USA Dietary Supplements Market Outlook to 2030

Region:North America

Author(s):Mukul

Product Code:KROD2525

October 2024

93

About the Report

USA Dietary Supplements Market Overview

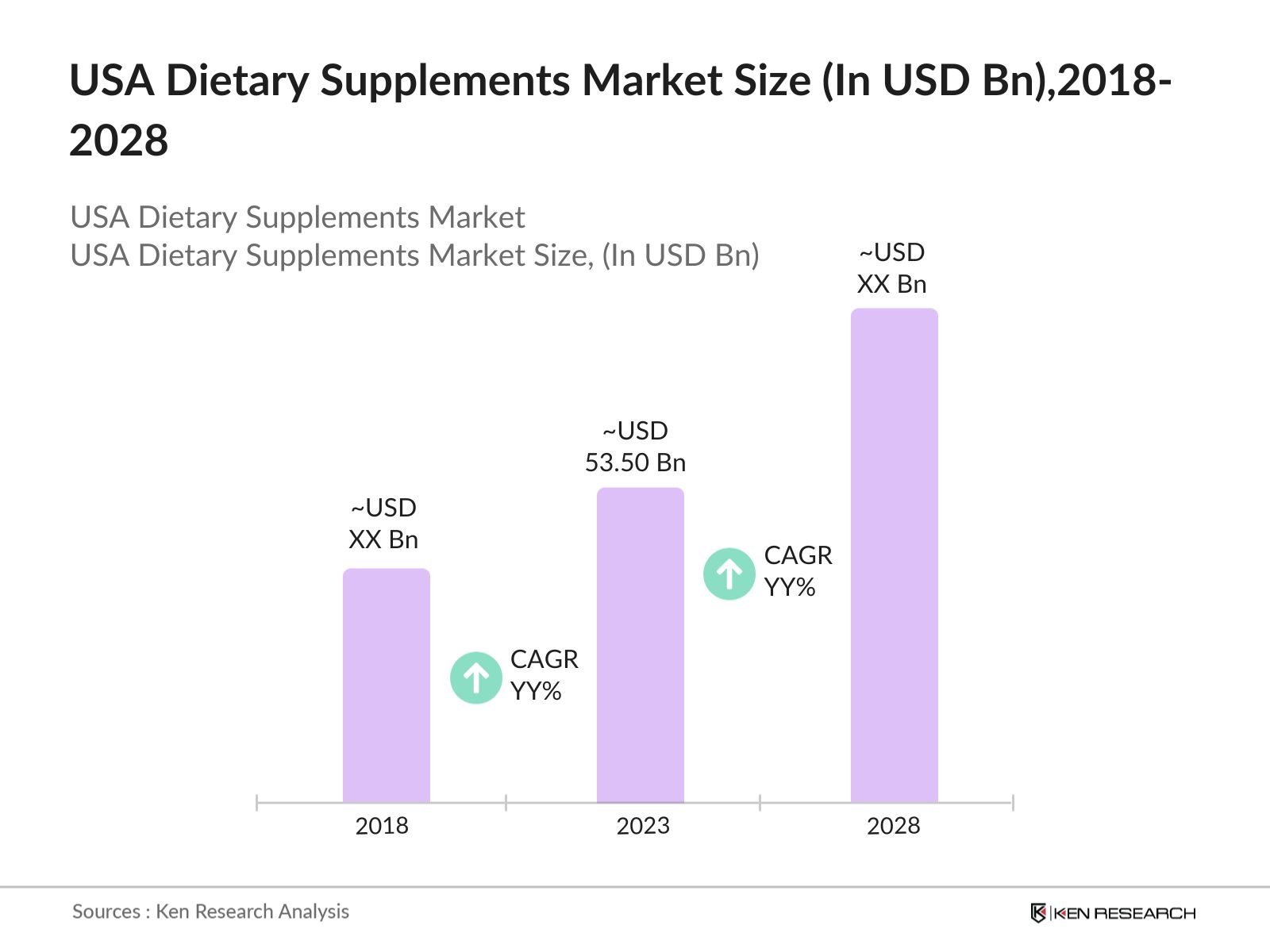

- The USA dietary supplements market was valued at USD 53.50 billion in 2023, driven by a heightened awareness of preventive healthcare, increased adoption of e-commerce platforms, and the rising elderly population. Consumer preference for vitamins, minerals, and herbal supplements has grown due to concerns about long-term health and wellness.

- Key players in the USA dietary supplements market include Abbott Laboratories, Pfizer Inc., Amway, Herbalife Nutrition, and Nestl Health Science. These companies lead the market due to their strong R&D capabilities, advanced distribution networks, and extensive product portfolios tailored to various health needs.

- Major cities driving the dietary supplements market in the USA include New York, Los Angeles, and Miami, with New York leading due to its high population density and purchasing power. The growing trend of personalized nutrition in these cities has further propelled market growth.

- In 2023, the U.S. Food and Drug Administration (FDA) launched the Supplement Safety and Innovation Initiative, promoting public awareness about the benefits and risks of dietary supplements. The initiative also introduced stricter regulations on labeling, enhancing product transparency and consumer trust.

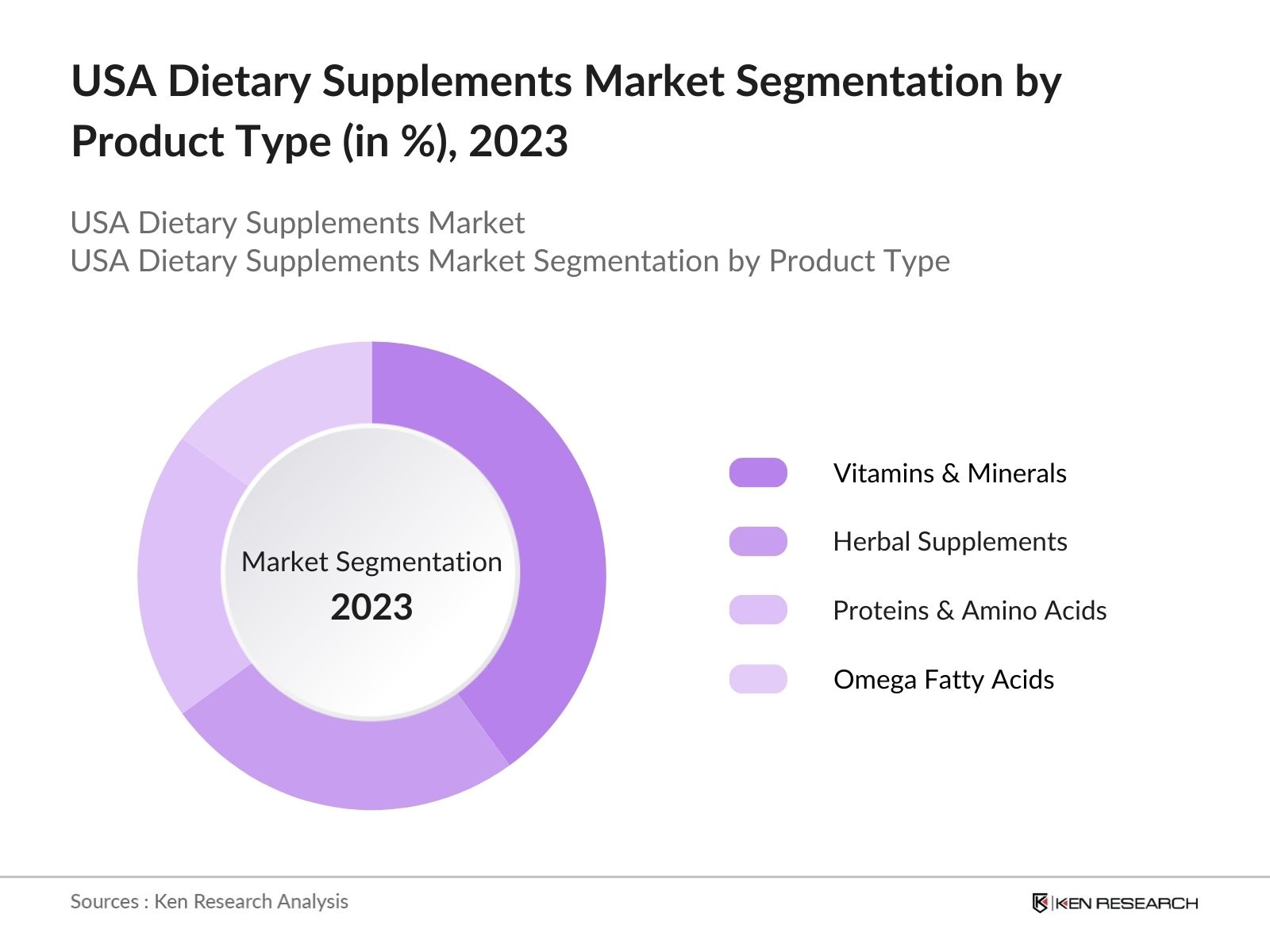

USA Dietary Supplements Market Segmentation

By Product Type: The USA dietary supplements market is segmented by product type into vitamins & minerals, herbal supplements, proteins & amino acids, and omega fatty acids. In 2023, vitamins & minerals dominated the segment due to their widespread use in general health maintenance and immune support, with a strong presence from brands like Centrum and Nature Made.

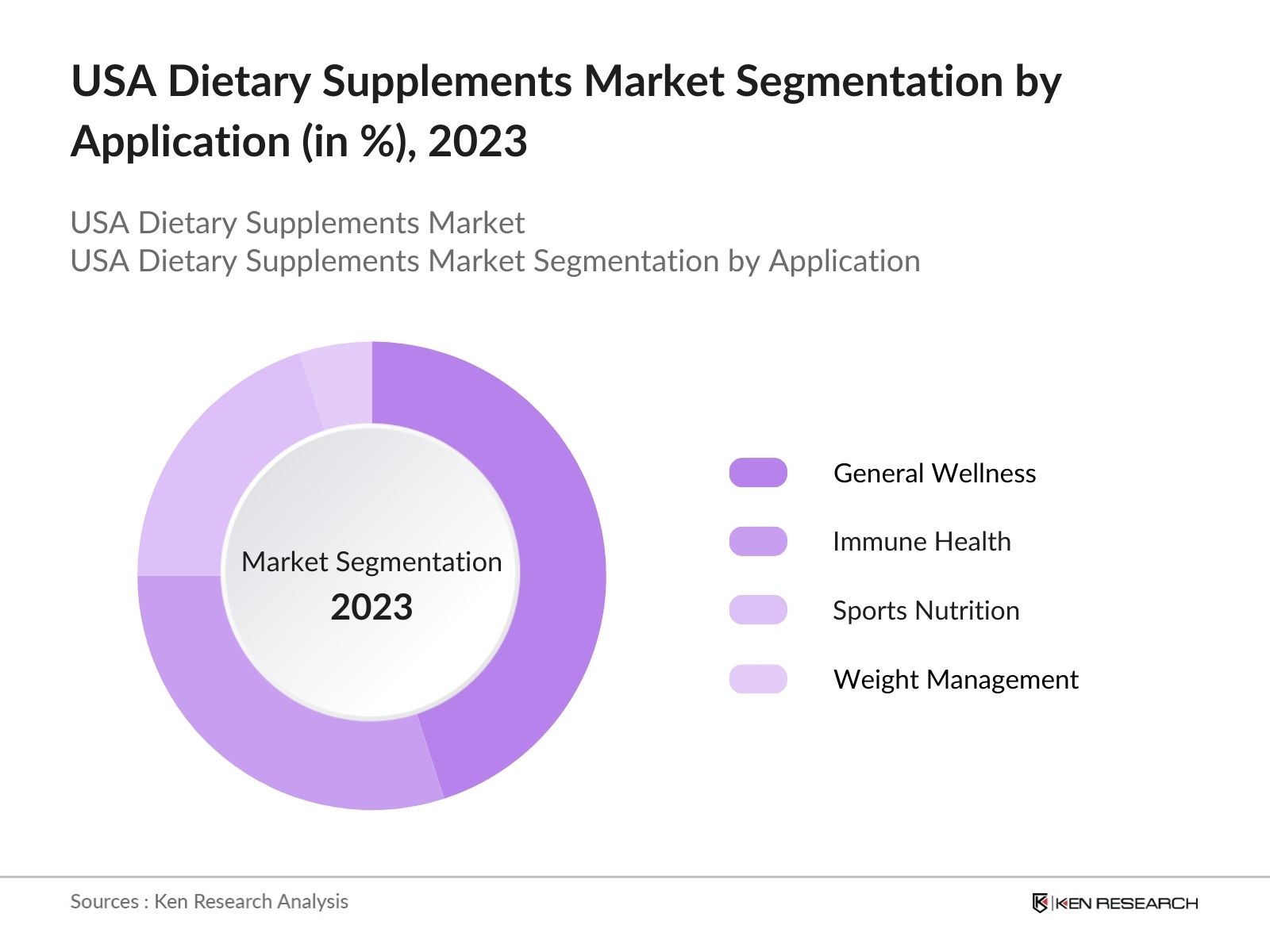

By Application: The USA dietary supplements market is segmented by application into general wellness, immune health, sports nutrition, and weight management. In 2023, g general wellness led the segment due to growing health consciousness across various age groups. Consumers increasingly focus on long-term health benefits, leading to higher demand for daily vitamins, multivitamins, and minerals aimed at maintaining overall wellness.

By Region: The USA dietary supplements market is segmented into North, South, East, and West regions. In 2023, the West region led the market due to its health-conscious consumer base and strong demand for organic and plant-based supplements. States like California are major contributors to this regional dominance.

USA Dietary Supplements Market Competitive Landscape

|

Company Name |

Established Year |

Headquarters |

|

Abbott Laboratories |

1888 |

Chicago, Illinois |

|

Pfizer Inc. |

1849 |

New York, New York |

|

Amway |

1959 |

Ada, Michigan |

|

Herbalife Nutrition |

1980 |

Los Angeles, California |

|

Nestl Health Science |

2011 |

Bridgewater, New Jersey |

- Herbalife Nutrition: In 2023, Herbalife Nutrition expanded its product lineup in the U.S. dietary supplements market to meet evolving consumer preferences, introducing several notable items. Among these are theHerbalife Nutrition Immunity Booster, designed to enhance immune support, theHerbalife Nutrition Collagen Powder, which targets the growing demand for skin health and beauty-from-within products, and theHerbalife Nutrition Protein Bars, aimed at bolstering the company's presence in the sports nutrition segment.

- Pfizer Inc.: In 2023, Pfizer expanded its dietary supplement portfolio in the U.S. market with the introduction of several new products, includingCentrum Men Ultra, a multivitamin formulated to cater to men's specific health needs,Caltrate Plus, a calcium and vitamin D supplement targeting bone health, andEmergen-C Immune+, a vitamin C and zinc supplement designed to support the immune system. These additions aim to address the evolving preferences of health-conscious consumers seeking targeted nutritional solutions to support their overall well-being.

USA Dietary Supplements Industry Analysis

USA Dietary Supplements Market Growth Drivers

- Increasing Health Awareness in the Elderly Population: In 2020, the elderly population in the USA was recorded at 55.8 million, according to the U.S. Census Bureau. The growing awareness among this demographic about preventive health has led to increased demand for supplements that support cardiovascular and bone health. This trend is expected to continue as more elderly individuals prioritize healthy aging and disease prevention.

- Rise in E-Commerce and Digital Health Platforms: In 2023, e-commerce sales in the USA totaled $1.1 trillion, with dietary supplements emerging as one of the fastest-growing categories. Platforms like Amazon and iHerb have made it easier for consumers to access a wide variety of supplements. Digital health platforms have also played a pivotal role in providing personalized supplement recommendations, boosting consumer confidence in the products.

- Consumer Demand for Natural and Plant-Based Supplements: The demand for plant-based and natural supplements has surged in the USA, driven by consumers preference for organic, clean-label products. According to industry reports, 65% of consumers in the USA actively seek out natural ingredients in their supplements. This shift towards plant-based products has been further accelerated by companies like Nestl Health Science acquiring Orgain, a leader in organic nutrition.

USA Dietary Supplements Market Challenges

- Regulatory Hurdles in Supplement Labeling: The FDA introduced stricter guidelines in 2023 for the labeling and marketing of dietary supplements, including tighter regulations on health claims and ingredient transparency. While these regulations are intended to protect consumers, they also pose challenges for manufacturers, who face increased compliance costs and potential delays in product launches.

- Growing Consumer Skepticism: Despite the market growth, 43% of Americans in 2023 expressed concerns about the efficacy of dietary supplements, particularly those sold online. This skepticism has prompted manufacturers to focus on third-party testing and certifications to rebuild trust with consumers, a trend that is expected to continue in the coming years.

USA Dietary Supplements Market Government Initiatives

- FDA Launches Initiative to Educate Consumers on Dietary Supplements: In June 2022, the FDA launched an educational initiative titled "Supplement Your Knowledge" aimed at enhancing public understanding of dietary supplements. This initiative provides a range of resources, including fact sheets, videos, and curricula designed for consumers, educators, and healthcare professionals to learn about the regulation, benefits, and risks associated with dietary supplements.

- Mandatory Product Listing Proposal (2022): In response to growing concerns about dietary supplement safety, lawmakers introduced the Dietary Supplement Listing Act of 2022, which aims to establish a mandatory product listing rule for all dietary supplements, enhancing the FDA's pre-market review authority.

USA Dietary Supplements Market Future Outlook

The USA dietary supplements market is poised for steady growth through 2028, driven by increasing consumer awareness of health and wellness, a growing elderly population, and advancements in personalized nutrition. As consumers become more informed about their specific health needs, the demand for supplements tailored to individual lifestyles and genetic profiles is expected to rise.

Future Market Trends

- Personalized Nutrition Solutions: Over the next five years, personalized nutrition is expected to become a key trend in the dietary supplements market. With advancements in genetic testing and AI-based health platforms, consumers will increasingly opt for supplements that cater to their unique health needs, offering a more tailored approach to preventive health.

- Increased Demand for Plant-Based Supplements: The shift towards plant-based diets will continue to drive demand for plant-based supplements, as more consumers seek natural and organic products. Companies are expected to focus on developing new formulations that cater to this growing segment, offering a wide range of herbal and vegan supplements.

Scope of the Report

|

By Product |

Vitamins & Minerals Herbal Supplements Proteins & Amino Acids Omega Fatty Acids |

|

By Application |

General Wellness Immune Health Sports Nutrition Weight Management |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Dietary Supplement Manufacturers

Healthcare Providers

Pharmacies & Drug Stores

Fitness Centers & Gyms

E-commerce Platforms

Government and Regulatory Bodies (U.S. FDA, HHS)

Investors and Venture Capital Firms

Health & Wellness Centers

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

Abbott Laboratories

Pfizer Inc.

Amway

Herbalife Nutrition

Nestl Health Science

The Natures Bounty Co.

GNC Holdings

Bayer AG

NOW Foods

Unilever

GlaxoSmithKline

Church & Dwight Co., Inc.

OLLY Public Benefit Corporation

Garden of Life

Table of Contents

USA Dietary Supplements Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

USA Dietary Supplements Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

USA Dietary Supplements Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Awareness in the Elderly Population

3.1.2. Rise in E-Commerce and Digital Health Platforms

3.1.3. Consumer Demand for Natural and Plant-Based Supplements

3.2. Challenges

3.2.1. Regulatory Hurdles in Supplement Labeling

3.2.2. Growing Consumer Skepticism

3.2.3. Supply Chain Disruptions and Rising Raw Material Costs

3.3. Opportunities

3.3.1. Innovation in Personalized Nutrition

3.3.2. Expansion of Plant-Based Supplements

3.3.3. Integration of Supplements with Health Tech

3.4. Trends

3.4.1. Increased Demand for Plant-Based Supplements

3.4.2. Personalized Supplement Recommendations

3.4.3. Eco-Friendly Packaging for Supplements

3.5. Government Regulation

3.5.1. FDA Supplement Safety and Innovation Initiative (2023)

3.5.2. Mandatory Product Listing Proposal (2022)

3.5.3. Public Health Campaign on Supplement Use

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

USA Dietary Supplements Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Vitamins & Minerals

4.1.2. Herbal Supplements

4.1.3. Proteins & Amino Acids

4.1.4. Omega Fatty Acids

4.2. By Application (in Value %)

4.2.1. General Wellness

4.2.2. Immune Health

4.2.3. Sports Nutrition

4.2.4. Weight Management

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

USA Dietary Supplements Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Abbott Laboratories

5.1.2. Pfizer Inc.

5.1.3. Amway

5.1.4. Herbalife Nutrition

5.1.5. Nestl Health Science

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

USA Dietary Supplements Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

USA Dietary Supplements Market Regulatory Framework

7.1. Supplement Labeling Standards

7.2. Compliance Requirements

7.3. Certification Processes

USA Dietary Supplements Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

USA Dietary Supplements Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

USA Dietary Supplements Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identifying Key Variables

The research begins by identifying the key variables influencing the USA Dietary Supplements Market. This step involves an in-depth review of various secondary and proprietary databases, including industry reports, government publications, and scientific journals. The primary focus is on market dynamics such as product types, regulatory frameworks, key players, distribution channels, and consumer behavior trends.

Step 2: Market Building

In this phase, statistics from the USA Dietary Supplements Market are compiled, focusing on historical market performance, product segmentations, and regional distributions. Data is sourced from government bodies like the U.S. Food and Drug Administration (FDA) and the U.S. Census Bureau, as well as other reliable sources. Detailed analysis of production volumes, sales revenue, and market shares is performed to assess the market size.

Step 3: Validating and Finalizing

To ensure data accuracy, we build market hypotheses and validate them through Computer-Assisted Telephonic Interviews (CATIs) with industry experts, including executives from leading supplement manufacturers and healthcare professionals. This qualitative validation ensures that the gathered data reflects the current market scenario and future trends.

Step 4: Research Output

The final step involves synthesizing data into actionable insights. Our team interacts with major market stakeholders such as dietary supplement manufacturers, distributors, e-commerce platforms, and government bodies in the USA to understand the market's supply chain dynamics, consumer demand patterns, and emerging technologies.

Frequently Asked Questions

1.How big is the USA Dietary Supplements Market?

In 2023, the USA dietary supplements market reached a value of USD 53.50 billion, fueled by growing awareness around preventive healthcare, the expanding use of e-commerce platforms, and a rising elderly population. Increased consumer interest in vitamins, minerals, and herbal supplements has been driven by concerns over long-term health and well-being.

2.What are the challenges in the USA Dietary Supplements Market?

Challenges in the USA dietary supplements market include stringent regulatory requirements imposed by the FDA, rising raw material costs in 2024, and increasing consumer skepticism regarding the efficacy of supplements, particularly those purchased online.

3.Who are the major players in the USA Dietary Supplements Market?

Key players in the USA dietary supplements market include Abbott Laboratories, Pfizer Inc., Amway, Herbalife Nutrition, and Nestl Health Science. These companies lead due to their strong distribution networks, product innovation, and extensive research and development capabilities.

4.What are the growth drivers of the USA Dietary Supplements Market?

Growth in the USA dietary supplements market drivers include an aging population seeking supplements for preventive health, increased consumer focus on immunity and wellness, and the rise of e-commerce platforms, which have made dietary supplements more accessible to a broader audience.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.