USA Crop Oil Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD1471

November 2024

97

About the Report

USA Crop Oil Market Overview

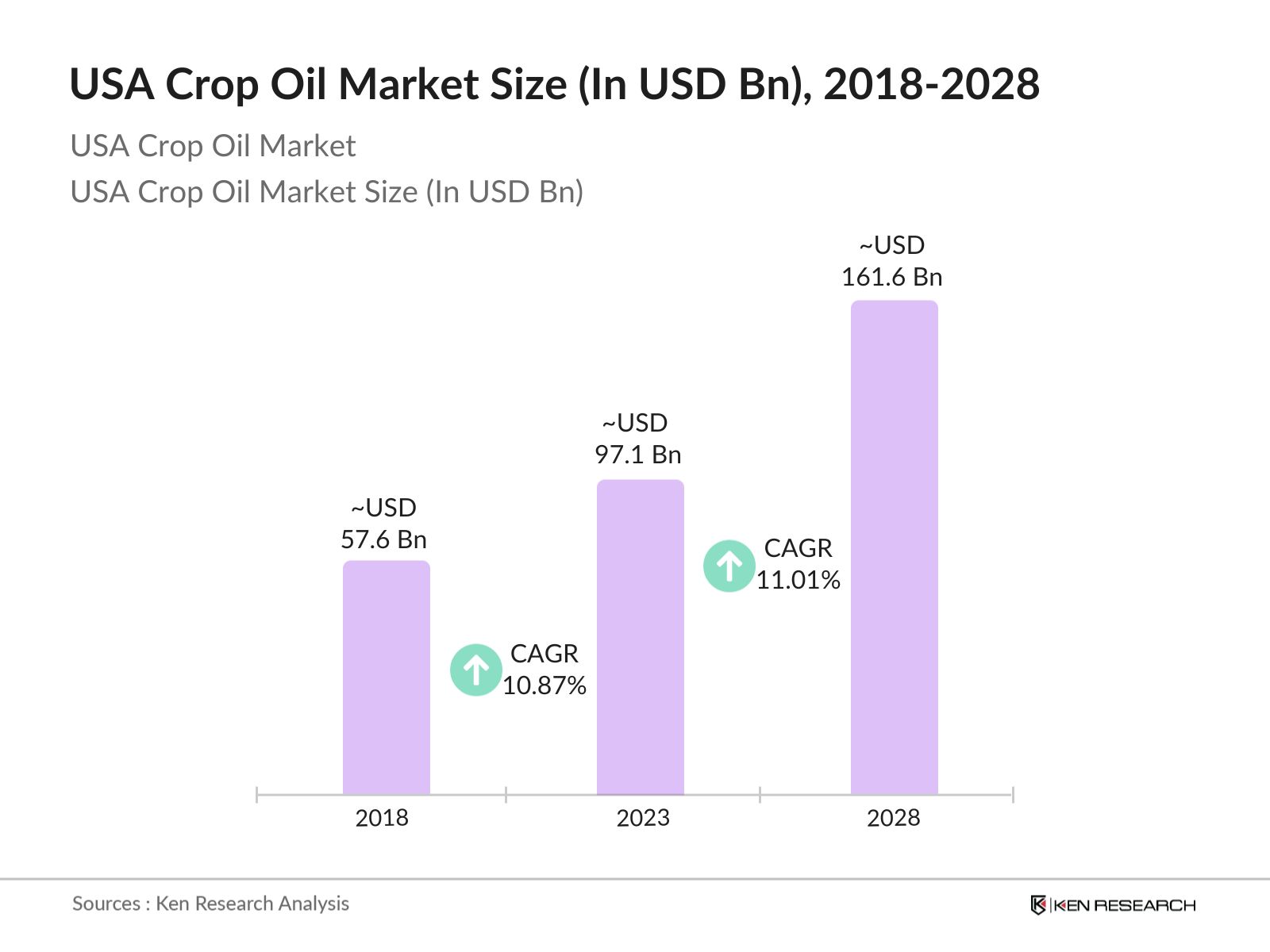

- The USA Crop Oil Market was valued at USD 57.6 billion in 2018 and reached USD 97.1 billion in 2023. This growth is primarily driven by the increasing demand for efficient agricultural solutions, the rising adoption of sustainable farming practices, and the growing awareness of the benefits of crop oil concentrates among farmers.

- The key players in the USA Crop Oil Market include Wilbur-Ellis Company, Brandt Consolidated, Inc., BASF SE, Croda International Plc, and Helena Agri-Enterprises LLC. These companies have leveraged their extensive research capabilities and distribution networks to develop advanced crop oil formulations that enhance pesticide performance and improve crop yields.

- In 2023, Brandt Consolidated, Inc. introduced a new line of crop oil concentrates optimized for low-volume sprays, addressing the needs of cost-sensitive farmers. This innovation has gained traction, with over 70% of farmers reporting improved pesticide efficacy and reduced input costs, enhancing crop protection and supporting sustainable practices.

- California led the USA Crop Oil Market in 2023, driven by its expansive agricultural sector and diverse crop production. The state's favourable climate and soil conditions, coupled with high adoption rates of advanced agricultural technologies, contributed to its dominance in the crop oil market.

USA Crop Oil Market Segmentation

The USA Crop Oil Market is segmented into application type, formulation type, and region.

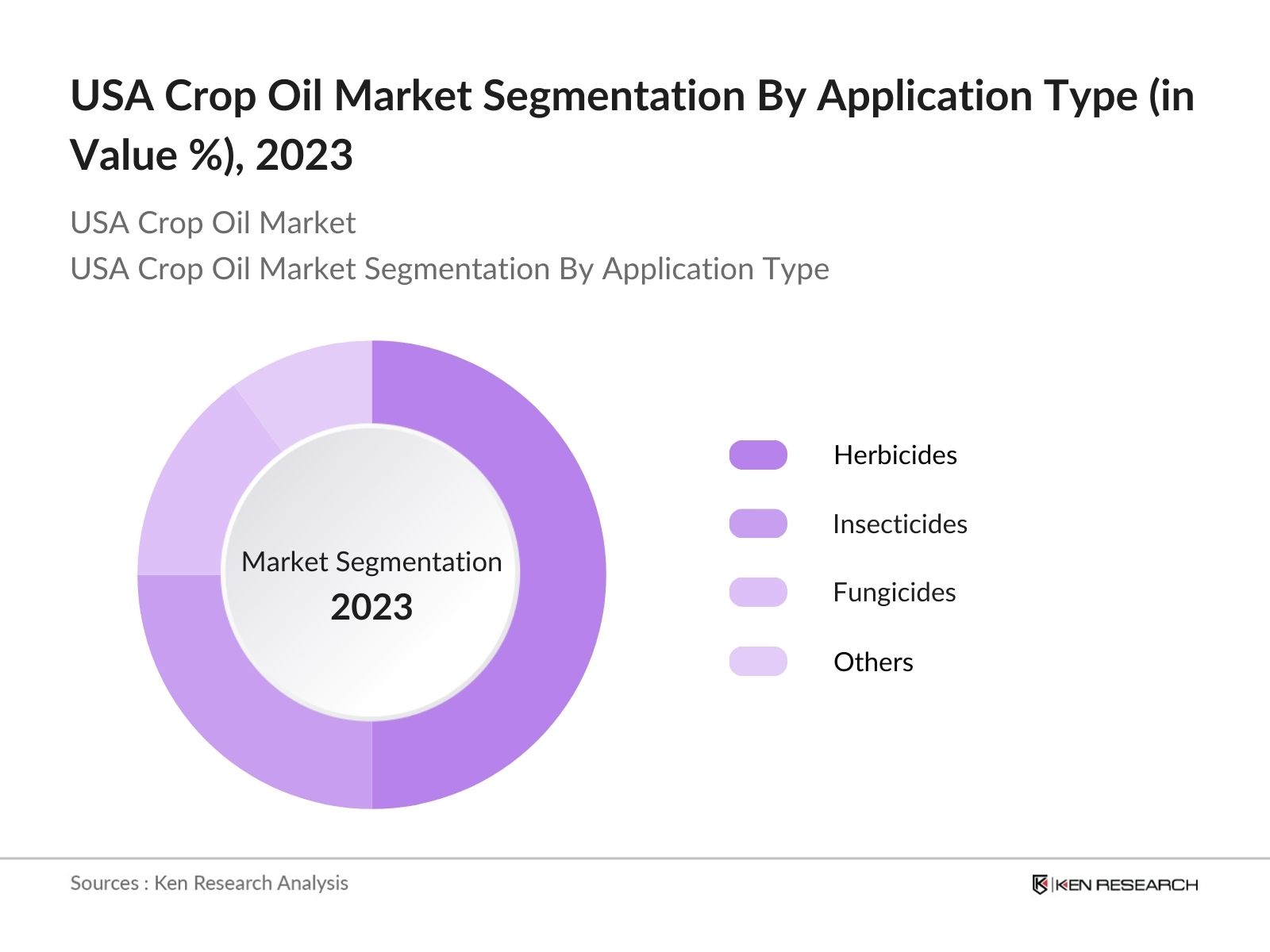

- By Application Type: The USA Crop Oil Market is segmented by application type into herbicides, insecticides, fungicides, and others. In 2023, the herbicides segment dominated the market due to the widespread use of crop oils to enhance the effectiveness of herbicides in controlling weeds across various crop types.

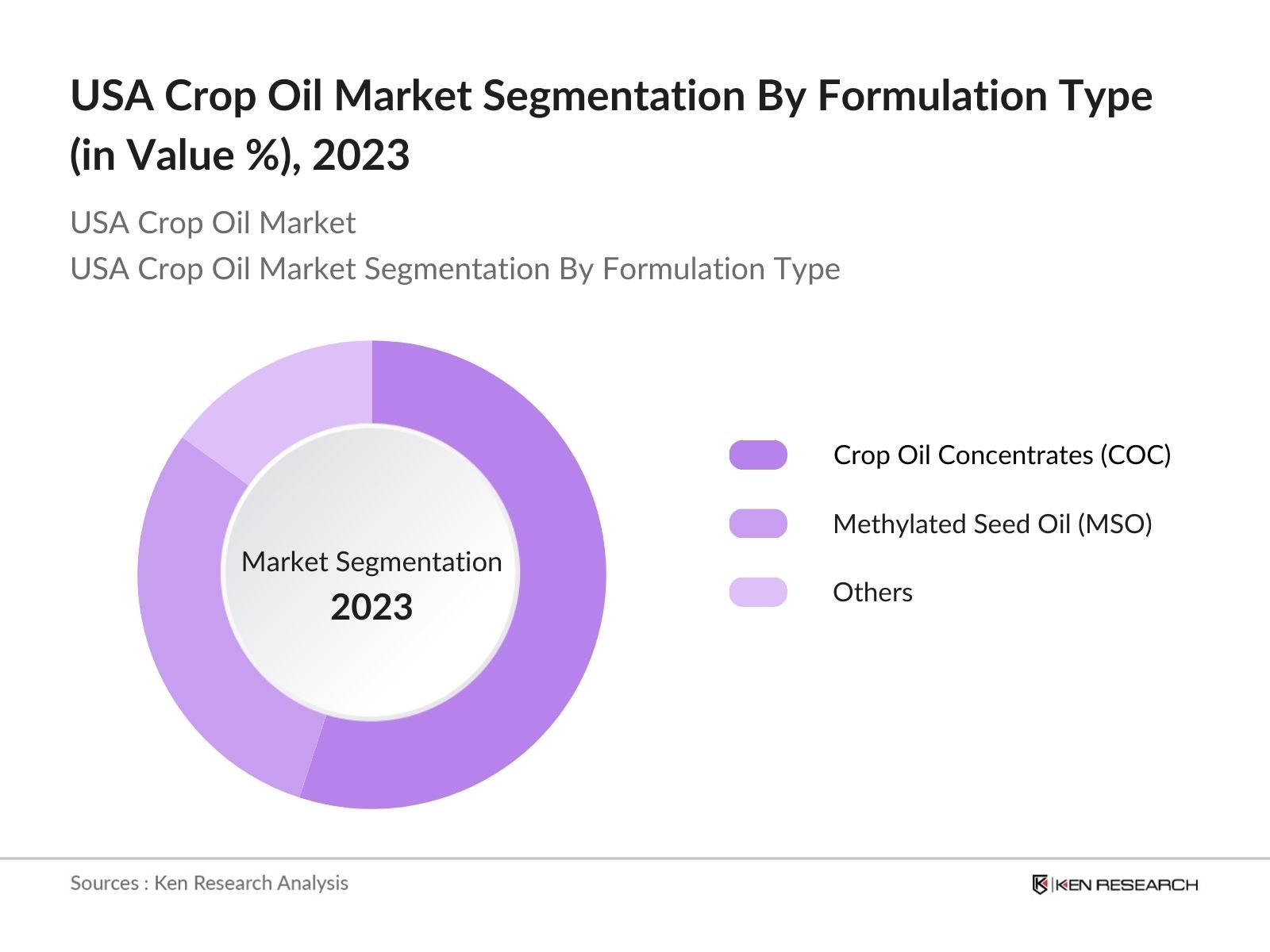

- By Formulation Type: The market is also segmented by formulation type into crop oil concentrates (COC), methylated seed oil (MSO), and others (including vegetable oils, adjuvants, etc.). Crop oil concentrates held the largest market share in 2023, driven by their compatibility with a wide range of pesticides and their ability to improve the coverage and absorption of active ingredients.

- By Region: The market is segmented by region into North, South, East, and West. In 2023, the Western region dominated the market, with California and other agricultural states like Washington and Oregon leading in crop oil usage due to their extensive fruit and vegetable farming.

USA Crop Oil Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Wilbur-Ellis Company |

1921 |

San Francisco, California |

|

Brandt Consolidated, Inc. |

1953 |

Springfield, Illinois |

|

BASF SE |

1865 |

Florham Park, New Jersey |

|

Croda International Plc |

1925 |

New Castle, Delaware |

|

Helena Agri-Enterprises LLC |

1957 |

Collierville, Tennessee |

- Croda International Plc: In 2023, Croda International Plc acquired Solus Biotech for KRW 350 billion. This acquisition enhances Croda's portfolio in biotechnology-derived active ingredients for beauty care, expanding its Asian manufacturing capabilities and establishing a new R&D hub, reflecting a commitment to sustainable innovation in personal care.

- BASF SE: In 2024, BASF SE announced plans to invest 900 million in its agricultural solutions division, focusing on research and development initiatives to support sustainable farming practices. This investment includes building a new fermentation plant for biological crop protection products at its Ludwigshafen site, expected to be operational in late 2025.

USA Crop Oil Market Analysis

USA Crop Oil Market Growth Drivers:

- Increasing Demand for Sustainable Farming Practices: With over 60% of farmers expressing a preference for environmentally friendly agricultural inputs, driven by rising consumer awareness and regulatory pressures to reduce chemical pesticide use, the demand for crop oil concentrates that enhance efficacy while supporting sustainability is on the rise.

- Technological Advancements in Crop Oil Formulations: Around 30% of new crop oil products launched in the last year were bio-based, improving performance in pesticide applications, and providing better crop safety and compatibility with various pesticides, thus driving market growth through continuous innovation in formulations.

- Expansion of Agricultural Activities: In regions like California and the Midwest, over 15 million acres of new farmland have been cultivated in the past five years, characterized by diverse crop production and a high adoption rate of advanced agricultural technologies, contributing to the increased demand for crop oils as essential inputs.

USA Crop Oil Market Challenges:

- Regulatory Hurdles: Stringent regulations on pesticide and adjuvant use present challenges for the crop oil market. For instance, over 50% of traditional pesticides have been restricted or banned in Europe, limiting product availability and forcing farmers to seek alternatives like crop oil concentrates to comply with regulatory standards.

- Fluctuations in Raw Material Prices: The crop oil market is sensitive to fluctuations in the prices of raw materials, particularly vegetable oils. These price variations can affect the production costs and pricing strategies of crop oil manufacturers, impacting market profitability.

USA Crop Oil Market Government Initiatives:

- Sustainable Agriculture Research and Education (SARE) Program: The Sustainable Agriculture Research and Education (SARE) Program, supported by the USDA, promotes sustainable farming practices, including environmentally friendly agricultural inputs like crop oils. Since its inception in 1988, SARE has funded over 1,400 grant projects to enhance profitability and environmental stewardship in agriculture through research and education.

- Pesticide Environmental Stewardship Program (PESP): The Pesticide Environmental Stewardship Program (PESP), initiated by the EPA, encourages the adoption of reduced-risk pesticides and pesticide adjuvants, including crop oils. With over 1,200 partners, PESP aims to reduce the environmental impact of pesticide use and promote safer agricultural inputs, enhancing environmental quality and sustainable farming practices.

USA Crop Oil Market Future Market Outlook

The USA Crop Oil Market is expected to reach USD 161.6 billion by 2028. The market is anticipated to shift towards more sustainable and efficient formulations, with a focus on bio-based crop oils and advanced adjuvant technologies.

USA Crop Oil Market Future Market Trends:

- Increased Adoption of Bio-Based Crop Oils: Over the next five years, the adoption of bio-based crop oils is expected to rise substantially as farmers seek sustainable alternatives to traditional formulations. Currently, bio-based products account for about 15% of the total oil market, and this is projected to increase as environmental concerns drive demand for sustainable agricultural practices.

- Integration of Digital Farming Solutions: The integration of digital farming solutions with crop oil applications is anticipated to enhance precision agriculture practices. By 2028, it is expected that over 60% of farmers will utilize digital platforms and IoT devices to optimize crop oil application rates, improving pest control efficiency and resource management in agriculture.

Scope of the Report

|

By Application Type |

Herbicides Insecticides Fungicides Others |

|

By Formulation Type |

Crop Oil Concentrates (COC) Methylated Seed Oil (MSO) Others |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Agricultural Input Manufacturers

Agrochemical Companies

Agricultural Equipment Manufacturers

Biotechnology Firms

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Wilbur-Ellis Company

Brandt Consolidated, Inc.

BASF SE

Croda International Plc

Helena Agri-Enterprises LLC

Winfield United

Loveland Products, Inc.

Gowan Company

Drexel Chemical Company

Nufarm Americas Inc.

UPL Limited

Precision Laboratories, LLC

CPS (Crop Production Services)

Arysta LifeScience

CHS Inc.

Table of Contents

1. USA Crop Oil Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Crop Oil Market Size (in USD Billion), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Crop Oil Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Sustainable Farming Practices

3.1.2. Technological Advancements in Crop Oil Formulations

3.1.3. Expansion of Agricultural Activities

3.2. Restraints

3.2.1. Regulatory Hurdles

3.2.2. Fluctuations in Raw Material Prices

3.3. Opportunities

3.3.1. Rising Demand for Bio-Based Crop Oils

3.3.2. Integration of Digital Farming Solutions

3.4. Trends

3.4.1. Adoption of Sustainable Crop Oil Solutions

3.4.2. Innovations in Crop Oil Concentrates

3.5. Government Regulation

3.5.1. Sustainable Agriculture Research and Education (SARE) Program

3.5.2. Pesticide Environmental Stewardship Program (PESP)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. USA Crop Oil Market Segmentation, 2023

4.1. By Application (in Value %)

4.1.1. Herbicides

4.1.2. Insecticides

4.1.3. Fungicides

4.1.4. Others

4.2. By Formulation Type (in Value %)

4.2.1. Crop Oil Concentrates (COC)

4.2.2. Methylated Seed Oil (MSO)

4.2.3. Others

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. USA Crop Oil Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Wilbur-Ellis Company

5.1.2. Brandt Consolidated, Inc.

5.1.3. BASF SE

5.1.4. Croda International Plc

5.1.5. Helena Agri-Enterprises LLC

5.1.6. Winfield United

5.1.7. Loveland Products, Inc.

5.1.8. Gowan Company

5.1.9. Drexel Chemical Company

5.1.10. Nufarm Americas Inc.

5.1.11. UPL Limited

5.1.12. Precision Laboratories, LLC

5.1.13. CPS (Crop Production Services)

5.1.14. Arysta LifeScience

5.1.15. CHS Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. USA Crop Oil Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. USA Crop Oil Market Regulatory Framework

7.1. Environmental Regulations

7.2. Compliance Requirements

7.3. Certification Processes

8. USA Crop Oil Market Future Market Size (in USD Billion), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. USA Crop Oil Market Future Market Segmentation, 2028

9.1. By Application (in Value %)

9.2. By Formulation Type (in Value %)

9.3. By Region (in Value %)

10. USA Crop Oil Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step: 2 Market Building

Collating statistics on the USA Crop Oil market over the years and analyzing the penetration of products as well as the ratio of suppliers to compute the revenue generated for the market. We will also review product quality statistics to ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple agricultural input companies and understand the nature of product segments and sales, consumer preference, and other parameters, which will support us in validating statistics derived through the bottom-to-top approach from agricultural input manufacturers.

Frequently Asked Questions

01. How big is the USA Crop Oil Market?

The USA Crop Oil Market was valued at USD 57.6 billion in 2018, reached USD 97.1 billion in 2023, and is projected to reach USD 161.6 billion by 2028. This growth is driven by increasing demand for efficient agricultural solutions and sustainable farming practices.

02. Who are the major players in the USA Crop Oil market?

The major players in the USA Crop Oil Market include Wilbur-Ellis Company, Brandt Consolidated, Inc., BASF SE, Croda International Plc, and Helena Agri-Enterprises LLC. These companies dominate the market with extensive research capabilities and advanced product formulations.

03. What are the growth drivers of the USA Crop Oil market?

The growth drivers of the USA Crop Oil Market include increasing demand for sustainable farming practices, technological advancements in crop oil formulations, and the expansion of agricultural activities.

04. What are the challenges in the USA Crop Oil market?

The USA Crop Oil Market faces challenges including regulatory hurdles, fluctuations in raw material prices, and competition from alternative agricultural inputs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.