USA Diesel Exhaust Fluid Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD1765

December 2024

90

About the Report

USA Diesel Exhaust Fluid Market Overview

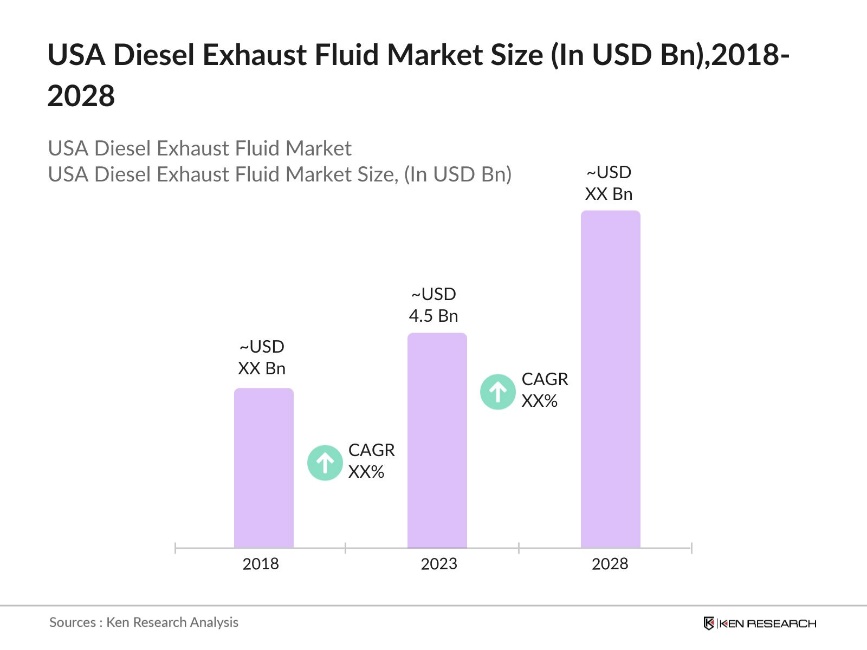

- The USA Diesel Exhaust Fluid (DEF) Market was valued at USD 4.5 billion in 2023, driven by the increasing adoption of Selective Catalytic Reduction (SCR) technology across diesel engines to comply with stringent environmental regulations. The growth is primarily fueled by the rising demand for cleaner fuel alternatives and the expanding fleet of commercial diesel vehicles that require DEF to reduce nitrogen oxide (NOx) emissions.

- The USA DEF market is dominated by key players such as Yara International, Cummins Filtration, Old World Industries, Royal Dutch Shell, and Brenntag AG. These companies have established themselves as leaders through strategic expansions, partnerships, and continuous innovations in DEF production and distribution, ensuring a steady supply to meet the growing demand.

- In 2022, Cummins Filtration announced it would be rebranding to 'Atmus Filtration Technologies' upon becoming a standalone company. The new name is derived from the word 'atmosphere' and signals a commitment to a clean, sustainable environment. Atmus' purpose is "Creating a better future by protecting what is important.

- In 2023, the state of Ohio was dominating the market due to high concentration of commercial and industrial activities, which contribute to a significant demand for DEF. Ohio's strategic location in the Midwest, a critical hub for transportation and logistics, makes it a key distribution center for DEF, ensuring efficient supply to surrounding regions.

USA Diesel Exhaust Fluid Market Segmentation

The USA Diesel Exhaust Fluid Market is segmented into different factors like by product type, by application and region.

By Product Type: The market is segmented by product type into bulk storage, portable containers, and pump dispensing systems. In 2023, bulk storage systems held the largest market share, due to its attributed to the widespread use of DEF in large fleets, which prefer bulk storage solutions for cost-effectiveness and convenience. The increasing number of commercial vehicles and the need for efficient refueling options have also contributed to the growth of this segment.

By Application: The market is segmented by application into commercial vehicles, passenger vehicles, and off-road equipment. The commercial vehicles segment dominated the market in 2023, driven by the high penetration of SCR technology in heavy-duty trucks, which are the largest consumers of DEF. The continuous growth of the logistics and transportation sectors in the USA further reinforces the segment's leading position.

By Region: The market is segmented by region into north, south, east, and west. The north region was dominating the market in 2023, due to the high concentration of industrial activities, a large commercial vehicle fleet, and a well-established logistics network in the region. Additionally, the presence of major DEF production facilities and distribution centers in the North further solidifies its leading position in the market.

USA Diesel Exhaust Fluid Market Competitive Landscape

USA Diesel Exhaust Fluid Market Major Players

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

Yara International |

1905 |

Oslo, Norway |

|

Cummins Filtration |

1958 |

Columbus, Indiana, USA |

|

Old World Industries |

1973 |

Northbrook, Illinois, USA |

|

Royal Dutch Shell |

1907 |

The Hague, Netherlands |

|

Brenntag AG |

1874 |

Essen, Germany |

- Yara International: In 2023, Yara announced its ambition to expand its clean ammonia operations in the USA by investing in blue ammonia capacity. This move is part of their broader strategy to decarbonize agriculture and related industries. The investment leverages the incentives provided by the Inflation Reduction Act, making the US an attractive location for producing decarbonized ammonia, which can be exported to Europe. This development aligns with Yara's goal to lead in green, blue, and grey ammonia distribution globally.

- Royal Dutch Shell: In 2024, Shell announced the completion of its acquisition of Brewer Oil Companys retail division, expanding its company-owned retail footprint in the U.S. by acquiring 45 fuel and convenience store sites in New Mexico. This expansion supports Shell's strategy to increase its presence in key U.S. markets and enhance its distribution network, which indirectly supports the supply and availability of Diesel Exhaust Fluid (DEF) across the region, particularly for commercial vehicle operators reliant on these sites for refueling.

USA Diesel Exhaust Fluid Market Analysis

USA Diesel Exhaust Fluid Market Growth Drivers

- Expansion in Infrastructure Development: The expansion of DEF infrastructure, including dispensing systems at fuel stations and truck stops, is a key market driver. Increased refueling points, especially in rural areas, improve DEF accessibility, encouraging adoption by commercial vehicle operators. This development is essential, given that trucks moved 61.9% of ground freight between the U.S. and Canada and 83.5% of trade with Mexico, totaling $948 billion in 2022.

- Stringent Emission Regulations: In 2024, the Environmental Protection Agency (EPA) enforced tighter emission regulations under the Clean Air Act, targeting a further reduction of NOx emissions from diesel engines. For medium-duty vehicles, the final standard is 274 grams of carbon dioxide per mile by 2032, a 44% reduction from 2026. This regulatory push has created a substantial and ongoing demand for DEF, fueling market growth as manufacturers and fleet operators comply with the updated standards.

- Adoption of Clean Diesel Technologies: The increasing awareness and adoption of clean diesel technologies, particularly in the commercial and industrial sectors, are driving the growth of the DEF market. Companies are investing in newer diesel engines equipped with SCR systems to reduce their environmental impact and meet regulatory requirements. This trend is further supported by government incentives and grants aimed at promoting cleaner diesel technologies.

USA Diesel Exhaust Fluid Market Challenges

- Supply Chain Disruptions: The DEF market faces considerable challenges due to supply chain disruptions, which can severely affect the consistent availability of DEF across the country. These disruptions often stem from logistical issues such as transportation delays, port congestion, or disruptions in the production process. In rural or remote areas, where the infrastructure for DEF distribution is less developed, these disruptions can lead to significant shortages.

- Volatility in Raw Material Costs: The DEF market is particularly sensitive to fluctuations in the cost of raw materials, with urea being the most critical component. Urea prices are subject to global market conditions, which can be influenced by factors such as geopolitical tensions, natural disasters, or changes in agricultural demand. When urea prices spike, DEF manufacturers face increased production costs, which can erode their profit margins.

USA Diesel Exhaust Fluid Market Government Initiatives

- Diesel Emissions Reduction Act (DERA): In 2024, the Diesel Emissions Reduction Act (DERA) has been a significant government initiative aimed at reducing emissions from diesel engines, including those requiring Diesel Exhaust Fluid (DEF). The program allocated substantial funding to retrofit older diesel vehicles with modern emission control technologies, such as Selective Catalytic Reduction (SCR) systems that rely on DEF. This initiative is designed to reduce harmful pollutants and encourage the adoption of cleaner diesel technologies across the trucking industry.

- California's Cap-and-Trade program: In 2024, California's Cap-and-Trade program, which has been in place for over a decade, continues to be a significant government initiative that indirectly impacts the Diesel Exhaust Fluid (DEF) market. By placing a cap on greenhouse gas emissions and allowing companies to trade emission allowances, the program encourages industries, including transportation, to adopt cleaner technologies. This drives demand for DEF as companies strive to comply with emission standards and reduce their environmental footprint.

USA Diesel Exhaust Fluid Market Future Outlook

The USA DEF Market is projected to grow exponentially by 2028. This growth will be driven by the continued expansion of SCR technology across various diesel applications, including off-road vehicles and stationary engines. Additionally, increasing awareness about environmental sustainability and stricter emission regulations will further boost the demand for DEF, positioning the market for sustained growth over the forecast period.

Market Trends

- Development of Bio-based DEF Alternatives: The market will witness the development and commercialization of bio-based DEF alternatives. By 2028, it is projected that bio-based DEF could account for up to 10% of the total market, driven by advancements in sustainable agriculture and biochemistry. The U.S. Department of Energy (DOE) is funding research projects to develop these alternatives, which will reduce the environmental impact of DEF production and cater to the growing demand for green solutions.

- Technological Innovations in DEF Production and Distribution: The market will experience technological innovations aimed at improving the efficiency of DEF production and distribution. By 2028, advanced sensor technology is expected to be integrated into DEF dispensers, providing real-time data on DEF levels, usage patterns, and quality. This innovation will enhance the supply chain's responsiveness and ensure that DEF is available where and when it is needed, driving operational efficiencies across the market.

Scope of the Report

|

By Product Type |

Bulk Storage Portable Containers Pump Dispensing Systems |

|

By Application |

Commercial Vehicles Passenger Vehicles Off-Road Equipment |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Commercial Vehicle Manufacturers

Agriculture Equipment Manufacturers

Industrial Machinery Manufacturers

Automotive OEMs

Logistics and Transportation Companies

Fleet Management Companies

DEF Dispensing Equipment Manufacturers

Oil and Gas Companies

DEF Storage Tank Manufacturers

Investors and VC Firms

Banks and Financial Institutions

Government Regulatory Bodies (e.g., Environmental Protection Agency)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Yara International

Cummins Filtration

Old World Industries

Royal Dutch Shell

Brenntag AG

BASF SE

TotalEnergies

Air Liquide

CF Industries

GreenChem

Peak Commercial & Industrial

Nitron Group

PotashCorp

BlueDEF

Kleen DEF

Table of Contents

1. USA Diesel Exhaust Fluid Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Diesel Exhaust Fluid Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Diesel Exhaust Fluid Market Analysis

3.1. Growth Drivers

3.1.1. Expansion in Infrastructure Development

3.1.2. Stringent Emission Regulations

3.1.3. Adoption of Clean Diesel Technologies

3.1.4. Increasing Fleet of Commercial Vehicles

3.2. Challenges

3.2.1. Supply Chain Disruptions

3.2.2. Volatility in Raw Material Costs

3.2.3. Environmental Impact of Urea Production

3.2.4. High Initial Costs for SCR Technology

3.3. Opportunities

3.3.1. Technological Innovations in DEF Production

3.3.2. Development of Bio-based DEF Alternatives

3.3.3. Expansion into Non-Road Diesel Applications

3.3.4. Increase in Government Incentives

3.4. Trends

3.4.1. Real-Time DEF Monitoring Systems

3.4.2. Increased Use of Sustainable DEF Solutions

3.4.3. Adoption of Smart Dispensing Systems

3.4.4. Growth in DEF Infrastructure in Rural Areas

3.5. Government Initiatives

3.5.1. Diesel Emissions Reduction Act (DERA)

3.5.2. California's Cap-and-Trade Program

3.5.3. Federal Grants for Clean Diesel Technologies

3.5.4. State-Level DEF Supply Programs

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. USA Diesel Exhaust Fluid Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Bulk Storage

4.1.2. Portable Containers

4.1.3. Pump Dispensing Systems

4.2. By Application (in Value %)

4.2.1. Commercial Vehicles

4.2.2. Passenger Vehicles

4.2.3. Off-Road Equipment

4.3. By End-User (in Value %)

4.3.1. Logistics and Transportation

4.3.2. Construction and Mining

4.3.3. Agriculture

4.4. By Technology (in Value %)

4.4.1. SCR Technology

4.4.2. EGR Technology

4.5. By Region (in Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. USA Diesel Exhaust Fluid Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Yara International

5.1.2. Cummins Filtration

5.1.3. Old World Industries

5.1.4. Royal Dutch Shell

5.1.5. Brenntag AG

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. USA Diesel Exhaust Fluid Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. USA Diesel Exhaust Fluid Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. USA Diesel Exhaust Fluid Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. USA Diesel Exhaust Fluid Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By End-User (in Value %)

9.4. By Technology (in Value %)

9.5. By Region (in Value %)

10. USA Diesel Exhaust Fluid Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on USA Diesel Exhaust Fluid Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA Diesel Exhaust Fluid Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple diesel producers companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from diesel producers companies.

Frequently Asked Questions

01 How big is the USA Diesel Exhaust Fluid (DEF) Market?

The USA Diesel Exhaust Fluid (DEF) Market was valued at USD 4.5 billion in 2023, driven by stringent environmental regulations, the expansion of the commercial vehicle fleet, and government initiatives promoting clean diesel technology.

02 What are the challenges in the USA Diesel Exhaust Fluid (DEF) Market?

Challenges in USA Diesel Exhaust Fluid Market include fluctuating urea prices, supply chain constraints, the high cost of SCR technology adoption, and environmental concerns over urea production. These factors pose risks to the market's stability and growth.

03 Who are the major players in the USA Diesel Exhaust Fluid (DEF) Market?

Key players in the USA Diesel Exhaust Fluid Market include Yara International, Cummins Filtration, Old World Industries, Royal Dutch Shell, and Brenntag AG. These companies dominate due to their extensive production capabilities, strong distribution networks, and innovative product offerings.

04 What are the growth drivers of the USA Diesel Exhaust Fluid (DEF) Market?

The USA Diesel Exhaust Fluid Market is propelled by the expansion of the commercial vehicle fleet, stringent emission regulations, government support for clean diesel initiatives, and the increase in long-haul freight transport across the country.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.