USA Durable Medical Equipment Market Outlook to 2030

Region:North America

Author(s):Sanjna Verma

Product Code:KROD1631

December 2024

100

About the Report

USA Durable Medical Equipment Market Overview

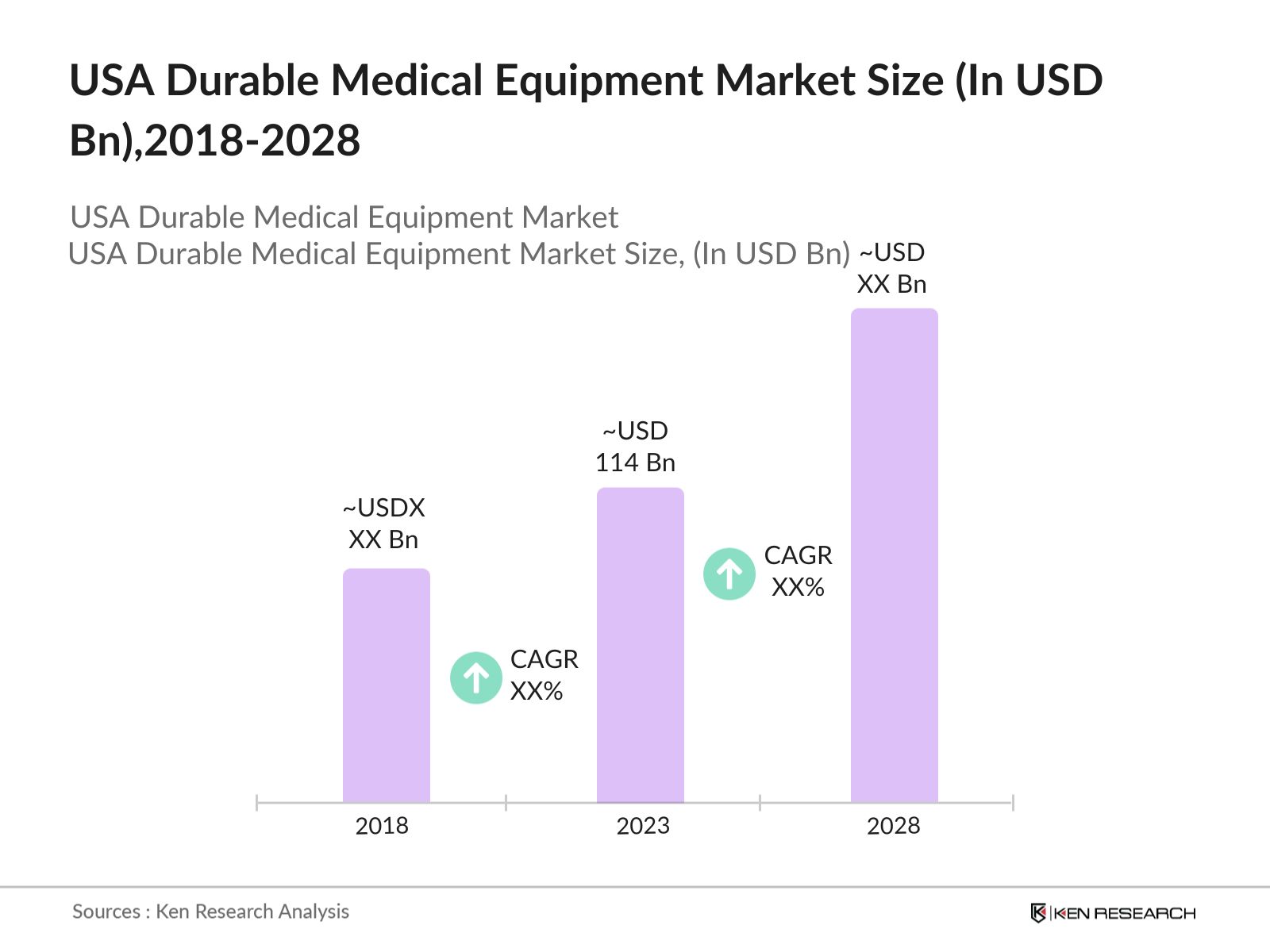

- USA Durable Medical Equipment (DME) market size reached USD 113 billion, driven by an aging population, increased prevalence of chronic diseases, and rising demand for home healthcare services. The market's expansion reflects a combination of technological advancements, increased healthcare spending, and a broader acceptance of DME in managing long-term care.

- The USA DME market is dominated by several key players, including Medtronic, Inc., Invacare Corporation, Hill-Rom Holdings, Inc., and Drive DeVilbiss Healthcare. These companies play a crucial role in market growth by continually innovating and expanding their product portfolios to meet the evolving needs of healthcare providers and patients.

- In 2023, Medtronic announced plans to expand its research and development operations in Hyderabad, India with $350 million investment. This investment will build on Medtronic's existing $160 million investment in the Medtronic Engineering & Innovation Center (MEIC) in Hyderabad, which already serves as the company's largest R&D facility outside the United States.

- Major cities such as New York, Los Angeles, and Chicago dominate the USA DME market due to their large populations, extensive healthcare facilities, and high concentration of elderly residents. These urban centers have a significant demand for DME, driven by both the volume of patients and the advanced healthcare infrastructure available, which supports a wide range of durable medical equipment needs.

USA Durable Medical Equipment Market Segmentation

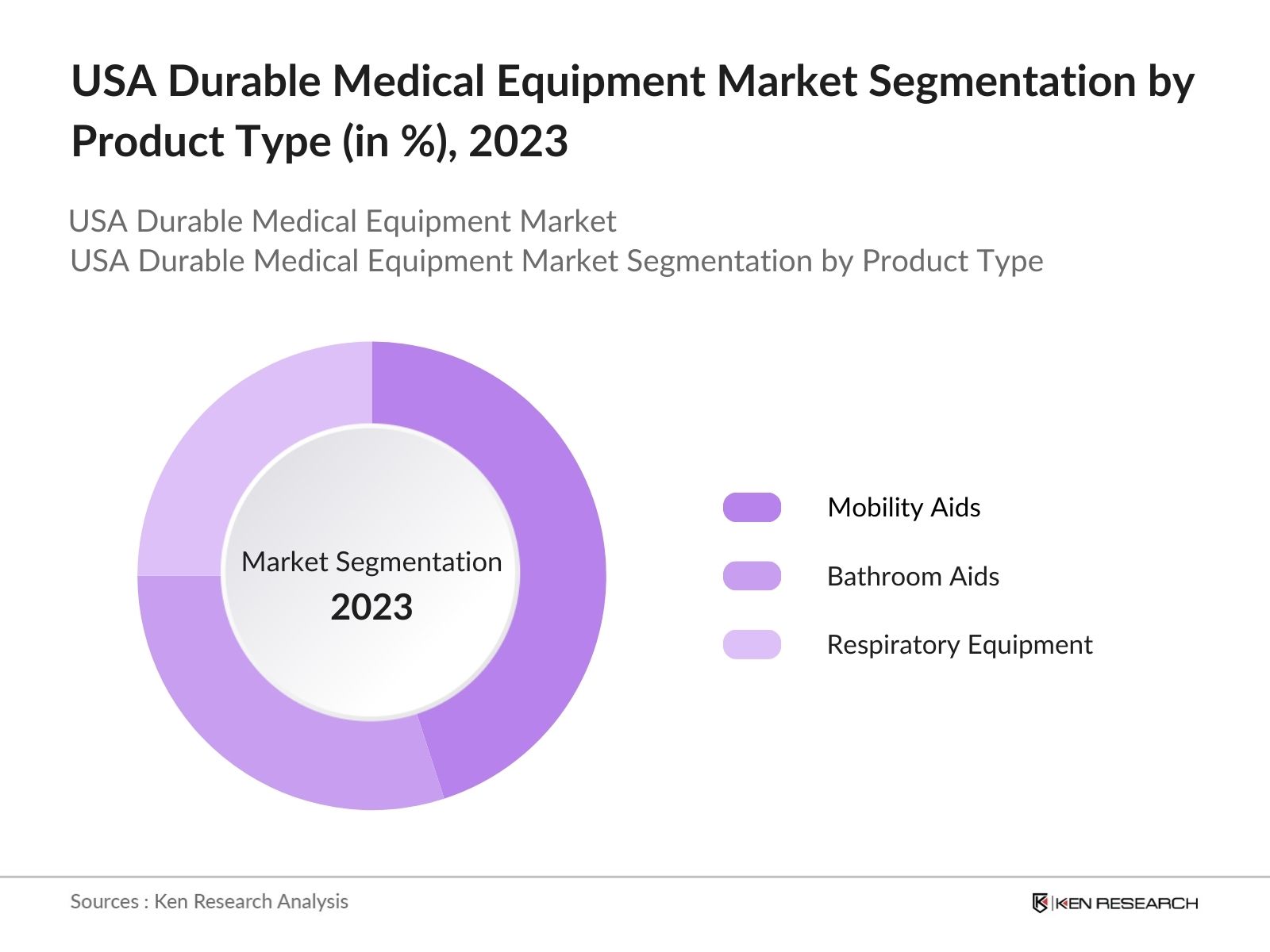

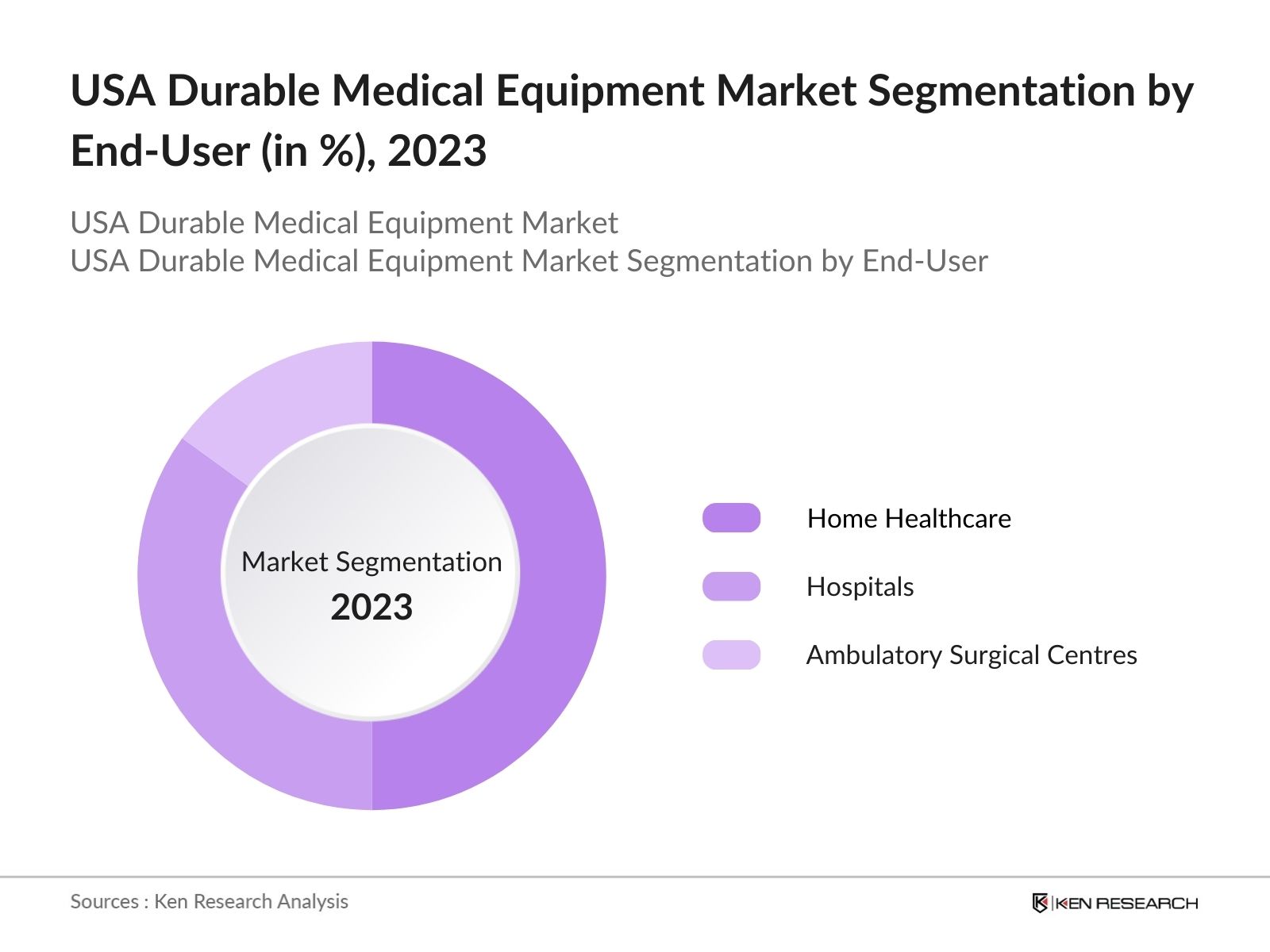

The USA Durable Medical Equipment Market can be segmented based on several factors:

By Product Type: USA Durable Medical Equipment Market is segmented by product type into mobility aids, bathroom safety devices, and respiratory equipment. In 2023, mobility aids dominated the market share due to the increasing aging population requiring wheelchairs, walkers, and scooters for enhanced mobility.

By End-User: USA Durable Medical Equipment Market is segmented by end-user into hospitals, home healthcare, and ambulatory surgical centers. Home healthcare has a dominant market share in 2023, driven by the increasing preference for home-based care due to the convenience and comfort it offers to patients, especially the elderly.

By Region: USA Durable Medical Equipment is segmented by region into North, East, South, and West. The South region dominates the market share in 2023, primarily due to its large population, higher incidence of chronic conditions like diabetes and cardiovascular diseases, and increased government funding for healthcare facilities.

USA Durable Medical Equipment Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Medtronic |

1949 |

Minneapolis, MN |

|

Invacare Corporation |

1885 |

Elyria, OH |

|

ResMed Inc. |

1989 |

San Diego, CA |

|

Stryker Corporation |

1941 |

Kalamazoo, MI |

|

Cardinal Health |

1971 |

Dublin, OH |

- ResMed Inc.: In 2024, ResMed Inc. launched a new line of sleep apnea devices, targeting both the hospital and home healthcare segments. This development was aimed at addressing the growing demand for home-based respiratory care equipment. This strategic move aligns with their ongoing commitment to innovation in sleep apnea and respiratory care products, as well as the growing trend towards out-of-hospital care settings.

- Stryker & Project C.U.R.E.: In 2024, Stryker partnered with Project C.U.R.E., the world's largest distributor of donated medical equipment and supplies, to donate medical equipment and supplies to under-resourced countries since 2007. This partnership demonstrates Stryker's commitment to advancing access to healthcare and healthcare technology globally.

USA Durable Medical Equipment Industry Analysis

Growth Drivers

- Rising Prevalence of Chronic Diseases: The increasing prevalence of chronic diseases such as diabetes, heart disease, and respiratory disorders is significantly driving the demand for durable medical equipment in the USA. In 2022, more than 29 million adults were reported to be suffering from three or more chronic conditions. These chronic conditions require long-term care and the use of various durable medical devices, contributing to the market's growth.

- Aging Population and Increased Life Expectancy: The growing elderly population in the USA is a major driver for the DME market. As of 2022, nearly58 million adults aged 65 and abovereside in the U.S., making up 17.3%of the total population. The elderly population is more prone to chronic conditions and disabilities, which require the use of durable medical equipment to enhance mobility, ensure safety, and improve quality of life, thereby driving market expansion.

- Expansion of Home Healthcare Services: The shift towards home healthcare services has been a significant driver of the DME market. Medicare and Medicaid play a crucial role in making DME more accessible. For example, Medicare covers a wide range of DME products, which helps defray costs for elderly patients and those with disabilities, thereby facilitating the transition to home healthcare settings. The demand for home-based medical care has increased the need for home-use DME such as hospital beds, portable oxygen concentrators, and home dialysis machines.

Market Challenges

- Stringent Regulatory Framework: The Food and Drug Administration (FDA) imposes rigorous standards on the approval and post-market surveillance of DME products. These regulations are necessary to ensure patient safety but can delay product launches and increase compliance costs for companies, posing a challenge for market players.

- Supply Chain Disruptions and Raw Material Shortages: The DME market in the USA has been impacted by supply chain disruptions and shortages of raw materials. These shortages have led to increased production costs and delays in product deliveries, hindering the ability of manufacturers to meet the growing demand.

Government Initiatives

- American Rescue Plan Act (ARPA) of 2021: The American Rescue Plan Act (ARPA) of 2021 is a significant economic stimulus bill aimed at addressing the ongoing impacts of the COVID-19 pandemic. The ARPA is valued at $30.5 billion and aims to reduce out-of-pocket expenses for patients and encourage the adoption of DME for home care, thereby boosting the market.

- FDAs Digital Health Innovation Action Plan (2024): The FDA's Digital Health Innovation Action Plan (2024) outlines a comprehensive strategy to enhance the regulation and oversight of digital health technologies. It aims to include guidance that clarifies the medical software provisions established by the 21st Century Cures Act to streamline the regulatory process for digital health products, particularly those that are lower-risk and do not require extensive pre-market review.

USA Durable Medical Equipment Future Market Outlook

USA Durable Medical Equipment Market is projected to witness significant growth by 2028, driven by an aging population, rising prevalence of chronic diseases, and advancements in medical technology. The market is expected to benefit from government initiatives aimed at improving healthcare infrastructure and expanding insurance coverage for essential medical equipment.

Future Trends

- Integration of Digital Health Technologies: In the next five years, the integration of digital health technologies into durable medical equipment is expected to revolutionize the market. Devices like smart wheelchairs with GPS tracking and home monitoring systems with real-time health data analytics will become more prevalent.

- Growing Demand for Home-Based Care Solutions: The trend towards home-based care is anticipated to continue, with an increasing number of patients opting for treatment in the comfort of their homes. This shift will drive the demand for portable and user-friendly durable medical equipment, such as home oxygen therapy devices and patient lifts.

Scope of the Report

|

By Material Type |

Mobility Aids Bathroom Safety Devices Respiratory Equipment |

|

By End-User |

Hospitals Home Healthcare Ambulatory Surgical Centers |

|

By Region |

North East South West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Hospitals and Healthcare Providers

Home Healthcare Agencies

Ambulatory Surgical Centers

Insurance Companies

Medical Equipment Manufacturers

Investment & Venture Capitalist Firms

Government & Regulatory Bodies (e.g., Centers for Medicare & Medicaid Services)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

Medtronic

Invacare Corporation

ResMed Inc.

Stryker Corporation

Cardinal Health

Drive DeVilbiss Healthcare

Philips Healthcare

Hill-Rom Holdings, Inc.

GE Healthcare

Sunrise Medical

GF Health Products, Inc.

Permobil AB

Pride Mobility Products Corp.

McKesson Corporation

Compass Health Brands

Table of Contents

1. USA Durable Medical Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

2. USA Durable Medical Equipment Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Durable Medical Equipment Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Chronic Diseases

3.1.2. Aging Population and Life Expectancy

3.1.3. Expansion of Home Healthcare Services

3.1.4. Technological Innovations

3.2. Restraints

3.2.1. High Costs and Limited Reimbursement Policies

3.2.2. Regulatory Challenges

3.2.3. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Technological Advancements in DME

3.3.2. Expansion of Telehealth Services

3.3.3. Rising Demand in Emerging Markets

3.4. Trends

3.4.1. Integration of Digital Health Technologies

3.4.2. Growth in Home-Based Care Solutions

3.4.3. Focus on Sustainable and Eco-Friendly Equipment

3.5. Government Regulations

3.5.1. Medicare Modernization Act of 2023

3.5.2. American Rescue Plan Act (ARPA) of 2021

3.5.3. FDAs Digital Health Innovation Action Plan (2024)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

4. USA Durable Medical Equipment Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Mobility Aids

4.1.2. Bathroom Safety Devices

4.1.3. Respiratory Equipment

4.2. By End-User (in Value %)

4.2.1. Home Healthcare

4.2.2. Hospitals

4.2.3. Ambulatory Surgical Centers

4.3. By Technology (in Value %)

4.3.1. Assistive Technology

4.3.2. Monitoring and Therapeutic Devices

4.4. By Distribution Channel (in Value %)

4.4.1. Online Retail

4.4.2. Specialty Stores

4.4.3. Hospitals and Clinics

4.5. By Region (in Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Durable Medical Equipment Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Medtronic

5.1.2. Invacare Corporation

5.1.3. ResMed Inc.

5.1.4. Stryker Corporation

5.1.5. Cardinal Health

5.1.6. Drive DeVilbiss Healthcare

5.1.7. Philips Healthcare

5.1.8. Hill-Rom Holdings, Inc.

5.1.9. GE Healthcare

5.1.10. Sunrise Medical

5.1.11. GF Health Products, Inc.

5.1.12. Permobil AB

5.1.13. Pride Mobility Products Corp.

5.1.14. McKesson Corporation

5.1.15. Compass Health Brands

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. USA Durable Medical Equipment Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. USA Durable Medical Equipment Market Regulatory Framework

7.1. Healthcare Standards and Compliance

7.2. Medicare and Medicaid Reimbursement Policies

7.3. FDA Regulations and Certification Processes

8. USA Durable Medical Equipment Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. USA Durable Medical Equipment Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By End-User (in Value %)

9.3. By Technology (in Value %)

9.4. By Distribution Channel (in Value %)

9.5. By Region (in Value %)

10. USA Durable Medical Equipment Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on USA Durable Medical Equipment Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA Durable Medical Equipment Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple durable medical equipment suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from durable medical equipment suppliers and distributors companies.

Frequently Asked Questions

01 How big is USA Durable Medical Equipment Market?

USA Durable Medical Equipment (DME) market size reached USD 113 billion, driven by an aging population, increased prevalence of chronic diseases, and rising demand for home healthcare services.

02 What are the growth drivers of the USA Durable Medical Equipment Market?

The USA Durable Medical Equipment Market is propelled by the rising prevalence of chronic diseases, an aging population, and the expansion of home healthcare services. Technological advancements in durable medical equipment also contribute significantly to market growth.

03 What are challenges in USA Durable Medical Equipment Market?

Challenges in the USA Durable Medical Equipment Market include high costs and limited reimbursement policies, stringent regulatory requirements, and supply chain disruptions. These factors can hinder market growth and increase operational costs for manufacturers.

04 Who are major players in USA Durable Medical Equipment Market?

Major players in the USA Durable Medical Equipment Market include Medtronic, Invacare Corporation, ResMed Inc., Stryker Corporation, and Cardinal Health. These companies lead the market due to their extensive product ranges, strong distribution networks, and continuous innovation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.