USA CRM Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD2788

November 2024

87

About the Report

USA CRM Market Overview

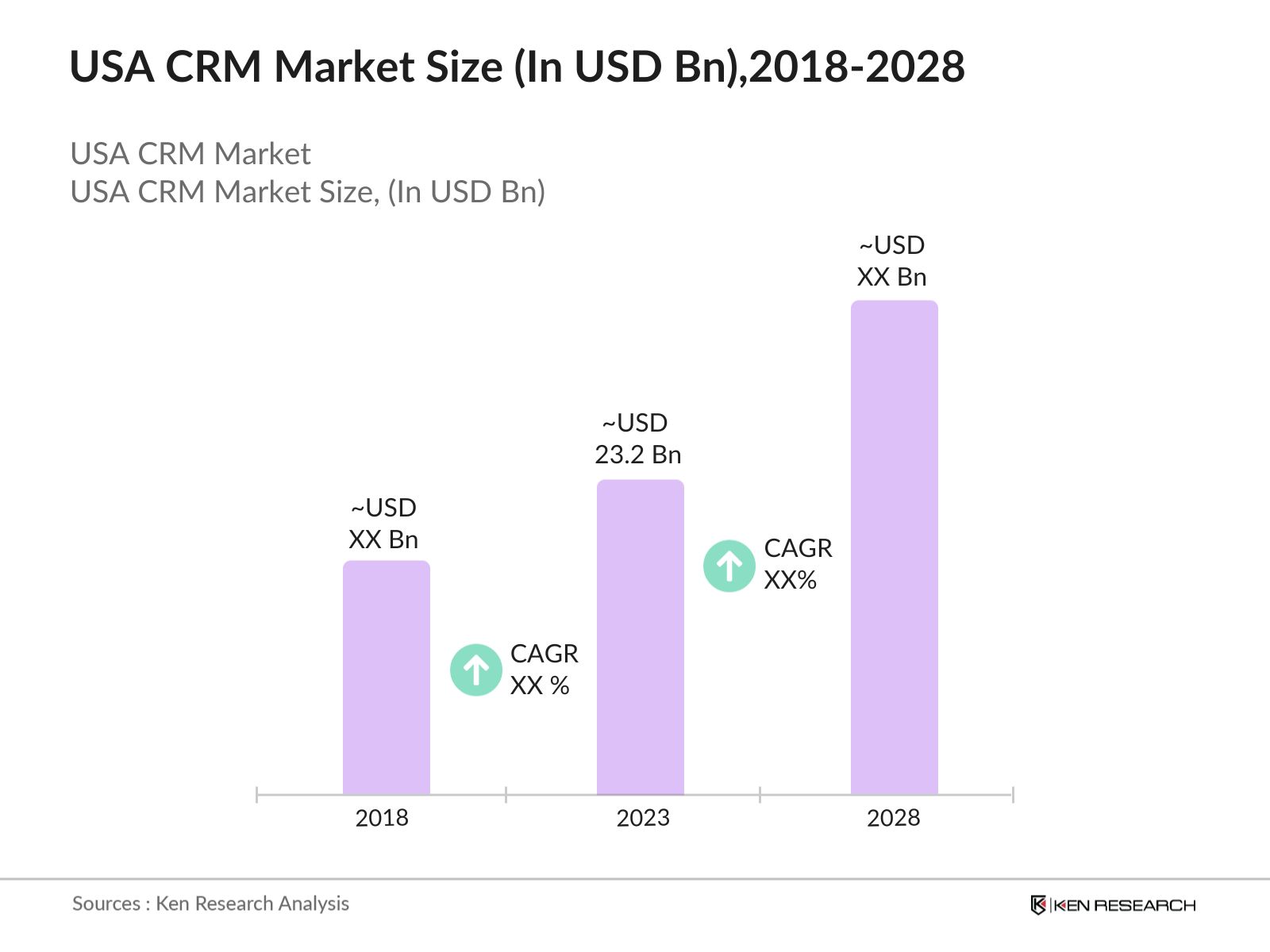

- The USA Customer Relationship Management (CRM) Software market is valued at USD 23.2 billion in 2023, driven by the growing demand for advanced customer engagement solutions, digital transformation across industries, and the integration of artificial intelligence and machine learning in CRM software.

- Major players in the USA CRM Market include Salesforce, Microsoft Dynamics, Oracle, SAP, and HubSpot. These companies are recognized for their comprehensive software solutions, offering cloud-based CRM platforms with customizable features. Salesforce continues to lead the market with its innovative customer engagement solutions and wide industry applicability.

- In the USA, regions like California, New York, and Texas are prominent markets for CRM solutions, driven by the high concentration of tech companies, financial institutions, and retail giants. These states are characterized by a mature CRM landscape, with significant investments in cloud-based and AI-powered platforms to enhance customer engagement and operational efficiency.

- In 2023, Salesforce launched new AI-powered CRM tools aimed at improving customer engagement and automating service operations. This launch highlights the trend of incorporating AI in CRM software to enhance customer experiences and optimize business processes.

USA CRM Market Segmentation

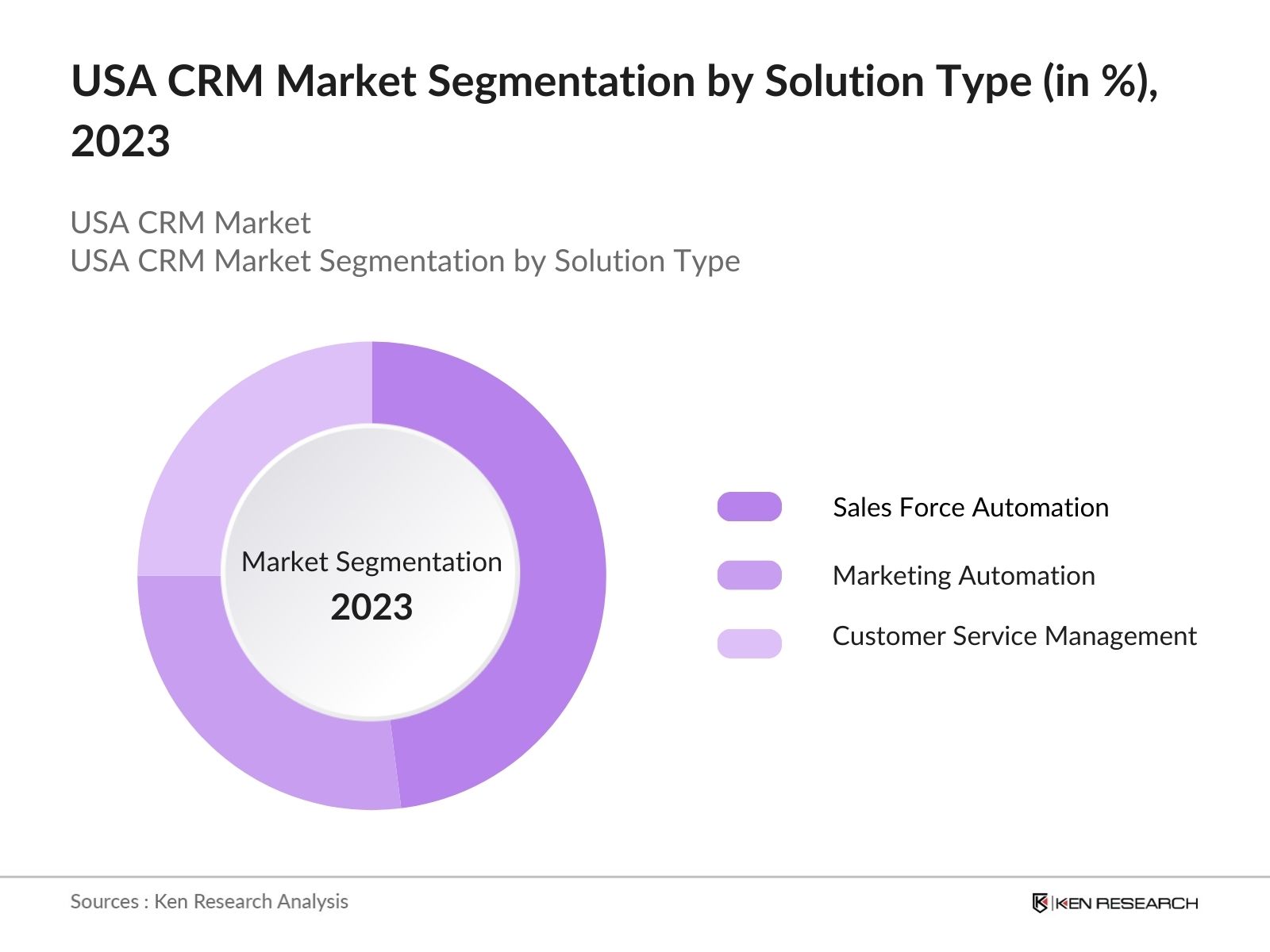

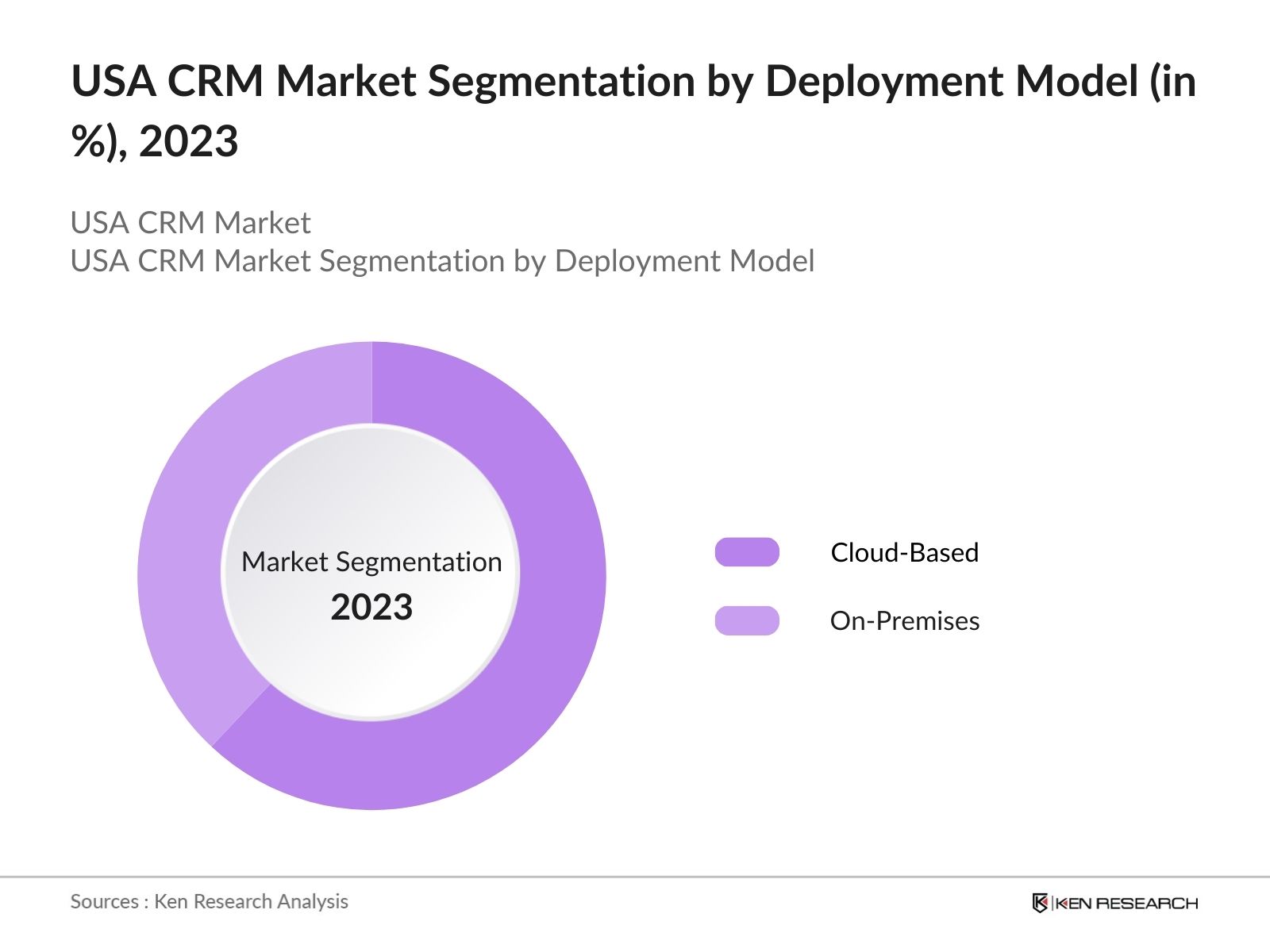

The USA CRM market can be segmented by solution type, deployment model & region:

- By Solution Type: The market is segmented into Sales Force Automation, Marketing Automation, and Customer Service Management. In 2024, Sales Force Automation continues to dominate due to its effectiveness in streamlining sales processes and improving lead management. Marketing Automation is rapidly gaining traction as businesses focus on data-driven marketing strategies and customer insights.

- By Deployment Model: The market is segmented into cloud-based and on-premises solutions. In 2024, cloud-based solutions dominate the market due to their scalability, flexibility, and lower initial costs. On-premises solutions hold a smaller share but are still relevant for organizations with strict data security and compliance requirements.

- By Region: The market is segmented regionally into the Northeast, Midwest, South, and West. In 2023, the Northeast leads the market, driven by the dominance of the finance and healthcare sectors, which have a high demand for CRM solutions to manage customer data and improve engagement strategies.

USA CRM Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Salesforce |

1999 |

San Francisco, USA |

|

Microsoft Dynamics |

2001 |

Redmond, USA |

|

Oracle |

1977 |

Austin, USA |

|

SAP |

1972 |

Walldorf, Germany |

|

HubSpot |

2006 |

Cambridge, USA |

- Salesforce: In 2023, Salesforce launched a new AI-powered feature called Einstein GPT, designed to enhance customer engagement by providing businesses with real-time insights into customer behavior. This feature allows companies to personalize interactions at scale and automate workflows. Salesforce's innovation strengthens its leadership in the CRM market.

- Microsoft Dynamics: In 2024, Microsoft Dynamics introduced enhanced integration with its Power Platform, allowing users to create custom CRM applications tailored to specific business needs without the need for extensive coding. This move was aimed at empowering organizations to optimize their CRM systems for unique workflows.

USA CRM Market Analysis

Market Growth Drivers:

- Digital Transformation Across Industries: In recent years, the USA has seen over 7,500 companies adopt CRM solutions, enhancing their customer engagement and operational efficiency. The shift towards digital transformation in sectors like finance, healthcare, and retail has led to a surge in demand for CRM systems that integrate with other digital platforms and technologies.

- Rise of E-commerce and Online Retail: The rapid expansion of e-commerce, which generated more than USD 1 trillion in revenue in the USA in 2023, has driven the adoption of CRM solutions across retail businesses. E-commerce platforms heavily rely on CRM tools to manage customer relationships, personalize shopping experiences, and analyze customer data for targeted marketing efforts.

- Integration of AI and Machine Learning: In 2023, over 15,000 businesses in the USA were using AI-driven CRM platforms to enhance customer service and sales processes. AI integrations have enabled companies to handle more than 20 million customer queries daily through automated systems like chatbots and predictive analytics, helping improve overall customer engagement and satisfaction.

Market Challenges:

- Data Privacy Concerns: As CRM software becomes more advanced in collecting and analyzing customer data, concerns over data privacy and regulatory compliance are increasing. Companies must navigate stringent regulations like the California Consumer Privacy Act (CCPA) to ensure customer data is protected.

- High Implementation Costs: The initial investment in CRM solutions, particularly for large-scale deployments, remains a challenge for smaller businesses. While cloud-based solutions reduce costs, the complexity of implementation and customization can deter potential adopters.

- Data Security and Cyber Threats: As CRM systems store vast amounts of sensitive customer data, they are prime targets for cyberattacks. Ensuring robust security protocols, encryption, and compliance with data privacy laws are critical challenges for businesses. A single data breach can have significant legal, financial, and reputational consequences, further complicating the adoption of CRM solutions.

Government Initiatives:

- Data Privacy Regulations: In 2023, the California Consumer Privacy Act (CCPA) imposed fines ranging from USD 2,500 to USD 7,500 per violation for non-compliance with data privacy laws. This regulation encourages companies using CRM systems to ensure stringent data protection practices and has led to increased investments in secure CRM solutions.

- Federal Support for Small Businesses: The Small Business Administration (SBA) provided USD 108 billion in loans and grants to help small businesses invest in digital tools, including CRM systems, to improve customer management and operational efficiency. This financial support has been crucial for small and mid-sized businesses seeking to adopt CRM technologies.

USA CRM Market Future Outlook

The USA CRM market is poised for continued growth, driven by the increasing demand for cloud-based solutions, the rise of AI-powered CRM tools, and the growing emphasis on customer-centric business models.

Future Market Trends:

- Increased Emphasis on Customer Data Privacy: As data privacy regulations, such as the CCPA, continue to evolve, CRM vendors will need to enhance security features and ensure compliance. CRM platforms will increasingly offer tools that help companies manage customer consent, comply with data privacy regulations, and ensure secure data storage and management.

- Focus on Customer Data Platforms (CDP): The development of customer data platforms that consolidate customer data from various sources will enhance the capabilities of CRM software, providing businesses with a more comprehensive view of their customers.

- Growth of Subscription-Based CRM Services: Subscription-based CRM models, particularly for small and medium enterprises (SMEs), will continue to grow. These services provide flexible payment options, easy upgrades, and lower initial costs, making advanced CRM capabilities more accessible to smaller businesses. As a result, the CRM market will expand further into previously underserved segments.

Scope of the Report

|

By Region |

Northeast Midwest South West |

|

|

By Solution Type |

Sales Force Automation Marketing Automation Customer Service Management |

|

|

Cloud-based On-premises |

|

|

By End-Use Industry |

Retail Finance Healthcare |

Products

Key Target Audience:

Banks and Financial Institutions

Venture Capitalists

Government and Regulatory Bodies (FTC, FCC, CFPB, NIST)

CRM Software Developers

E-commerce Companies

IT Consultants

Large Enterprises

Small and Medium Enterprises (SMEs)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2024-2028

Companies

Players Mentioned in the Report:

Salesforce

Microsoft Dynamics

Oracle

SAP

HubSpot

Zoho CRM

Freshworks CRM

SugarCRM

Pipedrive

Nimble CRM

Insightly

Apptivo

Base CRM

Copper CRM

Creatio

Table of Contents

1. USA CRM Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA CRM Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA CRM Market Analysis

3.1. Growth Drivers

3.1.1. Digital Transformation Across Industries

3.1.2. Rise of E-commerce and Online Retail

3.1.3. Integration of AI and Machine Learning

3.2. Restraints

3.2.1. Data Privacy Concerns

3.2.2. High Implementation Costs

3.2.3. Data Security and Cyber Threats

3.3. Opportunities

3.3.1. Cloud-Based Solutions

3.3.2. AI-Powered Tools

3.3.3. Customer Data Platforms (CDP)

3.4. Trends

3.4.1. Omnichannel CRM Solutions

3.4.2. Growth of Subscription-Based CRM Services

3.4.3. Increased Focus on Data Privacy

3.5. Government Regulation

3.5.1. Data Privacy Regulations (CCPA, FTC)

3.5.2. Federal Support for Small Businesses

3.5.3. Government Initiatives Promoting Digital Transformation

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. USA CRM Market Segmentation, 2023

4.1. By Solution Type (in Value %)

4.1.1. Sales Force Automation

4.1.2. Marketing Automation

4.1.3. Customer Service Management

4.2. By Deployment Model (in Value %)

4.2.1. Cloud-Based

4.2.2. On-Premises

4.3. By End-Use Industry (in Value %)

4.3.1. Retail

4.3.2. Finance

4.3.3. Healthcare

4.4. By Region (in Value %)

4.4.1. Northeast

4.4.2. Midwest

4.4.3. South

4.4.4. West

5. USA CRM Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Salesforce

5.1.2. Microsoft Dynamics

5.1.3. Oracle

5.1.4. SAP

5.1.5. HubSpot

5.1.6. Zoho CRM

5.1.7. Freshworks CRM

5.1.8. SugarCRM

5.1.9. Pipedrive

5.1.10. Nimble CRM

5.1.11. Insightly

5.1.12. Apptivo

5.1.13. Base CRM

5.1.14. Copper CRM

5.1.15. Creatio

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. USA CRM Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. USA CRM Market Regulatory Framework

7.1. Data Privacy Regulations

7.2. Compliance Requirements

7.3. Certification Processes

8. USA CRM Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. USA CRM Future Market Segmentation, 2028

9.1. By Solution Type (in Value %)

9.2. By Deployment Model (in Value %)

9.3. By End-Use Industry (in Value %)

9.4. By Region (in Value %)

10. USA CRM Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

We begin by referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, key players, and consumer behavior. We also assess the regulatory landscape and market dynamics specific to the USA CRM market, particularly the influence of data privacy regulations such as the CCPA and FTC guidelines.

Step 2: Market Building

We collect historical data on market size, growth rates, product segmentation (Sales Force Automation, Marketing Automation, and Customer Service Management), and deployment models (cloud-based and on-premises). Additionally, we analyze the distribution of CRM solutions across different industries such as retail, healthcare, finance, and IT & telecom. We ensure accuracy and reliability by examining market share and revenue generated by leading CRM providers.

Step 3: Validating and Finalizing

We perform Computer-Assisted Telephone Interviews (CATIs) with industry experts, including representatives from leading CRM software companies, technology consultants, and IT managers. These interviews help validate the statistics collected and provide insights into operational and financial aspects, such as pricing strategies, implementation challenges, and customer preferences.

Step 4: Research Output

Our team interacts with CRM software providers, industry analysts, and business users to understand the market dynamics, evolving consumer needs, and technological advancements. This process ensures that the final data reflects the actual market conditions, utilizing both a bottom-to-top and top-to-bottom approach for accuracy and completeness.

Frequently Asked Questions

1. How large is the USA CRM Market?

In 2024, the USA CRM Market is expected to reach USD 23.2 billion. The market's growth is driven by the increasing demand for digital transformation, AI integration, and the need for personalized customer engagement across various industries.

2. What are the challenges in the USA CRM Market?

Key challenges include data privacy concerns, particularly around regulations such as the CCPA, and the high costs of implementing large-scale CRM systems. Additionally, integrating CRM with existing legacy systems remains a significant challenge for many organizations.

3. Who are the major players in the USA CRM Market?

Major players in the USA CRM Market include Salesforce, Microsoft Dynamics, Oracle, SAP, and HubSpot. These companies dominate the market with their comprehensive and scalable CRM solutions across various industries.

4. What are the growth drivers of the USA CRM Market?

Growth drivers include the rapid expansion of e-commerce, the increasing focus on customer-centric business models, and the integration of AI and machine learning to provide predictive analytics and enhanced customer experiences. Additionally, the rise of cloud-based CRM solutions is contributing significantly to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.