USA Crash Barrier Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD468

July 2024

100

About the Report

USA Crash Barrier Market Overview

- In recent years, the USA crash barrier market has experienced substantial growth, this is reflected by the global crash barrier market reaching a valuation of USD 9.5 billion in 2023 growing at a CAGR of 3.8% between 2023-2028 driven by creasing road safety awareness, rising infrastructure development, and stringent government regulations.

- The USA crash barrier market is highly competitive, with key players including Lindsay Corporation, Trinity Industries Inc., Valmont Industries Inc., Hill & Smith Holdings PLC, and Tata Steel Europe.

- In 2023, Lindsay Corporation launched its new BarrierGuard 800 system, a modular, portable steel barrier that meets the latest safety standards. This development is important as it provides enhanced protection and flexibility for various road conditions.

- California leads the crash barrier market in the USA, driven by its extensive highway network and high traffic volume owing to its substantial investments in upgrading and expanding its road infrastructure.

USA Crash Barrier Market Segmentation

The USA Crash Barrier market is segmented by various factors like Product, Application, and Region.

By Product: The USA crash barrier market is segmented by product into rigid barriers, semi-rigid barriers, and flexible barriers. In 2023, Rigid barriers dominated the market in the USA crash barrier market under the product type segmentation. Their dominance is due to their high durability and ability to provide strong protection against vehicle impacts.

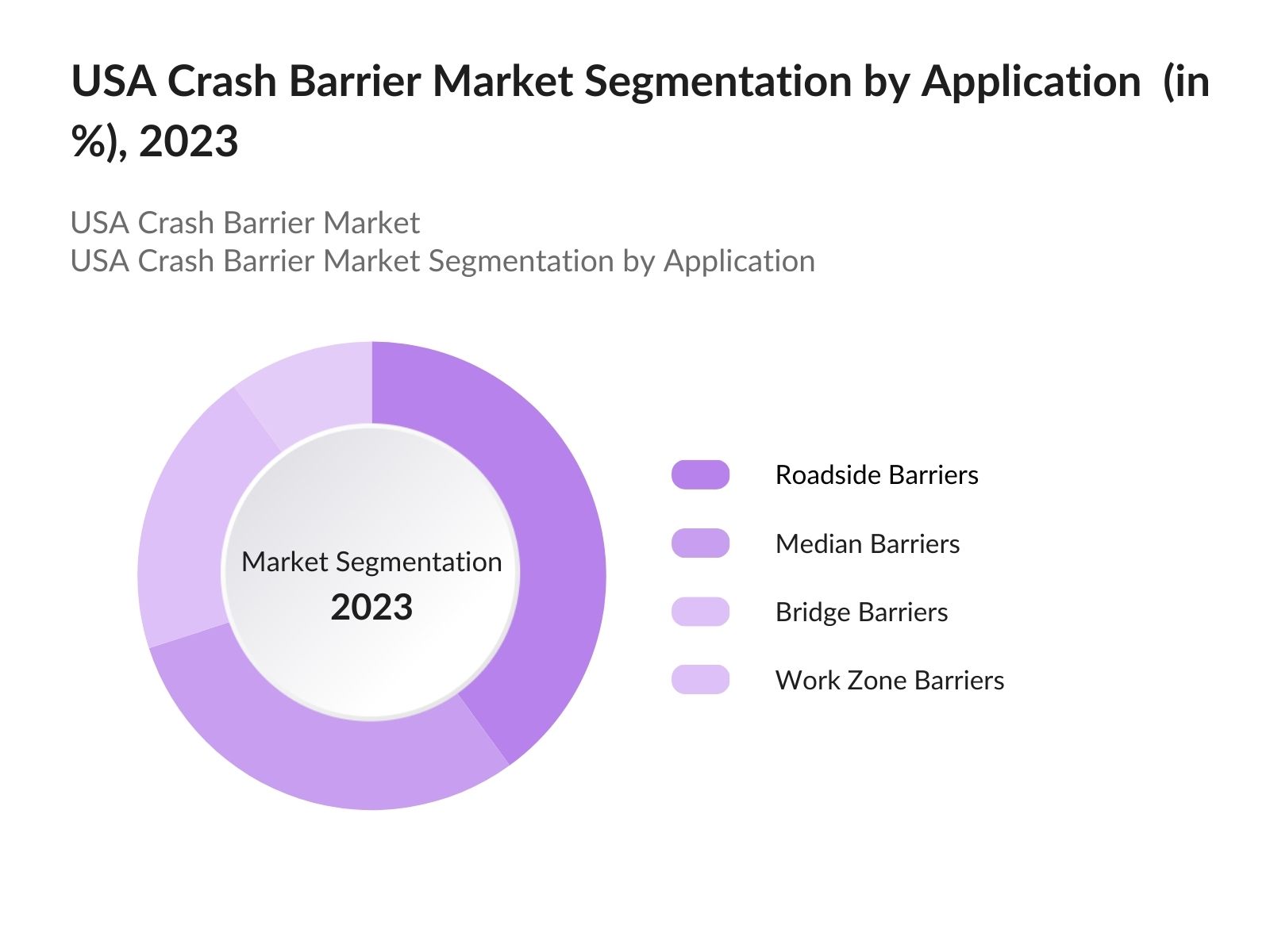

By Application: The USA crash barrier market is segmented by application into roadside barriers, median barriers, bridge barriers, and work zone barriers. In 2023, Roadside barriers dominated the market owing to the widespread need for protecting vehicles from roadside hazards, such as trees, poles, and ditches.

By Region: The USA crash barrier market is segmented by region into North, South, East, and West. In 2023, the Western region dominates the market. This dominance is due to the region's high traffic volume and extensive highway network, coupled with significant investments in road safety and infrastructure development.

USA Crash Barrier Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Lindsay Corporation |

1955 |

Omaha, Nebraska |

|

Trinity Industries Inc. |

1933 |

Dallas, Texas |

|

Valmont Industries Inc. |

1946 |

Omaha, Nebraska |

|

Hill & Smith Holdings PLC |

1966 |

West Midlands, UK |

|

Tata Steel Europe |

1907 |

London, UK |

- Lindsay Corporation: In June 2023, Lindsay Corporation, a leading global manufacturer and distributor of infrastructure equipment and technology, recently installed its first TAU-XR Xpress Repair Crash Cushion on U.S. roadways. The TAU-XR is the latest innovation in Lindsay's lineup of crash cushion systems.

- Hill & Smith Holdings PLC: In 2024, Hill & Smith Holdings PLC introduced a new line of eco-friendly crash barriers made from recycled materials. This innovation addresses environmental concerns and offers a sustainable alternative to traditional barriers, catering to the growing demand for eco-friendly infrastructure solutions.

USA Crash Barrier Market Analysis

USA Crash Barrier Market Growth Drivers

- Increasing Road Traffic Accidents: In 2024, the National Highway Traffic Safety Administration (NHTSA) reported over 8,650 road traffic accidents in the United States. The rise in traffic accidents has heightened the demand for effective crash barriers to enhance road safety and reduce fatalities. This surge in accidents is driving the installation of crash barriers across highways and urban roads.

- Expansion of Highways and Expressways: The Federal Highway Administration (FHWA) reported that in 2024, FHWA has launched over 3,700 bridge repair and replacement projects across the country and has begun the repair of more than 69,000 miles of roadways. The expansion of road networks necessitates the installation of crash barriers to ensure the safety of motorists and pedestrians, thus driving market growth.

- Advancements in Barrier Technology: The integration of smart technologies in crash barriers, such as sensors and IoT, has gained momentum. In 2024, around 500 miles of highways were equipped with smart crash barriers capable of real-time monitoring and maintenance. These technological advancements are enhancing the functionality and effectiveness of crash barriers, contributing to market growth.

USA Crash Barrier Market Challenges

- Budget Constraints of Local Governments: Many local governments face budget constraints that limit their ability to invest in new infrastructure. In 2024, several states reported budget deficits, impacting their capacity to fund road safety projects, including the installation of crash barriers. This financial strain hampers the widespread adoption of advanced crash barrier systems.

- Regulatory Hurdles: The approval and implementation of new crash barrier technologies are subject to stringent regulatory standards. In 2024, delays in obtaining regulatory approvals for innovative barrier solutions were reported, slowing down market growth. Navigating these regulatory hurdles remains a significant challenge for market players.

USA Crash Barrier Market Government Initiatives

- Safe Streets and Roads for All Program: In 2024, the U.S. Department of Transportation launched the "Safe Streets and Roads for All" program, with a $1 billion investment aimed at enhancing road safety infrastructure. This initiative includes the installation of crash barriers and other safety measures to reduce traffic fatalities and injuries.

- Infrastructure Investment and Jobs Act: The Infrastructure Investment and Jobs Act, passed in 2021, continued to drive investments in 2024. With a significant allocation towards road safety, the Act funds the installation of crash barriers and the improvement of existing infrastructure. This legislative support is crucial for market growth.

USA Crash Barrier Future Market Outlook

The USA crash barrier market is poised for remarkable growth, driven by increased adoption of smart barriers, government funding for road safety projects, and focus on sustainable infrastructure.

Future Market Trends

- Increased Adoption of Smart Barriers: Over the next five years, the adoption of smart crash barriers equipped with sensors and IoT technology is expected to rise. These barriers will provide real-time data on their condition and performance, enabling proactive maintenance and improving road safety.

- Government Funding for Road Safety Projects: Continued government investment in road safety infrastructure will drive the crash barrier market. Future funding initiatives are projected to allocate an additional funds for road safety by 2028, supporting the installation of advanced crash barriers across the country.

Scope of the Report

|

By Product |

Rigid Barriers Semi-Rigid Barriers Flexible Barriers |

|

By Application |

Roadside Barriers Median Barriers Bridge Barriers Work Zone Barriers |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Banks and Financial Institutions

Federal Highway Administration (FHWA)

Municipal Road Safety Authorities

Construction Companies

Infrastructure Development Firms

Road Safety Equipment Manufacturers

Engineering and Design Consultants

Insurance Companies

Traffic Management Companies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Lindsay Corporation

Trinity Industries Inc.

Valmont Industries Inc.

Hill & Smith Holdings PLC

Tata Steel Europe

Gregory Industries

Nucor Corporation

Armco Barrier Systems

Road Systems, Inc.

Avon Barrier Corporation Ltd

Delta Scientific Corporation

Peter Berghaus GmbH

Safe Direction Pty Ltd

Easi-Set Worldwide

Tertu Equipment

Ingal Civil Products

Bekaert

TrafFix Devices Inc.

Highway Care Ltd

CT Safety Barriers Ltd

Table of Contents

1. USA Crash Barrier Market Overview

1.1 USA Crash Barrier Market Taxonomy

2. USA Crash Barrier Market Size (in USD Bn), 2018-2023

3. USA Crash Barrier Market Analysis

3.1 USA Crash Barrier Market Growth Drivers

3.2 USA Crash Barrier Market Challenges and Issues

3.3 USA Crash Barrier Market Trends and Development

3.4 USA Crash Barrier Market Government Regulation

3.5 USA Crash Barrier Market SWOT Analysis

3.6 USA Crash Barrier Market Stake Ecosystem

3.7 USA Crash Barrier Market Competition Ecosystem

4. USA Crash Barrier Market Segmentation, 2023

4.1 USA Crash Barrier Market Segmentation by Product (in %), 2023

4.2 USA Crash Barrier Market Segmentation by Application (in %), 2023

4.3 USA Crash Barrier Market Segmentation by Region (in %), 2023

5. USA Crash Barrier Market Competition Benchmarking

5.1 USA Crash Barrier Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. USA Crash Barrier Future Market Size (in USD Bn), 2023-2028

7. USA Crash Barrier Future Market Segmentation, 2028

7.1 USA Crash Barrier Market Segmentation by Product (in %), 2028

7.2 USA Crash Barrier Market Segmentation by Application (in %), 2028

7.3 USA Crash Barrier Market Segmentation by Region (in %), 2028

8. USA Crash Barrier Market Analysts’ Recommendations

8.1 USA Crash Barrier Market TAM/SAM/SOM Analysis

8.2 USA Crash Barrier Market Customer Cohort Analysis

8.3 USA Crash Barrier Market Marketing Initiatives

8.4 USA Crash Barrier Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on USA Crash Barrier market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA Crash Barrier market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple essential crash barrier companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from crash barrier companies.

Frequently Asked Questions

01 How big is the USA Crash Barrier Market?

In recent years, the USA crash barrier market has experienced substantial growth, this is reflected by the global semiconductor market reaching a valuation of USD 9.5 billion in 2023 growing at a CAGR of 3.8% between 2023-2028 driven by creasing road safety awareness, rising infrastructure development, and stringent government regulations.

02 What are the challenges in the USA Crash Barrier Market?

Challenges in the USA crash barrier include high installation and maintenance costs, budget constraints of local governments, regulatory hurdles, and environmental concerns related to the production and disposal of crash barriers.

03 Who are the major players in the USA Crash Barrier Market?

Key players in the USA crash barrier market include Lindsay Corporation, Trinity Industries Inc., Valmont Industries Inc., Hill & Smith Holdings PLC, and Tata Steel Europe. These companies dominate due to their innovative product offerings, strategic partnerships, and strong market presence.

04 What are the growth drivers of the USA Crash Barrier Market?

The USA crash barrier market is propelled by factors such as the increasing rate of vehicular accidents, substantial government investment in infrastructure, the expansion of highways and expressways, and advancements in barrier technology.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.