USA Contraception Market Outlook to 2030

Region:North America

Author(s):Sanjana Verma

Product Code:KROD1250

December 2024

99

About the Report

USA Contraception Market Overview

- The USA contraception market is valued at USD 9 billion, driven by increasing awareness, government initiatives, and advancements in contraceptive technologies. Factors such as improved accessibility through healthcare programs and insurance coverages have propelled market growth, making contraception more affordable for a larger segment of the population. This includes expanded Medicaid coverage and initiatives under the Title X family planning program.

- Major cities such as New York, Los Angeles, and Chicago are dominant in the USA contraception market due to their large population base, better access to healthcare facilities, and extensive public health campaigns. Additionally, states like California and New York have robust family planning programs and Medicaid expansion policies, which support higher contraceptive uptake. The presence of well-established healthcare infrastructures, including clinics and pharmacies, further ensures widespread availability of contraception products in these areas.

- The Affordable Care Act (ACA) mandates that private insurance plans cover all FDA-approved contraceptive methods without copayments, ensuring access to contraceptives for 61 million women in 2023. This policy has had a profound impact on contraceptive use in the U.S., reducing financial barriers and increasing the use of long-acting reversible contraceptives (LARCs) and other modern methods. Medicaid also covers these services for low-income women, ensuring comprehensive access across demographics.

USA Contraception Market Segmentation

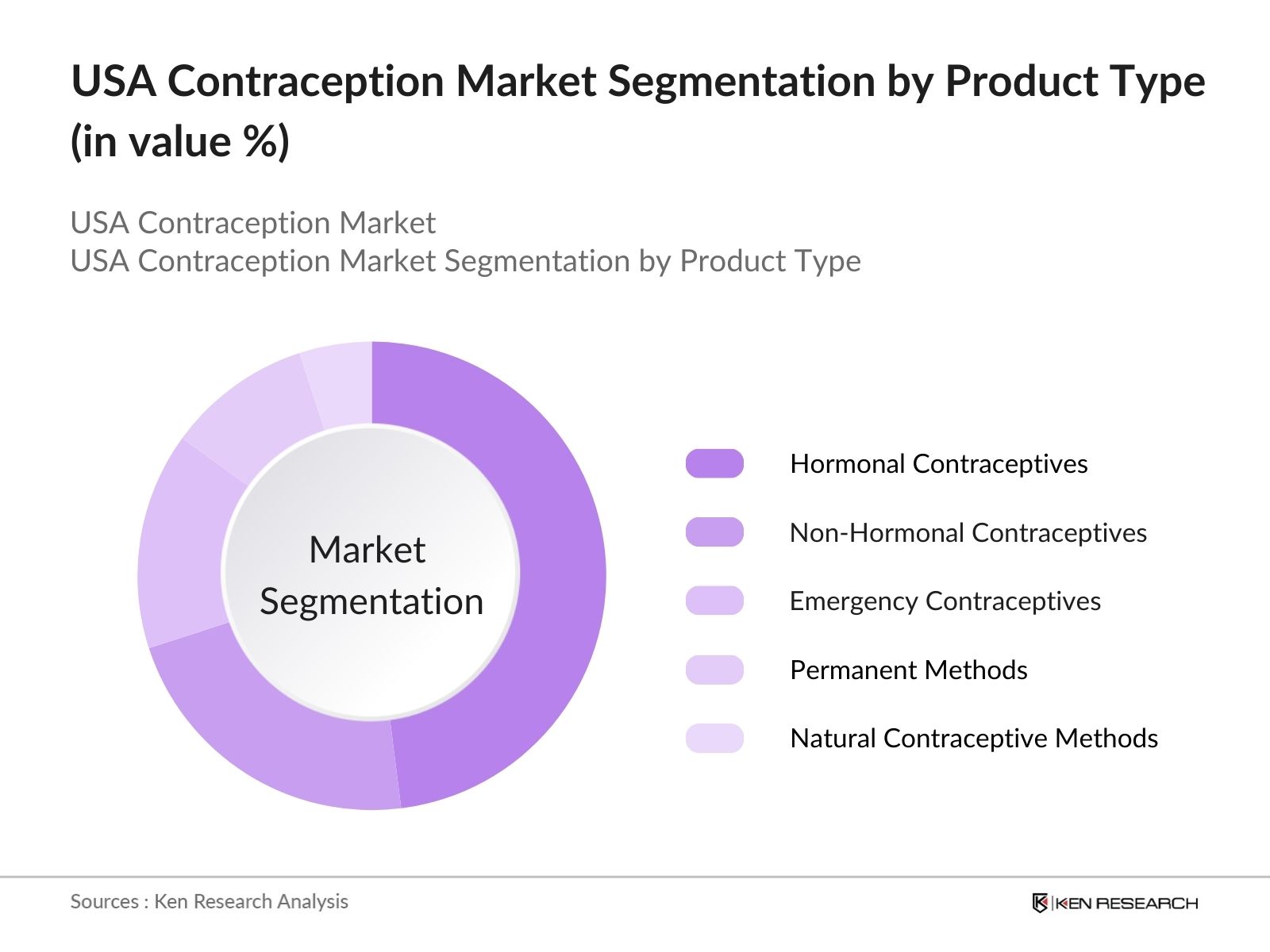

By Product Type: The USA contraception market is segmented by product type into hormonal contraceptives, non-hormonal contraceptives, emergency contraceptives, permanent methods, and natural contraceptive methods. Recently, hormonal contraceptives have had a dominant market share in the USA under the product type segmentation. This dominance is due to the ease of use and high efficacy of methods such as oral pills, patches, and hormonal IUDs.

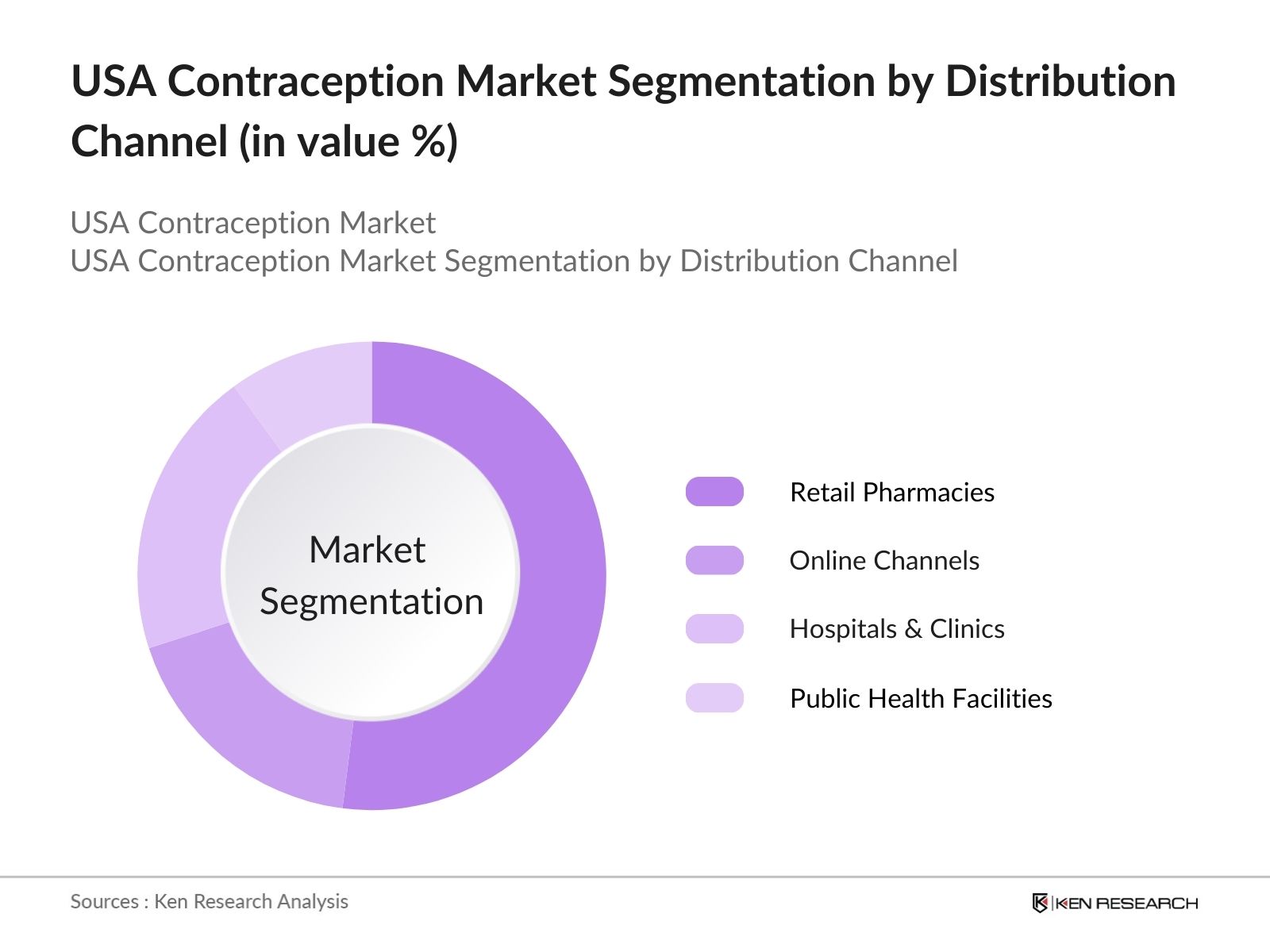

By Distribution Channel: The USA contraception market is segmented by distribution channel into retail pharmacies, online channels, hospitals & clinics, and public health facilities. Retail pharmacies hold a dominant position in this segmentation, driven by their extensive network and accessibility. Pharmacies, such as CVS and Walgreens, provide a wide range of contraception products, making it easy for consumers to purchase items over-the-counter or with a prescription.

By Distribution Channel: The USA contraception market is segmented by distribution channel into retail pharmacies, online channels, hospitals & clinics, and public health facilities. Retail pharmacies hold a dominant position in this segmentation, driven by their extensive network and accessibility. Pharmacies, such as CVS and Walgreens, provide a wide range of contraception products, making it easy for consumers to purchase items over-the-counter or with a prescription.

USA Contraception Market Competitive Landscape

The USA contraception market is dominated by major pharmaceutical and healthcare companies that provide a variety of products ranging from oral contraceptives to IUDs. Companies like Bayer AG and Pfizer Inc. lead the market with well-established brands, comprehensive product portfolios, and significant R&D investments. These players maintain strong distribution channels, partnering with pharmacies, clinics, and online platforms to ensure product accessibility across the country. The competitive landscape is also marked by the presence of both established companies and newer entrants who are leveraging technological advancements in contraception delivery systems.

|

Company Name |

Establishment Year |

Headquarters |

Key Products |

R&D Expenditure |

Global Presence |

Revenue (USD Bn) |

Recent Innovations |

Strategic Collaborations |

|

Bayer AG |

1863 |

Leverkusen, GER |

- |

- |

- |

- |

- |

- |

|

Pfizer Inc. |

1849 |

New York, USA |

- |

- |

- |

- |

- |

- |

|

Merck & Co. Inc. |

1891 |

New Jersey, USA |

- |

- |

- |

- |

- |

- |

|

Teva Pharmaceuticals |

1901 |

Israel |

- |

- |

- |

- |

- |

- |

|

Agile Therapeutics |

1997 |

New Jersey, USA |

- |

- |

- |

- |

- |

- |

USA Contraception Market Analysis

Growth Drivers

- Rising Awareness and Education Programs: In 2023, the U.S. government allocated $286 million through Title X for family planning services, providing crucial education on contraceptive methods to low-income and marginalized communities. Additionally, NGOs like Planned Parenthood have conducted widespread educational campaigns, increasing access to accurate contraceptive information for over 3 million individuals annually. This public health focus has been instrumental in improving contraceptive use, especially among younger populations.

- Increasing Access to Modern Contraceptive Methods: The Affordable Care Act (ACA) mandates contraceptive coverage under private insurance plans, ensuring access to 61 million women as of 2023, significantly expanding the adoption of modern contraceptives like oral pills, IUDs, and implants. The Medicaid program further strengthens access by covering 75% of contraceptive needs for low-income women, with nearly 40 million beneficiaries receiving subsidized contraception. The expansion of health insurance subsidies has resulted in more widespread use of modern contraception methods, contributing to a steady increase in their availability and affordability.

- Expanding E-commerce Channels for Contraception Distribution: The rise of digital health platforms such as Nurx and SimpleHealth has revolutionized contraception distribution in the USA. In 2023, over 1.5 million Americans used telemedicine to consult on and receive prescriptions for contraceptives, a number that has surged due to the COVID-19 pandemic and increased comfort with digital healthcare. E-commerce platforms have played a pivotal role in delivering contraceptives directly to consumers' homes, enhancing accessibility, particularly for those in remote or underserved areas.

Challenges

- Limited Access in Rural and Low-income Areas: Despite federal programs, access to contraceptives in rural and low-income areas remains a significant challenge. Approximately 19 million women in the U.S. live in contraceptive desertsareas lacking reasonable access to a clinic that offers the full range of contraceptive methods. Supply chain issues also exacerbate the problem, limiting the availability of essential contraceptives in remote locations. Federal support, while extensive, has yet to fully bridge the gap in these underserved regions.

- Side Effects and Health Concerns: Concerns about the side effects of hormonal contraceptives, such as weight gain, mood changes, and long-term fertility effects, continue to deter use. In a 2023 report, 1 in 5 women discontinued hormonal contraceptives due to these side effects, particularly those related to combined oral contraceptives. Medical complications, including increased risk of blood clots with specific hormonal methods, have also raised concerns, prompting the need for alternative non-hormonal methods.

USA Contraception Market Future Outlook

USA contraception market is expected to experience significant growth driven by continuous advancements in contraceptive technologies, increased awareness, and governmental support for reproductive health services. The rise in e-commerce platforms for the distribution of contraception products and the ongoing development of male contraceptives are likely to create new opportunities for market expansion. Furthermore, collaborations between pharmaceutical companies and telemedicine providers will improve the accessibility and distribution of contraception products, particularly in underserved areas.

Future Market Opportunities

- Emerging Technology in Contraceptions: Technological advancements in contraceptives, especially in long-acting reversible contraceptives (LARCs) like IUDs and implants, are providing new opportunities for growth. As of recent reports, about18% of all contraceptive users aged 1544rely on LARCs, with14% using IUDsand4% using implant. Innovations like wearable fertility devices are also emerging, offering women more control over their reproductive health with non-invasive solutions. This trend is expected to continue expanding the contraceptive options available, especially for women seeking long-term solutions.

- Growing Demand for Non-Hormonal Alternatives: With increasing concerns over hormonal contraceptives' side effects, demand for non-hormonal alternatives has surged. In 2023, nearly 7 million U.S. women used barrier methods like condoms or diaphragms, while digital apps for natural cycle tracking, such as Clue and Natural Cycles, gained over 4 million users. These methods provide an effective alternative for individuals seeking to avoid hormonal impacts, offering a growing market for non-invasive contraceptive solutions.

Scope of the Report

|

By Product Type |

Hormonal Contraceptives Non-Hormonal Contraceptives Emergency Contraceptives Permanent Methods Natural Contraceptive Methods |

|

By Distribution Channel |

Retail Pharmacies Online Channels Hospitals & Clinics Public Health Facilities |

|

By User Type |

Male Contraceptive Users Female Contraceptive Users |

|

By Age Group |

Teenagers and Young Adults Adults (20-35 Years) Older Adults (35+ Years) |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Pharmaceutical Manufacturers

Contraceptive Device Manufacturers

Hospitals & Clinics

Retail Pharmacies

Online Healthcare Platforms

Government and Regulatory Bodies (FDA, Department of Health and Human Services)

Investors and Venture Capitalist Firms

Health Insurance Providers

Companies

Players Mentioned in the Report

Bayer AG

Pfizer Inc.

Merck & Co. Inc.

Teva Pharmaceuticals

Agile Therapeutics

CooperSurgical, Inc.

Mylan N.V.

Apothecus Pharmaceutical Corp.

Church & Dwight Co., Inc.

Lupin Pharmaceuticals

Table of Contents

USA Contraception Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Contraception Usage and Adoption (Usage Rate, Accessibility, Demographics)

1.4. Key Market Dynamics

1.4.1. Key Stakeholders (Public Health Organizations, Manufacturers, Retailers)

1.4.2. Market Segmentation Overview

USA Contraception Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

USA Contraception Market Analysis

3.1. Growth Drivers

3.1.1. Rising Awareness and Education Programs (Public Health Initiatives, NGO Campaigns)

3.1.2. Increasing Access to Modern Contraceptive Methods (Insurance Coverage, Government Subsidies)

3.1.3. Favorable Regulatory Landscape (FDA Approvals, Title X Family Planning Program)

3.1.4. Expanding E-commerce Channels for Contraception Distribution (Digital Platforms, Telemedicine)

3.2. Market Challenges

3.2.1. Limited Access in Rural and Low-income Areas (Supply Chain Issues, Lack of Clinics)

3.2.2. Social and Cultural Barriers (Religious Opposition, Misinformation)

3.2.3. Side Effects and Health Concerns (Hormonal Impact, Medical Complications)

3.2.4. Competition from Non-Medical Contraceptive Methods (Natural Methods, Abstinence Education)

3.3. Opportunities

3.3.1. Emerging Technology in Contraception (Long-Acting Reversible Contraceptives, Wearable Devices)

3.3.2. Growing Demand for Non-Hormonal Alternatives (Barrier Methods, Natural Cycle Tracking)

3.3.3. Collaborations with Telehealth Services (Virtual Consultations, Online Prescriptions)

3.3.4. Increased Government Funding for Family Planning Programs (Medicaid, Health Grants)

3.4. Trends

3.4.1. Growth in Over-the-Counter Availability (Self-care Products, Retail Expansion)

3.4.2. Adoption of Mobile Applications for Contraception Tracking (Period and Fertility Tracking Apps)

3.4.3. Rise in Male Contraceptive Research and Products (Male Hormonal Contraceptives, Vasectomy Options)

3.4.4. Personalized Contraception Based on Genomics (DNA Testing, Tailored Hormone Solutions)

3.5. Government Regulation

3.5.1. FDA Approval Process for Contraceptives (Regulatory Pathways, Clinical Trials)

3.5.2. Title X Family Planning Policies (Funding Allocations, Service Accessibility)

3.5.3. Affordable Care Act's Impact on Contraceptive Coverage (Mandates, Private Insurance Coverage)

3.5.4. State-Level Restrictions and Legislations (Abortion Bans, Contraceptive Mandates)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

USA Contraception Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Hormonal Contraceptives (Oral Pills, Patches, Injections, IUDs)

4.1.2. Non-Hormonal Contraceptives (Condoms, Diaphragms, Copper IUDs)

4.1.3. Emergency Contraceptives (Morning-After Pills, Copper IUDs)

4.1.4. Permanent Methods (Sterilization for Men and Women)

4.1.5. Natural Contraceptive Methods (Fertility Awareness, Withdrawal)

4.2. By Distribution Channel (In Value %)

4.2.1. Retail Pharmacies

4.2.2. Online Channels

4.2.3. Hospitals & Clinics

4.2.4. Public Health Facilities

4.3. By User Type (In Value %)

4.3.1. Male Contraceptive Users

4.3.2. Female Contraceptive Users

4.4. By Age Group (In Value %)

4.4.1. Teenagers and Young Adults

4.4.2. Adults (20-35 Years)

4.4.3. Older Adults (35+ Years)

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

USA Contraception Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bayer AG

5.1.2. Pfizer Inc.

5.1.3. Merck & Co. Inc.

5.1.4. Teva Pharmaceuticals

5.1.5. Mylan N.V.

5.1.6. CooperSurgical, Inc.

5.1.7. Agile Therapeutics

5.1.8. Apothecus Pharmaceutical Corp.

5.1.9. Church & Dwight Co., Inc.

5.1.10. Lupin Pharmaceuticals

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, R&D Investment, Market Share, Manufacturing Capabilities, Geographical Reach, Recent Developments, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

USA Contraception Market Regulatory Framework

6.1. FDA Regulations and Approval Process

6.2. Health Insurance Portability and Accountability Act (HIPAA) Compliance

6.3. State-specific Regulatory Frameworks

6.4. Compliance Requirements for Manufacturers

USA Contraception Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

USA Contraception Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By User Type (In Value %)

8.4. By Age Group (In Value %)

8.5. By Region (In Value %)

USA Contraception Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase of this research involves mapping out the key stakeholders within the USA contraception market, including manufacturers, healthcare providers, and regulatory bodies. Extensive desk research is performed to identify critical variables like product adoption, distribution channels, and regulatory frameworks influencing market dynamics.

Step 2: Market Analysis and Construction

Historical data on contraceptive sales, revenue, and product penetration is gathered to build an analytical framework. This data is supplemented with insights from healthcare providers, who offer valuable perspectives on contraception usage trends and preferences across different consumer segments.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, we conducted interviews with healthcare professionals, pharmacists, and manufacturers. These consultations allowed us to cross-check data, ensuring accuracy in the identified trends and growth drivers, and to assess the operational challenges faced by industry players.

Step 4: Research Synthesis and Final Output

The final synthesis of the research includes the integration of quantitative data with qualitative insights. This comprehensive approach ensures a reliable assessment of the USA contraception market, providing stakeholders with actionable intelligence regarding current market conditions and future opportunities.

Frequently Asked Questions

01. How big is the USA Contraception Market?

The USA contraception market, valued at USD 9 billion in 2023, is primarily driven by increased consumer awareness, advancements in contraceptive technologies, and favorable government policies aimed at improving access to family planning services.

02. What are the challenges in the USA Contraception Market?

Challenges include in USA contraception market limited access in rural areas, social and cultural barriers to contraceptive use, and the health concerns related to long-term use of hormonal contraceptives. Additionally, competition from non-medical contraceptive methods also poses a challenge for market growth.

03. Who are the major players in the USA Contraception Market?

Key players in USA contraception market include Bayer AG, Pfizer Inc., Merck & Co. Inc., Teva Pharmaceuticals, and Agile Therapeutics. These companies dominate due to their extensive product portfolios, established brand presence, and strategic partnerships with healthcare providers.

04. What are the growth drivers of the USA Contraception Market?

Growth in USA contraception market is fueled by increasing public awareness, governmental support through Medicaid and Title X programs, and technological advancements such as long-acting reversible contraceptives (LARCs) and male contraceptive research.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.