USA E-Scooter Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD3990

November 2024

89

About the Report

USA E-Scooter Market Overview

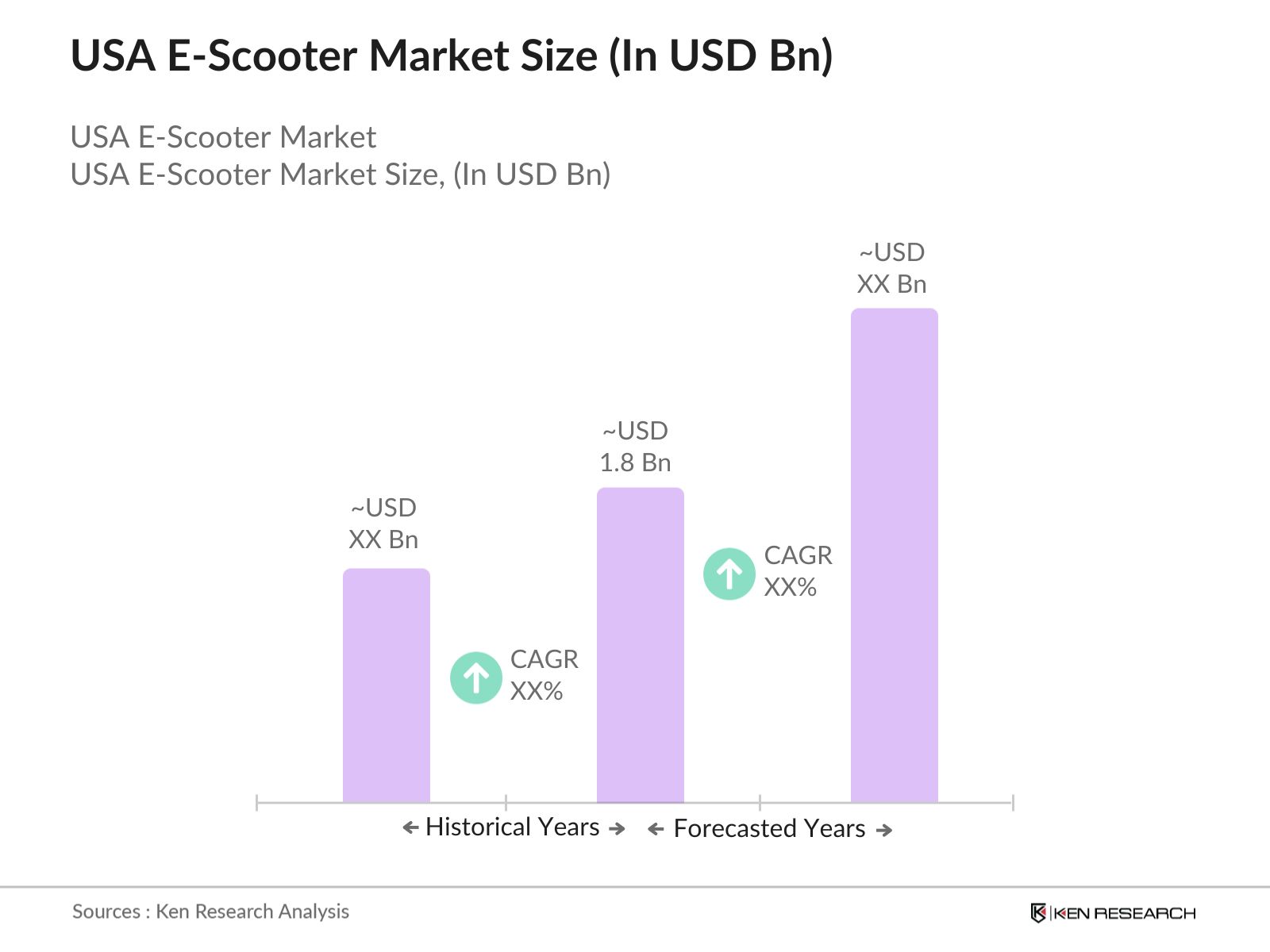

- The USA E-Scooter market has seen a strong upward trajectory and is valued at USD 1.8 billion, based on a five-year historical analysis. This growth is driven by increasing urbanization, sustainability concerns, and a shift toward eco-friendly transportation options. The growing adoption of shared mobility services, such as those provided by companies like Lime and Bird, further supports market expansion. Government incentives promoting electric vehicles (EVs), combined with an increasing number of bike lanes and infrastructure for micro-mobility, are also key contributors to market growth.

- The market is dominated by cities such as Los Angeles, San Francisco, and New York due to their high population density, well-developed urban infrastructure, and large-scale adoption of shared mobility solutions. These cities also benefit from favorable government policies and a greater willingness among residents to adopt eco-friendly transportation options. Additionally, many tech startups in these areas are collaborating with local governments to facilitate the integration of e-scooters into public transport systems, which supports their dominance in the market.

- State-level emission regulations have accelerated the shift towards electric mobility. California, for instance, has set a goal to phase out all gasoline-powered vehicles by 2035. As part of this initiative, the state has allocated $200 million in grants to incentivize e-scooter adoption as an alternative to combustion-engine scooters. By 2024, the California Air Resources Board reported that emissions from small, motorized vehicles had dropped by 12%, indicating the success of these measures in promoting greener alternatives.

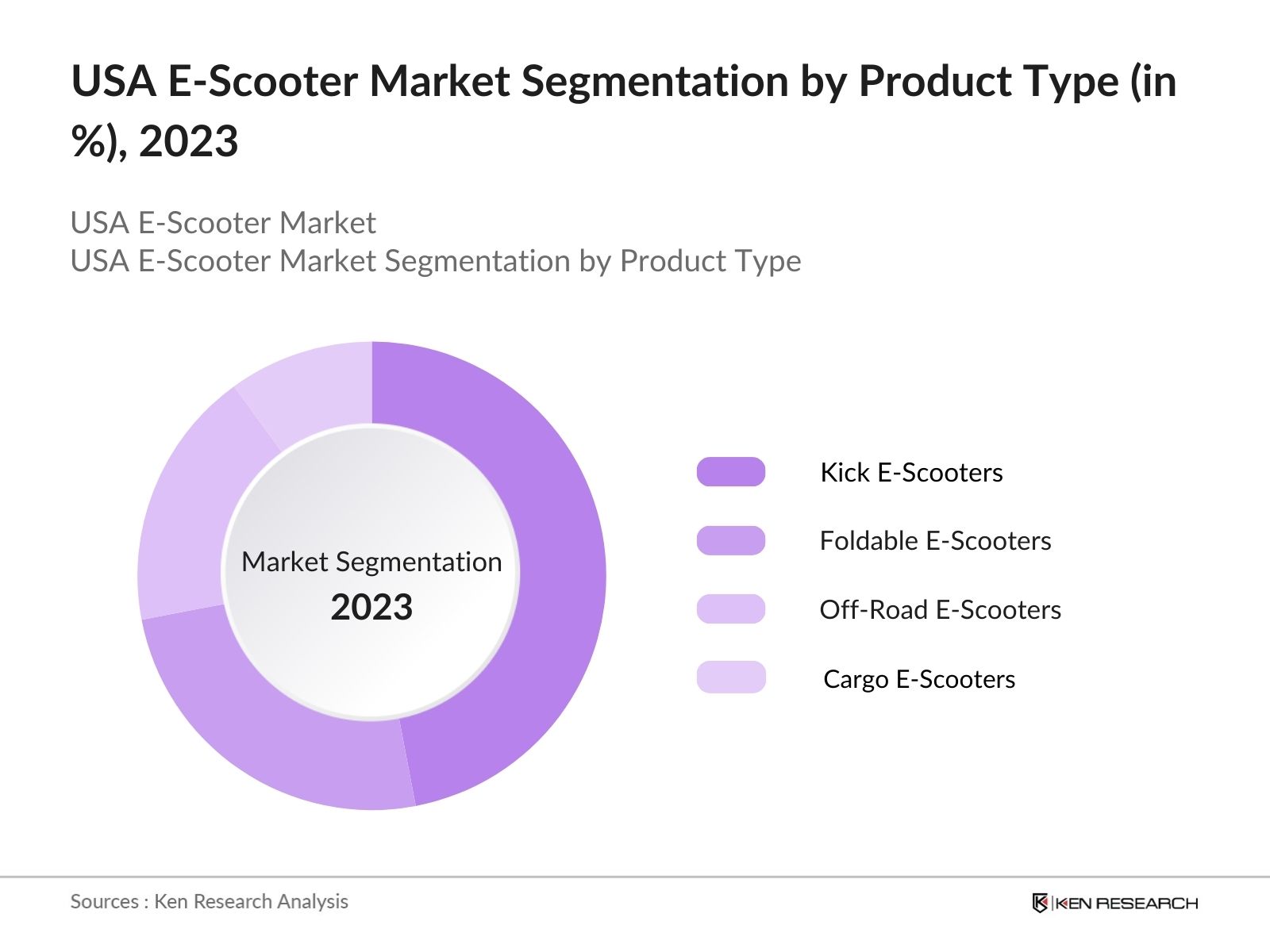

USA E-Scooter Market Segmentation

By Product Type: The market is segmented by product type into foldable e-scooters, kick e-scooters, off-road e-scooters, and cargo e-scooters. Among these, kick e-scooters currently hold the dominant share in the market due to their widespread adoption in urban areas. The simplicity and convenience of kick e-scooters make them ideal for short-distance commutes, especially in metropolitan cities where traffic congestion is a significant issue. Companies like Bird and Lime, which offer kick e-scooters as part of their fleet, have cemented their presence in this segment by offering affordable and easily accessible services to millions of users across the country.

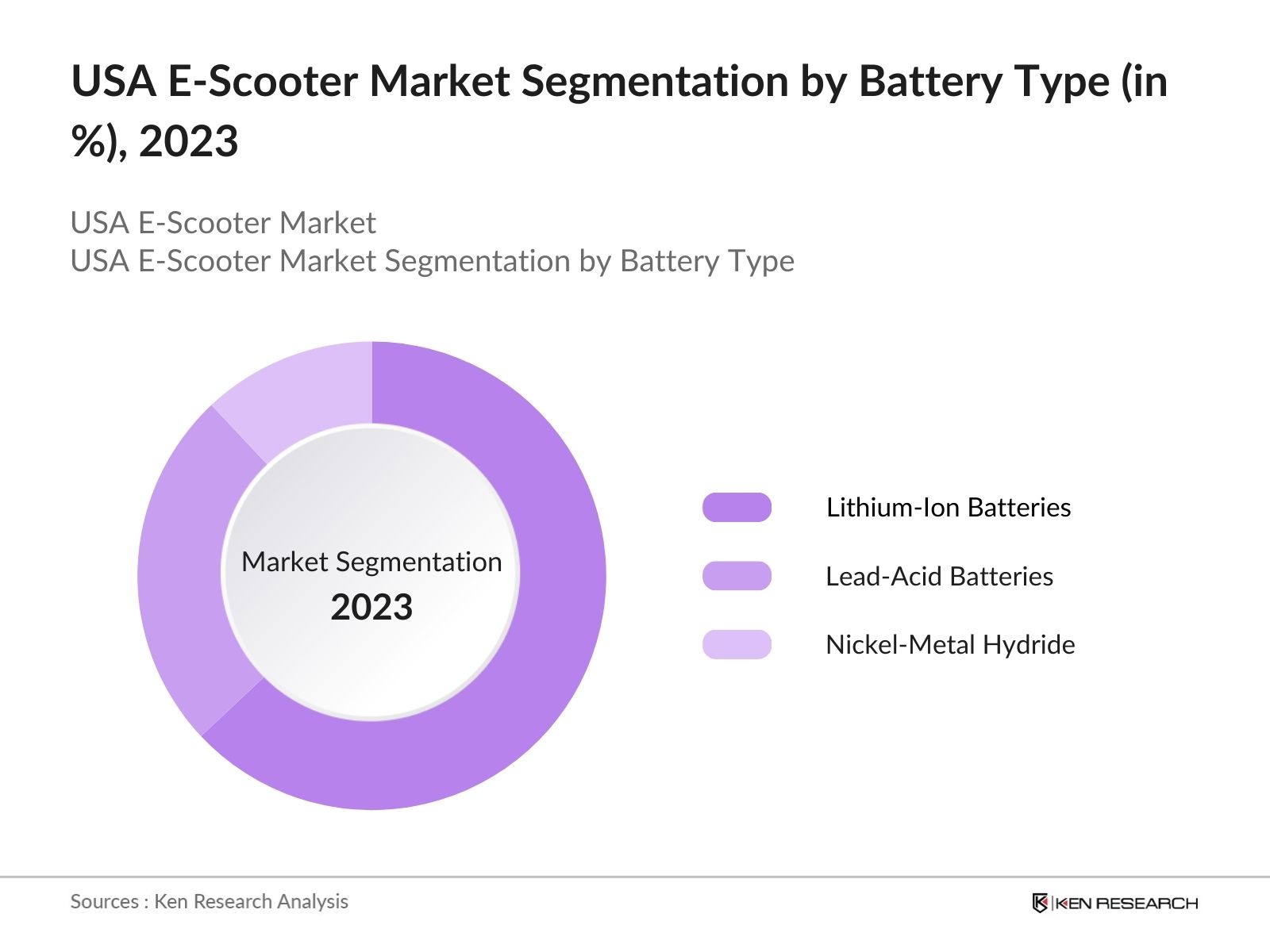

By Battery Type: The market is also segmented by battery type into lead-acid batteries, lithium-ion batteries, and nickel-metal hydride (NiMH) batteries. Lithium-ion batteries dominate this segment due to their high energy density, long life cycle, and lightweight nature. Lithium-ion technology has become the industry standard for e-scooters, driving demand in both consumer and shared mobility markets. Additionally, the rising demand for sustainable and high-performance vehicles has encouraged manufacturers to prioritize lithium-ion batteries in their production.

USA E-Scooter Market Competitive Landscape

The USA E-Scooter market is highly competitive, with key players dominating various segments. Established companies like Bird, Lime, and Segway-Ninebot have a stronghold due to their widespread service networks and innovation in product development. These companies continue to expand their market reach through strategic partnerships with city governments and ongoing investments in research and development to improve battery performance and safety standards.

|

Company Name |

Year Established |

Headquarters |

Fleet Size |

Key Partnerships |

Product Range |

Battery Technology |

Revenue (USD Bn) |

Innovation Index |

|---|---|---|---|---|---|---|---|---|

|

Bird |

2017 |

Santa Monica, CA |

||||||

|

Lime |

2017 |

San Francisco, CA |

||||||

|

Segway-Ninebot |

1999 |

Bedford, NH |

||||||

|

Spin |

2016 |

San Francisco, CA |

||||||

|

Razor USA LLC |

2000 |

Cerritos, CA |

USA E-Scooter Industry Analysis

Growth Drivers

- Electrification of Urban Mobility: The electrification of urban mobility is rapidly reshaping the transportation landscape in the USA, driven by significant government initiatives and sustainability goals. According to the U.S. Department of Transportation, over 15 million electric scooters have been introduced to cities across the country between 2022 and 2024. This transition has been propelled by efforts to reduce carbon emissions, aligning with the federal government's target of a 50% reduction in transportation-related emissions by 2030. Urban centers like New York and San Francisco have already allocated over $150 million in subsidies to promote electric mobility.

- Expansion of Ride-Sharing Models: The rise of ride-sharing models has bolstered the proliferation of e-scooters in urban areas. In 2023, more than 60 cities partnered with private operators, offering dockless scooters to their residents. Over 500,000 daily trips were reported in New York and Los Angeles alone in 2023, marking a significant shift towards shared mobility solutions. These models not only alleviate congestion but have also attracted over $1 billion in investments towards developing scalable, eco-friendly transportation alternatives.

- Public Transportation Integration: Integration with public transportation systems is a key driver of e-scooter adoption. By 2024, over 35% of major metropolitan areas had integrated e-scooter networks into their public transit systems, allowing seamless payment options via apps like Apple Pay and Google Wallet. Cities like Miami and Austin have invested over $50 million in building designated scooter lanes that connect commuters from transit hubs to their final destinations. Such investments align with the federal governments $1.2 trillion infrastructure bill, aimed at improving urban mobility.

Market Challenges

- Safety Concerns and Regulations: Safety remains a concern, with over 40,000 accidents reported in 2023 related to e-scooter use, according to the National Highway Traffic Safety Administration. This has prompted more than 25 states to implement stricter safety regulations, such as mandatory helmet use and speed limits below 15 mph. In 2024, the U.S. government allocated $250 million to improve e-scooter safety through initiatives such as public awareness campaigns and enhanced safety gear. However, consumer adoption is often hindered by perceived risks.

- High Upfront Costs: The high upfront costs associated with purchasing e-scooters, which average $500 to $1,000 per unit, remain a barrier for many consumers. While government subsidies have eased some financial burden, many potential users are deterred by the initial investment. In 2024, the U.S. saw a 12% increase in financing options, such as "buy now, pay later" services, which allowed over 300,000 consumers to purchase e-scooters with deferred payment plans. However, more affordable models are required to drive mass adoption.

USA E-Scooter Market Future Outlook

Over the next five years, the USA E-Scooter market is poised to experience considerable growth. This expansion will be driven by continuous government support, including infrastructure development for electric vehicles, the rise of smart city initiatives, and consumer demand for environmentally sustainable transportation options. Technological advancements in battery life, safety, and software integration, such as GPS and IoT features, will also play a pivotal role in driving future demand for e-scooters.

Future Market Opportunities

- Suburban and Rural Market Potential: There is significant untapped potential for e-scooter expansion in suburban and rural areas. In 2024, the U.S. Census Bureau reported that over 60 million Americans live in suburban or rural regions where public transportation options are limited. Governments in states like Texas and Ohio have invested over $150 million in pilot projects aimed at deploying e-scooters in underserved areas. These initiatives are designed to address the transportation gaps in regions where commuting distances are longer, offering new opportunities for market growth.

- Fleet Management Technology Innovations: Fleet management technologies, particularly in real-time tracking and predictive maintenance, are opening new avenues for e-scooter operators. In 2024, companies managing e-scooter fleets have collectively invested over $300 million in tech solutions, allowing them to reduce operational downtime by 20%. Real-time GPS monitoring and automated diagnostics have also improved fleet efficiency, making e-scooters more reliable and reducing repair costs by up to 30%. The Federal Transit Administration has highlighted these innovations as crucial for the sustainability of e-scooter networks.

Scope of the Report

|

By Product Type |

Foldable E-Scooters Kick E-Scooters Off-Road E-Scooters Cargo E-Scooters |

|

By Application |

Individual Consumer Ride-Sharing Platforms Logistics and Delivery Corporate Fleets |

|

By Power Output |

Below 250W 250W-500W Above 500W |

|

By Battery Type |

Lead-Acid Batteries Lithium-Ion Batteries Nickel-Metal Hydride |

|

By Region |

West Coast East Coast Midwest Southern States |

Products

Key Target Audience

Electric vehicle manufacturers

E-scooter fleet operators

Ride-sharing platform providers

Battery manufacturers

Government and regulatory bodies (Department of Transportation, Environmental Protection Agency)

Investments and venture capital firms

Infrastructure developers

Corporate mobility service providers

Companies

Major Players

Bird

Lime

Segway-Ninebot

Spin

Razor USA LLC

Boosted

Gogoro

Yadea Technology Group

Xiaomi

Apollo Scooters

Unagi Scooters

OKAI

Gotrax

Levy Electric

Hiboy

Table of Contents

1. USA E-Scooter Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA E-Scooter Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA E-Scooter Market Analysis

3.1. Growth Drivers (Government Regulations, Sustainability Goals, Urban Mobility Shift, Technological Innovation)

3.1.1. Electrification of Urban Mobility

3.1.2. Government Incentives for E-Scooter Adoption

3.1.3. Expansion of Ride-Sharing Models

3.1.4. Public Transportation Integration

3.2. Market Challenges (Infrastructure, Consumer Adoption, Safety Regulations, Battery Limitations)

3.2.1. Lack of Charging Infrastructure

3.2.2. Safety Concerns and Regulations

3.2.3. High Upfront Costs

3.2.4. Limited Battery Life and Range

3.3. Opportunities (Expansion into Suburban Areas, Fleet Management Solutions, Subscription Models)

3.3.1. Suburban and Rural Market Potential

3.3.2. Subscription-Based E-Scooter Models

3.3.3. Fleet Management Technology Innovations

3.4. Trends (Autonomous Scooters, Integration with Smart Cities, IoT Connectivity, Battery Swapping)

3.4.1. Autonomous E-Scooter Technology Development

3.4.2. Integration of E-Scooters with Smart City Platforms

3.4.3. Internet of Things (IoT) in E-Scooters

3.4.4. Battery Swapping Solutions

3.5. Government Regulation (Federal and State-Level Regulations, Emission Norms, Incentive Programs)

3.5.1. Federal Tax Incentives for E-Scooters

3.5.2. State-Level Emission Regulations

3.5.3. Local Incentives for E-Scooter Infrastructure Development

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (Market-Specific Metrics)

3.9. Competition Ecosystem

4. USA E-Scooter Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Foldable E-Scooters

4.1.2. Kick E-Scooters

4.1.3. Off-Road E-Scooters

4.1.4. Cargo E-Scooters

4.2. By Application (In Value %)

4.2.1. Individual Consumer

4.2.2. Ride-Sharing Platforms

4.2.3. Logistics and Delivery Services

4.2.4. Corporate Fleets

4.3. By Power Output (In Value %)

4.3.1. Below 250W

4.3.2. 250W-500W

4.3.3. Above 500W

4.4. By Battery Type (In Value %)

4.4.1. Lead-Acid Batteries

4.4.2. Lithium-Ion Batteries

4.4.3. Nickel-Metal Hydride (NiMH) Batteries

4.5. By Region (In Value %)

4.5.1. West Coast

4.5.2. East Coast

4.5.3. Midwest

4.5.4. Southern States

5. USA E-Scooter Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Lime

5.1.2. Bird

5.1.3. Spin

5.1.4. Razor USA LLC

5.1.5. Segway-Ninebot

5.1.6. Boosted

5.1.7. Gogoro

5.1.8. Yadea Technology Group

5.1.9. Xiaomi

5.1.10. Apollo Scooters

5.1.11. Unagi Scooters

5.1.12. OKAI

5.1.13. Gotrax

5.1.14. Levy Electric

5.1.15. Hiboy

5.2. Cross Comparison Parameters (Market Share, Geographic Presence, Innovation Index, Fleet Size, Revenue, Product Portfolio, Charging Infrastructure Partnerships, Subscription Models)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA E-Scooter Market Regulatory Framework

6.1. Emission Standards

6.2. Safety and Licensing Requirements

6.3. Vehicle Registration and Insurance Requirements

7. USA E-Scooter Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA E-Scooter Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Power Output (In Value %)

8.4. By Battery Type (In Value %)

8.5. By Region (In Value %)

9. USA E-Scooter Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Insights

9.3. White Space Opportunity Analysis

9.4. Branding and Positioning Strategy

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involved identifying key drivers, challenges, and opportunities within the USA E-Scooter Market by conducting extensive desk research and reviewing market reports, regulatory announcements, and government initiatives.

Step 2: Market Analysis and Construction

This step involved gathering and analyzing historical data on the USA E-Scooter market, including consumer adoption rates, the integration of e-scooters with public transportation systems, and charging infrastructure availability.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through in-depth interviews with key industry stakeholders, including e-scooter manufacturers and fleet operators, to gain insights into product demand, operational challenges, and future trends.

Step 4: Research Synthesis and Final Output

The final analysis was synthesized by integrating data from market trends, financial reports, and consumer behavior studies to ensure a comprehensive understanding of the USA E-Scooter market.

Frequently Asked Questions

01 How big is the USA E-Scooter Market?

The USA E-Scooter market is valued at USD 1.8 billion, driven by increasing urbanization, sustainability concerns, and the growth of shared mobility services.

02 What are the challenges in the USA E-Scooter Market?

Challenges in the USA E-Scooter include the lack of charging infrastructure, regulatory hurdles related to safety standards, and concerns over battery life and disposal.

03 Who are the major players in the USA E-Scooter Market?

Key players in the USA E-Scooter include Bird, Lime, Segway-Ninebot, Spin, and Razor USA LLC. These companies dominate the market through strong fleet management capabilities and wide geographic presence.

04 What are the growth drivers of the USA E-Scooter Market?

Key drivers in the USA E-Scooter market include government support for eco-friendly transportation, advancements in battery technology, and increasing consumer demand for alternatives to traditional vehicles in congested cities.

05 What role does government regulation play in the USA E-Scooter Market?

In the USA E-Scooter market Government regulation is crucial, with federal and state incentives encouraging the adoption of e-scooters, while local governments work on safety and infrastructure development.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.