USA Credit Card Market Outlook to 2030

Region:North America

Author(s):Samanyu

Product Code:KROD917

July 2024

100

About the Report

USA Credit Card Market Overview

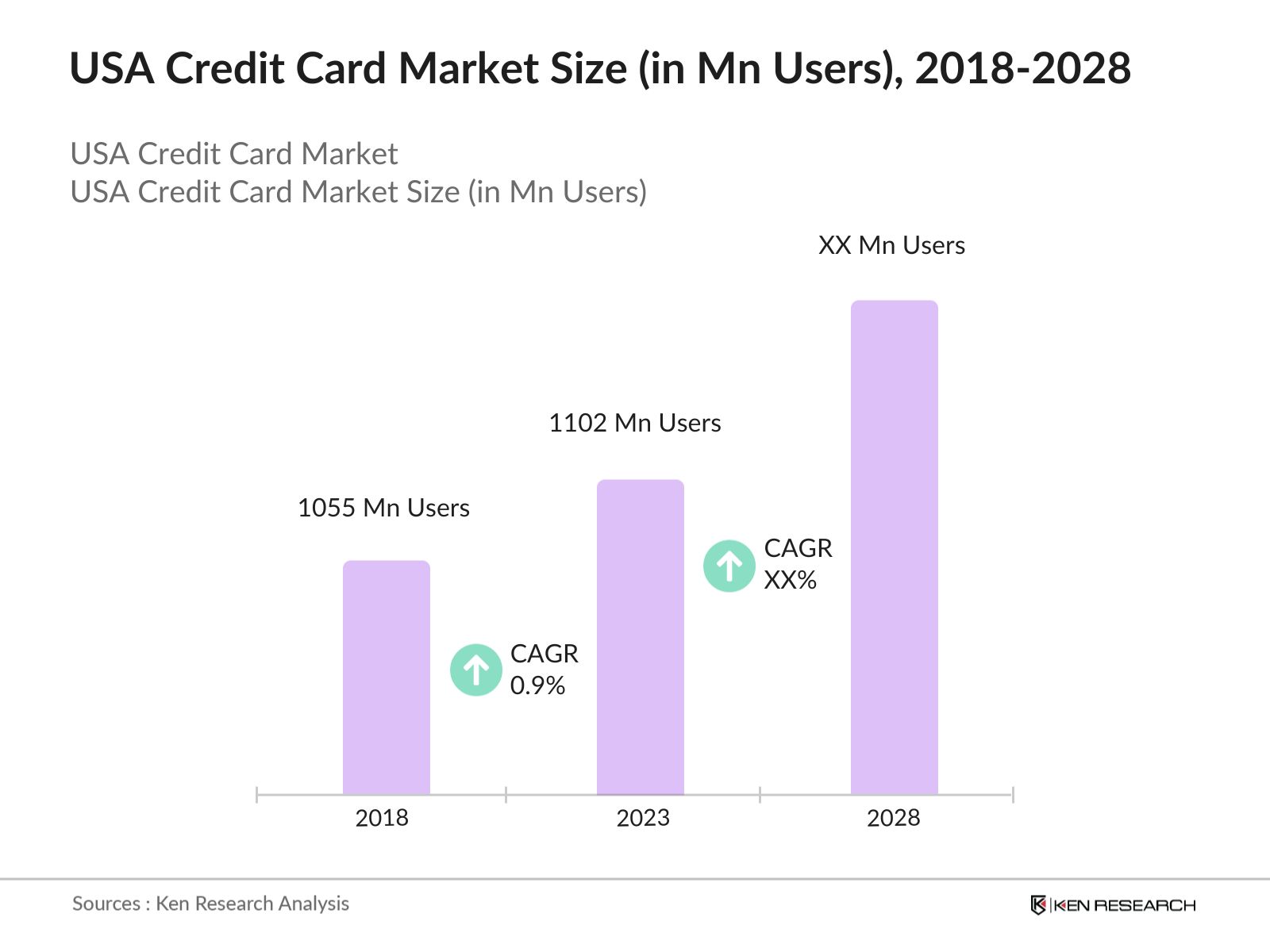

- The USA credit card market reached 1102 Mn users in 2023, driven by consumer spending, the rise of e-commerce, and increasing demand for credit among millennials with a CAGR of 0.9% during 2018-2023.

- Key players in the USA credit card market include Visa Inc., MasterCard Inc., American Express Company, Discover Financial Services, and Capital One Financial Corporation. These companies dominate the market with their extensive networks, innovative financial products, and strong brand presence.

- In 2023, Visa Inc. launched its Visa Installments program, allowing cardholders to split their purchases into equal monthly payments. This development reflects the growing consumer preference for flexible payment options. According to Visa's 2023 annual report, this program contributed to a 10% increase in transaction volume, demonstrating its impact on the market.

USA Credit Card Current Market Analysis

- California is a particularly dominant state in the USA credit card market, driven by its large population and high consumer spending. In 2023. The state's robust economy, significant tech industry presence, and high-income levels contribute to its dominance in the market.

- The key growth drivers for the USA credit card market include the rise of e-commerce, increasing consumer spending, and the popularity of rewards and cashback programs. In 2023, e-commerce sales in the USA reached $1.06 trillion, with credit cards being the preferred payment method for over 40% of these transactions.

- In response to the rising threat of credit card fraud, the U.S. government is investing in cybersecurity infrastructure. In 2024, USD 500 Mn is allocated to improve cybersecurity measures for financial institutions, up from USD 450 Mn in 2023. This investment aims to reduce the incidence of credit card fraud and enhance the security of digital transactions.

Market Segmentation

The USA Credit Card Market can be segmented based on several factors:

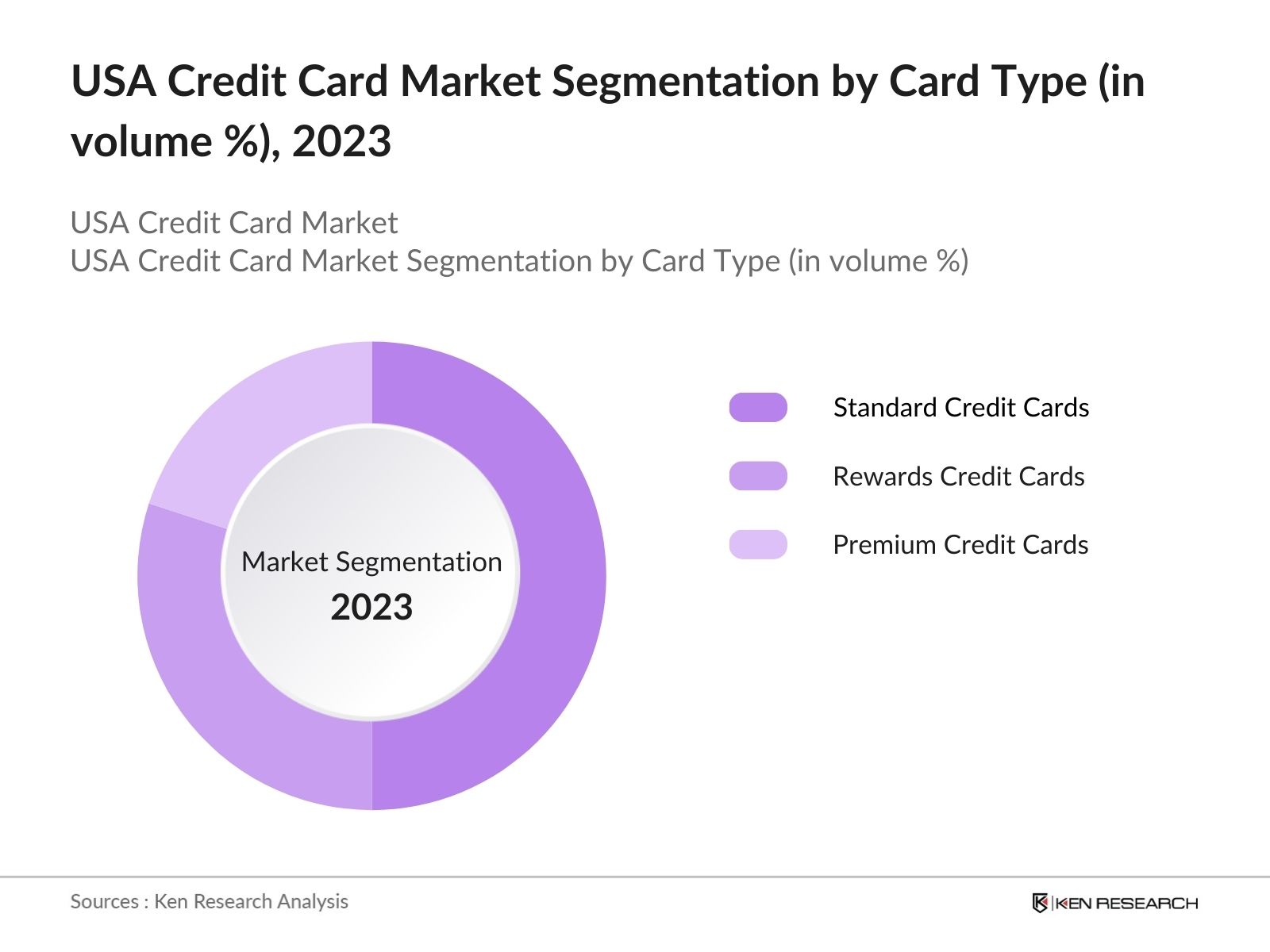

By Card Type: USA credit card market segmentation by card type is divided into standard, rewards and premium credit cards. In 2023, Standard credit cards dominate the market because they are accessible to a broad range of consumers and provide essential features for everyday use. Rewards credit cards are also highly popular due to the attractive incentives they offer, such as cashback and travel rewards.

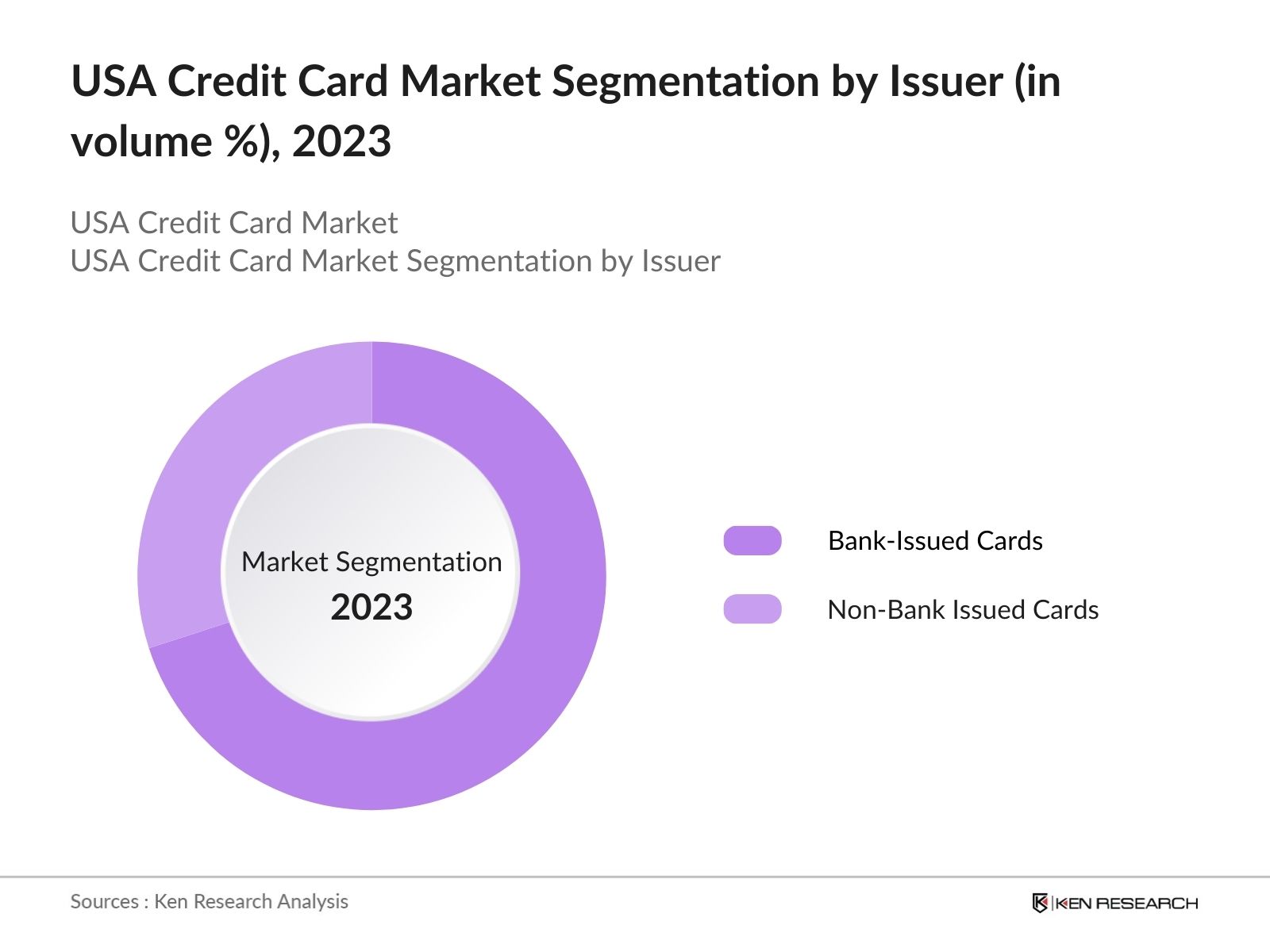

By Issuer: USA credit card market segmentation by issuer is divided into bank-issued and non-bank issued cards. In 2023, bank-issued cards dominate the market because of the trust and reliability associated with major banks. These institutions also have the resources to offer competitive interest rates, rewards, and comprehensive customer service.

By Region: USA credit card market segmentation by region is divided into north, south, east and west. In 2023, the South region dominating due to higher consumer spending and a larger population base. This region's robust economic activity and diverse demographics drive significant credit card usage and market growth, making it a key area for issuers.

USA Credit Card Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Visa Inc. |

1958 |

Foster City, CA |

|

MasterCard Inc. |

1966 |

Purchase, NY |

|

American Express Company |

1850 |

New York, NY |

|

Discover Financial Services |

1985 |

Riverwoods, IL |

|

Capital One Financial Corporation |

1994 |

McLean, VA |

- Introduction of (BNPL) Services: In 2023, several major credit card companies introduced BNPL services, allowing consumers to split their purchases into installments. By end of 2024, it is projected that over 15 Mn credit card users will adopt BNPL services, reflecting a shift towards more flexible payment options.

- Enhanced Rewards Programs: Credit card companies are continuously enhancing their rewards programs to attract and retain customers. By end of 2024, it is projected that over 30 Mn cardholders will benefit from new and improved rewards programs, compared to 27 Mn in 2023. These programs include higher cashback rates, travel rewards, and exclusive discounts.

- Partnerships with E-commerce Platforms: In 2023, American Express announced a partnership with major e-commerce platforms to offer exclusive benefits to cardholders. By end of 2024, it is estimated that this partnership will drive an additional USD 500 Mn in transaction volume for American Express, highlighting the importance of strategic alliances in the credit card market.

USA Credit Card Industry Analysis

USA Credit Card Market Growth Drivers:

- E-commerce Boom: The surge in e-commerce activities is a significant growth driver for the USA credit card market, with a large portion of these transactions being facilitated through credit cards. This increase is driven by a growing preference for online shopping and digital transactions, making credit cards a preferred payment method.

- Consumer Credit Demand: There is a rising demand for consumer credit in the USA, driven by increased consumer spending and borrowing. By end of 2024, American consumers are projected to take out USD 1.3 Tn in new credit card loans, up from USD 1.2 Tn in 2023. This demand is fueled by low-interest rates and the availability of various credit card products tailored to different consumer needs.

- Financial Inclusion Programs: Financial inclusion initiatives are expanding credit card usage among previously underserved populations. By end of 2024, over 25 Mn Americans are expected to gain access to credit cards through various inclusion programs, compared to 23 Mn in 2023. These initiatives are aimed at improving financial literacy and providing access to credit for lower-income groups.

USA Credit Card Market Challenges:

- Credit Card Fraud: Credit card fraud remains a significant challenge. In 2024, losses due to credit card fraud are expected to reach USD 10 Bn, up from USD 8.8 Bn in 2023. Despite advancements in security technologies, fraudsters continue to find new ways to exploit vulnerabilities in the system.

- High Consumer Debt: The increasing level of consumer debt is a major concern. In 2024, the total outstanding credit card debt in the USA is projected to exceed USD 1.2 Tn, up from USD 930 Bn in Q4 2023. This high debt level poses risks to both consumers and financial institutions, potentially leading to higher default rates.

- Regulatory Compliance: Adhering to stringent regulatory requirements is a constant challenge for credit card issuers. By end of 2024, compliance costs for major credit card companies are expected to exceed USD 1.5 Bn, driven by new regulations aimed at protecting consumers and ensuring fair lending practices.

USA Credit Card Market Government Initiatives:

- Financial Literacy Programs: The U.S. government has been enhancing financial literacy programs to promote responsible credit card use. By end of 2024, the Financial Literacy and Education Commission (FLEC) is expected to reach over 10 Mn participants through various workshops and online courses, an increase from 8.5 Mn in 2023. These programs aim to educate consumers on managing credit card debt and improving their financial health.

- Consumer Protection Measures: In 2024, the Consumer Financial Protection Bureau (CFPB) is set to introduce new regulations aimed at curbing predatory lending practices in the credit card industry. These measures are expected to protect 5 million consumers from unfair credit card practices, ensuring transparency and fairness in the issuance and management of credit cards.

- Support for Digital Payments: The U.S. government is promoting the adoption of digital payments, including credit card transactions, as part of its broader financial inclusion strategy. By end of 2024, government initiatives are expected to facilitate the distribution of 20 Mn new digital credit cards to underserved populations, compared to 15 Mn in 2023. This initiative aims to enhance access to financial services and promote economic participation.

USA Credit Card Future Market Outlook

The USA Credit Card Market is expected to show robust growth, driven by continued growth in consumer spending and digital payments.

Future Market Trends

-

- Increased Adoption of Digital Wallets: Over the next five years, the adoption of digital wallets is expected to rise significantly. By 2028, it is projected that 70% of credit card transactions will be conducted via digital wallets. This trend will be driven by advancements in mobile payment technologies and consumer preference for convenience and security.

- Growth of Artificial Intelligence (AI) in Fraud Detection: AI and machine learning technologies will play a crucial role in fraud detection and prevention. By 2028, it is estimated that AI-powered systems will help reduce credit card fraud losses by USD 5 Bn annually, enhancing the security of credit card transactions and protecting consumers.

- Expansion of Credit Access to Underserved Markets: Efforts to expand credit access to underserved markets will continue to grow. By 2028, it is expected that an additional 30 million Americans will gain access to credit cards through financial inclusion programs. This will drive further growth in the credit card market and support economic inclusion.

Scope of the Report

|

By Card Type |

Standard Credit Cards Rewards Credit Cards Premium Credit Cards |

|

By Issuer |

Bank-Issued Cards Non-Bank Issued Cards |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Financial Institutions

Investment and financial Analysts

Credit Reporting Agencies

Traders Loan EMI Credit Cards Players

Banks and financial Institutions

Banking Institutions Payment System Operators

Government and Regulatory Bodies (Federal Trade Commission)

BNPL Credit Cards Players

FinTech Firms

E-commerce Companies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Visa

MasterCard

American Express

Discover

JPMorgan Chase

Citibank

Bank of America

Wells Fargo

Capital One

US Bank

Barclays

HSBC

PNC

TD Bank

Synchrony Financial

Table of Contents

1. USA Credit Card Market Overview

1.1 USA Credit Card Market Taxonomy

2. USA Credit Card Market Size (in USD Bn), 2018-2023

3. USA Credit Card Market Analysis

3.1 USA Credit Card Market Growth Drivers

3.2 USA Credit Card Market Challenges and Issues

3.3 USA Credit Card Market Trends and Development

3.4 USA Credit Card Market Government Regulation

3.5 USA Credit Card Market SWOT Analysis

3.6 USA Credit Card Market Stake Ecosystem

3.7 USA Credit Card Market Competition Ecosystem

4. USA Credit Card Market Segmentation, 2023

4.1 USA Credit Card Market Segmentation by Card Type (in value %), 2023

4.2 USA Credit Card Market Segmentation by Issuer (in value %), 2023

4.3 USA Credit Card Market Segmentation by Region (in value %), 2023

5. USA Credit Card Market Competition Benchmarking

5.1 USA Credit Card Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. USA Credit Card Future Market Size (in USD Bn), 2023-2028

7. USA Credit Card Future Market Segmentation, 2028

7.1 USA Credit Card Market Segmentation by Card Type (in value %), 2028

7.2 USA Credit Card Market Segmentation by Issuer (in value %), 2028

7.3 USA Credit Card Market Segmentation by Region (in value %), 2028

8. USA Credit Card Market Analysts’ Recommendations

8.1 USA Credit Card Market TAM/SAM/SOM Analysis

8.2 USA Credit Card Market Customer Cohort Analysis

8.3 USA Credit Card Market Marketing Initiatives

8.4 USA Credit Card Market White Space Opportunity Analysis

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step: 2 Market Building:

Collating statistics on USA credit card market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA credit card market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step: 3 Research Output:

Our team will approach multiple credit card providers companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from credit card providers companies.

Frequently Asked Questions

01 How big is USA Credit Card Market?

The USA credit card market reached 1102 MN users in 2023, driven by consumer spending, the rise of e-commerce, and increasing demand for credit among millennials with CAGR of 0.9% during 2018-2023.

02 What are the challenges faced by the USA Credit Card Market?

The key challenges faced by the USA Credit Card Market are high consumer debt, regulatory changes, cybersecurity risks, and intense competition among issuers.

03 Who are the major players in the USA Credit Card Market?

Some of the major players in the USA Credit Card Market include Visa, MasterCard, American Express and Discover.

04 What are the factors driving USA credit card market?

Drivers include rising cashless transactions, rewards programs, payment tech advancements, and e-commerce growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.