USA Corrugated Packaging Market Outlook to 2030

Region:North America

Author(s):Shambhavi

Product Code:KROD6814

December 2024

92

About the Report

USA Corrugated Packaging Market Overview

- The USA Corrugated Packaging Market is valued at USD 75 billion, supported by increasing demand from e-commerce, retail, and FMCG sectors. The market is propelled by the growing trend toward sustainable packaging solutions and the rising need for efficient, recyclable, and cost-effective materials. Due to regulations encouraging recycling, the corrugated packaging industry benefits from its inherent sustainability, attracting demand from both industrial and consumer segments.

- States such as California, Texas, and Ohio lead the corrugated packaging market in the USA due to their high industrial activity and proximity to large logistics hubs. These regions serve as major manufacturing and distribution centers for various sectors, including electronics, retail, and e-commerce, where corrugated packaging is vital for protective shipping and sustainability objectives.

- Sustainability efforts continue to drive the corrugated packaging market, with U.S. regulations increasingly encouraging eco-friendly materials and recycling initiatives. In 2023, the U.S. EPA reported that paper and packaging recycling rates exceeded 70%, partly driven by consumer preferences for recyclable products. This trend is supported by regulations like California's Plastic Pollution Prevention Act, which aims to reduce single-use plastics and favors recycled packaging. Corrugated materials, as renewable resources, are gaining traction among retailers aiming to meet both regulatory standards and consumer demand for green packaging .

USA Corrugated Packaging Market Segmentation

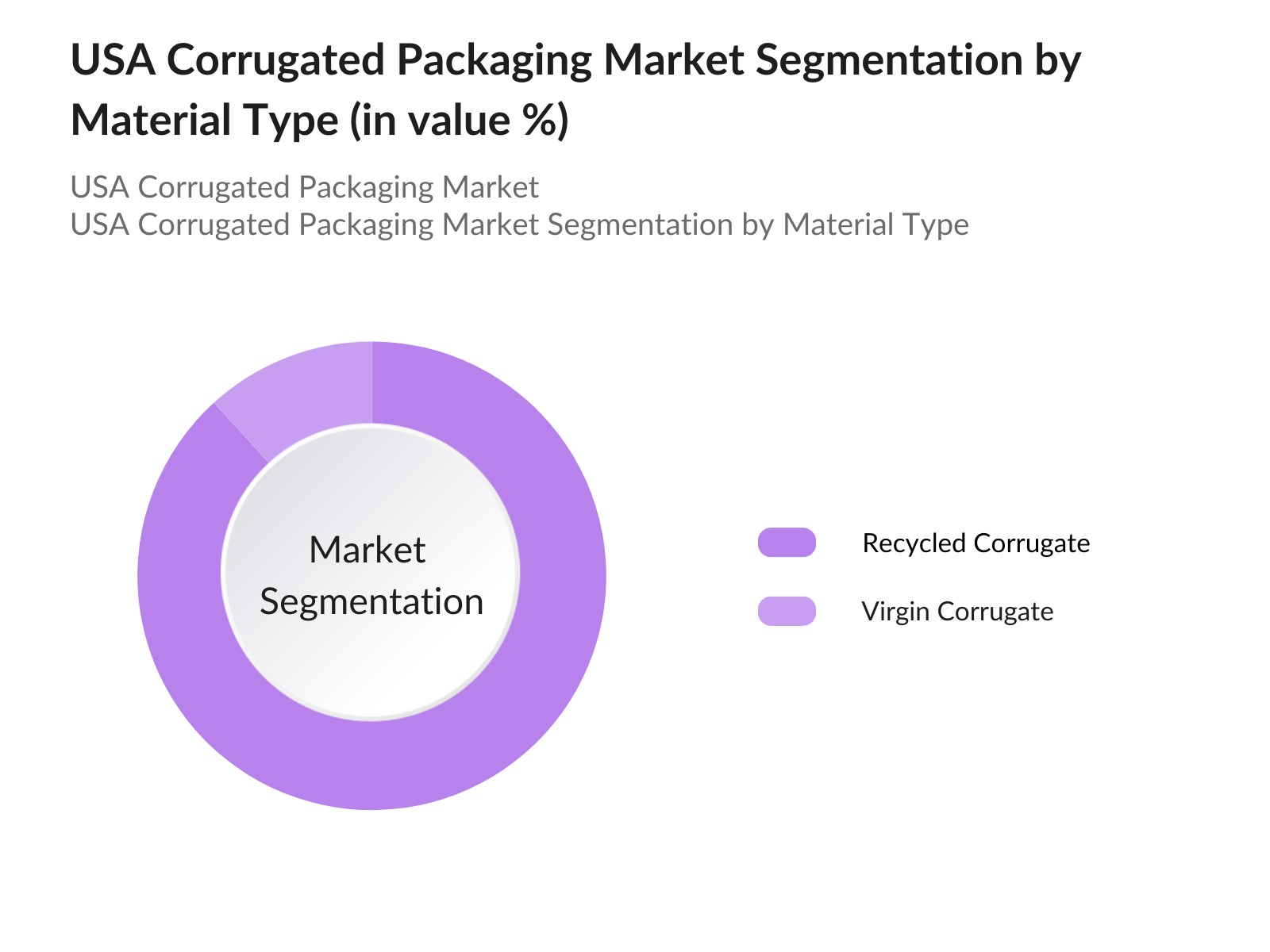

By Material Type: The USA Corrugated Packaging Market is segmented by material type into recycled corrugate and virgin corrugate. Recently, recycled corrugate holds a dominant market share due to environmental sustainability policies and consumer preference for eco-friendly options. Manufacturers leverage recycled materials to minimize waste and comply with stringent regulations, making it the preferred choice across various sectors.

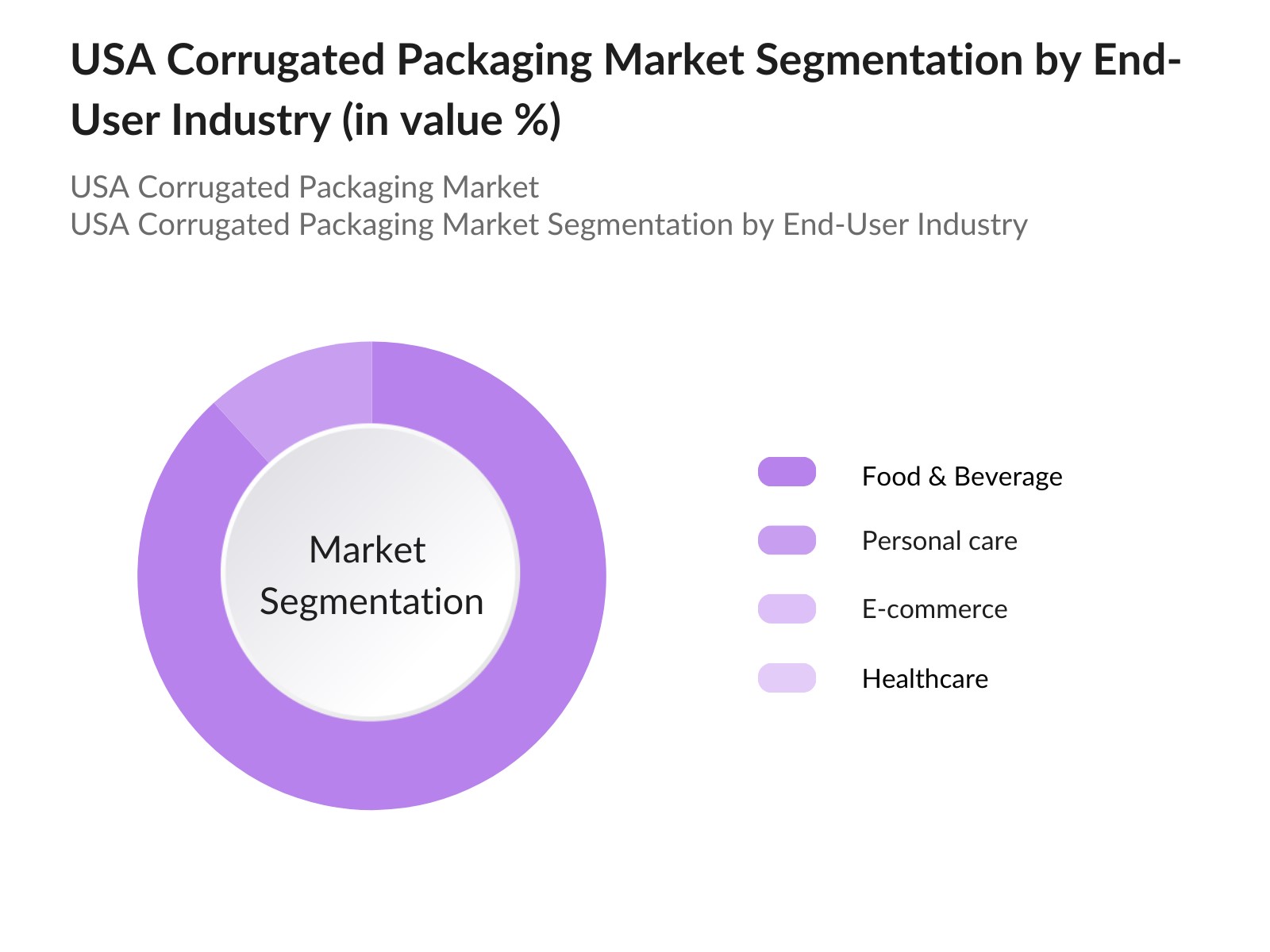

By End-Use Industry: This market is segmented by end-use industry into food & beverage, personal care, e-commerce, and healthcare. The food & beverage sector maintains a leading share in corrugated packaging usage due to the need for safe, hygienic, and durable packaging solutions that align with sustainability objectives. Corrugated packagings ability to withstand temperature fluctuations and provide protection ensures its popularity within this segment.

USA Corrugated Packaging Competitive Landscape

The USA Corrugated Packaging Market is led by prominent players with extensive distribution networks and innovative product offerings. Key competitors focus on sustainable practices, expanding market presence, and leveraging partnerships for market growth.

USA Corrugated Packaging Market Analysis

Growth Drivers

- Rise in E-commerce: The USA corrugated packaging market has been substantially boosted by the surge in e-commerce. In 2023, online retail sales in the U.S. surpassed $1.1 trillion, driving demand for corrugated packaging solutions that facilitate durable and sustainable shipping methods. E-commerce contributes to a high volume of shipments, with the U.S. Postal Service reporting over 7 billion packages delivered, marking an annual rise in package volume that directly impacts the corrugated sector's demand. The packaging industry's adaptation to meet diverse e-commerce needs has increased production, optimizing packaging designs for last-mile delivery resilience

- Expanding Food and Beverage Sector: Growth in the U.S. food and beverage sector has spurred a consistent demand for corrugated packaging. In 2023, the USDA reported a 6% increase in domestic fresh produce sales, much of which relies on corrugated boxes for transportation. Beverage sales, particularly in bottled and canned goods, have risen by over 4% since 2022, necessitating resilient packaging solutions that protect products through transit. Corrugated packaging's strength and stackability make it ideal for perishables and beverages, driving innovation in design to ensure freshness and compliance with food safety standards .

- Advancements in Digital Printing: Corrugated packaging has seen significant improvements in digital printing, enabling customization and shorter production runs. The packaging sector has invested in digital presses, allowing brands to adapt designs quickly to meet marketing demands. According to a 2024 report by the U.S. Census Bureau, over 40% of businesses have integrated digital printing for packaging, resulting in increased efficiency and brand-specific packaging flexibility. This shift allows for smaller, customizable batches, ideal for niche markets and seasonal promotions, catering to evolving consumer demands for personalized packaging

Market Challenges

- Raw Material Price Volatility (Paper, Pulp Price Fluctuations)

The corrugated packaging market faces considerable challenges due to the volatility in paper and pulp prices. The U.S. Bureau of Labor Statistics (BLS) noted that pulp prices rose by approximately 8% in 2023, driven by demand fluctuations and supply chain disruptions. As raw materials constitute a significant portion of production costs, this volatility directly impacts the profitability of packaging manufacturers, compelling them to adopt cost-saving measures or increase product prices. This price uncertainty is further exacerbated by global market dependencies, as over 30% of pulp used in U.S. production is imported . - High Production Costs (Energy Consumption, Machinery Investments)

Production costs for corrugated packaging remain high, driven by energy consumption and machinery upgrades. In 2023, U.S. energy costs increased by 5%, as reported by the U.S. Energy Information Administration (EIA), raising operational expenses for energy-intensive industries like corrugated packaging. Additionally, machinery investments in advanced printing technologies require significant capital, with high-speed digital presses costing upwards of $1 million. This financial burden pressures smaller firms and limits new entrants, potentially stalling market innovation and expansion

USA Corrugated Packaging Future Outlook

The USA Corrugated Packaging Market is expected to witness substantial growth driven by sustained demand in the e-commerce, retail, and industrial sectors. Increasing consumer preferences for eco-friendly solutions and the need for cost-effective, versatile packaging options will support ongoing development in this market.

Market Opportunities

- Recyclable Packaging Solutions: The shift towards recyclable packaging solutions presents an opportunity for the corrugated packaging market to implement closed-loop systems, where materials are reused within the supply chain. According to the U.S. Department of Commerce, recyclable packaging is now integral to over 60% of U.S. companies' sustainability goals. Lightweighting, reducing the amount of raw material per unit, is also gaining popularity to cut costs and improve efficiency. Corrugated packaging, being highly recyclable, aligns with government incentives promoting circular economy models, presenting manufacturers with a profitable niche in green packaging

- Digital Transformation in Packaging: IoT and smart packaging are transforming the corrugated packaging industry, allowing for real-time monitoring of package conditions during transit. In 2024, over 25% of U.S. logistics firms integrated smart packaging solutions, as noted by the U.S. Census Bureau. This technology enables temperature and humidity tracking, benefiting sectors like food and pharmaceuticals by ensuring product safety. The integration of digital sensors within corrugated boxes offers traceability, reducing losses and damages, and positioning companies to attract tech-savvy consumers who prioritize transparency

Scope of the Report

|

Product Type |

Corrugated Boxes Folding Cartons Rigid Boxes Sheets & Rolls |

|

Application |

Food & Beverage Consumer Electronics Pharmaceuticals E-commerce, Automotive |

|

Material Type |

Virgin Fiber Recycled Fiber Hybrid |

|

Printing Technology |

Flexographic Lithographic Digital Printing |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Packaging Manufacturers

Logistics and Shipping Companies

Food & Beverage Manufacturers

E-commerce Platforms

Healthcare Product Distributors

Government and Regulatory Bodies (U.S. Environmental Protection Agency, Department of Commerce)

Investor and Venture Capitalist Firms

Retail Chains and Wholesale Distributors

Companies

Players mentioned in the report

WestRock Company

International Paper Company

Packaging Corporation of America

Georgia-Pacific LLC

Smurfit Kappa Group

DS Smith Plc

Pratt Industries

Cascades Inc.

Oji Holdings Corporation

Sonoco Products Company

Mondi Group

Klabin S.A.

U.S. Corrugated, Inc.

Shorr Packaging Corp

Visy Industries

Table of Contents

1. USA Corrugated Packaging Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Dynamics

1.4 Market Segmentation Overview

2. USA Corrugated Packaging Market Size (USD Billion)

2.1 Historical Market Size Analysis

2.2 Year-On-Year Market Performance

2.3 Key Developments and Market Milestones

3. USA Corrugated Packaging Market Analysis

3.1 Growth Drivers

E-commerce Expansion (E-commerce, Retail, Food & Beverage)

Sustainability Initiatives (Recyclable Materials, Biodegradable Packaging)

Technological Advancements (Automation, Printing Technology)

Demand from FMCG and Industrial Goods (FMCG, Industrial)

3.2 Market Challenges

Fluctuating Raw Material Prices (Paper, Corrugated Medium)

Supply Chain Constraints (Logistics, Supplier Dependency)

Environmental Regulations (Recycling Standards, Waste Management)

Competitive Pressures (Brand Differentiation, Cost Pressures)

3.3 Opportunities

Innovation in Sustainable Packaging (Green Packaging, Eco-friendly Adhesives)

Expansion in Digital Printing (Personalization, Digitalization in Printing)

Rising Demand from Small & Medium Enterprises (SMEs, Custom Packaging)

Government Incentives for Green Packaging Initiatives

3.4 Trends

Automation in Manufacturing (Robotic Handling, AI-driven Quality Control)

Lightweight Packaging Demand (Cost-Efficiency, Transport Efficiency)

Growing Investment in Smart Packaging (QR Codes, RFID)

Adoption of Water-Based Inks and Coatings

3.5 Government Regulations

Environmental Compliance Standards (EPA, Green Seal)

Import-Export Regulations (Trade Tariffs, Import Duties)

Emission Standards (Carbon Emission, Energy Usage in Production)

Recycling Policy Requirements (Waste Reduction Targets, Packaging Waste Directive)

3.6 SWOT Analysis

3.7 Ecosystem Overview

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape and Market Positioning

4. USA Corrugated Packaging Market Segmentation

4.1 By Material Type (Value %)

Virgin Material

Recycled Material

Mixed Material

4.2 By Packaging Type (Value %)

Slotted Boxes

Folder Boxes

Rigid Boxes

Custom Die-Cut Packaging

4.3 By Application (Value %)

Food & Beverage Packaging

Consumer Electronics

Healthcare & Pharmaceuticals

Personal Care & Cosmetics

4.4 By End-Use Sector (Value %)

Retail and E-commerce

Manufacturing & Industrial

Fast-Moving Consumer Goods (FMCG)

Automotive

4.5 By Distribution Channel (Value %)

Direct Sales

Distribution Networks

Online Sales

5. USA Corrugated Packaging Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

International Paper

WestRock Company

Packaging Corporation of America

Smurfit Kappa Group

Georgia-Pacific LLC

Menasha Packaging

Pratt Industries, Inc.

DS Smith Plc

Cascades Inc.

Mondi Group

Oji Holdings Corporation

Sonoco Products Company

Rengo Co., Ltd.

Amcor Plc

KapStone Paper and Packaging

5.2 Cross Comparison Parameters (Employee Strength, Product Range, Technology Adoption, R&D Investment, Revenue Growth Rate, Customer Base Diversity, Market Expansion Strategies, Environmental Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives and Collaborations

5.5 Mergers & Acquisitions Analysis

5.6 Investment and Venture Capital Analysis

5.7 Government Grants and Funding

5.8 Private Equity Investments

6. USA Corrugated Packaging Market Regulatory Framework

6.1 Environmental Standards (EPA Compliance, Sustainable Forestry Initiative)

6.2 Certification and Compliance Processes (Forest Stewardship Council, FSC Certified Standards)

6.3 Recycling Compliance and Waste Management

7. USA Corrugated Packaging Market Future Size (USD Billion)

7.1 Future Market Size Analysis

7.2 Key Factors Influencing Future Growth

8. USA Corrugated Packaging Market Future Segmentation

8.1 By Material Type

8.2 By Packaging Type

8.3 By Application

8.4 By End-Use Sector

8.5 By Distribution Channel

9. USA Corrugated Packaging Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 White Space Opportunity Identification

9.3 Marketing and Sales Strategies

9.4 Customer Segmentation and Targeting

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

We begin with an ecosystem analysis that outlines the primary stakeholders in the USA Corrugated Packaging Market, collecting extensive data from secondary sources to outline industry-specific variables that impact market dynamics.

Step 2: Market Analysis and Construction

Historical data for the USA Corrugated Packaging Market is assessed, focusing on production rates, end-use segmentation, and demand metrics. This analysis enables a reliable calculation of current industry growth and segment-specific trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are reviewed and validated through expert interviews conducted with packaging specialists, providing insights on production innovations, material trends, and other operational factors in this market.

Step 4: Research Synthesis and Final Output

The final report includes direct insights from key players, encompassing sales data, consumer preferences, and regional trends. This ensures a validated, comprehensive analysis of the USA Corrugated Packaging Market.

Frequently Asked Questions

01. How big is the USA Corrugated Packaging Market?

The USA Corrugated Packaging Market is valued at USD 75 billion, driven by a strong presence in e-commerce and sustainability-driven consumer demand.

02. What are the key challenges in the USA Corrugated Packaging Market?

Challenges include volatile raw material costs and competition from alternative materials, making market adaptability crucial for sustained growth.

03. Who are the major players in the USA Corrugated Packaging Market?

Key players include WestRock, International Paper, Packaging Corporation of America, Georgia-Pacific, and Smurfit Kappa, known for their strong production capacities and commitment to sustainability.

04. What are the growth drivers of the USA Corrugated Packaging Market?

The growth of this market is fueled by the rise of e-commerce, demand for recyclable solutions, and advancements in lightweight packaging options.

05. Which segment dominates the USA Corrugated Packaging Market?

Recycled corrugate dominates due to increasing environmental regulations and the industrys shift towards sustainable practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.