USA Conversational AI Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD4281

December 2024

90

About the Report

USA Conversational AI Market Overview

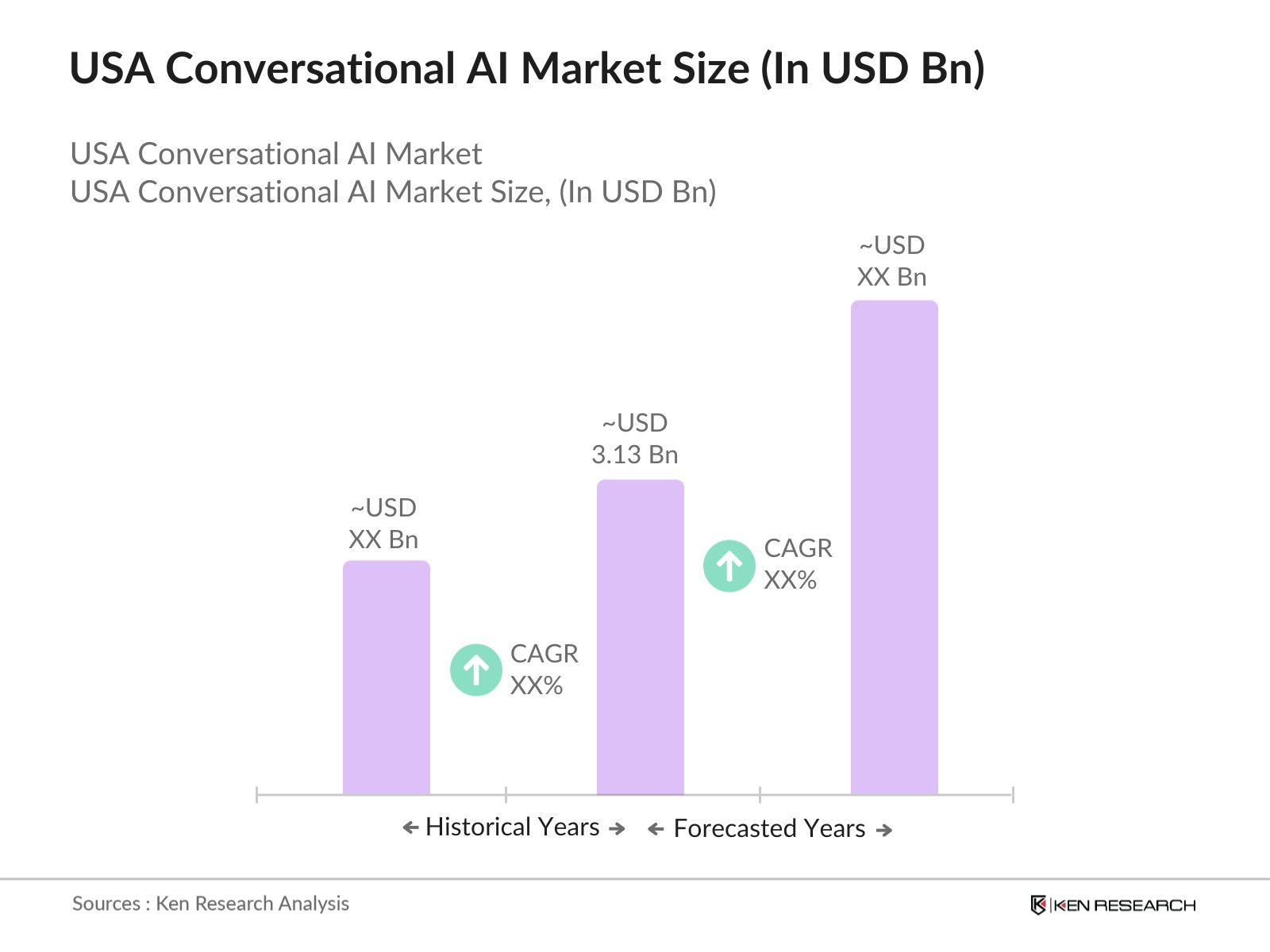

- The USA Conversational AI market is valued at USD 3.13 billion, based on a five-year historical analysis. The market is primarily driven by the rapid adoption of AI-powered customer service applications and virtual assistants in various industries, including healthcare, banking, and retail. The advancements in Natural Language Processing (NLP) and machine learning have significantly contributed to the market's growth, with increasing demand for personalized customer engagement. As companies prioritize automation and customer satisfaction, the market is poised for continuous growth.

- Major cities such as New York, San Francisco, and Seattle dominate the USA Conversational AI market due to their concentration of technology firms and startups, which drive innovation in AI technologies. These cities are also home to leading tech companies like Google, Amazon, and Microsoft, which have heavily invested in conversational AI solutions. The presence of venture capital and a highly skilled tech workforce further solidifies the dominance of these cities in the market.

- he U.S. government, through the National Institute of Standards and Technology (NIST), has introduced a framework to guide the development and deployment of AI technologies, including conversational AI. This initiative aims to establish ethical guidelines and ensure transparency in AI usage. In 2024, over 70% of AI projects in the U.S. are expected to align with this framework, ensuring safe and responsible AI development.

USA Conversational AI Market Segmentation

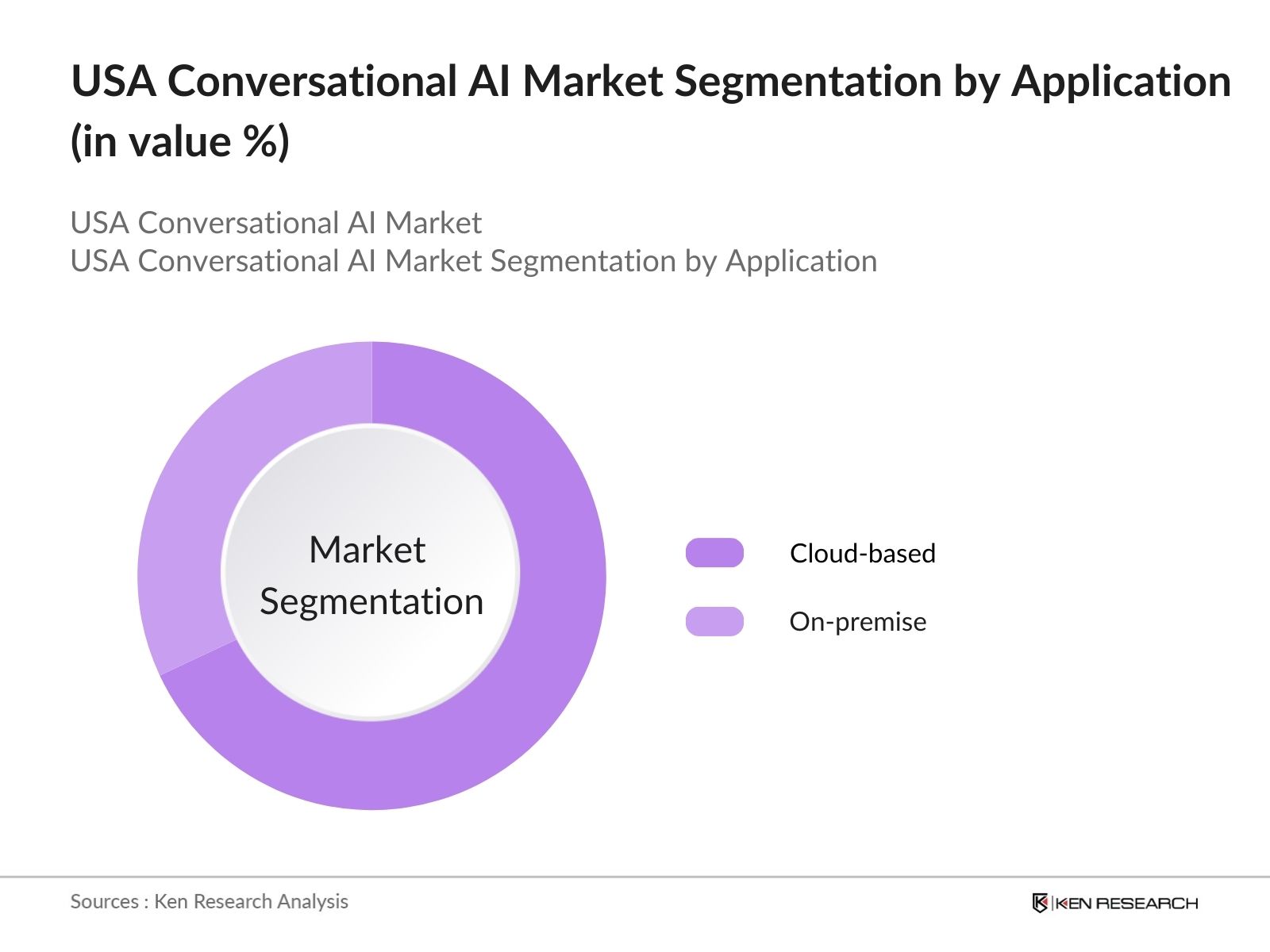

By Deployment Type: The USA Conversational AI market is segmented by deployment type into cloud-based and on-premise solutions. Cloud-based solutions dominate the market, with a share of 68% in 2023. This dominance is due to the flexibility and scalability of cloud infrastructure, which allows businesses to deploy AI solutions without significant capital expenditure on IT infrastructure. Cloud platforms also offer easier integration with other enterprise systems, making them a preferred choice for large corporations and SMEs alike.

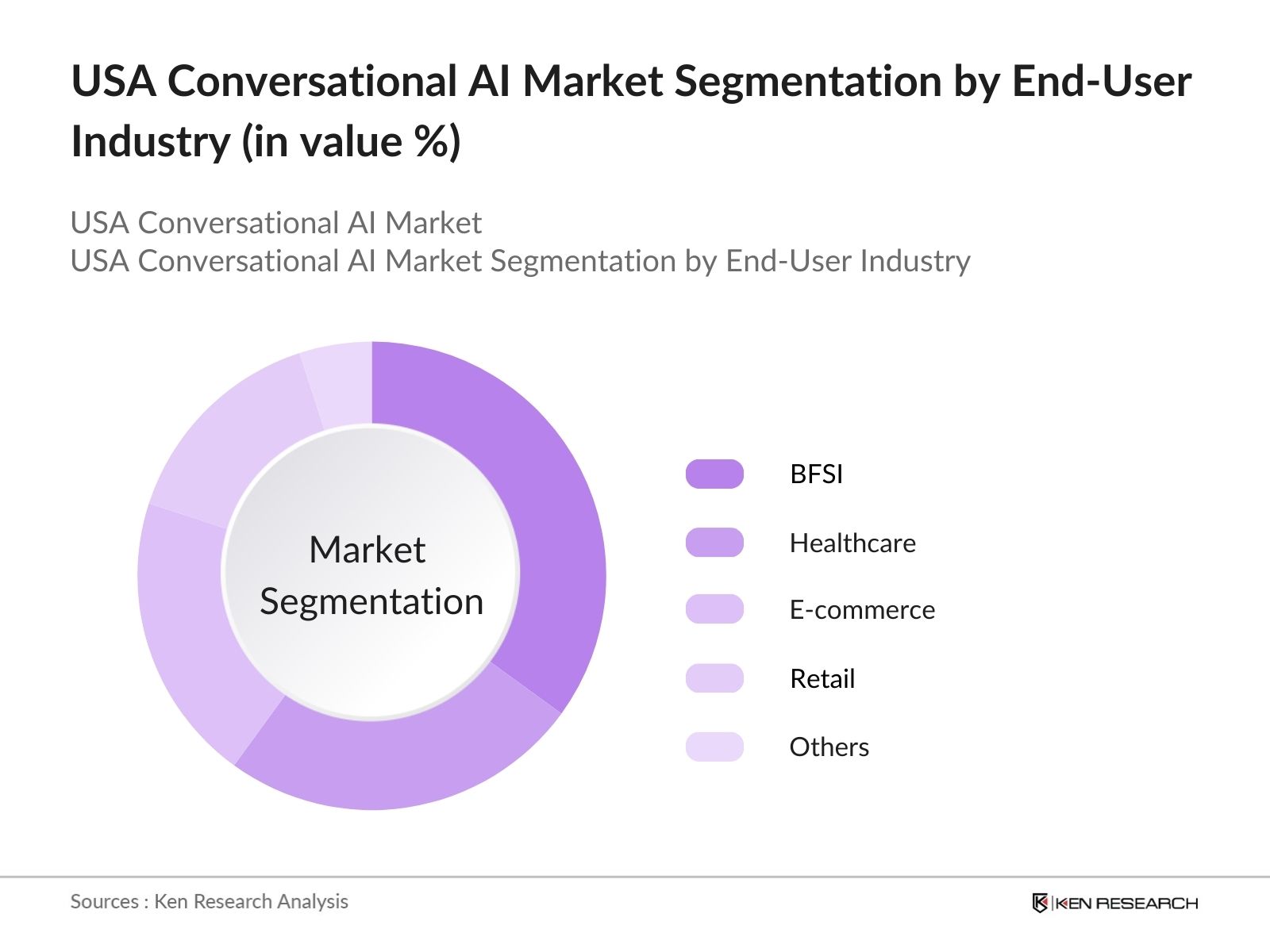

By End-user Industry: The market is also segmented by end-user industry into BFSI, healthcare, e-commerce, and retail. The BFSI sector holds a dominant market share of 35% in 2023. This is driven by the increasing use of conversational AI for automating customer service, enhancing fraud detection, and streamlining payment processing. Financial institutions are leveraging AI to improve customer engagement through personalized banking experiences, which has contributed to the growth of this segment.

USA Conversational AI Market Competitive Landscape

The USA Conversational AI market is dominated by several key players who lead in AI research, development, and deployment across various industries. The competitive landscape showcases the consolidation of the market among a few major companies that have invested significantly in AI-driven solutions.

|

Company Name |

Establishment Year |

Headquarters |

AI Patents |

Revenue (USD Bn) |

R&D Spending |

Global Presence |

Core Technology |

Partnership Networks |

|

Google LLC |

1998 |

Mountain View, CA |

- | - | - | - | - | - |

|

Amazon Web Services, Inc. |

2006 |

Seattle, WA |

- | - | - | - | - | - |

|

Microsoft Corporation |

1975 |

Redmond, WA |

- | - | - | - | - | - |

|

IBM Corporation |

1911 |

Armonk, NY |

- | - | - | - | - | - |

|

Nuance Communications |

1992 |

Burlington, MA |

- | - | - | - | - | - |

USA Conversational AI Market Analysis

Growth Drivers

- Adoption of AI in Customer Service: The adoption of AI in customer service is significantly driving the growth of the conversational AI market in the U.S. Companies are increasingly implementing AI-driven chatbots and virtual assistants to streamline customer interactions and enhance user experience. For instance, large companies like American Express and Bank of America use AI-powered assistants to manage customer queries and improve operational efficiency. In 2024, over 4 million customer service jobs in the U.S. are expected to involve some level of AI integration, reflecting the increasing dependency on AI for customer support.

- Surge in Use of NLP (Natural Language Processing) Technology: NLP has seen a massive surge in its use across industries like e-commerce, healthcare, and financial services. This technology helps conversational AI systems understand and interpret human language, making customer interactions smoother and more personalized. Major players such as Google and Microsoft are investing heavily in refining NLP models, and in 2024, it is estimated that nearly 60 million smart devices in the U.S. will be powered by NLP-driven AI, making it a critical driver for market growth.

- Advancements in Machine Learning Models: Machine learning (ML) is a key component of conversational AI, and continuous advancements in ML models have led to significant improvements in the accuracy and functionality of AI systems. For example, in the healthcare sector, AI models are now capable of diagnosing conditions and scheduling appointments with high efficiency, handling over 30 million interactions annually in 2024 in the U.S. alone. This has led to a growing reliance on AI systems for more complex and dynamic tasks in both customer-facing and backend operations.

Market Challenges

- Data Privacy and Security Concerns: With conversational AI systems managing sensitive customer information, concerns around data privacy and security remain prominent. The U.S. government, through agencies like the Federal Trade Commission (FTC), has introduced stringent regulations to safeguard user data, particularly in sectors like finance and healthcare. In 2024, there are projected to be over 5,000 reported data breaches involving AI-driven systems, pushing companies to invest in more robust security protocols to mitigate these risks.

- High Implementation Costs for Small Enterprises: Small and medium-sized enterprises (SMEs) often face challenges in adopting conversational AI due to high upfront costs associated with AI software and hardware. In 2024, it is expected that over 300,000 SMEs in the U.S. will continue to operate without AI integration due to financial constraints, slowing down the overall adoption rate among smaller businesses. Despite the availability of cloud-based solutions, the cost remains a significant hurdle for many companies.

USA Conversational AI Market Future Outlook

Over the next five years, the USA Conversational AI market is expected to see significant growth driven by continued technological advancements in AI, increasing demand for personalized customer experiences, and the integration of AI with omnichannel communication platforms. The expansion of AI into healthcare, banking, and e-commerce will also accelerate the markets development. The rise of voice-enabled AI and advancements in NLP will play a pivotal role in enhancing customer engagement and business operations across various industries.

Market Opportunities

- Expansion in Healthcare and Telemedicine: The healthcare sector in the U.S. presents significant opportunities for conversational AI, particularly in telemedicine and patient engagement. In 2024, over 150 million telemedicine consultations are expected to be facilitated by AI-driven platforms, making healthcare one of the fastest-growing sectors for conversational AI adoption. Companies like IBM and Oracle are actively developing AI-powered healthcare solutions to streamline patient interactions and reduce administrative burdens.

- Increasing Demand for Voice Assistants in Smart Devices: Smart devices equipped with voice assistants, such as Amazon Echo and Google Home, have seen a tremendous rise in demand across U.S. households. In 2024, it is projected that nearly 90 million homes will have at least one smart device featuring conversational AI, offering new opportunities for companies to tap into this growing market. The integration of AI-driven voice assistants into everyday devices continues to drive demand in the consumer electronics sector.

Scope of the Report

|

By Deployment Type |

On-premise Cloud-based |

|

By End-user |

BFSI Healthcare E-commerce and Retail Telecom Media and Entertainment |

|

By Application |

Customer Support Virtual Assistants Sales and Marketing Payment Processing |

|

By Technology |

Natural Language Processing (NLP) Machine Learning (ML) Automated Speech Recognition (ASR) Text-to-Speech (TTS) |

|

By Region |

North East Midwest South West |

Products

Key Target Audience

Technology Startups

AI Solution Providers

Healthcare Institutions

BFSI Sector Organizations

Retail and E-commerce Companies

Telecommunications Firms

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Federal Communications Commission - FCC)

Companies

Players Mentioned in the Report:

Google LLC

Amazon Web Services, Inc.

Microsoft Corporation

IBM Corporation

Nuance Communications

Salesforce

Oracle Corporation

SAP SE

Conversica Inc.

Kore.ai

Table of Contents

1. USA Conversational AI Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Conversational AI Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Conversational AI Market Analysis

3.1. Growth Drivers

3.1.1. Adoption of AI in Customer Service

3.1.2. Surge in Use of NLP (Natural Language Processing) Technology

3.1.3. Advancements in Machine Learning Models

3.1.4. Integration with E-commerce and Retail

3.2. Market Challenges

3.2.1. Data Privacy and Security Concerns

3.2.2. High Implementation Costs for Small Enterprises

3.2.3. Complexity in Multi-language and Multimodal Communication

3.2.4. Integration Issues with Legacy Systems

3.3. Opportunities

3.3.1. Expansion in Healthcare and Telemedicine

3.3.2. Increasing Demand for Voice Assistants in Smart Devices

3.3.3. Rising Investment in AI Startups

3.3.4. AI-driven Analytics for Personalized Marketing

3.4. Trends

3.4.1. Shift Toward Voice-enabled Conversational AI

3.4.2. Integration with Omnichannel Communication Platforms

3.4.3. Adoption of Cloud-based AI Solutions

3.4.4. Enhanced Customer Interaction with AI-driven Chatbots

3.5. Government Regulation

3.5.1. AI Ethics and Frameworks in the USA

3.5.2. Compliance with Data Protection Laws (CCPA, GDPR)

3.5.3. Government Initiatives in AI Research and Development

3.5.4. National AI Strategy Impact on Conversational AI

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Conversational AI Market Segmentation

4.1. By Deployment Type (In Value %)

4.1.1. On-premise

4.1.2. Cloud-based

4.2. By End-user (In Value %)

4.2.1. BFSI

4.2.2. Healthcare

4.2.3. E-commerce and Retail

4.2.4. Telecom

4.2.5. Media and Entertainment

4.3. By Application (In Value %)

4.3.1. Customer Support

4.3.2. Virtual Assistants

4.3.3. Sales and Marketing

4.3.4. Payment Processing

4.4. By Technology (In Value %)

4.4.1. Natural Language Processing (NLP)

4.4.2. Machine Learning (ML)

4.4.3. Automated Speech Recognition (ASR)

4.4.4. Text-to-Speech (TTS)

4.5. By Region (In Value %)

4.5.1. North East

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Conversational AI Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Google LLC

5.1.2. Amazon Web Services, Inc. (AWS)

5.1.3. Microsoft Corporation

5.1.4. IBM Corporation

5.1.5. Nuance Communications

5.1.6. Salesforce

5.1.7. Oracle Corporation

5.1.8. SAP SE

5.1.9. Conversica Inc.

5.1.10. Kore.ai

5.1.11. Rasa Technologies Inc.

5.1.12. SoundHound AI, Inc.

5.1.13. Clinc Inc.

5.1.14. Avaamo Inc.

5.1.15. Haptik.ai

5.2. Cross Comparison Parameters (Employee Count, Revenue, AI Patents, R&D Spending, Global Presence, Core Technology, Partnership Networks, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Support

5.9. Private Equity Investments

6. USA Conversational AI Market Regulatory Framework

6.1. Data Privacy Regulations

6.2. AI Auditing and Compliance

6.3. Certification Processes for AI Systems

7. USA Conversational AI Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Conversational AI Future Market Segmentation

8.1. By Deployment Type

8.2. By End-user

8.3. By Application

8.4. By Technology

8.5. By Region

9. USA Conversational AI Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a detailed ecosystem of key stakeholders in the USA Conversational AI Market. Desk research, including proprietary databases and secondary sources, is used to define variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this step, we analyze historical data on conversational AI market adoption, revenue generation, and market penetration across various industries such as BFSI, healthcare, and retail.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market trends and dynamics are validated through interviews with industry experts and executives from leading AI firms. This allows us to cross-verify data and gain deeper insights into the market.

Step 4: Research Synthesis and Final Output

Hypotheses on market trends and dynamics are validated through interviews with industry experts and executives from leading AI firms. This allows us to cross-verify data and gain deeper insights into the market.

Frequently Asked Questions

1. How big is the USA Conversational AI Market?

The USA Conversational AI market is valued at USD 8.5 billion, driven by the increasing demand for AI-powered customer service and virtual assistants across various industries.

2. What are the challenges in the USA Conversational AI Market?

The key challenges include concerns over data privacy and security, high implementation costs for small enterprises, and integration issues with legacy systems.

3. Who are the major players in the USA Conversational AI Market?

Key players include Google LLC, Amazon Web Services, Microsoft Corporation, IBM Corporation, and Nuance Communications, which lead in AI research and development.

4. What are the growth drivers of the USA Conversational AI Market?

The market is driven by advancements in Natural Language Processing (NLP), the rise of AI-powered customer engagement solutions, and increasing integration of AI in healthcare and banking sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.