Marietta Materials | 1993 | Raleigh, NC |

| CRH Americas Materials | 1970 | Atlanta, GA |

| LafargeHolcim Ltd | 2015 | Chicago, IL |

| CEMEX S.A.B. de C.V. | 1906 | Houston, TX |

- Vulcan Materials Company: As the largest producer of construction aggregates in the U.S., Vulcan significantly influences market dynamics through strategic acquisitions, such as the 2023 purchase of U.S. Concrete for USD 1.3 billion, and investments in advanced production technologies to enhance efficiency and output.

- Martin Marietta Materials: Martin Marietta impacts the market by expanding its production capabilities and distribution network. In 2023, the company invested USD 600 million to increase its aggregates production capacity in Texas, addressing the growing demand in one of the fastest-developing regions.

- LafargeHolcim Ltd: Known for its innovative solutions, LafargeHolcim drives market growth by introducing eco-friendly products and heavily investing in research and development. In 2023, the company launched a new line of sustainable aggregates made from recycled construction waste, aligning with global sustainability goals.

USA Construction Aggregate Industry Analysis

Growth Drivers

- Infrastructure Investment: The U.S. government has allocated significant funding to upgrade and develop transportation infrastructure. For example, the Infrastructure Investment and Jobs Act of 2021 dedicates $110 billion to roads, bridges, and major infrastructure projects. This massive investment is projected to drive the demand for aggregates, essential for constructing these infrastructures.

- Residential and Commercial Construction Boom: Metropolitan areas such as Dallas, Austin, and Phoenix are experiencing rapid population growth, with the U.S. Census Bureau reporting significant increases over the past decade. For instance, the National Association of Home Builders (NAHB) reported a surge in housing starts, reaching an annual rate of over 1.6 million units in 2023, indicating robust construction activity.

- Sustainable Construction Practices: The increasing focus on sustainability and eco-friendly construction practices has led to a higher demand for recycled aggregates. Policies promoting the use of recycled materials, such as the U.S. Environmental Protection Agency's (EPA) initiatives, have resulted in a 20% annual increase in the adoption of recycled aggregates in construction projects.

Challenges

- Supply Chain Disruptions: Supply chain disruptions caused by factors such as natural disasters, geopolitical tensions, and logistical challenges significantly impact the availability and cost of aggregates. The recent past highlighted these vulnerabilities, leading to an increase in transportation costs and delays in project timelines. Such disruptions can create uncertainty in the market and hinder the steady supply of raw materials.

- Market Competition: The aggregate market is highly competitive, with numerous players vying for market share. Smaller companies often struggle to compete with larger, well-established firms with extensive distribution networks and advanced production technologies. This competition can lead to price wars and reduced profit margins, making it challenging for smaller players to sustain their operations.

USA Construction Aggregate Industry Government Initiatives

- Federal Highway Administration (FHWA) Funding: The Federal Highway Administration (FHWA) provides annual funding to states for highway and infrastructure projects. In 2023, the FHWA allocated $52 billion for highway improvements, directly impacting the demand for aggregates.

- Clean Energy Initiatives: Government initiatives promoting clean energy and reducing carbon emissions indirectly impact the aggregate market. For example, policies encouraging the construction of wind and solar farms require substantial aggregate materials for foundations and infrastructure.

USA Construction Aggregate Market Future Outlook

The USA construction aggregate market is expected to experience substantial growth due to several key factors. Continuous urban development, particularly in metropolitan areas is driving the demand for aggregates. Significant advancements in sustainable construction practices, such as the increased use of recycled aggregates, are playing a crucial role in expanding the market.

Market Trends

- Urban Development Initiatives: Urban development projects are a major trend influencing the aggregate market. Cities such as Dallas, Phoenix, and Atlanta are investing in large-scale infrastructure projects to support population growth and economic expansion. According to the U.S. Census Bureau, these cities have seen significant population increases, necessitating extensive residential and commercial construction.

- Technological Innovations: Technological advancements are revolutionizing aggregate production, leading to enhanced efficiency and product quality. The adoption of advanced crushing and screening equipment is becoming more prevalent. Companies like Vulcan Materials and Martin Marietta have invested heavily in automation and AI technologies, resulting in a 15% increase in production efficiency.

Scope of the Report

|

By Product |

Crushed Stone Sand & Gravel Recycled Construction Aggregates |

|

By Type |

Coarse Fine |

|

By End- User |

Non-Building Residential Non-Residential |

Products

Key Target Audience – Organizations and Entities Who can Benefit by Subscribing this Report:

Residential construction firms

Commercial construction firms

Civil engineering contractors

Quarry operators

Crushed stone producers

Sand and gravel producers

Heavy machinery manufacturers

Crushing and screening equipment manufacturers

Conveyor system manufacturers

Government Infrastructure Departments

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Vulcan Materials Company

Martin Marietta Materials, Inc.

CRH plc

Lehigh Hanson, Inc.

LafargeHolcim Ltd.

Cemex S.A.B. de C.V.

Granite Construction Incorporated

HeidelbergCement AG

Colas USA

Oldcastle Materials, Inc.

CEMEX USA

Rogers Group Inc.

MDU Resources Group, Inc.

Holcim (USA) Inc.

Eurovia USA

Tilcon New York Inc.

Hanson Aggregates

Luck Companies

Graniterock

Summit Materials, Inc.

Table of Contents

1. USA Construction Aggregates Market Overview

1.1 USA Construction Aggregates Market Taxonomy

2. USA Construction Aggregates Market Size (in USD Bn), 2018-2023

3. USA Construction Aggregates Market Analysis

3.1 USA Construction Aggregates Market Growth Drivers

3.2 USA Construction Aggregates Market Challenges and Issues

3.3 USA Construction Aggregates Market Trends and Development

3.4 USA Construction Aggregates Market Government Regulation

3.5 USA Construction Aggregates Market SWOT Analysis

3.6 USA Construction Aggregates Market Stake Ecosystem

3.7 USA Construction Aggregates Market Competition Ecosystem

4. USA Construction Aggregates Market Segmentation, 2023

4.1 USA Construction Aggregates Market Segmentation by Product (in %), 2023

4.2 USA Construction Aggregates Market Segmentation by Type (in %), 2023

4.3 USA Construction Aggregates Market Segmentation by End-user (in %), 2023

5. USA Construction Aggregates Market Competition Benchmarking

5.1 USA Construction Aggregates Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. USA Construction Aggregates Market Future Market Size (in USD Bn), 2023-2028

7. USA Construction Aggregates Market Future Market Segmentation, 2028

7.1 USA Construction Aggregates Market Segmentation by Product (in %), 2028

7.2 USA Construction Aggregates Market Segmentation by Type (in %), 2028

7.3 USA Construction Aggregates Market Segmentation by End-user (in %), 2028

8. USA Construction Aggregates Market Analysts’ Recommendations

8.1 USA Construction Aggregates Market TAM/SAM/SOM Analysis

8.2 USA Construction Aggregates Market Customer Cohort Analysis

8.3 USA Construction Aggregates Market Marketing Initiatives

8.4 USAConstruction Aggregates Market White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2 Market Building:

Collating statistics on USA Aggregates Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA Aggregates Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4 Research output:

Our team will approach multiple Aggregate market companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Aggregate industry companies.Â

Frequently Asked Questions

01 How big is the USA Construction Aggregates market?

The USA construction aggregates market was valued at USD 35.4 billion in 2023. The market growth is driven by the construction and infrastructure activities across the country, fueled by government investments and urbanization trends.

02 Who are the major players in USA Construction Aggregates market?

The major players in the USA construction aggregates market include Vulcan Materials Company, Martin Marietta Materials, Inc., and CRH plc.

03 What factors drive the USA Construction Aggregates market?

Factors driving the USA Construction Aggregates market include Infrastructure Development, Urbanization, Technological Advancements and Investment In R&D.

04 What are some challenges of USA Construction Aggregates market?

Some challenges of the USA construction Aggregate Market include Environmental Concerns, Regulatory Compliance, Raw Material Scarcity and Infrastructure Bottlenecks

05 Which segment dominates the USA Construction Aggregates market?

Coarse dominate the USA Construction Aggregates market by type, accounting for more than a half of the market share in 2023.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.