USA Dynamic Random Access Memory (DRAM) Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD4074

November 2024

90

About the Report

USA Dynamic Random Access Memory (DRAM) Market Overview

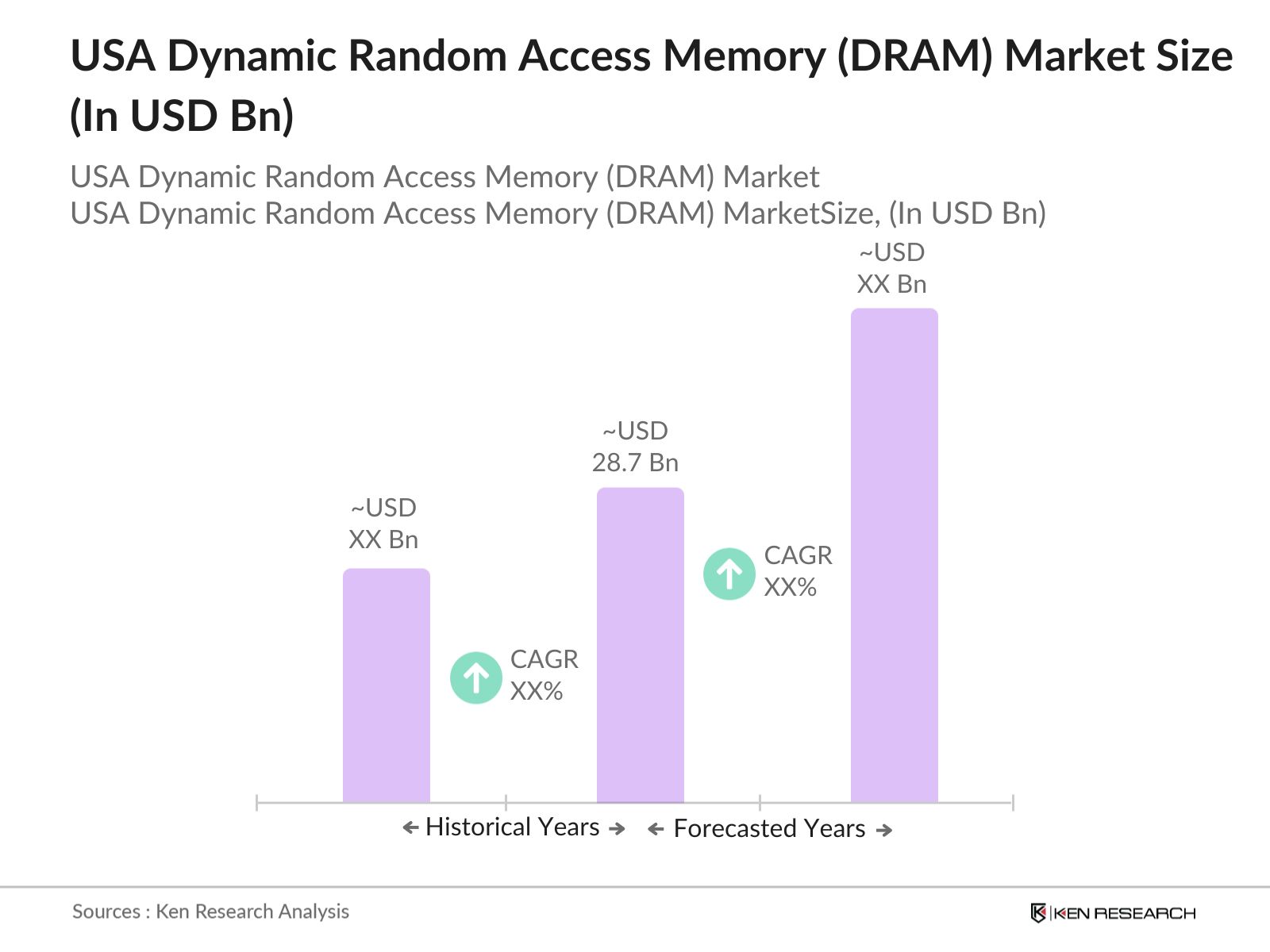

- The USA Dynamic Random Access Memory (DRAM) market is valued at USD 28.7 billion, based on a five-year historical analysis. This valuation is largely driven by increased demand from sectors such as data centers, cloud computing, and high-performance computing. Companies are heavily investing in high-capacity DRAM chips to handle the surge in data processing needs. The transition to DDR5 technology, supporting faster speeds and higher bandwidth, has further fueled market demand, driving the market's robust growth in the current year.

- Dominant regions in the USA DRAM market include Silicon Valley and other tech hubs along the West Coast. These areas are home to major data centers and cloud service providers, contributing to high DRAM consumption. Additionally, the Midwest and Southeast regions, which are significant manufacturing hubs for the automotive industry, have seen increasing DRAM use in autonomous driving technologies, contributing to their growing dominance in the market.

- The U.S. government has provided substantial incentives for local semiconductor production through the CHIPS Act, allocating $50 billion to enhance domestic manufacturing capacities. In 2024, $20 billions of these funds have been directed toward building and upgrading semiconductor fabrication plants, directly benefiting the DRAM sector. This incentivizes local production and aims to reduce dependency on foreign suppliers, securing supply chains and bolstering domestic DRAM production

USA Dynamic Random Access Memory (DRAM) Market Segmentation

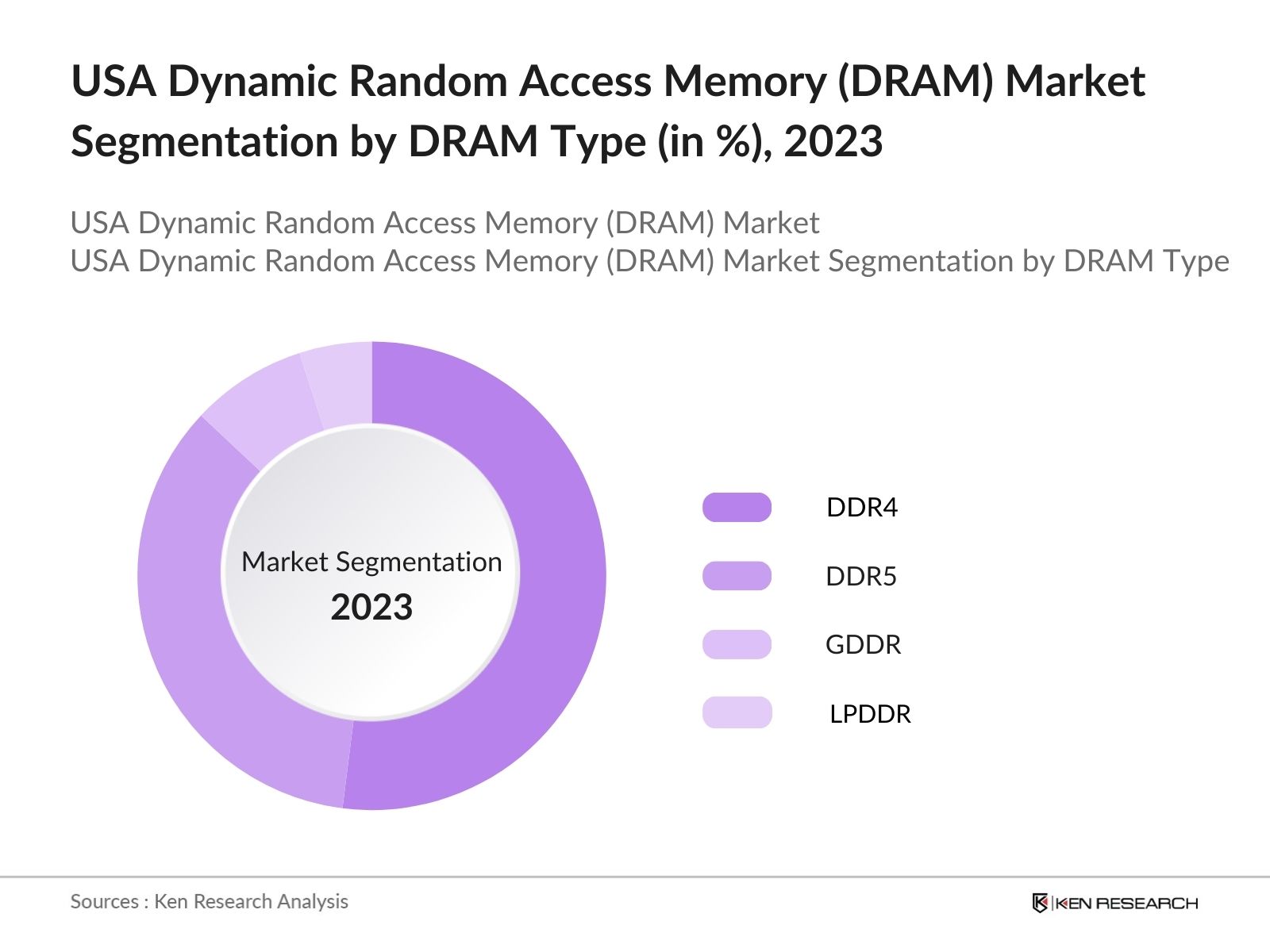

By DRAM Type: The market is segmented by product type into DDR4, DDR5, GDDR (Graphics DRAM), and LPDDR (Low Power DRAM). Recently, DDR4 has dominated the market due to its widespread usage in both consumer electronics and enterprise servers. Its versatility and cost-effectiveness have made it a staple in various industries, from cloud computing to smartphones. However, DDR5 is quickly catching up, driven by its superior performance and energy efficiency, which is increasingly critical for high-end computing applications, such as AI, machine learning, and big data analytics.

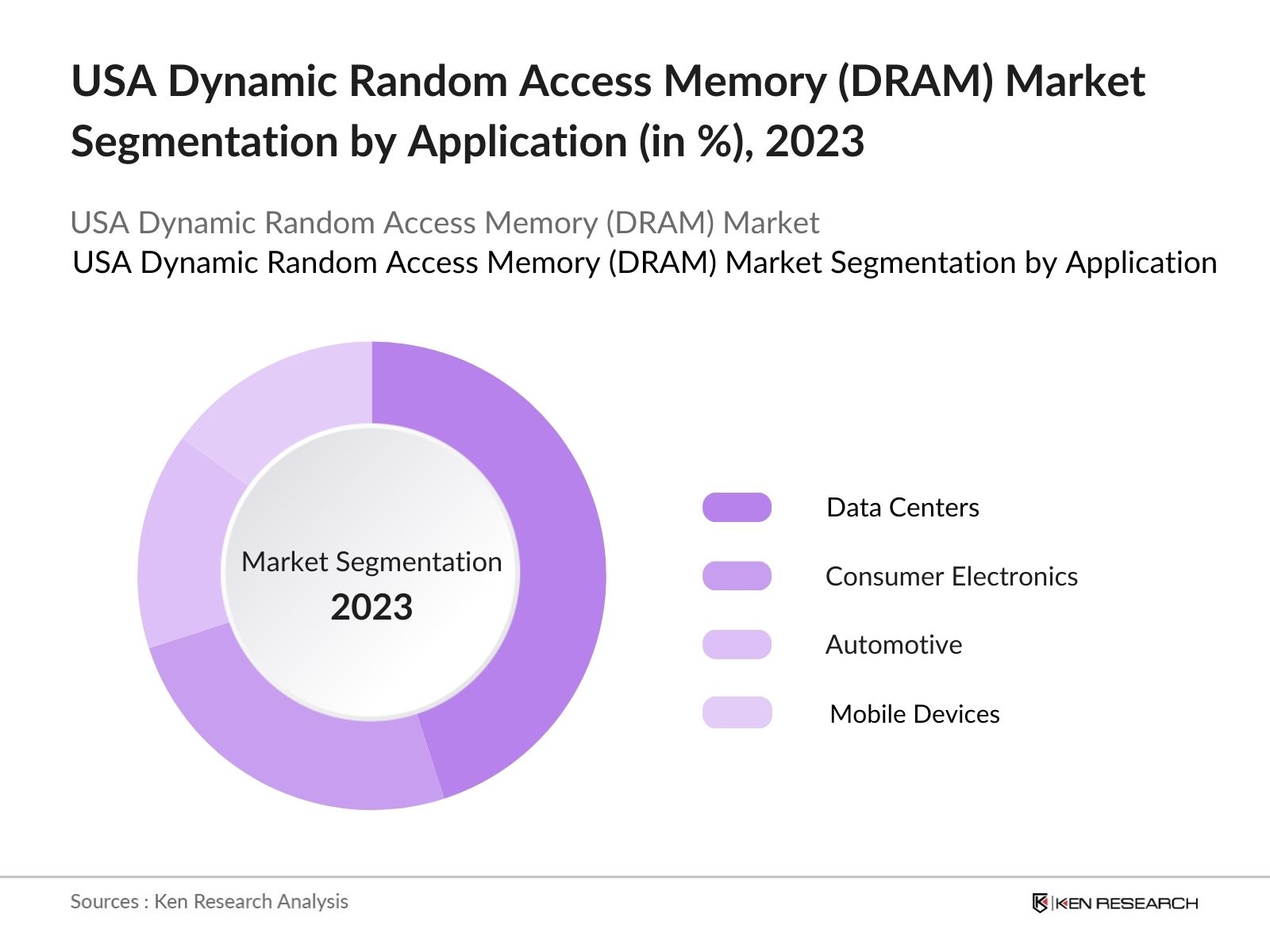

By Application: The market is also segmented by application into consumer electronics, data centers, automotive, and mobile devices. Data centers dominate the application segment due to the rapid expansion of cloud computing and the increased need for data storage and processing. DRAM is essential for providing fast access to large datasets, which is a key requirement for cloud service providers, enterprise IT environments, and AI systems. The rise in demand for faster and more efficient memory solutions in large-scale server farms has made this sub-segment the top consumer of DRAM.

By Application: The market is also segmented by application into consumer electronics, data centers, automotive, and mobile devices. Data centers dominate the application segment due to the rapid expansion of cloud computing and the increased need for data storage and processing. DRAM is essential for providing fast access to large datasets, which is a key requirement for cloud service providers, enterprise IT environments, and AI systems. The rise in demand for faster and more efficient memory solutions in large-scale server farms has made this sub-segment the top consumer of DRAM.

USA Dynamic Random Access Memory (DRAM) Market Competitive Landscape

USA Dynamic Random Access Memory (DRAM) Market Competitive Landscape

The market is dominated by a few major players that maintain strong control over supply, innovation, and pricing. This consolidation is driven by heavy capital investment in research and development, advanced manufacturing capabilities, and long-term contracts with large-scale buyers like cloud service providers. Key players such as Micron and Intel continue to lead in innovation and market share, with others like Samsung and SK Hynix playing significant roles due to their global production capacity and technological prowess.

|

Company |

Established Year |

Headquarters |

R&D Investment (USD) |

Technology Node |

Production Capacity |

Patent Portfolio |

Employee Strength |

Revenue (USD) |

Global Rank |

|---|---|---|---|---|---|---|---|---|---|

|

Micron Technology |

1978 |

Boise, Idaho |

|||||||

|

SK Hynix |

1983 |

Icheon, South Korea |

|||||||

|

Samsung Electronics |

1969 |

Suwon, South Korea |

|||||||

|

Intel Corporation |

1968 |

Santa Clara, California |

|||||||

|

Nanya Technology |

1995 |

Taiwan |

USA Dynamic Random Access Memory (DRAM) Industry Analysis

Growth Drivers

- Rise of Cloud Computing: The expansion of cloud computing is a significant growth driver for the DRAM market in the USA. In 2024, the U.S. cloud computing market continues to grow as more enterprises shift operations to cloud-based systems, increasing demand for high-speed DRAM. With the U.S. government investing $500 million in expanding digital infrastructure as part of its technological initiatives, the need for efficient memory like DRAM is accelerating. Furthermore, data centers supporting cloud computing are set to consume 1.3 billion kilowatt-hours of energy in 2024, underscoring the critical role DRAM plays in maintaining high-performance computing environments.

- Demand for High-Speed Processing: As businesses adopt AI and machine learning (ML) technologies, the need for high-speed processing is driving DRAM demand. In 2024, the U.S. Department of Energy continues its $1.2 billion investment in quantum computing and AI, fueling the need for faster and more efficient memory technologies like DRAM. U.S.-based companies are leading the push for faster processing capabilities to improve AI systems, which require vast amounts of DRAM to handle extensive data sets and computations efficiently.

- Government Policies Favoring Semiconductor Manufacturing: The U.S. CHIPS Act allocates over $50 billion to boost semiconductor manufacturing, which includes DRAM production. In 2024, $11 billion has already been invested in semiconductor research, benefiting DRAM manufacturers by promoting local production and reducing dependence on foreign imports. This policy aims to strengthen the semiconductor supply chain, a key element in DRAM production, ensuring the U.S. stays competitive globally.

Market Challenges

- Raw Material Scarcity: Raw material shortages remain a significant challenge for DRAM production. In 2024, the U.S. semiconductor industry faces a deficit in essential raw materials like neon and palladium, used in semiconductor manufacturing, including DRAM. Due to supply chain disruptions caused by geopolitical conflicts, material scarcity has delayed production cycles by an estimated 15%. This situation is worsened by limited availability of certain critical minerals within the U.S., further exacerbating production delays.

- Fluctuations in Pricing and Demand: DRAM pricing volatility continues to disrupt the market due to fluctuating demand from key sectors such as consumer electronics and data centers. In 2023, demand for DRAM components in the consumer electronics market declined temporarily, contributing to inventory excesses. By mid-2024, however, this demand is expected to stabilize due to increased consumer spending and infrastructure investments, but pricing inconsistencies remain a persistent challenge.

USA Dynamic Random Access Memory (DRAM) Market Future Outlook

Over the next five years, the USA DRAM market is expected to witness significant advancements, driven by rapid technological evolution in the semiconductor industry. The transition from DDR4 to DDR5 is expected to accelerate, offering increased speeds, bandwidth, and energy efficiency. Additionally, the rise of AI, 5G, and autonomous driving will drive demand for advanced DRAM products that can handle intensive data processing workloads. The government's emphasis on domestic semiconductor production through initiatives such as the CHIPS Act is also expected to boost local manufacturing capacity, making the USA a more competitive player in the global DRAM market.

Future Market Opportunities

- Expanding Edge Computing Applications: The growth of edge computing in the U.S. offers substantial opportunities for DRAM market expansion. By 2024, edge computing networks, which require localized processing power, are expected to manage 75% of enterprise-generated data. This drives up demand for DRAM modules optimized for low-latency processing. Edge computing systems are being deployed in smart factories, healthcare, and telecommunications, requiring robust memory solutions like DRAM to handle data-intensive applications.

- Rising Demand in Consumer Electronics and Mobile Devices: With the U.S. consumer electronics market thriving in 2024, particularly driven by mobile devices and IoT products, demand for DRAM is increasing. Over 310 million mobile devices were shipped in the U.S. in 2023, each requiring efficient memory solutions. The integration of advanced DRAM into 5G-enabled smartphones and IoT devices is driving the need for enhanced memory capacity and speed.

Scope of the Report

|

By DRAM Type |

DDR4 DDR5 GDDR LPDDR |

|

By Application |

Consumer Electronics Data Centers Automotive Mobile Devices |

|

By End-User Industry |

Information Technology Telecom Healthcare Automotive |

|

By Technology Node |

14nm 10nm 7nm and Below |

|

By Region |

West Coast Southeast Midwest Northeast |

Products

Key Target Audience

DRAM Manufacturers

Cloud Service Providers

Enterprise IT Companies

Automotive Manufacturers

Consumer Electronics Manufacturers

Banks and Financial Institutes

Government and Regulatory Bodies (U.S. Department of Commerce, Federal Trade Commission)

Investments and Venture Capitalist Firms

Data Center Operators

Companies

Major Players

Micron Technology

Samsung Electronics

SK Hynix

Intel Corporation

Nanya Technology

Winbond Electronics

Powerchip Semiconductor

Rambus

Infineon Technologies

Broadcom Inc.

Western Digital Corporation

Qualcomm

Nvidia Corporation

Kingston Technology

AMD

Table of Contents

USA DRAM Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (DRAM Types, Use Cases)

1.3. Market Growth Rate (Market Drivers)

1.4. Market Segmentation Overview

USA DRAM Market Size (In USD Bn)

2.1. Historical Market Size (In-Depth Growth Breakdown)

2.2. Year-On-Year Growth Analysis (Production Volume, Consumption)

2.3. Key Market Developments and Milestones (Technological Advancements, Manufacturing Trends)

USA DRAM Market Analysis

3.1. Growth Drivers (Technological Shift, Data Center Expansion, AI & ML Integration)

3.1.1. Rise of Cloud Computing

3.1.2. Demand for High-Speed Processing

3.1.3. Government Policies Favoring Semiconductor Manufacturing

3.2. Market Challenges (Supply Chain Disruptions, High Production Costs, Global Semiconductor Shortage)

3.2.1. Raw Material Scarcity (Impact on Production)

3.2.2. Technical Complexities in Manufacturing Advanced DRAM (Scaling Issues, Technical Barriers)

3.2.3. Fluctuations in Pricing and Demand

3.3. Opportunities (AI, 5G, and Autonomous Vehicle Growth; Emerging Use Cases)

3.3.1. Expanding Edge Computing Applications

3.3.2. Rising Demand in Consumer Electronics and Mobile Devices

3.3.3. Strategic Collaborations and Joint Ventures in Memory Tech

3.4. Trends (Miniaturization, 3D DRAM, DDR5 Transition, Energy-Efficient DRAM)

3.4.1. Emergence of Next-Gen DRAM Technologies (DDR5, LPDDR5)

3.4.2. Increasing Adoption of DRAM in AI and ML Applications

3.4.3. Development of 3D Stacked DRAM for High-Density Applications

3.5. Government Regulation (US Chips Act, Semiconductor Subsidies, Tariffs on Imports)

3.5.1. Government Incentives for Local Semiconductor Production

3.5.2. Environmental and Safety Regulations in Semiconductor Manufacturing

3.5.3. Trade Policies Impacting DRAM Imports and Exports

USA DRAM Market Segmentation

4.1. By DRAM Type (In Value %)

4.1.1. DDR4

4.1.2. DDR5

4.1.3. GDDR (Graphics DRAM)

4.1.4. LPDDR (Low Power DRAM)

4.2. By Application (In Value %)

4.2.1. Consumer Electronics

4.2.2. Data Centers and Enterprise Servers

4.2.3. Automotive and Industrial Applications

4.2.4. Mobile Devices

4.3. By End-User Industry (In Value %)

4.3.1. Information Technology

4.3.2. Telecom

4.3.3. Healthcare

4.3.4. Automotive

4.4. By Technology Node (In Value %)

4.4.1. 14nm

4.4.2. 10nm

4.4.3. 7nm and Below

4.5. By Region (In Value %)

4.5.1. West Coast (Silicon Valley, Tech Giants' DRAM Demand)

4.5.2. Southeast (Manufacturing Hubs)

4.5.3. Midwest (Automotive Industry)

4.5.4. Northeast (Data Center Concentration)

USA DRAM Market Competitive Analysis

5.1. Detailed Profiles of Major Companies (15 Competitors)

5.1.1. Micron Technology

5.1.2. SK Hynix

5.1.3. Samsung Electronics

5.1.4. Nanya Technology

5.1.5. Winbond Electronics

5.1.6. Powerchip Semiconductor

5.1.7. Western Digital Corporation

5.1.8. Intel Corporation

5.1.9. Rambus

5.1.10. Infineon Technologies

5.1.11. Broadcom Inc.

5.1.12. Kingston Technology

5.1.13. Nvidia Corporation (DRAM for GPUs)

5.1.14. AMD (DRAM for Servers and HPC)

5.1.15. Qualcomm (DRAM for Mobile Devices)

5.2. Cross Comparison Parameters (Inception Year, R&D Investments, DRAM Manufacturing Capacity, Market Share, Technology Node)

5.3. Market Share Analysis (Segment-Wise Share of Leading Companies)

5.4. Strategic Initiatives (Expansion, New Product Launches, Partnerships)

5.5. Mergers and Acquisitions (Recent Activity)

5.6. Investment Analysis (Capital Expenditure on New DRAM Manufacturing Facilities)

5.7. Venture Capital Funding (Emerging Startups in DRAM Technology)

5.8. Government Grants and Subsidies for DRAM Manufacturing

5.9. Private Equity Investments

USA DRAM Market Regulatory Framework

6.1. Compliance Requirements (Environmental, Labor)

6.2. Certification Processes (Industry Standards, Energy-Efficient DRAM)

6.3. Tariff Policies and Trade Barriers

USA DRAM Future Market Size (In USD Bn)

7.1. Future Market Size Projections (Based on Technological Shifts)

7.2. Key Factors Driving Future Market Growth (AI, IoT, 5G, Autonomous Vehicles)

USA DRAM Future Market Segmentation

8.1. By DRAM Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology Node (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

USA DRAM Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Tech Giants, SME DRAM Consumers)

9.3. Marketing Initiatives (Collaborations, Product Awareness Campaigns)

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research began by identifying critical variables impacting the USA DRAM Market, focusing on demand patterns across key sectors like cloud computing, automotive, and AI. This step involved extensive secondary research using government data, industry reports, and proprietary databases to construct a robust framework.

Step 2: Market Analysis and Construction

Historical data were analyzed to understand DRAM market dynamics, including production volumes, sales, and demand fluctuations across sectors. Market penetration was evaluated alongside technological advancements, enabling precise revenue estimates for different DRAM segments.

Step 3: Hypothesis Validation and Expert Consultation

Initial market hypotheses were validated through interviews with industry experts, including executives from leading DRAM manufacturers and tech companies. Insights into future trends and emerging technologies were obtained through these consultations.

Step 4: Research Synthesis and Final Output

A final synthesis of findings was conducted by combining quantitative data with qualitative insights from industry leaders. This synthesis helped finalize market forecasts and segment-wise analysis, ensuring a well-rounded view of the USA DRAM market.

Frequently Asked Questions

01. How big is the USA DRAM Market?

The USA DRAM market is valued at USD 28.7 billion in 2023, driven by surging demand from data centers, cloud services, and advancements in AI technology.

02. What are the challenges in the USA DRAM Market?

Key challenges in the USA DRAM market include global semiconductor supply chain disruptions, high manufacturing costs, and technical complexities in scaling DRAM production to newer technology nodes like 7nm and below.

03. Who are the major players in the USA DRAM Market?

Key players in the USA DRAM market include Micron Technology, Intel, Samsung Electronics, SK Hynix, and Nanya Technology. These companies dominate the market due to their innovation and large-scale manufacturing capacity.

04. What are the growth drivers of the USA DRAM Market?

The USA DRAM market is driven by the increasing need for high-performance memory in data centers, cloud computing, artificial intelligence, and autonomous vehicles. The shift towards DDR5 also offers improved performance and efficiency, driving adoption across various industries.

05. What are the opportunities in the USA DRAM Market?

Emerging opportunities in the USA DRAM market include the rise of edge computing, 5G infrastructure expansion, and AI-driven advancements, all of which require faster, higher-capacity DRAM solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.