USA Dental Burs Market Outlook to 2030

Region:North America

Author(s):Samanyu

Product Code:KROD6841

November 2024

88

About the Report

USA Dental Burs Market Overview

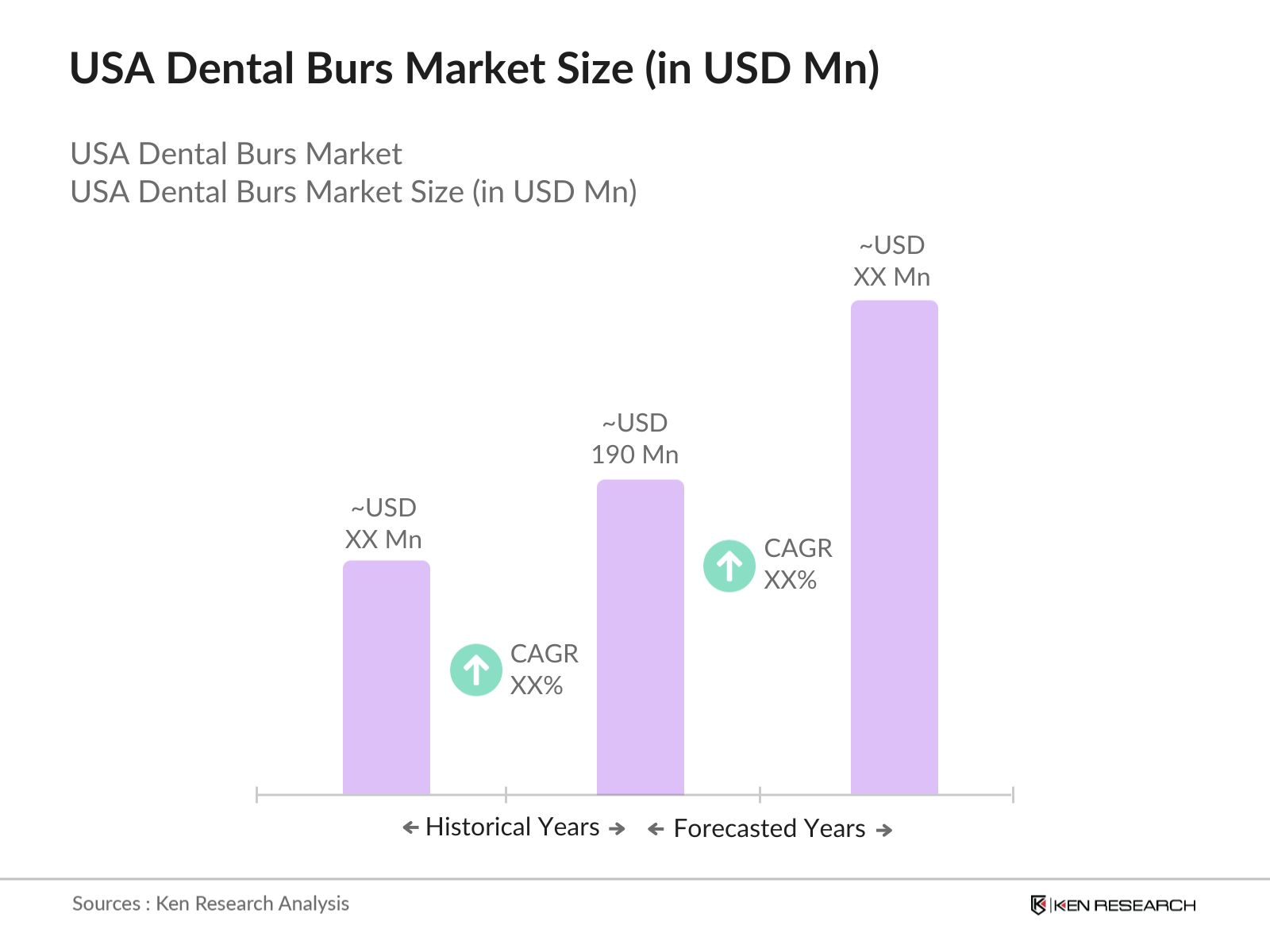

- The USA Dental Burs market is valued at USD 190 million, based on a five-year historical analysis. This market is primarily driven by rising prevalence of dental diseases such as dental caries and periodontal diseases, along with the increasing demand for advanced dental treatments. A growing number of dental clinics, hospitals, and specialty practices are also contributing to the expanding market. The advancement of CAD/CAM technologies in dental procedures is driving innovation in the development of dental burs, resulting in increased efficiency, precision, and cost-effectiveness for dental professionals.

- North America, particularly the USA, dominates the dental burs market due to its well-established healthcare infrastructure, high dental care awareness, and strong presence of key market players like Dentsply Sirona and 3M. The USA continues to lead in terms of research and development in dental technologies, including advanced materials like diamond and carbide burs, contributing to the markets growth. The countrys dominance is also supported by increasing consumer demand for aesthetic dentistry and dental implants, especially in major urban centers where access to specialized dental care is widely available.

- Minimally invasive dental procedures are gaining traction in the USA, with the American Dental Association reporting that in 2023, over 60% of dental treatments focused on minimally invasive techniques. This trend necessitates the use of specialized burs that allow for precision cutting with minimal damage to surrounding tissues. The growing popularity of these procedures drives demand for dental burs that can enhance accuracy and reduce patient recovery times, boosting market growth in this area.

USA Dental Burs Market Segmentation

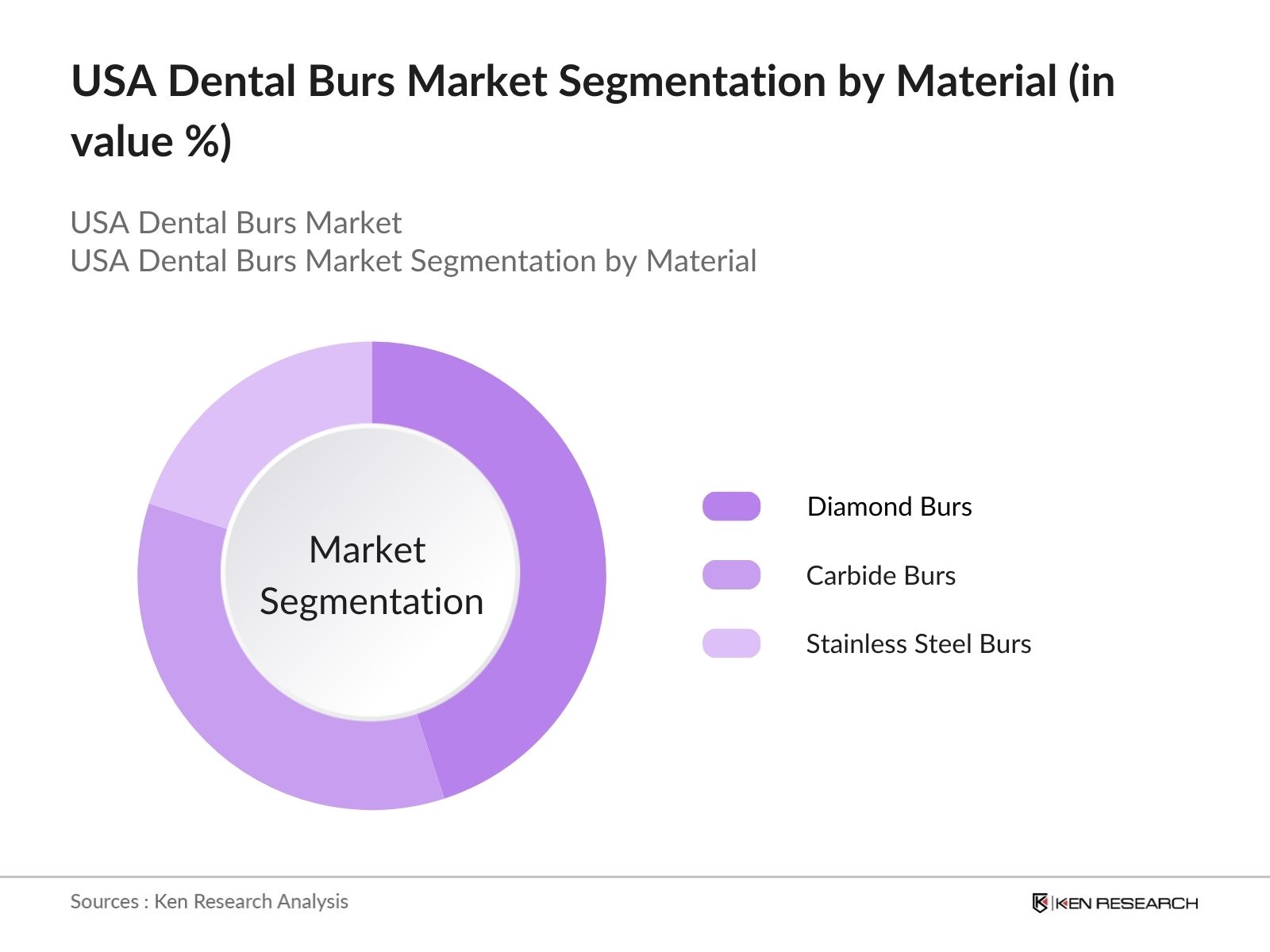

By Material: The market is segmented by material into diamond burs, carbide burs, and stainless-steel burs. Among these, diamond burs hold the largest market share, driven by their high precision, durability, and efficiency in handling complex dental procedures like cavity preparation and enamel shaping. The increasing focus on aesthetic dentistry and minimally invasive procedures has led to the growing adoption of diamond burs, especially in high-end dental clinics and specialized practices. These burs offer fine-tuned material removal, making them ideal for achieving precise aesthetic results.

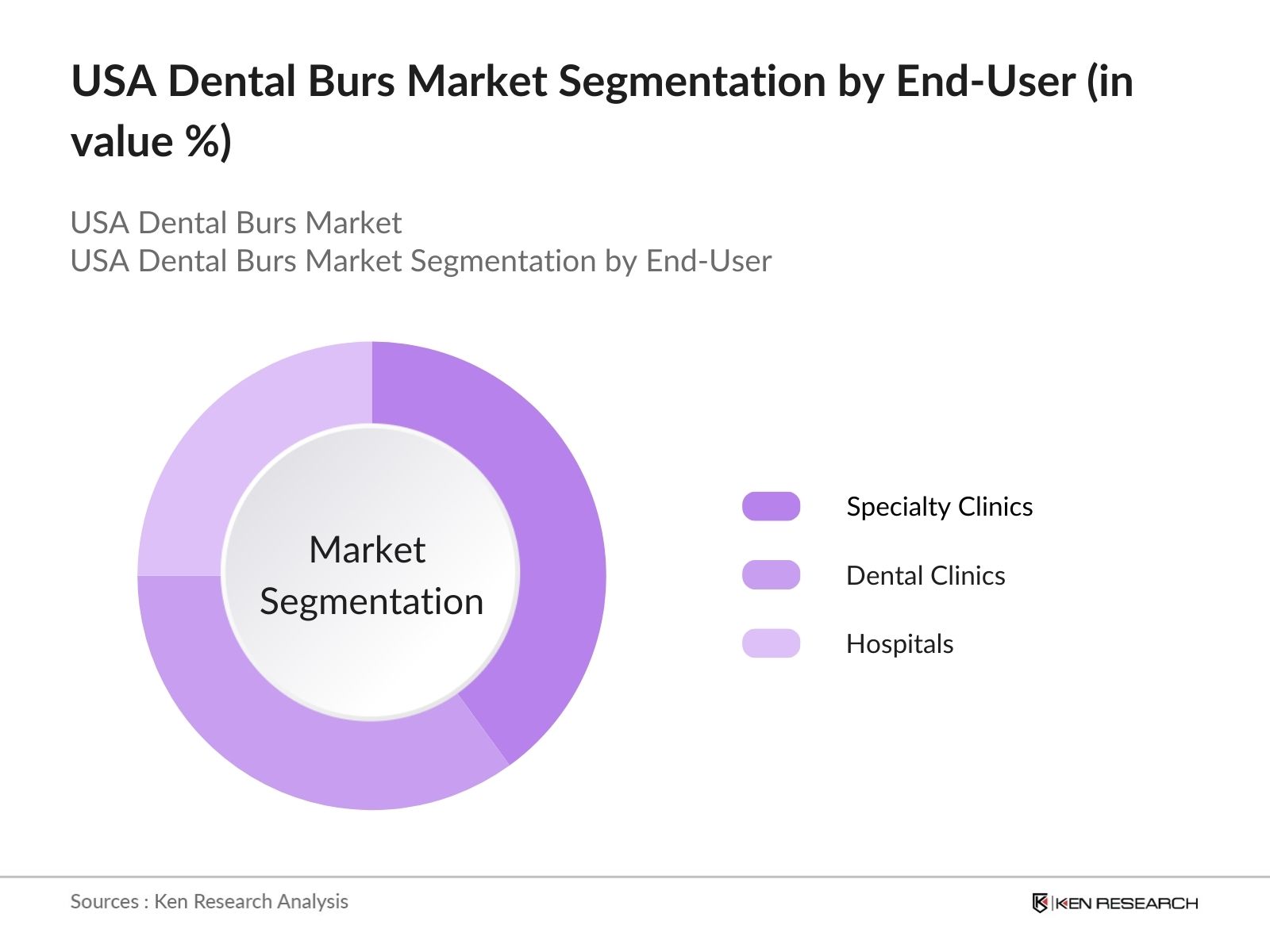

By End-User: The market is also segmented by end-users, including hospitals, dental clinics, and specialty clinics. Specialty clinics dominate the market, with the largest share attributed to their ability to offer personalized, high-quality care with advanced technology. These clinics have shorter waiting times and are more efficient in handling complex procedures like implants and orthodontics. The growth of this segment is also driven by the increasing number of independent dental practitioners establishing specialized practices.

USA Dental Burs Market Competitive Landscape

The market is highly competitive, with key players continuously investing in R&D and technological advancements to maintain a competitive edge. The market is characterized by a few dominant players with a global presence, focusing on expanding their product offerings and geographical reach. The competition is driven by innovation in materials, product performance, and customer satisfaction.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

R&D Investment |

Recent Acquisitions |

Partnerships |

|

Dentsply Sirona |

1899 |

Charlotte, USA |

||||||

|

3M |

1902 |

St. Paul, USA |

||||||

|

Brasseler USA |

1976 |

Savannah, USA |

||||||

|

Kerr Dental |

1891 |

Brea, USA |

||||||

|

Prima Dental Group |

1957 |

Gloucester, UK |

USA Dental Burs Industry Analysis

Growth Drivers

- Increasing Prevalence of Oral Diseases: The rising prevalence of oral diseases such as dental caries and periodontal disease is a significant driver for the USA dental burs market. According to the Centers for Disease Control and Prevention (CDC), over 47% of adults aged 30 years and older in the U.S. suffer from some form of periodontal disease, with dental caries being one of the most common chronic conditions. This increased burden on dental health services directly correlates to a higher demand for dental burs used in cavity preparations and other procedures. The high number of oral disease cases leads to increased patient visits, enhancing demand for effective dental instruments.

- Technological Advancements in Dental Burs: Technological advancements, especially in CAD/CAM systems, have revolutionized the production of dental prosthetics and contributed to the growing demand for precision dental burs. In the USA, over 21,000 dental practices have adopted CAD/CAM technologies, promoting the use of advanced burs compatible with these systems. Moreover, minimally invasive dentistry, which requires highly specialized and durable burs, has gained momentum. The American Dental Association (ADA) indicates that nearly 56% of dentists are increasingly performing minimally invasive procedures, necessitating advanced dental tools, including specialized burs, to keep up with new dental care techniques and improve patient outcomes.

- Growing Demand for Aesthetic Dentistry: Aesthetic dentistry, particularly implantology and the use of veneers, is on the rise in the USA. In 2023, it was reported that approximately 5 million dental implants are performed each year in the U.S., according to the American Academy of Implant Dentistry (AAID). This surge in demand for cosmetic dental procedures is driving the need for precision dental burs for drilling and shaping. The growing popularity of veneers and other aesthetic restorations also creates a demand for burs that can achieve fine and accurate cuts, supporting the expanding sector of cosmetic dentistry.

Market Challenges

- High Changing Frequency of Dental Burs: One of the major restraints in the dental burs market is the frequent need to replace burs, which increases operational costs for dental practices. A single dental bur may only last for 5-10 procedures before it needs replacement, depending on the material and usage. This high turnover rate leads to increased expenditures for dental clinics. With over 39 million dental procedures performed annually in the U.S., this frequent replacement becomes a significant cost burden, limiting the widespread adoption of certain high-end burs despite their advantages.

- High Costs of Advanced Materials: The cost of high-quality dental burs, particularly diamond-coated ones, is a significant restraint for the market. Diamond burs, often used for precision and durability, can be up to 4-5 times more expensive than traditional carbide burs. With over 201,000 practicing dentists in the USA, the high costs associated with these advanced materials may deter some clinics, especially smaller practices, from adopting these burs. Despite their efficiency and precision, the financial burden placed on dental offices by expensive burs contributes to pricing challenges in the market.

USA Dental Burs Market Future Outlook

Over the next five years, the market is expected to witness significant growth, fueled by continuous advancements in dental technology, the increasing prevalence of dental diseases, and a rising demand for aesthetic dental procedures. The integration of digital dentistry, along with the expansion of CAD/CAM technologies, will further drive market innovation, allowing for more efficient and precise dental procedures. Moreover, increasing awareness regarding oral health and the growing geriatric population will likely contribute to the sustained expansion of this market.

Future Market Opportunities

- Expansion in Dental Tourism: The USA has seen an increase in dental tourism, particularly from neighboring countries such as Canada and Mexico. According to the U.S. International Trade Administration, in 2023, dental care was one of the top medical services sought by international patients traveling to the U.S. This surge in dental tourism is driving demand for high-quality dental burs in advanced procedures such as dental implants and aesthetic surgeries, creating growth opportunities for the dental burs market as dental practices cater to an influx of international patients.

- Digital Integration in Dental Practices: The integration of digital technologies, such as artificial intelligence (AI) and 3D printing, in dental practices presents significant growth opportunities for the dental burs market. AI-assisted diagnosis and 3D-printed dental prosthetics are increasingly becoming standard practice, requiring specific dental burs compatible with these advanced systems. In 2023, the American Dental Association reported that over 10,000 dental clinics in the U.S. had integrated 3D printing into their practice. This technological shift is expected to drive the demand for dental burs tailored for digital workflows, improving precision and efficiency in dental procedures.

Scope of the Report

|

By Application |

Cavity Preparation Orthodontics Oral Surgery Implantology Other Dental Procedures |

|

By Material |

Diamond Burs Carbide Burs Stainless Steel Burs |

|

By Shank Type |

Long Straight Shank Latch-type Shank Friction Grip Shank |

|

By Head Shape |

Round-Shaped Pear-Shaped Cross-Cut Tapered Flame Burs |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Dental Equipment Manufacturers

Dental Clinics and Hospitals

Specialty Dental Clinics

Dental Surgeons and Orthodontists

Distributors and Retailers of Dental Products

Investors and Venture Capital Firms

Government and Regulatory Bodies (e.g., FDA, ADA)

Dental Associations and Professional Bodies

Companies

Players Mentioned in the Report

Dentsply Sirona

3M

Brasseler USA

Kerr Dental (Envista Holdings)

SS White Dental Inc.

Komet USA

Mani, Inc.

Shofu Dental Corporation

NTI-Kahla GmbH

Johnson Promident

Table of Contents

1. USA Dental Burs Market Overview

1.1. Definition and Scope (Market Size, Key End-Use Applications)

1.2. Market Taxonomy (Market Segmentation, Key Stakeholders)

1.3. Market Growth Rate (Demand Growth, Driving Factors)

1.4. Market Segmentation Overview (Product Types, Applications, End-users)

2. USA Dental Burs Market Size (In USD Mn)

2.1. Historical Market Size (Growth Trends, Key Developments)

2.2. Year-On-Year Growth Analysis (Key Drivers and Restraints)

2.3. Key Market Developments and Milestones (Technological Advancements, New Product Launches)

3. USA Dental Burs Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Oral Diseases (Dental Caries, Periodontal Disease)

3.1.2. Technological Advancements in Dental Burs (CAD/CAM Systems, Minimally Invasive Dentistry)

3.1.3. Growing Demand for Aesthetic Dentistry (Implantology, Veneers)

3.1.4. Rising Number of Dental Clinics and Hospitals

3.2. Restraints

3.2.1. High Changing Frequency of Dental Burs

3.2.2. High Costs of Advanced Materials (Diamond Burs)

3.2.3. Competitive Pricing Pressure Among Manufacturers

3.2.4. Regulatory Compliance Challenges

3.3. Opportunities

3.3.1. Expansion in Dental Tourism

3.3.2. Digital Integration in Dental Practices (AI, 3D Printing)

3.3.3. Emerging Markets for Dental Burs in Developing Countries

3.3.4. Strategic Partnerships for Product Innovation

3.4. Trends

3.4.1. Adoption of CAD/CAM Technology

3.4.2. Rise in Specialty Dental Clinics

3.4.3. Increasing Popularity of Minimally Invasive Procedures

3.4.4. Expansion of Portable Dental Equipment Solutions

4. USA Dental Burs Market Segmentation

4.1. By Application (In Value %)

4.1.1. Cavity Preparation

4.1.2. Orthodontics

4.1.3. Oral Surgery

4.1.4. Implantology

4.1.5. Other Dental Procedures

4.2. By Material (In Value %)

4.2.1. Diamond Burs

4.2.2. Carbide Burs

4.2.3. Stainless Steel Burs

4.3. By Shank Type (In Value %)

4.3.1. Long Straight Shank

4.3.2. Latch-type Shank

4.3.3. Friction Grip Shank

4.4. By Head Shape (In Value %)

4.4.1. Round-Shaped Burs

4.4.2. Pear-Shaped Burs

4.4.3. Cross-Cut Tapered Burs

4.4.4. Flame Burs

4.5. By Region (In Value %)

4.5.1 North-East

4.5.2 Midwest

4.5.3 West Coast

4.5.4 Southern States

5. USA Dental Burs Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Dentsply Sirona

5.1.2. Brasseler USA

5.1.3. 3M

5.1.4. Kerr Dental (Envista Holdings Corporation)

5.1.5. Prima Dental Group

5.1.6. Mani, Inc.

5.1.7. SS White Dental Inc.

5.1.8. Komet USA

5.1.9. Shofu Dental Corporation

5.1.10. NTI-Kahla GmbH

5.1.11. Johnson Promident

5.1.12. Micro-Mega

5.1.13. Strauss Diamond Instruments

5.1.14. Zimmer Biomet

5.1.15. Tri Hawk Inc.

5.2. Cross Comparison Parameters (Revenue, Market Share, Key Offerings, Distribution Network)

5.3. Market Share Analysis (By Key Companies and Materials)

5.4. Strategic Initiatives (Product Launches, R&D Investments)

5.5. Mergers and Acquisitions (Industry Consolidation, Key M&A Deals)

5.6. Investment Analysis (Venture Capital, Private Equity)

5.7. Technological Innovations and Patents

6. USA Dental Burs Market Regulatory Framework

6.1. FDA Regulations on Dental Devices

6.2. Compliance Requirements (Material Standards, Safety Protocols)

6.3. Certification and Testing Processes (ISO Standards, CE Marking)

7. USA Dental Burs Future Market Size (In USD Mn)

7.1. Future Market Size Projections (Key Growth Areas)

7.2. Key Factors Driving Future Market Growth (Innovations, Demographic Trends)

8. USA Dental Burs Future Market Segmentation

8.1. By Application (In Value %)

8.2. By Material (In Value %)

8.3. By Shank Type (In Value %)

8.4. By Head Shape (In Value %)

8.4. By Region (In Value %)

9. USA Dental Burs Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Dental Clinics, Hospitals, Specialty Practices)

9.3. White Space Opportunity Analysis

9.4. Marketing and Growth Initiatives

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Dental Burs Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA Dental Burs Market. This includes assessing market penetration, the ratio of suppliers to end-users, and revenue generation. Furthermore, an evaluation of dental treatment statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through consultations with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple dental burs manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Dental Burs Market.

Frequently Asked Questions

01. How big is the USA Dental Burs Market?

The USA Dental Burs market is valued at USD 190 million in 2023, driven by the growing demand for advanced dental procedures and technological innovations in dental materials.

02. What are the challenges in the USA Dental Burs Market?

Challenges in the USA Dental Burs market include the high frequency of replacement of dental burs, strict regulatory requirements, and pricing pressures among manufacturers due to intense competition.

03. Who are the major players in the USA Dental Burs Market?

Key players in USA Dental Burs market include Dentsply Sirona, 3M, Brasseler USA, Kerr Dental, and Prima Dental Group. These companies dominate the market due to their focus on innovation, extensive product portfolios, and strong distribution networks.

04. What are the growth drivers of the USA Dental Burs Market?

Growth drivers in USA Dental Burs market include the rising prevalence of oral diseases, increasing demand for aesthetic dentistry, advancements in CAD/CAM technologies, and the expanding number of dental clinics and hospitals across the country.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.