USA Draught Beer Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD8006

November 2024

82

About the Report

USA Draught Beer Market Overview

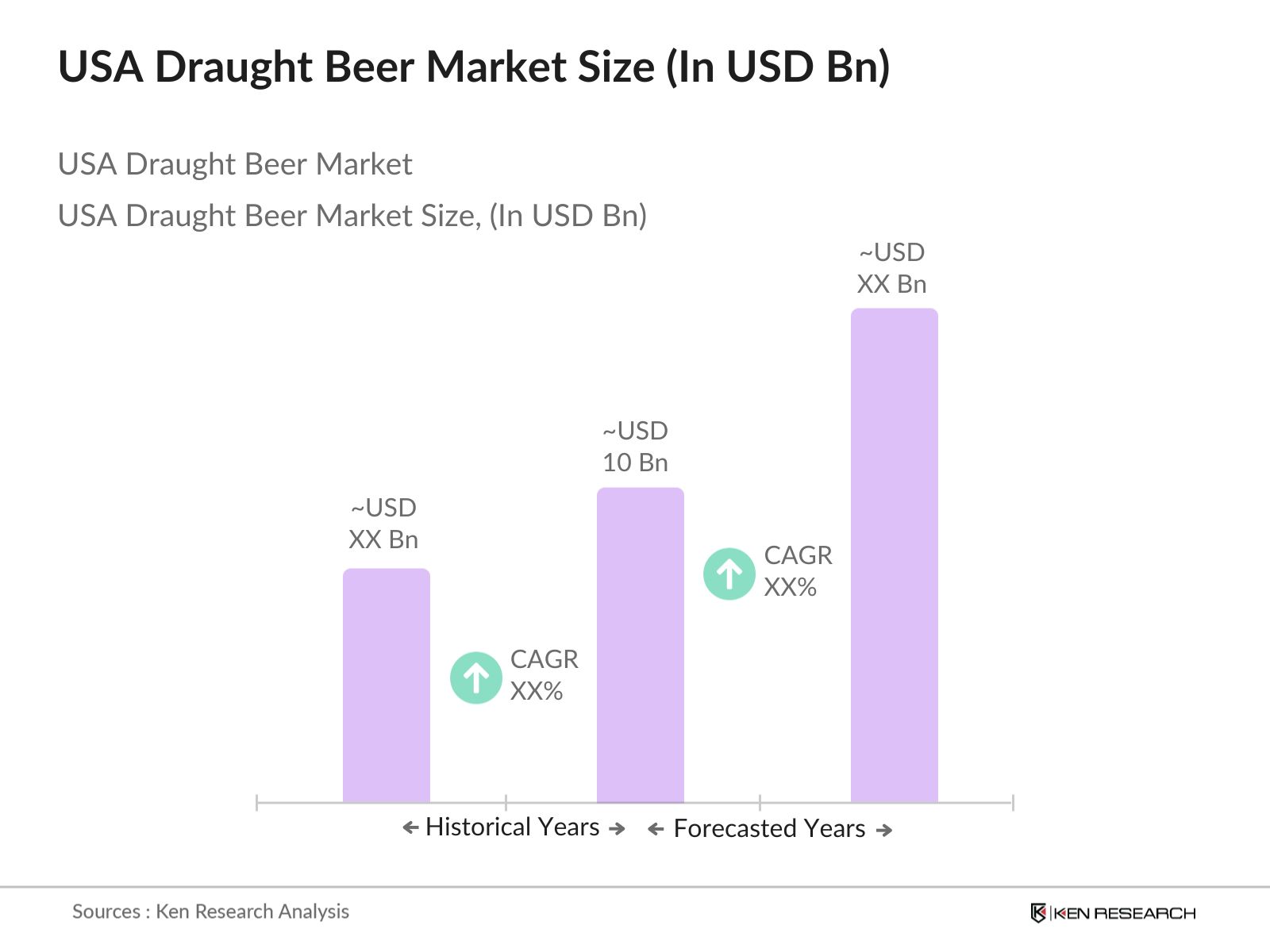

- The USA Draught Beer market is valued at USD 10 billion, based on a five-year historical analysis. This market is primarily driven by the rising consumer demand for premium and craft beers, particularly within the on-premise sector, such as bars and restaurants. The craft beer revolution, alongside the increasing disposable income of consumers, has contributed to the surge in consumption of unique beer flavors, driving steady market growth. Additionally, the growing trend of social drinking and experiential dining continues to bolster draught beer sales.

- The cities that dominate the USA draught beer market include Los Angeles, New York City, and Chicago, largely due to their high concentration of craft breweries, brewpubs, and a strong culture of beer consumption. These cities also benefit from a large number of tourists and local consumers who actively seek out premium and unique beer experiences. Additionally, major brewing hubs in these cities have easy access to raw materials and well-established distribution networks, ensuring their dominance.

- Alcohol licensing laws vary significantly across U.S. states, posing both challenges and opportunities for the draught beer market. As of 2023, 17 states had enacted more stringent alcohol distribution laws, requiring additional permits for breweries to serve draught beer on-premise. These state-wise variations affect how quickly breweries can expand.

USA Draught Beer Market Segmentation

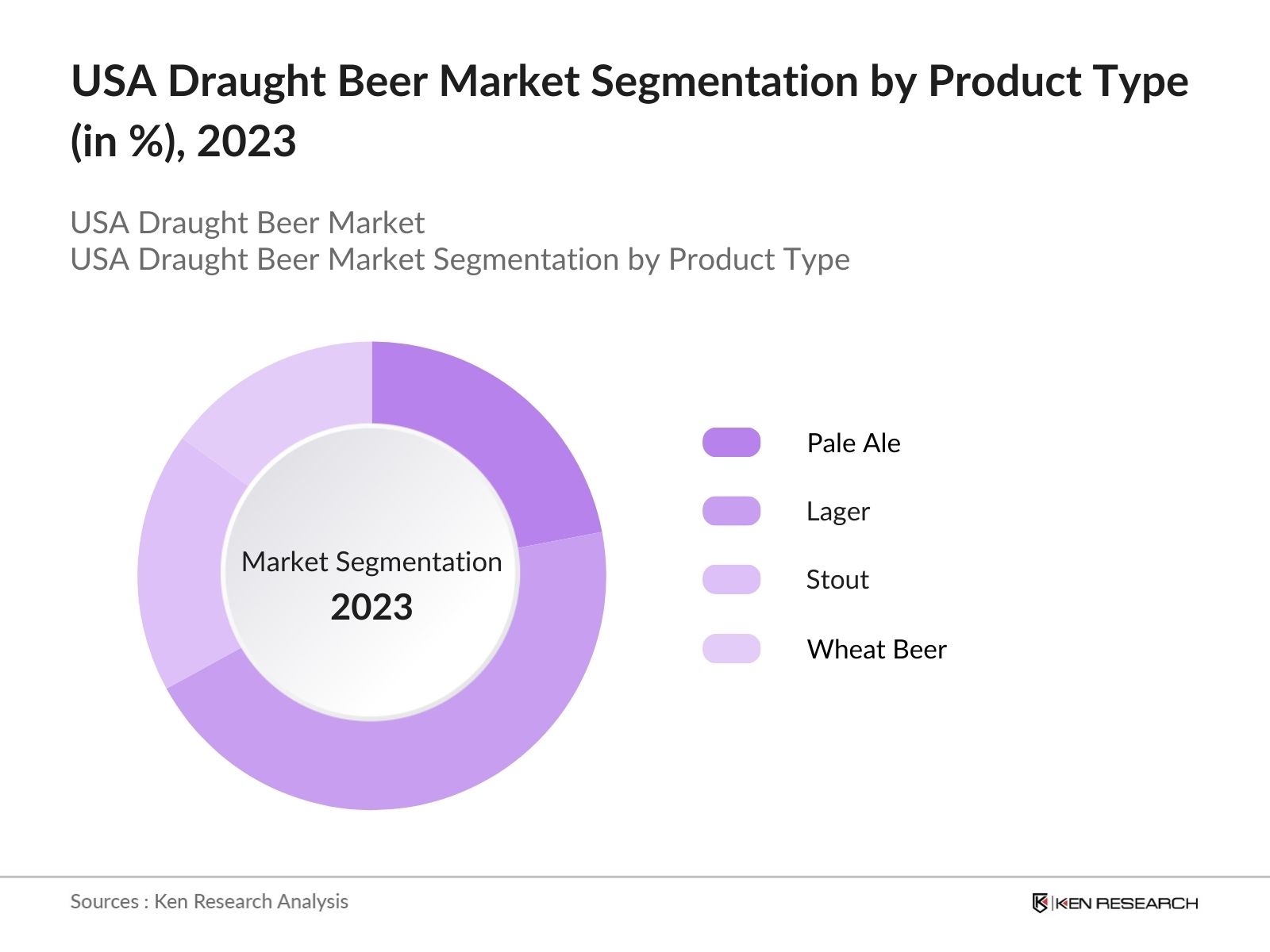

By Product Type: The USA draught beer market is segmented by product type into Pale Ale, Lager, Stout, and Wheat Beer. Among these, Lager continues to dominate market share due to its wide appeal and easy drinkability. Lager beers have a long-standing tradition in the US, being a preferred choice in both casual and premium settings. Brands like Budweiser and Coors have established themselves as staples, which has helped maintain Lagers strong presence in the market.

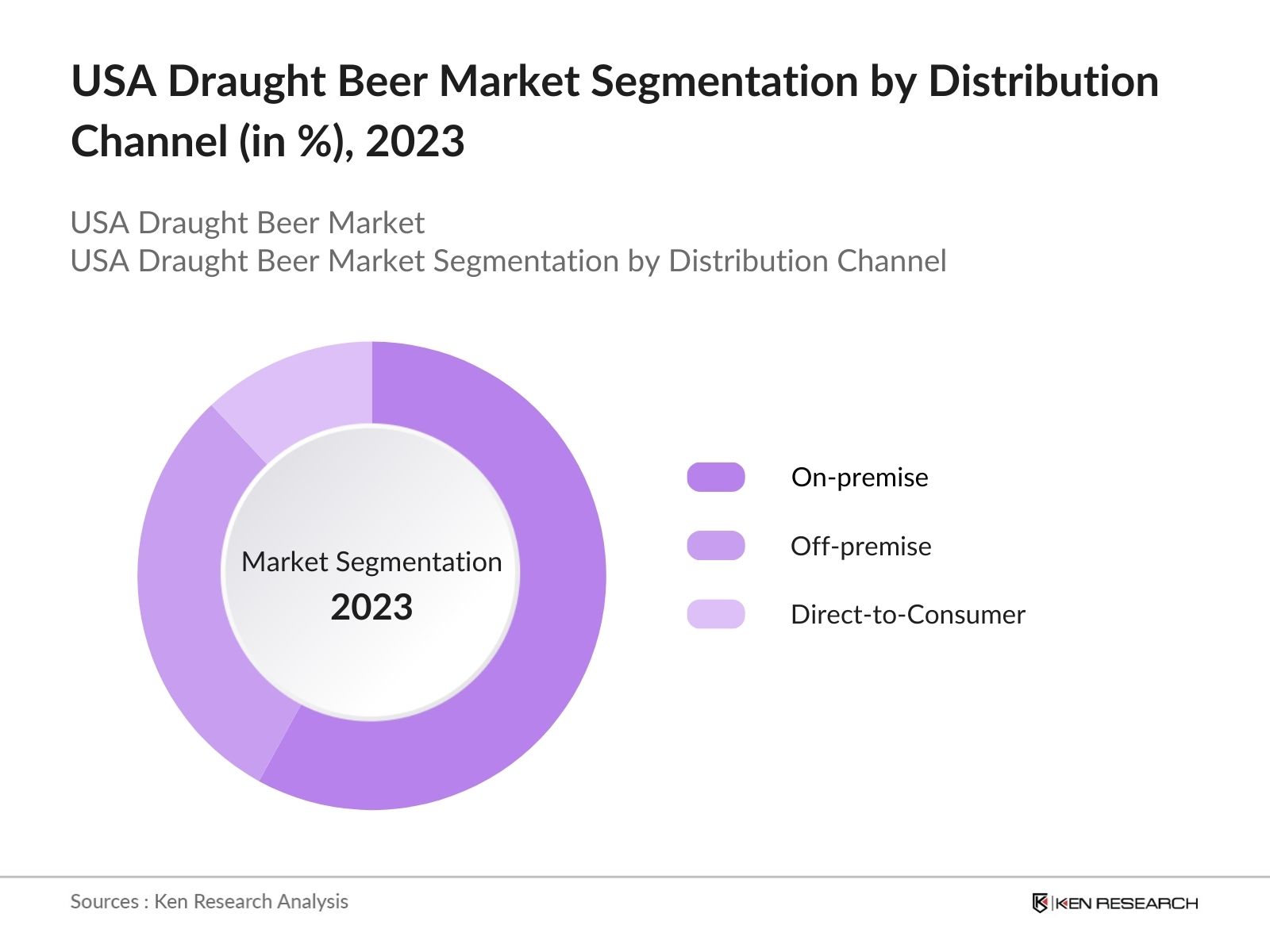

By Distribution Channel: The USA draught beer market is also segmented by distribution channel into On-premise (Bars, Restaurants, Pubs), Off-premise (Liquor Stores, Retail Chains), and Direct-to-Consumer (Microbreweries, Online Sales). The On-premise segment holds the dominant market share due to the experiential nature of draught beer consumption. Bars and restaurants are primary venues where consumers indulge in fresh, cold draught beers, which are often unavailable in off-premise outlets.

USA Draught Beer Market Competitive Landscape

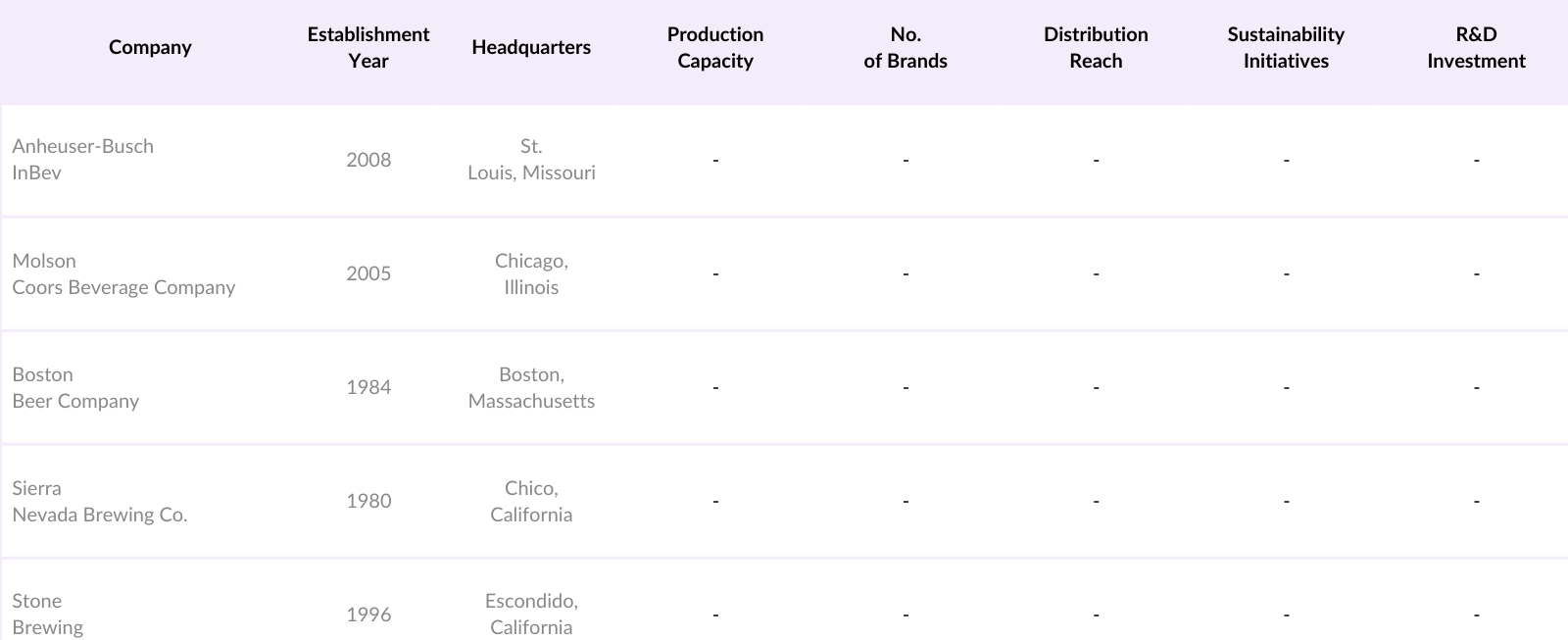

The USA draught beer market is characterized by the presence of both major global players and local craft breweries. This diverse competition has resulted in a rich offering of beer types and flavors catering to a wide range of consumer preferences. Companies like Anheuser-Busch InBev and Molson Coors dominate the mass-market, while regional craft breweries like Sierra Nevada and Stone Brewing focus on premium, artisanal beer offerings.

USA Draught Beer Industry Analysis

Growth Drivers

- Changing Consumer Preferences: Consumer preferences are shifting towards premium and craft beverages, which is evident in the growing demand for draught beer. With U.S. GDP growth estimated at $26.7 trillion in 2024, consumers are increasingly seeking unique drinking experiences over mass-produced beers. The National Beer Wholesalers Association (NBWA) reports that over 40 million adults are regular beer drinkers, and a significant proportion now favor premium and craft beer, further boosting draught beer consumption.

- Increasing Demand for Craft Beers: The surge in demand for craft beers plays a key role in the growth of the draught beer market. According to the U.S. Census Bureau, small and independent breweries contributed nearly 30% of beer industry revenue. This demand aligns with consumer desires for innovative, locally sourced, and higher-quality beers. In 2023, over 9,500 breweries were operating in the U.S., up from 9,100 in 2022, signaling the rising popularity of craft beer, which is predominantly served on draught in bars and restaurants, driving the overall market growth.

- Rising Disposable Income: Rising disposable income in the U.S. has a direct impact on increased spending on leisure activities, including on-premise draught beer consumption. With the national disposable personal income estimated at over $18 trillion in 2024, consumers are spending more on social experiences such as visiting bars, restaurants, and breweries. The average consumer expenditure on alcoholic beverages increased by $500 per household in 2023 compared to 2022, reflecting this shift.

Market Challenges

- Supply Chain Disruptions: Supply chain disruptions, particularly in raw materials like hops and aluminum for keg production, pose challenges for the draught beer market. In 2024, logistics delays and increased transportation costs continue to hinder distribution. The U.S. beer industry, which relies heavily on imported materials, has been affected by global supply chain bottlenecks. The U.S. Department of Commerce reported that logistics costs have increased by 15% in the past year, making it difficult for brewers to maintain consistent supply chains, ultimately impacting the availability of draught beer.

- Decline in Off-premise Sales: The decline in off-premise sales, particularly in retail environments, has created a challenge for the overall beer market. The U.S. Alcohol and Tobacco Tax and Trade Bureau (TTB) recorded a decrease of 5% in beer sales from liquor stores and supermarkets in 2023, driven by the consumer shift toward on-premise consumption and the rise of e-commerce alcohol sales. With more consumers opting for draught beer in social settings, the off-premise segment, which traditionally relied on bottled and canned beer sales, has seen a decline, limiting revenue streams for the draught beer market.

USA Draught Beer Market Future Outlook

Over the next five years, the USA draught beer market is expected to experience steady growth, driven by a continued consumer preference for craft and premium beer options. Key factors such as the rise in disposable incomes, an increasing number of breweries, and evolving consumer palates are anticipated to fuel demand.

Market Opportunities

- Rise of Microbreweries and Brewpubs: The proliferation of microbreweries and brewpubs presents a significant opportunity for the draught beer market. As of 2023, there were over 9,500 microbreweries and brewpubs operating in the U.S., up by nearly 400 from the previous year. These establishments focus heavily on draught beer offerings and are key drivers in local and regional beer markets. According to the Brewers Association, microbreweries contributed nearly $30 billion to the U.S. economy in 2022, offering substantial growth potential for draught beer sales, particularly as these small businesses expand their footprints.

- Sustainability Initiatives in Brewing: Sustainability initiatives in brewing are becoming increasingly important, providing an opportunity for breweries to differentiate themselves. By 2023, over 75% of U.S. breweries had adopted some form of sustainability program, whether through energy-efficient brewing processes, water conservation, or waste reduction. The U.S. Environmental Protection Agency (EPA) has highlighted that energy-efficient breweries can save up to $2 million annually on operating costs. Such initiatives not only reduce the environmental impact of draught beer production but also appeal to eco-conscious consumers, providing breweries with a competitive advantage.

Scope of the Report

|

By Product Type |

Pale Ale Lager Stout Wheat Beer |

|

By Category |

Craft Beers Mass-market Beers |

|

By Distribution Channel |

On-premise (Bars, Restaurants, Pubs) Off-premise (Liquor Stores, Retail Chains) Direct to Consumer (Microbreweries, Online Sales) |

|

By Alcohol Content |

Low-alcohol Draught Beer Regular Draught Beer |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Brewers and Microbreweries

Distributors and Retail Chains

On-premise Outlets (Bars, Restaurants, Pubs)

Direct-to-Consumer Platforms

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Alcohol and Tobacco Tax and Trade Bureau, State Liquor Authorities)

Sustainability and Environmental Agencies

Packaging and Keg Manufacturing Companies

Companies

Major Players in USA Draught Beer Market

Anheuser-Busch InBev

Molson Coors Beverage Company

Boston Beer Company

Sierra Nevada Brewing Co.

Stone Brewing

Lagunitas Brewing Company

New Belgium Brewing

Craft Brew Alliance

Deschutes Brewery

Yuengling Brewery

Table of Contents

1. USA Draught Beer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Volume in million liters, Revenue in USD Bn, Growth %)

1.4. Market Segmentation Overview (by Type, Category, Distribution Channel, Region)

2. USA Draught Beer Market Size (In USD Bn, In Million Liters)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis (Volume & Revenue)

2.3. Key Market Developments and Milestones

3. USA Draught Beer Market Analysis

3.1. Growth Drivers

3.1.1. Changing Consumer Preferences

3.1.2. Increasing Demand for Craft Beers

3.1.3. Rising Disposable Income

3.1.4. Growth in On-premise Consumption

3.2. Market Challenges

3.2.1. Supply Chain Disruptions

3.2.2. Decline in Off-premise Sales

3.2.3. Regulatory Constraints on Alcoholic Beverages

3.3. Opportunities

3.3.1. Rise of Microbreweries and Brewpubs

3.3.2. Sustainability Initiatives in Brewing

3.3.3. Expansion into Emerging Regions

3.4. Trends

3.4.1. Increased Adoption of Keg-as-a-Service Models

3.4.2. Focus on Low-Alcohol and No-Alcohol Draught Beers

3.4.3. Integration with Smart Tap Technology

3.5. Government Regulations

3.5.1. State-wise Alcohol Licensing Laws

3.5.2. Excise Duty Structure on Draught Beer

3.5.3. Sustainability and Waste Reduction Mandates

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Brewers, Distributors, Retailers, Consumers)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Draught Beer Market Segmentation

4.1. By Product Type (In Value %, In Volume %)

4.1.1. Pale Ale

4.1.2. Lager

4.1.3. Stout

4.1.4. Wheat Beer

4.2. By Category (In Value %, In Volume %)

4.2.1. Craft Beers

4.2.2. Mass-market Beers

4.3. By Distribution Channel (In Value %, In Volume %)

4.3.1. On-premise (Bars, Restaurants, Pubs)

4.3.2. Off-premise (Liquor Stores, Retail Chains)

4.3.3. Direct to Consumer (Microbreweries, Online Sales)

4.4. By Alcohol Content (In Value %, In Volume %)

4.4.1. Low-alcohol Draught Beer

4.4.2. Regular Draught Beer

4.5. By Region (In Value %, In Volume %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Draught Beer Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Anheuser-Busch InBev

5.1.2. Molson Coors Beverage Company

5.1.3. Constellation Brands

5.1.4. Heineken USA

5.1.5. Boston Beer Company

5.1.6. Sierra Nevada Brewing Co.

5.1.7. Stone Brewing

5.1.8. Lagunitas Brewing Company

5.1.9. New Belgium Brewing

5.1.10. Craft Brew Alliance

5.1.11. Deschutes Brewery

5.1.12. Yuengling Brewery

5.1.13. Dogfish Head Brewery

5.1.14. Founders Brewing Co.

5.1.15. Bell's Brewery

5.2. Cross Comparison Parameters

5.2.1. No. of Employees

5.2.2. Revenue (USD Bn)

5.2.3. Production Capacity (in Liters)

5.2.4. Headquarters

5.2.5. Market Share (%)

5.2.6. No. of Brands/Variants

5.2.7. Distribution Network

5.2.8. Sustainability Initiatives

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. USA Draught Beer Market Regulatory Framework

6.1. Alcohol Licensing Laws

6.2. Excise Duties and Tariffs

6.3. Environmental Compliance for Brewers

6.4. Labeling Requirements

6.5. Distribution and Transportation Regulations

7. USA Draught Beer Future Market Size (In USD Bn, In Million Liters)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Draught Beer Future Market Segmentation

8.1. By Product Type (In Value %, In Volume %)

8.2. By Category (In Value %, In Volume %)

8.3. By Distribution Channel (In Value %, In Volume %)

8.4. By Alcohol Content (In Value %, In Volume %)

8.5. By Region (In Value %, In Volume %)

9. USA Draught Beer Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins by mapping the entire draught beer ecosystem in the USA. Extensive desk research from secondary and proprietary databases helps in identifying key variables such as consumption trends, regulatory dynamics, and supply chain structures.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled to analyze market size, revenue, and consumption patterns across different product types and regions. Additionally, an assessment of the competitive landscape provides insights into market penetration and distribution channel preferences.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts, including executives from top brewing companies and distributors. These interviews help cross-verify data collected and provide operational insights from within the market.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing data gathered from brewers, distributors, and retailers to create a comprehensive report. This includes detailed market segmentation, competitive landscape analysis, and projections for future growth.

Frequently Asked Questions

01. How big is the USA Draught Beer Market?

The USA Draught Beer market is valued at USD 10 billion, based on a five-year historical analysis. This market is primarily driven by the rising consumer demand for premium and craft beers, particularly within the on-premise sector, such as bars and restaurants.

02. What are the challenges in the USA Draught Beer Market?

The major challenges include supply chain disruptions, stringent regulations around alcohol consumption, and the high cost of raw materials used in brewing.

03. Who are the major players in the USA Draught Beer Market?

Key players include Anheuser-Busch InBev, Molson Coors Beverage Company, Boston Beer Company, Sierra Nevada Brewing Co., and Stone Brewing, all of whom have a significant presence in the market.

04. What are the growth drivers of the USA Draught Beer Market?

The market is propelled by the growing consumer preference for craft beers, increasing disposable income, and the expansion of on-premise outlets such as bars and pubs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.