USA Data Discovery Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD9984

November 2024

93

About the Report

USA Data Discovery Market Overview

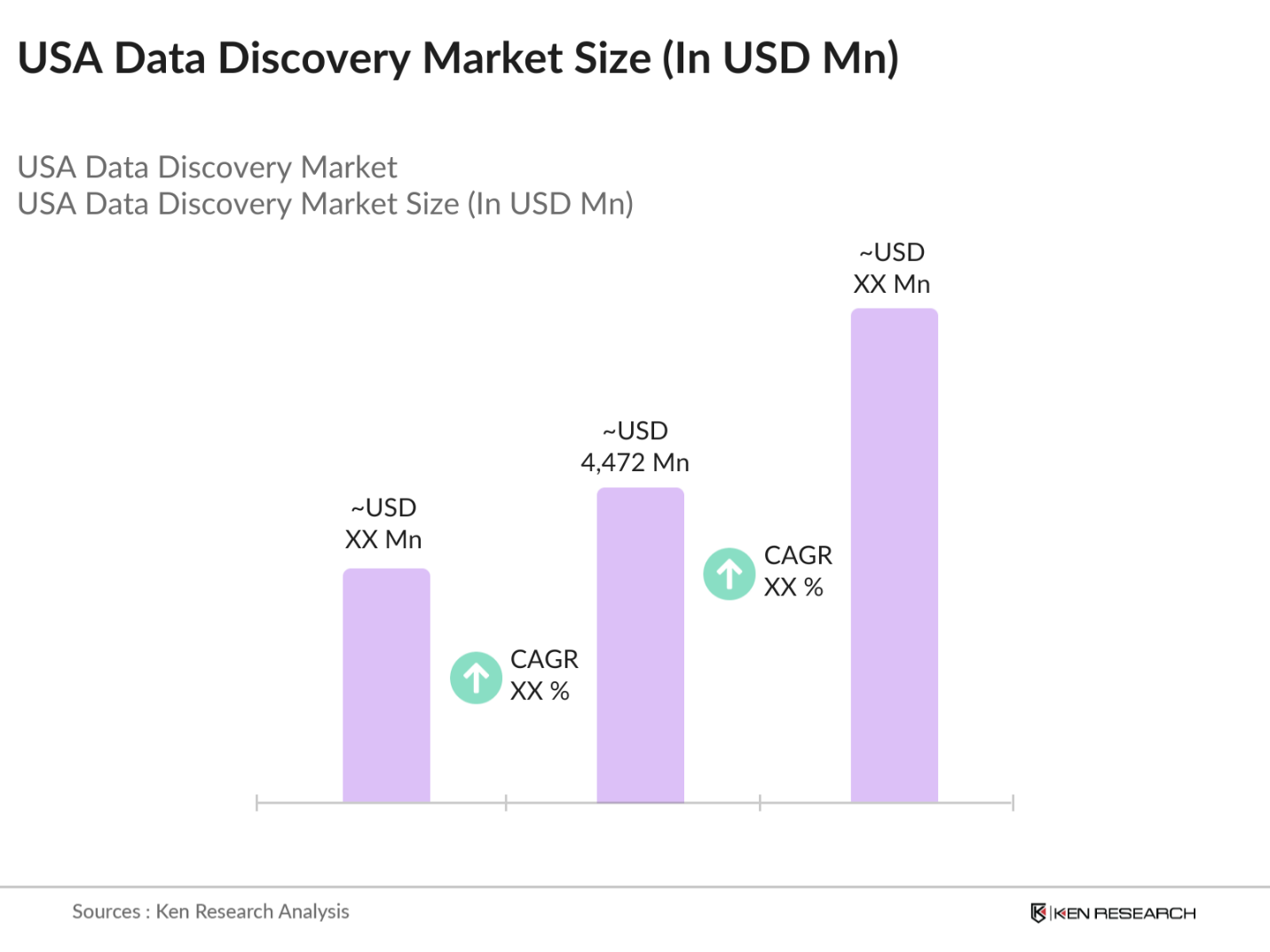

- The USA Data Discovery Market is valued at USD 4,472 million, based on a five-year historical analysis. The market's growth is primarily driven by the increasing need to manage complex, multi-structured data, fueling demand for data discovery tools that facilitate actionable insights across sectors like finance, healthcare, and IT. With data compliance regulations and privacy standards strengthening, the market is also benefiting from the adoption of AI-powered analytics solutions, which enhance data visualization and security measures, enabling companies to leverage their data effectively for strategic decision-making.

- Prominent players in the USA Data Discovery Market are concentrated in cities such as New York, San Francisco, and Austin. These cities hold a dominant position due to their dense technology infrastructure, high innovation rates, and presence of skilled talent in analytics and software development. These hubs attract significant investments, enhancing data discovery capabilities across industries and providing businesses with advanced analytics solutions.

- The U.S. is advancing its federal data protection mandates, responding to an increased emphasis on digital privacy and security. As of 2023, regulatory frameworks affect 70% of enterprises, with federal initiatives aimed at aligning with international standards, thus driving demand for compliant data discovery tools.

USA Data Discovery Market Segmentation

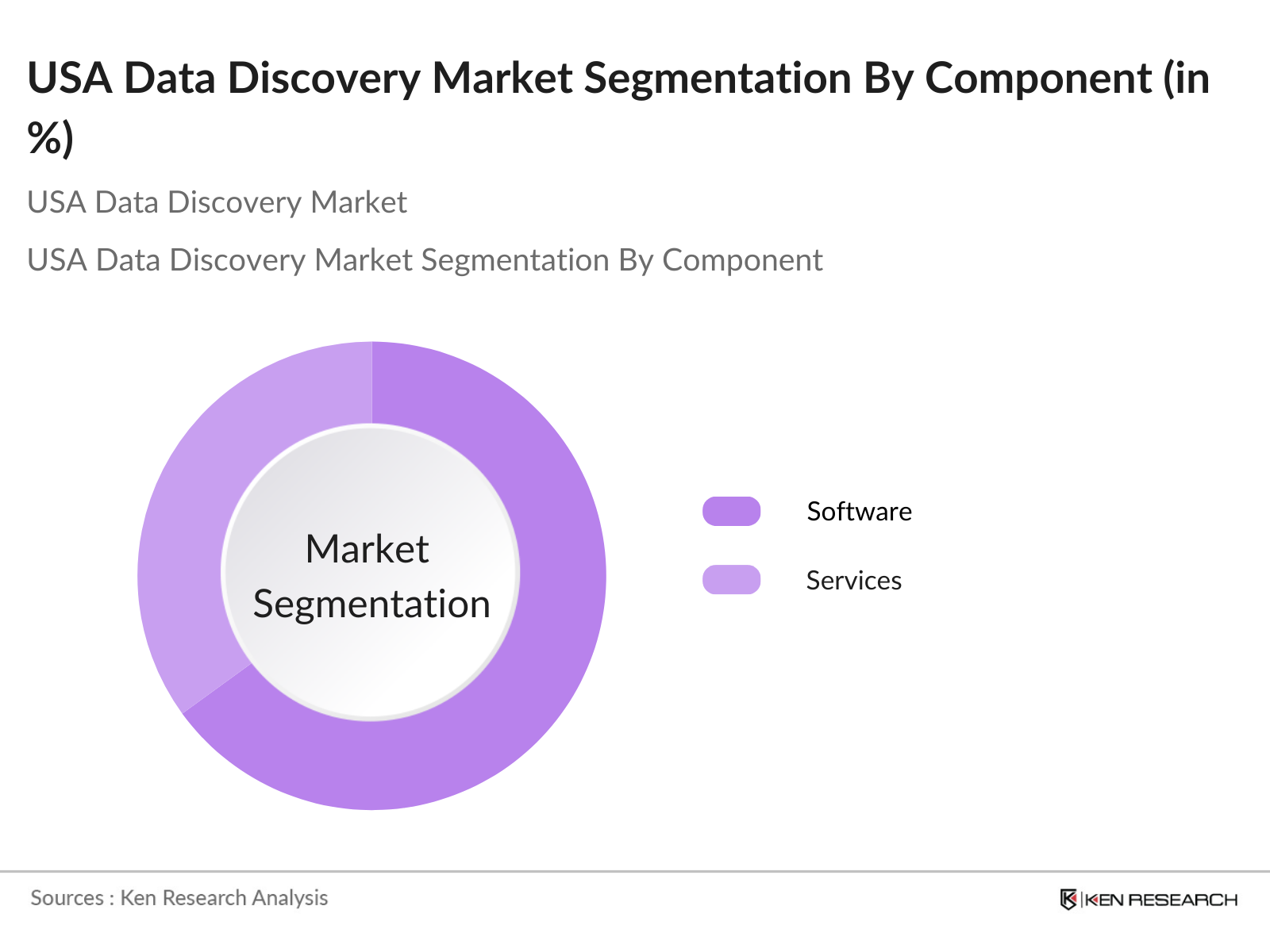

By Component: The market is segmented by component into software and services. Recently, software has a dominant market share under this segmentation, as businesses prioritize self-service data discovery tools that facilitate real-time insights. Software components, such as data visualization tools, enable companies to analyze vast datasets without needing extensive technical expertise, which has increased their adoption across the board. Managed and professional services, though smaller in share, support software integration and user training, which enhances the usability of data discovery platforms.

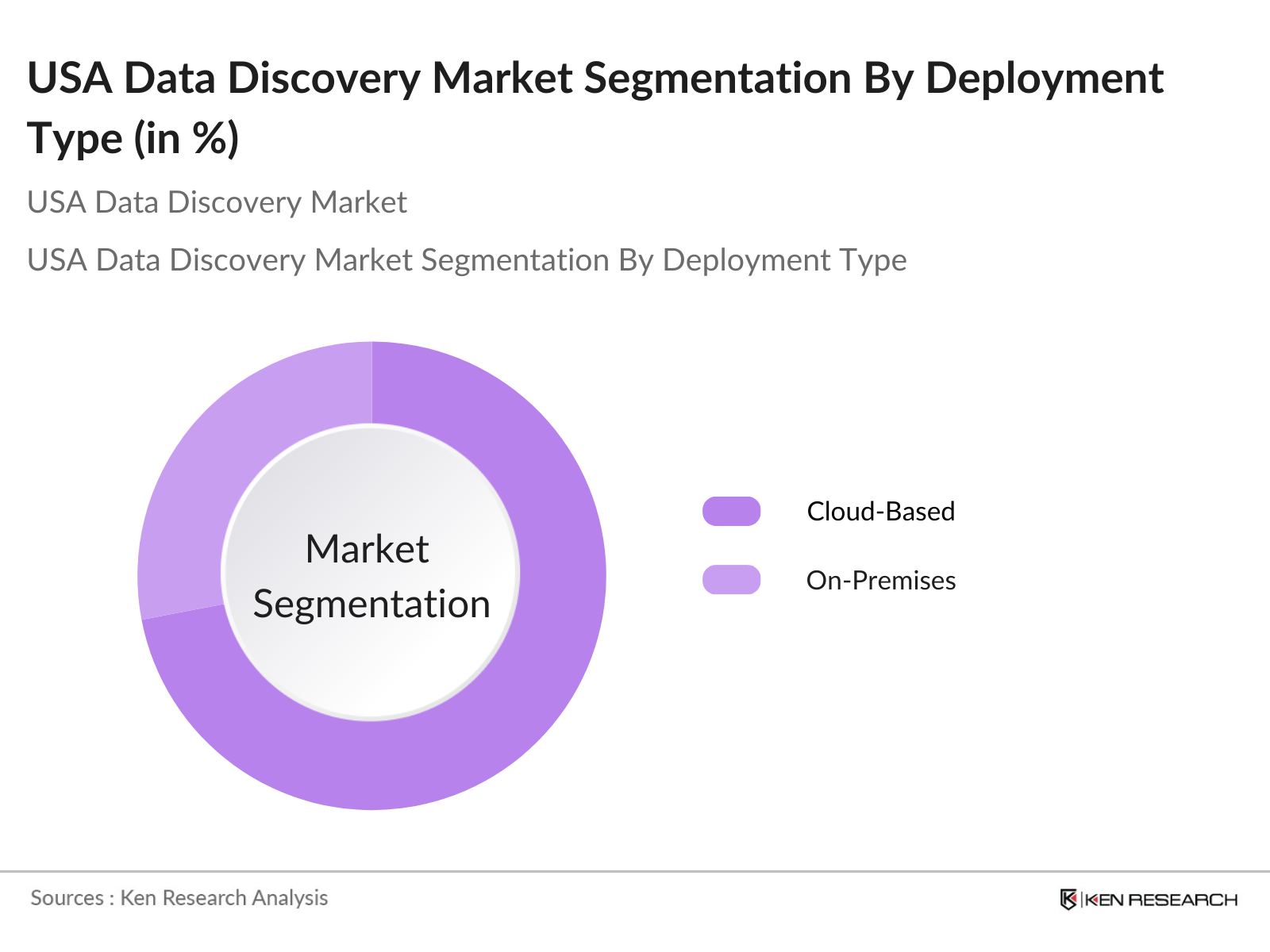

By Deployment Type: The USA Data Discovery Market is segmented by deployment type into cloud-based and on-premises solutions. Cloud-based deployment leads the market due to its scalability, cost efficiency, and accessibility, allowing companies to handle large datasets without extensive infrastructure investments. Cloud solutions support seamless data integration across regions and departments, addressing the increasing demand for cross-functional analytics. On-premises solutions remain relevant for highly regulated industries, like healthcare and finance, where data control and compliance are critical.

USA Data Discovery Market Competitive Landscape

The USA Data Discovery Market is primarily consolidated, with a few key players holding a significant share due to their strong technology platforms and extensive service offerings. The competition among companies is characterized by continuous innovation in data discovery platforms, integrating AI-driven insights, and improving data security. Here is an overview of the leading competitors:

USA Data Discovery Industry Analysis

Growth Drivers

- Increase in Unstructured Data Management: In 2024, businesses are addressing vast amounts of unstructured data generated daily, with projections indicating a continuation of this trend due to accelerated digitization. The IMF estimates that economic digitalization accounts for substantial portions of global productivity, which has implications for U.S. industries managing this data influx. The U.S. Bureau of Labor Statistics (BLS) shows that sectors like finance and healthcare are heavily reliant on unstructured data, intensifying demand for robust management solutions.

- Rise in Self-Service Analytics Tools: Driven by the adoption of analytics across non-technical fields, the deployment of self-service tools has surged, with 62% of businesses indicating active use. The availability of such tools correlates with a 15% increase in data analytics roles across the United States, as indicated by the U.S. BLS 2023 Occupational Outlook Handbook. This growth is further supported by the World Banks emphasis on skill transformation across sectors, positioning data discovery as a key driver in enhancing self-service capabilities for quicker insights.

- Regulatory Compliance and Data Privacy: Regulatory mandates surrounding data privacy, such as the General Data Protection Regulation (GDPR) adaptations in U.S. firms, have prompted a 32% rise in compliance roles in data-related sectors in 2023. The World Economic Outlook report also points out that stricter compliance and data governance strategies directly align with the need for more sophisticated data discovery tools.

Market Challenges

- Security Risks and Data Breaches: Data breaches have been rising, with the FBI reporting over 800 million records compromised in 2023 alone. The increasing sophistication of cyber-attacks, coupled with the growth of digital assets, has elevated cybersecurity risks, driving firms to spend heavily on data security and recovery, thus affecting the data discovery market's operational cost structure.

- High Implementation Costs: The initial cost of implementing data discovery tools is significant. The IMF projects that U.S. inflation will hover around 3.1% in 2024, impacting the prices of these technologies. The World Bank suggests that capital expenditure in tech innovations remains high due to inflationary pressures, which further strains investment in new data solutions.

USA Data Discovery Market Future Outlook

Over the next five years, the USA Data Discovery Market is expected to witness substantial growth, driven by a growing need for real-time data analytics, cloud-based deployment, and increasing regulatory requirements for data management. The expansion of AI capabilities within data discovery platforms will allow organizations to gain deeper insights and improve data governance. As more organizations recognize the strategic value of data in operational efficiency and customer insights, the demand for sophisticated data discovery tools will continue to grow.

Market Opportunities

- Adoption of AI-Powered Data Discovery Solutions: In the current market, AI integration in data discovery is witnessing robust growth. AI adoption has expanded rapidly, with AI-specific job roles increasing by 19% as reported by BLS. The World Economic Forum also highlights the economic advantage of AI-driven tools, estimating that AI in data discovery contributes to a 10-15% efficiency gain across sectors like healthcare and finance, positioning it as a significant opportunity for 2024.

- Expansion of Real-Time Analytics in Enterprise Applications: Real-time data analytics is essential for timely business insights. The IMF's report on global digitalization shows that real-time analytics contributes to agility in decision-making, with a substantial economic impact, particularly in service sectors where immediate insights enhance competitiveness. In 2023, U.S. enterprises reported a 28% increase in real-time analytics adoption in customer-centric applications, highlighting a promising avenue for data discovery tools.

Scope of the Report

|

By Component |

Software (Data Discovery Platforms, Visualization Tools) |

|

By Deployment Type |

Cloud-Based On-Premises |

|

By Application |

Security & Risk Management Sales and Marketing Supply Chain Analytics |

|

By End-User Industry |

BFSI Healthcare and Life Sciences IT & Telecom Retail and E-commerce |

|

By Region |

North America (United States, Canada) Europe Asia-Pacific Latin America |

Products

Key Target Audience

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Federal Trade Commission, Consumer Financial Protection Bureau)

Cloud Service Providers

Large-Scale Enterprises

Healthcare & Life Sciences Companies

Financial Services Institutions

Data Management Solutions Providers

Retail and E-commerce Businesses

Companies

Players Mentioned in the Report

IBM Corporation

Microsoft Corporation

Oracle Corporation

Salesforce Inc.

Google (Alphabet Inc.)

Amazon Web Services (AWS)

SAS Institute

Cloudera, Inc.

Tableau Software (Salesforce)

Tibco Software

Table of Contents

1. USA Data Discovery Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate and Key Metrics

1.4 Market Segmentation Overview

2. USA Data Discovery Market Size (in USD Mn)

2.1 Historical Market Size and Trends

2.2 Year-on-Year Growth Analysis

2.3 Key Milestones and Developments

3. USA Data Discovery Market Analysis

3.1 Market Growth Drivers

3.1.1 Increase in Unstructured Data Management (Market Parameter)

3.1.2 Rise in Self-Service Analytics Tools (Market Parameter)

3.1.3 Regulatory Compliance and Data Privacy (Market Parameter)

3.2 Market Challenges

3.2.1 Security Risks and Data Breaches (Market Parameter)

3.2.2 High Implementation Costs (Market Parameter)

3.3 Opportunities

3.3.1 Adoption of AI-Powered Data Discovery Solutions (Market Parameter)

3.3.2 Expansion of Real-Time Analytics in Enterprise Applications (Market Parameter)

3.4 Emerging Trends

3.4.1 Integration with Cloud-Based Platforms (Market Parameter)

3.4.2 Growth in Data Virtualization and Data Mesh (Market Parameter)

3.5 Regulatory Environment

3.5.1 Federal Data Protection Laws (Market Parameter)

3.5.2 Data Residency Requirements (Market Parameter)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. USA Data Discovery Market Segmentation

4.1 By Component

4.1.1 Software (Data Discovery Platforms, Data Visualization Tools)

4.1.2 Services (Managed Services, Professional Services)

4.2 By Deployment Type

4.2.1 Cloud-Based

4.2.2 On-Premises

4.3 By Application

4.3.1 Security & Risk Management

4.3.2 Sales and Marketing Analytics

4.3.3 Supply Chain Analytics

4.3.4 Financial Operations

4.4 By End-User Industry

4.4.1 BFSI

4.4.2 Healthcare and Life Sciences

4.4.3 IT & Telecom

4.4.4 Retail and E-commerce

4.4.5 Media and Entertainment

4.5 By Region

4.5.1 North America (United States, Canada)

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East and Africa

5. USA Data Discovery Market Competitive Analysis

5.1 Major Competitors

5.1.1 IBM Corporation

5.1.2 Microsoft Corporation

5.1.3 Oracle Corporation

5.1.4 Salesforce, Inc.

5.1.5 Google (Alphabet Inc.)

5.1.6 Amazon Web Services

5.1.7 SAS Institute

5.1.8 Cloudera, Inc.

5.1.9 Tableau Software (Salesforce)

5.1.10 Tibco Software

5.1.11 Alteryx, Inc.

5.1.12 Datameer

5.1.13 PKWARE, Inc.

5.1.14 Spirion, LLC

5.1.15 Egnyte, Inc.

5.2 Cross-Comparison Parameters (Revenue, Technology Integration, Product Innovation, Market Reach, Pricing Model, Customer Retention Rate, Number of Patents, Recent Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives and Developments

5.5 Mergers and Acquisitions

5.6 Venture Capital and Investment Analysis

5.7 Government Grants and Funding

6. USA Data Discovery Market Regulatory Framework

6.1 Data Compliance Standards (CCPA, GDPR)

6.2 Industry Certification Requirements

6.3 Data Residency and Cross-Border Data Transfer Regulations

7. USA Data Discovery Future Market Size (in USD Bn)

7.1 Projected Market Growth

7.2 Influencing Factors for Future Market Dynamics

8. USA Data Discovery Market Segmentation

8.1 By Component

8.2 By Deployment Type

8.3 By Application

9. USA Data Discovery Market Analyst Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Emerging Market Niches and White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves defining critical variables influencing the USA Data Discovery Market, including technology adoption rates, regulatory standards, and industry-specific requirements. Extensive desk research is conducted to identify key stakeholders and technological trends.

Step 2: Market Analysis and Construction

We analyze historical data on market growth, deployment types, and end-user industries. Quantitative and qualitative data from secondary sources, including databases and industry publications, provide insights into revenue generation and market penetration.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses around market growth drivers, challenges, and segment preferences are validated through expert consultations. Primary data is gathered via interviews with data discovery solution providers and industry practitioners.

Step 4: Research Synthesis and Final Output

In the final stage, the information from expert consultations and secondary research is synthesized to develop a comprehensive market analysis. This output includes actionable insights and forecasts, validated through a bottom-up approach to ensure reliability.

Frequently Asked Questions

01. How big is the USA Data Discovery Market?

The USA Data Discovery Market is valued at USD 4,472 million, based on a five-year historical analysis. The market's growth is primarily driven by the increasing need to manage complex, multi-structured data, fueling demand for data discovery tools that facilitate actionable insights across sectors like finance, healthcare, and IT.

02. What are the challenges in the USA Data Discovery Market?

Challenges include data privacy concerns, high implementation costs, and security risks that may affect adoption rates in specific sectors, such as finance and healthcare.

03. Who are the major players in the USA Data Discovery Market?

Key players include IBM Corporation, Microsoft Corporation, Oracle Corporation, Salesforce Inc., and Google, dominating through technological advancements and strategic partnerships.

04. What drives growth in the USA Data Discovery Market?

Growth is propelled by the need for real-time data analytics, AI integration, and enhanced data compliance, which improve decision-making efficiency in industries like IT, telecom, and retail.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.