USA Dairy Alternatives Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD1676

November 2024

91

About the Report

USA Dairy Alternatives Market Overview

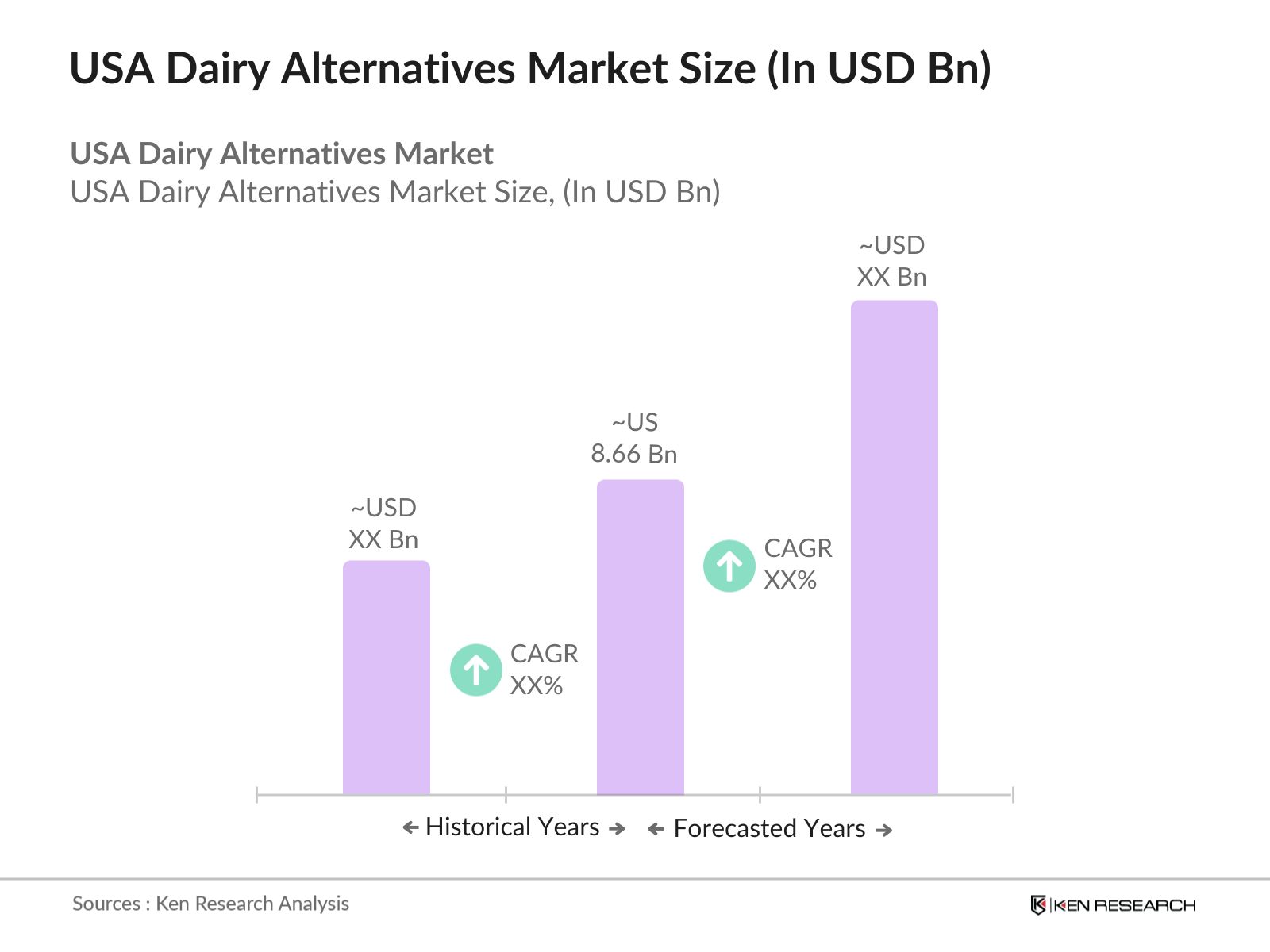

The USA Dairy Alternatives market size was valued at $8.66 billion in 2023 representing a compound annual growth rate (CAGR) of 6.81%. This growth is attributed to several factors, including rising health consciousness, lactose intolerance, and ethical concerns regarding animal welfare. Additionally, advancements in product development and the increasing availability of diverse dairy alternative products have further propelled market growth.

The USA Dairy Alternatives Market is dominated by several key players, including Danone North America, Blue Diamond Growers, Hain Celestial Group, SunOpta Inc. and Ripple Foods. These companies have established strong market positions through innovative product offerings, extensive distribution networks, and strategic acquisitions.

In 2023, Danone North America announced a $65 million investment over the next two years to create a new bottle production line at its facility in Jacksonville, Florida.This investment will increase production of several of Danone's coffee and creamer brands in the U.S., including International Delight, Silk plant-based creamers and SToK ready-to-drink coffee.

California stands out as the leading state in the USA Dairy Alternatives Market. In 2023, California dominated the market share. This dominance is attributed to the state's large population, high levels of health consciousness, and significant vegan and vegetarian communities. Additionally, California is home to several major dairy alternative manufacturers and a robust distribution network, further supporting its leading market position.

USA Dairy Alternatives Market Segmentation

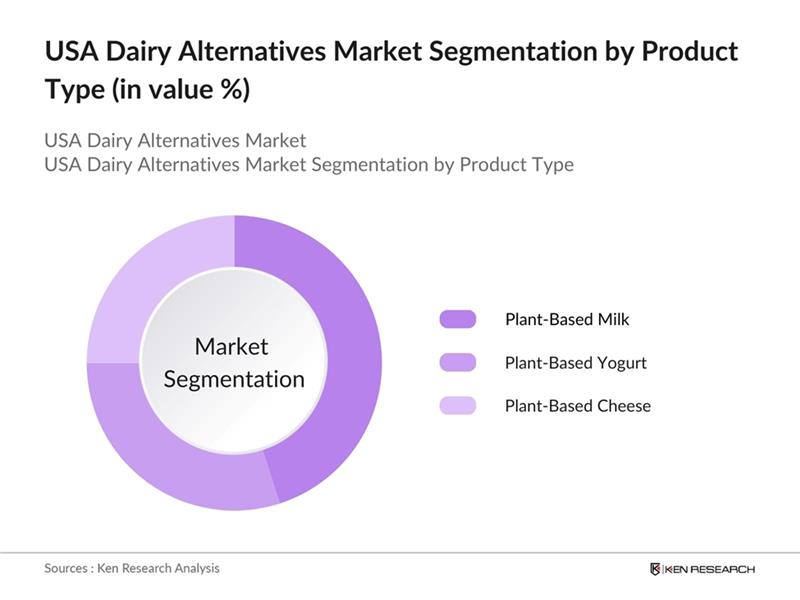

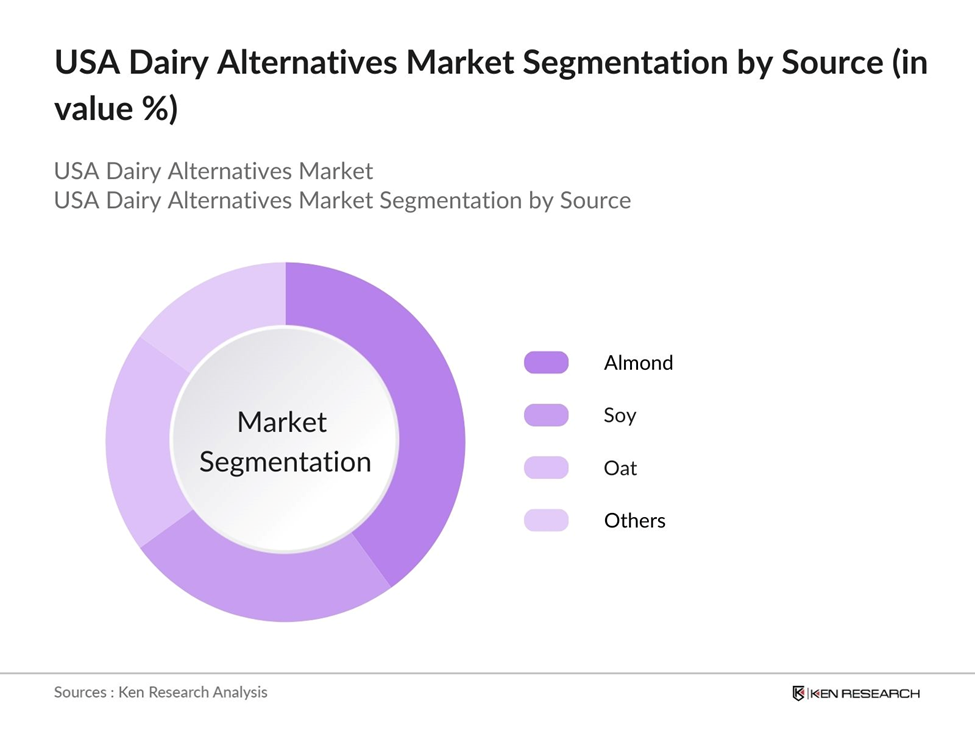

The USA Dairy Alternatives Market can be segmented based on several factors like product type, source and region.

By Product Type: The USA Dairy Alternatives Market is segmented by product type into plant-based milk, plant-based yogurt, and plant-based cheese. In 2023, plant-based milk held the dominant market share, driven by its widespread acceptance and variety of options available, such as almond, soy, oat, and pea milk. This is also due to increasing prevalence of lactose intolerance and a shift towards healthier lifestyles.

By Source: The market is segmented by source into almond, soy, oat, and others including coconut, rice, and hemp. In 2023, almond-based products held the largest market share, driven by their popularity and perceived health benefits. Almond milk, in particular, is favored for its low calorie and high nutrient content, appealing to health-conscious consumers.

By Region: The market is segmented by region into North, South, East, and West. In 2023, the West region held the dominant market share, largely driven by favorable climate for almond cultivation also supports the availability of almond-based products, a major segment of the dairy alternatives market. Additionally, the region's strong focus on sustainability and innovation in the food industry further drives its market leadership.

USA Dairy Alternatives Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Danone North America |

1919 |

White Plains, NY |

|

Blue Diamond Growers |

1910 |

Sacramento, CA |

|

The Hain Celestial Group |

1993 |

Lake Success, NY |

|

SunOpta Inc. |

1973 |

Eden Prairie, MN |

|

Ripple Foods |

2014 |

Berkeley, CA |

- SunOpta Inc.'s Sustainability Initiative: In 2024, SunOpta Inc. announced a sustainability initiative to reduce its carbon footprint by 25% over the next five years. The initiative includes investing in renewable energy sources and sustainable farming practices for plant-based ingredients. This move is expected to enhance SunOpta's reputation as a sustainable company and attract environmentally conscious consumers.

USA Dairy Alternatives Industry Analysis

Growth Drivers

- Health Consciousness and Lactose Intolerance: The rising awareness of health issues associated with dairy consumption, such as lactose intolerance, has been a major growth driver for the dairy alternatives market. In 2024, lactose intolerance affects about 15% of White adults in the U.S., while it affects about 85% of Black adults. This has led to a heave in demand for lactose-free alternatives, boosting the sales of products like almond milk and oat milk.

- Innovation in Product Development: Continuous innovation in the dairy alternatives market has led to the introduction of new and improved products. Companies like Ripple Foods and Oatly have launched fortified plant-based milks with added vitamins and minerals, catering to the nutritional needs of consumers. These innovations have enhanced the appeal of dairy alternatives, driving market growth.

- Increased Availability and Accessibility: The increased availability of dairy alternative products in mainstream retail channels has made these products more accessible to consumers. In 2024, major supermarket chains like Walmart and Kroger expanded their plant-based product lines, including a variety of dairy alternatives. This increased accessibility has made it easier for consumers to incorporate dairy alternatives into their diets, supporting market growth.

Challenges

- High Production Costs: Plant-based ingredients and specialized processing methods often result in higher production costs compared to traditional dairy products. In 2024, the average price of plant-based milk was approximately $5 per gallon, compared to $3 for traditional dairy milk. This cost disparity can make dairy alternatives less accessible to price-sensitive consumers.

- Consumer Misconceptions: Despite the growing popularity of dairy alternatives, there are still misconceptions among consumers regarding the nutritional value of these products. According to a 2024 survey by the National Dairy Council, Americans believe that plant-based milks lack essential nutrients found in dairy milk. Educating consumers about the nutritional benefits of dairy alternatives remains a challenge for the industry.

Government Initiatives

- USDA Grants for Plant-Based Research: The USDA recognizes alternative proteins, including plant-based dairy alternatives, as a key research priority for the bioeconomy. The 2023 Farm Bill could include alternative proteins as a new research activity within the Agriculture and Food Research Initiative (AFRI). This initiative is expected to drive innovation in the dairy alternatives market, enhancing production processes and increasing consumer confidence.

- FDA Labeling Regulations: In January 2022, the FDA submitted a draft policy titled "Labeling of Plant-based Milk Alternatives and Voluntary Nutrient Statements" to the Office of Management and Budget for review. The new labeling guidelines will be aimed at ensuring transparency and accuracy in product labeling, which can boost consumer trust in dairy alternatives.

USA Dairy Alternatives Market Future Outlook

The USA Dairy Alternatives Market is poised for continued growth by 2028. The market is expected to benefit from ongoing innovations in product formulations, increasing consumer adoption of plant-based diets, and the entry of new market players. The expansion of retail and e-commerce channels will further boost accessibility and availability of dairy alternatives, supporting sustained market growth.

Future Market Trends

- Expansion of E-Commerce Channels: The expansion of e-commerce channels is expected to significantly boost the dairy alternatives market. It is estimated that online sales of plant-based products will account for a major part of the total sales in the U.S. This shift will be driven by the convenience of online shopping and the availability of a wider range of products. Companies are likely to invest in strengthening their online presence and optimizing e-commerce strategies to capture this growing market.

- Innovation in Plant-Based Ingredients: Continued innovation in plant-based ingredients is expected to drive the development of new dairy alternative products. Research and development efforts are focused on improving the taste, texture, and nutritional profile of plant-based products. For instance, the use of novel ingredients such as hemp, quinoa, and flaxseed is expected to increase, offering consumers more diverse and appealing options.

Scope of the Report

|

By Product Type |

Plant-based Milk Plant-based Yogurt Plant-based Cheese |

|

By Source |

Almond Soy Oat Others |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Dairy Alternative Manufacturers

Health and Wellness Retailers

Supermarkets and Hypermarkets

Nutritional Supplement Companies

Food Safety and Standards Authorities

Food Innovation Hubs

U.S. Department of Agriculture (USDA)

Food and Drug Administration (FDA)

Investors and VC Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Danone North America

Blue Diamond Growers

The Hain Celestial Group

SunOpta Inc.

Ripple Foods

Califia Farms

Good Karma Foods

Forager Project

Oatly Inc.

Elmhurst 1925

MALK Organics

Miyoko's Creamery

Kite Hill

Silk

So Delicious

Table of Contents

1. United States Dairy Alternatives Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. United States Dairy Alternatives Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. United States Dairy Alternatives Market Analysis

3.1. Growth Drivers

3.1.1. Rising Lactose Intolerance and Dairy Allergies

3.1.2. Increasing Vegan and Plant-Based Diet Adoption

3.1.3. Environmental and Sustainability Concerns

3.1.4. Technological Advancements in Product Development

3.2. Market Challenges

3.2.1. High Production Costs

3.2.2. Taste and Texture Preferences

3.2.3. Regulatory and Labeling Issues

3.3. Opportunities

3.3.1. Expansion into Untapped Markets

3.3.2. Product Diversification and Innovation

3.3.3. Strategic Partnerships and Collaborations

3.4. Trends

3.4.1. Introduction of Novel Plant-Based Ingredients

3.4.2. Fortification with Nutrients

3.4.3. Clean Label and Organic Products

3.5. Government Regulations

3.5.1. FDA Guidelines on Plant-Based Labeling

3.5.2. Nutritional Standards and Compliance

3.5.3. Import and Export Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competitive Landscape

4. United States Dairy Alternatives Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Plant-Based Milk

4.1.2. Yogurt Alternatives

4.1.3. Cheese Alternatives

4.1.4. Ice Cream Alternatives

4.1.5. Butter and Spreads Alternatives

4.2. By Source (In Value %)

4.2.1. Soy

4.2.2. Almond

4.2.3. Coconut

4.2.4. Oats

4.2.5. Rice

4.2.6. Others (Hemp, Pea, Cashew)

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Convenience Stores

4.3.3. Online Retail

4.3.4. Specialty Stores

4.4. By End-User (In Value %)

4.4.1. Household

4.4.2. Food Service Industry

4.4.3. Food Processing Industry

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. United States Dairy Alternatives Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Danone S.A.

5.1.2. Blue Diamond Growers

5.1.3. The Hain Celestial Group, Inc.

5.1.4. SunOpta Inc.

5.1.5. Califia Farms

5.1.6. Ripple Foods

5.1.7. Kite Hill

5.1.8. Oatly Inc.

5.1.9. Daiya Foods Inc.

5.1.10. Good Karma Foods, Inc.

5.1.11. Elmhurst 1925

5.1.12. Miyoko's Creamery

5.1.13. Forager Project

5.1.14. Tofutti Brands, Inc.

5.1.15. Follow Your Heart

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, Distribution Network, Recent Developments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. United States Dairy Alternatives Market Regulatory Framework

6.1. FDA Regulations on Plant-Based Products

6.2. Labeling and Nutritional Claims

6.3. Compliance Requirements

6.4. Certification Processes

7. United States Dairy Alternatives Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. United States Dairy Alternatives Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Source (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. United States Dairy Alternatives Market Analysts’ Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on USA Dairy Alternatives market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA Dairy Alternatives market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple dairy alternatives suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from dairy alternatives suppliers and distributors companies.

Frequently Asked Questions

01 How big is the USA Dairy Alternatives Market?

The USA Dairy Alternatives Market was valued at $8.66 billion in 2023. This market has experienced significant growth due to increasing health consciousness, lactose intolerance, and ethical concerns about animal welfare, leading to a growing preference for plant-based dairy products.

02 What are the growth drivers of the USA Dairy Alternatives Market?

Key growth in the USA Dairy Alternatives Market drivers include rising health consciousness and lactose intolerance, ethical and environmental concerns about dairy farming, continuous innovation in product development, and increased availability of dairy alternative products in mainstream retail channels, making them more accessible to consumers.

03 What are the challenges faced by the USA Dairy Alternatives Market?

Challenges in the USA Dairy Alternatives Market include high production costs of plant-based products, regulatory hurdles with new labeling requirements, consumer misconceptions about the nutritional value of dairy alternatives, and supply chain issues, such as environmental factors affecting crop yields for plant-based ingredients.

04 Who are the major players in the USA Dairy Alternatives Market?

Major players in the USA Dairy Alternatives market include Danone North America (Silk, So Delicious), Blue Diamond Growers (Almond Breeze), The Hain Celestial Group (Dream, WestSoy), SunOpta Inc., and Ripple Foods. These companies lead through innovative products and extensive distribution networks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.