USA Desktop Virtualization Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD11224

November 2024

87

About the Report

USA Desktop Virtualization Market Overview

- The USA Desktop Virtualization market, valued at USD 6 billion, has seen steady growth driven by the increased adoption of remote work models and the significant cost efficiency offered by virtualized solutions. This market is further propelled by the scaling of IT operations and demand for infrastructure flexibility, supported by major technological advancements in virtualization solutions. Additionally, as companies shift towards digital transformation, the need for scalable desktop virtualization has increased, supporting cost savings in operational expenditures and hardware investments.

- Metropolitan areas such as New York, San Francisco, and Chicago dominate the USA Desktop Virtualization market due to the high concentration of technology-dependent enterprises, especially in finance, IT, and consulting sectors. These cities boast advanced infrastructure, a highly skilled IT workforce, and established technology networks that drive higher demand for virtual desktop infrastructure (VDI) solutions to support secure and scalable remote work environments.

- The U.S. desktop virtualization market is heavily influenced by stringent data protection laws such as GDPR, CCPA, and HIPAA. GDPR compliance is critical for any U.S. company processing European citizens' data, while the California Consumer Privacy Act (CCPA) ensures similar privacy rights for California residents. HIPAA imposes rigorous security standards on healthcare organizations to protect patient data. For virtual desktop infrastructure (VDI) providers, adherence to these standards is non-negotiable, given that improper handling of personal or health data could result in hefty penalties, legal liabilities, and damaged reputation.

USA Desktop Virtualization Market Segmentation

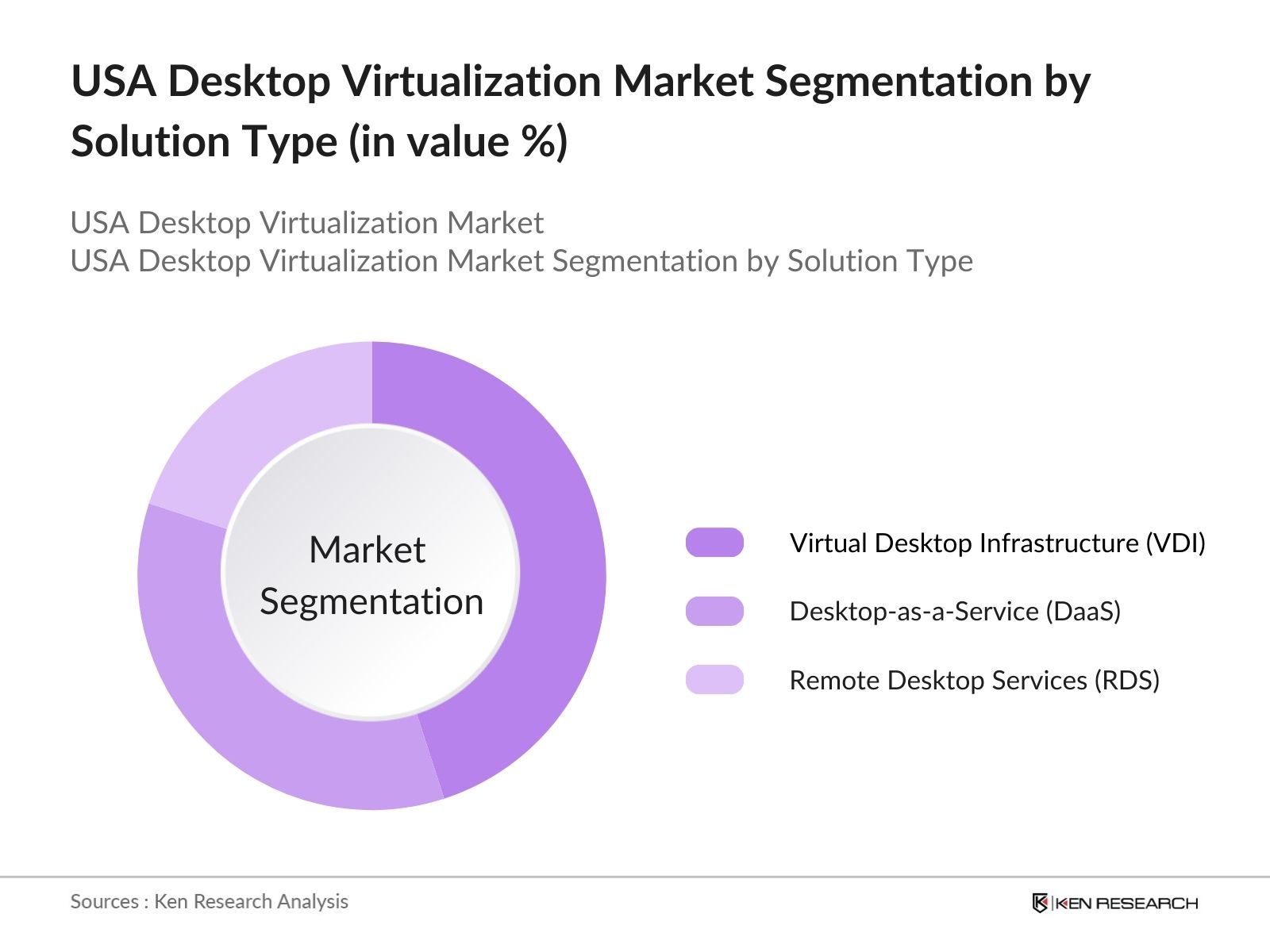

By Solution Type: The USA Desktop Virtualization market is segmented by solution type into Virtual Desktop Infrastructure (VDI), Desktop-as-a-Service (DaaS), and Remote Desktop Services (RDS). Currently, VDI holds a dominant market share in the solution type segmentation due to its security benefits and centralized management capabilities, which appeal to large enterprises. Many organizations prefer VDI for its ability to provide a high level of control over end-user environments, aligning with data security and compliance requirements in sectors like healthcare and finance.

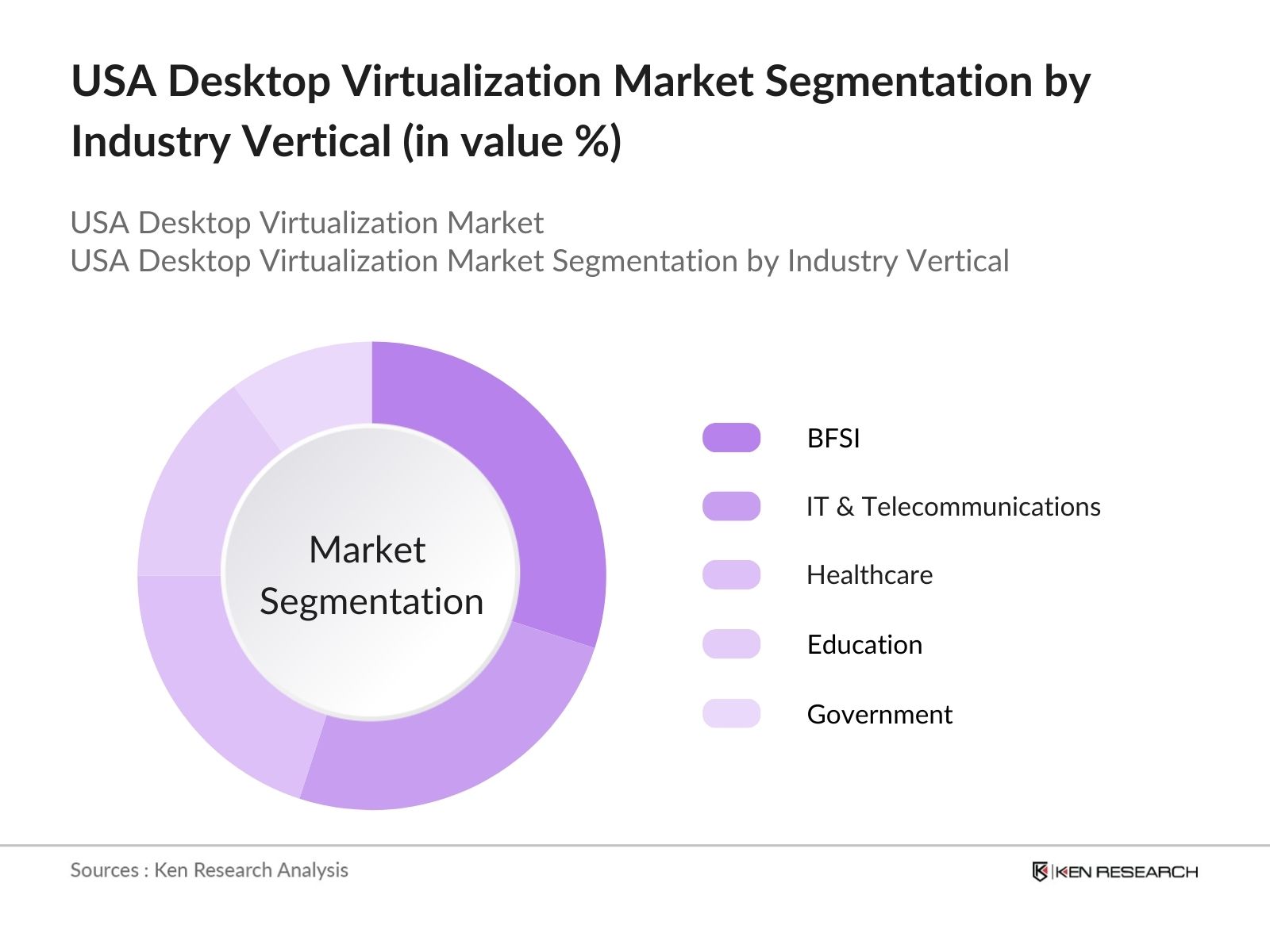

By Industry Vertical: The market is also segmented by industry verticals, including BFSI, IT & Telecommunications, Healthcare, Education, and Government. The BFSI sector holds a significant share in the industry vertical segmentation, largely due to the need for secure, remote data access and stringent regulatory compliance. Desktop virtualization in BFSI enables secure data handling while maintaining cost efficiency in large-scale IT management.

By Industry Vertical: The market is also segmented by industry verticals, including BFSI, IT & Telecommunications, Healthcare, Education, and Government. The BFSI sector holds a significant share in the industry vertical segmentation, largely due to the need for secure, remote data access and stringent regulatory compliance. Desktop virtualization in BFSI enables secure data handling while maintaining cost efficiency in large-scale IT management.

USA Desktop Virtualization Market Competitive Landscape

USA Desktop Virtualization Market Competitive Landscape

The USA Desktop Virtualization market is characterized by prominent players with specialized offerings tailored to varied organizational needs. Key companies hold influence due to their advanced solutions and integrations with cloud technology, enhancing scalability and reducing the reliance on traditional infrastructure.

USA Desktop Virtualization Market Analysis

Growth Drivers

- Increased Cloud Adoption: The U.S. desktop virtualization market is experiencing robust growth driven by cloud adoption across sectors, including financial services, healthcare, and education. This adoption aligns with the North American IT sector's significant expenditure on cloud infrastructure, forecasted to reach nearly $138 billion in 2024. Cloud infrastructure enhances flexibility and supports essential workload migration, which is crucial for companies managing complex IT environments.

- Demand for Remote Work Solutions: With an estimated 36 million U.S. workers working remotely in 2024, demand for remote solutions has surged. Desktop virtualization addresses this demand by facilitating secure and efficient access to corporate resources. As a result, there has been a notable increase in implementing Virtual Desktop Infrastructure (VDI) across diverse industries, where secure, mobile, and manageable environments are prioritized for both cost and productivity benefits. This shift directly supports the continued need for efficient and accessible remote work solutions that align with BYOD policies and virtual desktop models.

- Scalability of Virtualization Solutions: Virtualization's scalable architecture is particularly beneficial for large enterprises and rapidly growing SMBs. In sectors like healthcare and finance, desktop virtualization has become vital in supporting fluctuating demands while maintaining secure data access. Scalable VDI deployments meet growing digital workspace needs without extensive physical hardware, making it a sustainable option.

Challenges

- Security and Compliance Concerns: One of the major challenges in desktop virtualization is the high requirement for stringent data security and compliance with industry standards such as HIPAA and GDPR. With virtualized environments being accessed remotely, maintaining data integrity and privacy becomes complex, requiring advanced cybersecurity measures. Enterprises investing in VDI must incorporate multi-layer security models to address these risks effectively, especially as North America sees a rise in data breaches in virtual and cloud environments.

- High Initial Deployment Costs (Capex vs. Opex): The initial deployment costs associated with virtual desktop environments remain a barrier, particularly for SMBs. While the operational expenditure (OPEX) savings are substantial, the upfront capital expenditure (CAPEX) needed for infrastructure, licenses, and integration can be prohibitive. Many organizations are cautiously balancing CAPEX with anticipated OPEX benefits as they decide on desktop virtualization, which affects the overall adoption pace across smaller firms.

USA Desktop Virtualization Market Future Outlook

USA Desktop Virtualization market is expected to experience strong growth, propelled by increased enterprise adoption of hybrid work models, ongoing cloud infrastructure improvements, and rising concerns over data security. Further advancements in artificial intelligence and machine learning in virtualization solutions are anticipated to enhance scalability and efficiency, making desktop virtualization more accessible to SMEs and startups.

Market Opportunities

- Growth of Hybrid Cloud Environments: The hybrid cloud model in the U.S. is expanding significantly, with the market projected to reach $94 billion by 2030, reflecting the demand for flexible, secure environments where private and public clouds coexist. Notably, approximately 90% of U.S. enterprises have adopted a multi-cloud strategy that often incorporates hybrid solutions, particularly in industries handling sensitive data like healthcare and finance. The public sector also sees accelerated cloud adoption due to the FedRAMP program, which assures compliance and security standards across federal agencies. This growth supports increased efficiency, data privacy, and regulatory compliance through secure hybrid environments.

- Expansion in SMBs and Startups: Desktop-as-a-Service (DaaS) solutions are particularly appealing to U.S. small and medium-sized businesses (SMBs) due to their cost-effectiveness and reduced IT overheads. Approximately32% of businesseshave deployed desktop virtualization technology (VDI), with an additional12%planning to adopt it by 2021. This indicates a growing trend, especially among small and medium-sized businesses (SMBs). The hybrid clouds ability to manage costs effectively without extensive infrastructure investment makes it attractive to these companies, especially as they expand remotely in competitive markets.

Products

Key Target Audience

Large Enterprises in Finance, Healthcare, and Education Sectors

IT Infrastructure Providers

Cloud Service Providers

Data Security and Compliance Organizations

Network Service Providers

End-User Technology Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Federal Communications Commission, National Institute of Standards and Technology)

Companies

Players Mentioned in the Report

VMware, Inc.

Citrix Systems, Inc.

Microsoft Corporation

Amazon Web Services, Inc.

IBM Corporation

Google LLC

Red Hat, Inc.

Nutanix, Inc.

Oracle Corporation

Parallels International GmbH

Table of Contents

1. USA Desktop Virtualization Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Desktop Virtualization Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Desktop Virtualization Market Analysis

3.1 Growth Drivers

3.1.1 Increased Cloud Adoption (Cloud Infrastructure Integration)

3.1.2 Demand for Remote Work Solutions (Remote Workforce Penetration)

3.1.3 Scalability of Virtualization Solutions (Scalability and Flexibility)

3.1.4 Cost-Efficiency in IT Operations (IT Cost Savings and Optimization)

3.2 Market Challenges

3.2.1 Security and Compliance Concerns (Data Security and Privacy)

3.2.2 High Initial Deployment Costs (Capex vs. Opex)

3.2.3 Need for High Bandwidth (Network Requirements)

3.2.4 Complexity of IT Infrastructure (Management Complexity)

3.3 Opportunities

3.3.1 Growth of Hybrid Cloud Environments (Hybrid Cloud Strategy)

3.3.2 Expansion in SMBs and Startups (SMB Market Penetration)

3.3.3 Advances in AI for Enhanced Virtualization (AI & Machine Learning Integration)

3.3.4 Rising Need for Cybersecurity Solutions (Cybersecurity Integration)

3.4 Trends

3.4.1 Increased Use of Hyper-Converged Infrastructure (HCI Deployment)

3.4.2 Movement towards DaaS (Desktop-as-a-Service)

3.4.3 Adoption of Zero-Trust Security Models (Zero Trust Architecture)

3.4.4 Integration of VDI with 5G Technology (5G Network Utilization)

3.5 Government Regulations

3.5.1 Data Protection Regulations (GDPR, CCPA, HIPAA)

3.5.2 Government Initiatives for IT Modernization (Government IT Strategy)

3.5.3 Federal Cloud Computing Mandates (FedRAMP Compliance)

3.5.4 Industry-Specific Compliance Standards (Financial, Healthcare)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. USA Desktop Virtualization Market Segmentation

4.1 By Solution Type (In Value %)

4.1.1 Virtual Desktop Infrastructure (VDI)

4.1.2 Desktop-as-a-Service (DaaS)

4.1.3 Remote Desktop Services (RDS)

4.2 By Organization Size (In Value %)

4.2.1 Large Enterprises

4.2.2 Small and Medium Enterprises (SMEs)

4.3 By Deployment Model (In Value %)

4.3.1 On-Premises

4.3.2 Cloud-Based

4.3.3 Hybrid

4.4 By Industry Vertical (In Value %)

4.4.1 BFSI

4.4.2 IT & Telecommunications

4.4.3 Healthcare

4.4.4 Education

4.4.5 Government

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Desktop Virtualization Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 VMware, Inc.

5.1.2 Citrix Systems, Inc.

5.1.3 Microsoft Corporation

5.1.4 Amazon Web Services, Inc.

5.1.5 IBM Corporation

5.1.6 Google LLC

5.1.7 Red Hat, Inc.

5.1.8 Nutanix, Inc.

5.1.9 Oracle Corporation

5.1.10 Parallels International GmbH

5.2 Cross Comparison Parameters (Market Share, Revenue, Cloud Integration, Platform Support, Customization Options, Security Features, Licensing Models, User Base)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Desktop Virtualization Market Regulatory Framework

6.1 Data Protection Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. USA Desktop Virtualization Market Future Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Desktop Virtualization Market Future Segmentation

8.1 By Solution Type (In Value %)

8.2 By Organization Size (In Value %)

8.3 By Deployment Model (In Value %)

8.4 By Industry Vertical (In Value %)

8.5 By Region (In Value %)

9. USA Desktop Virtualization Market Analyst Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step entails developing an extensive ecosystem map encompassing all critical players in the USA Desktop Virtualization market. This process involves exhaustive secondary research through industry databases and proprietary sources to outline influential market dynamics and key variables.

Step 2: Market Analysis and Construction

In this phase, historical data analysis is conducted to examine market growth trends, including market penetration and regional adoption. Additionally, service quality metrics are reviewed to ensure that revenue estimates align with current market conditions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are constructed and validated through expert interviews using computer-assisted telephonic interviews (CATIs) with executives and specialists from major market players. This consultation phase gathers operational and strategic insights crucial to data validation.

Step 4: Research Synthesis and Final Output

The final stage synthesizes all acquired data and insights from desktop virtualization providers to verify sub-segment performance, consumer behavior, and revenue metrics. This approach ensures the analysiss reliability and accuracy, yielding a comprehensive report on the USA Desktop Virtualization market.

Frequently Asked Questions

01. How big is the USA Desktop Virtualization Market?

The USA Desktop Virtualization market is valued at USD 6 billion, driven by the increasing adoption of cloud infrastructure and demand for secure, flexible remote access solutions across various sectors.

02. What are the challenges in the USA Desktop Virtualization Market?

Challenges in the USA Desktop Virtualization market include concerns around data security, high initial deployment costs, and the need for stable high-bandwidth networks to support seamless virtual desktop experiences.

03. Who are the major players in the USA Desktop Virtualization Market?

Key players in USA Desktop Virtualization market include VMware, Inc., Citrix Systems, Inc., Microsoft Corporation, Amazon Web Services, Inc., and IBM Corporation, known for their innovative solutions and integrations with other enterprise technologies.

04. What are the growth drivers of the USA Desktop Virtualization Market?

Growth in USA Desktop Virtualization market is driven by increased cloud adoption, the need for scalable IT solutions to support remote work, and advancements in cybersecurity, which provide secure data handling for sectors like finance and healthcare.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.