USA E-Cig Market Outlook to 2030

Region:North America

Author(s):Shambhavi

Product Code:KROD7317

December 2024

85

About the Report

USA E-Cig Market Overview

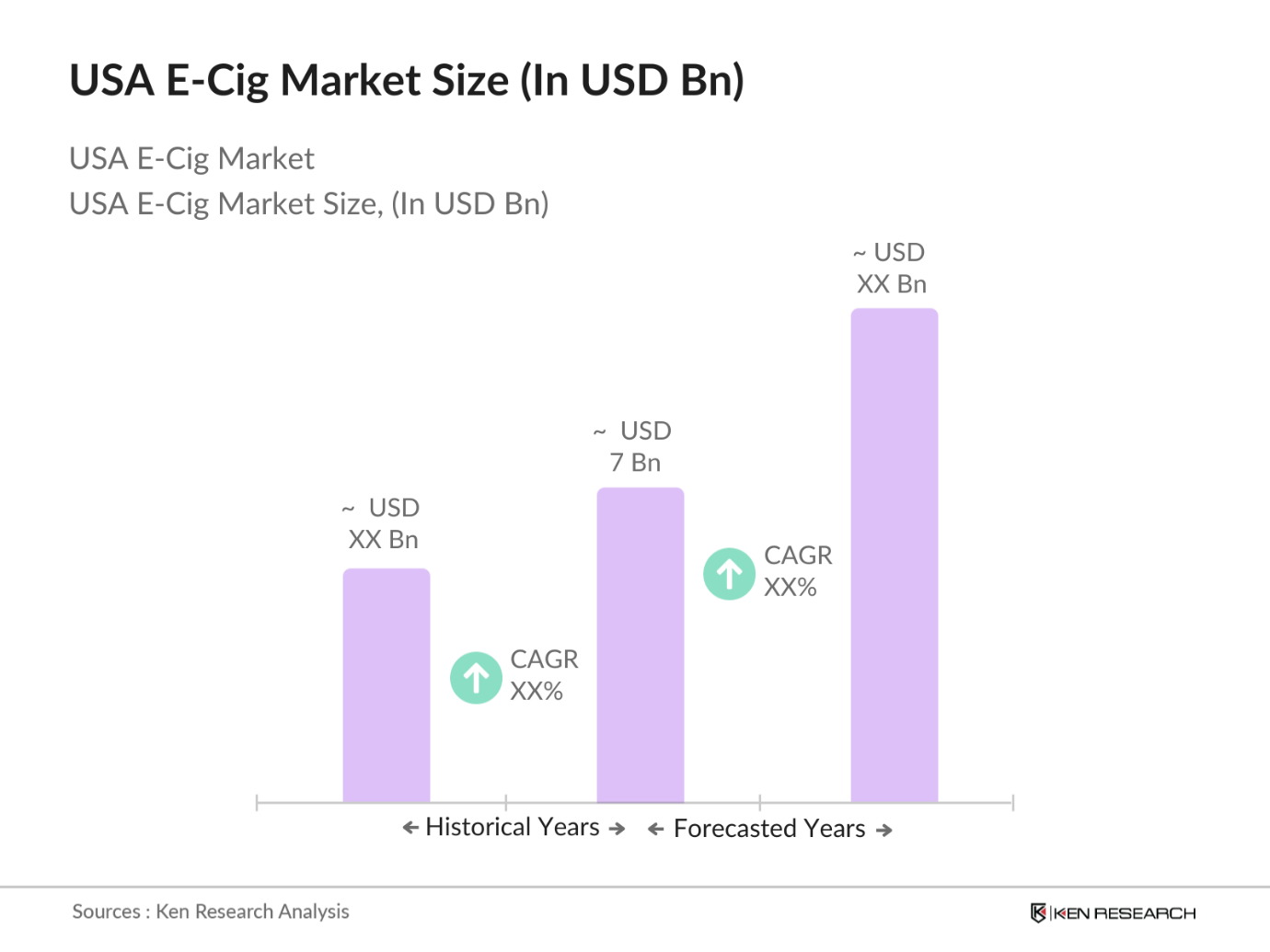

- The USA E-Cig market is valued at USD 7 billion, reflecting a steady expansion over the last five years. This growth is largely driven by a rising preference for smokeless alternatives, particularly among younger demographics and former smokers seeking reduced harm options. Increasing awareness regarding the potential benefits of e-cigarettes over traditional tobacco products has fueled this demand. The market expansion is also supported by innovative product developments from key industry players, who continually introduce advanced, customizable e-cig options, attracting a broader consumer base.

- In the USA, California and New York dominate the e-cig market due to progressive regulations and a sizable consumer base interested in alternative nicotine products. California, with its strong focus on public health and environmental consciousness, has encouraged product innovations and regulations to support reduced-risk tobacco alternatives. New York, a highly populous state with significant urban centers, shows high consumption patterns, driven by an increasing shift toward health-conscious choices among adults, particularly in cities like Los Angeles, San Francisco, and New York City.

- The FDAs regulatory measures to cap nicotine levels in e-cigarettes aim to reduce addiction risks, particularly among minors. With synthetic nicotine regulation implemented in April 2022, manufacturers are now required to limit nicotine content to prevent overuse. This regulation has curtailed the availability of high-nicotine products, pushing the market towards safer alternatives and reducing the risks of dependency

USA E-Cig Market Segmentation

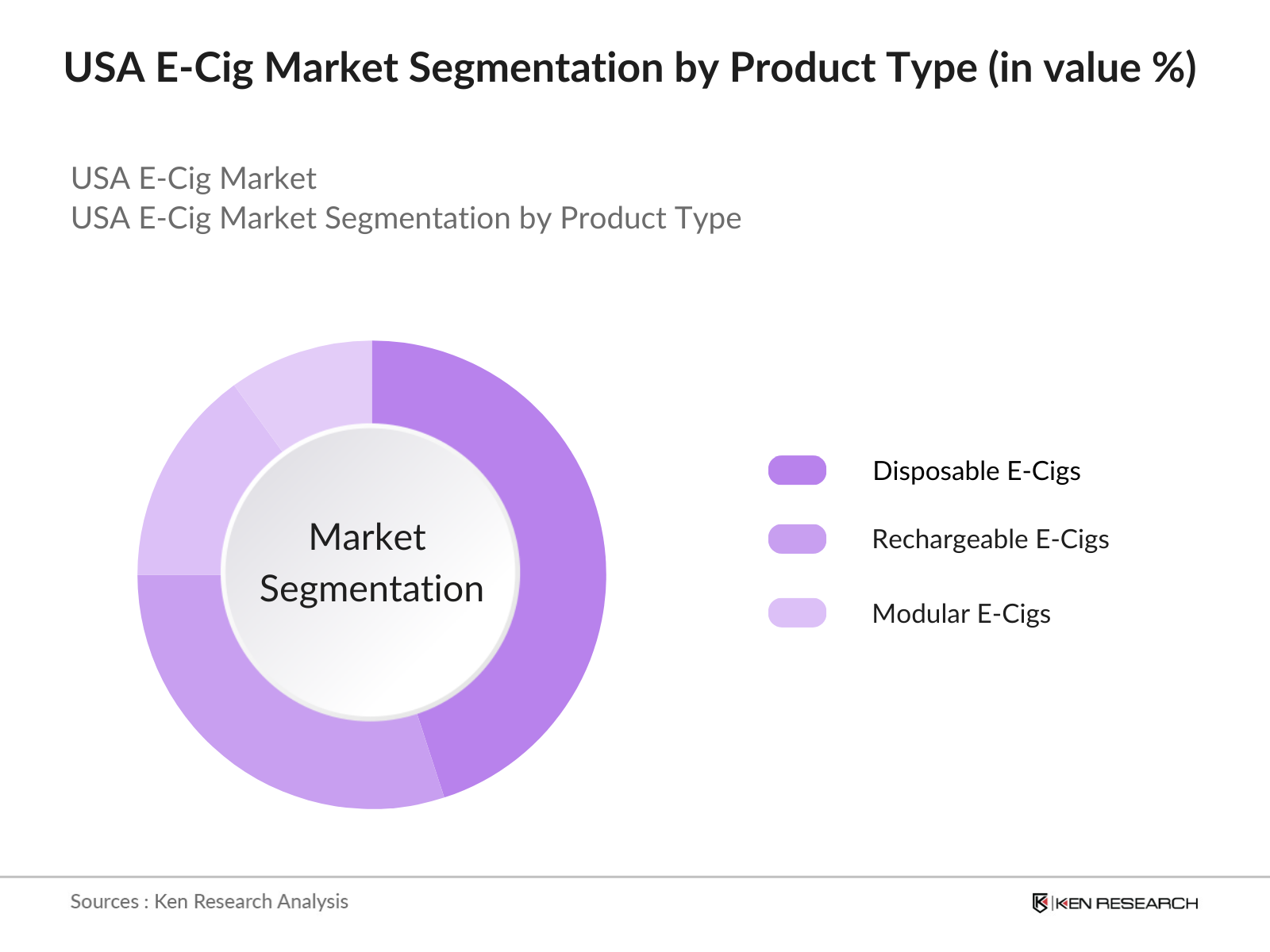

By Product Type: The USA E-Cig market is segmented by product type into disposable e-cigs, rechargeable e-cigs, and modular e-cigs. Recently, modular e-cigs hold a dominant market share in this segment due to their customizable features, allowing users to adjust nicotine levels and flavors to meet personal preferences. This adaptability has made modular e-cigs especially popular among frequent users who seek enhanced experiences beyond standard disposables, contributing to their market leadership.

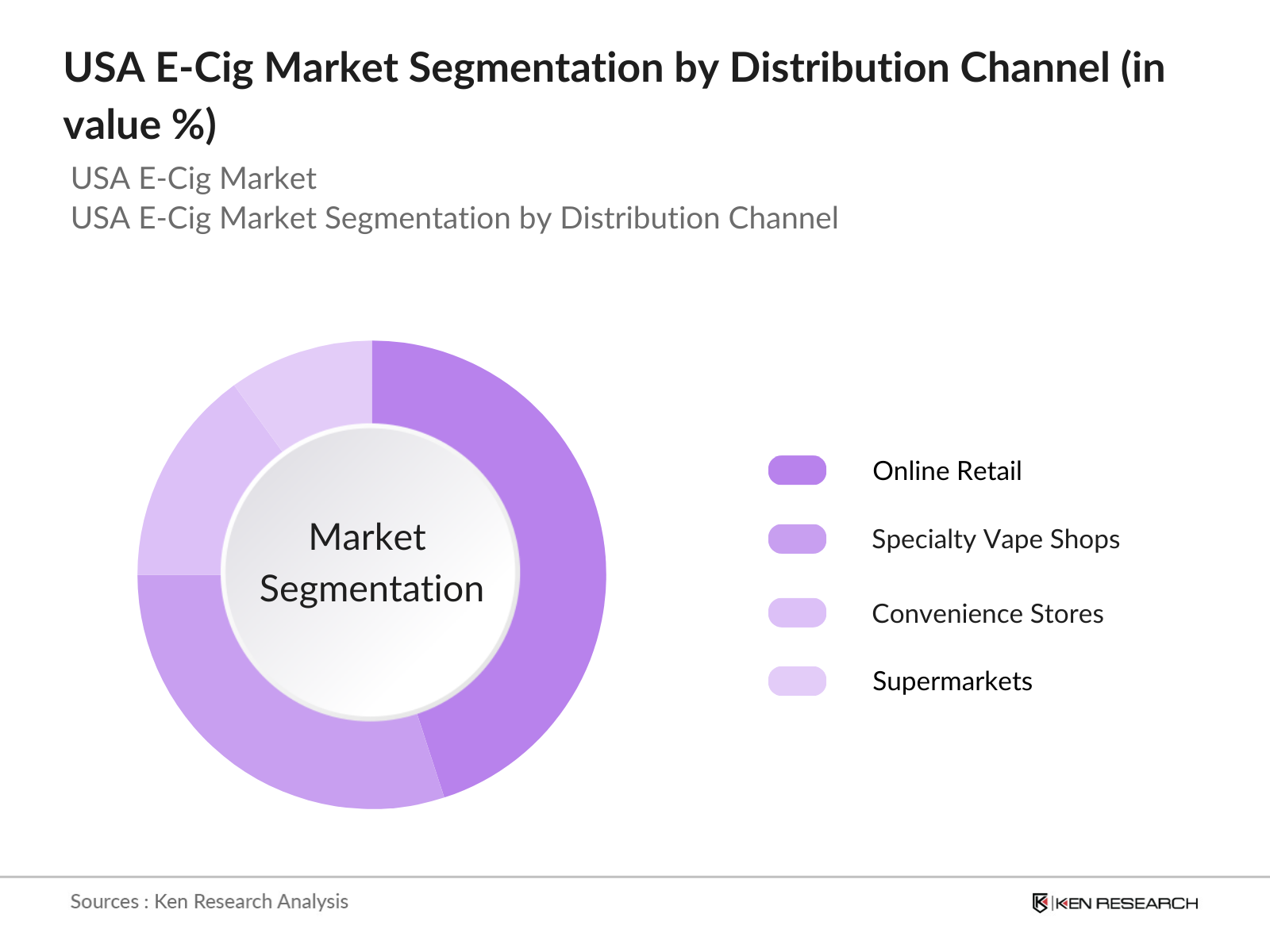

By Distribution Channel: Distribution channels in the USA E-Cig market include online retail, specialty vape shops, convenience stores, and supermarkets. Online retail is the leading sub-segment due to its accessibility, a broad range of product offerings, and convenience for consumers, especially during recent years where online shopping has grown significantly. The ability to compare products and brands on online platforms, along with discounts and subscription options, has made online retail the preferred choice for many consumers.

USA E-Cig Market Competitive Landscape

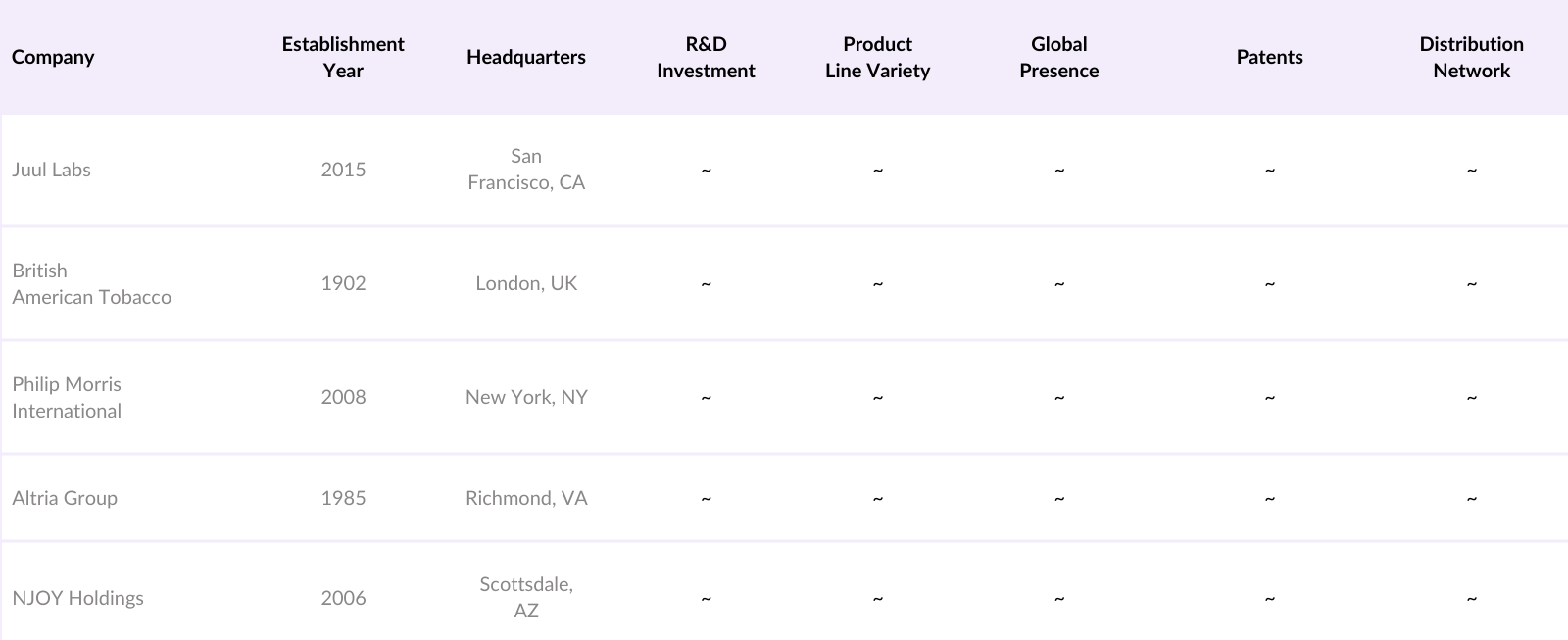

The USA E-Cig market is led by several prominent players, each contributing to the market with unique innovations and strategic initiatives.

The USA E-Cig market is dominated by a mix of established global tobacco brands like British American Tobacco and Philip Morris International and specialized companies like Juul Labs. This blend of major players showcases both extensive brand loyalty and rapid innovations, contributing to competitive product offerings and sustained consumer interest.

USA E-Cig Market Analysis

Growth Drivers

- Rising Consumer Demand for Smokeless Alternatives: The CDC reports that 55.6% of middle and high school students in 2024 preferred disposable e-cigarettes, reflecting a shift toward smokeless nicotine options. The rising demand for smokeless alternatives is particularly prominent among young adults, influenced by a preference for nicotine control and variety in flavors. This consumer shift is reinforced by findings from the CDC Foundation, which highlights the broad appeal of flavored e-cigarettes87.6% of young users prefer flavored options, contributing to the demand for smokeless and customizable vaping products that cater to diverse preferences

- Technological Advancements in E-Cig Design: Recent innovations in e-cig technology, such as refillable pods and adjustable mod systems, have catered to an increasingly tech-savvy consumer base. Devices offering features like temperature control, rechargeable batteries, and multiple flavor compatibility have gained popularity, with 15.6% of young users selecting prefilled pods as of 2024. These advancements provide users with an improved experience by allowing better control over nicotine intake, making e-cigarettes an attractive alternative to traditional options

- Favorable Regulatory Shifts: Regulatory changes supporting reduced-harm products have contributed to the e-cig markets growth. For example, FDAs recent regulatory focus on managing nicotine levels and enforcing age restrictions has promoted the responsible use of e-cigarettes among adults. In 2023, approximately 62.5% growth was observed in e-cigarette sales nationwide due to these supportive policies. State-level actions, such as Californias flavored e-cigarette ban, have influenced consumer preference towards non-flavored, regulated options, creating a structured regulatory framework within which the market can expand

Market Challenges

- Stringent Regulations and Compliance: The U.S. e-cigarette market faces strict regulatory scrutiny, particularly from the FDA and state legislatures. For instance, the FDAs enforcement on synthetic nicotine products and the requirement for age verification in sales have imposed compliance burdens on manufacturers and retailers. States like California have introduced stringent regulations on flavors, impacting nearly 35% of e-cigarette sales between 2022 and 2023. Such regulatory measures have created entry barriers for new players, thus affecting market growth and diversification

- Health-Related Concerns and Backlash: The health risks associated with e-cigarette use, particularly among youth, have raised public health concerns. Data from the CDC show that 26.3% of high school e-cig users in 2024 reported daily use, often in flavored varieties. Growing evidence of health risks tied to nicotine dependency has led to societal backlash, particularly concerning the mental and physical effects on younger users. This has contributed to negative perceptions and potential regulatory tightening, complicating market dynamics and expansion efforts

USA E-Cig Market Future Outlook

The USA E-Cig market is projected to continue its growth trajectory over the coming years, spurred by continuous innovations in e-cigarette technology and an expanding consumer base seeking alternative nicotine options. Industry players are expected to invest heavily in R&D to create next-generation products that offer enhanced safety, customization, and better user experience. Additionally, regulatory adjustments supporting reduced-risk tobacco products will likely drive further market expansion.

Market Opportunities

- Innovation in Sustainable Pareen Packaging: There is a substantial opportunity in developing sustainable packaging solutions within the corrugated packaging market. Corrugated products, especially those with water-based adhesives and green ink, align with consumer preferences for low-impact packaging. The EPA notes that 60% of consumers prefer eco-friendly packaging, enhancing the market share for companies adopting green materials. This shift towards sustainable practices is further supported by state-led initiatives, which provide tax incentives for sustainable packaging .

- Expansion in Digital Printing: The integration of digital printing within corrugated packaging offers significant growth opportunities, as brands seek customized solutions. By enabling small-scale print runs without additional costs, digital printing supports the rise of personalization in packaging. A study from the Printing United Alliance highlights that digital printing in packaging can enhance brand recall by 40%, making it a valuable addition for retail and FMCG applications, where consumer engagement is a priority .

Scope of the Report

|

Product Type |

Disposable E-Cigs |

|

Rechargeable E-Cigs |

|

|

Modular E-Cigs |

|

|

Flavors |

Tobacco |

|

Mint |

|

|

Fruit |

|

|

Menthol |

|

|

Distribution Channel |

Online Retail |

|

Specialty Vape Shops |

|

|

Convenience Stores |

|

|

Supermarkets |

|

|

Battery Type |

Built-in Battery |

|

Replaceable Battery |

|

|

Region |

Northeast |

|

Midwest |

|

|

South |

|

|

West |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, CDC)

Online Retail Chains

Specialty Vape Shops

Major Supermarkets

Tobacco Control Organizations

Public Health Advocacy Groups

Nicotine Addiction and Rehabilitation Centers

Companies

Players mentioned in the report

Juul Labs

British American Tobacco

Philip Morris International

Altria Group

NJOY Holdings

Reynolds American

Imperial Brands

Japan Tobacco Inc.

VMR Products

Eleaf

Vaporesso

Innokin

Joyetech

Logic Technology Development

Mistic E-Cigs

Table of Contents

USA E-Cig Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Market Segmentation Overview

USA E-Cig Market Size (In USD)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Milestones

USA E-Cig Market Analysis

3.1. Growth Drivers

3.1.1. Increased Health Awareness

3.1.2. Rising Consumer Demand for Smokeless Alternatives

3.1.3. Technological Advancements in E-Cig Design

3.1.4. Favorable Regulatory Shifts

3.2. Market Challenges

3.2.1. Stringent Regulations and Compliance

3.2.2. Health-Related Concerns and Backlash

3.2.3. Increased Market Saturation

3.3. Opportunities

3.3.1. Development of Customizable and Flavored Products

3.3.2. Expanding Distribution Networks

3.3.3. Rise in Online E-Cig Sales Channels

3.4. Trends

3.4.1. Adoption of Smart Technology and IoT Integration

3.4.2. Emphasis on Sustainability and Eco-friendly Products

3.4.3. Increased Focus on Premium Product Lines

3.5. Government Regulation

3.5.1. FDA Regulations on E-Cig Nicotine Levels

3.5.2. State-wise Legal Restrictions

3.5.3. Advertising and Marketing Compliance

3.6. SWOT Analysis

3.7. Value Chain and Ecosystem Analysis

3.8. Porters Five Forces Analysis

USA E-Cig Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Disposable E-Cigs

4.1.2. Rechargeable E-Cigs

4.1.3. Modular E-Cigs

4.2. By Flavors (In Value %)

4.2.1. Tobacco

4.2.2. Mint

4.2.3. Fruit

4.2.4. Menthol

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Specialty Vape Shops

4.3.3. Convenience Stores

4.3.4. Supermarkets

4.4. By Battery Type (In Value %)

4.4.1. Built-in Battery

4.4.2. Replaceable Battery

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

USA E-Cig Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Juul Labs

5.1.2. British American Tobacco

5.1.3. Philip Morris International

5.1.4. Altria Group

5.1.5. Reynolds American

5.1.6. Imperial Brands

5.1.7. Japan Tobacco Inc.

5.1.8. NJOY Holdings

5.1.9. VMR Products

5.1.10. Eleaf

5.1.11. Vaporesso

5.1.12. Innokin

5.1.13. Joyetech

5.1.14. Logic Technology Development

5.1.15. Mistic E-Cigs

5.2 Cross Comparison Parameters (Product Portfolio, Number of Patents, Headquarters Location, Market Share, Regional Presence, Distribution Network, Marketing Strategy, Innovation Index)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Trends

5.7 Venture Capital Funding

USA E-Cig Market Regulatory Framework

6.1. E-Cig and Nicotine Content Regulations

6.2. State and Federal Compliance Requirements

6.3. Labeling and Packaging Standards

USA E-Cig Future Market Analysis (In Value)

7.1. Future Growth Potential

7.2. Key Factors Influencing Future Demand

USA E-Cig Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Product Differentiation Strategies

8.3. Strategic Marketing and Distribution Plans

8.4. Risk Assessment and Mitigation

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involved a comprehensive mapping of all key stakeholders within the USA E-Cig market. Through rigorous desk research and access to proprietary databases, the main variables influencing market dynamics were identified to ensure an in-depth analysis.

Step 2: Market Analysis and Construction

We analyzed historical data, including product adoption, user demographics, and competitive landscape, to assess market development. Key metrics such as product availability and technological advancement were reviewed to build an accurate market outlook.

Step 3: Hypothesis Validation and Expert Consultation

Expert interviews were conducted with industry professionals via computer-assisted telephone interviews (CATIs) to validate our hypotheses. This approach provided unique insights into consumer preferences, market trends, and growth drivers directly from e-cig manufacturers and distributors.

Step 4: Research Synthesis and Final Output

In the concluding phase, direct engagement with e-cigarette companies was conducted to refine our research. This ensured that the data synthesized from primary and secondary sources accurately represents the USA E-Cig market landscape.

Frequently Asked Questions

01. How big is the USA E-Cig Market?

The USA E-Cig market, valued at USD 7 billion, is driven by an increasing preference for smokeless nicotine alternatives among health-conscious consumers.

02. What are the challenges in the USA E-Cig Market?

Challenges include strict FDA regulations, public health concerns, and competition from traditional tobacco products, which impact market accessibility and consumer trust.

03. Who are the major players in the USA E-Cig Market?

Major players in the market include Juul Labs, Philip Morris International, British American Tobacco, Altria Group, and NJOY Holdings, each influencing market trends through innovation and strategic distribution.

04. What are the growth drivers of the USA E-Cig Market?

Key drivers include technological advancements in product design, increasing awareness of reduced-risk products, and a shift toward smokeless alternatives by traditional smokers.

05. What is the future outlook for the USA E-Cig Market?

The market is expected to grow steadily, driven by regulatory support for smokeless alternatives and evolving consumer preferences towards customizable e-cig products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.