US Contact Lenses Market Outlook to 2030

Driven by the increasing cases of eye disabilities and a growing aging population

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD209

August 2023

85

About the Report

Market Overview:

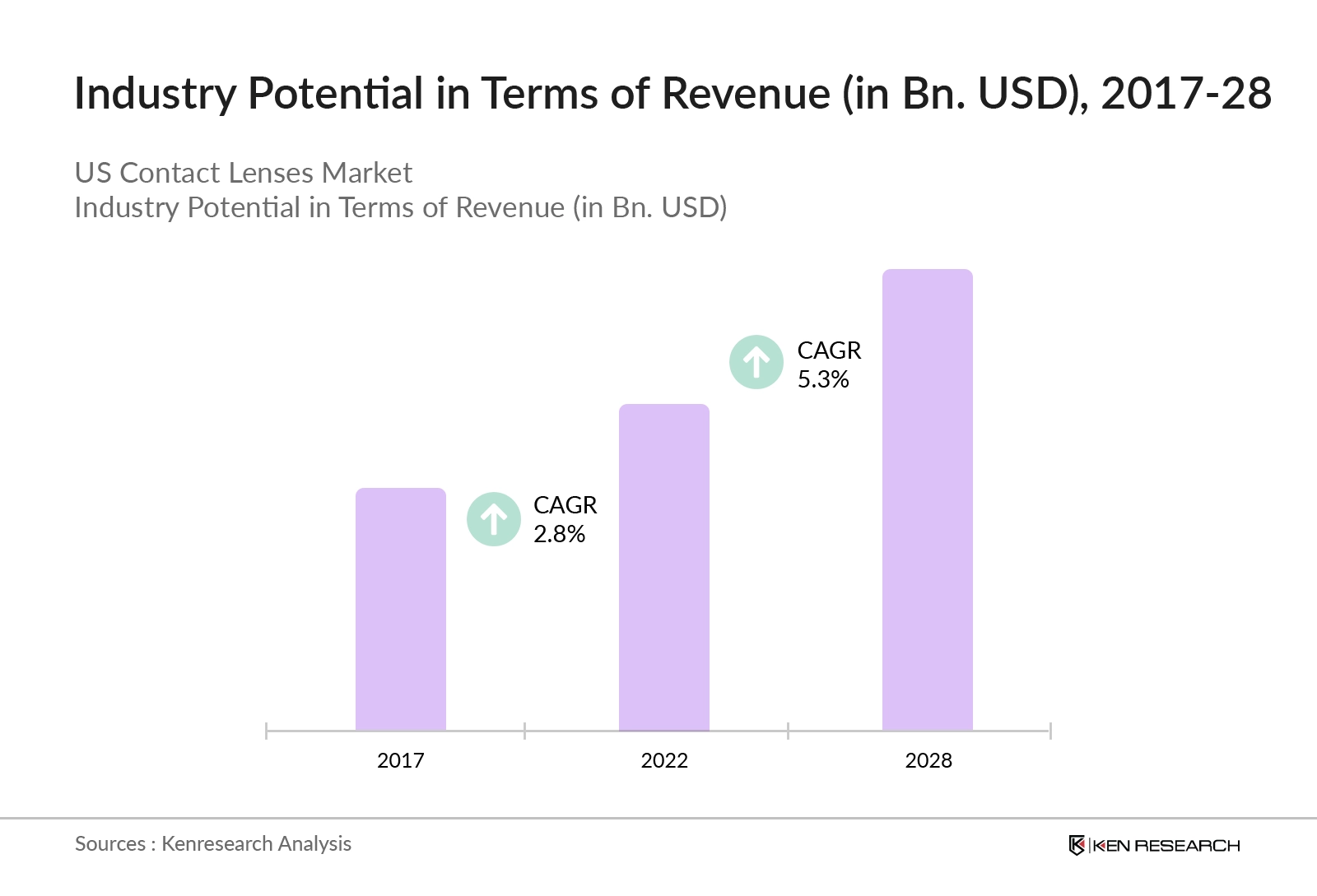

The US Contact lenses market is the largest market for contact lenses and is estimated to grow at a CAGR of 5.3% in the next five years. The increasing population of people with eye disabilities such as nearsightedness (myopia), farsightedness (hyperopia), and distorted vision at all distances (astigmatism) are the major reasons why this market is developing year by year in America. The contact lens market is also making huge developments in the area of Research & Development as a result new technologies and innovations are helping them to understand the customer’s needs and requirements more easily.

In 2022, 45 million Americans are using lenses as they are facing some sort of eye problem and one-third of them are women. People prefer contact lenses as per their preference like soft contact lenses, hybrid contact lenses, Rigid Gas permeable lenses, and others. The contact lenses market is highly competitive and due to its upward growth, new players are also arriving in the market alongside the existing one.

The US contact lenses market is huge and has several significant players competing in the market. Both domestic and International Players are dominating the US contact lenses market, companies such as Johnson and Johnson vision care Inc, Alcon, the Copper Companies Inc, Menicon Co., Ltd, Hoya Corporation, Essilor Luxottica, Star Surgical, Carl Zeis Meditec AG, and Bausch & Lomb are operating in the market.

US Contact Lenses Market Analysis

- Following the pandemic, the US contact lens market is expected to increase at a good rate. The US contact lens market is expected to grow at a 5.3% CAGR between 2023 and 2028.

- Marker leaders like Copper Companies Inc., Johnson & Johnson, and Alcon have increased their R&D expenditure and are investing aggressively in the R&D department to improve existing technology and discover innovations in the market of contact lenses. This was done to increase lens efficiency, research new technologies, and embrace current lens-making techniques.

- Thanks to the latest technology now companies are coming up with new products. Alcon, another key player in the market, has introduced the TOTAL30 product. In America and Europe, this is a premium, reusable Toric lens for astigmatism.

- Another Variable that is helping the US contact lenses market is the involvement of AI (Artificial Intelligence) in the production of lenses production across the country. Not only in America but even in the global lens market influence of AI is increasing day by day. American Companies are also aiming to apply AI (Artificial Intelligence) in lens manufacture and development. AI uses a simple clinical symptomatic approach, and contact lenses that track the client's physiological limits via a remote chip, and a small sensor are important breakthroughs in biomedicine.

Key Trends by Market Segment:

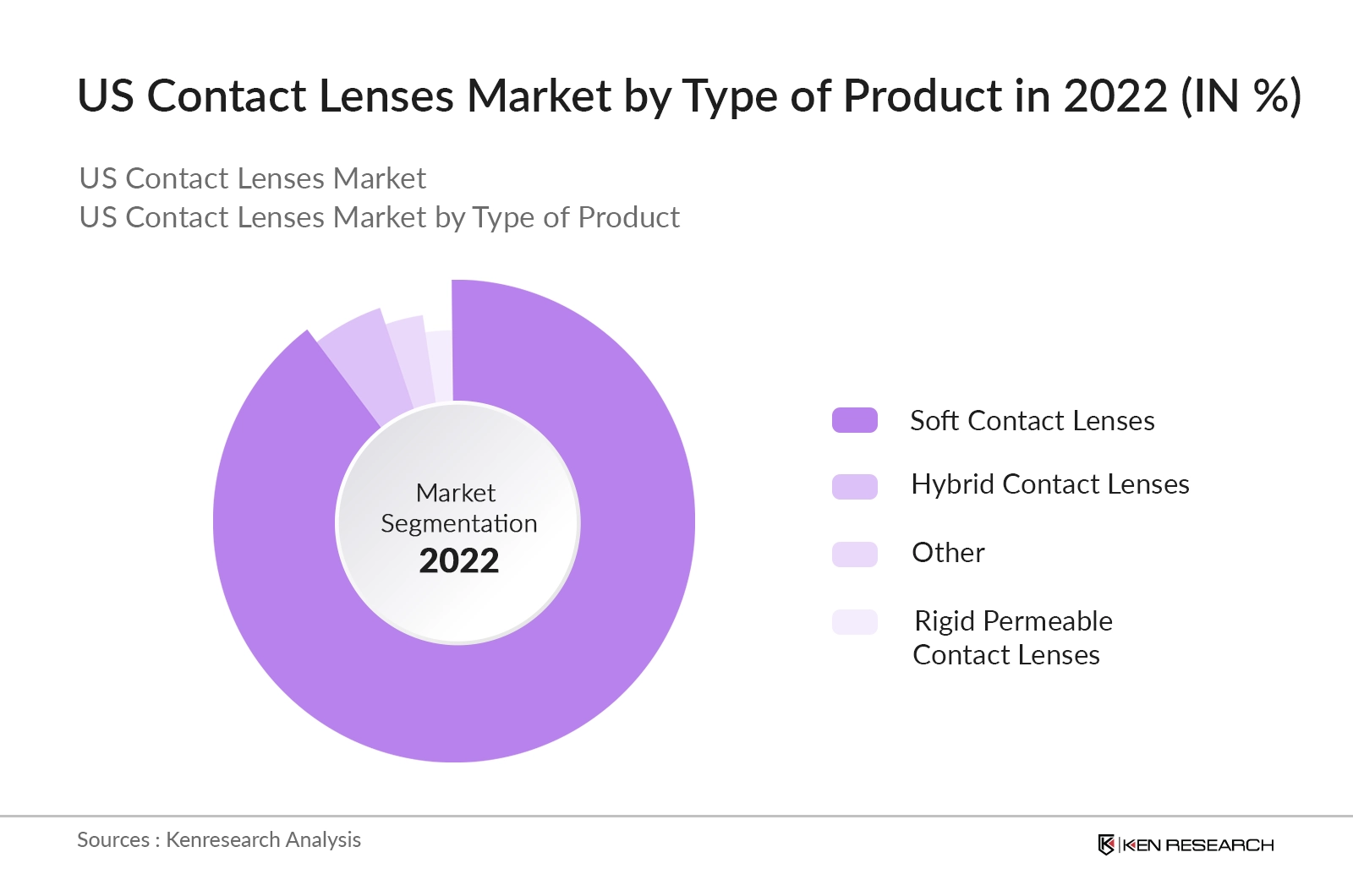

By Type of Products: US Contact lenses segmented into soft contact lenses, Hybrid contact lenses, Rigid gas permeable contact lenses, and other types. In 2022, Soft contact lenses were dominating the contact lenses market and in the product segment.

- Because soft contact lenses are built of adaptable, water-absorbent polymers that are comfortable to utilize and adjust. Owing to that majority of contact wearers prefer soft contact lenses.

- Hybrid contact lenses coordinated the finest qualities of soft and solid gas-permeable lenses. They have a firm internal ring for clarity and an adaptable external band for comfort. RGP lenses are comprised of a harder substance that lets oxygen pass over, boosting eye well-being. They are more strong than soft lenses and allow sharper vision rectification.

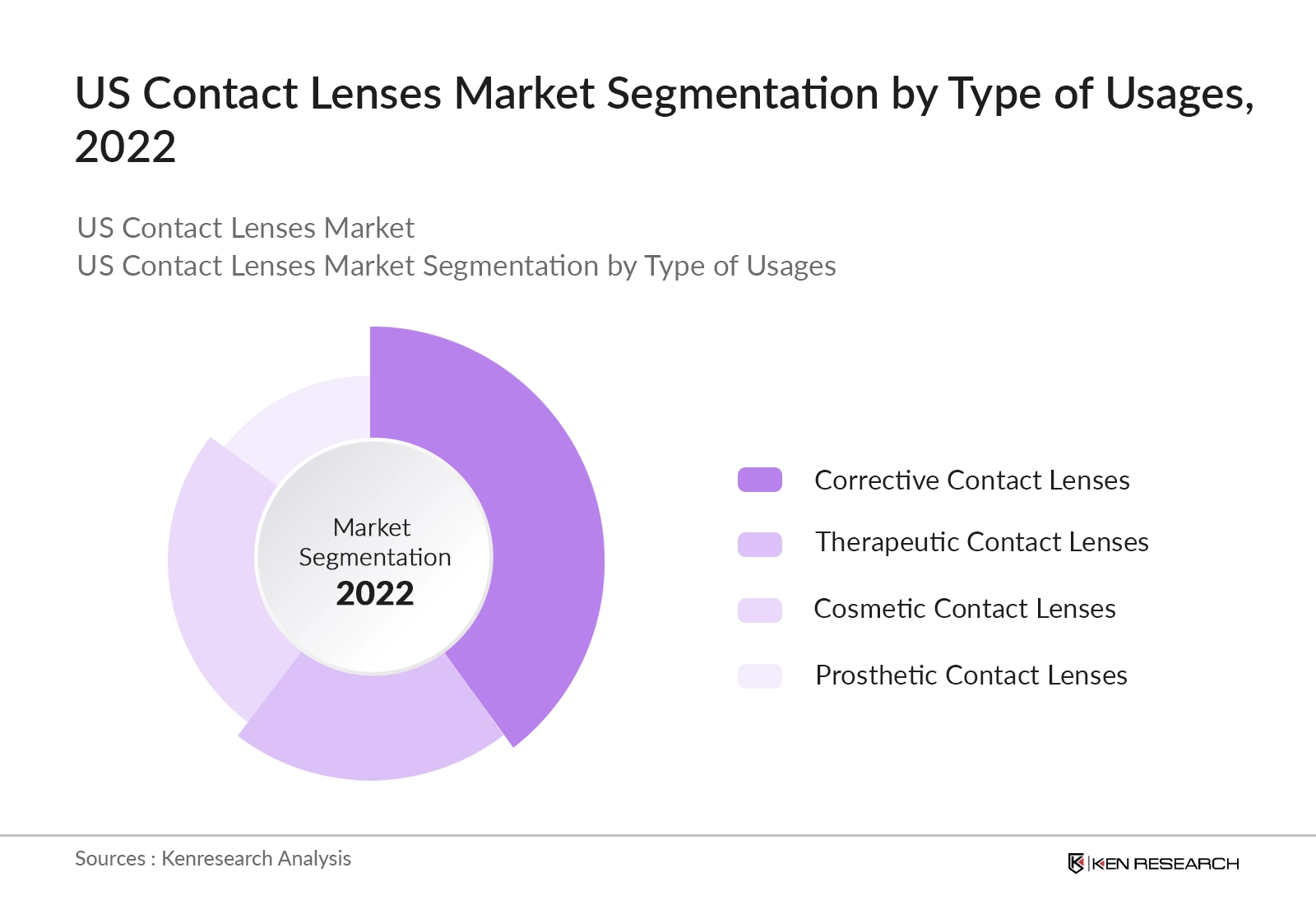

By Type of Usage: The US is divided into four categories based on the type of Usage that are: Corrective contact lenses, Therapeutic contact lenses, Cosmetic contact lenses, and Prosthetic contact lenses. Out of the four categories, corrective contact lenses are leading the market. Because corrective contact lenses are planned to address refractive errors, such as myopia (nearsightedness), hyperopia (farsightedness), astigmatism, and presbyopia. These lenses modify the way light enters the eye, guaranteeing that it centers accurately on the retina, hence giving clear vision.

- Therapeutic contact lenses are endorsed to manage particular eye conditions, help in healing, or give relief from distress. These lenses are utilized to ensure the cornea amid recovery from wounds, surgeries, or certain eye diseases.

- Cosmetic contact lenses are utilized to alter or improve the appearance of the eye. They can modify eye color, make extraordinary impacts, or add patterns. Prosthetic contact lenses are utilized to improve the appearance of a distorted or harmed eye due to damage, infection, or congenital conditions.

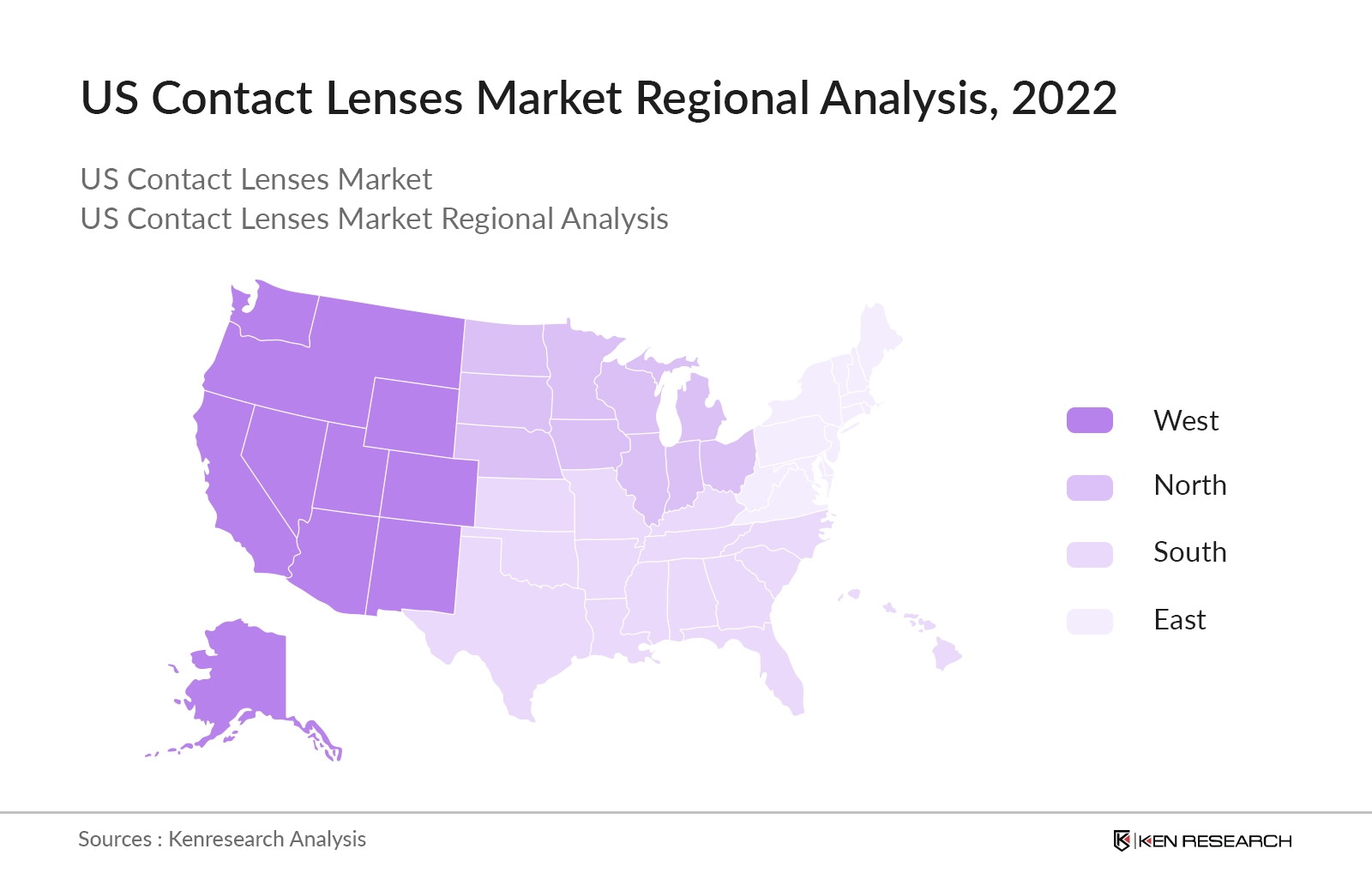

By Geography: When it comes to segmentation of the US contact lenses market on the bases of the region. Then it is mainly divided into four major regions: North, East, West, and South. The northern region is dominating the contact lenses market in America in 2022 because urban centers in the north are the hubs of eye care serveries in the country. States such as New York, New Jersey, Massachusetts, Pennsylvania, and others are part of the northern region.

The south region includes states like Florida, North Carolina, Georgia, and Virginia. This region has a huge market for daily disposable lenses due to the warmer climate. East region of America also influences a major portion of the US contact lenses market as it has several medical facilities located in the region. The west region has the most advanced lens technologies in the country thus it has a market for digital contact lenses.

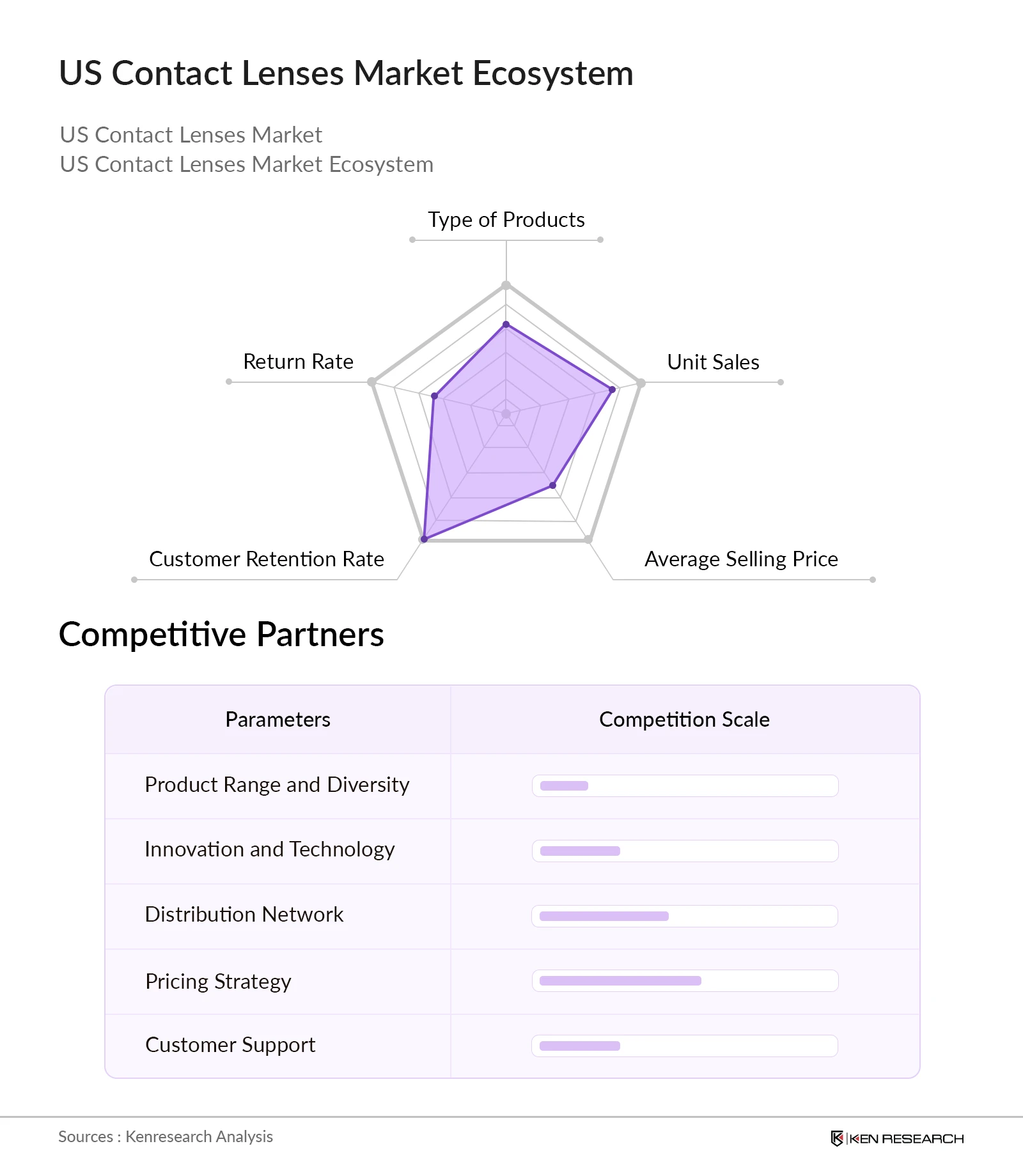

Competitive Landscape:

In the US contact lens market, several companies are active. Johnson and Johnson Vision Care Inc, Alcon, Bausch & Lomb, the copper companies Inc, Menicon Co., Ltd, Hoya Corporation, Essilor Luxottica, Star Surgical, and Carl Zeis Meditec AG are the major participants in this market.

However, a few companies dominate the market, including Johnson & Johnson Vision Care Inc, Alcon, and Bausch & Lomb. These two businesses control about half of the contact lens market. These companies are constantly increasing their operations as they acquire more and more clients. All of these companies are aggressively investing in the US contact lens market.

The US contact lens market is highly competitive, variables contributing to the competitive landscape incorporate product advancement, pricing techniques, brand reputation, distribution systems, and the capacity to adjust to advancing consumer inclinations.

Manufacturers frequently contribute to research and advancement to present new technologies and materials that upgrade lens comfort, vision rectification, and comfort. Marketing efforts, organizations with eye care professionals, and online retail channels moreover play a part in forming competitiveness. As the market is set to witness huge growth in the coming years the market will witness several new entrants in the market. New entrants will bring innovation and will pose a lot of difficulties to the existing players.

Recent Developments:

- Contact lens producers are focusing on technological developments to upgrade wearer comfort, progress vision rectification, and address issues like dry eyes. Smart contact lenses with integrated sensors for observing well-being measurements and expanded wear were being explored.

- The rise of e-commerce is impacting the dissemination of contact lenses. Online retailers were picking up popularity due to their comfort, competitive costs, and subscription-based models for lens replenishment.

- June 2022: Johnson & Johnson Vision, a part of Johnson & Johnson MedTech, received FDA clearance for its latest contact lens innovation, ACUVUE OASYS MAX 1-Day and ACUVUE OASYS MAX 1-Day MULTIFOCAL.

- Progresses in lens manufacturing permitted for more personalized and custom-fit lenses, tending to particular vision needs and eye shapes. This drift is especially outstanding in specialty lenses like Toric and multifocal lenses.

Future Outlook:

The US contact lenses market is expected to grow at a CAGR of 5.3% from 2022 to 2028 with an increasing number of eye inaccuracies among the younger population.

- The market of contact lenses market is expected to grow at a steady rate due to the increasing number of lens wearers population and individuals with visual impairments, growing eye safety concerns and awareness of disposable lenses, and emerging focus on the optics and optometry field development.

- Daily disposable lenses are expected to take over the market in the product category as these lenses are the first choice of customers due to their easy handling and the convenience it provides.

- Future lenses, will be able to monitor eye pressure, identify glaucoma (a disease that destroys the optic nerve), and even generate images of the retinal vasculature for early identification of hypertension, stroke, and diabetes.

- Contact lenses will be used to identify systemic and ocular surface diseases, manage and cure a variety of ocular ailments, and as devices to correct presbyopia, regulate the progression of myopia, or provide augmented vision. New advancements in contact lens packing and storage containers are also discussed.

Scope of the Report

|

US Contact Lenses Market Segmentation |

|

|

By Type of Products |

Soft Contact Lenses Hybrid Contact Lenses RGP Contact Lenses |

|

By Type of Design |

Corrective contact lenses Therapeutic contact lenses Cosmetic contact lenses Prosthetic contact lenses |

|

By Region |

North West South East |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Potential Market Entrants

Contact lenses Companies

Retailers

Market Researchers and Analysts

Distributors and suppliers

E-commerce companies

Potential Investors

Industry Associations

Government Bodies & Regulating Authorities

Period Captured in the Report:

Historical Period: 2017-2022

Base Year: 2022

Forecast Period: 2022-2028

Companies

Major Players Mentioned in the Report:

Johnson and Johnson Vision Care Inc

Alcon

Bausch & Lomb

The copper companies Inc

Menicon Co. Ltd

Hoya Corporation

Essilor Luxottica

Star Surgical

Table of Contents

1. Executive Summary

2. US Contact Lenses Market Overview

2.1 Taxonomy of the Market

2.2 Industry Value Chain

2.3 Ecosystem

2.4 Government Regulations/Initiatives for the Market

2.5 Growth Drivers of the US Contact Lenses Market

2.6 Issues and Challenges of the US Contact Lenses Market

2.7 Impact of COVID-19 on the US Contact Lenses Market

2.8 SWOT Analysis

3. US Contact Lenses Market Size, 2017 – 2022

4. US Contact Lenses Market Segmentation

4.1 By Product Type, 2017 - 2022

4.2 By Usage, 2017 - 2022

4.3 By Regional Split (North/East/West/South), 2017 - 2022

5. Competitive Landscape

5.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

5.2 Strategies Adopted by Leading Players

5.3 Company Profiles Comparison

5.3.1 Alcon Laboratories Inc.

5.3.2 The Copper Companies Inc

5.3.3 Menicon Co.

5.3.4 Hoya Corporation

5.3.5 Essilor Luxottica

5.3.6 Johnson & Johnson Vision Cre INc

5.3.7 Bausch & Lomb

6. US Contact Lenses Market Size, 2022 – 2028

7. US Contact Lenses Market Segmentation

7.1 By Product Type, 2022 – 2028

7.2 By Usage, 2022 - 2028

7.3 By Regional Split (North/East/West/South), 2022 - 2028

8. Analyst Recommendations

9. Research Methodology

10. Disclaimer

11. Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Market Building:

Collating statistics on the contact lenses market over the years, penetration of marketplaces, and service providers ratio to compute revenue generated for the contact lenses products. We will also review product quality statistics to understand the revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team has approached multiple contact lenses companies providing channels and understanding the nature of product segments and sales, consumer preference, and other parameters, which supported us validate statistics derived through the bottom-to-top approach from contact lenses providers.

Frequently Asked Questions

01 How big is the contact lens market in US?

The market size of US Contact lens market is $5.76 billion

02 What percent of US wears contacts?

16.7% of population in the United States wears contact lenses

03 What is the future scope of contact lenses in USA?

US Contact Lenses Market is expected to grow at a CAGR of 5.3% in 2023-2033

04 Who is the market leader in contact lenses in USA?

Johnson & Johnson has the largest market share in 2022. The dominance of the company is due to number of product launches & strategic collaborations with other players to strengthen its position in the market

05 How many Americans need lenses or contacts?

Over 61% of Americans need some kind of vision correction

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.