USA Cybersecurity Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD1033

August 2024

84

About the Report

USA Cybersecurity Market Overview

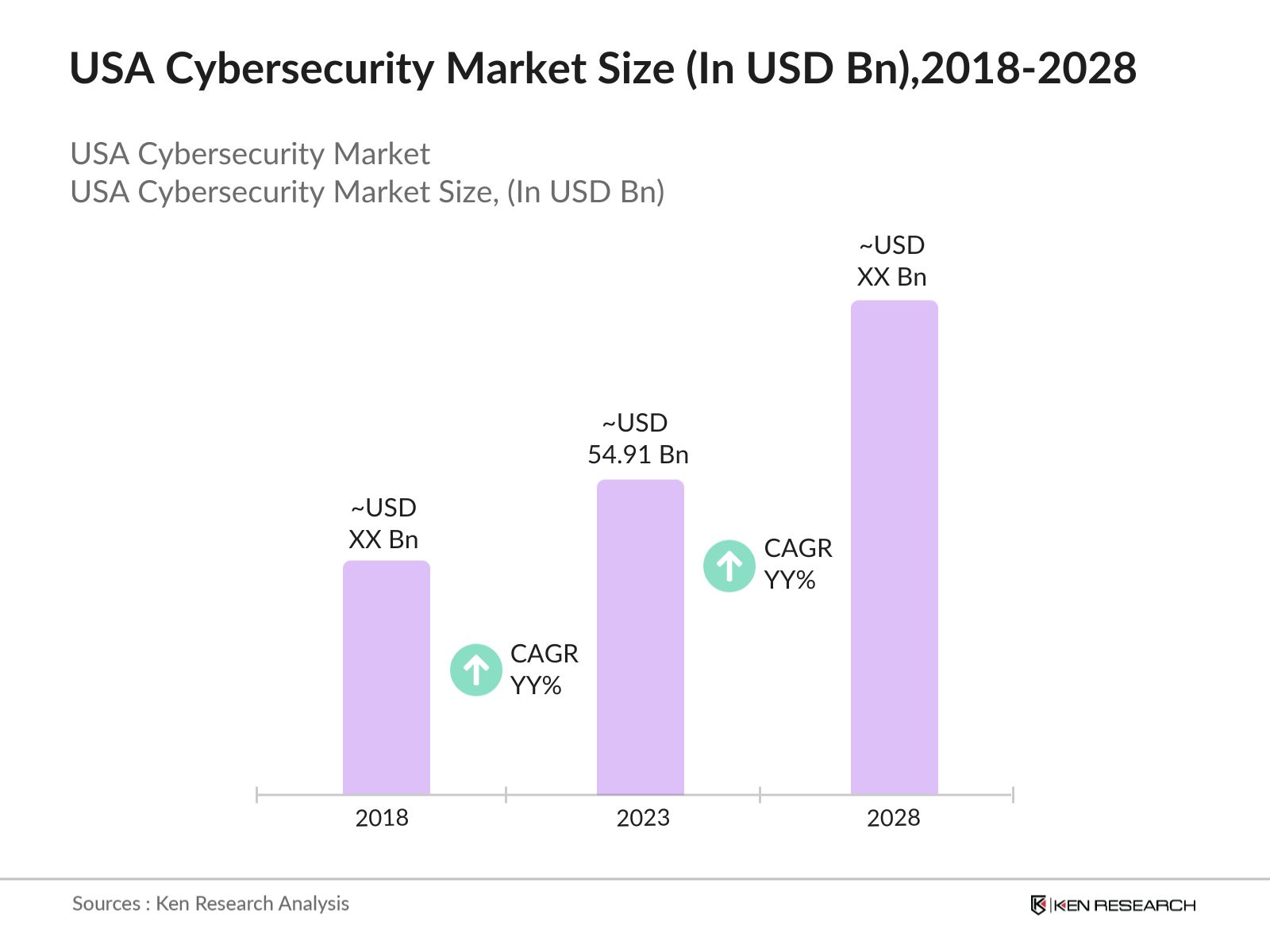

- The USA Cybersecurity Market size was valued at USD 54.91 billion in 2023. This growth is driven by the increasing frequency and sophistication of cyberattacks, which has necessitated greater investment in cybersecurity solutions. The rise of remote work, the proliferation of IoT devices, and stringent regulatory requirements have significantly contributed to market expansion.

- Key players in the USA cybersecurity market include IBM Corporation, Cisco Systems, Palo Alto Networks, Check Point Software Technologies, and Fortinet. These companies dominate the market through continuous innovation, extensive product portfolios, and strategic acquisitions that enhance their cybersecurity offerings.

- In 2023, Ransomware payments in 2023 surpassed the USD 1 billion mark, the highest number ever observed. High-profile incidents, such as the Colonial Pipeline attack, highlighted the critical need for enhanced cybersecurity measures. These attacks have prompted organizations to invest in advanced threat detection and response solutions.

- California is a dominant state in the USA cybersecurity market due to its concentration of tech companies and startups. The state's robust technology ecosystem, access to venture capital, and proximity to leading tech hubs contribute to its market dominance.

USA Cybersecurity Market Segmentation

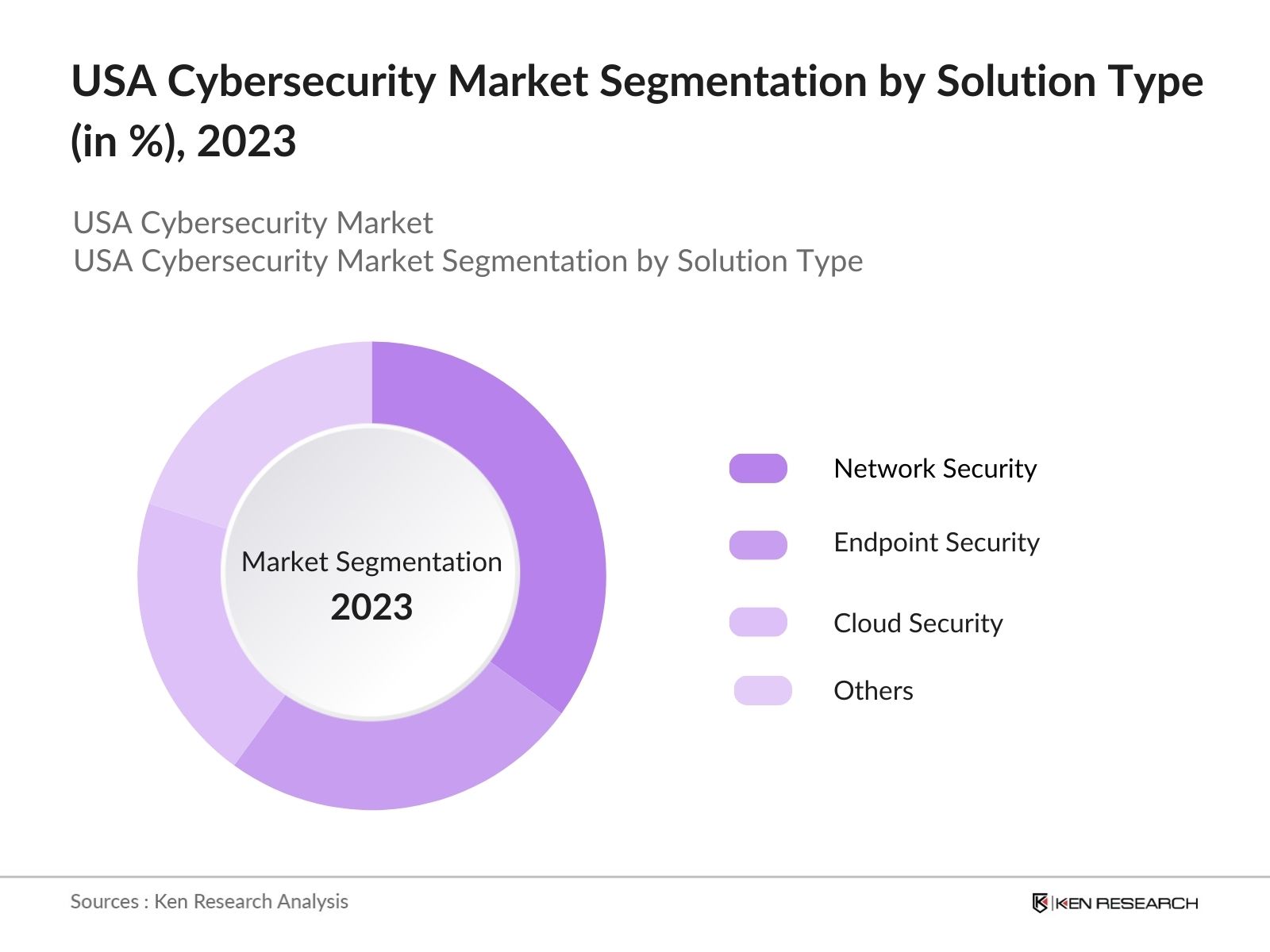

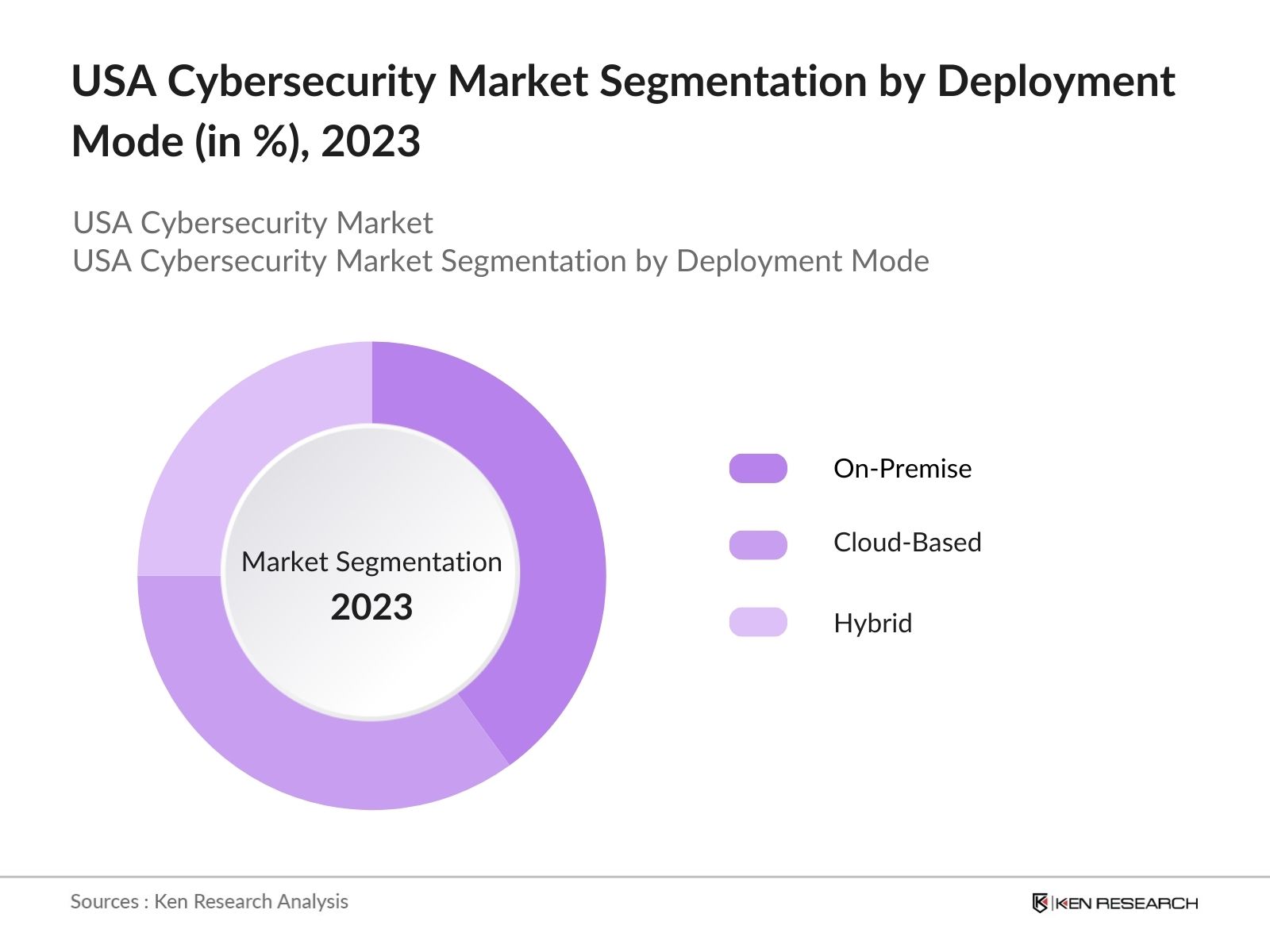

The USA cybersecurity market can be segmented in various factors like solution, deployment, and region.

By Solution: The USA cybersecurity market is segmented by solution into network solution, endpoint solution, cloud security, and others. In 2023, Network security solutions, including firewalls, intrusion detection systems (IDS), and virtual private networks (VPNs), are critical for protecting enterprise networks. In 2023, network security dominates the market due to the increasing need to safeguard network infrastructure against sophisticated cyber threats.

By Deployment: The USA cybersecurity market is segmented by deployment into on-premise, cloud-based, and hybrid. In 2023, on-premise deployment, where security solutions are installed and run on local servers, many large enterprises prefer on-premise solutions for better control over their security infrastructure.

By Region: The USA cybersecurity market is segmented by region into north, east, west, and south. In 2023, the northern region dominates, including states like New York and Massachusetts, due to the high concentration of financial institutions and large enterprises requiring advanced cybersecurity measures.

USA Cybersecurity Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

IBM Corporation |

1911 |

Armonk, New York |

|

Cisco Systems |

1984 |

San Jose, California |

|

Palo Alto Networks |

2005 |

Santa Clara, California |

|

Check Point Software |

1993 |

Tel Aviv, Israel |

|

Fortinet |

2000 |

Sunnyvale, California |

- Palo Alto Networks: On May 7, 2024, Palo Alto Networks introduced new security solutions infused with Precision AI. These solutions are designed to defend against advanced threats, particularly those generated by AI, and to safeguard organizations adopting AI technologies. The company emphasizes the urgency of adopting integrated security solutions to combat the rising number of unique threats, which average 2.3 million dailies.

- Fortinet: In May 2024, Fortinet announced the industry's first generative AI IoT security assistant and new GenAI capabilities for network and security operations. This includes deeper integrations of FortiAI across the Fortinet Security Fabric.

USA Cybersecurity Market Analysis

USA Cybersecurity Market Growth Drivers

- Increase in Cybercrime: In 2023, the FBI reported over 800,000 cybercrime complaints, resulting in losses exceeding USD 12.5 billion. The rise in sophisticated attacks like ransomware and phishing has necessitated robust cybersecurity measures. The financial sector, in particular, saw an increase in cyber incidents, driving demand for advanced security solutions.

- Expansion of IoT Devices: The number of IoT devices in use in the USA exceeded 13 billion in 2023. This surge in connected devices has expanded the attack surface, compelling organizations to invest heavily in cybersecurity solutions to protect sensitive data and ensure network integrity. The healthcare sector, with over 1 billion connected devices, is particularly vulnerable and drives significant demand for cybersecurity products.

- Digital Transformation Initiatives: In 2023, businesses in the USA spent USD 1 trillion on digital transformation initiatives. As companies migrate to cloud environments and adopt new technologies, the need for cybersecurity to protect digital assets has intensified. The retail sector, with its shift to online platforms and digital payments, is a significant contributor to this growth.

USA Cybersecurity Market Challenges

- Shortage of Skilled Cybersecurity Professionals: The USA faced a deficit of over 700,000 cybersecurity professionals in 2023. This talent gap hinders the ability of organizations to effectively combat cyber threats. Despite efforts to bridge this gap through education and training programs, the shortage remains a significant challenge for the industry.

- Rapid Evolution of Cyber Threats: Cyber threats are evolving at an unprecedented pace, with new vulnerabilities being discovered daily. In 2023, over 18,000 new vulnerabilities were reported, making it challenging for cybersecurity firms to keep pace. This rapid evolution necessitates continuous investment in research and development to stay ahead of potential threats.

USA Cybersecurity Market Government Initiative

- National Cybersecurity Strategy: In 2023, the U.S. government launched the National Cybersecurity Strategy, enhance national cyber defenses. This initiative focuses on public-private partnerships, increased funding for cybersecurity research, and improved threat intelligence sharing among federal agencies and private sector entities.

- Public Awareness Campaigns: DHS appropriated USD 400 million in FY 2023 for state, territorial, local, and tribal cybersecurity grant programs, which is part of a broader effort to enhance cybersecurity resilience across various communities. This initiative aims to reduce the risk of cyber incidents by promoting safe online behavior and encouraging the use of strong, unique passwords and multi-factor authentication.

USA Cybersecurity Market Future Outlook

The USA cybersecurity market is growing over the next five years, driven by increasing growing cyber insurance, expansion of quantum-safe security, focus on supply chain, and adoption of autonomous security.

USA Cybersecurity Future Market Trends

- Growth in Cyber Insurance: By 2028, the demand for cyber insurance is expected to surge. As cyber threats become more sophisticated, businesses will increasingly seek insurance coverage to mitigate financial losses from cyber incidents. The insurance industry will play a crucial role in shaping cybersecurity practices by incentivizing robust security measures.

- Increased Focus on Supply Chain Security: Supply chain security will become a top priority for organizations by 2028. In response to high-profile supply chain attacks, such as the SolarWinds breach, businesses will invest heavily in securing their supply chains. Expenditure on supply chain security solutions, reflecting the critical need for end-to-end protection.

Scope of the Report

|

By Solution |

Network Security Endpoint Security Cloud Security |

|

By Deployment Mode |

On-Premise Cloud-Based Hybrid |

|

By Region |

North East West South |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Air Conditioning Manufacturers

Refrigeration Equipment Manufacturers

Food Processing Companies

Pharmaceutical Companies

Hospitality Industry

Automotive Industry

Government Regulatory Bodies (e.g., Bureau of Energy Efficiency)

Cold Storage Facilities

Logistics and Warehousing Companies

Investment Firms

Building and Construction Companies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

IBM Corporation

Cisco Systems

Palo Alto Networks

Check Point Software Technologies

Fortinet

Symantec Corporation

McAfee, LLC

Trend Micro Incorporated

CrowdStrike Holdings, Inc.

FireEye, Inc.

Juniper Networks, Inc.

Sophos Group plc

RSA Security LLC

Imperva, Inc.

Splunk Inc.

Table of Contents

1. USA Cybersecurity Market Overview

2. USA Cybersecurity Market Size (in USD Bn), 2018-2023

3. USA Cybersecurity Market Analysis

4. USA Cybersecurity Market Segmentation, 2023

5. USA Cybersecurity Market Competition Benchmarking

6. USA Cybersecurity Market Future Market Size (in USD Bn), 2023-2028

7. USA Cybersecurity Market Future Market Segmentation, 2028

8. USA Cybersecurity Market Analysts’ Recommendations

Â

Research Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on USA cybersecurity market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA cybersecurity industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple technology companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such technology companies.

Frequently Asked Questions

01 How big is the USA Cybersecurity market?

The USA cybersecurity market size was valued at USD 54.91 billion in 2023. This growth is driven by the increasing frequency and sophistication of cyberattacks, which has necessitated greater investment in cybersecurity solutions.

02 What are the challenges in USA Cybersecurity market?

The USA cybersecurity market faces challenges such as a shortage of skilled cybersecurity professionals, the rapid evolution of cyber threats, high costs of cybersecurity solutions, and integration complexities with existing IT infrastructure.

03 Who are the major players in the USA Cybersecurity market?

Leading companies in the USA cybersecurity market include IBM Corporation, Cisco Systems, Palo Alto Networks, Check Point Software Technologies, and Fortinet. These companies are known for their comprehensive cybersecurity solutions and continuous innovation.

04 What are the main growth drivers of the USA Cybersecurity market?

Key growth drivers for the USA cybersecurity market include the increasing number of cyberattacks, the proliferation of IoT devices, digital transformation initiatives, and stringent regulatory compliance requirements.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.