USA Cryogenic Equipment Market Outlook to 2030

Region:North America

Author(s):Meenakshi

Product Code:KROD3421

October 2024

84

About the Report

USA Cryogenic Equipment Market Overview

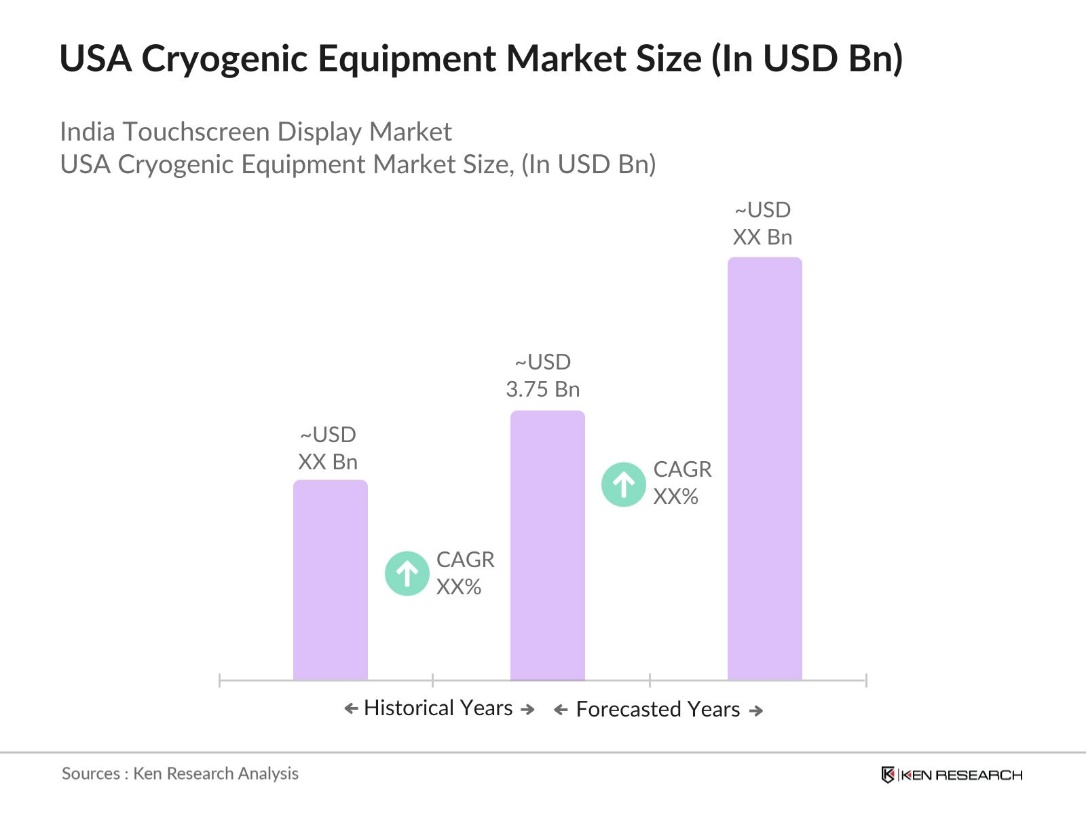

- The USA Cryogenic Equipment market is valued at USD 3.75 billion, driven by the rising demand for liquefied natural gas (LNG) infrastructure and industrial gas applications. This growth is supported by the expansion of energy projects and increasing utilization in healthcare, particularly in medical gas storage and cryosurgery. The industry's robust performance is further strengthened by technological advancements in cryogenic equipment, improving efficiency and reliability across sectors, especially in energy, healthcare, and manufacturing.

- The dominant regions in the USA Cryogenic Equipment market include Texas, California, and Louisiana, which have a strong presence due to their advanced LNG infrastructure, petrochemical plants, and industrial gases industry. These regions are also hubs for energy production, and their access to ports facilitates the import and export of cryogenic gases. Additionally, California's leadership in aerospace and research facilities contributes to the states prominent position in the market.

- The U.S. Environmental Protection Agency (EPA) proposed rules to implement a methane emissions fee under the Inflation Reduction Act of 2022. The rules target oil and gas facilities emitting over 25,000 metric tons of CO equivalent per year. Starting in 2025, facilities exceeding emissions thresholds will be charged $900 per ton of excess methane. This fee increases to $1,200 in 2026 and $1,500 in 2027, incentivizing emissions reductions across the sector.

USA Cryogenic Equipment Market Segmentation

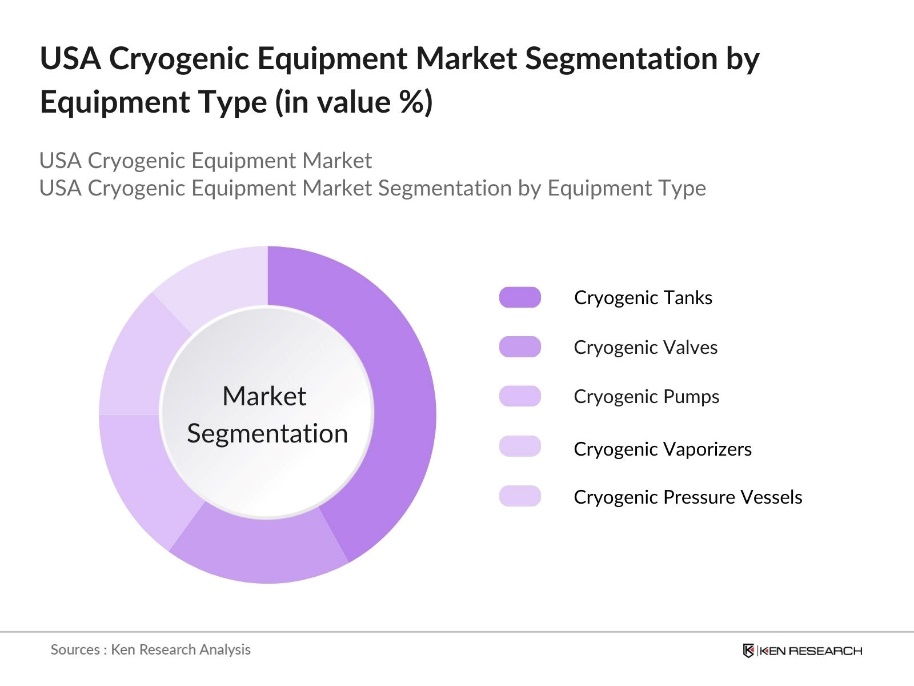

- By Equipment Type: The USA Cryogenic Equipment market is segmented by equipment type into cryogenic tanks, cryogenic valves, cryogenic pumps, cryogenic vaporizers, and cryogenic pressure vessels. Among these, cryogenic tanks hold the largest market share in 2023 due to the widespread use of cryogenic tanks for the storage and transportation of LNG and industrial gases such as oxygen, nitrogen, and argon. The increasing demand for energy-efficient storage solutions and the growth of LNG as an alternative energy source have further fueled the market for cryogenic tanks.

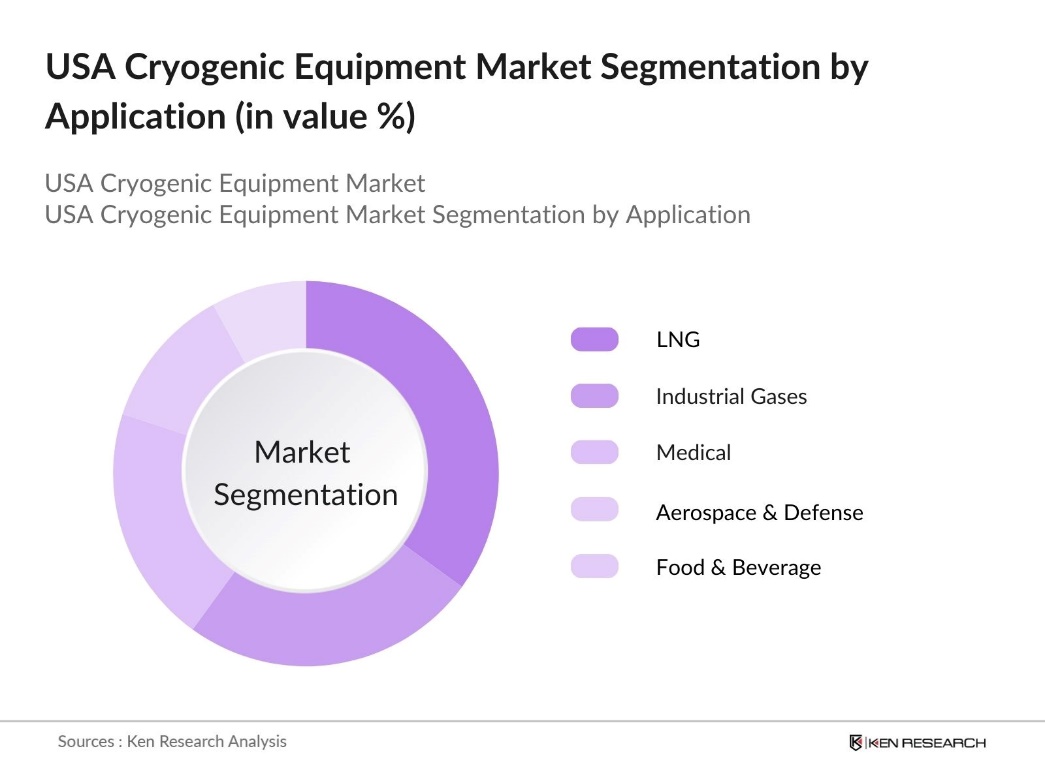

- By Application: The market is also segmented by application into LNG, industrial gases, medical, aerospace & defense, and food & beverage. The LNG segment leads with a market share, driven by the growing adoption of LNG as a cleaner energy source. The USAs position as a global leader in LNG exports has necessitated the development of robust cryogenic infrastructure, and the use of cryogenic equipment is integral to the storage and transportation of LNG in liquid form at extremely low temperatures.

USA Cryogenic Equipment Market Competitive Landscape

The competitive landscape of the USA Cryogenic Equipment market includes both domestic and global companies, with key players like Air Liquide, Linde plc, and Chart Industries leading the charge. These firms benefit from strong industrial partnerships and investments in R&D, particularly in energy and medical applications. The competition among these companies is primarily driven by the need for technological innovation, as well as expanding applications in industries such as healthcare, energy, and aerospace.

|

Company Name |

Established Year |

Headquarters |

Market Presence |

Product Portfolio |

R&D Investment |

Innovation Focus |

Cryogen Type Expertise |

Major Industry Focus |

|

Air Liquide |

1902 |

Paris, France |

||||||

|

Linde plc |

1879 |

Dublin, Ireland |

||||||

|

Chart Industries |

1992 |

Georgia, USA |

||||||

|

Cryofab Inc. |

1971 |

New Jersey, USA |

||||||

|

Parker Hannifin |

1917 |

Ohio, USA |

USA Cryogenic Equipment Industry Analysis

Growth Drivers

- Expansion in LNG Demand: The global Liquefied Natural Gas (LNG) industry has seen substantial growth, driven by a surge in demand for natural gas as a cleaner alternative to coal and oil. In 2022, the United States exported 88.9 million metric tons of LNG, making it the world's largest exporter. The expansion of LNG infrastructure, particularly in the Gulf Coast region, continues to propel the need for cryogenic equipment, which is essential for LNG storage and transportation.

- Technological Advancements in Superconductors: The development of high-temperature superconductors, which rely on cryogenic cooling, has bolstered the demand for cryogenic equipment. The DOE recently announced a $10 million investment in three projects to develop novel technologies to manufacture high-performance superconducting tapes in the United States, including power grids and particle accelerators. These advancements necessitate advanced cryogenic cooling systems to maintain the superconductors' low operating temperatures, often near -200C.

- Industrial Gas Demand (Oil and Gas, Steel, Electronics): Cryogenic equipment is essential for the storage and transportation of industrial gases, which are widely used in sectors such as oil and gas, steel, and electronics. These industries depend on high-purity gases like oxygen and nitrogen for various processes. The growing demand for steel and electronics has further driven the need for cryogenic storage solutions, as these sectors require advanced systems to safely handle and store large volumes of gases.

Market Challenges

- High Initial Capital Investment: Setting up cryogenic equipment infrastructure requires significant initial capital investment. The costs associated with establishing cryogenic storage facilities, especially for applications like LNG, can be substantial. These high upfront expenses present a financial challenge, particularly for smaller operators in sectors such as healthcare and industrial gas. The requirement to purchase and install specialized equipment can act as a barrier to entry, limiting the adoption of cryogenic technologies, even though these systems offer long-term operational benefits.

- Operational Challenges (Equipment Maintenance, Cryogenic Insulation): Maintaining cryogenic equipment poses operational challenges due to the extreme low temperatures required for its operation. Regular maintenance is essential, as cryogenic systems are prone to wear and tear over time. Insulation is a critical component in preventing heat from entering the system, but insulation failures can lead to significant operational disruptions and potential losses. Ensuring the integrity of the insulation and overall system performance requires ongoing attention and resources, which can increase operational complexity and costs for industries relying on cryogenic technologies.

USA Cryogenic Equipment Market Future Outlook

The USA Cryogenic Equipment market is expected to experience significant growth over the next five years, driven by increased demand for LNG infrastructure, advancements in cryogenic technologies, and the expanding medical and aerospace sectors. The market will benefit from investments in clean energy initiatives, especially LNG as a transitional fuel, and the ongoing innovation in medical applications of cryogenics, such as cryosurgery and biological storage.

Market Opportunities

- Growth in Hydrogen Energy Storage: As the U.S. government continues to prioritize clean energy initiatives, hydrogen is gaining prominence as a key energy source. This shift drives the need for large-scale cryogenic storage systems, as hydrogen must be stored at extremely low temperatures to remain in liquid form. The increasing focus on hydrogen as a sustainable energy solution is creating substantial demand for cryogenic technology to support its storage and distribution.

- Emerging Applications in Aerospace and Defense: Cryogenic technology is playing an increasingly vital role in the aerospace and defense sectors, particularly in areas like rocket fuel storage and satellite cooling systems. Cryogenic systems are essential for the storage of fuels used in space missions and the cooling of critical components in satellites. The growing reliance on advanced cryogenic equipment in these sectors is creating a opportunities for manufacturers.

Scope of the Report

|

Equipment Type |

Cryogenic Tanks Cryogenic Valves Cryogenic Pumps Cryogenic Vaporizers Cryogenic Pressure Vessels |

|

Application |

LNG, Industrial Gases Medical Aerospace & Defense Food & Beverage |

|

End-User |

Energy & Power Healthcare Chemicals & Petrochemicals Metallurgy Electronics |

|

Cryogen Type |

Nitrogen Oxygen Argon Helium LNG |

|

Region |

North-East Midwest Southern Western |

Products

Key Target Audience

Energy and Power Companies

Industrial Gas Manufacturers

Aerospace and Defense Companies

Food & Beverage Companies

Government and Regulatory Bodies (U.S. Department of Energy, OSHA)

Investments and Venture Capitalist Firms

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

Air Liquide

Linde plc

Chart Industries

Cryofab Inc.

Parker Hannifin

INOXCVA

Technifab Products Inc.

Emerson Electric Co.

Flowserve Corporation

Wessington Cryogenics

Taylor-Wharton

Herose GmbH

Gardner Cryogenics

Cryogenic Industries

Cryostar

Table of Contents

1. USA Cryogenic Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Cryogenic Equipment Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Cryogenic Equipment Market Analysis

3.1. Growth Drivers

3.1.1. Expansion in LNG Demand

3.1.2. Rising Application in Healthcare (Medical gases storage, cryosurgery)

3.1.3. Industrial Gas Demand (Oil and Gas, Steel, Electronics)

3.1.4. Technological Advancements in Superconductors

3.2. Market Challenges

3.2.1. High Initial Capital Investment

3.2.2. Operational Challenges (Equipment maintenance, cryogenic insulation)

3.2.3. Energy Consumption and Efficiency Issues

3.3. Opportunities

3.3.1. Growth in Hydrogen Energy Storage

3.3.2. Emerging Applications in Aerospace and Defense

3.3.3. R&D in Cryobiology and Food Preservation

3.4. Trends

3.4.1. Automation and Remote Monitoring of Cryogenic Systems

3.4.2. Miniaturization in Cryogenic Cooling Systems

3.4.3. Shift to Sustainable Cryogenic Solutions

3.5. Government Regulations

3.5.1. Environmental Regulations (EPA standards, GHG emissions control)

3.5.2. Safety Standards (OSHA regulations for cryogenic handling)

3.5.3. Trade Tariffs Impacting Equipment Imports

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Cryogenic Equipment Market Segmentation

4.1. By Equipment Type (In Value %)

4.1.1. Cryogenic Tanks

4.1.2. Cryogenic Valves

4.1.3. Cryogenic Pumps

4.1.4. Cryogenic Vaporizers

4.1.5. Cryogenic Pressure Vessels

4.2. By Application (In Value %)

4.2.1. Liquefied Natural Gas (LNG)

4.2.2. Industrial Gases (Oxygen, Nitrogen, Argon)

4.2.3. Medical (Cryosurgery, Biological Storage)

4.2.4. Aerospace and Defense

4.2.5. Food and Beverage

4.3. By End-User (In Value %)

4.3.1. Energy & Power

4.3.2. Healthcare

4.3.3. Chemicals & Petrochemicals

4.3.4. Metallurgy

4.3.5. Electronics

4.4. By Cryogen Type (In Value %)

4.4.1. Nitrogen

4.4.2. Oxygen

4.4.3. Argon

4.4.4. Helium

4.4.5. Liquefied Natural Gas (LNG)

4.5. By Region (In Value %)

4.5.1. North-East USA

4.5.2. Midwest USA

4.5.3. Southern USA

4.5.4. Western USA

5. USA Cryogenic Equipment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Air Liquide

5.1.2. Linde plc

5.1.3. Chart Industries

5.1.4. Cryofab Inc.

5.1.5. Parker Hannifin

5.1.6. INOXCVA

5.1.7. Technifab Products Inc.

5.1.8. Emerson Electric Co.

5.1.9. Flowserve Corporation

5.1.10. Wessington Cryogenics

5.1.11. Taylor-Wharton

5.1.12. Herose GmbH

5.1.13. Gardner Cryogenics

5.1.14. Cryogenic Industries

5.1.15. Cryostar

5.2. Cross Comparison Parameters (Revenue, Headquarters, Inception Year, Market Presence, Product Portfolio, Innovation Focus, Cryogen Type Expertise, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Cryogenic Equipment Market Regulatory Framework

6.1. Environmental Standards (GHG Emission Control, Clean Air Act compliance)

6.2. Compliance Requirements (FDA Medical Device Regulations for Cryogenic Equipment)

6.3. Certification Processes (ISO Certification for Cryogenic Products)

7. USA Cryogenic Equipment Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Cryogenic Equipment Future Market Segmentation

8.1. By Equipment Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Cryogen Type (In Value %)

8.5. By Region (In Value %)

9. USA Cryogenic Equipment Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of all major stakeholders within the USA Cryogenic Equipment market. This is achieved through desk research and the use of secondary and proprietary databases. The objective is to identify key variables such as demand drivers, supply constraints, and technological innovations.

Step 2: Market Analysis and Construction

In this step, we analyze historical data related to the USA Cryogenic Equipment market, assessing demand for cryogenic tanks, vaporizers, and pumps across various applications. Market penetration, the ratio of suppliers to customers, and revenue generation will also be evaluated.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through interviews with industry experts across different sectors like energy, healthcare, and manufacturing. These consultations provide valuable insights into operational and financial performance.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing research from interviews with cryogenic equipment manufacturers. This includes cross-verifying statistics from a bottom-up approach to ensure a comprehensive, accurate analysis of the market.

Frequently Asked Questions

01. How big is the USA Cryogenic Equipment Market?

The USA Cryogenic Equipment Market is valued at USD 3.75 billion, driven by increased LNG infrastructure development, growing industrial gas demand, and advancements in cryogenic medical applications.

02. What are the challenges in the USA Cryogenic Equipment Market?

Challenges in the market include high capital investment requirements, maintenance costs for cryogenic systems, and energy efficiency concerns, especially with respect to storage and transportation of cryogenic gases.

03. Who are the major players in the USA Cryogenic Equipment Market?

Major players include Air Liquide, Linde plc, Chart Industries, Cryofab Inc., and Parker Hannifin. These companies lead the market with advanced cryogenic solutions across energy, healthcare, and industrial sectors.

04. What are the growth drivers of the USA Cryogenic Equipment Market?

Growth is driven by increased LNG demand, technological advancements in cryogenics, and expanding applications in the medical field, such as biological storage and cryosurgery. Additionally, the growth of hydrogen energy storage is a key factor.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.