USA Cosmetics Market Outlook to 2030

Region:North America

Author(s):Mukul Soni

Product Code:KROD11094

December 2024

87

About the Report

USA Cosmetics Market Overview

- The USA cosmetics market, valued at USD 62.95 billion, is driven by a surge in consumer interest in natural and organic products, enhanced by an increased focus on sustainable packaging. This growth is underpinned by an expanding base of informed consumers who prioritize quality ingredients, alongside a high level of disposable income across the country. Product innovations catering to skincare and personal wellness trends have also catalyzed market growth.

- The USA cosmetics market is primarily dominated by cities like New York, Los Angeles, and Miami. These regions are influential due to their strong retail ecosystems, high population densities, and a fashion-forward consumer base with access to premium, niche brands. Additionally, these cities act as trendsetters, driving national demand through concentrated media and influencer presence, which helps in widespread consumer adoption.

- The FDA mandates clear labeling of all cosmetics ingredients, a requirement that has grown more stringent due to increased consumer demand for transparency. The agency reported a 20% increase in label audits in 2023, reflecting its focus on ingredient clarity and consumer protection. This regulation aligns with the broader trend of consumers seeking information on what they apply to their skin

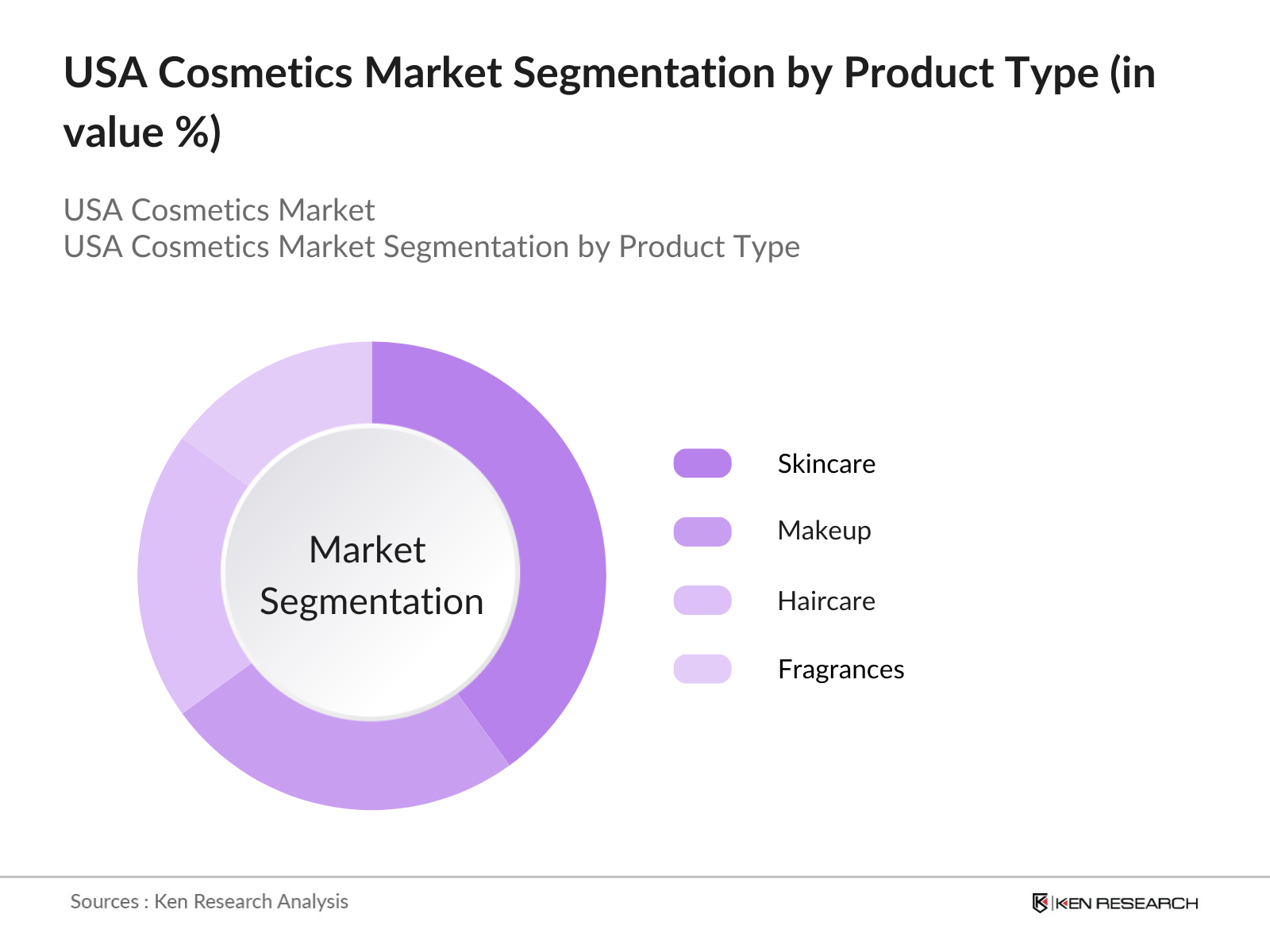

USA Cosmetics Market Segmentation

- By Product Type: The USA cosmetics market is segmented by product type into skincare, haircare, makeup, fragrances, and personal care. Skincare holds a dominant market share within this category due to the growing consumer interest in anti-aging products and personalized skincare solutions. The rise of premium skincare brands such as La Mer and Tatcha, coupled with consumer education on skincare routines, has driven the popularity and growth of this segment.

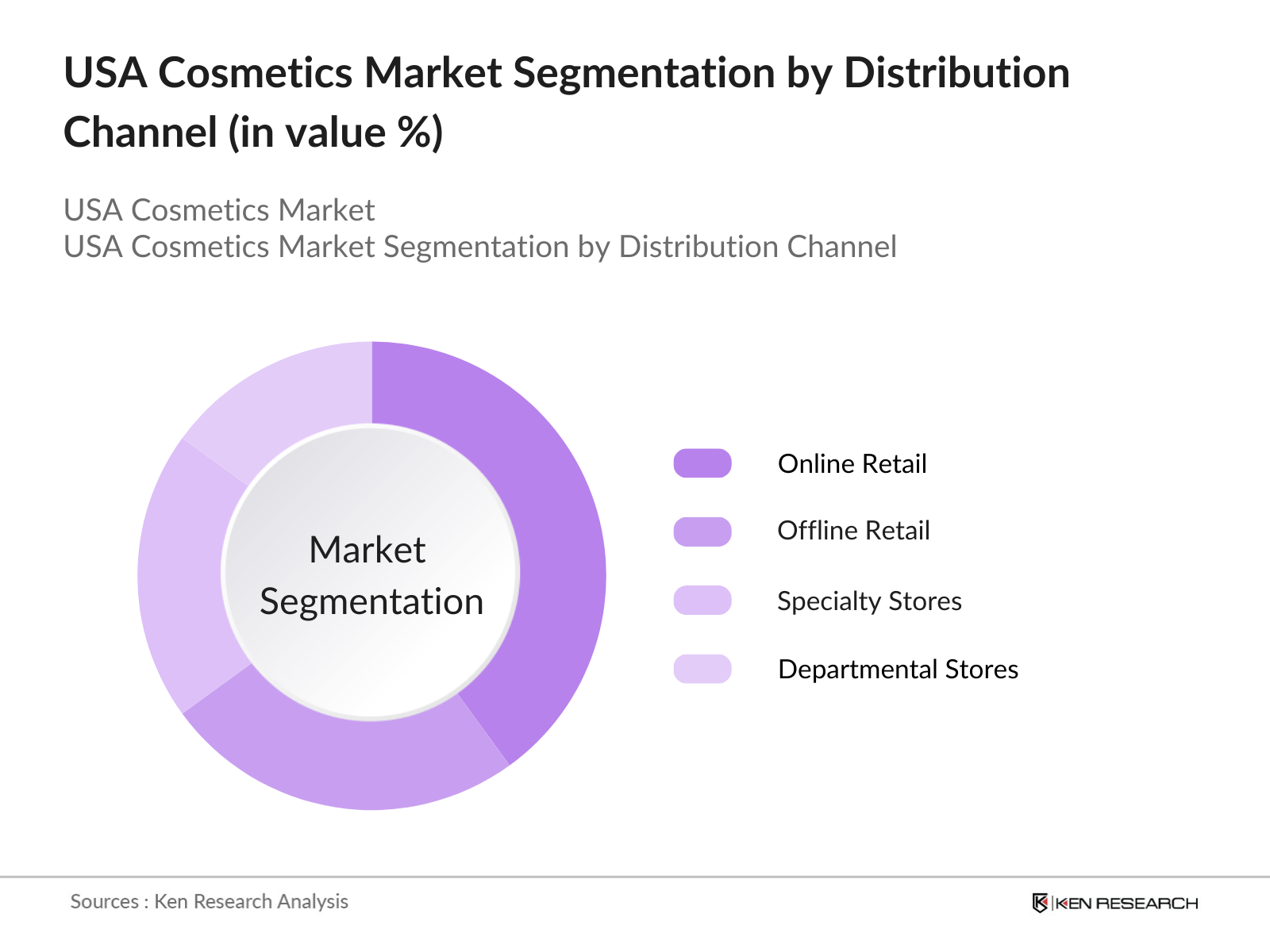

- By Distribution Channel: The distribution channels in the USA cosmetics market include online retail, offline retail, specialty stores, departmental stores, and supermarkets & hypermarkets. Online retail leads the segment as e-commerce giants like Amazon and beauty-focused platforms such as Sephora have leveraged a seamless shopping experience. This shift is primarily due to the convenience of product access, detailed product reviews, and a broader selection, all accessible at the consumers fingertips.

USA Cosmetics Market Competitive Landscape

The USA cosmetics market features significant competition from both established brands and emerging niche players. Major players such as Este Lauder, L'Oral, and Procter & Gamble dominate the market, capitalizing on their established brand portfolios and extensive distribution networks. Smaller brands have also emerged with unique positioning, particularly in clean beauty and organic product lines, intensifying market competition.

USA Cosmetics Industry Analysis

Growth Drivers

- Increasing Consumer Awareness: Consumer awareness around skincare and cosmetics ingredients has surged due to an increase in internet usage, with 91% of Americans having internet access, a significant boost from previous years. This high internet penetration drives consumers to seek information on product ingredients, safety, and efficacy. In the U.S., the search for terms like "clean beauty" and "paraben-free products" has increased by 40% in the last three years. As consumers become more knowledgeable, their demand for transparent, safe, and effective cosmetics grows, favoring brands that disclose ingredients and meet safety standards.

- Rise in Disposable Income: Disposable income in the U.S. has increased steadily, with the average household earning approximately $90,000 annually as of 2023. This boost in income allows consumers to allocate more funds to premium cosmetics, skincare, and wellness products. Growth in personal consumption expenditures, which reached over $14 trillion, supports the expansion of non-essential goods like cosmetics, especially in metropolitan areas where disposable incomes are higher. This rise supports enhanced spending on high-quality and luxury cosmetics.

- Demand for Natural and Organic Products: With heightened awareness of environmental issues, 70% of American consumers express a preference for natural and organic cosmetics, particularly in urban areas like New York and California. This shift aligns with consumer trends towards wellness, with natural product imports increasing by 20% since 2022. This demand pressures brands to innovate with eco-friendly and sustainable product lines, catering to an audience willing to invest in high-quality natural formulations.

Market Restraints

- Regulatory Compliance and Product Safety: The U.S. FDA enforces stringent regulations on cosmetics, requiring compliance with the Federal Food, Drug, and Cosmetic Act. Cosmetic products must be free of harmful contaminants and meet rigorous safety testing standards. In 2023 alone, the FDA recalled over 30 non-compliant cosmetics products, showing strict oversight. The pressure to adhere to these standards increases costs for companies, especially with the growing consumer demand for ingredient transparency and safety.

- High Competition and Pricing Pressure: The U.S. cosmetics market is characterized by intense competition among numerous brands, both domestic and international. This saturation leads to pricing pressures, as brands compete for customer loyalty. According to BEA data, over 300 cosmetic companies operate in the U.S., contributing to a dynamic but challenging market landscape where pricing strategies are essential for market positioning. The high number of competitors makes customer retention more challenging and requires brands to invest heavily in differentiating their products.

USA Cosmetics Market Future Outlook

The USA cosmetics market is expected to experience robust growth over the next five years, supported by consumer shifts toward eco-conscious products, demand for organic ingredients, and innovation in anti-aging formulations. With advancements in technology and the proliferation of online platforms, companies are anticipated to tap into broader demographics. Growing interest from Gen Z and millennial consumers in clean beauty is likely to further catalyze market expansion.

Market Opportunities

- Expansion in E-commerce Channels: E-commerce in the U.S. generated over $1 trillion in revenue in 2023, with cosmetics contributing significantly as consumers increasingly turn to online platforms for purchases. Major cosmetics brands report double-digit growth in online sales, with urban consumers favoring the convenience and variety that online channels offer. The expansion of mobile commerce also allows for more targeted digital marketing, offering brands the opportunity to engage directly with a diverse customer base.

- Growth in Mens Grooming Sector: The mens grooming market in the U.S. has seen a substantial rise, with mens skincare products witnessing a 25% increase in demand over the last three years. The segments growth is supported by an increase in disposable income and shifting cultural perceptions regarding mens grooming. Urban centers have seen especially strong demand, with male consumers spending more on high-quality grooming products, ranging from moisturizers to beard care.

Scope of the Report

|

By Product Type |

Skincare Haircare Makeup Fragrances Personal Care |

|

By Distribution Channel |

Online Retail Offline Retail Specialty Stores Departmental Stores Supermarkets & Hypermarkets |

|

By Gender |

Male Female Unisex |

|

By End-User |

Individual Consumers Professional Salons |

|

By Price Range |

Premium Mid-Range Budget |

Products

Key Target Audience

Cosmetics Manufacturers

Online Retailers

Specialty Beauty Stores

Skincare and Wellness Clinics

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, EPA)

Raw Material Suppliers

Packaging and Sustainability Consultants

Companies

Players Mentioned in the Report:

Este Lauder Companies

L'Oral USA

Procter & Gamble

Coty Inc.

Shiseido Americas

Revlon, Inc.

Mary Kay Inc.

Johnson & Johnson

Edgewell Personal Care

Kao USA Inc.

Avon Products, Inc.

Glossier, Inc.

Drunk Elephant

Function of Beauty

Tatcha

Table of Contents

1. USA Cosmetics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Growth Rate (Revenue, Volume)

1.4. Market Segmentation Overview

2. USA Cosmetics Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Cosmetics Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Awareness

3.1.2. Rise in Disposable Income

3.1.3. Demand for Natural and Organic Products

3.1.4. Technological Innovations in Product Formulation

3.2. Market Challenges

3.2.1. Regulatory Compliance and Product Safety

3.2.2. High Competition and Pricing Pressure

3.2.3. Rising Raw Material Costs

3.3. Opportunities

3.3.1. Expansion in E-commerce Channels

3.3.2. Growth in Mens Grooming Sector

3.3.3. Demand for Personalized Beauty Solutions

3.4. Trends

3.4.1. Clean Beauty and Sustainability

3.4.2. Demand for Premium Skincare Products

3.4.3. Growth of the Anti-Aging Segment

3.5. Government Regulation

3.5.1. FDA Regulations and Compliance Requirements

3.5.2. Labeling and Ingredient Transparency

3.5.3. Import and Export Restrictions

3.6. SWOT Analysis

3.7. Competitive Ecosystem

3.8. Porters Five Forces Analysis

4. USA Cosmetics Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Skincare

4.1.2. Haircare

4.1.3. Makeup

4.1.4. Fragrances

4.1.5. Personal Care

4.2. By Distribution Channel (In Value %)

4.2.1. Online Retail

4.2.2. Offline Retail

4.2.3. Specialty Stores

4.2.4. Departmental Stores

4.2.5. Supermarkets & Hypermarkets

4.3. By Gender (In Value %)

4.3.1. Male

4.3.2. Female

4.3.3. Unisex

4.4. By End-User (In Value %)

4.4.1. Individual Consumers

4.4.2. Professional Salons

4.5. By Price Range (In Value %)

4.5.1. Premium

4.5.2. Mid-Range

4.5.3. Budget

5. USA Cosmetics Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Este Lauder Companies

5.1.2. Procter & Gamble

5.1.3. L'Oral USA

5.1.4. Unilever

5.1.5. Coty Inc.

5.1.6. Shiseido Americas

5.1.7. Revlon, Inc.

5.1.8. Mary Kay Inc.

5.1.9. Johnson & Johnson

5.1.10. Edgewell Personal Care

5.1.11. Kao USA Inc.

5.1.12. Avon Products, Inc.

5.1.13. Glossier, Inc.

5.1.14. Drunk Elephant

5.1.15. Function of Beauty

5.2 Cross Comparison Parameters (Revenue, Headquarters, No. of Employees, Product Range, Brand Portfolio, Target Audience, Market Share, R&D Investment)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment and Funding Analysis

6. USA Cosmetics Market Regulatory Framework

6.1 Product Safety Standards

6.2 Labeling and Packaging Regulations

6.3 Compliance with Environmental Regulations

7. USA Cosmetics Market Future Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

8. USA Cosmetics Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Gender (In Value %)

8.4 By End-User (In Value %)

8.5 By Price Range (In Value %)

9. USA Cosmetics Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Key Customer Insights

9.3 Branding and Positioning Strategy

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping critical stakeholders within the USA cosmetics market ecosystem. Extensive desk research, drawing from both public and proprietary data sources, allows for an in-depth understanding of variables influencing market dynamics.

Step 2: Market Analysis and Construction

Data on historical revenue patterns, consumer preferences, and channel penetration rates are consolidated and analyzed. This step also includes evaluating the competitive landscape and segment-wise performance to construct an accurate market assessment.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are validated through interviews with industry experts, including representatives from leading cosmetic brands. These insights ensure data accuracy and contextual understanding, enriching the overall market assessment.

Step 4: Research Synthesis and Final Output

Final data synthesis involves direct communication with manufacturers, distributors, and retailers to validate findings and refine market projections. This collaborative approach ensures that the analysis remains relevant, accurate, and reflective of current trends and dynamics.

Frequently Asked Questions

01. How big is the USA Cosmetics Market?

The USA cosmetics market was valued at USD 62.95 billion, driven by increased demand for natural and organic products and a growing focus on premium skincare solutions.

02. What are the major challenges in the USA Cosmetics Market?

Key challenges include regulatory compliance, high competition, and pricing pressures, particularly with an influx of niche brands. Rising raw material costs also impact profitability.

03. Who are the major players in the USA Cosmetics Market?

Major players include Este Lauder, L'Oral USA, Procter & Gamble, Coty Inc., and Shiseido, known for their strong brand portfolios and established market presence.

04. What are the growth drivers of the USA Cosmetics Market?

Growth is driven by consumer interest in eco-friendly and sustainable products, the rise in e-commerce, and demand for skincare innovations that cater to wellness and anti-aging.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.