USA Customer Relationship Management (CRM) Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD3779

November 2024

81

About the Report

USA Customer Relationship Management Market Overview

- USA Customer Relationship Management (CRM) market is valued at USD 24 billion. The growth of the market is primarily driven by the increasing demand for businesses to enhance their customer experiences through personalized services. This growth is further supported by the widespread adoption of cloud computing technologies, which has made CRM solutions more accessible to small and medium enterprises (SMEs).

- The USA is home to dominant cities such as San Francisco and New York, which lead the CRM market. San Francisco, being the headquarters for tech giants like Salesforce, benefits from a vibrant ecosystem of innovation and talent. Meanwhile, New York's dominance stems from its role as a global financial hub, where financial services companies heavily rely on CRM systems to manage client relationships and comply with regulatory requirements. These cities attract top-tier talent and technology investments, fueling the growth of the CRM market.

- Data protection laws like the California Consumer Privacy Act (CCPA) and the European Union's General Data Protection Regulation (GDPR) are heavily influencing the CRM market. According to the U.S. Federal Trade Commission, businesses spent over $7 billion on data protection and compliance measures in 2023. These regulations require CRM systems to be fully compliant with stringent data management practices, impacting both CRM adoption and functionality in the USA.

USA Customer Relationship Management Market Segmentation

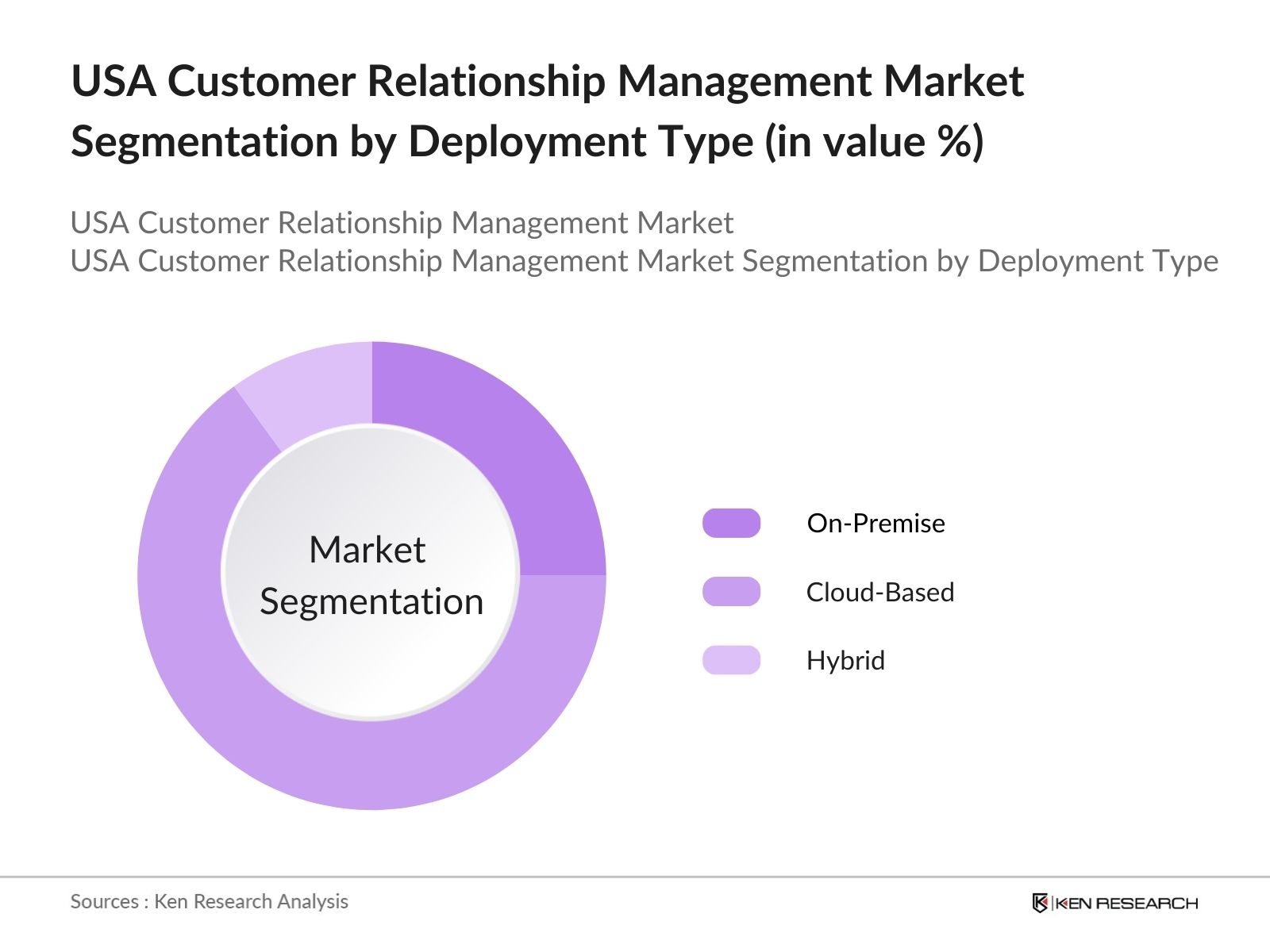

By Deployment Type: The USA CRM market is segmented by deployment type into on-premise, cloud-based, and hybrid solutions. Cloud-based CRM systems hold the largest market share due to their cost-efficiency, scalability, and flexibility. These solutions allow businesses to access real-time data from any location, making them ideal for companies with geographically dispersed teams. Additionally, cloud-based CRMs reduce the burden of IT management and infrastructure costs, making them particularly attractive to SMEs.

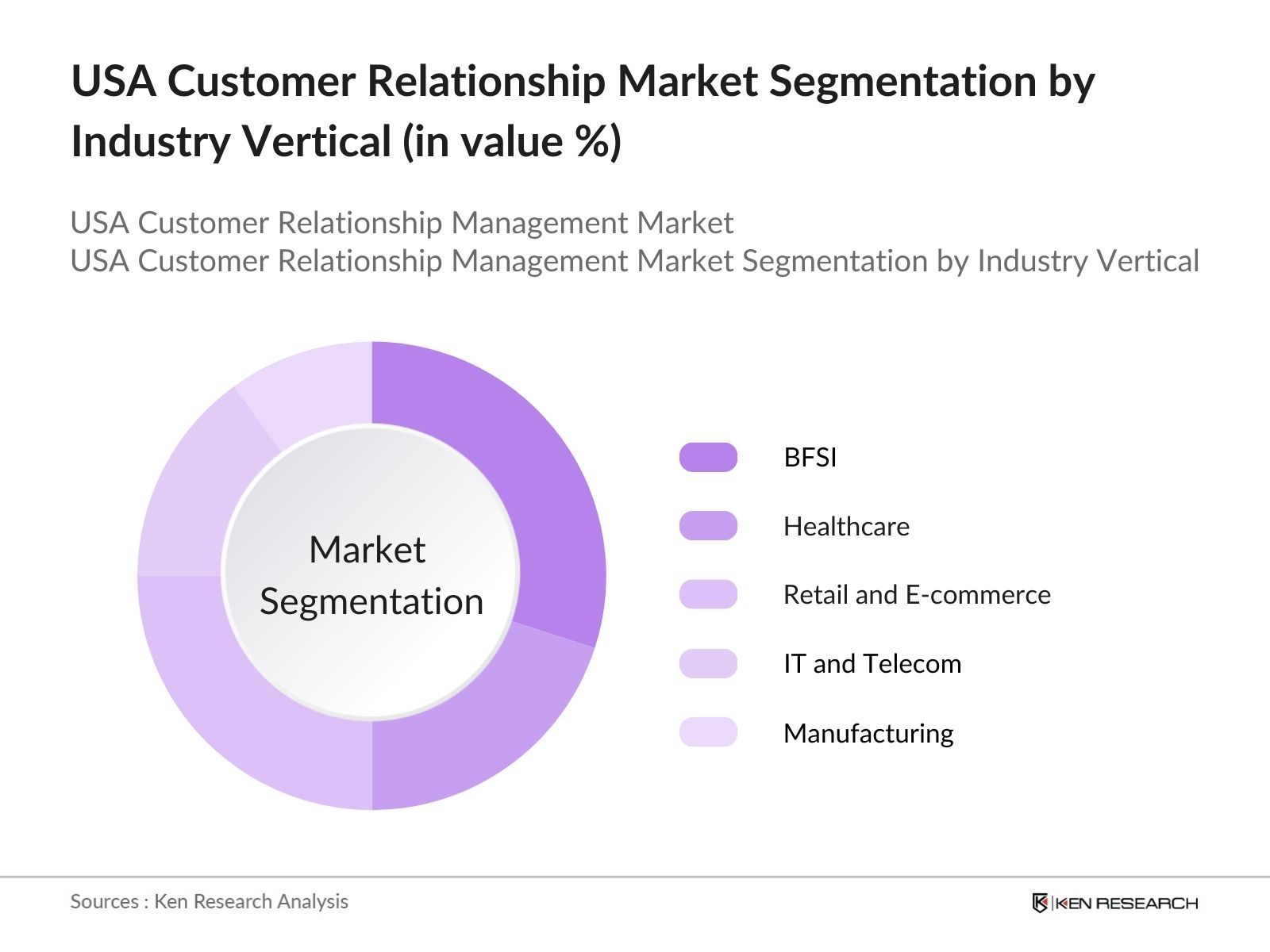

By Industry Vertical: The USA CRM market is also segmented by industry vertical into BFSI (Banking, Financial Services, and Insurance), healthcare, retail and e-commerce, IT and telecom, and manufacturing. The BFSI sector dominates the market as financial institutions increasingly adopt CRM solutions to manage vast amounts of customer data, improve client engagement, and ensure compliance with regulatory frameworks. The growing emphasis on customer retention and personalized services in financial services further drives the adoption of CRM in this sector.

USA Customer Relationship Management Market Competitive Landscape

The USA CRM market is characterized by strong competition, with both global giants and emerging players. The market is dominated by a few major companies that continuously innovate to maintain their market position. For instance, Salesforce, the largest player in the market, leads the charge with its comprehensive cloud-based CRM platform that integrates AI-driven analytics. Other players, such as Microsoft Dynamics 365, SAP CRM, and Oracle CRM, continue to offer specialized solutions catering to various industry needs.

|

Company |

Establishment Year |

Headquarters |

Cloud Offering |

Customization Options |

AI Integration |

Mobile Accessibility |

Customer Support |

Market Share |

|

Salesforce |

1999 |

San Francisco, CA |

- |

- |

- |

- |

- |

- |

|

Microsoft Dynamics 365 |

2003 |

Redmond, WA |

- |

- |

- |

- |

- |

- |

|

SAP CRM |

1972 |

Walldorf, Germany |

- |

- |

- |

- |

- |

- |

|

Oracle CRM |

1977 |

Austin, TX |

- |

- |

- |

- |

- |

- |

|

HubSpot |

2006 |

Cambridge, MA |

- |

- |

- |

- |

- |

- |

USA Customer Relationship Management Market Analysis

Growth Drivers

- Increasing Digital Transformation: In 2024, the global push towards digital transformation has accelerated across various industries, especially in the USA. The United Nations E-Government Survey indicates that significant progress has been made in digital governance, with many countries enhancing their digital infrastructure and services, which reflects a broader trend toward digital integration in both public and private sectors. This shift is driven by the need to enhance efficiency and customer engagement.

- Rise of Cloud-Based Solutions: Cloud-based CRM solutions are growing in prominence due to the global cloud services market expanding, projected to reach a market value of $940 billion by 2024, according to the International Monetary Fund (IMF). The USA has a strong foothold in this domain with tech giants offering scalable cloud-based CRM systems. U.S. companies use some form of cloud infrastructure to store customer data and manage customer relationships, making this a primary growth driver in the CRM market.

- Growing Adoption in SMEs: The U.S. Small Business Administration (SBA) reports that SMEs account for99.9%of all U.S. businesses, which aligns with the figure of around33.2 million SMEsoperating in the country as of 2024. With around 33.2 million SMEs operating in the USA in 2024, there has been a significant shift toward adopting affordable, cloud-based CRM solutions. This trend is bolstered by the increasing need for SMEs to manage customer relationships efficiently to remain competitive, especially as remote work and digital transactions become the norm.

Challenges

- High Integration Costs: While CRM systems offer extensive benefits, the high cost of integration remains a significant challenge for many U.S. businesses, especially SMEs. For many smaller enterprises, this financial burden can hinder CRM adoption despite its long-term benefits. The challenge is exacerbated by hidden costs like training, maintenance, and upgrades required post-integration.

- Data Privacy and Compliance Issues: Data privacy concerns remain a top challenge for CRM platforms, especially in light of evolving regulations such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR). According to the U.S. Federal Trade Commission (FTC), over 280,000 data privacy complaints were filed in the USA in 2023. Businesses face stringent requirements for protecting customer data, with fines for non-compliance reaching up to $7,500 per violation under CCPA. This significantly impacts CRM adoption, as compliance costs can be substantial.

USA Customer Relationship Management Future Market Outlook

Over the next five years, the USA CRM market is expected to continue its robust growth, driven by advancements in AI, machine learning, and the increasing adoption of cloud-based technologies. The integration of automation and analytics will further enhance the capabilities of CRM systems, enabling businesses to offer more personalized and efficient services. Additionally, the growing focus on customer experience management, particularly in industries like retail and financial services, will spur demand for more sophisticated CRM platforms.

Market Opportunities

- Integration of AI and Machine Learning: In 2024, AI and machine learning are transforming CRM platforms by enabling businesses to offer personalized experiences and predictive analytics. According to a report by the National Institute of Standards and Technology (NIST), AI adoption is expected to generate $500 billion in revenue globally by 2025, with the U.S. being a major contributor. CRM systems leveraging AI are helping companies streamline customer insights, automate workflows, and improve customer satisfaction.

- Expansion into Vertical-Specific Solutions: As industries seek specialized CRM solutions, there is growing demand for vertical-specific CRM tools in sectors like healthcare, real estate, and manufacturing. The U.S. Department of Commerce reported that in 2024, the healthcare industry alone is expected to spend over $12 billion on IT services, including CRM systems tailored to patient relationship management. This trend indicates substantial opportunities for CRM vendors to develop industry-focused solutions that address sector-specific needs.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Deployment Type |

On-Premise Cloud-Based Hybrid |

|

By Application |

Sales and Marketing Automation Customer Service and Support Lead Management Analytics & Reporting |

|

By Organization Size |

Large Enterprises Small and Medium Enterprises (SMEs) |

|

By Industry Vertical |

BFSI Healthcare Retail and E-commerce IT and Telecom Manufacturing |

|

By Region |

North-East Mid-West South West |

Products

Key Target Audience

CRM Software Vendors

IT Service Providers

SaaS Companies

Telecom Companies

BFSI Companies

Retail and E-commerce Companies

Government and Regulatory Bodies (e.g., Federal Trade Commission, U.S. Department of Commerce)

Investors and Venture Capitalist Firms

Companies

Major Players in the USA CRM Market

Salesforce

Microsoft Dynamics 365

SAP CRM

Oracle CRM

HubSpot

Zoho CRM

SugarCRM

Freshworks

Pipedrive

Insightly

Zendesk Sell

Creatio

Nimble

Apptivo

Copper

Table of Contents

1. USA CRM Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Market Penetration Rate)

1.4. Market Segmentation Overview

2. USA CRM Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA CRM Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Digital Transformation

3.1.2. Rise of Cloud-Based Solutions

3.1.3. Growing Adoption in SMEs

3.1.4. Need for Improved Customer Engagement and Retention

3.2. Market Challenges

3.2.1. High Integration Costs

3.2.2. Data Privacy and Compliance Issues

3.2.3. Lack of IT Infrastructure in Some Regions

3.3. Opportunities

3.3.1. Integration of AI and Machine Learning

3.3.2. Expansion into Vertical-Specific Solutions

3.3.3. Growing Demand for Customization and Automation

3.4. Trends

3.4.1. AI-Driven Insights and Analytics

3.4.2. Omnichannel CRM Solutions

3.4.3. Mobile CRM Adoption

3.4.4. Subscription-Based Pricing Models

3.5. Government Regulations

3.5.1. Data Protection Regulations (CCPA, GDPR)

3.5.2. Cybersecurity Frameworks (NIST, CIS Controls)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA CRM Market Segmentation

4.1. By Deployment Type (In Value %)

4.1.1. On-Premise

4.1.2. Cloud-Based

4.1.3. Hybrid

4.2. By Application (In Value %)

4.2.1. Sales and Marketing Automation

4.2.2. Customer Service and Support

4.2.3. Contact and Lead Management

4.2.4. Analytics and Reporting

4.3. By Organization Size (In Value %)

4.3.1. Large Enterprises

4.3.2. Small and Medium Enterprises (SMEs)

4.4. By Industry Vertical (In Value %)

4.4.1. BFSI (Banking, Financial Services, and Insurance)

4.4.2. Healthcare

4.4.3. Retail and E-commerce

4.4.4. IT and Telecom

4.4.5. Manufacturing

4.5. By Region (In Value %)

4.5.1. North-East

4.5.2. Mid-West

4.5.3. South

4.5.4. West

5. USA CRM Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Salesforce

5.1.2. Microsoft Dynamics 365

5.1.3. SAP CRM

5.1.4. Oracle CRM

5.1.5. Zoho CRM

5.1.6. HubSpot

5.1.7. SugarCRM

5.1.8. Freshworks

5.1.9. Pipedrive

5.1.10. Insightly

5.1.11. Zendesk Sell

5.1.12. Creatio

5.1.13. Nimble

5.1.14. Apptivo

5.1.15. Copper

5.2. Cross Comparison Parameters (Deployment Model, Key Features, Customization Capabilities, Pricing Models, Integration Capabilities, Customer Support Services, Scalability, Customer Reviews)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA CRM Market Regulatory Framework

6.1. Data Privacy and Compliance

6.2. Cybersecurity Protocols

6.3. Industry-Specific Regulations (HIPAA, FINRA Compliance, SOX Compliance)

7. USA CRM Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA CRM Future Market Segmentation

8.1. By Deployment Type (In Value %)

8.2. By Application (In Value %)

8.3. By Organization Size (In Value %)

8.4. By Industry Vertical (In Value %)

8.5. By Region (In Value %)

9. USA CRM Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase of research includes identifying key market variables through comprehensive desk research. This step is supported by secondary and proprietary databases that provide insights into the main drivers, challenges, and trends within the USA CRM market.

Step 2: Market Analysis and Construction

In this phase, historical data related to market size, revenue growth, and CRM adoption rates is compiled. Additionally, we evaluate industry penetration across various verticals such as BFSI, healthcare, and retail.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions and hypotheses are tested by conducting interviews with industry experts through telephone or online consultations. These expert insights help validate the key drivers and challenges affecting the CRM market.

Step 4: Research Synthesis and Final Output

The final phase includes synthesizing the research findings into actionable insights. We conduct further consultation with CRM vendors to ensure data accuracy and present the findings in a comprehensive market report.

Frequently Asked Questions

1. How big is the USA CRM market?

The USA CRM market is valued at USD 24 billion, driven by the increasing need for businesses to offer personalized customer experiences and improve client engagement.

2. What are the challenges in the USA CRM market?

Key challenges include high integration costs, data privacy concerns due to strict regulations like GDPR and CCPA, and the need for continuous software updates to stay competitive.

3. Who are the major players in the USA CRM market?

The market is dominated by players such as Salesforce, Microsoft Dynamics 365, SAP CRM, Oracle CRM, and HubSpot, which offer robust solutions tailored to the needs of different

4. What are the growth drivers of the USA CRM market?

The growth of the USA CRM market is fueled by the rising adoption of cloud-based solutions, the integration of AI and machine learning technologies, and the increasing demand for customer retention and analytics tools.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.