USA E- Bike Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD1825

October 2024

89

About the Report

USA E-Bike Market Overview

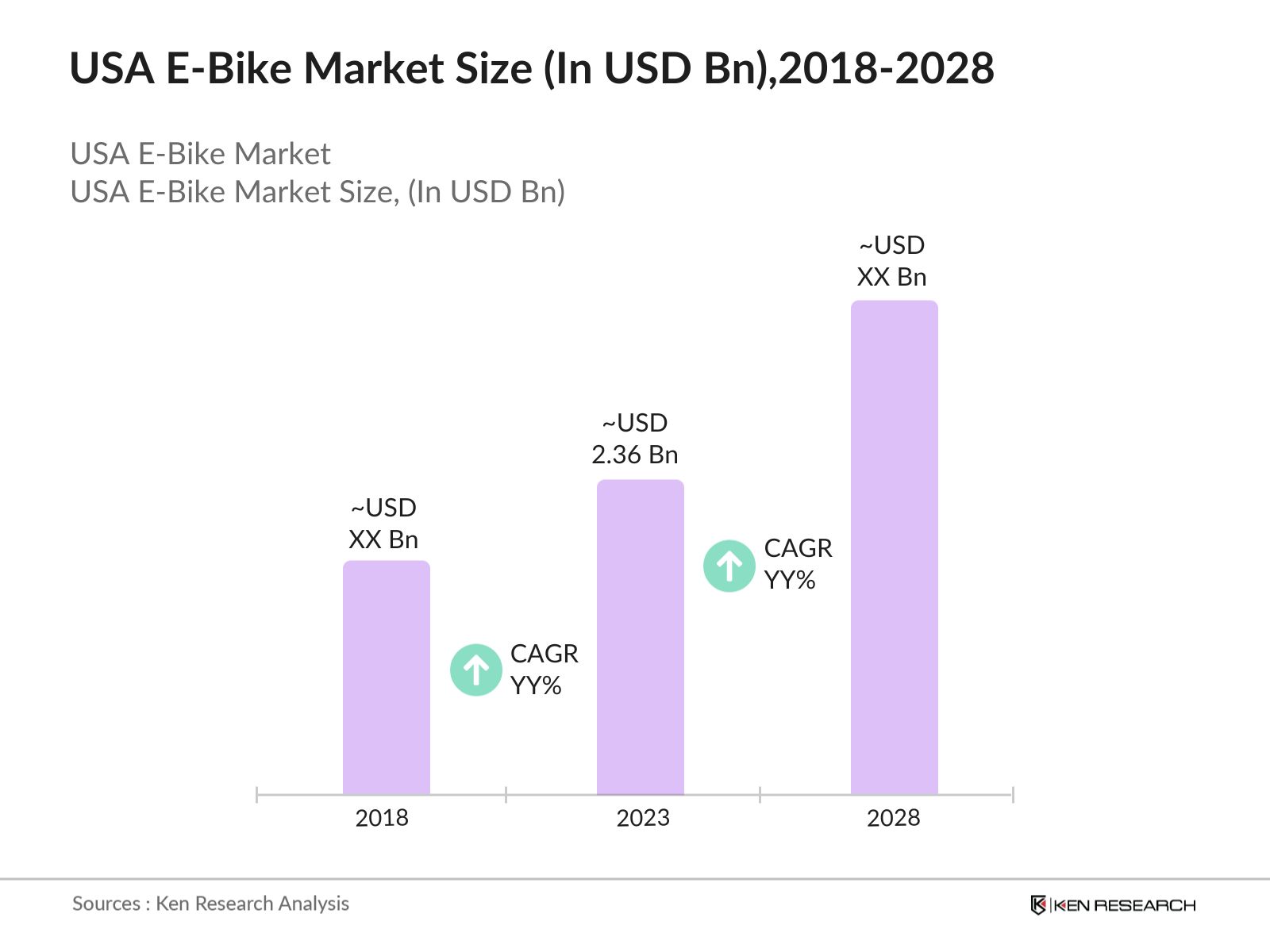

- The USA E-Bike Market was valued at USD 2.36 billion in 2023. This growth is primarily driven by increasing urbanization, rising environmental concerns, and advancements in e-bike technology. Consumers are increasingly opting for e-bikes as a sustainable and cost-effective alternative to traditional transportation.

- The key players in the market include major brands such as Rad Power Bikes, Trek Bicycle Corporation, Specialized Bicycle Components, Bulls Bikes, and Ancheer. These companies have established strong market positions through a combination of innovative technology, extensive distribution networks, and strategic partnerships.

- Rad Power Bikes has launched four new e-bike models for 2024, including the Radster Trail and Radster Road, alongside updates to the RadWagon 5 and RadExpand 5 Plus. Each model features the new Safe Shield Battery, offering 60-65 miles of range, enhanced safety features, and is priced around $2,000.

- California remains the dominant region in the market, by the state's strong infrastructure for bicycling, combined with supportive local policies and high environmental awareness, drives its leading position. Major urban areas like Los Angeles and San Francisco have seen rapid adoption of e-bikes, further solidifying California's dominance.

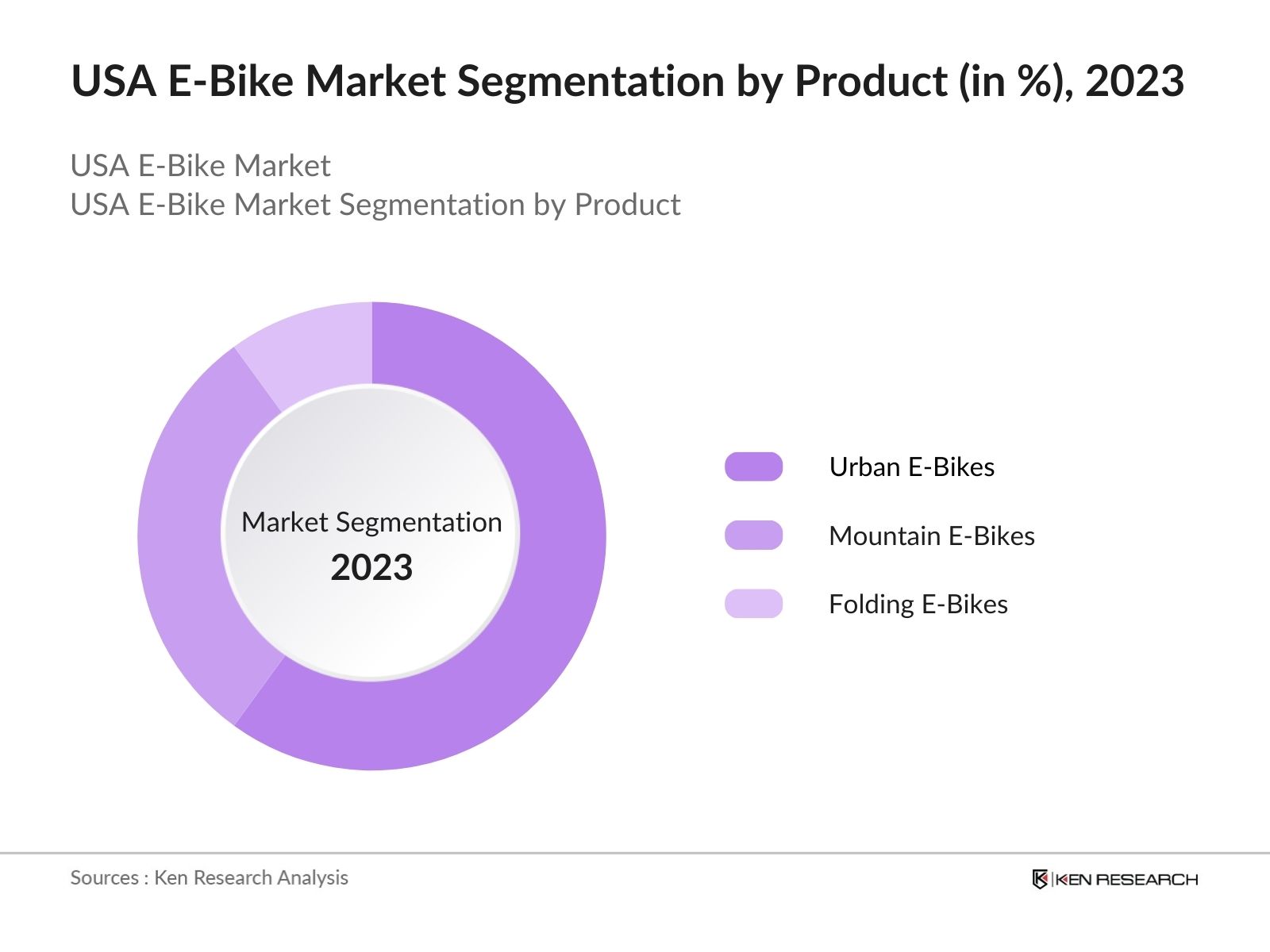

USA E-Bike Market Segmentation

The market is segmented into various factors like product, battery type, and region.

By Product: The market is segmented by product into urban E-Bikes, mountain E-Bikes, and folding E-Bikes. In 2023, City/Urban e-bikes held a dominant market because of their practicality for commuting and ease of use in urban settings. These bikes are designed for comfort and efficiency, making them ideal for city dwellers.

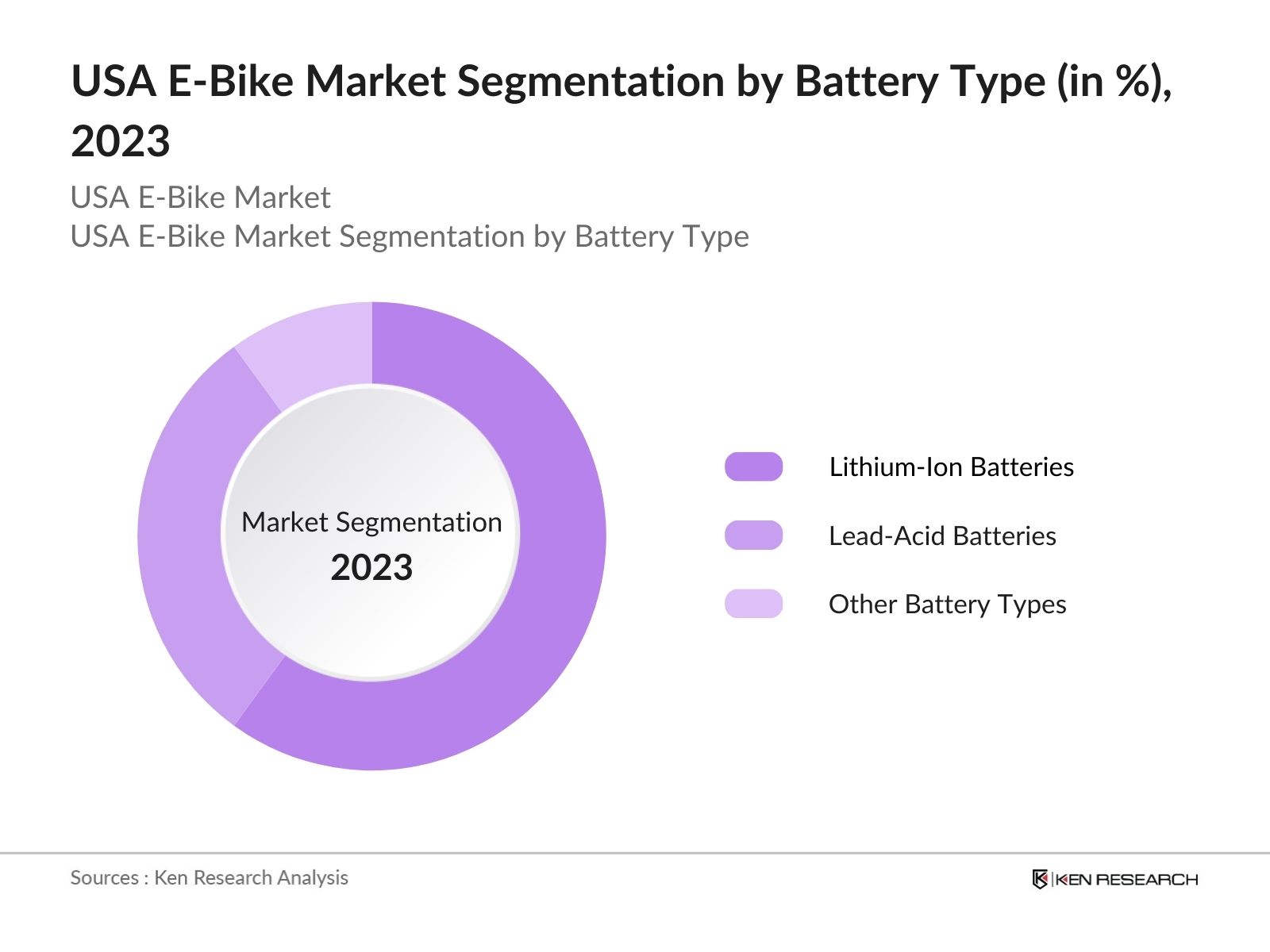

By Battery Type: The market is segmented by battery type into Lithium-Ion Batteries, Lead-Acid Batteries, and Other Battery Types. In 2023, Lithium-ion batteries dominate the market with high energy density, longer lifespan, and lighter weight compared to other battery types. Technological advancements have further solidified their position in the market.

By Region: The market is segmented by region into North, South, East, and West. In 2023, the West region holds the largest market share by extensive cycling infrastructure, progressive environmental policies, and high adoption rates contribute to its leading position.

USA E-Bike Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Rad Power Bikes |

2007 |

Seattle, WA |

|

Trek Bicycle Corp. |

1976 |

Waterloo, WI |

|

Specialized Bicycle |

1974 |

Morgan Hill, CA |

|

Bulls Bikes |

1995 |

Cologne, Germany |

|

Ancheer |

2012 |

Los Angeles, CA |

- Specialized Bicycle: Specialized Bicycle Components has recently introduced the Turbo Vado SL, an ultra-lightweight e-bike with advanced connectivity features. This innovation aims to cater to tech-savvy consumers and enhance the riding experience, reflecting the companys commitment to leading-edge technology.

- Trek Bicycle Corp.: Trek Bicycle Corporation expanded its e-bike lineup in 2024 with the introduction of the Trek Verve+, featuring a new, more efficient motor system. The Verve+ is designed to offer improved performance and extended battery life, catering to the growing demand for high-performance e-bikes. The launch is expected to boost Trek's market share and reinforce its position as a leading player in the e-bike industry.

USA E-Bike Market Analysis

Market Growth Drivers

- Rising Last-Mile Delivery Demand: The e-bike industry is driven by sustainable urban mobility initiatives, with cities promoting eco-friendly transportation to combat congestion and emissions. Government incentives like tax credits enhance adoption, while advancements in battery technology improve performance. This shift reflects a growing consumer preference for efficient, green commuting solutions.

- E-Bike Share Program: E-bikes have been a game-changer for bike share programs, with nearly half of Citi Bike rides in New York and over 75% of rides in Lincoln, Nebraska on e-bikes, despite making up only 20% of the fleet.E-bikes have led to a 43% increase in trips in Philadelphia between 2022 and 2023.Omaha's bike share system fully recovered from the pandemic and exceeded one million annual rides for the first time in 2023 thanks to the launch of e-bikes.

- Expansion of E-Bike Infrastructure: The rapid expansion of e-bike infrastructure across major U.S. cities is a growth driver. This infrastructure development is facilitated by federal and local funding initiatives aimed at improving urban mobility. The improved infrastructure is anticipated to drive higher adoption rates of e-bikes, as safer and more accessible routes encourage usage.

Market Challenges

- Supply Chain Disruptions: The e-bike industry continues to face supply chain disruptions, particularly in the procurement of key components such as batteries and electronic systems. In 2024, the global shortage of lithium-ion batteries is impacting production schedules and leading to delays. The supply chain issues are compounded by geopolitical tensions and trade restrictions, leading to increased costs for manufacturers and potential price hikes for consumers.

- High Initial Cost of E-Bikes: Despite decreasing costs over time, the initial purchase price of e-bikes remains relatively high compared to traditional bicycles. This higher cost can be a barrier to entry for many potential consumers, particularly in lower-income demographics. The high initial investment required for e-bikes, combined with limited consumer incentives in some regions, can slow down market adoption.

Government Initiatives

- Federal E-Bike Incentive Program: The Federal E-Bike Incentive Program, introduced in 2024, provides a tax credit of up to 30% (maximum $1,500) for purchasing e-bikes costing less than $5,000. An additional $200 million in funding is allocated for 2024, resulting in a 35% increase in e-bike sales compared to 2023, promoting eco-friendly transportation and reducing emissions.

- City-Based E-Bike Subsidy Programs: A proposed initiative in Illinois aims to establish a statewide e-bike incentive program. This program would offer tax credits and rebates to reduce the financial barrier of e-bikes, which can cost over $2,000. With e-bike sales outpacing car sales, this initiative seeks to promote sustainable transportation, reduce congestion, and lower carbon footprints statewide.

USA E-Bike Market Future Outlook

The future trends in the USA e-bike industry include the integration of AI and IoT technologies in e-bikes, expansion of e-bike sharing programs across major cities, development of advanced battery technologies, and increased government support for e-bike adoption through new policies and incentives.

Future Market Trends

- Integration of AI and IoT in E-Bikes: By 2028, e-bikes are expected to increasingly integrate artificial intelligence (AI) and Internet of Things (IoT) technologies. These advancements will enable features such as real-time performance monitoring, predictive maintenance, and enhanced navigation. According to market projections, the adoption of AI and IoT in e-bikes is expected to increase by 2028, driven by advancements in smart technology and consumer demand for connected devices.

- Development of Advanced Battery Technologies: Significant advancements in battery technology are expected by 2028, including the development of solid-state batteries and improved lithium-ion batteries. These technologies are projected to enhance battery performance, increase energy, and reduce charging times. The continued R&D investment in battery technology is anticipated to drive further growth in the e-bike market by offering consumers a longer range and better performance.

Scope of the Report

|

By Product |

Urban E-Bikes Mountain E-Bikes Folding E-Bikes |

|

By Battery Type |

Lithium-Ion Batteries Lead-Acid Batteries Other Battery Types |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Green Technology Investors

Tech Innovation Firms

E-Bike Companies

Bank and Financial Institutions

Logistics Companies

Recreational Vehicle Companies

Venture Capitalist

Government Regulatory Bodies

Companies

Players Mentioned in the Report:

Rad Power Bikes

Trek Bicycle Corporation

Specialized Bicycle Components

Bulls Bikes

Ancheer

Giant Bicycles

Bulls Bikes

Riese & Mller

Cannondale

Haibike

Merida

Ancheer

Pedego Electric Bikes

Stromer

IZIP

Table of Contents

1. USA E-Bike Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA E-Bike Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA E-Bike Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of E-Bike Infrastructure

3.1.2. Rising Last-Mile Delivery Demand

3.1.3. Growing Adoption in Municipal Fleets

3.1.4. Increased Investment in E-Bike Technology

3.2. Challenges

3.2.1. Supply Chain Disruptions

3.2.2. Regulatory Hurdles

3.2.3. High Initial Cost of E-Bikes

3.2.4. Battery Disposal and Recycling Issues

3.3. Government Initiatives

3.3.1. Federal E-Bike Incentive Program

3.3.2. City-Based E-Bike Subsidy Programs

3.3.3. Infrastructure Development Grants

3.3.4. Research and Development Funding

3.4. Recent Developments

3.4.1. Rad Power Bikes Launches New Model

3.4.2. Trek Bicycle Corporation Expands E-Bike Lineup

3.4.3. Specialized Introduces Turbo Vado SL

3.4.4. Ancheer Partners with Battery Manufacturer

3.5. Future Trends

3.5.1. Integration of AI and IoT in E-Bikes

3.5.2. Expansion of E-Bike Sharing Programs

3.5.3. Development of Advanced Battery Technologies

3.5.4. Increased Government Support for E-Bike Adoption

4. USA E-Bike Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Electric Mountain Bikes

4.1.2. Electric Road Bikes

4.1.3. Electric Commuter Bikes

4.2. By Battery Type (in Value %)

4.2.1. Lithium-Ion Batteries

4.2.2. Lead-Acid Batteries

4.2.3. Others

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. USA E-Bike Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Rad Power Bikes

5.1.2. Trek Bicycle Corporation

5.1.3. Specialized Bicycle Components

5.1.4. Ancheer

5.1.5. Bulls Bikes

5.1.6. Bulls Bikes

5.1.7. Riese & Mller

5.1.8. Pedego Electric Bikes

5.1.9. Ancheer

5.1.10. Propella

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. USA E-Bike Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. USA E-Bike Market Regulatory Framework

7.1. Federal Regulations

7.2. State-Level Regulations

7.3. Certification Processes

8. USA E-Bike Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. USA E-Bike Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Battery Type (in Value %)

9.3. By Sales Channel (in Value %)

9.4. By Region (in Value %)

10. USA E-Bike Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on USA E-Bike industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA E-Bike Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple automotive companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such automotive companies.

Frequently Asked Questions

01 How big is the USA E-Bike market?

The USA E-Bike Market was valued at USD 2.36 billion in 2023. This growth is primarily driven by increasing urbanization, rising environmental concerns, and advancements in e-bike technology.

02 What are the challenges in USA E-Bike market?

The major challenges in the USA E-Bike market include supply chain disruptions, regulatory hurdles, high initial costs of e-bikes, and issues related to battery disposal and recycling.

03 Who are the major players in the USA E-Bike market?

Key players in the USA E-Bike market include Rad Power Bikes, Trek Bicycle Corporation, Specialized Bicycle Components, Bulls Bikes, and Ancheer.

04 What are the main growth drivers of the USA E-Bike market?

The growth of the USA E-Bike market includes expansion of e-bike infrastructure in urban areas, increased demand for last-mile delivery services, growing adoption in municipal public transportation fleets, and significant investments in e-bike technology and innovation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.