USA Digital Marketing Software Market Outlook to 2030

Region:North America

Author(s):Meenakshi

Product Code:KROD2791

November 2024

98

About the Report

USA Digital Marketing Software Market Overview

- The USA Digital Marketing Software Market is valued at USD 23.5 billion, based on a five-year historical analysis. This substantial market size is driven by the increasing adoption of digital platforms by businesses, the surge in online consumer behavior, and advancements in marketing automation technologies. Additionally, the integration of artificial intelligence and machine learning in marketing tools has significantly enhanced campaign effectiveness and ROI, further propelling market growth.

- Major cities such as New York, San Francisco, and Chicago dominate the USA Digital Marketing Software market due to their robust technological infrastructure and the presence of numerous leading tech firms. These cities serve as hubs for innovation and attract top talent in the digital marketing sphere. Furthermore, the high concentration of startups and established enterprises in these metropolitan areas fosters a competitive environment that drives continuous advancements in digital marketing solutions.

- The U.S. governments focus on data privacy continues to shape the digital marketing landscape. The California Consumer Privacy Act (CCPA) and Children's Online Privacy Protection Act (COPPA) impose stringent requirements on how companies collect, store, and use consumer data. By 2024, compliance with these regulations resulted in businesses investing in new data protection measures. Companies face significant fines for non-compliance, leading to higher operational costs.

USA Digital Marketing Software Market Segmentation

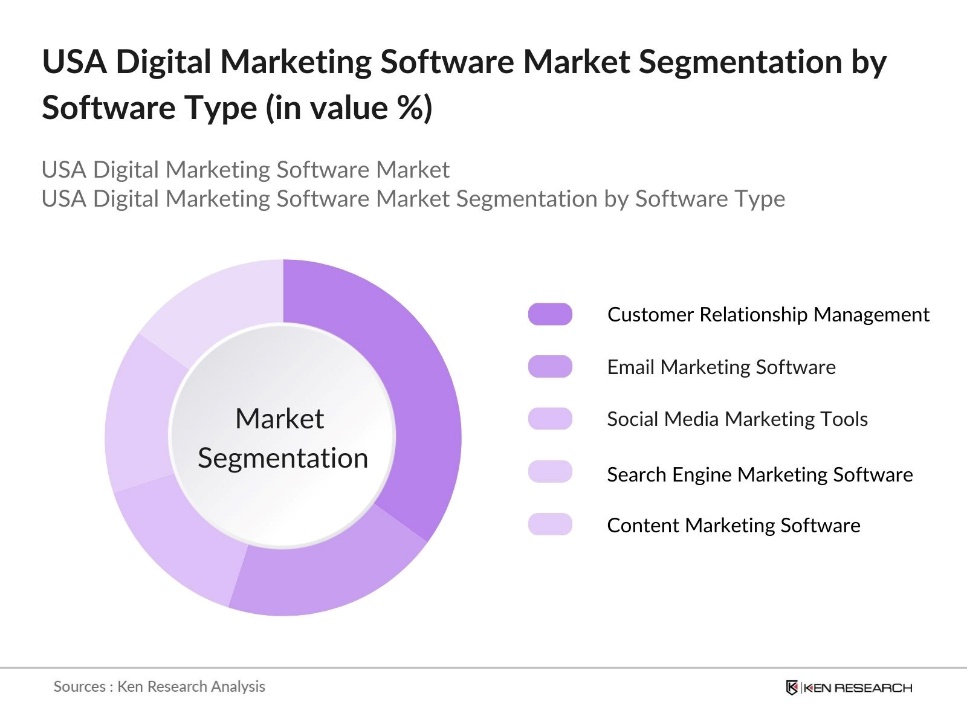

By Software Type: The USA Digital Marketing Software market is segmented by software type into Customer Relationship Management (CRM) tools, Email Marketing Software, Social Media Marketing Tools, Search Engine Marketing (SEM) Software, and Content Marketing Software. Recently, CRM tools have held a dominant market share, accounting for 35% of the market in 2023. This dominance is attributed to their ability to streamline customer interactions, enhance data management, and provide actionable insights through analytics. Leading CRM platforms like Salesforce and HubSpot have established strong market presence, offering comprehensive features that cater to diverse business needs.

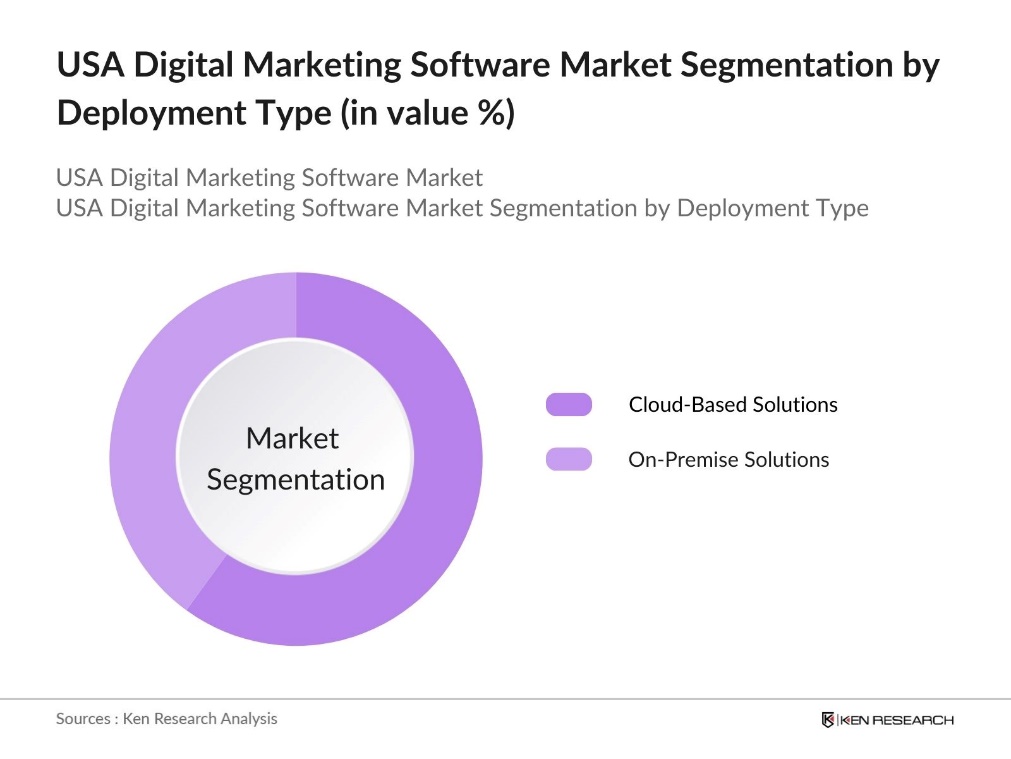

By Deployment Type: The market is further segmented by deployment type into On-Premise Solutions and Cloud-Based Solutions. Cloud-Based Solutions dominate the market with a 60% share in 2023. This preference is due to the scalability, flexibility, and cost-effectiveness offered by cloud platforms. Businesses are increasingly moving away from traditional on-premise installations in favor of cloud-based services that provide seamless updates, enhanced security features, and easier integration with other digital tools. The ability to access marketing software remotely has also become a critical factor, especially with the rise of remote work environments.

USA Digital Marketing Software Market Competitive Landscape

The market is dominated by a few major players, including Adobe Systems, Salesforce, HubSpot, Oracle Corporation, and Microsoft. This consolidation highlights the significant influence of these key companies, which leverage their extensive product portfolios, strong brand recognition, and continuous innovation to maintain their market leadership. These companies invest heavily in research and development to introduce advanced features such as AI-driven analytics and automation tools, which cater to the evolving needs of businesses across various industries.

|

Company |

Establishment Year |

Headquarters |

Revenue (2023 USD) |

Number of Employees |

Product Portfolio |

Global Reach |

Market Share (%) |

|

Adobe Systems |

1982 |

San Jose, CA |

|||||

|

Salesforce |

1999 |

San Francisco, CA |

|||||

|

HubSpot |

2006 |

Cambridge, MA |

|||||

|

Oracle Corporation |

1977 |

Redwood City, CA |

|||||

|

Microsoft |

1975 |

Redmond, WA |

USA Digital Marketing Software Industry Analysis

Growth Drivers

- Rise in Digital Ad Spend (Ad Spend, ROI): The growth of digital ad spend in the U.S. continues to be a key driver for digital marketing software. The forecast for global spending on digital advertising in 2023 is approximately $424.3 billion, driven largely by businesses seeking higher ROI through online platforms. Companies are shifting budgets from traditional media to digital channels, capitalizing on programmatic advertising and real-time bidding to optimize ad performance. The U.S. governments digital economy policy reinforces the importance of digital transformation, which accelerates digital ad investments.

- Increasing Use of AI in Marketing (AI Adoption, Campaign Automation): AI adoption has surged in digital marketing, with over 69.1% of companies incorporating AI-driven tools to automate campaigns and improve personalization as of 2024. This automation has driven down operational costs while enhancing targeting precision. U.S.-based companies are leveraging AI for predictive analytics, chatbot integration, and dynamic content delivery. AIs use in marketing aligns with the broader economic focus on enhancing productivity and efficiency, backed by the U.S. Department of Commerces initiatives on AI and data innovation.

- Mobile Advertising and App Marketing (Mobile Usage, Engagement Metrics): Mobile advertising is a key driver in digital marketing, with increasing reliance on mobile devices. The widespread use of mobile apps and significant time spent on them have made mobile-first strategies essential for businesses. The growth in mobile internet usage further emphasizes the shift toward mobile advertising, as brands aim to engage users where they spend most of their time.

Market Challenges

- Data Privacy Regulations (Compliance Costs, GDPR, CCPA): Data privacy regulations like the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) create significant compliance burdens for businesses. Companies face high costs to ensure they meet the requirements of these laws, while ongoing changes in state and federal regulations require continuous adaptation. The Federal Trade Commission (FTC) monitors privacy compliance, and the regulatory landscape is expected to become even more stringent for digital marketers.

- Ad Fraud and Viewability Concerns (Ad Verification, Losses to Ad Fraud): Ad fraud remains a major issue for businesses, with fraudulent clicks, impressions, and bots diminishing the effectiveness of digital marketing campaigns. Viewability concerns also challenge marketers, as ensuring ads are seen by genuine users becomes increasingly difficult. To address these challenges, efforts are underway to implement stronger ad verification standards to reduce losses and improve the transparency and efficiency of online advertising.

USA Digital Marketing Software Market Future Outlook

Over the next five years, the USA Digital Marketing Software market is expected to exhibit robust growth driven by continuous advancements in artificial intelligence, increased adoption of omnichannel marketing strategies, and the growing importance of data analytics in decision-making processes. The rise of personalized marketing and the integration of emerging technologies such as augmented reality (AR) and virtual reality (VR) are anticipated to create new opportunities for innovation.

Market Opportunities

- Expansion in Emerging Markets (Market Penetration, Localized Campaigns): U.S.-based digital marketing software providers are finding growth opportunities in emerging markets like Latin America and Asia, where internet usage is on the rise. Companies can tap into these regions by offering localized campaigns and software solutions that cater to the unique preferences and needs of these markets. By doing so, they can expand their global presence and capitalize on the growing digital landscape in these regions.

- Integration of Omnichannel Marketing (Customer Journey Mapping, Multi-Platform Strategies): Omnichannel marketing has become crucial for U.S. companies, enabling them to offer seamless customer experiences across various digital and physical channels. These strategies integrate platforms such as email, social media, websites, and in-store promotions to maintain consistent messaging. Mapping the customer journey across multiple touchpoints improves retention and enhances sales conversion rates, making omnichannel strategies essential for businesses aiming to boost engagement and customer loyalty.

Scope of the Report

|

By Software Type |

Customer Relationship Management (CRM) Tools Email Marketing Software Social Media Marketing Tools Search Engine Marketing (SEM) Software Content Marketing Software |

|

By Deployment Type |

On-Premise Solutions Cloud-Based Solutions |

|

By Enterprise Size |

Small and Medium Enterprises (SMEs) Large Enterprises |

|

By End-User Industry |

Retail BFSI Healthcare IT & Telecom Media & Entertainment |

|

By Region |

North East Midwest South West |

Products

Key Target Audience

Telecommunication Companies

Retail and E-commerce Platforms

Media and Entertainment Companies

Automotive Industry Players

Government and Regulatory Bodies (Federal Trade Commission - FTC)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Adobe Systems

Salesforce

HubSpot

Oracle Corporation

Microsoft

IBM Corporation

ActiveCampaign

Constant Contact

Mailchimp

Sprout Social

Table of Contents

1. USA Digital Marketing Software Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Digital Marketing Software Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Digital Marketing Software Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Digital Ad Spend (Ad Spend, ROI)

3.1.2. Increasing Use of AI in Marketing (AI Adoption, Campaign Automation)

3.1.3. Mobile Advertising and App Marketing (Mobile Usage, Engagement Metrics)

3.1.4. Growth in Social Media Platforms (User Growth, Engagement Rate)

3.2. Market Challenges

3.2.1. Data Privacy Regulations (Compliance Costs, GDPR, CCPA)

3.2.2. Ad Fraud and Viewability Concerns (Ad Verification, Losses to Ad Fraud)

3.2.3. Saturation of Marketing Tools (Market Fragmentation, Vendor Selection)

3.3. Opportunities

3.3.1. Expansion in Emerging Markets (Market Penetration, Localized Campaigns)

3.3.2. Integration of Omnichannel Marketing (Customer Journey Mapping, Multi-Platform Strategies)

3.3.3. Personalized Marketing Strategies (Behavioral Targeting, Dynamic Content)

3.4. Trends

3.4.1. Increased Usage of Video Marketing (Video Consumption, Engagement Metrics)

3.4.2. Shift Towards Influencer Marketing (Influencer ROI, Brand Engagement)

3.4.3. Growth of Programmatic Advertising (Programmatic Spend, Automation)

3.5. Government Regulation

3.5.1. Data Protection and Privacy Laws (GDPR, CCPA, COPPA)

3.5.2. FTC Guidelines for Digital Ads (Disclosure Requirements, Compliance)

3.5.3. Policies Affecting Digital Content and Copyright (DMCA, Fair Use)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. USA Digital Marketing Software Market Segmentation

4.1. By Software Type (In Value %)

4.1.1. Customer Relationship Management (CRM) Tools

4.1.2. Email Marketing Software

4.1.3. Social Media Marketing Tools

4.1.4. Search Engine Marketing (SEM) Software

4.1.5. Content Marketing Software

4.2. By Deployment Type (In Value %)

4.2.1. On-Premise Solutions

4.2.2. Cloud-Based Solutions

4.3. By Enterprise Size (In Value %)

4.3.1. Small and Medium Enterprises (SMEs)

4.3.2. Large Enterprises

4.4. By End-User Industry (In Value %)

4.4.1. Retail

4.4.2. BFSI

4.4.3. Healthcare

4.4.4. IT & Telecom

4.4.5. Media & Entertainment

4.5. By Region (In Value %)

4.5.1. North East

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Digital Marketing Software Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Adobe Systems

5.1.2. Salesforce

5.1.3. HubSpot

5.1.4. Oracle Corporation

5.1.5. Microsoft

5.1.6. IBM Corporation

5.1.7. ActiveCampaign

5.1.8. Constant Contact

5.1.9. Mailchimp

5.1.10. Sprout Social

5.1.11. Hootsuite

5.1.12. SharpSpring

5.1.13. Marketo (An Adobe Company)

5.1.14. SEMrush

5.1.15. Optimizely

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Global Reach, Market Share, Key Strategic Alliances)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Digital Marketing Software Market Regulatory Framework

6.1. Data Protection and Privacy Regulations (GDPR, CCPA, COPPA)

6.2. Compliance Requirements (FTC, FCC, Do-Not-Call)

6.3. Certification Processes (ISO/IEC Standards for Information Security, SOC 2 Compliance)

7. USA Digital Marketing Software Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Digital Marketing Software Future Market Segmentation

8.1. By Software Type (In Value %)

8.2. By Deployment Type (In Value %)

8.3. By Enterprise Size (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. USA Digital Marketing Software Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Digital Marketing Software Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA Digital Marketing Software Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple digital marketing software providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Digital Marketing Software market.

Frequently Asked Questions

01. How big is the USA Digital Marketing Software Market?

The USA Digital Marketing Software market was valued at USD 23.5 billion, driven by the increasing adoption of digital platforms by businesses and advancements in marketing automation technologies. The market continues to expand as companies invest more in enhancing their online presence and customer engagement strategies.

02. What are the challenges in the USA Digital Marketing Software Market?

Challenges in USA Digital Marketing Software market include data privacy regulations such as GDPR and CCPA, which increase compliance costs for businesses. Additionally, the high competition among software providers leads to market saturation, making it difficult for new entrants to establish a foothold. Ad fraud and ensuring accurate ROI measurement also pose significant challenges.

03. Who are the major players in the USA Digital Marketing Software Market?

Key players in the USA Digital Marketing Software market include Adobe Systems, Salesforce, HubSpot, Oracle Corporation, and Microsoft. These companies dominate due to their extensive product portfolios, strong brand recognition, and continuous innovation in digital marketing solutions.

04. What are the growth drivers of the USA Digital Marketing Software Market?

The USA Digital Marketing Software market is propelled by factors such as the rise in digital ad spend, increasing use of artificial intelligence in marketing, and the growth of social media platforms. Additionally, the shift towards personalized and omnichannel marketing strategies enhances customer engagement and drives market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.